Copy trading is basically delegated decision-making. You are picking the person who clicks the buttons, but you’re not handing off the consequences. The trades still run through your account. Your balance still eats the drawdowns. And the platform still decides how closely your entries and exits match what the lead trader actually got.

That’s important because a lot of copy-trading promos lean on a “hands-off” idea. And, here’s the part people miss: automation doesn’t reduce risk; it reduces friction. When it’s easy to trade, it’s easy to scale errors especially in leveraged perpetual futures, where one sharp move can liquidate positions.

This guide focuses on where things usually break: behavior (panic exits and strategy hopping), setup (copy settings, slippage, position sizing), and platform risk (controls, transparency, custody, and trading halts). By the end, you’ll have a way to vet traders, set guardrails, and know when to stop copying.

Check out our guide on the top crypto trading platforms.

What Is Copy Trading in Crypto (And What It Is Not)

Copy trading is a system that automatically mirrors another trader’s orders in your account, usually in spot markets or derivatives like perpetual futures. The key feature is automated execution: once you opt in and set your parameters, the platform attempts to replicate the lead trader’s entries and exits.

Copy Trading Is A System That Automatically Mirrors Another Trader’s Orders In Your Account

Copy Trading Is A System That Automatically Mirrors Another Trader’s Orders In Your AccountWhat copy trading is:

- Automated execution based on another trader’s actions.

- A way to delegate trade selection and timing while keeping control of allocation and stop thresholds.

- A social product, where rankings, filters, and community cues influence who gets copied.

What copy trading is not:

- Passive investing.

- A guarantee that you will match the lead trader’s results.

- A substitute for understanding leverage, fees, and platform risk.

How Crypto Copy Trading Works in Practice

Account linking

Most platforms require you to allocate funds to a copy relationship, either by assigning capital to a copy module or by using a dedicated copy sub-account. Sub-accounts can reduce operational confusion and make it easier to review performance without mixing copied trades with manual trades.

Some platforms explicitly highlight transparency upgrades, such as clearer leverage data and more detailed trade information for copiers. For example, BingX’s documentation describes copy logic and data transparency upgrades aimed at giving followers more control and clearer visibility.

Proportional vs fixed-amount copying

Copy systems generally use one of two sizing models:

- Proportional sizing: Your position sizes scale relative to the lead trader, often based on an allocation ratio or equity.

- Fixed-amount sizing: You copy a fixed notional amount per trade.

Proportional sizing can be intuitive, but it can amplify risk if the lead trader uses high leverage and you allocate too much of your equity. Fixed-amount sizing can reduce leverage surprises, but it introduces other issues, like minimum order size mismatches and inconsistent exposure across assets.

A practical way to choose: pick the mode that produces predictable exposure for your account size, even if that means you diverge from the lead trader’s exact sizing.

Execution latency, slippage, and fill differences

Even when the copy system triggers your order immediately, you can still get a different entry price than the lead trader. That gap is commonly referred to as slippage. Curious what slippage means? We've got just the article for you.

Some platforms also apply slippage controls to protect entry price. Binance’s spot copy trading guide explains how to set a max entry slippage, and notes that customization is available up to 3%, with default caps listed for major pairs.

In futures copy trading, slippage protection can be more nuanced. Binance’s futures copy trading FAQ states that default slippage protection is 0.5% for BTCUSDT and ETHUSDT and 1.5% for other pairs, and it also notes that slippage protection does not apply to closing positions.

Why your results never perfectly match the lead trader

Even if the lead trader is honest and skilled, your results can differ because:

- You get different fills due to slippage and timing.

- You pay different fees depending on your tier and product.

- Funding payments in perpetual futures affect net returns depending on holding time and funding intervals.

- Copy logic can fail or scale down trades if you hit limits (minimum trade size, position limits, margin constraints).

Copy Trading vs Portfolio Management vs Signals

Copy trading often gets lumped together with signals and managed portfolios, but the control structure is different.

