Human emotions can be a great thing no doubt. They allow us to feel things like happiness, love, empathy, laughter and so on. Feelings like love and joy allow us to enjoy aspects of our crazy journey through this thing called life, while emotions such as fear are what tell us that even though they look cute and cuddly, it is not okay to crawl into a bear’s den for some warm snuggly cuddles.

But for anyone who isn’t a sociopath, or suffers from unrelenting apathy or alexithymia, being void of all emotions, we all know that emotions can sometimes get in the way as well and do more harm than good. We all have those moments of reflection; we remember those times where we let our emotions get the better of us and clouded our judgment in situations that we regret.

Whether it’s that irrational tingle of jealousy or self-doubt that gets us into trouble, or maybe we lost our cool at work and had a full-blown meltdown and rage-quit, it is true that while emotions are needed for survival and have many uses, they can be both our best friend, and our worst enemy.

Emotions play a part in all of our daily activities, which include our investment decisions. Whether it is bias and conviction, or fear and greed, these are often the most difficult hurdles to overcome when making intelligent and well-informed investment decisions. Fear and greed are the two biggest emotional enemies that plague all investors, regardless of their experience, they are very difficult feelings to reign in and keep under control as they sit at the core of our very human instinct.

Many professional investors will sound like a record stuck on repeat as they state the mantra, “emotions have no place in investing,” and I agree. Though you don’t need to take my word for it, just take a look at the hundreds of articles written by respected publications such as Investopedia and CNBC that discuss how and why to avoid emotional investing, and the countless books written on how to not let emotions destroy your well laid out and defined investment strategies.

On that note, everyone should have an investment strategy. Check out Guy's Crypto Investment Strategy if you need some tips and tricks on where to start building yours.

Why Emotions are an Investor's Worst Enemy

It is a sad truth that the majority of retail investors lose money, or underperform the market, whether it is in Forex, Crypto, Stocks etc. One of the main reasons is that retail investment behaviour is often emotionally fueled which has been proven time and time again to be a losing long-term strategy.

One could argue accurately that there are a host of other reasons such as retail investors do not have access to the resources such as research teams, tools, and analytical data as the investment firms which is why they underperform, and I would agree with that as well, but for the purpose of this article, we are only going to be exploring the emotional side of investing. If the average retail investor could consistently outperform investment firms and fund managers, then there would be no use for fund managers, investment bankers, Wall Street and the lot of them.

Average Investors Earn Below Average Returns Image via thebalance

Average Investors Earn Below Average Returns Image via thebalance Everyone has heard the very simple investment concept, “buy low and sell high,” which sounds easy enough right? That is literally all you need to do to make money in the markets, so why do the majority of people underperform or lose money when investing? It all comes down to fear and greed I am afraid.

As our investments start to go up, greed kicks in and we don’t want to sell as we hold on thinking, “what if it goes higher?” Anyone who sold Bitcoin at 20k is likely kicking themselves as they watched it shoot up to 60k, but ultimately, it is greed that makes us hold onto assets for too long and instead of selling for a profit, most investors get too greedy to cash out and end up holding assets as their price plummets back down to Earth.

While taking profits too early can be a bummer, anyone who has experienced selling early will likely tell you that they are happy that they sold too early vs if they had held too long and “diamond handed,” an investment all the way back down to zero or negative. As the saying goes, “nobody has ever gone broke taking profits.”

