The moon is made of pancakes, according to PancakeSwap, and interacting with their platform is practically a piece of cake. If you’ve not heard of them before, or would like to find out more about it before wading into its syrup-y goodness, go here for the lowdown. In this guide, we will walk you through the fun world of PancakeSwap, where there are various ways to earn some delicious sweetness at risk levels suitable for practically everyone.

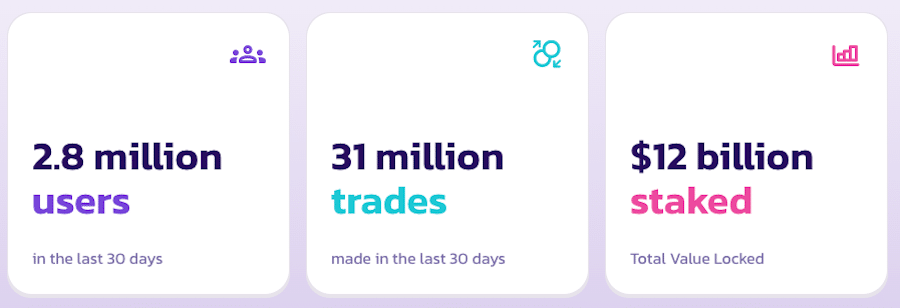

Impressive numbers Image via PancakeSwap Finance

Impressive numbers Image via PancakeSwap FinanceIntroduction

PancakeSwap is one of the top DeFi protocols on the Binance Smart Chain with some decent metrics. BNB tokens are used to pay for gas fees on this protocol. Users are rewarded with their native token CAKE that allows them to participate more fully by voting, playing lottery, and making predictions, just to name a few.

The first thing that caught my eye immediately when the homepage loaded is the cute sleepy-eyed bunny floating around with the bottle pack behind its back. This image alone is enough to convince me that the website designers surely have some intention of getting more women to jump onboard their platform. Given the skewed male-female ratio in the crypto world, the efforts from the design team at Pancake Swap is laudable, and I’m buying it! Ok, no more staring at cute bunny, let’s get down to business.

Welcome to PancakeSwap

Welcome to PancakeSwap Getting Started with PancakeSwap

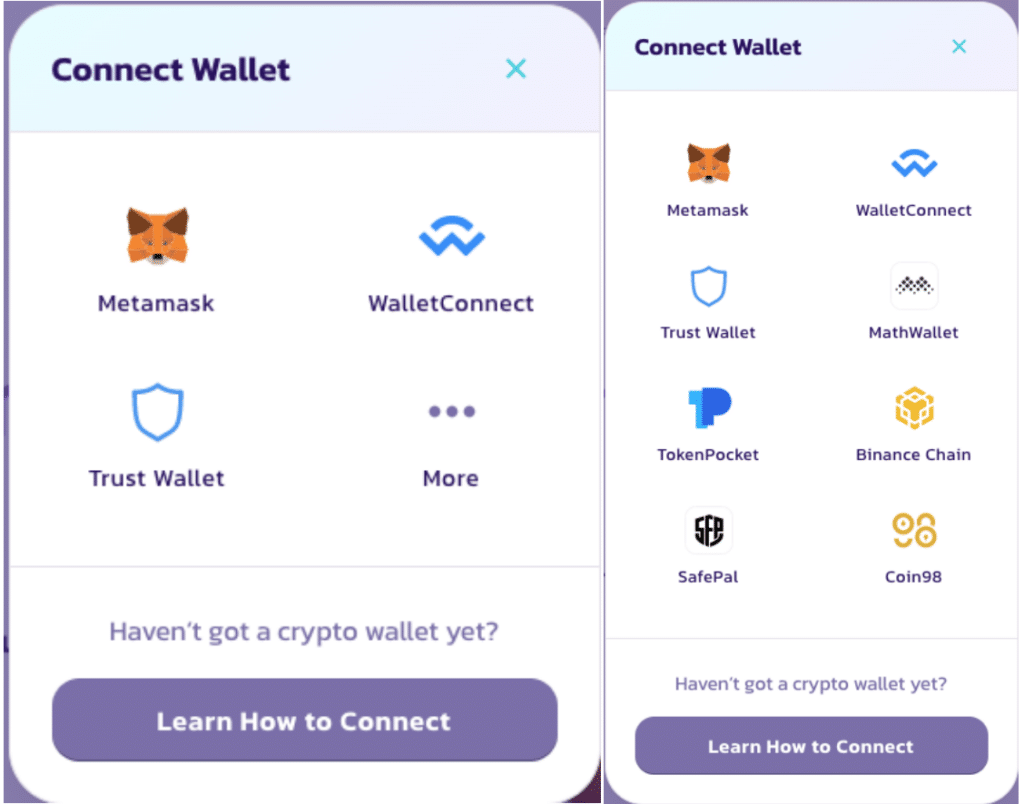

1. Connect Wallet

Connect a Web3.0 wallet with the platform. The usual suspects are here plus some minor players that are displayed upon clicking the three dots. There’s even a handy guide at the bottom to show you how to connect to wallets if you need help.

Choose your favorite wallets to connect with the platform

Choose your favorite wallets to connect with the platform 2. Customizing the platform for your experience. (optional)

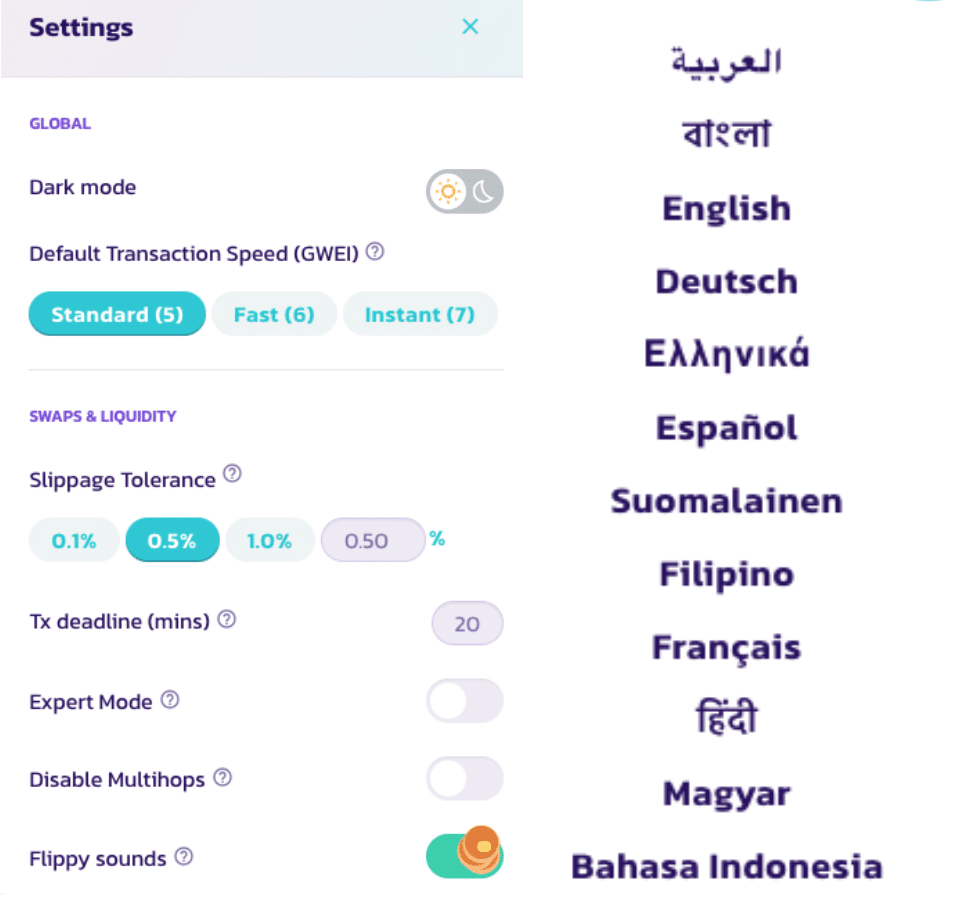

If you’re eager to get started, you can skip this step. However, taking a bit of time for customisation might make for more pleasing future engagement. Next to the price of the CAKE token is a globe icon for language selection. Scroll down if you don’t see your language. They have a good variety so it’s highly likely you will find what you’re looking for. The cogwheel icon next to it is the Settings icon. Hover your mouse over the mini Help button next to each setting for additional information about it.

Select your language and change settings where applicable

Select your language and change settings where applicable Slippage Tolerance - For those who are unfamiliar with the concept of slippage, it means that the order is fulfilled at a price different from what you expected. If it exceeds the tolerance level selected, the transaction will not go through.

Let’s say you want to swap 10 CAKE tokens for BNB. The price per CAKE token is $18.50. With a 0.5% slippage, you accept the price range of $18.40 - $18.59. Any transactions beyond that range won’t get put through.

Tx deadline (mins) - due to traffic jam writing to the blockchain, how long are you willing to wait before calling off the transaction?

Expert Mode - only for those who know what they’re doing.

Disable Multihops - Sometimes, swapping two tokens isn’t as straightforward as A to B. It might involve other tokens acting as a go-between. Disabling it means you’re only taking direct flights, no stopovers in between.

Flippy sounds - On by default (and they sound cute too!)

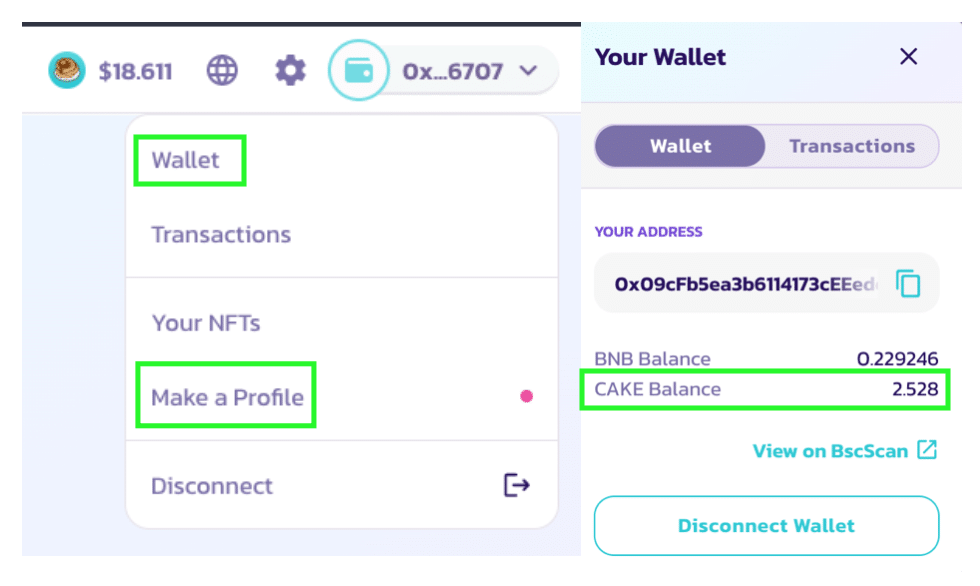

One other piece of prep-work you might need to do is to set a profile. You can do that by hovering the mouse over the wallet to reveal the dropdown menu. Here is also where you can check your past transactions and check out any NFTs you have in your collection. Since the profile set-up is part of the NFT section, I will go through it over there.

The guide is organised by lowest to highest risk to help readers of all risk levels get started as quickly as possible. A quick note: risk is defined as "the possibility of losing money", so the lower the risk level, the least likely you will lose money. If you know your risk level, feel free to skip to the ones that appeal to you. Now let the fun begin with (drumroll, please)…

Syrup Pool (Risk level 1)

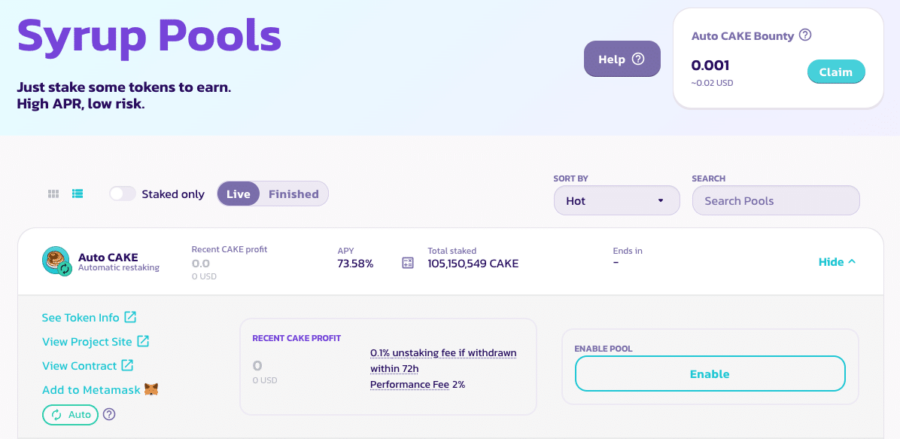

One of the easiest ways to experience the platform and have some skin in the game is by staking tokens in the Syrup Pool. Most of the pools have a limited time to allow people to stake their tokens in them, except for the CAKE pool which has no time limit. The pools also require you to do some manual farming, i.e. you need to click on the Harvest button. The only exception is the AutoCAKE pool that do the harvesting for you. It really is set-and-forget! The APRs, ranging from 50.15% to 132.55%, aren't too bad either, in exchange for little to no work needed on the users' end.

Take note of the 0.1% unstaking fee if you change your mind within 72 hours every time you manually deposit tokens to the pool. There is also a 2% performance fee for every withdrawal made, which they call yield harvest. CAKE tokens collected from these fees are burned to keep the token deflationary.

In the Syrup Pools, there is a special reward called Auto CAKE Bounty that incentivises users to stake in the Auto CAKE pool as they are seen to be providing a service to other users.

How to Get In (Adding to the Pool)

The idea of auto-compounding sits well with me so I'm going ahead by clicking the Enable button to gain access to the pool. There is a $0.12 transaction fee which I pay through the Metamask wallet.