Signal providers vs copy traders

Signal providers typically deliver trade ideas. You still decide whether to act, when to enter, and how much size to take. In other words, signals are informational.

Copy trading systems automate execution. Once you opt in, trades can be opened and closed automatically according to the lead trader’s actions and your configured parameters.

Discretionary vs automated execution

Signals are discretionary because you choose whether to execute. Copy trading is automated because the system executes on your behalf once configured.

Who controls risk in each model

- Signals: You control execution and sizing.

- Copy trading: The lead trader controls entries and exits, while you control allocation, stop thresholds, and whether you keep copying.

- Portfolio management: A manager may have discretion to trade under a mandate, and regulatory obligations can differ by jurisdiction.

The common misconception is that copy trading removes responsibility. It does not. It changes what you are responsible for: selecting a trader and configuring risk instead of placing each trade yourself.

Who Copy Trading Is Actually For

Copy trading can make sense for:

- Beginners who use guardrails: If you’re learning the basics of risk, copying can offer market exposure, and as long as you stick to clear caps, position limits, and pre-set stop rules.

- Time-constrained traders: If you can’t actively manage entries and exits, copy trading can offer a structured way to participate without watching charts all day.

- People who treat it like a system, not a shortcut: Copying works best when it’s monitored and adjusted over time, and not treated as a “set it and forget it” product.

Copy trading is a poor fit for:

- Anyone expecting passive income.

- Anyone who cannot tolerate drawdowns emotionally.

- Anyone chasing leaderboard ROI without understanding leverage, fees, and copy mechanics.

A Severity Framework for Copy Trading Mistakes

Not all copy trading mistakes are equal. Some are annoying but survivable. Others can wipe an account in a single volatile session. A severity framework helps you focus on what actually moves the needle: protecting downside first, then improving efficiency.

Not All Copy Trading Mistakes Are Equal. Some Are Annoying But Survivable

Not All Copy Trading Mistakes Are Equal. Some Are Annoying But SurvivableHere is the scannable logic used throughout this guide:

🔴 Critical Mistakes: Can wipe accounts.

🟡 Moderate Mistakes: Reduce profitability.

🟢 Minor Mistakes: Optimization errors.

🔴 Critical Mistakes: Account-threatening errors

These mistakes create a realistic path to liquidation, massive drawdowns, or irreversible capital loss. They usually come from exposure you did not fully understand, not “bad luck.”

Critical mistakes typically involve:

- Hidden leverage exposure, especially in perpetual futures.

- No hard loss limits at the follower level.

- Copying based on short-term ROI without drawdown context.

- Falling for manipulated track records or insufficient transparency.

- Platform-level failures that prevent exits during volatility (halts, outages, copy failures).

If you fix only one tier, fix this one. A perfectly optimized copy mode does not matter if one leveraged position can dominate your account outcome.

🟡 Moderate Mistakes: Profit-reducing errors

These mistakes rarely blow the account up immediately, but they quietly degrade performance until the strategy no longer delivers what the headline metrics promised. This is where many copiers “lose slowly” and blame the trader, when the real issue is structure.

Moderate mistakes typically involve:

- Over-concentration, such as allocating 100% of copy capital to one trader.

- Fake diversification, where multiple copied traders are highly correlated.

- Ignoring costs, including trading fees, performance fees or profit sharing, and funding in perps.

- Behavioral churn, like strategy hopping after a losing streak or panic stopping at the wrong time.

Fixing this tier is how you turn “copy trading that looks good on paper” into “copy trading that survives real market conditions.”

🟢 Minor Mistakes: Optimization errors

On their own, these probably won’t make or break your outcome. Still, they can quietly cost you—through slippage, tracking differences, and little leaks that are easy to miss. Focus on them after you’ve got the high-priority risks under control.

Minor mistakes typically involve:

- Using the wrong sizing mode for your account size (proportional vs fixed).

- Minimum trade size mismatches that cause partial replication.

- Over-monitoring and constant tweaking, which often locks in losses and reduces recovery odds.

Weak review cadence, such as never checking whether the trader’s behavior drifted.

