Editor’s Note: We fully updated this guide in February 2026 to make it more practical, more crypto-native, and easier to apply in real trading conditions. The previous version leaned heavily on long-form narrative and broad psychology concepts. This refresh is built as a playbook: a quick-start section, clearer definitions, tighter “rules that prevent bad clicks,” expanded coverage of crypto-specific triggers, and more actionable tools like checklists, cooldown rules, journaling prompts, and a 90-day implementation plan. We also revised the structure, added real-world case studies, and streamlined the guide for faster reading and better on-page navigation.

Crypto Trading Psychology in 2026 (Quick Start)

If charts are the map, psychology is the hands holding the steering wheel. This section gives you the “what,” the “why crypto is worse,” and the rules that keep you consistent when the screen gets loud.

Quick Answer: What is crypto trading psychology?

Crypto trading psychology is the study and management of the thoughts, emotions, and habits that affect how you enter, manage, and exit trades. In practice, it’s the difference between following your plan and reacting to price like it’s an alarm.

Crypto amplifies it because the combo of high volatility, easy leverage, 24/7 markets, and always-on social feeds turns small emotions into big clicks.

5 signs you need this guide

- Revenge trading: “I’m getting it back” becomes your strategy.

- Moving stops wider: You turn invalidation into negotiation.

- Doom-scrolling X/Telegram: Your feed starts steering your entries.

- Overtrading chop: Fees pile up while edge disappears.

- “Hope” trades: You stay in because exiting feels like admitting you were wrong.

TL;DR: The 10 rules that stop emotional trades

- Define risk before entry: Size the trade from the stop, not from the vibe.

- Place the stop immediately: No stop = no trade.

- Never move a stop wider: If it needs “more room,” your thesis is weak or your size is too big.

- One loss = mandatory cooldown: Step away for a fixed time before the next decision.

- Cap daily damage: Daily loss limit hits, trading ends. No debates.

- Fewer trades, higher quality: Trade A+ setups only, especially in chop.

- No feed-driven entries: If the idea came from your timeline, treat it as late until proven otherwise.

- Pre-plan exits: Write invalidation + take-profit logic before you click buy/sell.

- Use alerts, not staring: Reduce the chart-slot-machine loop.

- Grade process, not PnL: Reward rule-following, not lucky green candles.

Key Takeaways

- Psychology is execution: Most traders don’t fail on strategy, they fail between plan and click.

- Crypto magnifies impulses: Volatility + leverage + 24/7 + socials means you need tighter rules than in slow markets.

- Remove negotiation: Daily limits, cooldowns, and “no wider stops” protect you from “just this once.”

- Win with consistency: Fewer, cleaner trades beats constant activity.

- Track behavior: Improve rule adherence and outcomes usually follow.

How This Guide Was Built

I didn’t write this because I wanted to do a “mindset” article. I wrote it because trading has a way of making you do strange things, even when you know better.

I started taking crypto trading seriously around 2022, and like a lot of people, I thought the main job was learning charts, setups and market structure. I treated it like school: study hard, take notes, get better. For a while, it felt like it was working. I could explain what I was doing. I had rules. I could even sound disciplined when I talked about it.

Then the pressure showed up.

Not the big dramatic kind. The normal kind: a losing streak, a choppy week, a trade that almost works then stops you out and runs without you. That’s when I noticed the real problem wasn’t “strategy.” It was what happened between my plan and my execution. I’d hesitate on good setups because I was still carrying the last loss. Or I’d take a mediocre trade because sitting out felt unbearable. Or I’d start negotiating with risk, telling myself I was being flexible when I was really just trying to avoid feeling wrong.

The annoying part is that none of this feels irrational while you’re doing it.

So this guide is basically built from me asking one question over and over: what keeps a trader consistent when their brain is doing the opposite of helpful? I’m not pretending I solved it perfectly. I’m not some zen robot. But I did figure out what actually moved the needle.

Here’s what I used to build this guide:

My own screw-ups (and patterns). I paid attention to the repeat offenders: moving stops, overtrading chop, chasing after I missed a move, trying to “win it back.” Same mistakes, different outfits.

- Risk-first rules that remove negotiation. Anything that relies on willpower eventually breaks. So I leaned into rules that make it harder to do something stupid: daily loss limits, cooldowns after losses, position sizing that doesn’t change with mood.

- Simple checklists and routines. Not because they’re sexy, but because they work when you’re tired, tilted, or overconfident. Especially in crypto, where your phone is basically a 24/7 trigger machine.

- Behavioral finance and psychology basics. Stuff like loss aversion, recency bias, confirmation bias. Not as theory, but as “here’s how it shows up in a real trade, and here’s the rule that fixes it.”