Yummy Syrup that makes CAKE taste soo much better

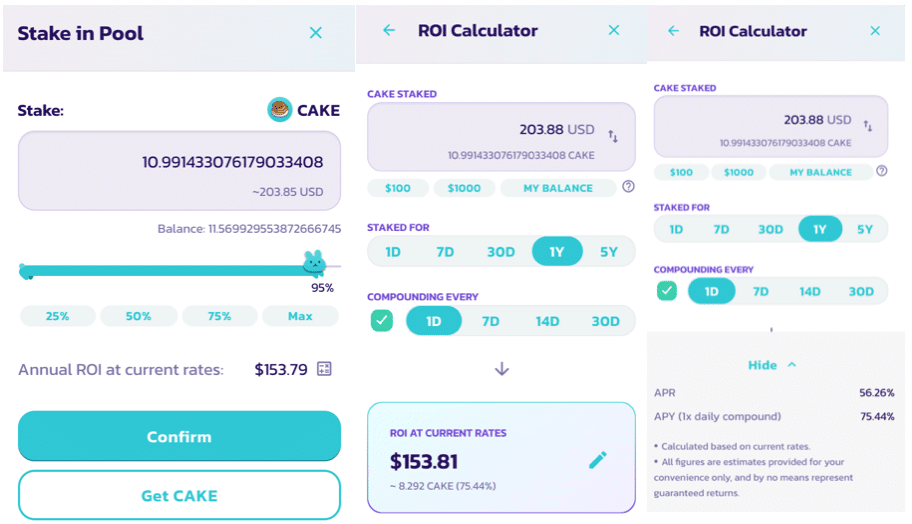

Yummy Syrup that makes CAKE taste soo much betterOnce enabled, I click the Stake button and am greeted with a pop-up window asking for input. While it's possible to type the amount I want, it's just a lot more fun using the bunny slider, which was what I did. Based on the amount intended for staking, the platform calculates the annual ROI at current rates.

Look how much I can get for doing nothing!

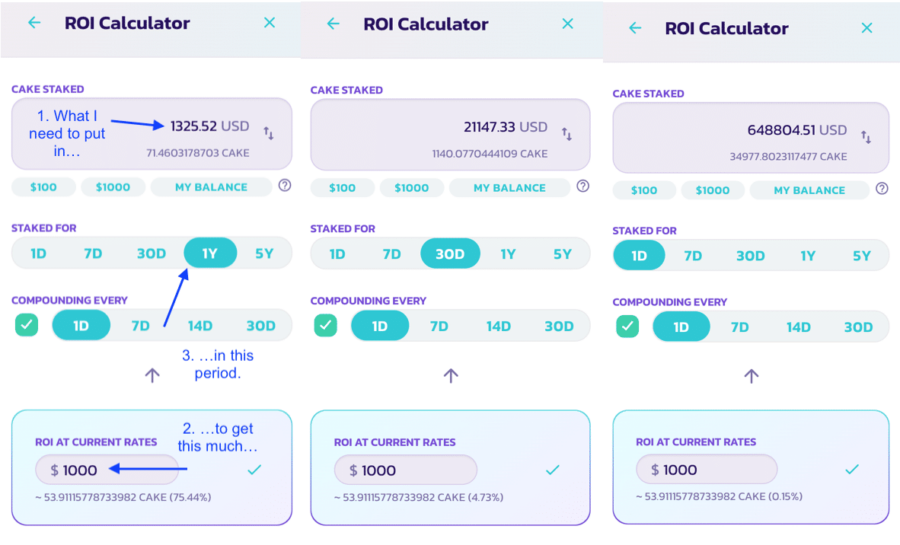

Look how much I can get for doing nothing!Another cool feature about the calculator icon next to it lets you key in your desired ROI so you can see how many tokens you would need to stake to make that amount of money.

You get what you put in

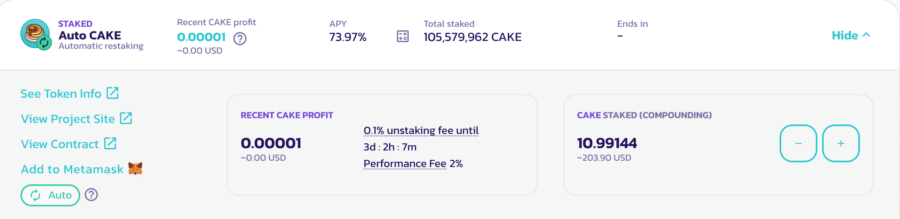

You get what you put in I went ahead to confirm the amount to stake, paid the gas fee, and voila! I'm in the game.

Let's start earning, baby!

Let's start earning, baby! If you choose to join the manual CAKE pool, you will also get Syrup tokens, which are basically IOUs to prove you own the CAKE tokens. These will be returned to the platform when you withdraw from the pool. It's important that you have the same amount of Syrup tokens as the CAKE tokens you want to withdraw.

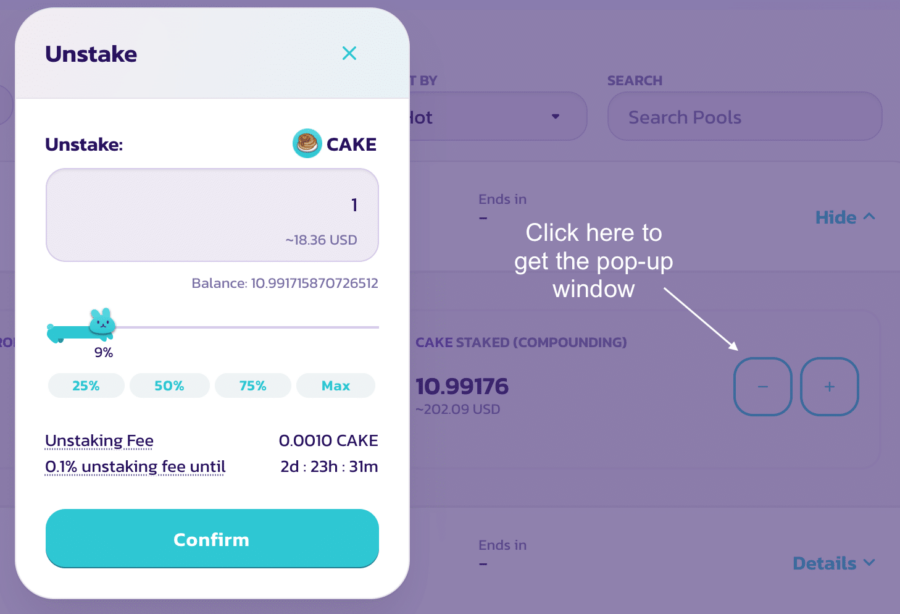

How to Get Out (Removing from the Pool)

Getting out is also easy. Simply click the '-' button and enter / use the bunny slider to key-in how much you want to take back. The Unstaking Fee is calculated in CAKE. Click Confirm to continue.

Getting out safely and easily

Getting out safely and easily After clicking Confirm, you will need to pay the gas fee to complete the transaction.

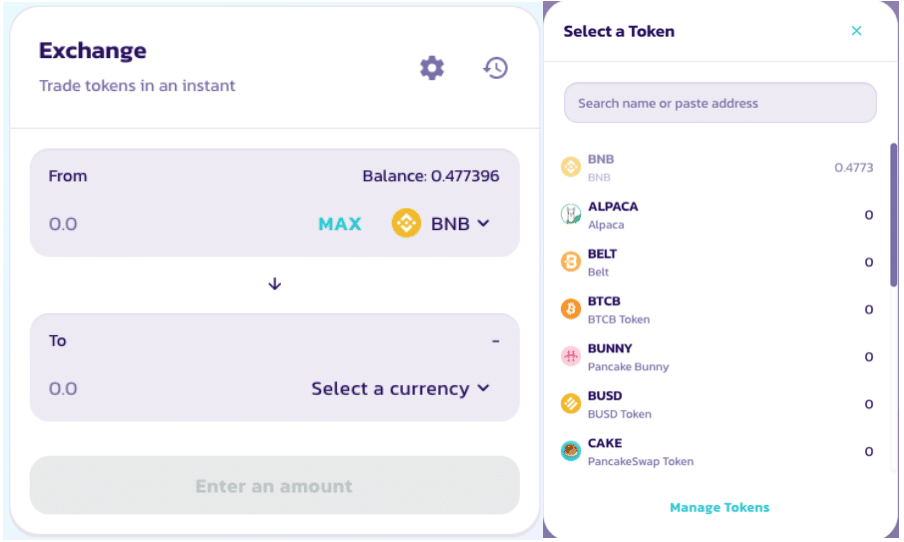

Trade | Exchange (Risk level 1)

Exchange is for swapping one token for another. To swap, the top section is what the token you want to get rid of. The bottom section is the token you want to acquire. By default, the protocol displays tokens only on the Binance Smart Chain.

Choose the pair of tokens to swap

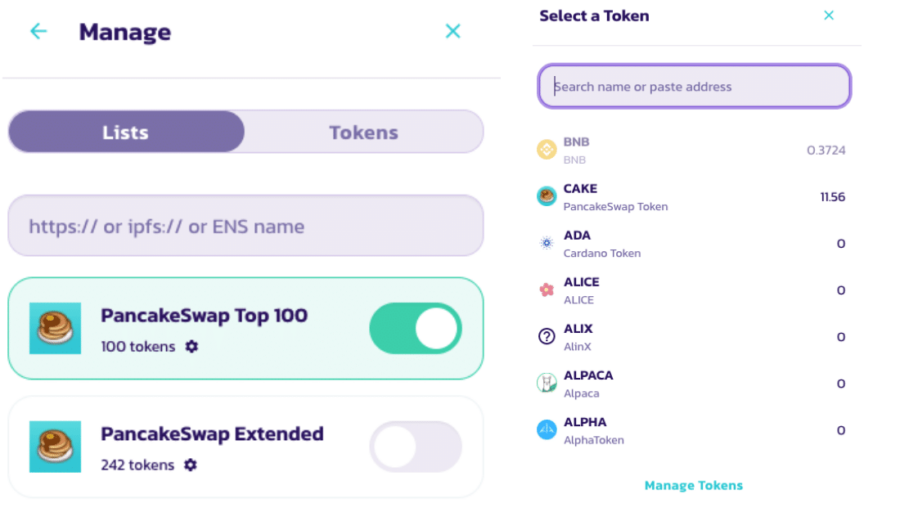

Choose the pair of tokens to swap If you want to see more tokens on the list, there is the option to add them through the Manage Tokens function. Selecting either the PancakeSwap Top 100 or PancakeSwap Extended would generally yield what you might be looking for. You can also import lists of tokens by its IPFS or ENS name.

More tokens to choose from

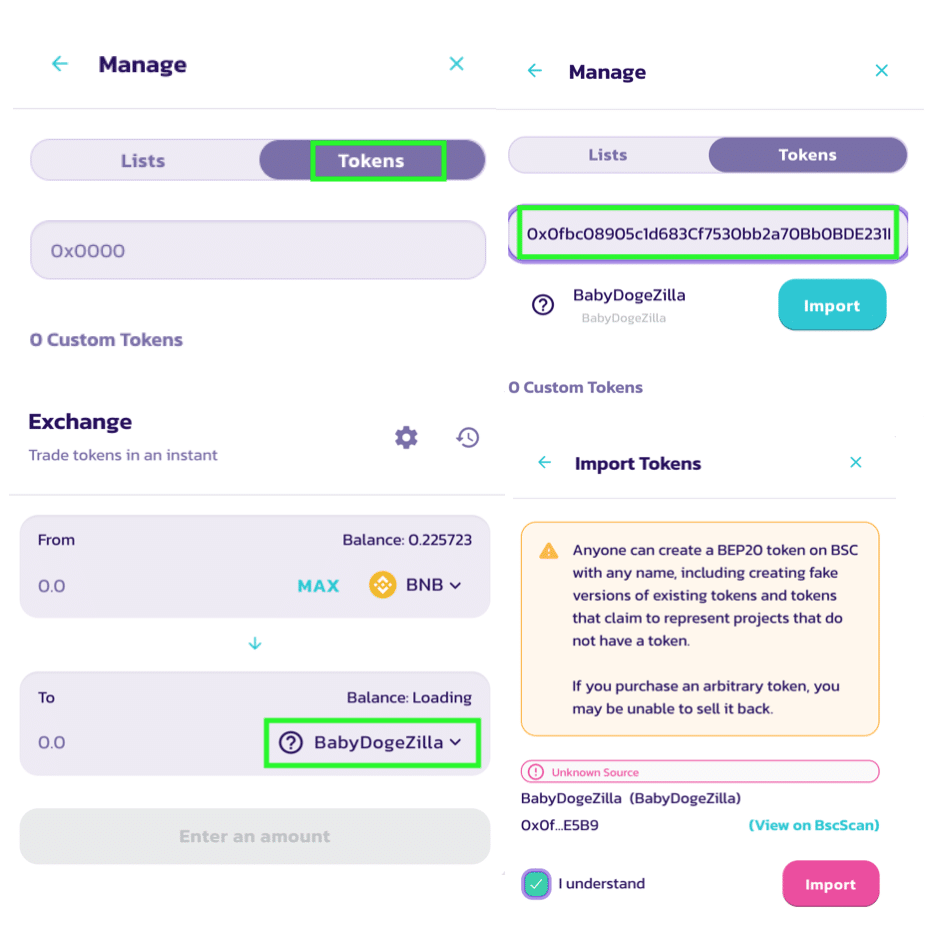

More tokens to choose from If you have a particular token in mind that you'd like to swap for that's nowhere in the list, click on the Tokens tab and enter the token's Contract number into the field. Once it appears, click the Import button to proceed to the next step. A warning will appear. This is a good time to check that the token you intend to swap to is a legit one. It pays to verify it on BscScan just in case. Click Import if you're really, really sure. It will appear on the list and be available for an exchange.

Be careful when adding an unknown token to the list.

