Cryptocurrency mining is at the heart of proof-of-work (PoW) networks, such as Bitcoin and Litecoin, ensuring the integrity, security, and decentralization of the blockchain. But for those interested in participating, one key question often arises: Is it better to mine solo or join a mining pool?

Let’s break it down, piece by piece.

This comprehensive guide walks you through the technical mechanics, advantages, disadvantages, and profitability implications of solo mining and pool mining. Whether you're a hobbyist with a single rig or exploring large-scale operations, understanding these two strategies is essential for making informed decisions before you decide to enter the crypto-mining world.

Key Takeaways

- Solo mining offers full block rewards but comes with high risk and extremely low odds of success, especially for individuals without massive hash power.

- Pool mining provides consistent, smaller payouts and is generally a safer option for beginners and small-scale miners.

- ASICs deliver high efficiency but are limited to certain coins, while GPUs offer more flexibility and lower upfront costs.

- Mining profitability depends on low electricity costs, reliable internet, cooling solutions, and effective hardware monitoring.

- Altcoins like Monero and Ravencoin are more accessible for GPU miners compared to Bitcoin, and hybrid strategies can balance stability with solo mining upside.

What Is Cryptocurrency Mining?

Cryptocurrency mining is the process by which transactions are validated and added to a blockchain, the decentralized ledger that underpins most digital currencies.

In proof-of-work (PoW) systems, miners use computational power to solve complex mathematical problems, a process known as “hashing,” to secure the network and keep it running smoothly.

The first miner to solve the problem gets to add a new block of transactions to the blockchain and is rewarded with newly minted coins (block subsidy) and transaction fees.

This process isn’t just about earning rewards. Mining:

- Secures the network by making it computationally infeasible for malicious actors to alter transaction history.

- Validates and bundles transactions into blocks, ensuring only legitimate transactions are recorded.

- Distributes new coins into circulation, following a predictable issuance schedule.

In Bitcoin, for example, mining involves finding a specific nonce value so that the SHA-256 hash of the block header falls below a network-defined difficulty target. This “puzzle” is hard to solve but easy for the network to verify once a solution is found.

A Quick Overview of the Mining Process

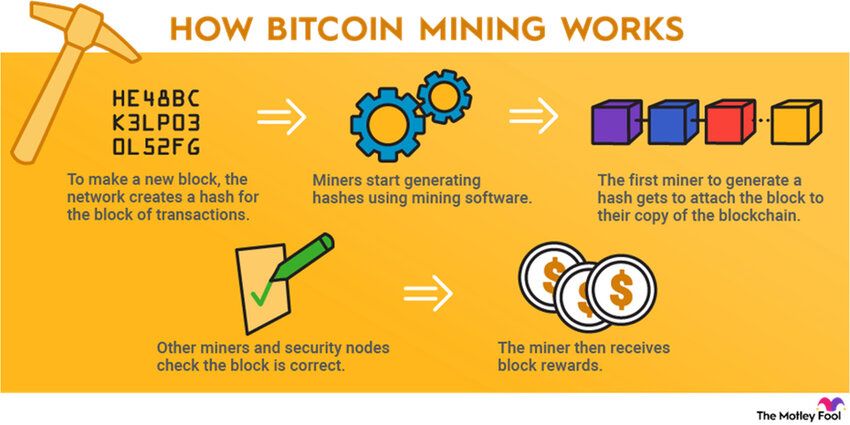

Let’s break down the mining process step by step with an example of Bitcoin mining:

Visual Representation of How Bitcoin Mining Works. Image via ResearchGate

Visual Representation of How Bitcoin Mining Works. Image via ResearchGateThe above image shows that the mining process happens as follows:

- Transaction Collection: Pending transactions are gathered into a block by the miner’s node.

- Hashing and Nonce Search: The miner’s hardware repeatedly hashes the block header, incrementing a nonce value each time, until the resulting hash meets the network’s current difficulty target.

- Block Submission: The first miner to find a valid hash broadcasts the new block to the network.

- Block Validation: Other nodes verify the block’s validity and, if accepted, add it to their copy of the blockchain.

- Reward Distribution: The successful miner receives the block subsidy and all transaction fees included in the block.