- Crypto-specific reality. Leverage is everywhere, markets never close, social feeds move faster than price sometimes, and narratives can bully you into acting. So the guide is designed for that environment, not for some slow-moving textbook market.

That’s the core idea: I’m not trying to help you feel calm. I’m trying to help you act consistent, even when you don’t feel calm. Because in my experience, most accounts don’t get blown up by one catastrophic decision. They get chipped away by a hundred “just this once” decisions that happen when the chart gets loud.

If this guide does its job, it gives you a playbook you can still follow on your worst day. That’s what I wish I had earlier.

Why Your Brain Is Bad at Trading

You are not “weak” for feeling fear or greed. Your brain is doing what it was designed to do. The issue is that the brain’s threat-response system is not optimized for fast markets.

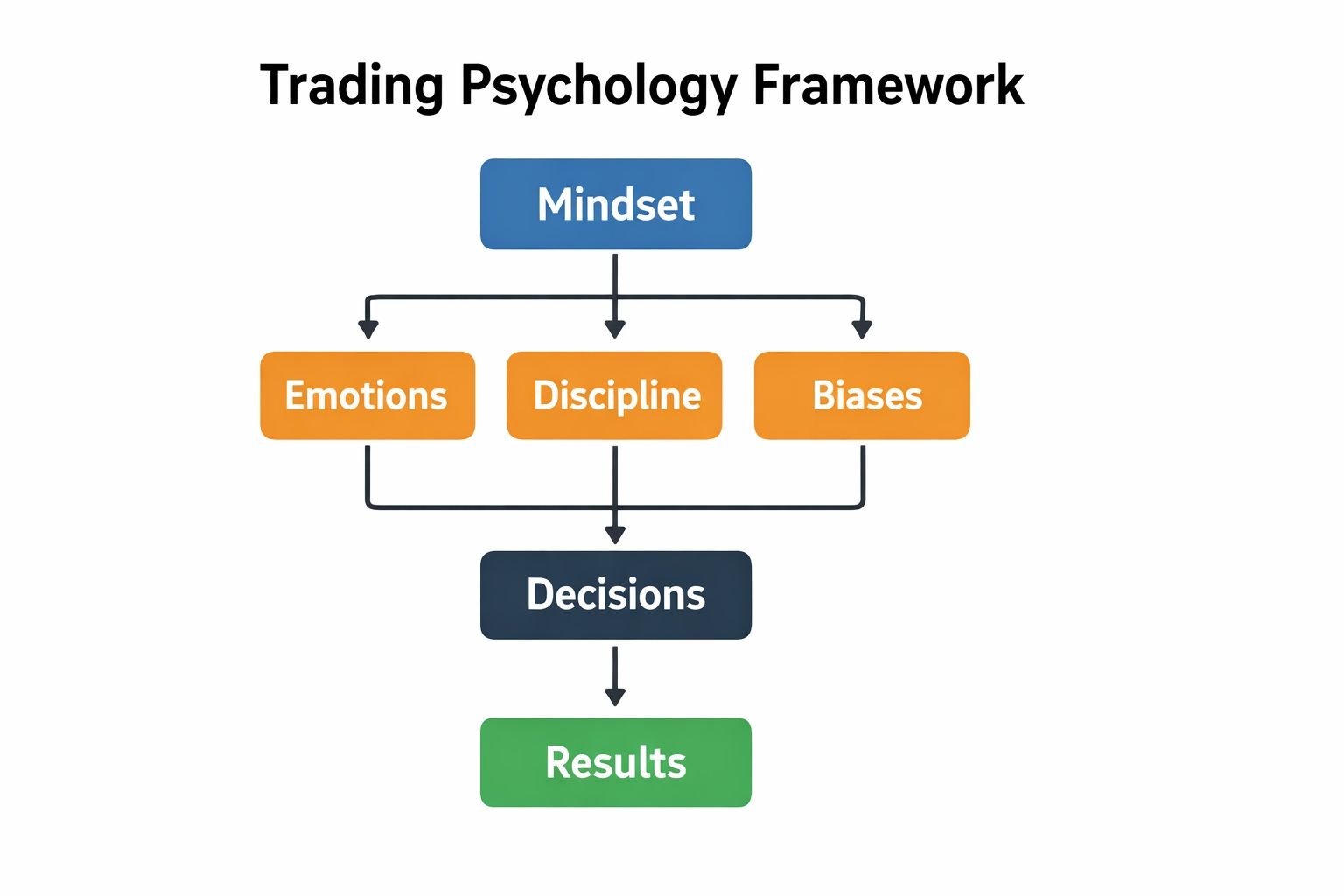

A Trading Psychology Framework For Better Understanding

A Trading Psychology Framework For Better Understanding The survival brain vs the trader brain

Here is the simplest version. When your brain senses threat, it pushes you toward speed. That is useful if you are stepping out of traffic. It is less useful when you are managing a leveraged position in a market that can spike both ways in minutes.

