Trading Bitcoin can be quite a risky endeavour. It is known to be one of the most volatile assets in the world. Even as more and more traders get on board and increase adoption, it still suffers from large price swings.

Generally, when most people invest in Bitcoin, they are taking the long view. They are investing in the hope that the price of Bitcoin will increase in the foreseeable future. This trade has worked well for a number of investors who label themselves as "Hodlers".

However, there may be a time that a trader wants to take an opposite view on Bitcoin. The asset does often suffer from corrections and these can be quite severe. There are also times that a trader will want to take a short position to hedge a long position.

Shorting Bitcoin is also slightly more involved than investing in the asset. In the case of shorting an asset, the trader will often use a derivative instrument or a proxy asset. The latter is an asset that is correlated with Bitcoin and the former is an asset that is derived from Bitcoin.

We will run through the definitive list of assets and instruments that the trader can use when shorting Bitcoin as well as the places where they can access them.

Derivative Instruments

Derivative instruments are those that will move in some proportion to the movement of the reference asset. They have been around for more than a century and have been used not only by speculators but by those farmers and producers.

Derivative instruments are essentially paper assets in the sense that they are bets on the value of the asset. They are also generally levered instruments which means that they are able to move at many multiples of the price of Bitcoin itself.

Let us look into three of the most prominent derivative instruments.

Bitcoin Futures

Bitcoin Futures have been in the news quite a bit recently. This is mainly off of news that the CME were launching Bitcoin futures. This was followed promptly by a similar move by the CBOE. There are also a number of other exchanges that want to list Bitcoin futures this year such as Nasdaq.

What are futures?

Futures are an agreement to buy / sell an asset at some predetermined price in the future. This is the future price that you have agreed to buy or sell the asset. If you agree to buy the asset in the future this is "long" position and if you agree to sell it is a short position.

The pre-determined date in the future is the delivery date for the futures contract when it must be settled. These used to be settled through the physical delivery of goods but are these days just settled with cash.

In order to enter a futures contract with a counter party, you will have to place an initial margin and maintenance margin with the broker. These are usually a percentage of the value of the total contract (Notional). Hence, they can be highly leveraged.

Where can you get Bitcoin Futures?

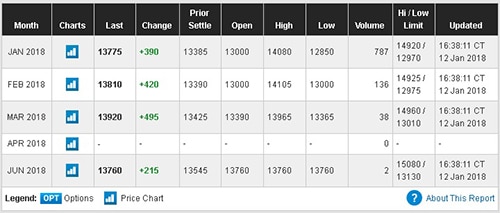

Overview of CME Group Futures – Image via CME Group

Overview of CME Group Futures – Image via CME GroupThere are two options that you have in order to enter a Bitcoin future. If you wanted to trade the Futures that were on the exchanges such as the CBOE and the CME then you would need an account with a broker that has acces to these instruments.

These are advantageous as they are regulated instruments that are listed on reputable exchanges. When you trade them through your online broker, you are effectively buying them on the CBOE or CME exchange.

Currently, the leverage on the Bitcoin futures at the CME are quite low. For example, the maintenance margin on these instruments is about 40% which means that there is not that much leverage. Similarly, not many online brokers will offer access to these instruments.

The other option is to use an online exchange that operated as the market maker for these instruments. Perhaps one of the best known of these exchanges is the Bitcoin Mercantile exchange (BitMex). They are based in Hong Kong and have numerous attractive Bitcoin futures contracts and something called a "perpetual contract".

The Perpetual contract works very much like a traditional future but there is no expiry and the future price is the current price. You can short a perpetual contract for the same effect with the 100:1 leverage. In the image below you have a screenshot of the contract in question. You would sell the contract in the case of shorting Bitcoin.

The Bitmex Perpetual Contract Interface. Source: Bitmex.com

The Bitmex Perpetual Contract Interface. Source: Bitmex.comMoreover, at Bitmex the margin required is a mere 1% of the Notional of the futures contract. That means that the leverage on the contract is quite substantial. A 1 point move in BTC will result in a 100 point move in your contract.