This cycle repeats roughly every 10 minutes on the Bitcoin network, with the difficulty adjusting every 2,016 blocks to maintain this interval.

For further details on Bitcoin mining profitability, please refer to our article here.

Understanding the mining cycle is only one part of the equation. Behind every successful block mined lies a foundation of powerful hardware and carefully optimized infrastructure.

Whether you're solving hashes solo or contributing to a mining pool, the capabilities of your mining equipment and the efficiency of your operational setup play a decisive role in your success. To assess your mining potential and profitability, it’s essential to explore the types of hardware available and the supporting resources that enable high-performance mining.

Mining Hardware and Resources

The efficiency and profitability of your mining operation depend heavily on your hardware and supporting infrastructure.

ASICs (Application-Specific Integrated Circuits)

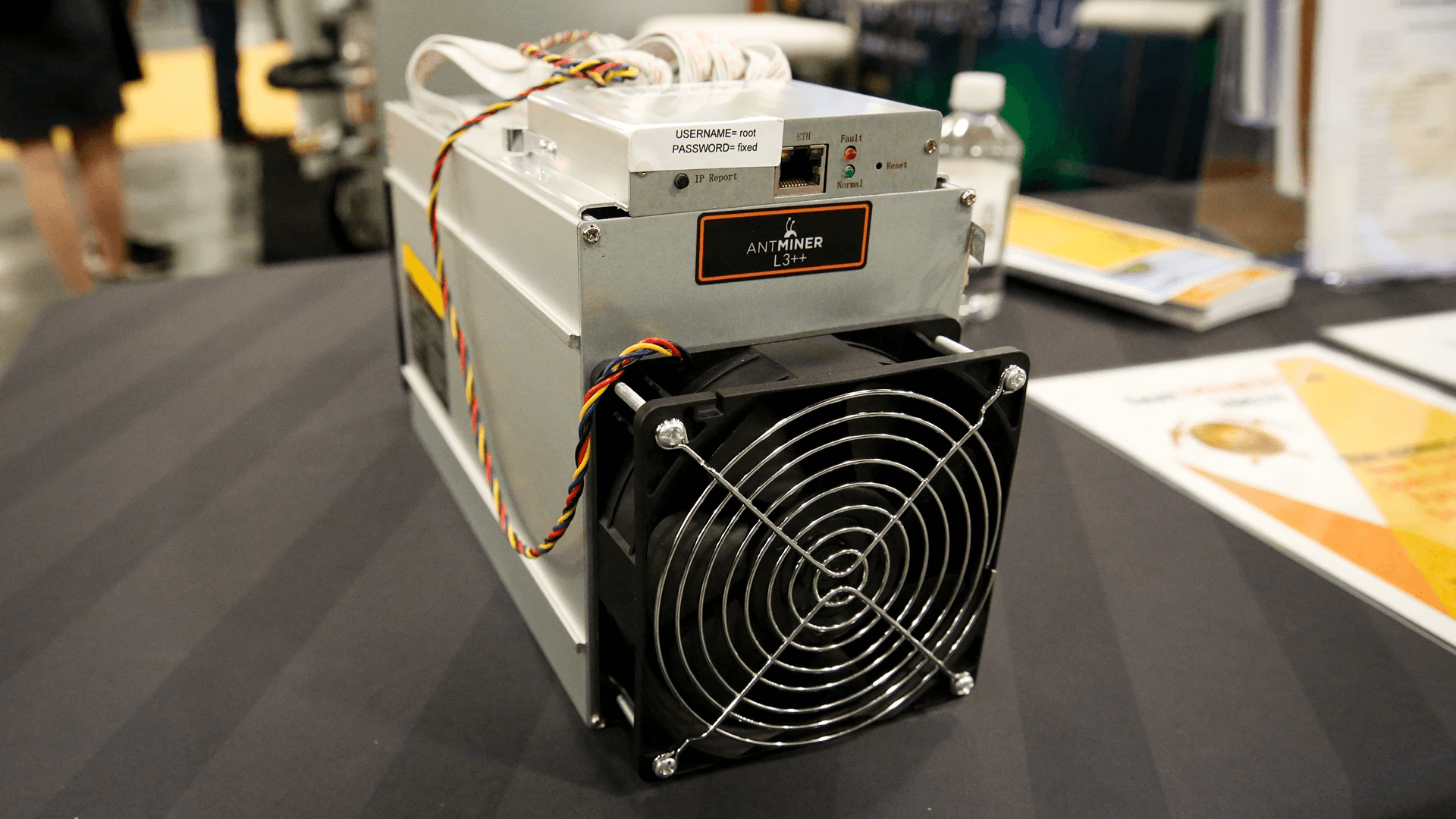