Stress flips a switch. Your brain starts looking for threats and quick exits, not clean decisions. Planning and impulse control drop off, which is why your perfectly reasonable plan can vanish the second a candle rips against you.

I’ve had moments where I could literally feel that switch flip. One minute I’m following my plan, the next I’m clicking like I’m trying to “fix” the chart. The trade didn’t change. My state did.

The giveaway for me is speed: if I’m suddenly rushing, checking five timeframes, or wanting to adjust something right now, I’m reacting not trading.

This is why “just be disciplined” is not a real plan. Discipline in trading is mostly environmental design:

You make key decisions in advance, when you are calm.

You reduce exposure to triggers that spike emotion.

You use rules and automation so your worst impulses do not get a vote.

Loss aversion in crypto

People tend to feel the sting of a loss much more sharply than the satisfaction of a gain. In fact, losing something often hurts about twice as much as winning the same thing feels good. That’s why, in finance and beyond, we sometimes see people make choices that don’t quite add up because avoiding a loss feels more urgent than chasing a gain.

I didn’t notice this at first because it disguises itself as “being sensible.” I’d take profit early and tell myself I was being disciplined, when really I just wanted the relief of not being wrong anymore.

And on the other side, I’ve held losers longer than I should have, not because the setup still made sense, but because closing it felt like writing a loss in permanent ink.

In crypto, loss aversion usually shows up as three predictable mistakes:

You cut winners early to lock in relief.

You hold losers because exiting feels like admitting failure.

You sabotage sizing after a loss because you want emotional recovery, not a clean process.

The fix is not pretending you do not care. The fix is removing negotiation. Your exit rules should be decided before entry, based on invalidation, not on how you feel in the moment.

If you want the foundational framework behind this concept, it comes from work on prospect theory, which explains why people treat gains and losses asymmetrically.

Dopamine, attention, and the “chart-slot-machine” loop

Staring at short timeframes can turn trading into a variable reward loop. Every candle is a mini outcome, and the brain wants to resolve uncertainty quickly. That can lead to impulse entries and constant tinkering.

I’ve caught myself doing the classic loop: “just one more candle,” then another, then another. You don’t even realise you’re waiting for the chart to give you permission to act.

When I’m in that mode, I start seeing trades everywhere. Not because there are more setups, but because my brain is bored and looking for a hit.

A high-impact change is to reduce exposure to triggers:

- Replace constant watching with alerts.

- Reduce timeframes you monitor live.

- Use rules for when you are allowed to intervene.

The Crypto Context Update (2024–2026): Why This Era Hits Harder

The mental game is the same as ever. What’s different is the environment. Crypto runs nonstop, narratives whip around fast, and leverage makes the market less forgiving when you slip up.

Halving, ETFs, and narrative shocks

Bitcoin’s halving is a programmed reduction in block rewards that occurs every 210,000 blocks, often described as roughly every four years. For a deeper dive, head over to our article on Bitcoin halving.

Narratives can trigger impatience: traders enter too early, add leverage because “it has to happen,” then get forced out when price chops.

Spot ETFs added a different psychological trigger: mainstream validation. The SEC’s approval of spot Bitcoin exchange-traded products became a major 2024 inflection point, as described in the SEC Chair’s public statement. For traders, the problem is not the ETF itself. The problem is the emotional story traders attach to it.

The attention economy of crypto

Crypto news moves at social speed. That encourages “information overload bias,” where you feel like you must act because you saw something new.

If you want a clean rule: If the trade idea is coming from your feed, it is probably coming late. Build a system where your feed does not get a vote during execution hours.

Market makers and liquidity shifts

Many scary wicks are not personal. They are market structure: thin order books, clustered stop zones, and leveraged positions getting closed automatically.

Order books in crypto aren’t steady. Depth and spreads shift across exchanges and across the day, so your trading costs and price impact can change a lot, especially when the market is stressed.

The practical psychology point: Sudden moves are normal in crypto. If your plan assumes “smooth price action,” your emotions will constantly be surprised.

What this means for your rules:

- Size positions assuming volatility, not hoping for calm.

- Use fewer trades when liquidity is thin.

- Avoid stacking correlated exposure across multiple positions.

Emotional Mastery: The 5 Emotions That Blow Up Accounts

This section turns emotions into actions. You cannot stop emotions from showing up. You can stop them from driving the mouse.