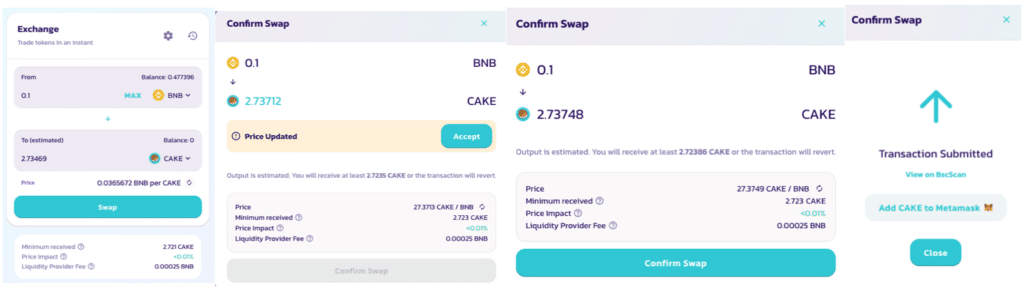

Be careful when adding an unknown token to the list. By clicking on the Swap button, I now have a chance to confirm whether I want the trade to happen. If there are changes to the price, it will also be reflected here, giving me another chance to say yay or nay. After I've accepted the price, the Confirm Swap button lights up. I accept the confirmation via my Metamask wallet, and the swap is complete. I can also view the transaction on the Binance Smart Chain.

The swapping process

The swapping process Price Impact refers to how this order impacts the availability of tokens available in the liquidity pool. The smaller the order, the less impact it will have.

The Liquidity Provider fee is a 0.25% fee, broken down as follows:

0.17% - for liquidity providers

0.03% - for the Pancake Swap Treasury

0.05% - for buying back CAKE to be burnt.

Trade | Liquidity (Risk Level 2)

If you want to give liquidity pools a try, this is the place to do so. If you're new to the concept of liquidity pools, you can watch this video to learn more together with its associated risks. In summary, you can be a liquidity provider by putting forward a pair of tokens of equal value with each other. Others will be able to borrow from this pool and pay fees which you can earn by being part of the pool. You get liquidity provider (LP) tokens that act as proof of your participation in the pool which are deposited into your wallet. Simply return them to the platform to get your staked tokens back.

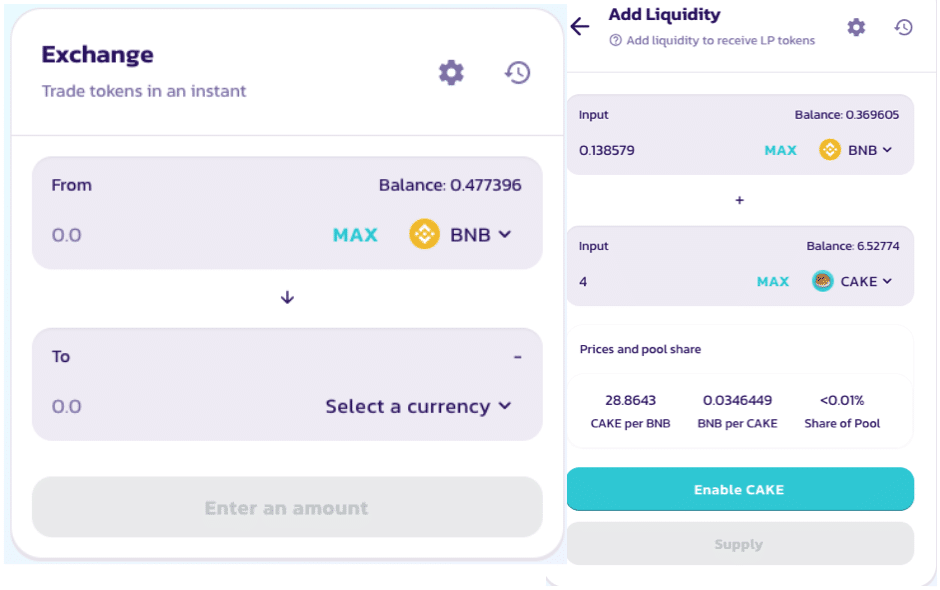

Click on the +Add Liquidity button to get started and select the pair of tokens you want to be a liquidity provider for together with the amount involved.

Joining in the liquidity pool

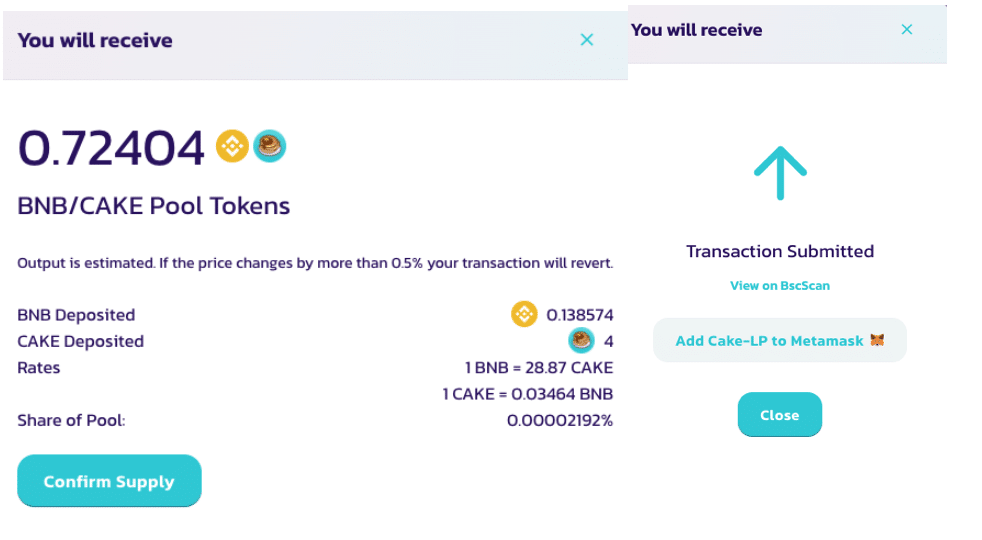

Joining in the liquidity pool Enable CAKE to confirm participation of the pool. You can also see your share of the pool with what you are planning to offer. The 0.17% liquidity provider fee will be distributed to each contributor of the pool proportionate to their share.

Check everything looks good and click Confirm Supply

Check everything looks good and click Confirm Supply Once you have the LP tokens in your wallet, it's time for it to earn its keep by putting it to work in a ...

Farm (Risk level 2)

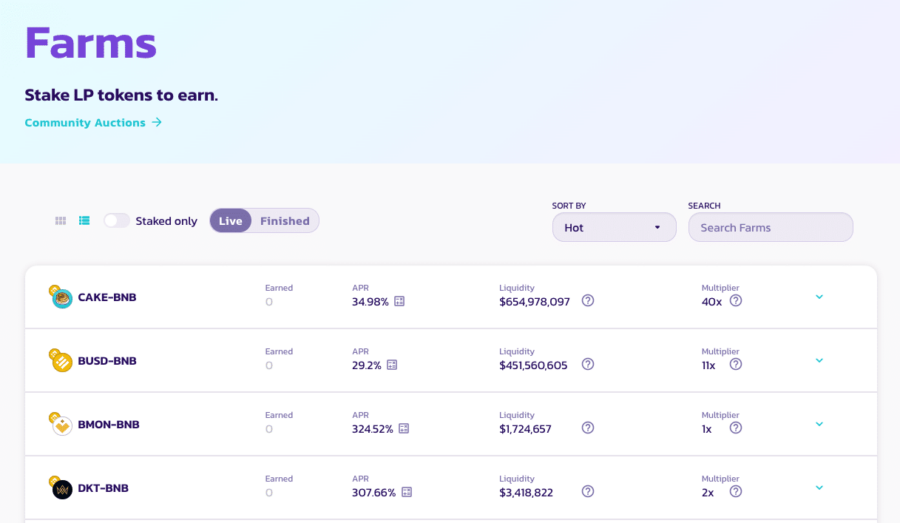

We have a list of the farms available to earn more money from. What you’ll earn is the CAKE token. The main factors affecting the rate of exchange include the annual percentage rate (APR), liquidity, and Multiplier. Hover the mouse over the mini Help icon for a description of the Multiplier which mainly deals with the number of CAKE tokens produced in this farm. You can also sort the list by Hot, APR, Multiplied, Earned and Liquidity metric in the Sort By dropdown list. If there is a particular farm you’re looking for, put in the LP token in the Search section.

List of Farms available to plant seeds in

List of Farms available to plant seeds in The ROI calculator (same as the one seen previously) is also available here to help you calculate your potential ROI. It is next to the APR rate.

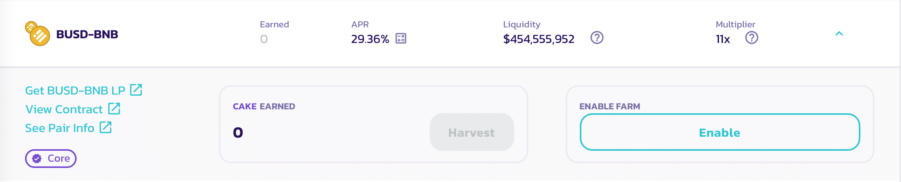

How To Farm

To get started, select the farm you want to be a part of by clicking on the Enable button. Pay the gas fee associated with gaining access to this plot of farming land. The Enable button changes to Stake LP button.

Gain access to the farm you want.

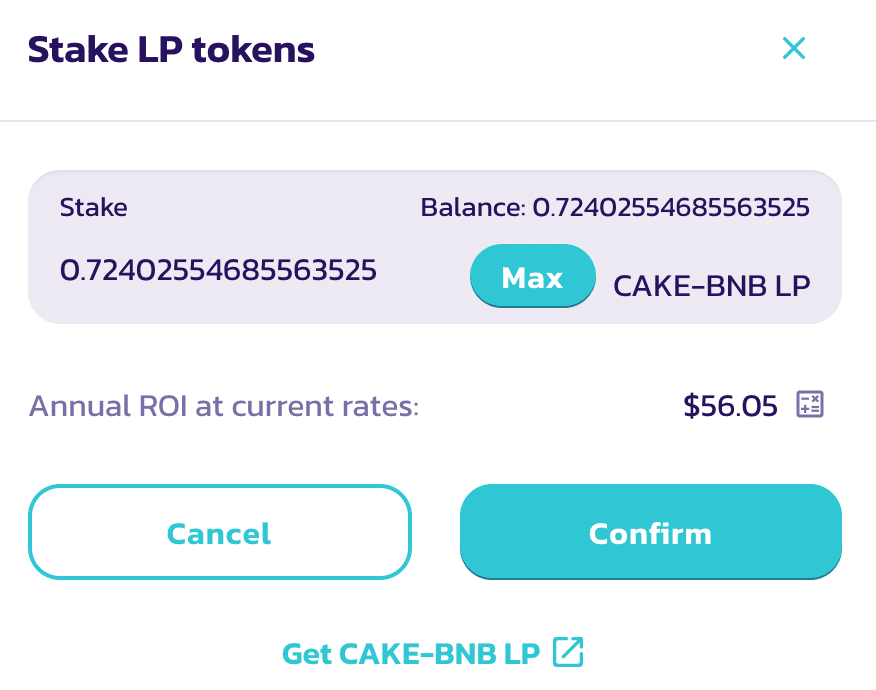

Gain access to the farm you want. Click the Stake LP button to confirm the amount of LP tokens you want to stake.

Stake 'em, grow' em!

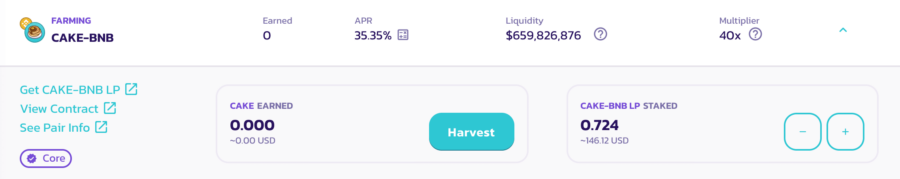

Stake 'em, grow' em! Congratulations! You're officially a farmer. Don't forget to harvest the tokens when they're ready! Watch out for the harvest fee though. While it's up to you to decide when to harvest, it's worth keeping in mind what you'd like to get after the fees are deducted. Different wallets may have slightly differing fees.

Wait for your crops to grow.

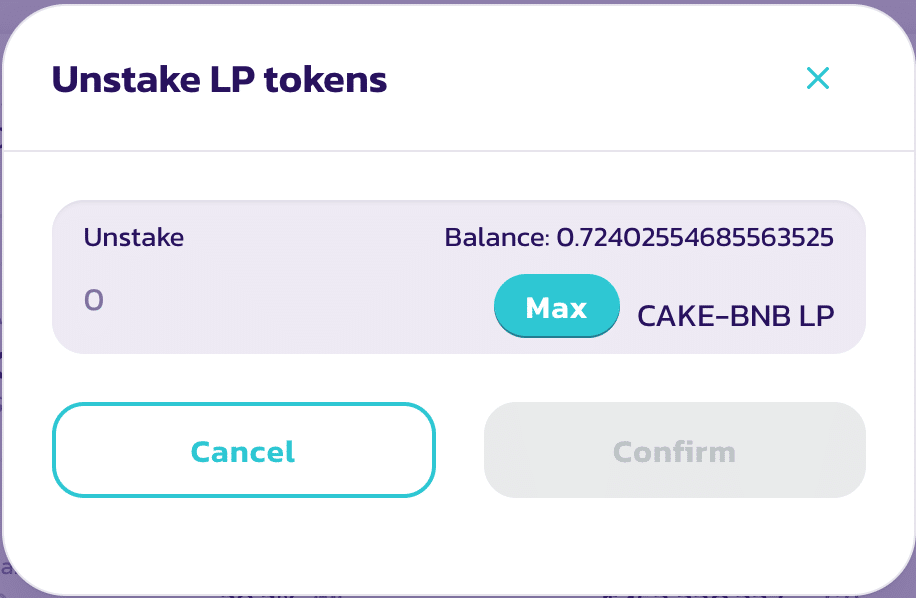

Wait for your crops to grow. Adding/Removing LP Tokens

If you'd like to add or remove the LP tokens, click the '-'/'+' button and a window pops up for you to key-in what you want to do. Add/remove tokens manually or use the MAX button to add/remove all the LP tokens.