An Application-Specific Integrated Circuit (ASIC) is a microchip engineered specifically for one purpose, and that is crypto mining, which means solving a single algorithm like Bitcoin’s SHA-256 with maximum efficiency.

A Close-Up Of The Antminer L3++, A Popular ASIC Miner. Image via Miningstore

A Close-Up Of The Antminer L3++, A Popular ASIC Miner. Image via MiningstoreUnlike general-purpose CPUs or versatile GPUs, ASICs are custom-built for speed and energy efficiency in mining a particular coin.

This specialization makes them far more powerful and profitable for major cryptocurrencies, but also inflexible, as they can’t be repurposed for other algorithms or tasks. Read this guide to get a better understanding of how cryptocurrency mining works with ASIC chips.

GPUs (Graphics Processing Units)

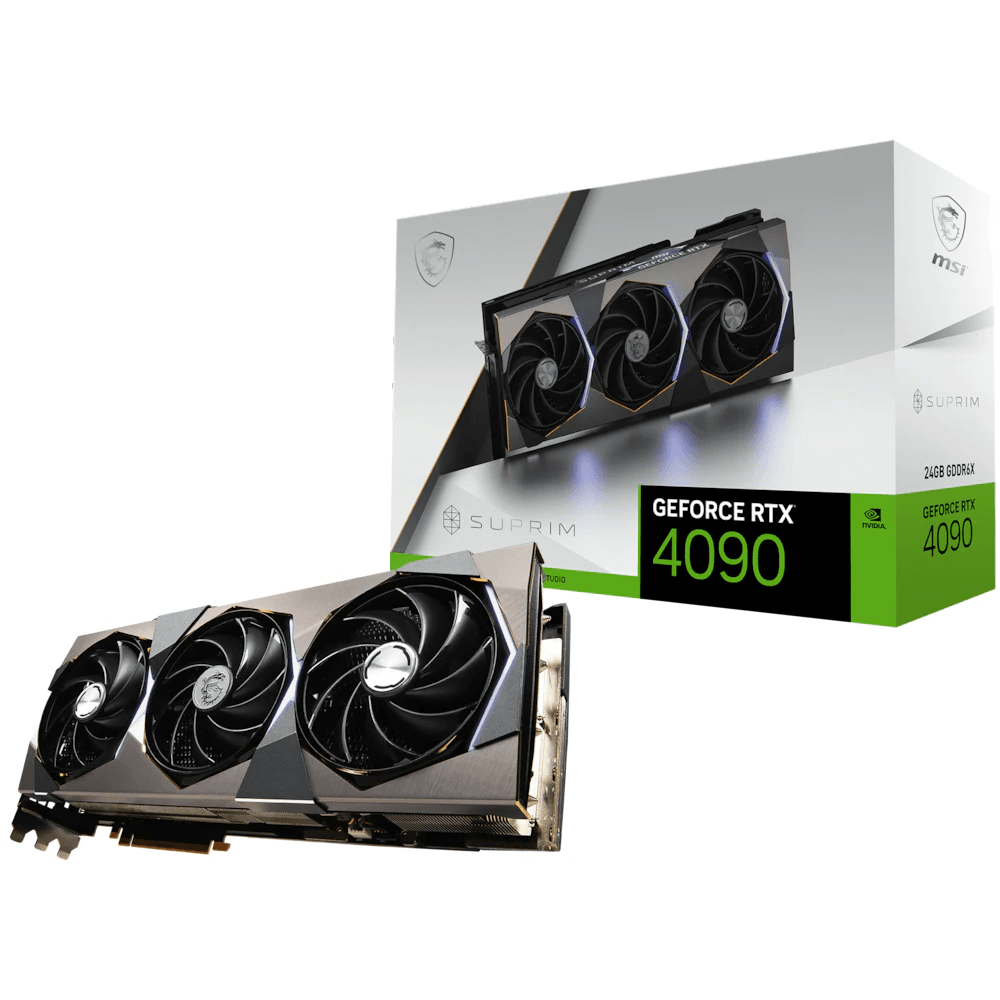

A Graphics Processing Unit (GPU) is a powerful, highly parallel processor originally designed to render images and video in computers and gaming systems.