You Cannot Stop Emotions From Showing Up, But You Can Stop Them From Driving The Mouse

You Cannot Stop Emotions From Showing Up, But You Can Stop Them From Driving The MouseOverview table

| Emotion | Physical signs | Typical mistake | Counter-strategy |

|---|---|---|---|

| Fear | shallow breathing, tight chest, tunnel vision | panic selling, stop meddling | pre-set exits, step-away rule |

| Greed | urgency, “just a bit more,” overstimulation | oversized positions, chasing | take-profit tiers, trade caps |

| Hope | bargaining, ignoring invalidation | holding losers, moving stops | invalidation checklist, time stops |

| Frustration | irritation, fast clicking | revenge trades | cooldown timer, strict loss limits |

| Boredom | restlessness, chart surfing | overtrading chop | no-trade conditions, alternative tasks |

1. Fear (panic selling, hesitation, stop meddling)

Fear often spikes after a fast wick, a liquidation cascade, or a scary headline. It can also show up as hesitation, where you miss good entries because you are still processing the last loss.

Three tactics:

- Breathing protocol: Take 6 slow breaths before you change a trade. It sounds basic because it is basic, and it works because your body is part of decision-making.

- Pre-set exits: Place your stop and take-profit logic immediately after entry.

- Step-away rule: If you want to intervene mid-trade, step away for two minutes first.

“If-Then” rules:

- If my heart rate spikes, I reduce size on the next trade or stop trading.

- If I want to move a stop wider, I close the trade instead.

2. Greed (FOMO, oversized positions, “just a bit more” exits)

Greed is often urgency disguised as opportunity. It shows up in chasing green candles, adding leverage after wins, and refusing to take profits because you want the perfect exit.

Three tactics:

- Use predefined take-profit tiers.

- Cap max concurrent trades.

- Add a “no green-candle chasing” rule.

3. Hope (holding losers, denial, moving stops)

Hope becomes dangerous when it replaces evidence. If the setup is invalidated, staying in is not “conviction.” It is avoidance.

Three tactics:

- Write invalidation criteria before entry.

- Use a time stop (exit if it does nothing by a certain time).

- Require a “data check” before you are allowed to stay in.

4. Frustration (revenge trading, angry clicking)

Frustration is one of the biggest account killers because it speeds you up. You trade faster, size bigger, and ignore checks.

Three tactics:

- Use a strict cooldown timer after a loss.

- Use a journal prompt immediately after any rule break.

- One-trade maximum after a losing day.

5. Boredom (overtrading chop, forcing setups)

Boredom is a stealth emotion. It makes you hunt for trades that are not there. In sideways markets, boredom becomes death-by-fees.

Three tactics:

- Set a trade limit per session.

- Define no-trade conditions.

- Keep an “alternative tasks” list ready.

Pre-trading ritual checklist

- Sleep check: Did I get enough rest to make decisions?

- Risk check: Do I know my max loss today?

- Setup check: What is my A+ setup?

- Distraction check: Is my phone out of reach?

During-trade checklist

- Is the stop placed?

- Is the position size consistent with my plan?

- Am I reacting to price or following rules?

- Do I need to step away for two minutes?

After-trade review checklist

- Did I follow the plan?

- What emotion was strongest, and when?

- Did I break any rule? If yes, why?

- What is one adjustment for tomorrow?

