Crypto margin trading may not be for everyone.

However, those that are able to use if effectively and in a risk controlled manner can increase their returns for a set amount of capital. It gives them the ability to trade on borrowed money.

It is also a great way for traders to not only take a long view on the asset in question but also to short sell it.

In this post, we will give you everything that you need to know about crypto margin trading. We will also give you some essential hints and tips as well as look at some of the best places to trade on margin.

What is Margin Trading?

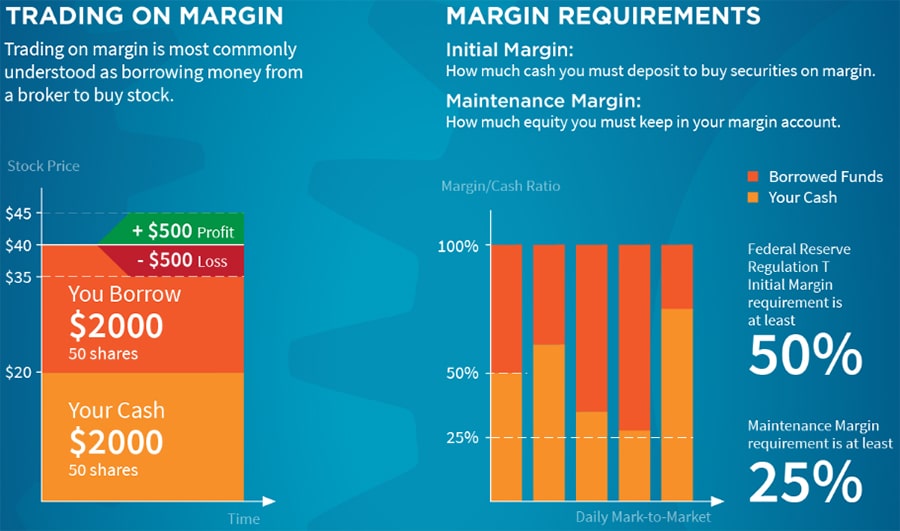

Margin trading is essentially the practice of trading with money that has been borrowed. You are trading with "leverage" as the margin (collateral) that you are putting down for the trade is usually only a fraction of the amount required.

Given that this is a leveraged position, you are able to increase your profits (and losses) from a given movement in the price of the asset. This is why margin trading can often be considered a double-edged sword.

Of course, given that with margin trading you are borrowing funds, there will be fees involved. These are interest rates or "overnight" rates that are applied to the total amount that you have outstanding.

Practical Example

Let us assume that you would like trade some Bitcoin on margin. The exchange in question will have maximum leverage (or minimum margin) that is required for you to take the position. Let us assume that the min margin is 20%.

This means that if you would like to take a position in Bitcoin you will need to put down 20% of the amount of the notional of the trade. So, if your position is in 10BTC you will need to put down 2BTC as collateral or margin.

This also means that the leverage on the position is 5X. Leverage is a measure of how much your position will react to the movement in the underlying asset. So, in this example, if the price of Bitcoin moves by 1% your position will move by c. 5% (percentage approximation).

Example of a Margin Trade on Stock. Image via Interactive Brokers

Example of a Margin Trade on Stock. Image via Interactive BrokersYou can now see why margin trading can be lucrative and at the same time risky. Some exchanges and brokerage firms allow leverage to go up to 10 - 100 times. A well-placed trade can either make you a highly profitable return or completely wipe out your capital.

In order to avoid the latter outcome, some brokerage firms will require what is called a "Maintenance Margin". This is the minimum that is required to be held in the margin account once the trade has been opened. If the position falls below this then the trader will get a margin call from the broker.

Pros & Cons of Margin Trading

There are quite a few advantages that come with margin trading that are universally agreed:

- Greater Return: This is of course an obvious one. Margin trading allows you leverage which means that your return is X times larger than without (where "X" is the leverage level).

- Can Short the Asset: Margin trading also allows you to short the asset in question which means that you can benefit from falls in the price as well.