Tge MSI GeForce RTX 4090 Is Often Used In GPU-Based Crypto Mining Setups. Image via Challengly

Tge MSI GeForce RTX 4090 Is Often Used In GPU-Based Crypto Mining Setups. Image via Challengly In cryptocurrency mining, GPUs have become popular because of their ability to perform many calculations simultaneously, making them well-suited for solving the complex mathematical problems required by many mining algorithms.

Unlike ASICs, GPUs are versatile and can mine a wide variety of coins and algorithms, and can also be repurposed for tasks like gaming, AI, or scientific computing when not mining. This flexibility, combined with relatively lower upfront costs, makes GPUs a preferred choice for hobbyists and those looking to mine altcoins.

Infrastructure Considerations

Mining is far more than plugging in a machine. Efficient, profitable operations require:

- Strong power infrastructure: Mining is an energy-intensive process; access to cheap, reliable electricity is crucial.

- Advanced cooling: ASICs and GPUs generate significant heat. Data centers utilize optimized airflow, HVAC systems, or even immersion cooling to maintain the longevity and efficiency of their hardware.

- Stable, low-latency Internet: Network interruptions can lead to missed blocks and lost revenue.

- Monitoring and management: Tools like Hive OS and Awesome Miner help track performance, temperatures, and profitability across multiple rigs.

This foundational knowledge sets the stage for understanding how solo and pool mining models leverage these resources and what it takes to succeed in each.

What Is Solo Mining?

Let’s begin with the most independent and often most challenging form of cryptocurrency mining.

Visual Representation of Solo Mining. Image via Blocktrade

Visual Representation of Solo Mining. Image via BlocktradeSolo mining is the process where an individual miner attempts to find new blocks on their own, without joining forces with others in a pool. This approach is the original, “pure” form of mining envisioned in Bitcoin’s early days, granting the miner full control and, if successful, the entire block reward.

How Solo Mining Works

In solo mining, you operate your mining hardware and connect it directly to a full node of the blockchain network (such as Bitcoin Core). Here’s how the process unfolds:

Full Node Operation

You must run a complete node, which means downloading and maintaining the entire blockchain. This node validates all transactions and blocks independently, ensuring you are a direct participant in the network’s consensus process.

Direct Network Communication

Your mining hardware (ASICs or GPUs) communicates with your node, submitting candidate blocks as it searches for a valid solution to the current cryptographic puzzle.

Block Discovery

If your hardware is the first on the network to find a valid block hash (meeting the current difficulty target), your node broadcasts this block to the network. Other nodes verify and, if accepted, add it to their copy of the blockchain.

Reward Collection

If the block is accepted, you receive the entire block subsidy and all transaction fees from the included transactions, no middlemen, and no pool operator fees.

This setup demands technical proficiency: you must configure your node, maintain uptime, and ensure your mining software is correctly pointed to your local node’s RPC interface. Latency, network reliability, and hardware stability all directly impact your chances of success.

Advantages of Solo Mining

Now let’s take a look at some of the advantages of Solo mining.

Full Reward Ownership: Every time you successfully mine a block, you receive the entire block reward and all transaction fees. For Bitcoin, this means 3.125 BTC plus fees (as of 2025) per block—a significant sum compared to the fractional payouts in pools.

Greater Network Autonomy: By running a full node and mining independently, you help decentralize the network, reducing reliance on large pools and strengthening the blockchain’s resilience against centralization risks.

No Pool Fees: Unlike pool mining, where operators typically charge a 1–3% fee, solo miners keep 100% of their earnings. Over time, this can make a difference, especially for large-scale operations.