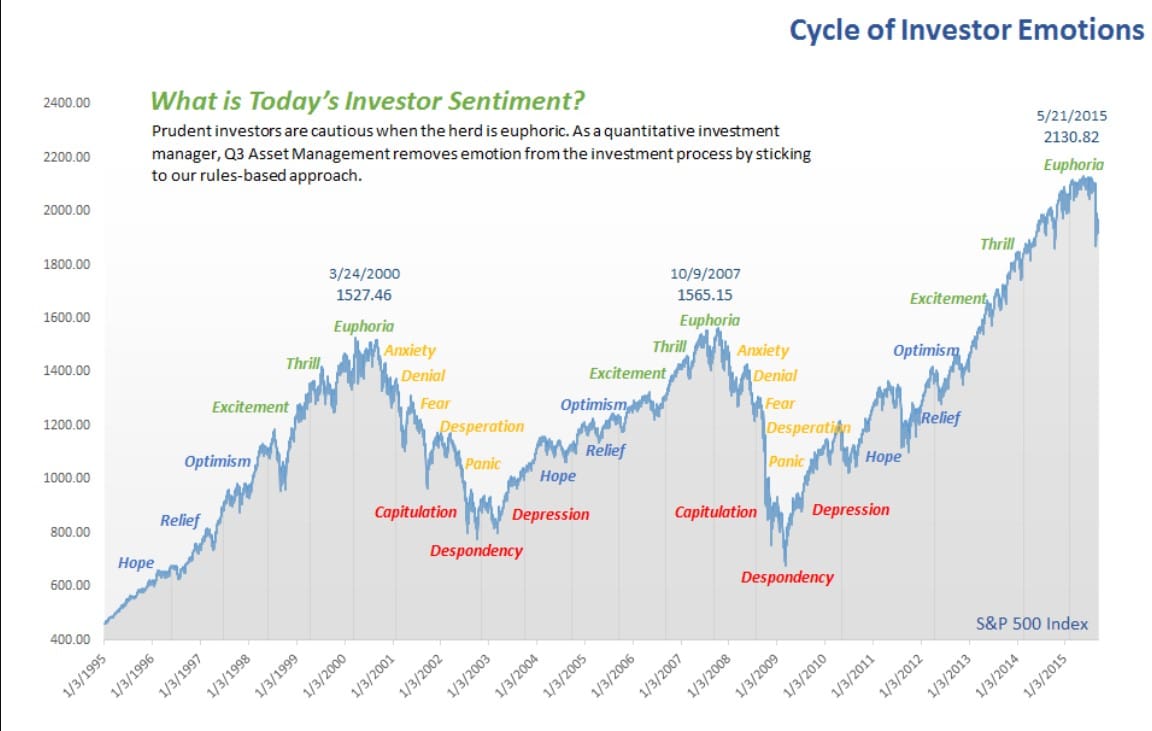

An Image Showing the Investor Sentiment Lifestyle. Watch Out for Euphoria, This is Where Investors Get Burned by Greed Image via q3tactical.com

An Image Showing the Investor Sentiment Lifestyle. Watch Out for Euphoria, This is Where Investors Get Burned by Greed Image via q3tactical.com Buying into and holding past the Euphoria stage of investing is where the majority of investors get wrecked as their investment has been going well, they feel like geniuses as they are rich! (on paper) and they are so confident that their investment is going to the moon that they continue to hold and they may even start piling more money in here at this stage…No longer buying low, nor selling high, are they? And like all markets, the downturn is just around the corner and they were too greedy to sell.

Even at the first sign of a market dip, greed makes many investors hold on hoping the dip is temporary and price may resume so instead of selling after markets dipped 10%, they will hold as prices continue their downward spiral. Here is another great chart showing this mentality.