- Structured Trades: When combined with different degrees of leverage and buys / sells, margin trading allows the investor to place more structured trades. They can essentially develop strategies that look quite a bit like option trades.

As most may know, increasing returns in the cryptocurrency markets also means increasing risk. Trading on margin does not come without its drawbacks:

- Larger Losses: As we said, leverage is a double edged sword. Sure you can increase the returns on the upside by X but you can also magnify your losses. If you do not have risk management structures in place you can very quickly deplete your capital.

- Funding Cost: Even if you have a view on the direction on the asset and the trade does eventually go that way, you are still at risk of a margin call and a liquidation. This is because with leverage often a small move in the opposite direction could result in your position being called or closed. Of course, given that you are borrowing funds in order to place the trade you will have to pay interest on those funds. This is the rollover rate that is applied to the position. If you have a really large position and you keep this open for an extended period of time it can eat into your profit.

The key thing to appreciate about margin trading is that there are risks and that these risks can be significant if you do not have a strategy.

However, most successful margin traders will agree that as long as you are able to most effectively manage these risks, you can make a success of it. This is something that we will touch on a bit more below in some of Margin Trading Top Tips.

Crypto Margin Trading Exchanges

So, you have now decided that you would like try your hand at some margin trading. The next most important step is for you to find a platform that is best suited to your individual needs. This is important because the margin and futures products offered by these exchanges can be vastly different.

In the below list we take a look at some of the best-known crypto margin trading platforms. It is important to point out that these are by no means exhaustive and there may be other exchanges that offer similar products. Be sure to do your research before you start using the services of such exchanges / brokers.

BitMEX

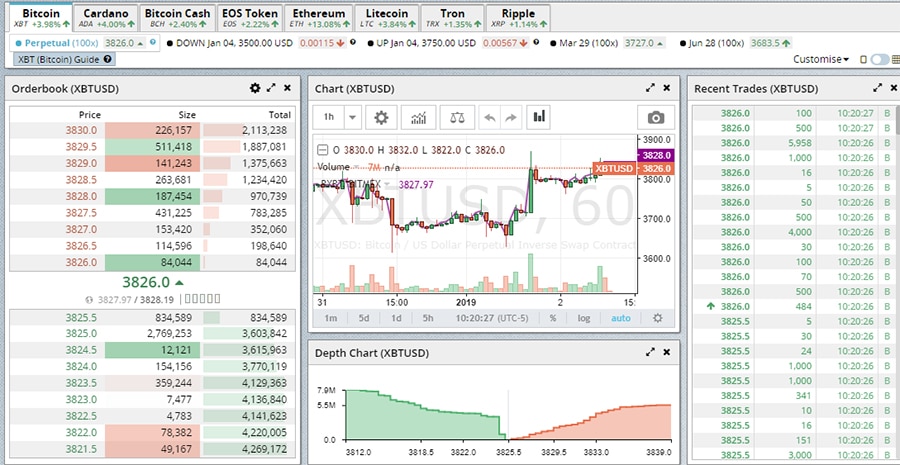

BitMEX is perhaps one of the best-known derivatives and margin trading platforms that are currently on the market. They have been around since 2014, operate out of Hong Kong and are registered in the Seychelles.

The products that are offered at BitMEX are Futures instruments. These can be considered analogous to spot margin trading with the difference being that you are trading an instrument that will be settled and closed sometime in the future on a future price.

BitMEX does have a spot price version of their futures contract and this is their "perpetual swap".

The BitMEX futures trading platform

The BitMEX futures trading platformThis is essentially a rolling futures contract that does not have an expiry price. It will be marked-to-market every day based on the movement in the price of the underlying asset and will never reach a termination.

When it comes to the leverage numbers at BitMEX, they are pretty high. For example, on their premier BTC futures contract, the minimum amount that you are required to put down is 1% of the notional. This implies a 100x leverage on the underlying asset.

Once your position has been opened then BitMEX has a more refined calculation for the maintenance margin. You won't get a margin call from BitMEX but they will draw on your funds or, in the event of fund depletion, they will liquidate your position.