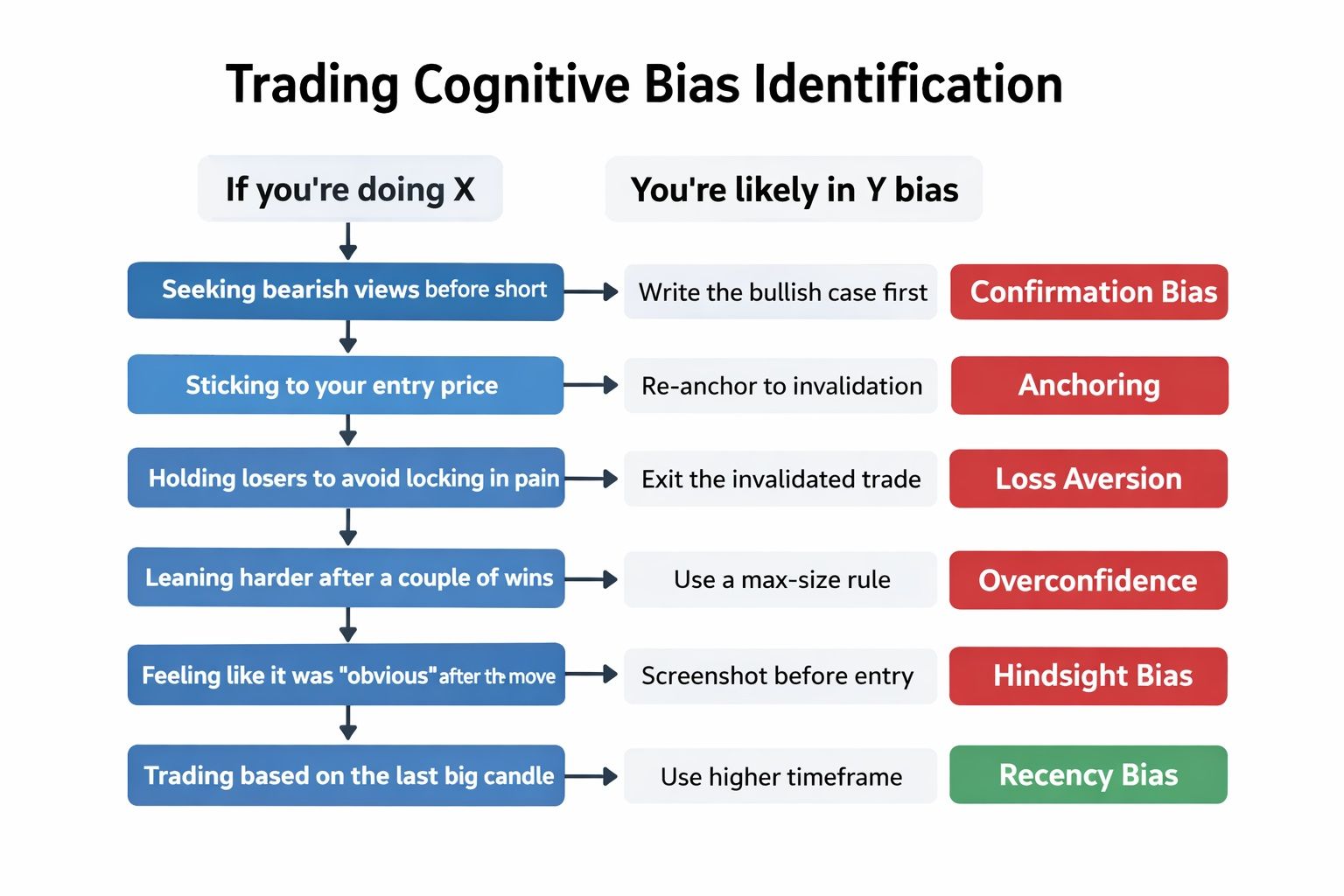

Cognitive Traps: The 7 Biases Crypto Traders Actually Get Stuck In

Biases are not character flaws; they are predictable shortcuts. The goal is to spot them early, then use a rule that forces you back to reality.

A Simple Bias Identification Flowchart

A Simple Bias Identification FlowchartBias wheel overview

- Confirmation bias: Seeking info that agrees with you.

- Anchoring: Sticking to a number like entry price or ATH.

- Loss aversion: Avoiding the pain of a realized loss.

- Overconfidence: Leverage creep after wins.

- Hindsight bias: “It was obvious” after the move.

- Recency bias: The last candle feels like destiny.

- Availability bias: Viral news feels more likely than it is.

1. Confirmation bias (the “I only watch bullish takes” trap)

Crypto example: you fall in love with a thesis, then interpret every dip as “discount” even after the market structure breaks.

Fix: Argue the opposite. Write down the best bearish case before you enter. You do not need to believe it. You need to see it.

2. Anchoring (stuck on your entry price / ATH / old range)

Anchoring shows up when you refuse to exit because “it will come back to my entry,” or when you set targets based on an old level that no longer matters.

Fix: Re-anchor to invalidation and current structure, not to memory.

3. Loss aversion (hold losers, sell winners)

This is where the pain of being wrong keeps you in a trade that is no longer valid.

Fix: Journaling prompt. “What evidence says I should still be in?” If you cannot answer clearly, you are not trading, you are hoping.

4. Overconfidence (early wins, leverage creep)

Overconfidence is rarely loud. It is subtle: a little bigger size here, a higher leverage there, less patience because you feel “in sync.”

Fix: A confidence cap. After a winning streak, you do not increase size until you complete a weekly review.

5. Hindsight bias (chart looks obvious later)

After the fact, charts look clean. In the moment, they are messy. Hindsight bias makes you overestimate how “readable” the market is.

Fix: Screenshot and write your thesis before entry. Not after. If you want a framework for this kind of deliberate note-taking, consider building templates in Notion.

6. Recency bias (last candle feels like destiny)

Recency bias makes you treat the last move as the next move. It can turn one candle into a full narrative.

Fix: Timeframe hierarchy. If you are trading a 4-hour setup, the 1-minute candle does not get to overrule it.

7. Availability bias (viral news feels more probable than it is)

If a story is everywhere, it feels more likely to matter. That can push you into impulsive trades on rumors.

Fix: Use a news checklist. “Is this confirmed? Is it new? Does it change my plan or just my mood?”

Discipline and Risk: The Psychology of Not Blowing Up

Discipline is structure. The goal is to remove decisions you cannot be trusted to make during stress.

