Although there are numerous stories abound of people who have made massive returns on their investments from investing in particular cryptocurrencies, it is also important to understand that there is a lot of risk in these markets.

People tend to always here about that one person who made millions from an early investment in Bitcoin. Or they may have heard of that one guy who made a killing on an investment in an ICO. However, they don't tend to hear about the massive failures or people who lost a fortune on an ill-advised cryptocurrency investment.

As with all investments and trading, the successful investors who are able to consistently make strong returns are those that have effective risk management strategies in place. They also make investment decisions based on cold calculated analysis rather than simple "hunches".

In the below post, we try to take a look at some effective ways of managing cryptocurrency risk as well as some tips that will help you make the right decisions when trading.

Don't Let Hype Drive You

One of the biggest enemies to successful investing is possibly your own human impulses. You have to avoid some of the raw impulses that we may feel such as "FOMO" (Fear of Missing Out). When someone is making decisions based on whether they could be "too late to the party" they tend to invest in a cryptocurrency asset that they may not know much about or one that could be peaking.

One of the biggest enemies to successful investing is possibly your own human impulses. You have to avoid some of the raw impulses that we may feel such as "FOMO" (Fear of Missing Out). When someone is making decisions based on whether they could be "too late to the party" they tend to invest in a cryptocurrency asset that they may not know much about or one that could be peaking.

This happened quite recently to someone I know who invested close to $10,000 in NEO (Antshares) when it had its meteoric rise in August. Although NEO is a proven technology, his investment came just prior to the announcement from China that they would ban ICOs.

This obviously had a large impact on NEO as it was based in China and was to be used as the main blockchain where the issuers would raise their funds. He lost almost 50% of his investment. Although NEO may recover, it was quite a different outcome to the 100%+ return that happened the week before his investment.

This cautionary tale shows that you should not automatically expect that past trends will continue forever. Always be wary of imminent corrections in the price that could come at random.

This could also happen in the ICO space if you were invest on an overhyped ICO. Although your analysis says that the project does not really warrant an investment, you may still be tempted to invest based on the amount of press that has been thrown around with regards to the ICO.

Diversification is Key

It has been one of most well-known investment beliefs for almost a century. Keeping all your eggs in one basket is placing a lot of faith in only that basket. This is as true for cryptocurrency as it is for any other asset. If you put all your investments in one token, you are taking a great deal of "idiosyncratic risk".

Idiosyncratic risk is a term that has been used in traditional finance to describe risks that are not systematic across an asset class or sector. They are limited to only a particular asset and are very hard to predict. For example, a systematic risk in cryptocurrency is regulation, risk aversion sentiments etc. This is something that drives all the assets to a degree.

On the other hand, an idiosyncratic risk for Iota for example, could be an announcement that a cryptocoins hashing algorithm was broken. This risk was unique to IOTA and no one could really predict it. It brought down the value of IOTA only when the rest of the market was relatively bullish.

When you are invested in more than one cryptocurrency asset, the idiosyncratic risk in your portfolio decreases. As you keep adding more coins this unique risk will fall. Theoretically, one would think that an investment in nearly all crypto assets would be a good move.

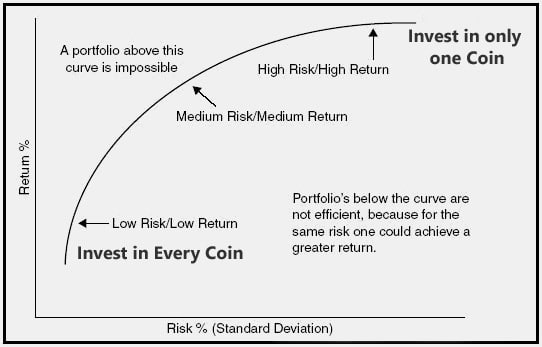

However, idiosyncratic risk is something which could also help on the upside. The more assets you have, the more you erode your chances of taking part in a rally in the price of the token. Hence, it is wise to find a balance. In traditional investment theory, this would be finding the optimal place on the "efficient frontier" graph. We have this in the below image.

Without going too much into the technical aspect of how the Efficient frontier works, it is mainly a balance of risk vs. return. The investor has to try and find the sweet spot between what they want to achieve and the risk they are willing to take.

Without going too much into the technical aspect of how the Efficient frontier works, it is mainly a balance of risk vs. return. The investor has to try and find the sweet spot between what they want to achieve and the risk they are willing to take.

If the investor has invested all in one coin, then the risk is at the top of the curve. Similarly, if the investor has invested in all coins available to him / her then they would be at the bottom of the curve and this would have low risk but also low reward. The optimal place is somewhere in-between on the graph.