While it has its benefits, even solo mining has its disadvantages. Let’s take a look at some.

Disadvantages of Solo Mining

Solo mining, as it goes in the name suggests, involves one taking up the entire cost and investment of the process.

Extremely Low Odds of Success: Unless you control a substantial portion of the network’s total hash rate, your chances of finding a block are slim. For example, with 1 PH/s on a 500 EH/s Bitcoin network, you might statistically expect to find a block once every several years.

High Initial and Operating Costs: Solo mining requires significant investment in hardware, infrastructure, and electricity. You also need the technical know-how to maintain your node and mining rigs.

Irregular and Unpredictable Income: Unlike pool mining’s steady payouts, solo mining income is highly variable. You could go months or years without a reward, making financial planning challenging and increasing the risk of never recouping your investment.

For most miners, especially those without access to cheap electricity or industrial-scale hardware, these challenges are tough to overcome. That’s why many turn to the alternative option of pool mining.

What Is Pool Mining?

Crypto mining boomed the mining industry for quite a bit, but for the mining industry to grow, it had to grow more competitive and required a larger participation.

Pool mining has become the dominant strategy for most participants. Pool mining allows individuals to combine their computational power, smoothing out the variance and providing more reliable, frequent payouts.

How Mining Pools Work

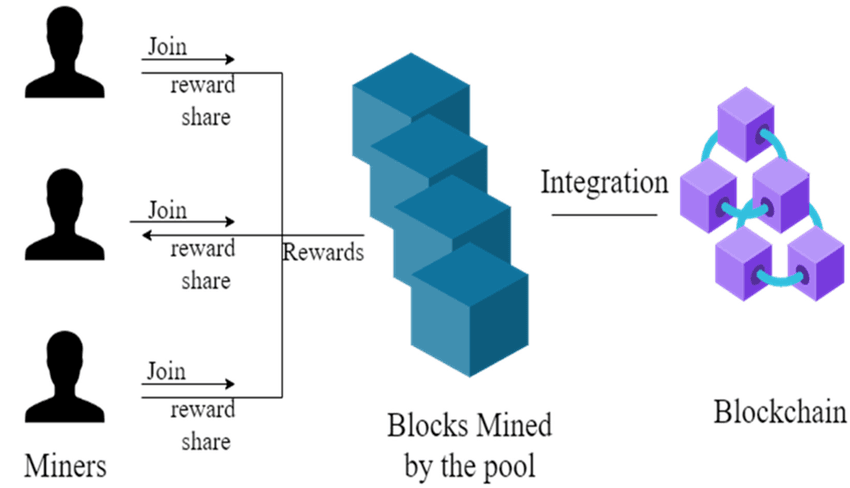

A mining pool is a coordinated group of miners who share their hash power over a network.

This Diagram Shows How Individual Miners Join A Pool And Receive Proportional Rewards. Image Via ResearchGate

This Diagram Shows How Individual Miners Join A Pool And Receive Proportional Rewards. Image Via ResearchGateHere’s how these pools work:

Work Distribution

The pool operator assigns small, solvable pieces of the mining puzzle, called “shares,” to each participant. Your mining hardware works on these shares and submits results back to the pool.

Block Submission and Validation

When a participant in the pool finds a valid block, the pool broadcasts it to the network. The pool receives the block reward and transaction fees.

Reward Allocation

The pool divides the reward among participants based on the amount of work (shares) each contributed. Most pools use payout models like Pay Per Share (PPS) or Pay Per Last N Shares (PPLNS) to ensure fairness and transparency.

The pool operator manages network connectivity, block propagation, and reward distribution, allowing individual miners to focus on running their hardware. Click here and read our article to get a better understanding of how mining pools work.

Advantages of Pool Mining

Some of the advantages of pool mining include:

Steady and Predictable Income: By pooling resources, miners receive frequent, smaller payouts proportional to their contributed hash power. This dramatically reduces the variance and unpredictability of mining income.

Lower Entry Barriers: Even miners with a single GPU or low-power ASIC can participate and earn rewards, making mining accessible to hobbyists and newcomers.

Operational Simplicity: Pool mining is easier to set up and maintain. The pool handles network communication, block submission, and payout logistics, allowing miners to focus on hardware performance.

