Whether you are a crypto novice or have a wealth of experience purchasing or trading cryptocurrencies, you know there is one frustrating problem we all have to navigate.

Here's a scenario you may understand. Suppose you purchase crypto tokens from a reputable cryptocurrency exchange. You buy your chosen tokens and transfer your holdings to a MetaMask wallet. This simple transaction took maybe 5 to 10 minutes.

A few weeks later, the crypto market enters a bull run. Suddenly, your tokens have trebled in value, and you have a nice fat profit from your token holdings. You decide to sell some of the tokens and get some cash in your bank account. Easy, right? Here's where the problem occurs.

Firstly, you cannot exchange crypto for fiat currency in the MetaMask wallet (or any crypto wallet). So, you transfer the tokens back to the exchange (which is now a centralised exchange point with custody of your deposited holdings).

Secondly, you then you discover the crypto exchange cannot convert to fiat currency either. OK, so the next step is to send your crypto tokens to a fiat off-ramp platform like Coinbase or Gemini. Eventually, after much fiddling about, you convert your tokens to fiat currency and request a withdrawal.

We think you'll agree that it's an annoying process. Above all, it's not attached to real-world logic, so because of this fundamental flaw, individuals and companies hesitate to adopt cryptocurrencies into their mainstream practices. Moreover, businesses want cash flow and new customers, but the current situation isn't conducive to streamlining payments for new users.

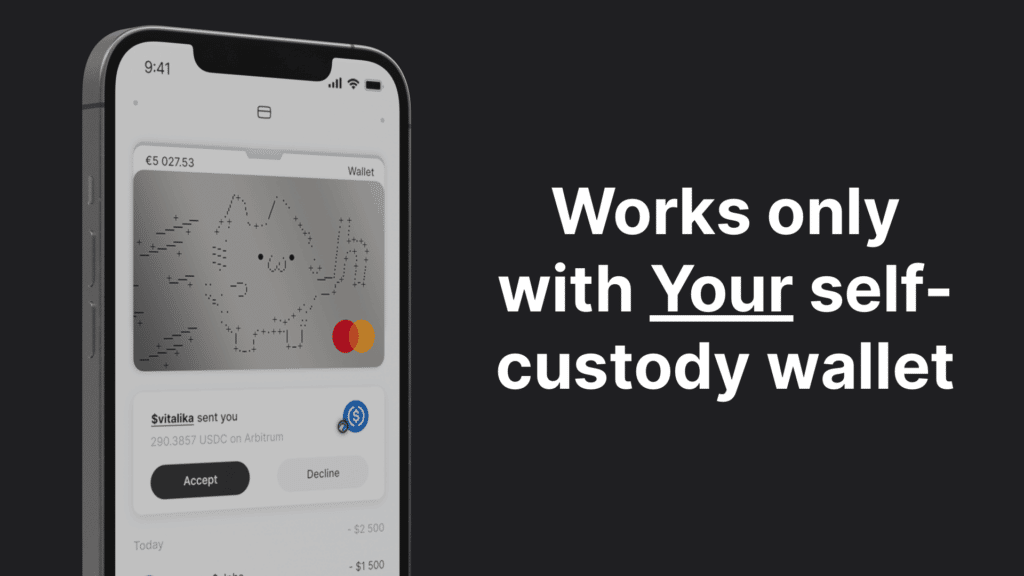

Image Source: Holyheld: Transforming the Web3 Payment Industry

Image Source: Holyheld: Transforming the Web3 Payment Industry

The Core Limitations of the Web3 Payment Industry

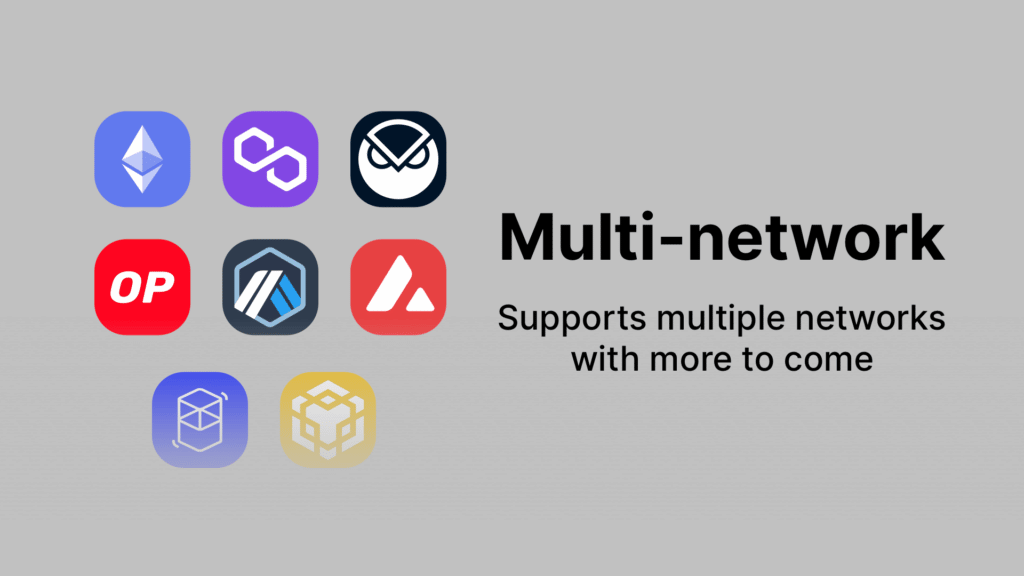

Over fifty blockchains exist, but even the major networks don't have access to a native solution as current crypto debit cards aren't multichain. That results in costly gas fees as users have no choice but to utilise the Ethereum network.