Remove your tokens here

Remove your tokens here Initial Farm Offerings (IFO)

Be one of the first to get your hands on some brand-spanking new PancakeSwap tokens as soon as they are available. As you know in crypto, early adopters take the most rewards! These IFOs are available for a limited time only, so check back regularly for the appearance of new farms.

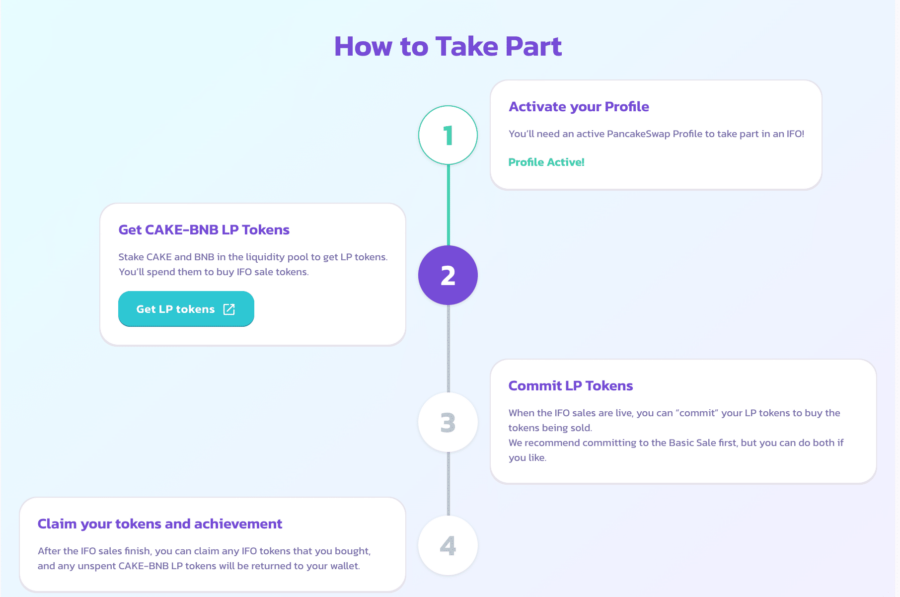

The guide down is a mini-roadmap showing you how to take part. Basically, the steps are:

- Activate your Profile. Scroll down this article to learn about this in the Set Up a Profile section.

- Get CAKE-BNB LP tokens. These are needed as currency to buy the IFO sale tokens.

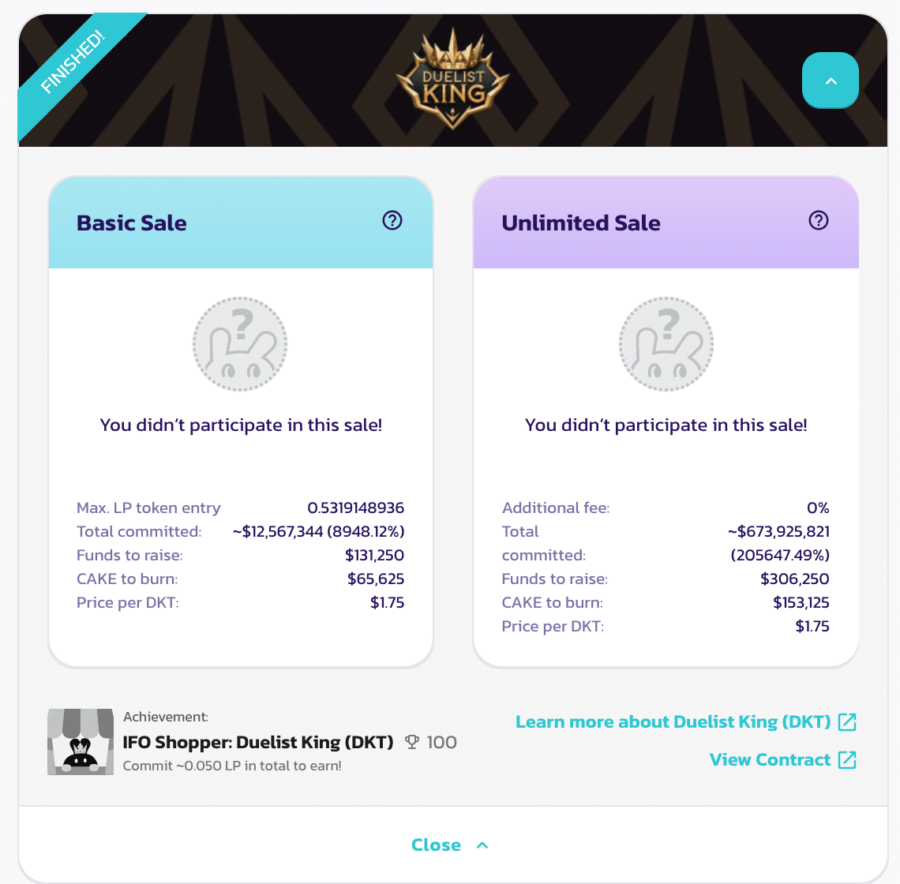

- When the IFO sales are live, use the LP tokens to swap/buy the new tokens on sale. There are two kinds of sales: Basic and Unlimited.

Basic Sale limits the number of LP tokens that can be committed but each token yields a higher return. Unlimited Sale, as the name suggests, puts no limit on the number of tokens committed, but additional fees will be charged. - Last but not least, claim the IFO tokens bought when the sale is finished and the unspent LP tokens will be returned to your wallet.

How to take part in new farm offerings

How to take part in new farm offerings An example of a Initial Farm Offering (IFO)

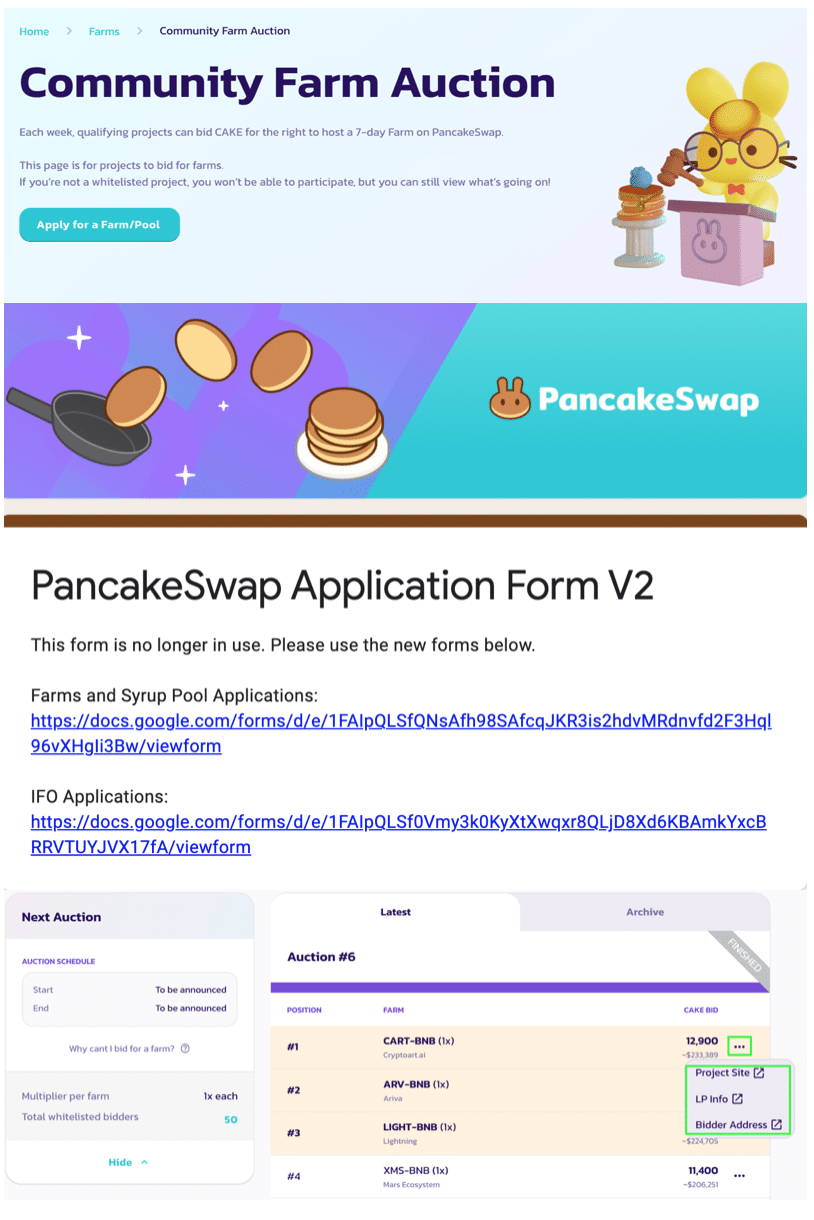

An example of a Initial Farm Offering (IFO) Community Farm Auction

Another way to participate in the Farm section without being an actual farmer is to bid for the right to host a Farm on PancakeSwap for 7 days. If you're interested, click the Apply for a Farm/Pool button to get started. This will lead you to two GoogleDoc forms. Select the one that represents the type of farm you want to operate and fill out the form. Only approved projects will be able to bid for a farm to be set-up in PancakeSwap. CAKE tokens are required for the bid. You can always take a peek at current bids for new farms too. Select the three buttons next to a farm you're interested in to find out more.

List of farms bidding to get set up to issue LP tokens.

List of farms bidding to get set up to issue LP tokens. Prediction: Beta version (Risk Level 4.5)

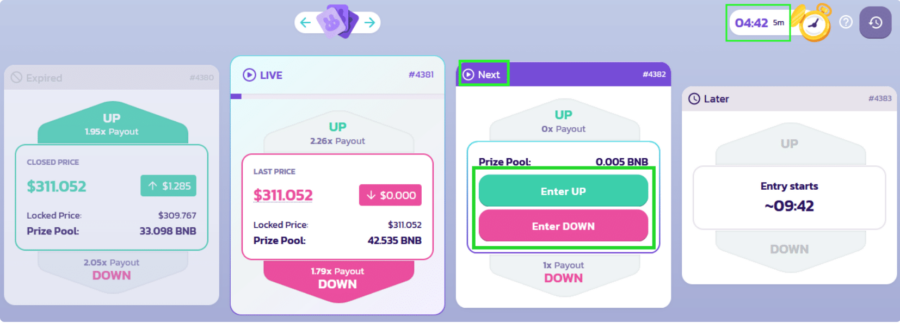

If you fancy yourself to be a dab hand with the market charts, test yourself by making predictions on the BNBUSDT price during one of several rounds by putting down CAKE tokens to back up your guess. If you guess right, you could stand to win a nice chunk of change. If not, there's always the next round. Since this product is still in Beta, you need to sign a T&C saying you understand the risks involved. Also, once you've decided on your position and put down BNB to back it, you can't change your mind, so bet carefully!

Here's how it works:

- If you click "UP" and the closing price is higher than the locked price at the end of the 5-min round, you win! If not, you lose.

- If you click "DOWN" and the closing price is lower than the locked price, you win! if not, you lose.

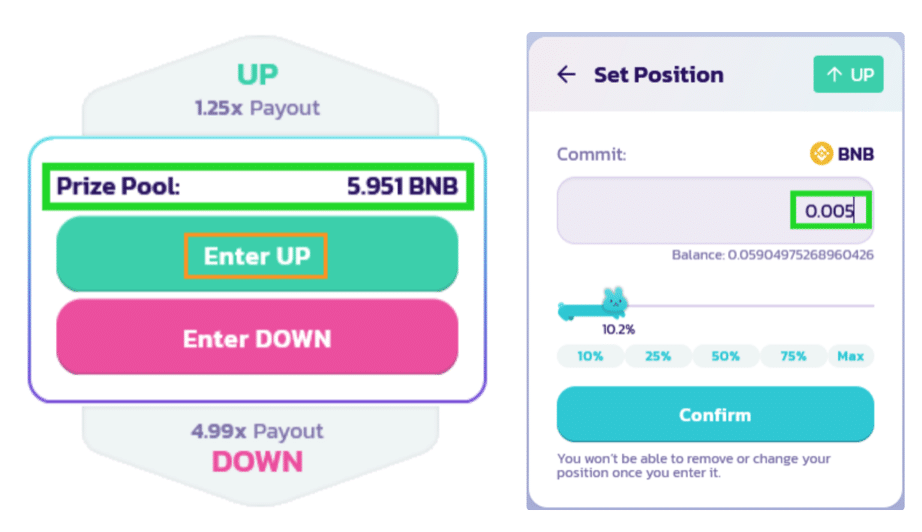

How to make a prediction

Before you begin, check the timer in the top-right area. Make sure you have plenty of time left before making a prediction. Give yourself at least a minute or so. Next, select "UP" or "DOWN" in the upcoming round marked "Next".

Make predictions before time runs out

Make predictions before time runs out Each pool carries different level of rewards known as reward multiplier. This changes based on people's predictions, reflected in the "Prize Pool", just above the buttons. Let's go with UP. This brings up a new window, asking you to "Commit" some BNB to back up your prediction. Enter, click the percentage button or slide in your bets. Click Confirm when you're satisfied.

Place yer bets!

Place yer bets! There will be a short wait to ensure there is enough time to participate in the upcoming round. If successful, the "Entered" message will pop up. You're ready to go! You can watch the price update during the 5 minutes if you like. However, it is not possible to change your mind once your bet is in.