Disadvantages of Pool Mining

Disadvantages of pool mining include:

Pool Fees: Most pools charge a fee (typically 1–3%) on rewards to cover operational costs. Over time, these fees can eat into profits, especially for high-volume miners.

Centralization Risks: Large pools can accumulate significant portions of the network’s hash rate, increasing the risk of centralization and potential 51% attacks. This undermines the decentralized ethos of cryptocurrencies.

Dependency on Operators: Miners must trust the pool operator to be honest, transparent, and technically competent. Poor management or malicious behavior can lead to lost rewards or downtime.

It's fair to say that both Solo and Pool Mining have their pros and cons; however, the key decision factor becomes which one is profitable and aligns with our resources.

Profitability Comparison: Solo vs Pool Mining

Answering the main question, of which approach offers better profitability and sustainability to us, depends a lot on our resources and bandwidth. Solo and pool mining both have different mechanisms of rewards, as the processes and hardware requirements they have are different.

Solo And Pool Mining Have Different Mechanisms Of Rewards. Image via Shutterstock

Solo And Pool Mining Have Different Mechanisms Of Rewards. Image via ShutterstockReward Distribution and Consistency

Solo Mining offers the full block reward, but payouts are extremely rare and unpredictable unless you control a massive hash rate. This leads to high variance and long periods without income.

On the other hand, Pool Mining provides regular, predictable payouts in:

- Pay-Per-Share (PPS)

- Pay-Per-Last-N-Shares (PPLNS)

- Full Pay-Per-Share (FPPS)

With these payouts, you earn a steady stream of smaller rewards, making it easier to plan finances and reinvest in hardware.

Mining Difficulty and Hashrate Requirements

Bitcoin and similar networks adjust mining difficulty every 2,016 blocks to maintain a consistent block interval. As global hash rate rises, the difficulty increases, making it harder for solo miners to compete.

Solo miners face significantly reduced odds of finding a block without a substantial share of the network's hash rate. In contrast, pool mining combines the hash power of numerous participants, enabling even small-scale miners to earn rewards.

Cost Factors and Return on Investment (ROI)

Mining to this point sounds like an easy task, right? But between the hardware, electricity costs, and network volatility, your return on investment (ROI) hinges on a complex web of factors.

Let’s break it down.

Solo mining demands a heavy upfront investment. High-performance ASIC miners, like the Antminer S19 XP, can cost anywhere from $3,000 to $15,000+ per unit, and you’ll likely need several to remain competitive.

Add to this the cost of specialized power infrastructure, cooling systems, and consistently high electricity bills, especially in areas with expensive energy. Maintenance and hardware downtime add unpredictability and additional costs.

In contrast, pool mining offers a far more accessible and predictable path. You can start with lower capital, sometimes just a single GPU, and rely on the combined hash power of the pool to generate steady, more frequent payouts. Although pool fees (typically 1–3%) cut into your earnings, the reliability of income makes ROI easier to calculate and manage.

If you spend $1,000 on a GPU rig and earn $2/day after fees and power costs, your break-even point is around 500 days (about 1.4 years). Regular payouts allow for better budgeting, reinvestment, and quicker adjustments if market conditions shift.

Halvings & Market Shocks: The ROI Wildcards

Major events like Bitcoin’s halving, which cuts block rewards every four years, can drastically alter the ROI equation. For example, the 2024 halving reduced rewards from 6.25 BTC to 3.125 BTC per block. Solo miners now face even tougher odds to recover costs unless they have ultra-cheap electricity or strike blocks more often than expected.

Pool miners, though also affected, tend to weather these changes better due to more consistent income and shared operational risks.

Allows miners to start small, even with a single GPU. Lower capital requirements and regular payouts make ROI calculations more straightforward.

Events like Bitcoin’s quadrennial halving reduce the block subsidy, impacting profitability for all miners. Solo miners, who depend on rare block finds, are hit especially hard.

Risk, Volatility, and Strategic Considerations

In cryptocurrency mining, selecting the right strategy involves more than just hardware and electricity. It requires an understanding of the cryptocurrency market and the associated risks that come with mining. A miner’s choice between solo and pool mining should align with their risk tolerance, ability to manage inconsistent rewards, and long-term objectives.