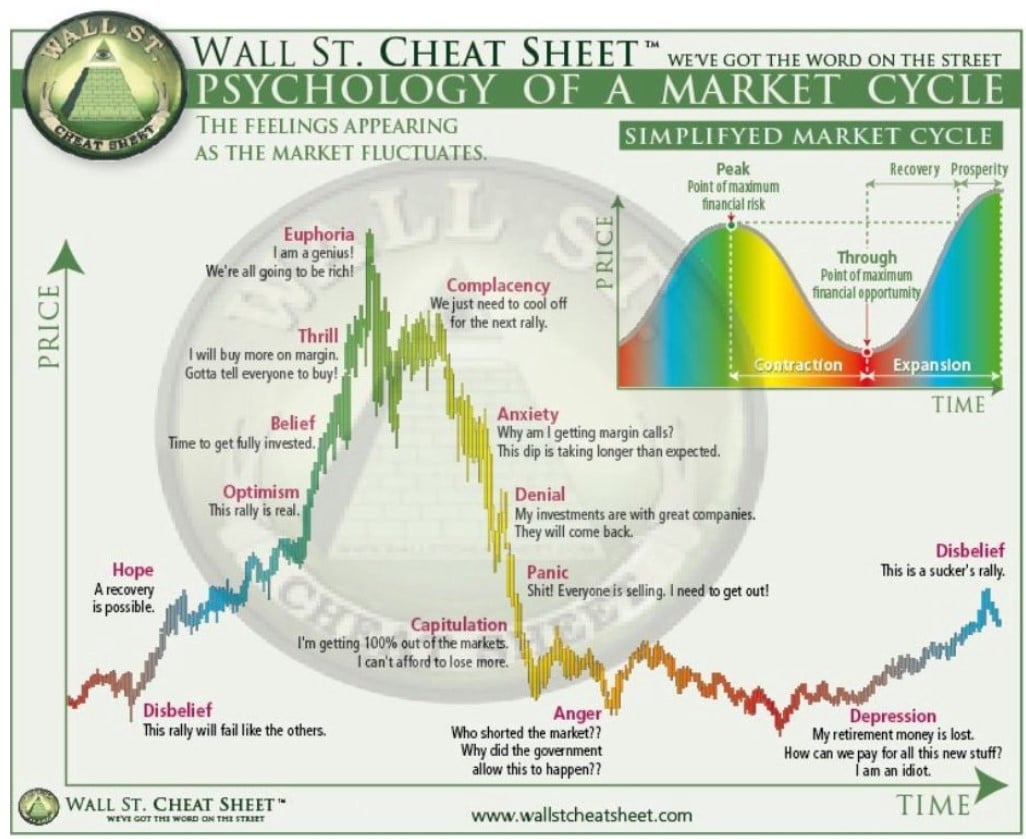

Popular Graphic Highlighting Investor mentality image via steemit.com

Popular Graphic Highlighting Investor mentality image via steemit.com Fear is the other side of the ugly two-faced emotion monster that wrecks investors, and this comes in two flavours. The first scenario where investors allow fear to hurt their portfolio is that many investors will get spooked at every little dip in the market and sell early, even if price is in an overall uptrend, not allowing the full market cycle or trend to play out.

As a very crude and simple example, say a market goes up 5% drops 2% up 5% drops 2% up 5%, many investors would have panic sold at the first 2% drop and sold, missing out on the additional 10% rally that followed. The next way that fear can be a terrible beast is that many investors will panic sell at a loss if price falls below their entry position and they are in a net overall loss.

This is obviously not always a bad idea as prices often can continue to fall for extended periods of time, but often when investors sell at a loss, if they would have just held through the dip, ignored the fear about losing money and remembered their logic and conviction as to why they invested in the first place and held onto their macro perspective they likely would have held as price potentially rallied again and went in their favour.

As an ex-financial advisor and an investor in traditional markets, I have a lot of respect and admiration for Warren Buffet, who is often considered the greatest investor of all-time…As a crypto investor, he is a real downer, but that is for another article such as I’ve highlighted in my article on Crypto vs Traditional Investments. While I avidly disagree with his crypto sentiment, the man deserves credit where it is due and I want to quote one of his famous expressions as it could not be more true, regardless of the markets.

“Be fearful when others are greedy, and be greedy when others are fearful,”

-Warren Buffet wrote in a 1986 Berkshire Hathaway Shareholder letter.

An even darker quote that highlights a similar narrative about doing the opposite of whatever emotions are fueling the markets, essentially, buying low and selling high, comes from Baron Rothschild, an 18th-century British nobleman and member of the Rothschild banking family, one of the wealthiest families in history who made a fortune buying in the panic and crashed markets that followed the Battle of Waterloo:

“The time to buy is when there is blood in the streets,”

-Baron Rothschild following the Battle of Waterloo

Though that quote isn’t meant to be taken quite so literal in today's society as people use it to describe that the time to buy is when the markets are down (blood red) in the streets, (Wall Street). This is often known as contrarian investing, and it is very difficult to do as it goes against human nature and instinct. As markets are crashing, everyone is terrified and wanting to sell, but that is the best time to buy which feels sort of like trying to catch a falling knife.

While the best time to sell is when the markets are skyrocketing and everyone is piling in thinking that an asset is going to the moon, it is hard to sell when you think you may make a bucket load of cash if you just hold on a bit longer. But how do you know if the markets are in euphoric greed or panic fear? Well, that is where the very useful fear and greed index comes in.

What is the Fear and Greed Index?