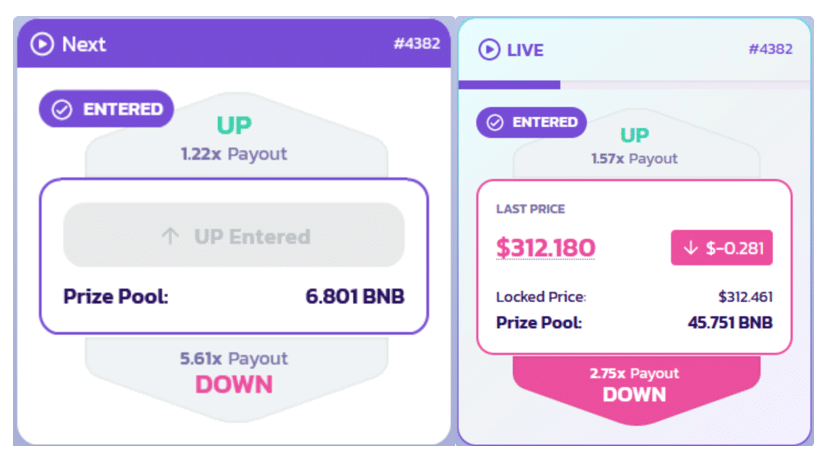

Will I be right? Yes? No?

Will I be right? Yes? No? The Results

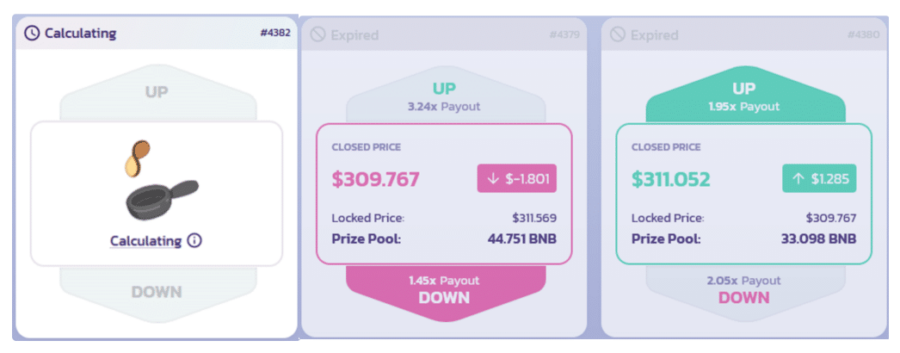

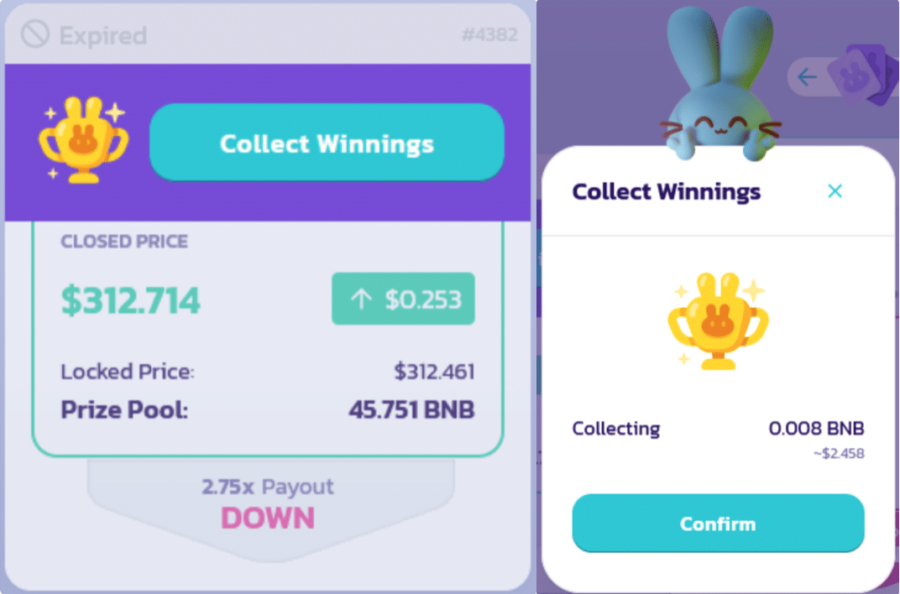

After the 5 minutes is up, the results get calculated, indicated by the "LIVE" window changing to "Calculating" to "Expired". The results will be displayed either as a green up arrow or red down arrow.

The moment you've been waiting for

The moment you've been waiting for Viewing Past Results

It's likely that you may step away for a while, or a long time, from the Predictions page and missed out on seeing the result when it is announced. Fear not, there's a way to reverse time (sort of)!

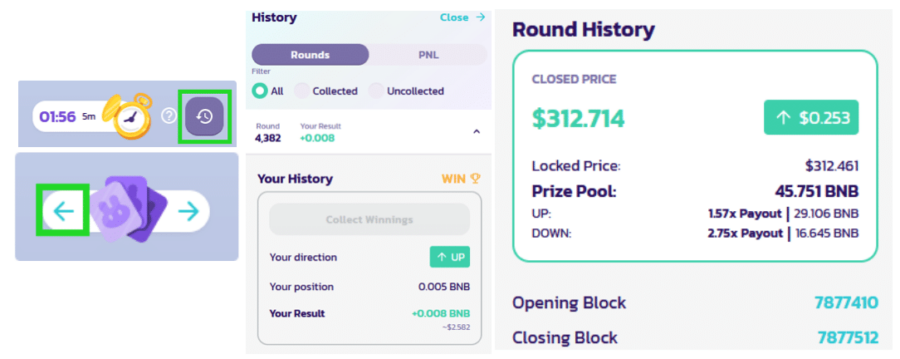

Click on the left/right arrows next to the bunny icon or the icon next to the timer. The "History" panel pops up with information on the most recent round together with any winnings you might be eligible for. Click on the round for more information.

A historical record of previous bets placed.

A historical record of previous bets placed. Collecting Past and Present Winnings

If you are the grand winner of the round, you get to click on the Collect Winnings button. A new window pops up showing you your reward. Click the Confirm button to collect the money into your wallet. From the History window above, you can also check for winnings from past rounds and collect them too.

Money money please hop in.

Money money please hop in. Viewing historic wins and losses

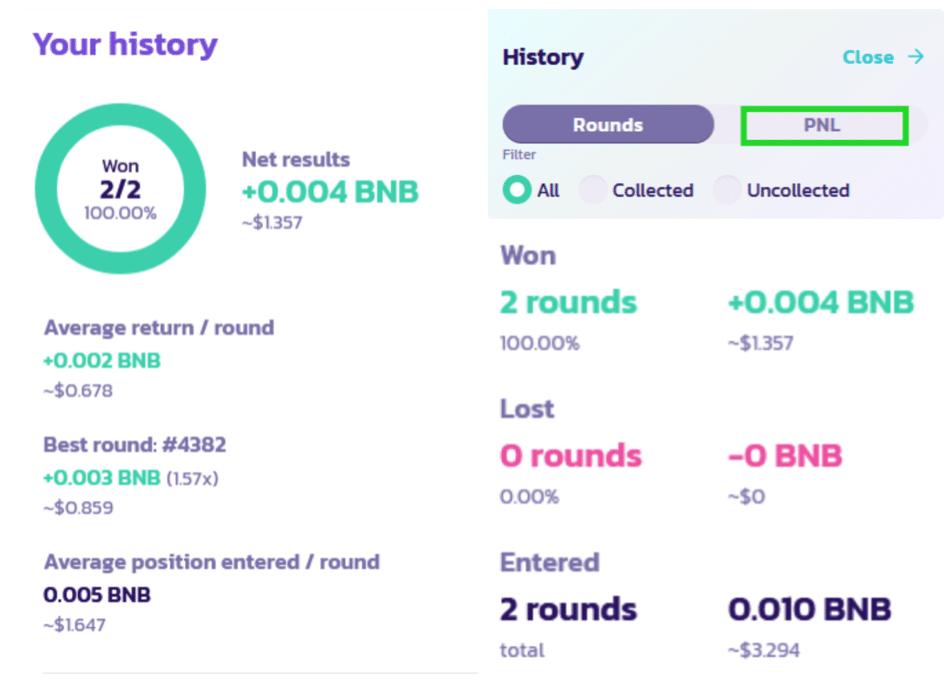

If you have done more than your fair share of predictions and want to know what your track record looks like, click on the PNL tab in the History window. You'll see some stats to give you an idea how (un)successful you were. Perhaps these stats can help you up your game in the future?

Your track record of past predictions

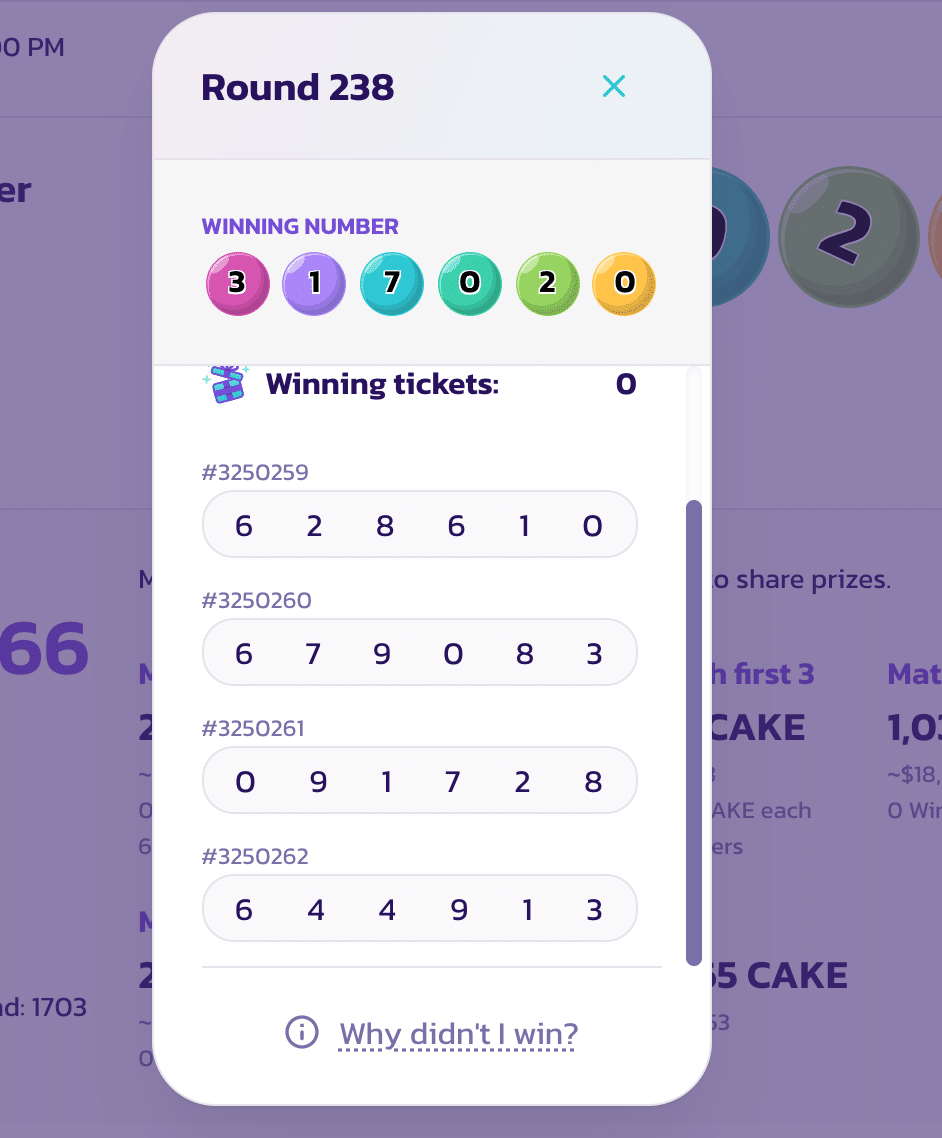

Your track record of past predictions Lottery (Risk Level 5)

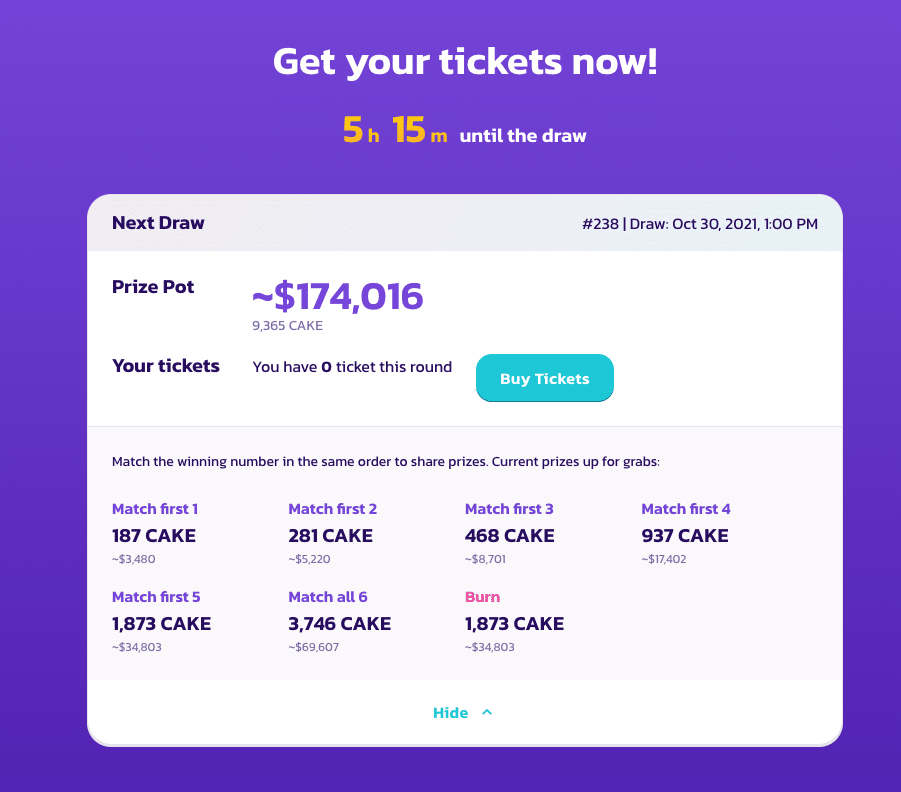

This is nothing more than going to the casino and having a roll of the dice on roulette. The chances of losing your money is very high. However, if Lady Luck is passing by in your neighbourhood, it's worth a shot! There is a fixed number of tokens for each pool. More winners in a pool means less tokens for everyone.

Feeling Lucky?

Feeling Lucky? Here's how it works:

- Click Buy Ticket -> Enable button to gain access to this product.