BitMEX also has a range of other cryptocurrrency assets. In the below table we have a list of the coins on offer at BitMEX as well as their margin and and trading fees.

| Coin | Min Margin | Taker Fee | Maker Rebate | Settlement Fee |

| Bitcoin | 1% | 0.0750% | (0.0250%) | 0.0500% |

| Ethereum | 2% | 0.2500% | (0.0500%) | NA |

| Litecoin | 3% | 0.2500% | (0.0500%) | NA |

| Bitcoin Cash | 5% | 0.2500% | (0.0500%) | NA |

| Cardano | 5% | 0.2500% | (0.0500%) | NA |

| Ripple | 5% | 0.2500% | (0.0500%) | NA |

There are also a host of other things to consider when you are trading on BitMEX. You have many more options around trade functionality and risk management. If you wanted a complete overview then you are advised to check out our comprehensive BitMEX review.

Deribit

Deribit is another Bitcoin derivative exchange that has been around since 2016. They are based in Amsterdam in the Netherlands.

Like BitMEX, Deribit also offers these futures contracts on the price of Bitcoin. However, Deribit is one of the only fully operational crypto option exchange. They provide a market for a range of different option instruments on Bitcoin.

We won't go into too much detail on options here. This is because although short options do require posting margin, options are not really margin trading instruments. You can read our comprehensive guide to crypto options should you want more information.

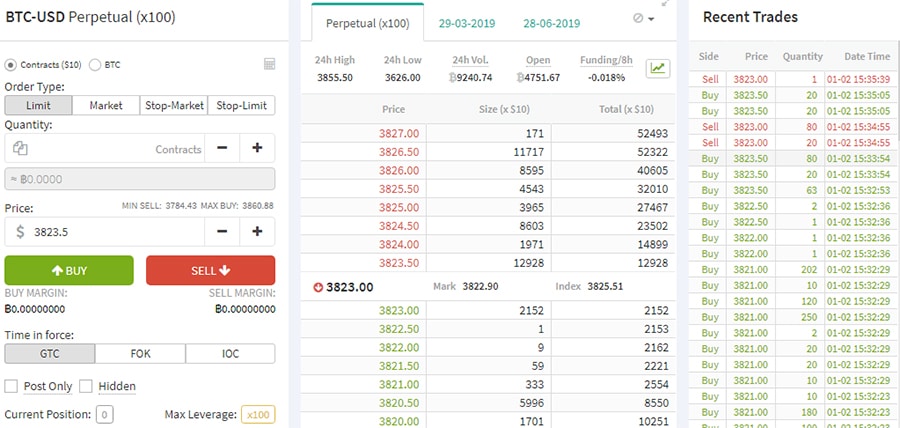

Deribit platform with Perpetual contract order books

Deribit platform with Perpetual contract order booksLike BitMEX, Deribit also has a minimum of 1% margin on their main Bitcoin futures. It is important to note that this 1% margin is not constant and will adjust by a factor of 0.5% for each 100BTC size in the position.

However, unlike BitMEX, Deribit lists their Maintenance Margin. This is predefined and is 0.55% and is also scaled according to the size of the position.

Something else that Deribit has on the margin side that is not on offer at other exchanges is what they call their "portfolio margin". This is an interesting feature that allows traders to offset margin requirements on particular trades based on positions they have in others.

If you want to read more about portfolio margin, their option instruments or more about their advanced platform then you can read our complete Deribit overview.

Kraken

Those of you who have been in the Bitcoin market for some time will no doubt have heard of Kraken. They are perhaps one of the oldest Bitcoin exchanges around having launched in 2011. Kraken is based in San Francisco in the USA.

They are best known for being a physical crypto exchange although they have started offering services akin to margin trading. They allow users to borrow funds in order to take positions in particular coins.

Unlike BitMEX and Deribit, these margin requirements are really quite tame. The minimum margin that you can post is 20% of the Notional which implies a leverage of 5X. Nevertheless, you can still short the crypto assets by selling with borrowed funds.

These leverage limits as well as total borrowing limit will vary according to what pair you are trading as well as what account level you have been verified up to. If you wanted to get more information on this then you check out their margin borrow limits.