How to use this framework

Use severity as an order of operations:

- Eliminate risks first: Cap downside, verify transparency, understand leverage, set follower-level limits.

- Reduce drag next: Diversify by behavior, account for total costs, and stop strategy-hopping.

- Optimize last: Tune copy settings and review cadence once the system is stable.

The biggest trap is fixing these out of order. Optimizing sizing mode does not matter if you are unknowingly copying extreme leverage.

Critical Copy Trading Mistakes (Account-Threatening)

These are the mistakes that can turn copy trading from a convenience into a fast-track to liquidation, often before you realize what’s happening.

A Look At Account-Threatening Copy Trading Mistakes

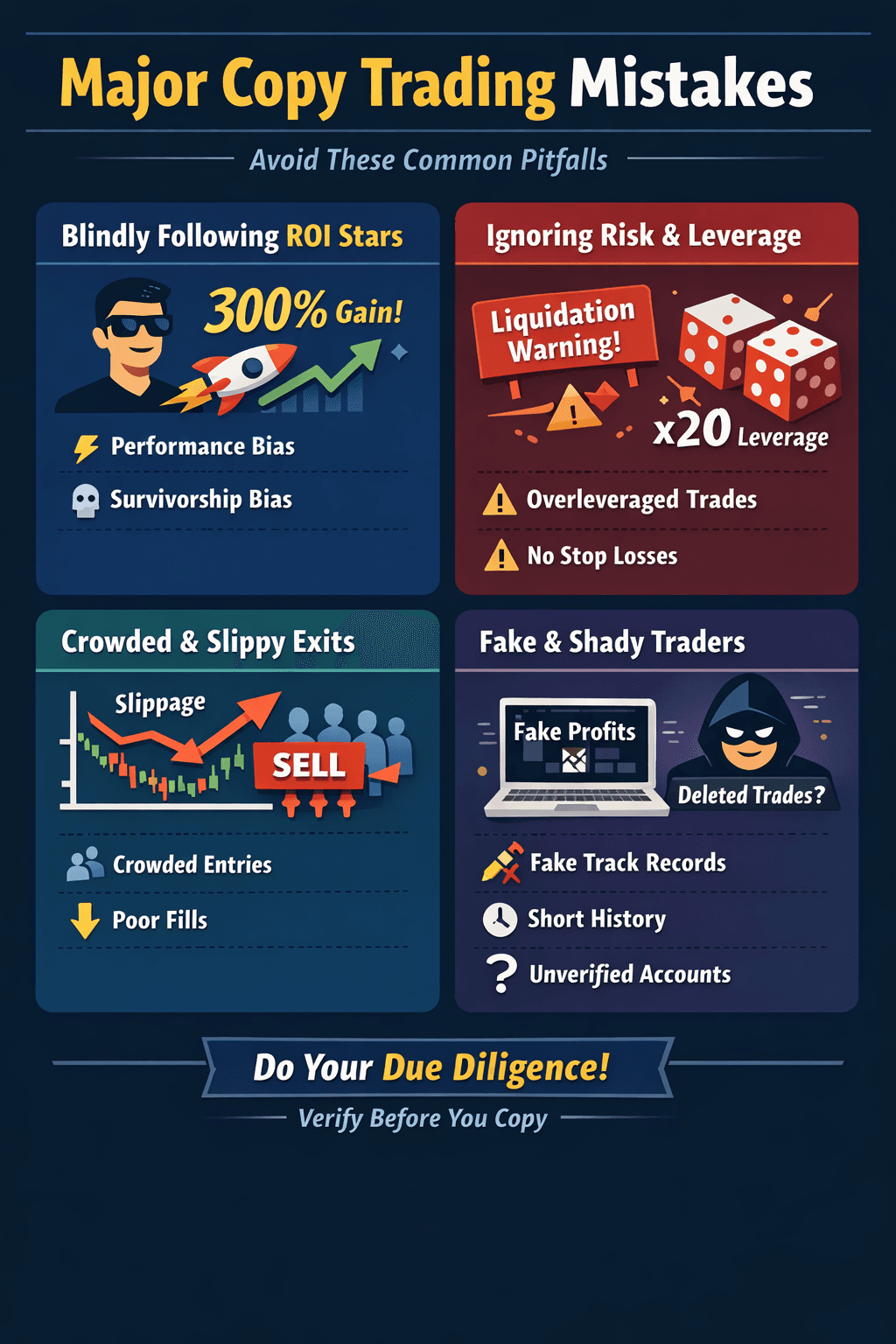

A Look At Account-Threatening Copy Trading MistakesBlindly Following Popular or High-ROI Traders

Copy trading leaderboards reward short-term results, and short-term results in crypto are often dominated by luck, leverage, and risk concentration.

Two common mental traps come up repeatedly:

- Performance bias: Treating recent gains as proof of skill, when it might just be the right strategy at the right time.

- Survivorship bias: Judging from a filtered sample, since losing traders and failed accounts often drop out—so you’re mostly seeing the survivors.

Survivorship bias is not just a theory. A well-cited academic paper on performance studies explains how survivorship can distort observed results and create misleading conclusions about predictability. That dynamic is explored in “Survivorship Bias in Performance Studies” by Brown, Goetzmann, Ibbotson, and Ross.

Crowded trades and slippage

When a trader becomes popular, followers become part of the trade. A crowded entry can worsen fills, especially on smaller pairs. The lead trader’s fill might represent the top of the order book, while follower fills walk down the book.

This is one reason platforms offer max slippage settings and why follower outcomes often drift below headline performance during volatile periods.

Why short-term ROI is a trap

Short-term ROI can be inflated by:

- High leverage.

- Concentrated bets.

- Strategies that look smooth until they fail.

A trader can post a viral month and still be one bad day away from a blowup. If you only select on ROI, you are selecting the strategy most likely to look best right before it breaks.

Let's look at some of the metrics that can come in handy.

Maximum Drawdown (MDD)