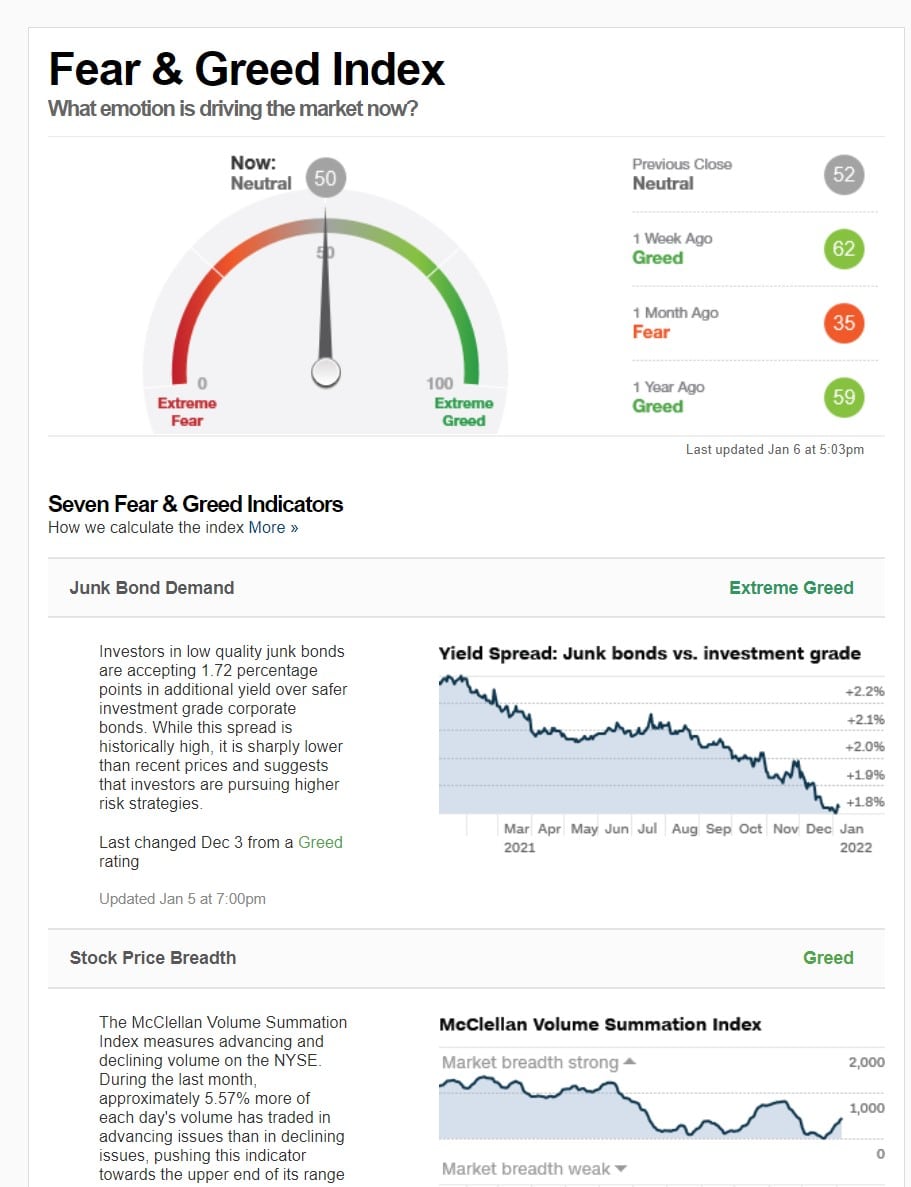

There are different fear and greed indexes for different markets. CNNMoney was the first to create The Fear and Greed Index for the stock market to measure two of the primary emotions that influence how much investors are willing to pay for stocks. The index is measured on a daily, weekly, monthly, and yearly basis.

In theory, the index is used to gauge whether the stock market is fairly priced and examines seven different factors to establish how much fear and greed is in the market. The seven factors are measured on a scale from 0 to 100 and include market momentum, market strength, trading volume, put and call options, junk bond demand, market volatility and safe-haven demand. Feel free to browse Investopedia for a full explanation of how the fear and greed index is weighted.