Of course, leverage can be a double edged sword. One could make a lot of money on a Bitcoin short but could also lose a substantial amount if the markets were to move against you. The last thing that you need is a severe margin call and closed out positions for lack of liquidity.

Bitcoin Options

Another derivative instrument that is very popular in trading circles are Options. These are asymmetric instruments that give the holder the right but not the obligation to buy or sell an asset at some predetermined price in the future.

Hence, unlike a future, the trader does not have to exercise the option if it is not profitable. This optionality obviously has to have a cost to the holder. This is the premium that is paid for the option. If you wanted to short Bitcoin, then you would buy a PUT option.

A PUT option gives the holder the right but not the obligation to sell the Bitcoin at some predetermined price in the future. This means that if the price is much lower than this price (strike price) then the Options contract will expire in the money and the holder will get paid for that.

However, given that it is an option, the holder may choose not to exercise it. In other words, if the price is much higher than the strike at expiry then the option will expire worthless and the holder will not exercise it.

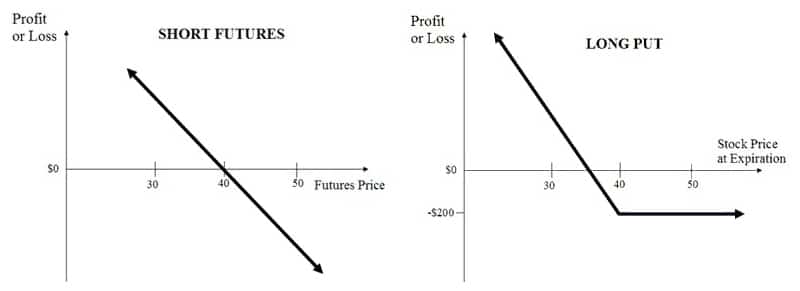

As a comparison between a future and an option, you can take a look at the image below. You can see the profile of the pay-out that one has. The option has a max loss that one can incur.

Comparison on Payoff of Short Future and Long PUT. Source: theoptionsguide.com

Comparison on Payoff of Short Future and Long PUT. Source: theoptionsguide.comSome people prefer the fact that they do not have to exercise the option and it is more an "insurance policy" and this is why it is termed the option premium. This is why options are often used as hedging instruments by those who hold the underlying asset.

Holders of options also have the chance to choose the option expiry price that most applies to them. Hence, they dont have to strike the option "at the money" rate.

Where Can one Trade Bitcoin Options?

There are currently no regulated option exchanges for retail traders to invest in. There are option market makers in the Over the Counter (OTC) market such as Ledger X. However, in order to open an account at Ledger X you require over $1m as well as an "eligible swap participant" status.

This makes it quite an administrative process to trade options on Ledger X for the ordinary retail crypto trader. There is another option which is much easier and also has a range of different options one can trade. This is an option exchange out of Holland called Deribit.

They are open to traders in many different jurisdictions. They have quite a diverse range of options that the trader can make use of with numerous different strikes and expiries. In the below example is a 26 Jan PUT option at Deribit that is going for a premium of $1,785.

Deribit PUT Option for Expiry January 26. Source: deribit.com

Deribit PUT Option for Expiry January 26. Source: deribit.comShorting Bitcoin on Derebit merely requires you to select the timeframe that you were interested in shorting and then the number of Bitcoin that you would like to short. The price of the option in the case above is about 12% of the amount of Bitcoin Notional.

Bitcoin Contracts for Difference

Contracts for Difference (CFDs) are essentially derivative instruments that will move in according to the difference in the price of the underlying asset. They are very similar to spread betting instruments that are often offered in the UK.

Unlike Futures and Options, they are marked to market at the end of every day and the trader will be liable for the difference if the price moved against him or he will get a pay-out if it moved in the direction of his trade.

CFDs are not traded on an exchange but are traded directly against a broker or market maker. They will make money on the spreads that they have on the instruments. Much like the BitMex options, CFDs are highly levered and this makes them really volatile.