In terms of fees, you will be charged a standard fee for opening the position as well as a fee for rolling over the position every 4 hours. The opening fee and rollover fees are the same and are 0.01% for the XBT and USDT base positions and 0.02% for all of the other base cryptocurrencies.

If you were interested in more information about their trading platform as well as their options for physical cryptocurrency trading then you can read our Kraken exchange review.

Huobi Pro

Like Kraken, Huobi is actually a physical Bitcoin exchange that is now offering crypto margin trading. Huobi launched their services in 2013 in China and now have their head offices in Singapore. They have now also opened up a subsidiary in the USA.

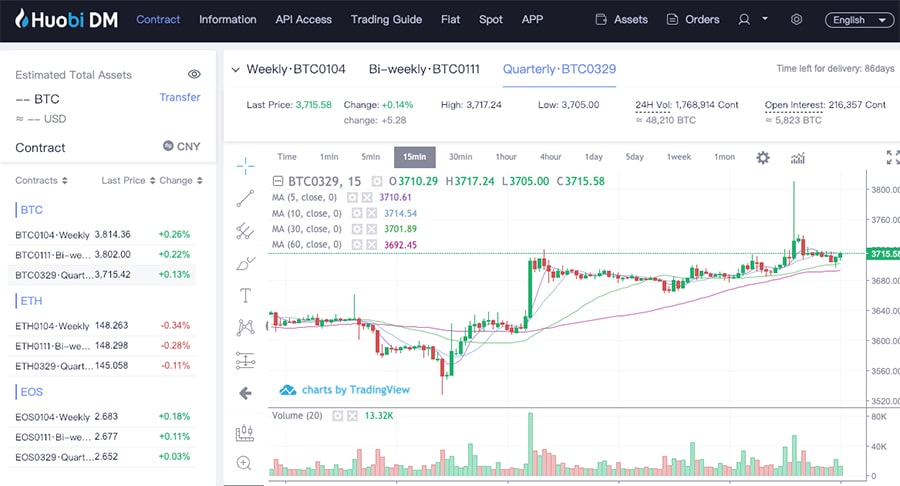

Much like BitMEX has done with their perpetual futures, Huobi has created their own form of financial derivative and margin product. This is the Huobi DM and it has only recently been launched as a separate exchange service.

The Huobi DM Trading Interface with Quarterly Contracts

The Huobi DM Trading Interface with Quarterly ContractsLike a perpetual future or spread betting product, the Huobi DM is an instrument that will give you leveraged exposure to the underlying asset. However, unlike the perpetual futures contracts, these have expiration dates and can be settled weekly, bi-weekly and quarterly.

In terms of the leverage that you are allowed to go up to with these contracts, they offer 1X, 5X, 10X and 20X. So, with a max leverage of 20X they are not as high as BitMEX or Deribit but is greater than on Kraken.

Huobi will also operate a Maintenance Margin Rate. This is used as an indicator to assess the risk of the position moving too quickly into loss making for Huobi. Below is a simple formula which shows how it is calculated on the exchange.

MMR = (Equity Balance / Used Margin) * 100% - Adjustment Factor

The margin call coefficient or "Adjustment Factor" will vary according to the risk of the position and the individual instrument. When the Maintenance Margin Rate falls below 0 then Huobi will initialize a liquidation on your position.

There is much more to Huobi than their margin trading and they have a plethora of other products. We won't go into any of that detail over here but you can get more information in our Huobi Exchange review.