CNN’s Market Fear and Greed Index Image via money.cnn

CNN’s Market Fear and Greed Index Image via money.cnn This became such a popular metric and useful tool that the same concept was applied to other markets such as our beloved crypto market. The Crypto Fear and Greed index was published by the website Alternative.me and measures the emotions and sentiment driving the crypto markets.

According to the website, the index was created to try and save people from emotionally overreacting to FOMO as markets are rising and selling irrationally when they see red numbers. The Crypto Fear and Greed Index measures data from five Bitcoin-related sources, with each data point being valued the same as the day before in order to visualise progress in sentiment change. The current index is for Bitcoin and other large cryptocurrencies, but the team stated that they are working on separate indices for different altcoins soon.

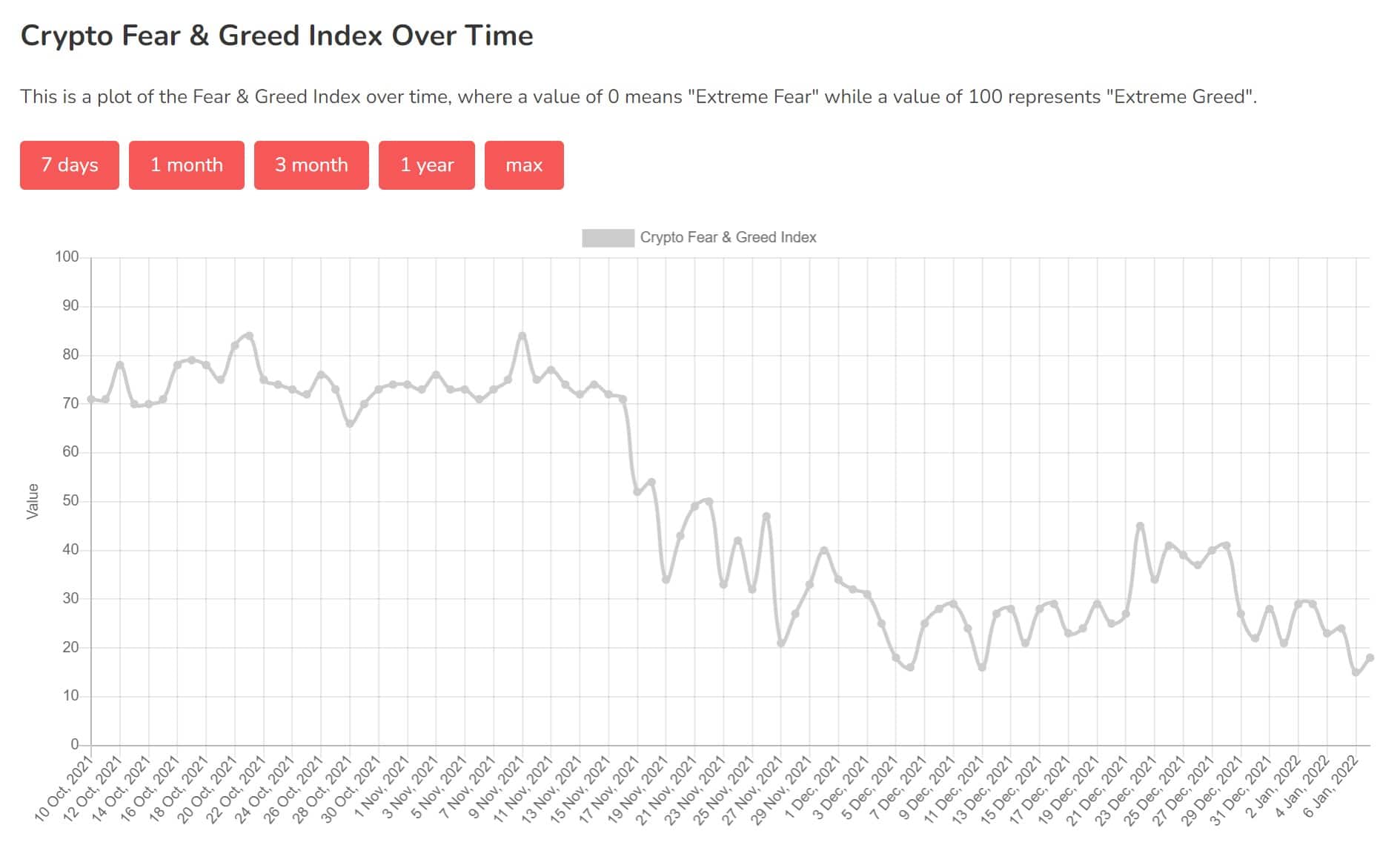

Crypto Fear and Greed Index Image via alternative.me

Crypto Fear and Greed Index Image via alternative.me The different factors measured in the Crypto Fear and Greed index are as follows:

- Volatility (25%)- The index measures the current volatility and max drawdowns of Bitcoin and compares it to the corresponding average values of the last 30 and 90 days.