Further, gas fees are not dependent on the amount of a transaction. What that means is that an individual could pay the same fees for a small transaction as a whale requesting a significant transaction. It's far from an ideal solution.

In addition, many providers don't engage with Web3 infrastructure. They cannot provide privacy and compliance for the Web3 audience. There is limited token support, which subsequently excludes thousands of tokens and their communities.

Moreover, fiat currency and programmable money are not connected, preventing many companies from improving the user experience and impacting potential profitability.

The cryptocurrency space needs a simple payment solution that bridges digital currency with fiat currency.

Introducing Holyheld: A Real-world Web3 Payment Solution

Holyheld launched in September 2020 to test performance and gauge public interest. Since then, Holyheld has focused on building a Mastercard debit card product that covers the entire Web3 space, the metaverse, crypto projects and protocols, and DAOs. One card solves the existing payment issues for every segment in the space.

Holyheld has created innovative technology that enables crypto fungibility, enhancing consumer behaviour patterns. Above all, Holyheld doesn't create the logic for digital currencies. Instead, it provides interaction in real-use cases for the real world.

What that means for Web3 users is the reduction of centralised processes. Instead of a five or six-step process to convert cryptocurrency to fiat money, the single process with Holyheld is logical - Holyheld debit card to Merchant (real-world logic).

What underpins Holyheld's decision to change the financial future of individuals and organisations across the globe? That is to say, the Holyheld team has built the company underpinned by philosophies and beliefs that translate into a set of core values.

Image Source: Holyheld: Digital First Supports Google Pay & Apple Pay Coming Soon

Image Source: Holyheld: Digital First Supports Google Pay & Apple Pay Coming Soon

Holyheld's Core Values

Every decision is underpinned by Holyheld's core values when building new products:

- Privacy first: Holyheld believes that everyone deserves the right to privacy and subsequently creates products that respect user confidentiality.

- Community-driven: Holyheld values its community highly as essential to the success of the project.

- Fair and open: Holyheld seeks to remove discrimination and bias in the belief in a future of fair and open digital finance.

- Permissionless: Holyheld endorses non-custodial services and believes that only the user should have access to their keys and have the facility to make financial decisions of their own.

- Open-source: Holyheld's ethos is that innovation cannot exist without an open environment and that its open-source code achieves that goal for users.

- Fun: Holyheld is at the forefront of Fintech. It’s hard. It’s complicated and often nerve-wracking. The Holyheld team believes having fun means loving what you are building, enjoying the journey and embracing the challenges

Holyheld's values are the foundation behind its strong community, but how does Holyheld work?

How Holyheld Works

Holyheld creates smart contract logic that can be used across blockchains and is standardised to settle for fiat currency. It cuts out a massive part of the current payment process. Cryptocurrency is exchanged for fiat currency, which can then be used through standard spending methods, such as Mastercard. Most importantly, the Holyheld debit card becomes a way to spend your digital money in the real world, globally, online and offline.

Holyheld has onboarded over 30+ primitives, showing 20% growth over three months.

Open Ecosystem Strategy

Holyheld works closely with protocols and networks to extend their use cases into the real world. Likewise, the technical architecture allows projects to build web3 primitives on or with Holyheld for various use cases, such as:

- Yield generation

- Lending

- Streaming

- NFTs and more.

Subsequently, users can continue using their favourite protocols whilst benefitting from accessing real-world finance via the debit card.

Holyheld's potential use cases are nearly infinite and can support practically any logic created by any project, protocol or service. Let's look at a few examples of actual use cases.

Example Use Cases for Holyheld

Use Case 1: Self-repaying Car Leasing

This corporate use case example enables people to use crypto assets as collateral for borrowing. The user's crypto holdings earn yield and automatically repay interest on the loan or pay it in full.

The car leasing example certaintly demonstrates the reduction of friction in loan repayments. Holyheld enables users to set automatic loan repayments from the crypto assets earning a yield.

To clarify, the car owner connects to Holyheld and then the car dealership, cutting out time-consuming and fiddly processes.

Use Case 2: A Money Streaming Protocol

The Holyheld protocol integrates with the protocol to provide an efficient salary streaming service. As a result, employees can receive salary payments at predefined frequencies, even as frequently as every 20 seconds.

Existing crypto salary payments involve an elongated flow:

- Employer to stream

- Stream to batching and standardisation

- It then goes for settlement

- Finally, the cash settlement

The Holyheld simplified payment solution works by the employer connecting to Holyheld and then to the employee with the money on the card. Subsequently, employees get paid in real-time without ever needing to touch crypto, a relief for non-crypto experienced employees.