Poloniex

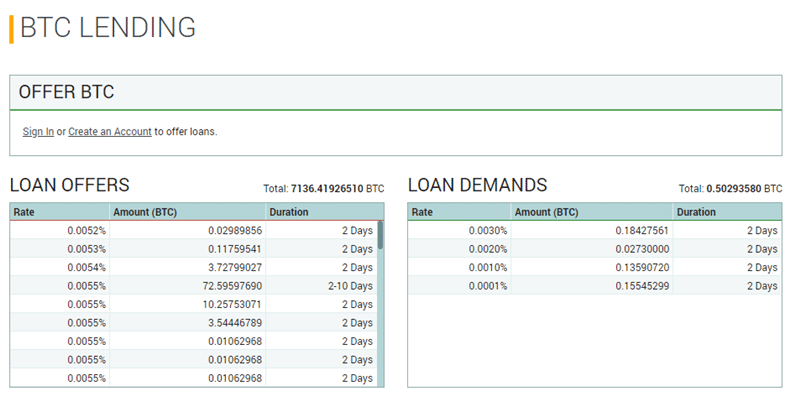

Another exchange that is offering lending services to their traders is that of Poloniex. They are a US based exchange that were launched in 2014. They have also been in the news recently as they were acquired by Circle Financial.

Not only can you borrow funds to trade on margin at Poloniex but you can also elect to be on the other side as the one who is offering funds up. In other words, you can be the margin provider and earn the fees that come with someone borrowing crypto from you.

In terms of the leverage limits, these are the lowest on offer among the exchanges currently. For example, the max that they will allow on BTC is 2.5X which implies an initial margin of 40%.

BTC Lending platform on Poloniex exchange

BTC Lending platform on Poloniex exchangeWhat is worth pointing out though is that unlike BitMEX, Huobi and Deribit, Poloniex requires full KYC to be done before you can start trading with them. While this may not be a deal breaker for some traders, there are many others who value their privacy and don't feel comfortable sharing this.

There is further bad news for those Poloniex traders that are based in the United States. They have only just recently stopped offering their BTC lending and margin features for these traders.

This is probably because of the rules that have been put in place post purchase by Circle. However, this option should still be available for those traders who are based in other jurisdictions.

Apart from the unfortunate news for US traders and the low leverage levels, Poloniex is a pretty advanced exchange with large coin coverage. If you would like more information on their platform and trading products then you can read our Poloniex review.

Margin Trading Top Tips

If you have decided that you want to progress to trading on margin, then you need to make sure that you know what you are using risk management best practices when placing your trades. Here are some pro tips that you can use in order to make the most of your margin trading:

- Start Small: There is no reason to jump in with 50 - 100X leverage when you are first starting your trading. You have to ease into it with lower leverage levels which don't have so much drawdown risk. If you get wiped out and liquidated on highly leveraged position then it is likely to affect your confidence negatively going forward.

- Avoid Excessive Leverage: Tying in with the point above, there is not really ever a need to go over 50X leverage on any of these exchanges. In fact, there have been studies done that have showed that using excessive leverage on assets such as Bitcoin are less optimal and can lead to premature liquidation. Remember, even if a trade goes in the direction that you were hoping short term fluctuations with large leverage could quickly kick you out of the trade.

- Use Stop Losses: In the event that a trade does end up going in the opposite direction then you need to adequate stop losses in place. All of these exchanges listed above have stop loss functionality in their orders and there is really no excuse not to use them. If you are using technical analysis to inform your trading then you should place these stops at levels that indicate a reversal of trend. Some exchanges have stop losses set to guaranteed by default. Some require you to pay more for the privilege (which we highly suggest)

- Invest only what you can afford: This one is pretty obvious but is still often overlook especially for the newer traders. You should have a defined amount of funds that you would like to stake on an exchange, a trading strategy and even a particular trade. Never chase losses and don't let your emotions get in the way of your margin trading.

Many of these tips will of course relate to cryptocurrency trading in general. It is also about knowing what you do know, knowing what you don't and learning what you don't know. If you have a general respect for margin trading then you should be fine.

Conclusion

Cryptocurrency margin trading is a great way for you to make returns on funds that are not your own. This is actually what banks do when you deposit your money with in their accounts. They use the funds to generate higher returns for their own pocket.

Of course, you are not a bank and banks are backed by the government agencies.

However, this does not mean that the financials of it should not apply. As long as you have an appropriate crypto trading strategy and have the right risk management protocols in place then margin trading could be an attractive option.

It of course goes without saying that you should always Do Your Own Research (DYOR). This is especially true for a highly leveraged crypto margin products.