Focus on Ideas, not Tokens

Sometimes people can get carried away and invest in a Coin or token merely based on performance or the rumours / buzz around the coin. This is particularly prevalent when people consider investments in ICOs and relatively new coins. However, this is not really the best way to do your due diligence.

Sometimes people can get carried away and invest in a Coin or token merely based on performance or the rumours / buzz around the coin. This is particularly prevalent when people consider investments in ICOs and relatively new coins. However, this is not really the best way to do your due diligence.

It is important that you focus on the idea rather than only the token or the start-up. There are numerous coins that operate in a particular field which you can spread your risk out. For example, you have Ethereum and NEO which are both tokens that are focused on smart contract technology.

You could also bet on the Internet of Things blockchain technology through a cryptocurrency like IOTA. There are options for cloud storage blockchain solutions such as Filecoin or Sia Coin. You need to look at the numbers and make the decision about whether you agree with the underlying idea.

Once you have faith in a particular idea, then you can start to spread your investment out among all of the particular coins within that idea to get the diversification that you are comfortable with.

Hedging With Other Assets

Although you may be quite bullish on cryptocurrencies, once you have a large percentage of your portfolio in these assets it gets harder to manage cryptocurrency risk in general. This is where other asset classes could come in handy.

If you want to hedge some of the systematic cryptocurrency risk in your portfolio then you could look at assets that have a high negative correlation with cryptocurrencies. This would usually be assets such as stocks as they are seen as "risk loving" assets.

The other benefit of using traditional assets to hedge the crypto risk is that you can use a host of derivative instruments such as options and futures. These derivative investments are relatively more affordable because they are unfunded. They only require minimal collateral to hold them.

Of course, as the cryptocurrency derivative market expands, there is hope would be that instruments such as options will give investors the chance to hedge the direct "delta" exposure on their cryptocurrency investments through these options.

The Hidden Dangers of Illiquidity

There are many people who will invest in a number of different and rarely traded cryptocurrencies without taking into consideration the impacts of illiquidity. Liquidity will determine how easy it is for you to close out of positions that you hold.

There are many people who will invest in a number of different and rarely traded cryptocurrencies without taking into consideration the impacts of illiquidity. Liquidity will determine how easy it is for you to close out of positions that you hold.

If you have bought a large amount of coins and would like to exit your position, an ilquid market could work against you. Essentially, although the latest price the asset traded at may be "high", there may not be the buyers who are willing to buy the asset from you at that high.

Moreover, in illiquid markets, the actions that you are taking to trade the coins could lead to adverse reactions in the price. For example, if the market thinks that someone with "inside knowledge" is trying to close out their positions, they may get spooked and dump their holding as well.

This is the worst of both worlds as now not only can you not sell your coins but the price has fallen as a result of the actions that you took.

Hence, the moral of the story is that you should try and invest in coins that are relatively more liquid. This would save you a lot of hassle when it comes to closing out your position at a price that you thought was favourable for an exit position.

Possibility of Mining Coins

Most of these methods of managing cryptocurrency risk are aimed at mitigating the risk from fluctuations in price. However, unlike dividend paying equities or interest paying bonds, most cryptocoins will not pay you income for holding them

This is because they rely on Proof of Work mining. This is when a miner will set up a mining rig and solve cryptographic hash functions to produce more coins. These are now so expensive and competitive that one can't just set up a home PC and mine the coins like they used to.

However, some crypotcurrency is mined through a process called Proof-of-Stake (POS) mining. This is where coins would be mined based on the amount of cryptocurrency particular people held. Hence, if you hold a particular amount of cryptocurrency, you can be rewarded additional coins for "mining". This would usually just entail you just leaving the client connected while the coins were mined based on your stake.

Although the list of POS coins is rather limited at the moment, Ethereum aims to implement POS mining with an improvement protocol called Casper. This will hopefully be rolled out in the next year which will allow large Ethereum holders to mine the second most valuable cryptocurrency.

Get Rich Slowly

There seems to be a great amount of emphasis placed on getting rich quickly in Cryptocurrencies. There is this belief that you can find a coin to invest in and you will triple your investment in 3 weeks. However, these types of investors are not really the ones that have made great returns.

The early investors in Bitcoin who bought in 2010 and 2011 believed in the idea and not really how much money they could make. They were of the view that Bitcoin would revolutionise the world of finance and hence had an intrinsic value many multiples of the original price.

They kept holding their positions through the massive climb and fall after the Mt Gox crash. They had a goal that was more than just money, returns and "To the Moon". Hence, these are the investors who sit today with immense wealth. They were long term greedy.

As an investor, you should have a similar mind-set. Believe in the ideas, believe in your investments, manage your cryptocurrency risks and focus on the future.