Selecting The Right Strategy Involves More Than Just Hardware And Electricity. Image via Shutterstock

Selecting The Right Strategy Involves More Than Just Hardware And Electricity. Image via ShutterstockCrypto markets are highly volatile, with daily price swings of 5–10% that affect the value of mined coins, network difficulty, and overall profitability. When prices rise, more miners join the network, increasing difficulty and reducing individual rewards. During downturns, exits from mining reduce difficulty but also coin value.

Profitability is a moving target, influenced by coin prices, block rewards, fees, and regulatory changes. Strategic planning and risk assessment are essential, especially for those investing heavily in hardware and infrastructure. CapEx and OpEx must be evaluated carefully, as market shifts can quickly turn a profitable setup into a financial burden.

As we compare solo and pool mining strategies, it's important to first understand how differing levels of risk tolerance and financial planning shape the best path forward for each miner.

Risk Tolerance and Financial Planning

Mining is not a one-size-fits-all endeavor. The chosen strategy must reflect the miner's financial situation, risk tolerance, and operational goals. Understanding these variables helps determine whether one should engage in solo mining, join a mining pool, or pursue alternative strategies such as dual mining or coin switching.

Key considerations for Solo Mining:

- Full block rewards, but very low probability of success.

- High operational costs with no income smoothing.

- Best for miners with large setups and speculative strategies.

Key Considerations for Pool Mining:

- Regular payouts improve budgeting and financial planning.

- Lower barrier to entry for small-scale and hobbyist miners.

- Access to features like merge mining and multiple coin support

Coin Selection: Is Bitcoin the Only Option?

When strategizing mining operations, the choice of which coin to mine is as important as the method used.

While it remains the most recognized and valuable coin, its high entry barriers- such as the need for specialized ASIC hardware and access to cheap electricity make it impractical for most individual miners.

Instead, a range of alternative coins (altcoins) offer more accessible and potentially profitable opportunities, especially for those using consumer-grade CPUs and GPUs.

Below is a table summarizing the top coins to mine, highlighting their mining rewards, algorithms, and hardware requirements:

| Cryptocurrency | Mining Algorithm | Block Reward | Hardware Required | Block Time |

|---|---|---|---|---|

| Bitcoin (BTC) | SHA-256 | 3.125 BTC | ASIC | 10 minutes |

| Monero (XMR) | RandomX | 0.6 XMR | CPU or GPU (ASIC-resistant) | 2 minutes |

| Litecoin (LTC) | Scrypt | 6.25 LTC | ASIC (GPU possible) | 2.5 minutes |

| Ravencoin (RVN) | KawPow | 2,500 RVN | CPU or GPU (ASIC-resistant) | 1 minute |

| Dogecoin (DOGE) | Scrypt | 10,000 DOGE | ASIC (GPU in pools) | 1 minute |

| Ethereum Classic (ETC) | Etchash | 2.048–2.56 ETC | GPU (ASIC recommended) | 13–15 seconds |

| Zcash (ZEC) | Equihash | 1.56–3.125 ZEC | GPU (ASIC possible) | 75–90 seconds |

This selection demonstrates that Bitcoin is not the only viable coin for mining. Coins like Monero, Ravencoin, and Ergo are designed to be ASIC-resistant, promoting decentralization and making mining accessible to individuals with standard hardware.

Others, such as Litecoin and Dogecoin, offer lower barriers to entry and can be mined with less specialized equipment, especially when joining mining pools.

Choosing the right coin depends on your hardware, electricity costs, and strategic goals. Whether you prioritize privacy, decentralization, or potential profitability.

Technical Requirements and Setup

The mining strategy is only as effective as the hardware and software infrastructure supporting it. Regardless of whether a miner chooses to go solo or join a pool, the technical demands of modern mining require good planning, configuration, and maintenance.

The Technical Demands Of Modern Mining Require Good Planning. Image via Shutterstock

The Technical Demands Of Modern Mining Require Good Planning. Image via ShutterstockWhat You Need to Solo Mine

Solo mining is a technically demanding process that requires miners to independently connect to a blockchain network, validate transactions, and attempt to discover blocks without assistance.