Maximum drawdown measures the largest observed decline from a peak to a subsequent low over a period.

Drawdown duration

Drawdown duration measures the time required to recover from a drawdown and reach the previous equity high. It matters because prolonged recoveries increase the odds of emotional decision-making and strategy abandonment.

Risk-adjusted returns (intro only)

Risk-adjusted measures help compare returns relative to volatility. The Sharpe ratio is the classic starting point. The original framing comes from William F. Sharpe’s work on fund performance, which is available in Sharpe’s “Mutual Fund Performance” paper. You do not need to compute Sharpe to use the idea. You just need to stop treating ROI as a complete story.

Ignoring Risk Controls and Leverage Exposure

This is the fastest route to catastrophic losses.

In copy trading, risk exists at two levels:

- Trader-level risk: The lead trader’s leverage, position sizing, and exit discipline.

- Follower-level risk: Your allocation, stop thresholds, and copy settings.

Trader-level vs follower-level risk

A lead trader decides what to trade and when. You decide how much of your capital is exposed and whether there are hard loss limits.

The mistake is assuming the platform’s defaults are “safe.” Defaults are designed for broad usability. Your goal is to fit risk to your own tolerance and account size.

Hidden leverage amplification

Leverage multiplies both gains and losses. In perpetual futures, you also face funding payments and higher turnover costs.

In perpetual futures, funding rates are periodic payments exchanged between long and short traders intended to help keep perp prices aligned with spot prices. In Binance Futures, for example, the interest rate is fixed at 0.03% daily by default, which is expressed as 0.01% per funding interval because funding occurs every eight hours.

The point is not that funding is always costly; the point is that a copied strategy that holds positions through many funding intervals can leak returns even if the direction is right.

Why one bad trade can dominate outcomes

Copy trading can concentrate tail risk in ways that feel invisible:

- A high-leverage position can lose a large percentage of equity on a modest move.

- Averaging down can turn a manageable loss into a catastrophic one.

A crowded exit can produce worse fills for followers than for the lead trader, especially when slippage protection does not apply to exits, as noted in Binance’s futures copy trading slippage protection explanation.