- Each ticket costs about USD5 in CAKE tokens. You get a discount for buying more.

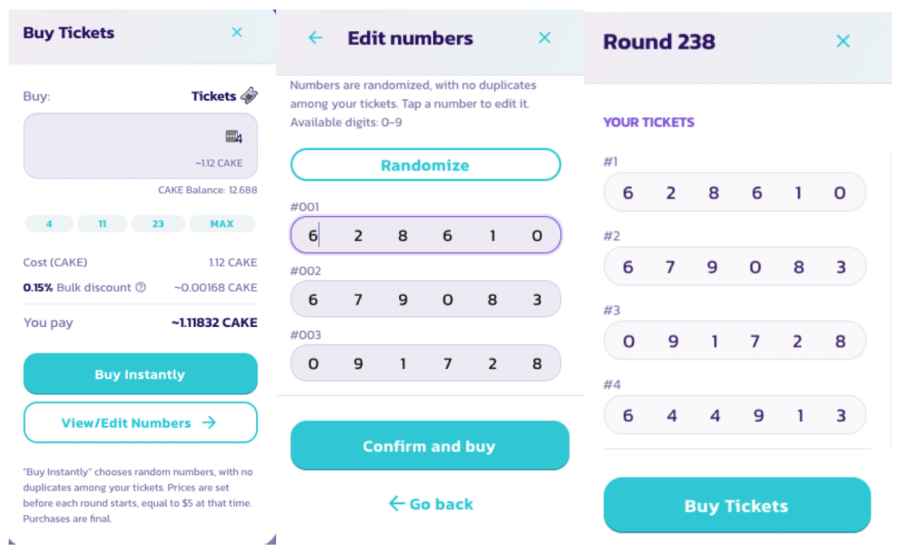

- You can choose to Buy Instantly to generate a random 6-digit number or put in your lucky numbers to feel more in control.

I leave my Fate to faith.

I leave my Fate to faith. - Match your number with the one revealed in order from left to right. While it's great that you can win a prize with just the first digit, it's always better to have more matches for a higher prize.

As it turns out, better luck next time!

No matches of the first number.

No matches of the first number. PancakeSwap Analytics

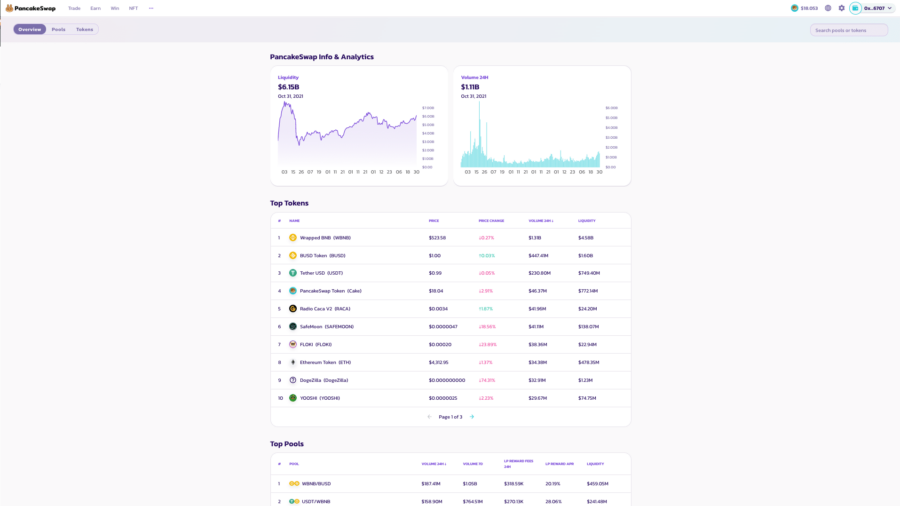

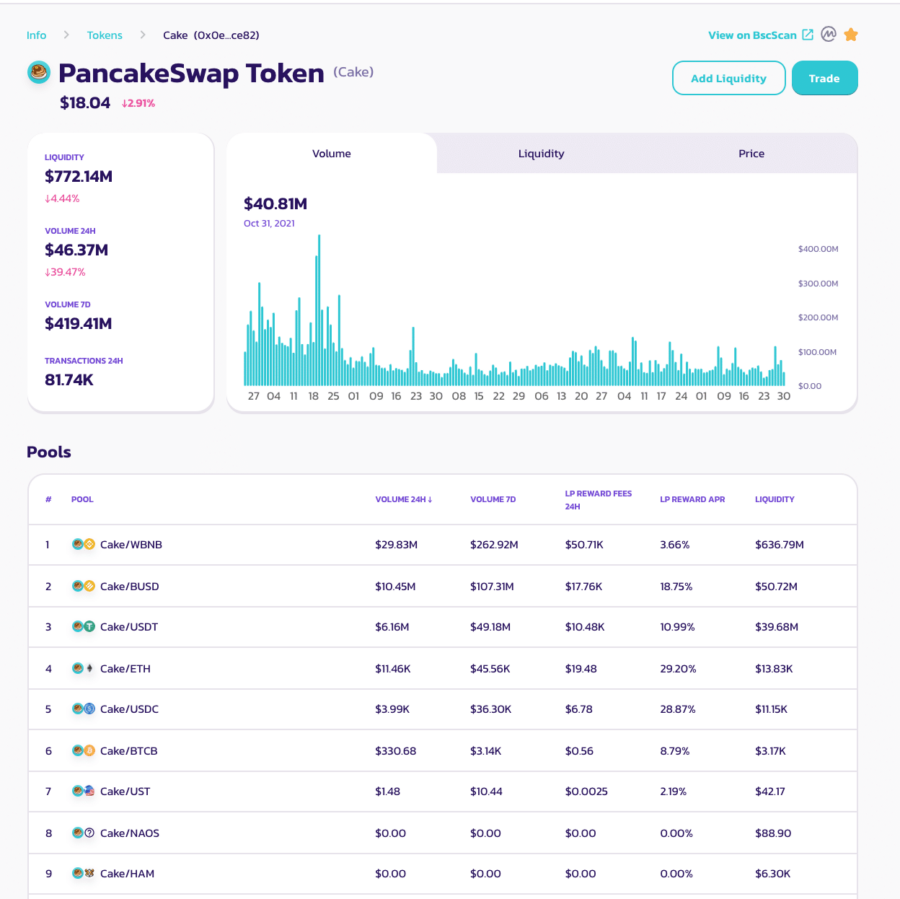

PancakeSwap has their own analytics page to help users gain a clear picture of the state of things in bunny land. These stats are categorised in three ways: Overview, Pools, and Tokens.

Overview

As the name implies, this is the general picture consisting of the following 5 elements: liquidity, 24H volume, top tokens and top pools, ordered by the 24H volume, and all transactions in bunny land in the interest of transparency. These transactions can be further filtered by swaps, adds, and removes. If you know what you're looking for, you can also search for it through the search bar on the top-right corner.

The lowdown of what's happening in bunny land

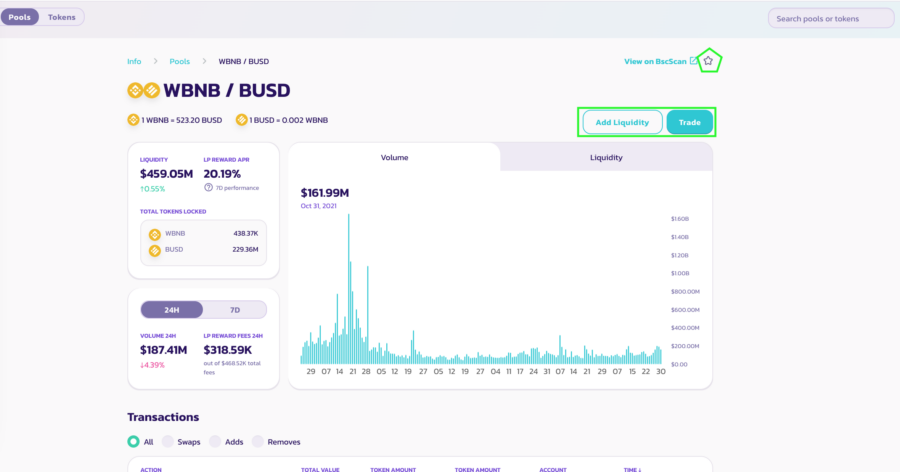

The lowdown of what's happening in bunny land Pools

This section gives you the list of pools similar to what you see in the Overview section. Clicking on an individual pool leads you to a more detailed view of it. There is a Add Liquidity button and Trade button, making this a one-stop place to do everything you need. You can also save this to your Watchlist by clicking on the star button at the top-right corner of the page.

One-stop place for all things pool-related

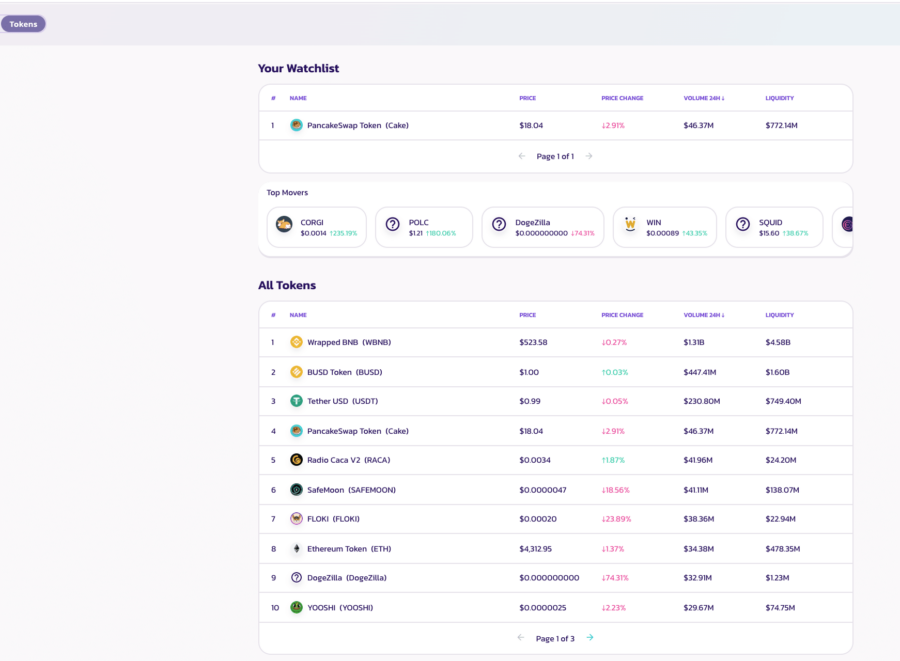

One-stop place for all things pool-related Tokens

Just like the Pools section, this area is all about the tokens. Individual stats for each token including the pools that use them and transactions are also visible here. Current top movers are also shown here.

Looking for a top-moving token? Find it here!

Looking for a top-moving token? Find it here! Learn more about your favourite token here

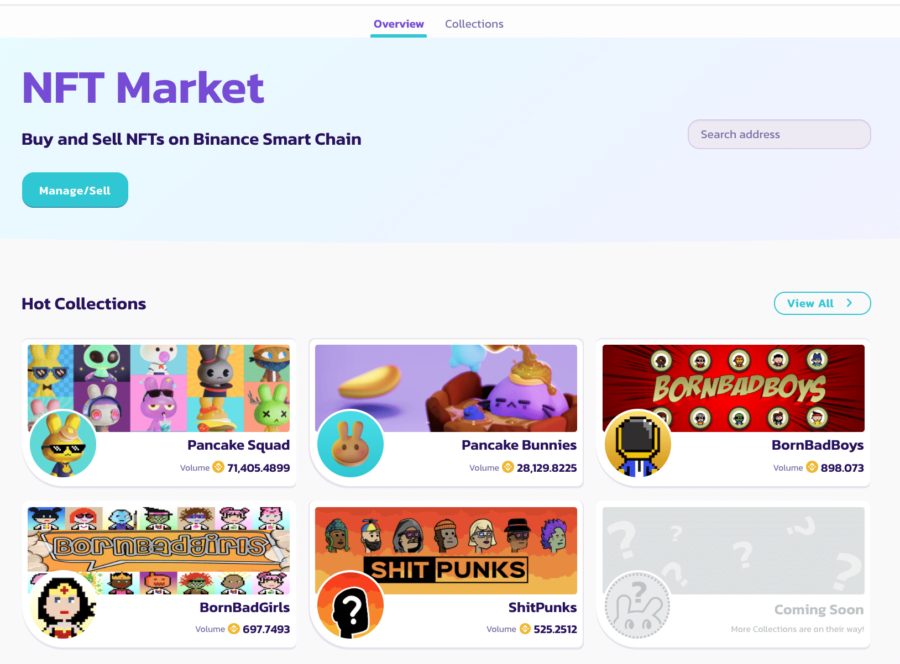

Learn more about your favourite token here NFT Market

The team at PancakeSwap knows that not everyone is a yield-chasing farmer. With the amount of work they've put in to design the webpage for maximum cuteness, it makes perfect sense to monetize that cuteness to bits by offering bunnies (and other types) for sale in their own NFT Market. Without further ado, let's go (I can't wait to get my hands on those bunnies)!

Overview

The main page gives you an idea of the kinds of NFT collections available in the market. These collections aren't exclusive by any means (most of them are on OpenSea), but you might be able to snag one at a good price here, especially for the ones designed by the PancakeSwap team.

Welcome to the market!