The 1% rule (and why traders break it emotionally)

The “1% rule” is simple: risk a small, consistent portion of your account per trade. Many traders break it after losses because they want relief quickly, and after wins because they feel invincible.

Simple example:

- $10,000 account.

- 1% risk per trade = $100 maximum loss.

- If your stop is $0.50 away, your position size is 200 units ($100 / $0.50).

The math is easy. The hard part is sticking to it when emotions are loud.

Your trading plan

A trading plan does not need to be fancy. It needs to be specific.

Minimum viable plan:

- Market type you trade (spot, perps, options).

- Setups you allow (2–3 max).

- Entry criteria (what must happen).

- Invalidation (what proves you wrong).

- Exit plan (take profits, stop, time stop).

- Max daily loss.

- Max trades per day.

If your plan does not say when you stop, your emotions will decide for you.

Stop-loss psychology (why moving stops feels “safe” but isn’t)

Moving a stop wider feels like giving the trade “room,” but it is usually avoidance. A stop is not a suggestion. It is the price where your thesis is wrong.

Rules that help:

- You can only tighten stops, not widen them.

- You can only adjust stops in your favor, based on pre-defined logic.

- If you feel tempted to remove a stop, you reduce size or exit.

Journaling that actually works

A good journal is not a feelings dump. It is a feedback loop.

What to record:

- Setup name and rationale.

- Entry and stop logic.

- Emotion level (1–10) at entry, mid-trade, exit.

- Rule adherence: yes or no, plus which rule broke.

- Screenshot before entry.

Weekly review prompts:

- Which setup performed best?

- What emotion caused the most damage?

- What rule breaks repeated?

- What is one change for next week?

If you want a dedicated tool, Edgewonk focuses heavily on behavior and journaling workflows. If you want something simple that still supports imports and review, Tradervue is another option.

Process score (grade yourself on rules, not PnL)

If you only track profit and loss, your brain learns the wrong lesson. A green day can come from bad behavior. A red day can come from perfect execution in a noisy market.

Use a simple process score:

Score each trade on rule adherence (for example 0 to 5).

Track the weekly average.

Your goal is to improve the score, not to force a specific outcome.

A high process score with flat PnL is a good sign. It usually means you are building consistency. Over time, consistency is what gives you a real edge.

Recovery: What to Do After an Emotional Blow-Up

Everyone has a bad day. The difference between a growing trader and a broken account is what happens next.

The 24-hour reset protocol

The next 24 hours are about lowering your nervous system, not proving you can win.

- No trading.

- Sleep and hydration first.

- Step away from social feeds.

- Light movement, even a walk.

You are not broken. Your nervous system is loud.

The 7-day rebuild plan (tiny positions + strict rules)

The goal is to rebuild trust in your process.

- Reduce size dramatically.

- Fewer trades.

- Only A+ setups.

- Journal daily.

- End the week with a review.

If you cannot trade small, you cannot trade big safely.

The “revenge trading” circuit breaker

Hard limits remove negotiation:

- Max losses per day.

- Max trades per day.

- Mandatory cooldown after any loss.

Accountability helps. Share your rules with a buddy, or keep a checklist you must complete before every trade.

When to stop trading entirely (for now)

Clear criteria:

- Sleep deprivation.

- Anxiety spikes tied to trading.

- Compulsive checking.

- Inability to follow basic rules like stop placement.

If trading is becoming compulsive or harmful, consider professional support. That is not weakness. It is risk management.

Psychology by Trading Style: Day Trading vs Swing Trading vs Long-Term

Different time horizons create different psychological traps. Your rules should match the style you actually trade, not the style you wish you traded.

Day trading psychology

Day trading is vulnerable to noise addiction and decision fatigue.

Fixes:

- Session windows (trade only specific hours).

- Automation (alerts, bracket orders).

- Fewer charts, fewer markets.

Swing trading psychology

Swing trading demands patience, which can create the “checking too often” problem.

Fixes:

- Alerts instead of constant monitoring.

- Weekly plan review.

- Time stops to avoid endless holds.

Long-term investing psychology

Long-term holders face drawdown stress and thesis drift.

Fixes:

- Thesis checklist.

- Rebalancing rules.

- Boundaries on doom-scrolling.

If you are investing rather than trading, The Coin Bureau’s portfolio optimization guidance can help you think in systems rather than in impulses.

Psychology by Market Regime: Bull, Bear, Sideways

Market conditions change, but many traders keep trading the same way. That mismatch is a major psychological trigger.

| Regime | Common mistake | Rule |

| Bull | leverage creep | cap size and trades |

| Bear | panic trading | reduce exposure |

| Sideways | overtrading | add no-trade conditions |

Bull markets

Rule: Increase quality filters, not trade frequency. Bull markets make bad habits look smart.