The Holyheld solution allows employers to have complete control over staff payouts, whether transacting Wrapped or staked tokens, including LIDO, Yearn Finance, Alchemix, Olympus, Inverse, Vesta, Liquidity, and many many more.

Wrapped or staked tokens (including LIDO, Yearn Finance, Alchemix, Olympus, Inverse, Vetsa, Liquidity and many more) are created to enhance the utility of the underlying tokens. Still, what it also means is that those tokens may be not as easily accessible or liquid as underlying assets. Above all, timing the market, performing additional transactions, there is no difference for the user. Use full utility of wrapped, staked, or vault tokens instead of the underlying assets.

The benefits of the Holyheld protocol are significant and a game changer for many organisations that rely on centralised payment solutions

Image Source: Holyheld: Game Changing Centralised Payment Solutions

Image Source: Holyheld: Game Changing Centralised Payment Solutions

Benefits of the Holyheld Crypto Debit Card

The Holyheld card is available for free to residents in 31 countries within Europe. Meanwhile, Holyheld is working to enable card orders in the U.S and several Latin American countries.

Users can top up their Holyheld debit card from any self-hosted wallet with any liquid ERC-20 token from a supported network: Ethereum, Fantom, Polygon, BSC, Avalanche, Optimism or Arbitrum with more networks to follow.

Holyheld uses zero-knowledge technology, so there is no access to personal information or funds when connecting users to the debit card top-up. Custom integrations with protocols enable Holyheld to create new payment primitives for projects that can make new payments directly to the card via Holyheld's open infrastructure.

The Holyheld debit card has a unique set of benefits. Certainly, no existing platforms offer crypto debit cards that have the full features of the Holyheld debit card. For example, many leading crypto platforms are custodial. Holyheld is multi-chain by default and the only platform supporting primitives.

The five core benefits of the Holyheld debit card

- Web3 primitives support

- On/off ramp

- Multi-chain access

- ERC-20 tokens supported

- Live customer support: Very few platforms have live support

Holyheld's offering to Web3 is the first of its kind, so let's look at why this Web3 payment solution is so powerful for the industry.

What makes Holyheld Payment Primitives Powerful?

For most platforms, moving cryptocurrency to fiat currency is a convoluted process. Users pay with tokens that may be staked, wrapped, etc. After that, the token has to be unwrapped, or unstaked, which can be complicated as centralised cryptocurrency exchanges like Binance or Coinbase do not support non-native tokens.

Firstly, tokens then must be exchanged for ETH or a stablecoin like USDC. At this juncture, the exchange takes custody of your tokens. Secondly, the next step is to convert the stablecoins to fiat currency and, finally, request a bank transfer, which could take up to 48 hours with some exchanges.

Above all, the Holyheld debit card removes all of that hassle. You receive the token, top up the card with your chosen amount and confirm the on-chain transaction. The simplicity is a core benefit, but also consider the extra security as nobody has custody of your funds at any stage of the transaction.

Holyheld has a strong team working towards a better financial future for all. The Holyheld solution to one of the frustrating issues in the Web3 space seems simple, but how did it begin? Who is behind this game-changing payment solution?

Image Source: Holyheld: Finally! Hassle free Crypto to Fiat transactions

Image Source: Holyheld: Finally! Hassle free Crypto to Fiat transactions

Founders and Partners

The Founders' mission is to improve global access to finance. In addition, they believe that the innovation of evolving crypto technology should benefit everyone.

The scope and ease of the Holyheld financial solutions has attracted many new partners to the platform, and there are over twenty potential partners currently on a waiting list.

Current Holyheld Partners

- Hats Finance

- Liquity

- Keep3r Fixed Forex

- Vesta

- Railgun

- DoinGud

- PrimeDAO

- Iron Bank

- Teller

- Morpho

- Berachain

- Alchemix

- Debt DAO

- B8

- Yearn Finance

- Olympus

- Sherlock

- Angle Protocol

- Klima DAO

- Ithil

- Push Protocol

- Idle Finance

- Concave

- Inverter Network

A broad range of partners are seeking access to Holyheld solutions, and the protocol endeavours to maintain fairness and openness within its community.

Conclusion: Is Holyheld the Disruptive Change we Need in Web3 Payment Solutions?

To sum up, Holyheld is the first financial services app that allows users to store, receive and send crypto assets using a simple wallet with the Holyheld debit card. To date, over 2000 users have signed up for the service.

Typically, with a new-to-market product, there is hesitancy for individuals and organisations to adopt the new protocol. In Holyheld's case, the benefits of removing the hassle of converting digital currencies to fiat money that we have become used to, but are still irritated by, are indisputable.

Streamlining crypto payments is naturally an exciting prospect for organisations. With over 24 partners and a waiting list, organisations appear keen to take advantage of the enhanced crypto payment solutions, making it easier for their users and undoubtedly reducing the costs of ineffective payment solutions.

Holyheld is a new type of payment solution native to the space. Above all, Holyheld's USP is the open infrastructure, not the debit card. Holyheld allows other protocols and projects to build new payment primitives on top of or with Holyheld .

The Holyheld team continues working on new products and solutions, and we look forward to observing progress over the next few years.