- Market momentum/Volume (25%)- The index measures the current volume and market momentum and compares it with the last 30/90-day average values and puts those two values together.

- Social Media (15%)- The index is able to analyze market-related keywords across Reddit and Twitter to check how fast and how many interactions are related to Bitcoin. The team notes that this feature is still experimental, and they are optimizing how the function works.

- Surveys (15%)- Using strawpoll.com, which is a large public polling platform, there are weekly crypto polls asking people how they see and feel about the market. This metric is currently paused as the team doesn’t feel it is worth giving those results too much attention.

- Dominance (10%)- The dominance of a coin resembles the market cap share of the entire crypto market. A rise in Bitcoin dominance is often caused by fear as it is the “safe-haven,” for crypto investors, and when Bitcoin dominance shrinks people are more confident and therefore greedy and willing to speculate in smaller altcoins as investors are looking for the potential of higher gains as many altcoins can out-perform Bitcoin in the short term.

- Trends (10%)- The index pulls data from Google Trends for various Bitcoin-related search queries, focusing more on the changing of search volumes as well as other popular Bitcoin-related searches.

The Crypto Greed and Fear Index can be Analyzed Over Time Image via alternative.me

The Crypto Greed and Fear Index can be Analyzed Over Time Image via alternative.me With all that data, the index crunches the numbers into a simple meter from 0 to 100, with zero being extreme fear while 100 means extreme greed.

Benefits of the Fear and Greed Index

A common theory of contrarian investing goes back to the fact that most retail investors lose money so smart investors should do the opposite. While everyone tries to buy low and sell high and thinks they can do it, the statistics show that human emotion trumps logic and most investors end up buying high and selling low.

The Fear and Greed index is a very simple yet useful tool that can provide us with a reminder to dismiss our emotions, or confirm our concerns about whether or not we are too emotionally driven, and look at the numbers. Numbers don’t lie and investing is a numbers game of probability, chance and trying to make well-informed and calculated bets. Proper investment decisions cannot be made without stats, numbers, figures, tools, reports, and data to support our directional biases on the markets and the Fear and Greed Index is one of those helpful tools that help ensure we aren’t investing based on emotions.

When the index shows extreme fear, this can be a sign that investors are worried and prices are likely down which could be a great buying opportunity (buying low). Conversely, when investors are too greedy, that can signal that the market may be overheated and is due for a correction, signaling that investors may want to consider taking profit (selling high).

Of course, this index is just one tool and should be used in conjunction with other analysis metrics and tools and should not be relied on alone to make investment decisions.

Thanks, Investopedia, Could not Have Said it Better Myself Image via Investopedia

Thanks, Investopedia, Could not Have Said it Better Myself Image via Investopedia Criticisms of the Fear and Greed Index