If you copy trade with leverage, your first priority is not “find a better trader.” It is “make sure one bad trade cannot dominate my account.”

Failing to Detect Scams and Manipulated Track Records

Fake or manipulated track records are common in social trading, so treat every trader profile like a due-diligence check, not proof of skill.

Red flags

- Very short track records: A trader with a few weeks of history is not proven. In crypto, a few weeks can be one market regime.

- Inconsistent position sizing: Big swings in position size without explanation can signal gambling behavior, revenge trading, or performance engineering to climb rankings.

- Deleted trade history: If trade history can be hidden, deleted, or reset in a way that prevents you from seeing losing trades, your ability to evaluate risk is compromised. Even when a platform does not literally allow deletion, partial visibility can create the same effect: you cannot audit what happened.

Difference between verified vs unverified traders

“Verified” does not automatically mean “good,” but verification can signal that a trader is accountable under platform rules. Binance notes that to become a spot copy trading lead trader, the user must have a verified Binance account. On platforms where lead trader vetting is weaker, you should assume higher risk of misleading presentation.

Why social proof is exploitable in copy trading

Follower counts, comment sections, and “top trader” badges can be gamed. Popularity is not a risk metric. In practice, popularity can increase crowding, and crowding increases fill risk.

A simple safety filter: if you cannot explain how the trader makes money in one paragraph, do not allocate meaningful capital.

Moderate Copy Trading Mistakes (Profit-Reducing)

These mistakes usually won’t wipe you out overnight, but they quietly drain returns through bad sizing, hidden costs, and emotional interference.

A Look At Copy Trading Mistakes That Can Eat Into Your Profits

A Look At Copy Trading Mistakes That Can Eat Into Your ProfitsPoor Capital Allocation and Over-Concentration

A common copy trading failure is not picking a “bad trader,” but allocating capital in a way that makes a single trader dominate outcomes.

Copying one trader with 100% capital

If you allocate 100% of your copy budget to one trader, you are making a single point-of-failure bet. Even a skilled trader can face deep drawdowns. Concentration increases the chance you panic stop at the worst time.

Correlation risk between copied traders

Copy traders often diversify by counting traders instead of counting exposures. In crypto, correlation is often high because many strategies concentrate on the same liquid assets and react to the same liquidity events.

A practical test: if your copied traders win and lose together, you are not diversified.

Why “diversification” can still be fake

Diversification fails when:

- Traders use the same asset universe.

- Traders rely on the same market regime.

- Traders all scale leverage up in the same conditions.

To diversify meaningfully, diversify by behavior and risk profile, not by usernames.

Ignoring Fees, Funding Rates, and Copy Costs

Copy trading can quietly turn a decent strategy into a mediocre one once all-in costs are counted.

Platform fees

Most platforms charge on every entry and exit, so frequent copying compounds costs faster than many people expect. For example, Bitget’s spot trading fees are 0.1% maker / 0.1% taker, and Bitget’s futures trading fees are 0.02% maker / 0.06% taker.

Even small rates add up: 20 round trips (20 entries + 20 exits = 40 fills) at 0.06% per fill is roughly 2.4% of notional paid in trading fees alone (40 × 0.06%).

Performance fees

Some copy products also take a cut of profits. Bitget’s docs note spot copy trading profit sharing uses a High Water Mark and is settled weekly every Monday at 8:00 AM (UTC+8).

Bitget also explains that followers typically pay a profit-sharing fee of 10%–20% (depending on the trader’s settings), and that the maximum profit share ratio for spot elite traders was increased to 10% after an update.

On the futures side, Bitget’s new futures copy trading guide notes profit sharing can be settled daily at 00:00 (UTC+8), but only if positions are fully closed.

Funding rate bleed in perps

If you’re copying perpetual futures, funding can behave like a recurring holding cost. Binance explains funding occurs every 8 hours and the payment is calculated as Nominal Value × Funding Rate.