Bear markets

Rule: Reduce exposure, widen timeframes, protect capital. Survival matters more than activity.

Sideways/chop

Rule: Fewer trades, tighter selection, accept “no edge” periods.

Tools and Apps for Trading Psychology

Tools will not fix discipline. But the right tools can reduce triggers, automate execution, and make reviews easier.

Right Tools Can Reduce Triggers, Automate Execution, And Make Reviews Easier

Right Tools Can Reduce Triggers, Automate Execution, And Make Reviews EasierJournaling and review tools

What features matter:

- Tags for emotions and rule breaks.

- Screenshot support.

- Stats by setup and time of day.

- Easy imports from exchanges or brokers.

For dedicated journaling platforms, consider Edgewonk or a lightweight workflow in a spreadsheet if you prefer full control.

Mindfulness and focus tools

This is not about becoming a monk. It is about lowering baseline stress so you can follow rules.

Options:

- Headspace for guided routines.

- Calm for meditation and sleep support.

- Insight Timer for a large free library.

Sentiment tools (use as inputs, not signals)

Sentiment is useful as context, not as a trigger.

- The Crypto Fear and Greed Index is a popular sentiment gauge.

- LunarCrush tracks social and narrative momentum.

- Santiment offers on-chain and social datasets.

How to use without getting hypnotized:

- Check sentiment once per day, not every hour.

- Use it to avoid extremes, not to chase them.

- If sentiment makes you feel urgency, step back.

Automation to reduce emotion

Automation is one of the cleanest psychology tools:

- Alerts at key levels.

- Bracket orders with pre-defined exits.

- Predefined take-profit tiers.

Real Crypto Case Studies: Psychology Lessons Written in Blood

Case studies matter because they show how biases look in real time. The goal is not to relive disasters. It is to map failure patterns to rules.