Welcome to the market! Collections

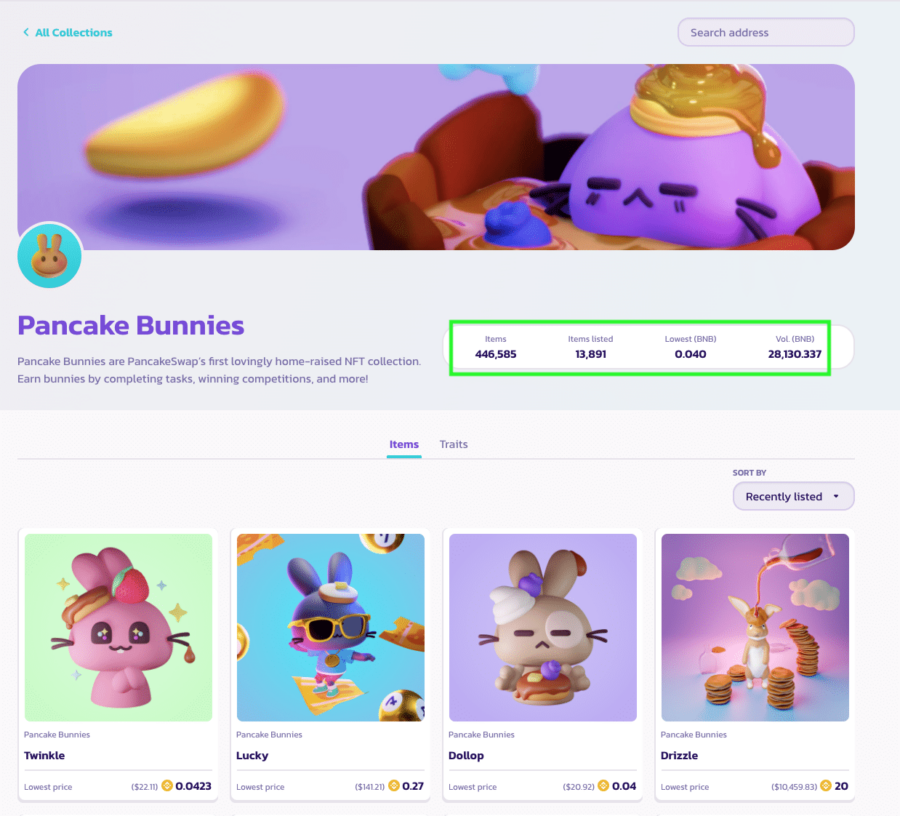

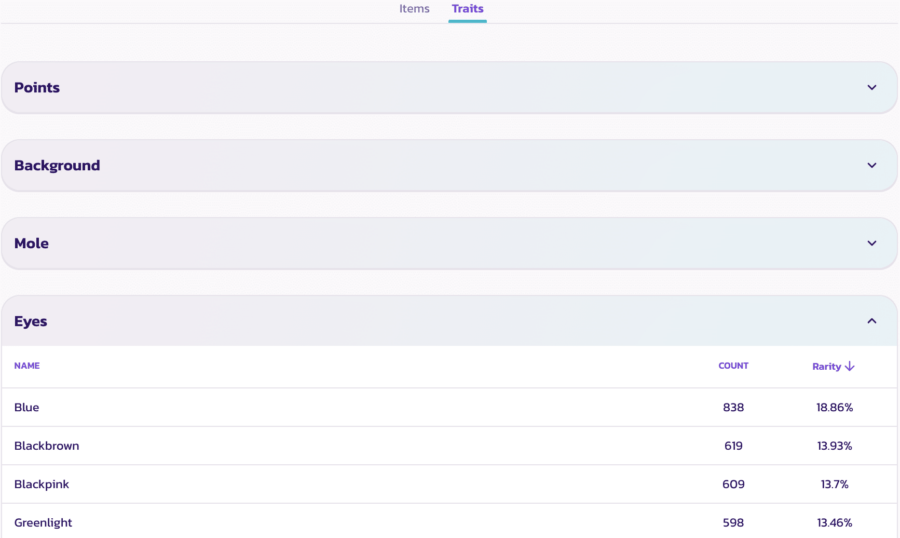

The first collection I want to find out more about are the Pancake Bunnies. Each collection has 4 main stats: number of Items, Items listed, Lowest value and trading Volume (in BNB). Click on the Traits tab to see the bunnies sorted by rarity together with their corresponding prices.

So here's where all the bunnies hang out... Why's that bunny worth 100BNB?!

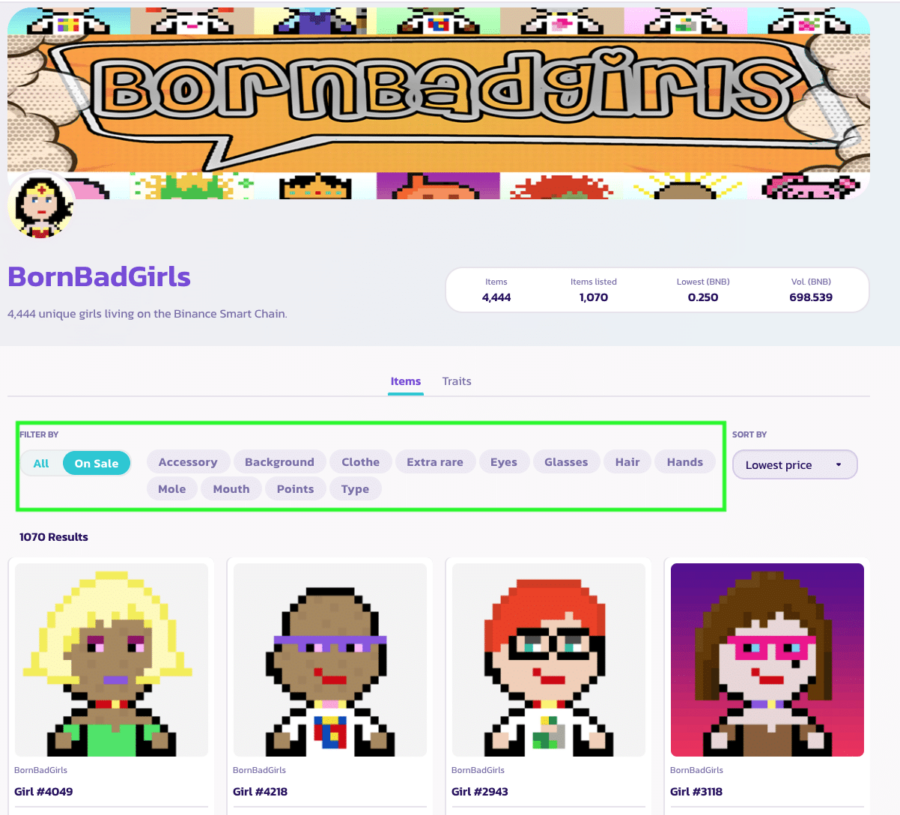

So here's where all the bunnies hang out... Why's that bunny worth 100BNB?! Other collections that are more similar to the CryptoPunks style can be filtered by other characteristics such as hair, eyes, accessory etc. Here's an example with BornBadGirls (yeah, girls rock!).

All girls are a combination of traits that make them unique.

All girls are a combination of traits that make them unique.  All traits individually sorted by rarity.

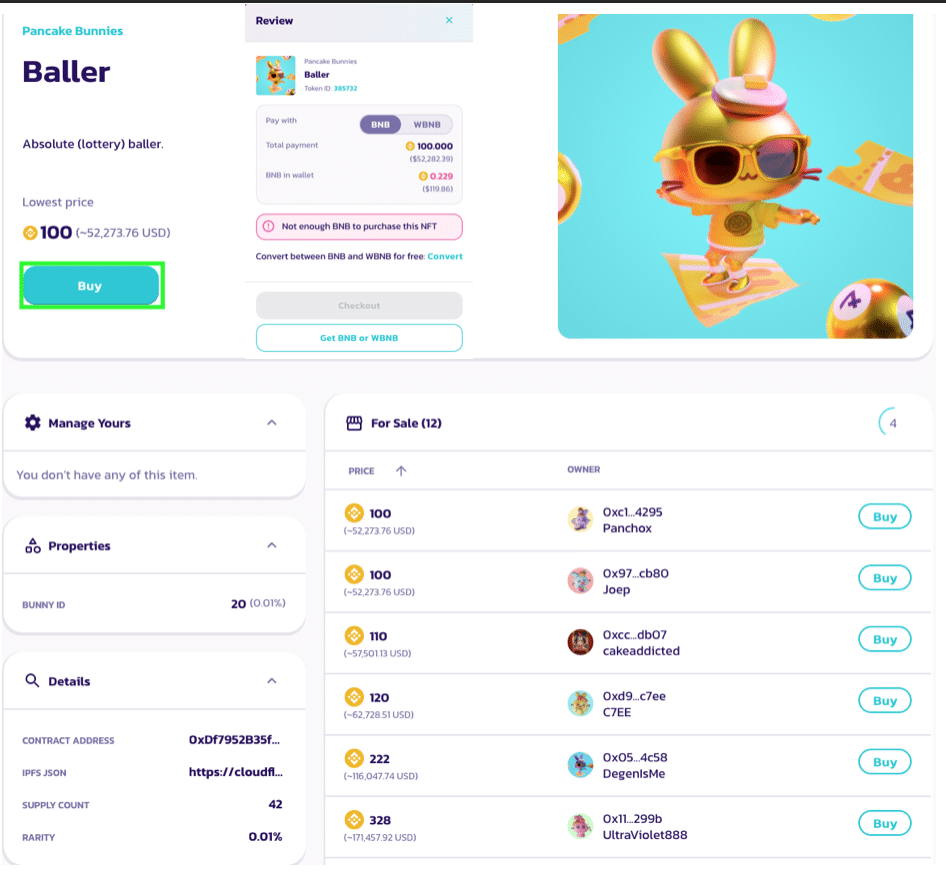

All traits individually sorted by rarity. Clicking on the individual bunny (ahem, item/character) gives you some detailed stats and who's selling in case you'd like to buy from them, as opposed to buying it directly from the platform. However, it doesn't mention the reason for the rarity, which would be nice to know. It is possible to find out based on analysing the traits but that's a roundabout way. My best guess is the low supply count number.

The most expensive bunny in the collection

The most expensive bunny in the collection Now that you've gotten a glimpse of the rarity factor for each Item, it's time to get our hands on one of them! To do that we need to activate our profile.

Setting Up a Profile

Hover the mouse over your wallet connection and go to "Make a Profile". You can also check your wallet to see how many CAKE tokens you have.

Check to see if you need to make any top-ups to your wallet.

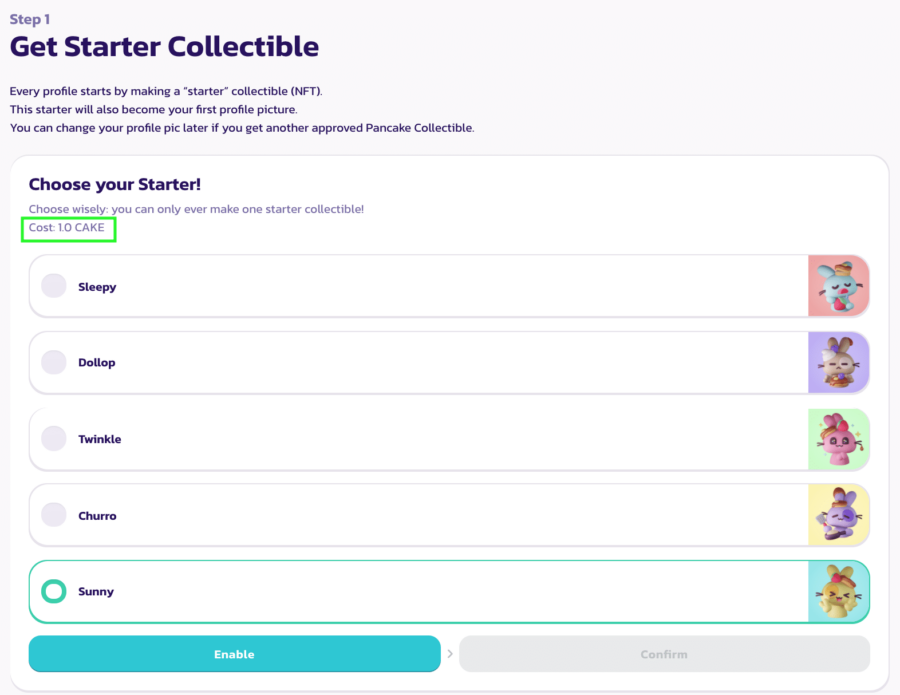

Check to see if you need to make any top-ups to your wallet. After clicking on "Make a Profile", you'll be greeted with the first step, picking a NFT as your profile avatar. If you'd like to take a look at the stats for the characters offered, feel free to go to the Pancake Bunnies collection and check them out. Once you've decided which one takes your fancy, make your choice here.

Because this is a beginner NFT, the cost is fairly low at 1 CAKE. When you're happy with your choice, click the Enable button to pay the transaction fee. Once paid, the Confirm button lights up allowing you to mint the NFT. Click Confirm to mint the NFT and pay the gas fee.

Time to get my grubby hands on a bunny!

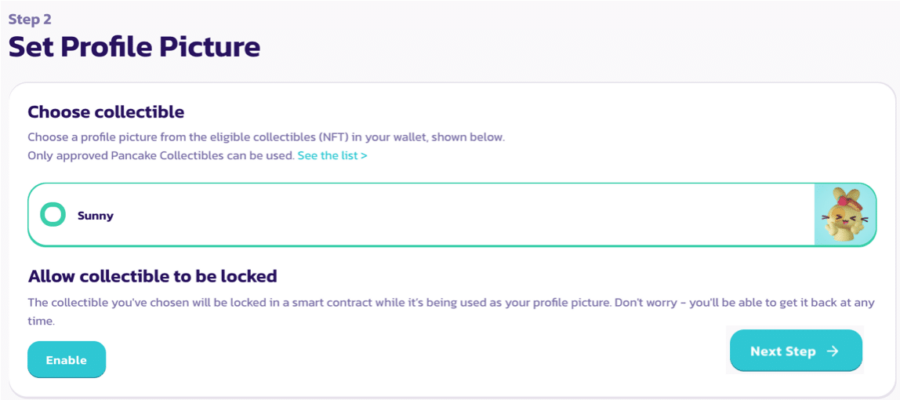

Time to get my grubby hands on a bunny! Set your Profile Picture with the newly-minted NFT by clicking the Enable button which triggers another transaction fee. Once paid, the Next Step button lights up.