Binance Academy adds a useful reference point: By default, Binance Futures uses 0.03% daily interest, split into three 0.01% fundings (one every 8 hours). On a $10,000 position, paying 0.01% three times per day is about $3/day—roughly $90 over 30 days—even if the trade direction is “right.”

Why ROI dashboards often hide these costs

Dashboards often emphasize gross ROI. Followers should ask:

- Is ROI net of fees?

- Is it net of funding?

- Does it include performance fees?

- How are missed fills and slippage treated?

If the platform cannot answer those questions clearly, you are evaluating a highlight reel, not a strategy.

Emotional Overrides and Strategy Abandonment

Copy trading is social by design, and social trading environments amplify behavioral mistakes.

- Panic stops: People panic stop during drawdowns, often closing at the worst possible time.

- Strategy hopping: Switching traders frequently tends to lock in losses and miss recoveries. It is performance chasing disguised as “risk management.”

- Confirmation bias in social trading environments: Communities reward certainty and streaks. That can push followers to ignore risk signals, especially when a trader is popular.

If you feel the urge to change traders because you are “bored,” you are probably over-allocating and under-planning.

Minor Copy Trading Mistakes (Optimization Opportunities)

These mistakes usually blow up your account, but they can meaningfully improve results by fixing small setup and review issues that compound over time.

Not Rebalancing or Reviewing Performance Periodically

Copy trading should not be micromanaged daily, but it should be reviewed on a schedule.

A practical cadence:

- Weekly quick check: Leverage exposure, major asset changes, abnormal losses.

- Monthly deeper review: Drawdown profile, recovery patterns, whether costs are eroding returns.

Why constant tweaking is also harmful:

Frequent changes often convert normal variance into real losses. Most systems look worse when you interfere at random times.

Using the Wrong Copy Mode or Scaling Settings

Optimization mistakes often come from copy settings and account-size constraints.

Proportional vs fixed sizing

Proportional sizing can overexpose you if your allocation is too large. Fixed sizing can create inconsistent exposure if the trader trades many assets or scales positions frequently.

Minimum trade size mismatches

If your account is small, you may not be able to replicate the trader’s incremental adds and trims. That changes risk and changes outcomes.

Execution mismatch examples

- A simple example: A lead trader adds $50 to a position several times. If your minimum trade size or fixed sizing cannot replicate those increments, you might only copy the larger add. You end up with a different average entry, different risk, and different exit behavior.

- Another example comes from platform constraints: Binance’s rules explain that when copy amount exceeds 80% of market depth, the system caps the opening copy amount to 80% of depth, which can produce partial replication in crowded or illiquid conditions. That is described in Binance’s copy trading rules.

How to Evaluate a Copy Trader Properly

Evaluating a copy trader isn’t really about picking the “best” one. The goal isn’t to identify the highest-return trader, but a strategy you can follow consistently without breaking your risk rules under pressure.

Core Metrics That Actually Matter

Maximum drawdown and drawdown duration

Start with how bad the worst period was and how long recovery took. If you cannot tolerate that drawdown emotionally or financially, you are mismatched.

Win rate vs expectancy

Win rate alone is weak. A high win rate can hide rare, huge losses. Expectancy is what matters: the average outcome after accounting for wins and losses.

Volatility-adjusted performance (intro to Sharpe ratio)

The Sharpe ratio is a classic tool for comparing returns relative to volatility, introduced in Sharpe’s work on fund performance, which you can see in Sharpe’s “Mutual Fund Performance” paper.

Consistency over time

Look for performance across more than one market regime. A strategy that only works in one kind of market is not necessarily robust.

Strategy Fit Checklist

Before you copy anyone, you need to know what you’re actually copying.

- Market regime fit: Ask yourself: when does this strategy make money?

Only when markets are ripping in one direction? Or can it survive when price chops sideways and does nothing for weeks? - Leverage: Is leverage the engine, or just a tool?

If returns disappear without leverage, that’s a red flag. Healthy strategies can stand on their own and use leverage intentionally, not desperately. - What they trade: Are they sticking to major, liquid coins where risk is more predictable?