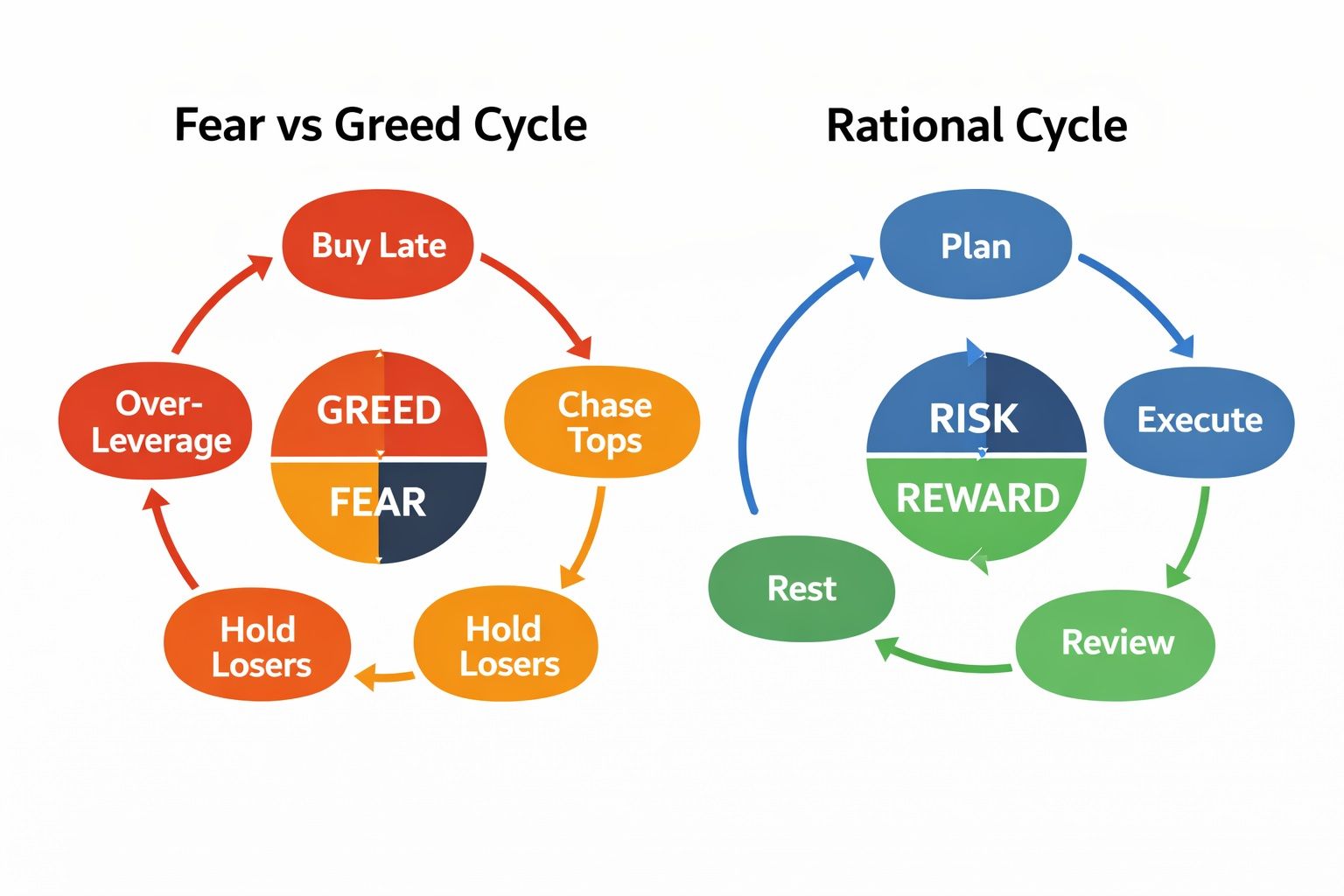

Fear vs Greed Cycle Infographic + Rational Cycle Alternative

Fear vs Greed Cycle Infographic + Rational Cycle AlternativeLUNA/UST (May 2022): confirmation bias + hope

LUNA and UST are a clean example of how confirmation bias and hope team up to keep traders in a narrative long after the chart stops agreeing.

What traders told themselves:

“The peg always returns.”

“It is just a temporary de-peg.”

“If I sell now, I am selling the bottom.”

What invalidation looked like:

The peg repeatedly failed to recover cleanly.

Liquidity confidence evaporated fast.

Price action shifted from volatility to structural collapse, where each “bounce” was weaker and shorter.

A useful official reference here is the SEC’s Terraform Labs complaint, which lays out how UST and LUNA were presented and how the unwind unfolded.

Rules to adopt:

Thesis-break triggers: write down exactly what proves you wrong before you enter.

Exposure caps: limit how much one thesis can damage you.

Stablecoin checklist: understand the mechanism, collateral model, and reflexive risks before treating it like cash.

FTX (Nov 2022): normalcy bias + herd panic

Normalcy bias is the belief that things will keep working because they have been working. When confidence cracks, the herd swings the other way.

FTX’s Chapter 11 case record provides a straightforward timeline of the crisis and filing on the case portal.

Rules to adopt:

- Counterparty risk checklist for centralized platforms.

- Withdrawal discipline (do not ignore early warning signs).

- Spread risk across custody options.

ETF-era FOMO (Jan 2024): narrative momentum and late entries

ETF headlines created a “now or never” feeling for many traders. The Congressional Research Service overview of the SEC approvals is a solid factual anchor for what happened in January 2024.

Rules to adopt:

- No chasing headlines.

- Staged entries.

- If it is viral, treat it as late until proven otherwise.

A 2025–2026 alt-season style example: greed + overconfidence

Alt cycles often tempt traders into leverage creep and ignoring exits because everything is moving.

Rules to adopt:

- Profit-taking ladders.

- Exposure ceilings by sector.

- Maximum number of open positions.

The 90-Day Trading Psychology Action Plan

If you want a real change, you need a timeline. This plan is designed to build stability first, then habits, then optimization.

Week 1 (stabilize)

- Build your minimum viable plan.

- Set loss limits and trade caps.

- Start a journal.

- Reduce size.

Weeks 2–4 (install habits)

- Pre-trading ritual every session.

- Bias checks before every trade.

- Weekly review.

- Fewer trades, higher quality.

Month 2–3 (optimize and stress-test)

- Track triggers and patterns.

- Refine setups.

- Remove behaviors that keep repeating.

- Stress-test rules with small size before scaling.

Success metrics (process-first)

Track:

- Rule adherence percentage.

- Average risk-to-reward on planned trades.

- Max drawdown limit compliance.

- Number of impulse trades per week.

Printable checklist and Notion template: Add placeholders for a downloadable checklist and a Notion template version of the plan, so readers can implement without friction.

Resources and Further Learning

Best books

Trading in the Zone by Mark Douglas: Best for probability thinking and staying consistent even when outcomes vary.

The Daily Trading Coach by Brett Steenbarger: Best for structured self-coaching and building habits you can measure.

Trading for a Living by Alexander Elder: Best for linking psychology, method, and risk management into one practical framework.

Trade Your Way to Financial Freedom by Van K. Tharp: Best for position sizing and system thinking, especially if you want rules that scale.

Coin Bureau next steps

- Crypto risk management

- Secure Crypto exchanges

- Dollar-cost averaging (useful for long-term psychology)

- Stop-Loss Hunting

If you only do 3 things

If you only do 3 things, make sure to do these.

-

Define risk before entry and place the stop immediately.

-

Set daily loss limits and enforce cooldowns after losses.

-

Journal rule adherence and review weekly, then adjust one thing at a time.