Below are the key components needed to operate a solo mining system effectively:

- Full Node Setup: Download and maintain the entire blockchain (e.g., over 500 GB for Bitcoin). Configure mining software to communicate with the node via RPC (Remote Procedure Call) protocols.

- High-Speed Internet Connection: Essential for maintaining synchronization with the network and avoiding missed blocks. The internet connection must be stable and low-latency to maximize uptime.

- Reliable Power Supply and Cooling: Requires industrial-grade electrical systems for high-powered rigs. And advanced cooling systems (air, liquid, or immersion) to manage heat output.

- Monitoring and Automation: Software to track hash rate, temperature, uptime, and potential errors. Use of custom scripts and remote access tools for 24/7 oversight and auto-restarts.

Solo miners must be technically proficient and financially prepared, as the costs and maintenance demands are significantly higher than those for pool mining.

How to Join a Mining Pool

If solo mining feels too resource-intensive or risky, joining a mining pool is a smart and accessible alternative. It allows you to contribute your computing power to a collective group, improving your chances of earning consistent rewards.

Here's a step-by-step guide to get started:

Pool Selection

Choose a pool based on key factors like fees, size, payout method (PPS, PPLNS), reputation, and server location. Larger pools like F2Pool, Antpool, ViaBTC, and BTC.com offer frequent payouts, though they may contribute to network centralization.

Software Configuration

Install mining software compatible with your hardware—popular options include PhoenixMiner, Bminer, and CGMiner. Input the pool’s URL, your worker name, and your wallet address to start contributing shares.

Wallet Setup

Use a secure wallet to receive payouts. Many pools support direct payouts to hardware wallets like Ledger and Trezor, or software wallets such as Exodus and Trust Wallet, ensuring your earnings are stored safely.

Monitoring

Most mining pools provide dashboards where you can track hash rates, submitted shares, and earnings. For deeper insights, consider third-party apps like Minerstat or Hive OS to manage and monitor performance remotely.

Worried about finding the best pools? We have researched the top mining pools for you right here.

When Is Solo Mining Worth It?

Once you’ve accounted for the essential factors like hardware investment, electricity costs, and time commitment, a few additional elements can determine whether solo mining is the right choice. Here's when it might make sense:

- Access to Ultra-Cheap Electricity: If you have access to surplus, renewable, or subsidized power, your operational costs can be drastically reduced, making solo mining much more viable.

- Ownership of High-End Mining Rigs: Powerful, efficient hardware gives you a competitive edge when racing against the network to solve blocks, especially in less saturated or newer chains.

- Targeting Niche or New Coins (Spec Mining): Solo mining low-difficulty or emerging cryptocurrencies can be highly rewarding if the coin gains traction and appreciates over time.

These factors, combined with the right timing and strategy, can tip the balance in favor of solo mining for those willing to take on more risk for potentially higher rewards.

When Pool Mining Is the Smarter Option

For most miners, pool mining is the logical choice

- Lower Capital Requirements: Start mining with minimal investment, even with a single GPU.

- Minimal Technical Knowledge Needed: Pools simplify setup and management, making mining accessible to all skill levels.

- Consistent and Transparent Returns: Frequent payouts and clear reward structures make it easier to plan and grow your mining operation.

Even experienced miners often use pools for steady income while experimenting with solo mining on new coins.

Final Verdict: Choosing the Right Mining Strategy

Should you go solo or join a pool?

Solo mining can be highly rewarding, but it’s typically best suited for those with deep technical knowledge, access to cheap electricity, and the capital to invest in powerful hardware.

For most individuals, pool mining presents a more accessible and stable option. It lowers the entry barrier, provides more predictable payouts, and spreads operational and financial risks across multiple participants.

Whether you're a beginner or someone without the infrastructure for large-scale operations, joining a mining pool is generally the smarter, more sustainable path.

That said, a hybrid approach might offer the best of both worlds. By mining established coins in a pool for steady returns while solo mining new or low-difficulty coins for potentially high rewards, miners can diversify risk and increase upside potential.

Ultimately, your ideal strategy should align with your technical capabilities, financial situation, and long-term goals in the evolving landscape of crypto mining.