They are also much simpler to trade and get access to. There are numerous brokers that offer CFD products to trade on a range of different cryptocurrency assets. The trader will merely have to select whether they want to enter a short or a long position, the amount and then trade.

For example if you were to use the IQ Option CFD product, you would have an initial margin requirement. Once you have entered the short CFD position, your position will constantly be margined and at the end of the day it will be consolidated.

As one can see from the above platform example on IQ Option, the margin required on these CFDs is 5% which means that the price of your portfolio will react by a 20 to a price move of 1.

The only disadvantage of CFDs is that they are not regulated in the USA. This will mean that there are not a great deal of brokers that will offer their services to traders in this jurisdiction. In this case the US trader is best position to trade futures on the CBOE or CME with their local broker.

Trading Correlated Assets

If you would like to place a short trade on Bitcoin without actually trading the underlying instrument and derivatives are not a practical solution (regulations and otherwise), then you can trade an asset that is highly correlated with Bitcoin.

Correlation implies that the asset will move in the same or opposite direction to Bitcoin and is impacted by the price of Bitcoin. In the case of Bitcoin, there are indeed some equity stocks that will move based on Bitcoin price swings.

They are either businesses that invest in Bitcoin related businesses or they are those companies that cater to the Bitcoin industry.

Taking a look at an example of a company that invests in Bitcoin related businesses is Overstock Inc. This company has recently pivoted away from simple internet retailing and has rolled out a cryptocurrency investment arm. They were also one of the first online retailers to take Bitcoin.

Given this exposure to the Bitcoin price, it is likely that overstock is highly correlated with Bitcoin. In fact, taking a look at the below graph you can see just how much the stock price reacts to Bitcoin price movements.

Correlation Between Bitcoin and Overstock Shares. Source: tradingview.com

Correlation Between Bitcoin and Overstock Shares. Source: tradingview.comHence, if you are Bearish on the price of Bitcoin, you could merely short the shares of overstock at your local broker. You could do this by either entering short future positions or options on the OSTK shares which are traded on Nasdaq.

If you were thinking of shorting the shares of a company that offers services to the industry, then the large graphics card manufacturers could be a good option. Companies such as Nvidia and AMD could serve as good companies to target.

They produce the GPU units that are used by miners to mine coins similar to Bitcoin. These coins often react to the price of Bitcoin. If there is a slump in the price of cryptocurrencies, the sales on these chips will fall and hence the price should also react.

However, this trade is likely to be less direct than that of overstock. There are a number of other factors which drive the sales and prices of these stocks and the reaction in the stock price may not move according to the exact Bitcoin price in the short term.

If you wanted to short Bitcoin through a proxy asset such as Overstock then you can use the online broker that you may currently have. There are a range of options and futures on stock prices as it is a well-established market.

More Options Later in Future

One of the most anticipated actions will be the launch of Bitocoin ETFs (Exchange Traded Funds). These are essentially collective investment vehicles that will track the price of Bitcoin one for one. Once they are launched as an exchange instrument, one can be certain that futures and options on the ETF will follow.

There will also be a range of brokers who will offer numerous derivative instruments on the ETFs. Moreover, the view is that an ETF launch will add weight to the notion of wide scale adoption. We could then likely see a number of other instruments to short Bitcoin.

For example, exotic options such as Binary options could also be an options for traders with enough wide scale adoption. This is something that Cantor Fitzgerald is also considering for 2018.

Risk Management is Key

No matter the instrument or asset that you when shorting Bitcoin, you have to make sure that you have appropriate risk management protocol in place. As many of these instruments are levered, your capital can be wiped out quite quickly.

Similarly, Bitcoin can be a temperamental asset to trade and has "rekt" many a trader before. It can sometimes defy trends and react within minutes to virtually no news at all. If trading on margin, make sure that you always place automated stops and take profits at comfortable levels.

Lastly, as with any trading, never risk more on shorting Bitcoin than you can afford to lose.