Or are they constantly rotating into small, volatile assets that can blow up fast? - Risk behavior: What happens when they’re wrong?

Do they cut the trade and move on or do they average down, add size, and hope price comes back?

If you can’t explain the strategy in simple, plain English, you don’t understand it yet, and that means you’re not ready to allocate meaningful capital..

Behavioral Signals to Watch

Numbers look great when markets cooperate. Behavior is what shows up when they don’t.

These signals tell you whether there’s a real system underneath the performance.

- Clear communication: Do they explain why they’re doing things, what the risks are, and when something changes?

Or do updates feel vague, reactive, or confusing? - How they handle losses: Losses are normal. What matters is the response.

Do they stay calm and follow their rules or start improvising, chasing trades, and breaking their own process? - Strategy drift: Watch closely for sudden changes.

New assets, higher leverage, longer hold times usually mean something has changed.

If you see drift, historical performance loses its value, because you may no longer be copying the same strategy that produced those results.

Platform-Level Risks and Differences You Must Understand

Copy trading outcomes are shaped by platform design as much as trader skill. Two platforms can show the same trader with similar headline metrics while producing different follower outcomes due to execution rules, limits, and transparency standards.

How Copy Trading Differs Across Platforms

Interface-driven behavior differences

Platforms that rank traders primarily by short-term ROI nudge users toward performance chasing. Platforms that emphasize risk metrics and filters nudge users toward process thinking.

Risk controls availability

Binance notes that its copy trading feature includes risk management tools such as the ability to set maximum loss limits and allocate only a portion of total capital to copy trading.

Transparency standards

Transparency varies by platform and product. Some platforms emphasize detailed trade breakdowns and follower-facing controls. Copy Trading 2.0 transparency upgrades are one example of a platform explicitly addressing visibility improvements for followers.

Custody, Fund Segregation, and Platform Risk

Who holds funds

On centralized platforms, funds are typically held by the platform while you trade. That means your copy trading risk includes platform custody risk, not just trading strategy risk.

What happens if the platform halts trading

If a platform halts trading, experiences outages, or enforces restrictions during extreme volatility, your copy relationship can break at the worst moment. You may be unable to exit when you want, or exits may occur at worse prices than expected.

Why this matters in extreme volatility

Crypto volatility compresses decision time. In a liquidation cascade, even small delays can create large outcome differences. Platform resilience, order handling, and clearly communicated limits become critical, whether you copy trade or trade manually.

On fund segregation, the practical point is separation and traceability. Some regulated financial firms are required to safeguard client money and custody assets using segregation and record-keeping rules designed to protect customers if a firm fails. The UK’s financial regulator explains that firms that hold client money or safe custody assets must follow its CASS framework to help keep client assets safe if firms fail. FCA guidance on client money and assets is a good example of what “segregation” is trying to achieve in regulated markets.

Crypto platforms vary widely here, and copy trading does not change custody reality. If a platform uses dedicated copy accounts or sub-accounts, it can make it easier to separate exposure and track performance. If it does not, you should be stricter with self-enforced limits so you do not accidentally stack manual and copied exposure.

That gets you full fidelity on the outline’s “fund segregation” concept, using a regulator source, without making claims about any specific exchange’s internal custody model.

Regulatory, Tax, and Compliance Considerations

Copy trading doesn’t remove your legal or tax responsibility, and the rules around “social trading” vary widely by country. So it’s worth checking compliance, reporting, and record-keeping before you start.

Regulatory Status Varies by Jurisdiction

EU considerations (MiFID-style suitability concepts)

Rules vary by jurisdiction and product structure. In the EU context, ESMA has published guidance that clarifies aspects of MiFID II suitability requirements, which is commonly referenced in investor protection discussions.

Platform KYC expectations

Most major centralized platforms require identity verification for access to features, withdrawals, or certain products. This can affect what copy trading features are available and how smoothly you can operate during stress events.