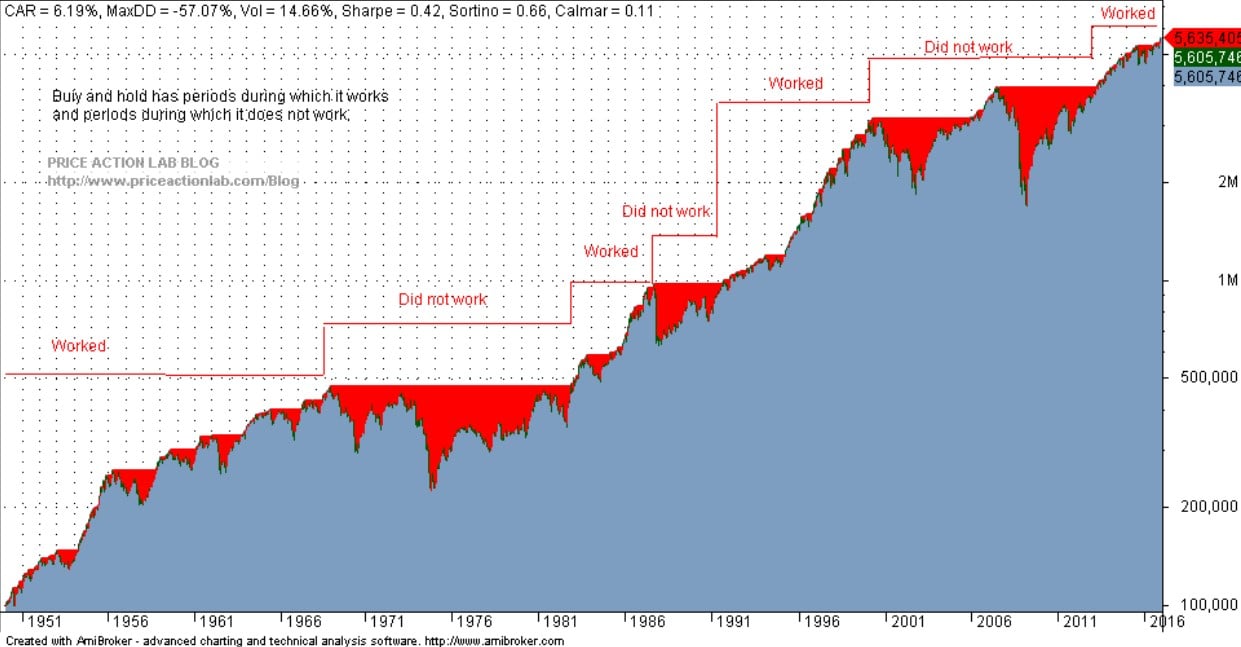

Some skeptics feel that investors rely too much on this index and it can encourage poor investment habits such as trying to time the markets, which has been shown statistically to be a losing strategy for many investors. Buy and hold strategies are often the best way to make money in the markets and by relying on tools such as the Fear and Greed Index, investors may sell when it would have been more advantageous to hold.

The Crypto Fear and Greed Index can encourage investors to actively trade in and out of coins more often than they should, missing out on long term capital appreciation and having transaction fees eat away at profits.

Sometimes Buying and Holding is the Right Call, Sometimes it’s Not Image via mikeharrisny.medium

Sometimes Buying and Holding is the Right Call, Sometimes it’s Not Image via mikeharrisny.medium Closing Thoughts

While the Fear and Greed Index gives us really valuable insight into the overall sentiment of the market, it should not be used as gospel and solely relied on for investment decisions. I think it is one of many important metrics to keep an eye on, and used in conjunction with other fantastic metrics like those that can be found on the website lookintobitcoin.com. In my opinion, The Fear and Greed Index is great for those of us so deep into crypto that we forget to look outside of our own bubble.

Just about everyone I socialize with is into crypto and sometimes we can get caught in our own echo chambers when we are only surrounded by other crypto enthusiasts. Sometimes it can be hard to remember that we are still early and most people are not here yet, so, while I may be feeling euphoric after a crypto conference and all my friends meet up and talk about Bitcoin, we may be all be feeling very confident in it and think we are nearing a top but the Fear and Greed Index could read that people are over-all still fearful and that our euphoria may be completely misplaced so it can act as a great “reality check.”

As far as the criticisms go, it is up to each individual investor to figure out what is right for them as there is never a one size fits all solution to investing. There are a lot of investment experts with a lot of data to back up their claims that trying to time the markets is impossible and a fool's game over time, while there are many others who claim that even if you can time the tops and bottoms with a 10-20% error for margin (as nobody will ever time the very top and bottom) in crypto and can time the stock market tops and bottoms with a margin of error of 10-30 days that you will enjoy far better gains.

Each camp has its merits, and both are valid opinions. Investing is a life-long learning journey and depends on each person’s biases, how much time and effort they are willing to put in, what markets they are trading and how much expert knowledge they have, and whether or not they are confident that they will be able to accurately time the market as one mistake in timing can lead to some serious losses, or significantly hinder potential long-term gains.