Sunny is gonna be me :)

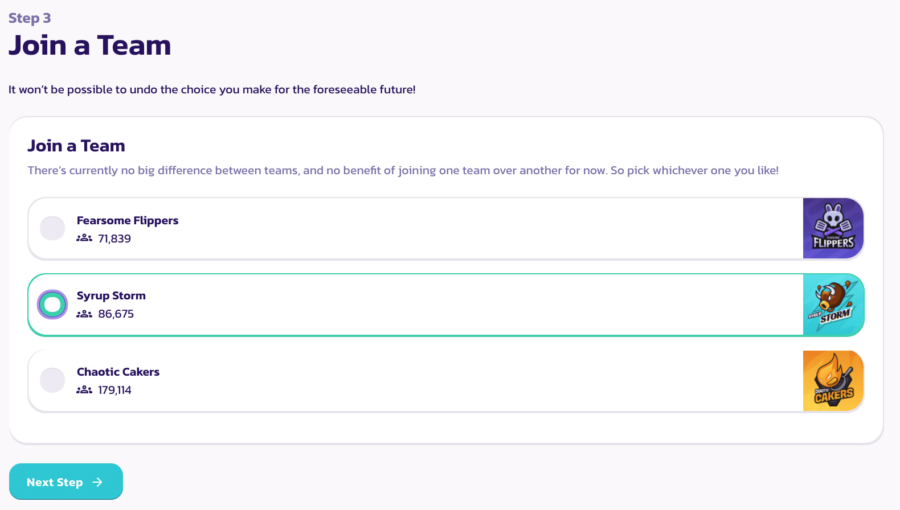

Sunny is gonna be me :) The next step is to join a team. There isn't a lot of information about the teams, so it's entirely up to you which one you choose. As of now, there aren't any special benefits but this choice can't be undone. Choose whichever tickles your fancy and click Next Step.

Try closing your eyes and pick one

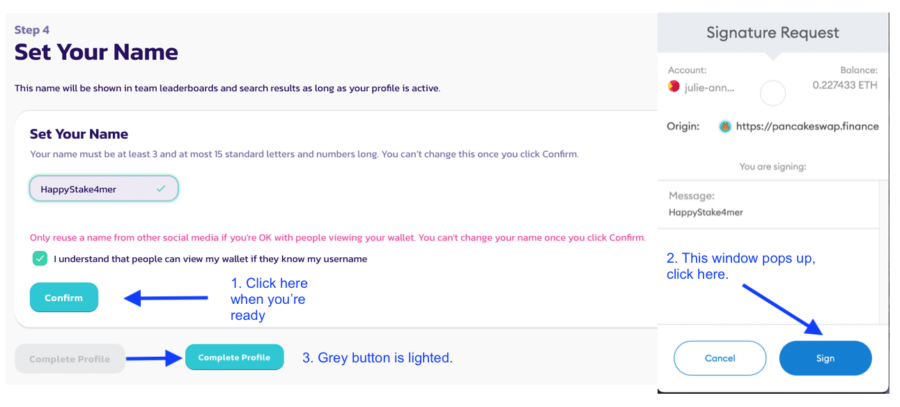

Try closing your eyes and pick one The most important step is finally here: choosing your name. If you want to maintain a consistent presence, you probably already know what name you want to use. Some of you might like to take this chance to create a new identity. Whatever you decide, know that you can't change it later on, so it's ok to take some time for this.

Click "Confirm" when you're ready, and a Signature Request pops up asking for your signature. Click the "Sign" button and that cause the Complete Profile button to light up.

Pick a name you like.

Pick a name you like. Click the Complete Profile button to Enable and Confirm this transaction.

The last time you need to pay gas fee for this action.

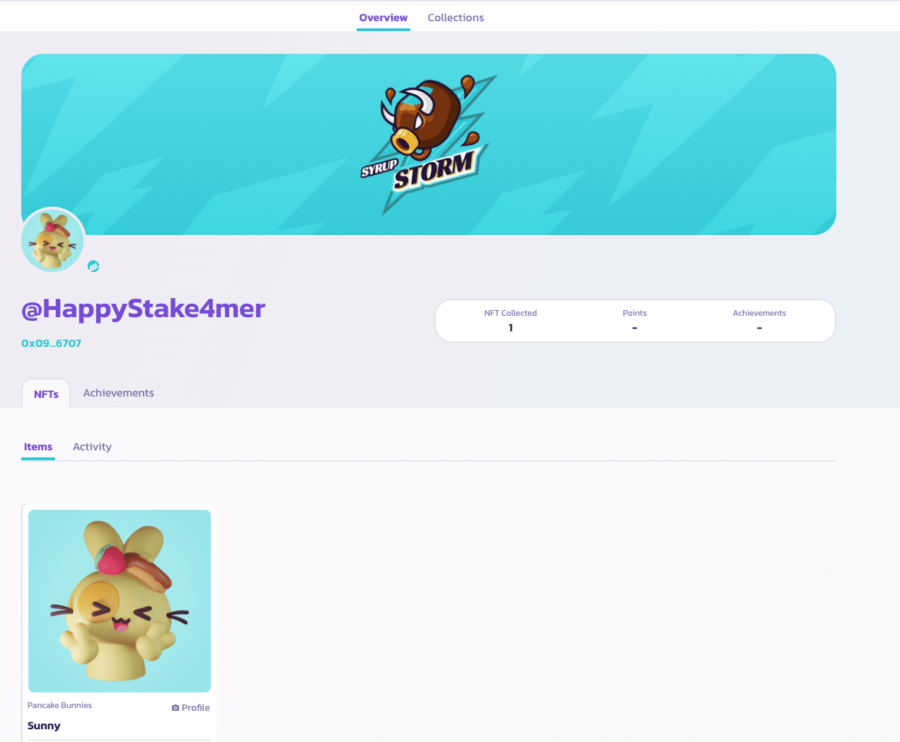

The last time you need to pay gas fee for this action.  Ta-da! Profile is now complete!

Ta-da! Profile is now complete! Voting

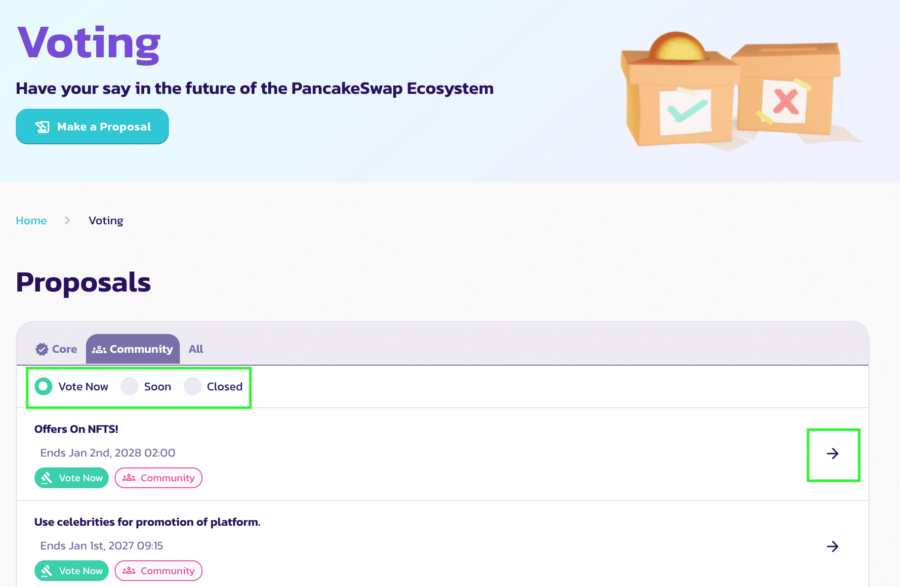

All blockchain projects thrive on community participation and this is no exception. Having invested what may be a fair amount of money on the platform, it would make sense to also have an active voice in how the platform is run. The most obvious way to do so would be to vote on proposals, or make one if you have a good idea on how to make it better.

To make a proposal, simply click on the "Make a Proposal" button and fill in the form outlying your proposal.

There are two kinds of proposals to vote for: Core and Community. Each kind comes with three statuses: Vote Now, Soon and Closed, ie past proposals.

Check out proposals listed to have an idea of what people are interested in.

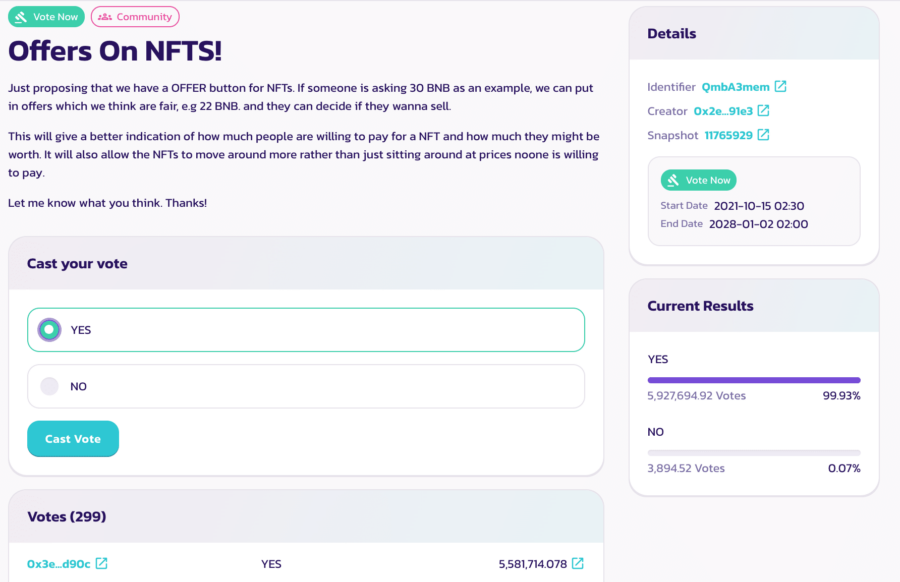

Check out proposals listed to have an idea of what people are interested in. Click on the arrow to get details of the proposal. In this page, the Current Results reflect the number and percentage of votes collected thus far. To cast your vote, click either the Yes or No button and click "Cast Vote".

Cast your vote for a worthwhile cause.

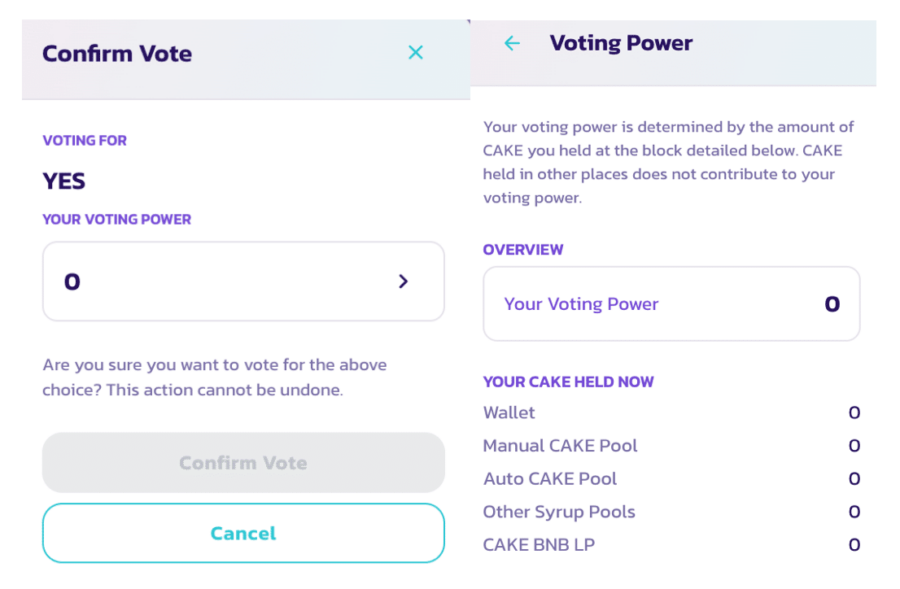

Cast your vote for a worthwhile cause. Unfortunately, I don't hold enough CAKE to be able to put in a vote.

Uh oh, need more CAKE!

Uh oh, need more CAKE! Conclusion

Now that you have a good understanding of how the platform works and the various ways you can choose to participate on it, are you keen to get started? If you are, here's my suggestion to get the most out of it, in the following order:

- Get some BNB and CAKE tokens into your wallet with a ratio of 1.1 : 25. If you have one or the other, use the Exchange to help you achieve that ratio. The 0.1 is to help with the gas fees of which there are quite a number, even though the amount is a small one. An exchange between two tokens can easily result in paying gas fees two or three times.

- Stake the CAKE in the Auto CAKE Syrup Pool for gain. This is practically free money. Use the ROI Calculator to figure out how much you can get as rewards based on current APR. Some other tokens might give you insane APR but those are usually quite unstable so unless you're the type whose eyes are glued to the page more than you spend sleeping, CAKE is a much safer bet.

- Harvest the rewards from the pool periodically and join the CAKE-BNB liquidity pool to get LP tokens. Where possible, try to increase your share of the pool to get more.

At this point, you have a few ways to put the tokens to good use:

4a. Farm the LP tokens in the farm of your choice to get more CAKE. You can put the extra CAKE back into the Syrup Pool to get even more CAKE!

4b. Use some of the LP tokens to get into Initial Farm Offerings. This is a short-term strategy because most of the farm pools are only valid for 7 days, so if you have a small chunk of spare time, it's worth getting into it but it requires close monitoring and it is quite high risk. However, those insane APRs can potentially net you some nice gains that you can then splurge on some NFTs. After all, life's not all about making money. If you get the occasional itch to take a walk on the wild side, try your hand at a few lottery tickets.

One thing I've learnt about buying lottery tickets is always set your own numbers, especially the first one. If you buy 4 tickets, and set a different beginning number per ticket, you have a higher chance of winning something since matching just the first number is enough.

If chart-reading and TA is your thing, then you might be able to make some nice cash with predictions. The downside is that page is in Beta, which means it doesn't always work, thus not to be relied on for any kind of steady income.

Oh, and always have enough CAKE to be able to vote in proposals that appeal to you. True decentralisation requires everyone to do their own bit, so if you like the platform to stay healthy, please vote.