Why “copying” doesn’t remove responsibility

Even when execution is automated, you are still choosing the trader, setting the allocation, and bearing the results. If you copy a reckless strategy, the platform does not absorb the consequences for you.

Tax Implications of Copy Trading

- Each copied trade is your trade: In many tax systems, trades executed in your account are your trades, even if triggered by a copy mechanism.

- Frequency = complexity: Higher trade frequency increases record-keeping and tax calculation complexity, especially with derivatives and multiple fills.

- Record-keeping importance: In the US, the IRS generally treats “virtual currency” as property for federal tax purposes. The IRS’s virtual currency FAQ points back to its core guidance, including Notice 2014-21, which states that virtual currency is treated as property.

This is general information, not tax advice. If copy trading creates a lot of trades in your account, it can make taxes more complicated, so consider speaking with a qualified tax professional in your jurisdiction.

A Safer Framework for Copy Trading Success

Shift from “copying winners” to running a rules-based process: Diversify across vetted traders, cap downside with strict risk limits, and define clear stop conditions before you start.

Judge Systems, Not Streaks. Streaks Are Easy To Market, But Systems Are What You Can Survive

Judge Systems, Not Streaks. Streaks Are Easy To Market, But Systems Are What You Can SurviveShift From Outcome Thinking to Process Thinking

Outcome thinking is: “This trader made 40% last month.”

Process thinking is:

- What risks produced that return?

- How large are drawdowns when it goes wrong?

- Does performance depend on one market condition?

- Would I hold this strategy through its normal worst month?

Judge systems, not streaks. Streaks are easy to market. Systems are what you can survive.

Why consistency beats viral returns: Viral returns often require viral risk. Followers tend to experience the downside more intensely due to fees, slippage, and execution mismatch.

Build a Multi-Trader, Risk-Capped Portfolio

A safer copy structure usually includes:

- Multiple traders with distinct behaviors.

- Risk caps per trader so no single strategy can dominate outcomes.

- Correlation awareness so you are not copying the same bet five times.

- A review cadence that is rules-based, not emotional.

Allocation logic does not need to be complicated. The core idea is to cap the downside from any single trader and spread exposure across different styles.

Rebalancing triggers can be simple:

- If one trader grows to an outsized share of your copy allocation, reduce exposure back to your cap.

- If a trader’s drawdown materially exceeds their historical norm, reduce or stop copying.

- If costs (fees, funding) consistently overwhelm gross gains, reassess strategy fit.

Know When to Stop Copying a Trader

You need exit rules before you start copying.

Performance deterioration signals:

- Drawdowns that are larger or longer than the trader’s historical pattern.

- Repeated sharp losses after a period of consistency.

Strategy deviation:

- Sudden leverage increases.

- New asset universe exposure.

- Different holding periods without explanation.

Market regime mismatch:

- A trend strategy suffering in sideways chop.

- A mean-reversion strategy failing in sustained trends.

- Stopping should be a planned decision, not a panic reaction.

How to Choose the Right Copy Trading Platform

Coin Bureau’s job is to be platform-agnostic and education-first. The goal is not to “pick a winner,” but to know what to demand from any platform.

Use this checklist:

- Security features: Account protections, withdrawal controls, incident transparency.

- Transparency: Full trade history visibility, leverage visibility, performance methodology.

- Risk controls: Allocation caps, maximum loss limits, copy stop-loss tools, slippage settings.

- Execution reliability: Clear handling of order types, copy failures, minimum trade sizes, scaling.

- Support and documentation: Clear help articles, exportable history, responsive support.

If a platform cannot clearly explain why follower results differ from lead trader results, assume replication quality may be worse than advertised.

Final Thoughts: Copy Trading Is Delegation, Not Abdication

Copy trading can be useful, but only if you treat it as delegation with accountability. You are delegating trade selection and execution timing, but you still own:

- The decision to copy.

- The allocation size.

- The guardrails.

- The platform risk.

- The compliance and tax burden tied to trades executed in your name.

If you approach copy trading with that mindset, you avoid the most expensive misconception in social trading: that delegation means abdication.