There are countless ways to build a crypto portfolio. Many investors will simply DCA and hodl forever, others try and trade in and out of the markets, others YOLO in and put their life savings into Dogecoin, while more sophisticated investors will use tried and tested, proven investment strategies and techniques such as Modern Portfolio Theory.

Modern Portfolio Theory has been around for decades and has become the foundation for how many accredited investors and firms approach investing. Though this concept was originally created for traditional markets, mainly equity markets, it can be applied efficiently to crypto assets as well.

This article will teach you everything you need to know about Modern Portfolio Theory, and how it can be used to build a crypto portfolio.

What is Modern Portfolio Theory

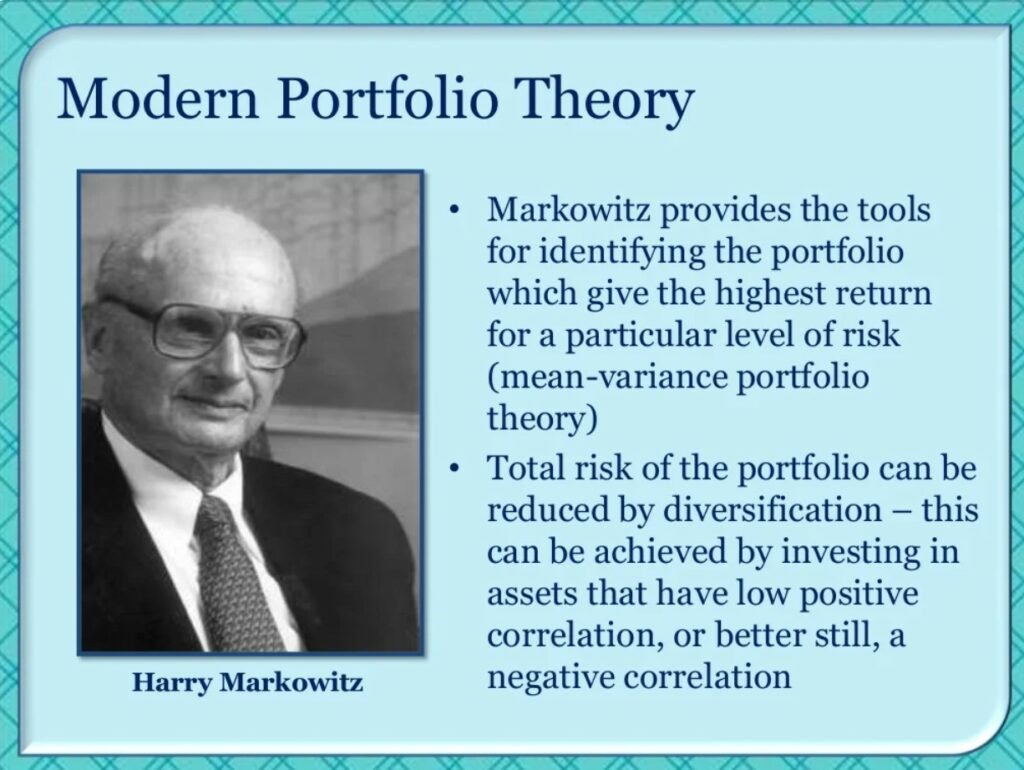

Modern Portfolio Theory was a concept coined long before cryptocurrency, back in 1952 by American economist Harry Markowitz. Modern Portfolio Theory (MPT) is a practical method for selecting investments in a way that maximizes returns with an acceptably low level of risk that is in line with an investor's risk tolerance.

Markowitz first pioneered the concept in his paper “Portfolio Selection,” and was even awarded a Nobel Prize for his work on the theory. Needless to say, any time an economist wins a Nobel Prize for a theory, that theory is likely to be followed and utilized by many for decades to come. MPT, to this day, is a very popular investment strategy practiced by both traditional investors and cryptocurrency investors looking to build a cryptocurrency portfolio.

Harry Markowitz- Founder of MPT. Image via slideshare.net

Harry Markowitz- Founder of MPT. Image via slideshare.netOne of the key components of Modern Portfolio Theory is diversification. To put simply, diversification is a way of avoiding “putting all your eggs in one basket.” A smart move, as diversifying your wealth across non-correlated assets and variance factors helps to ensure that no matter what happens in the world economy, at least one of your assets is hopefully performing well.

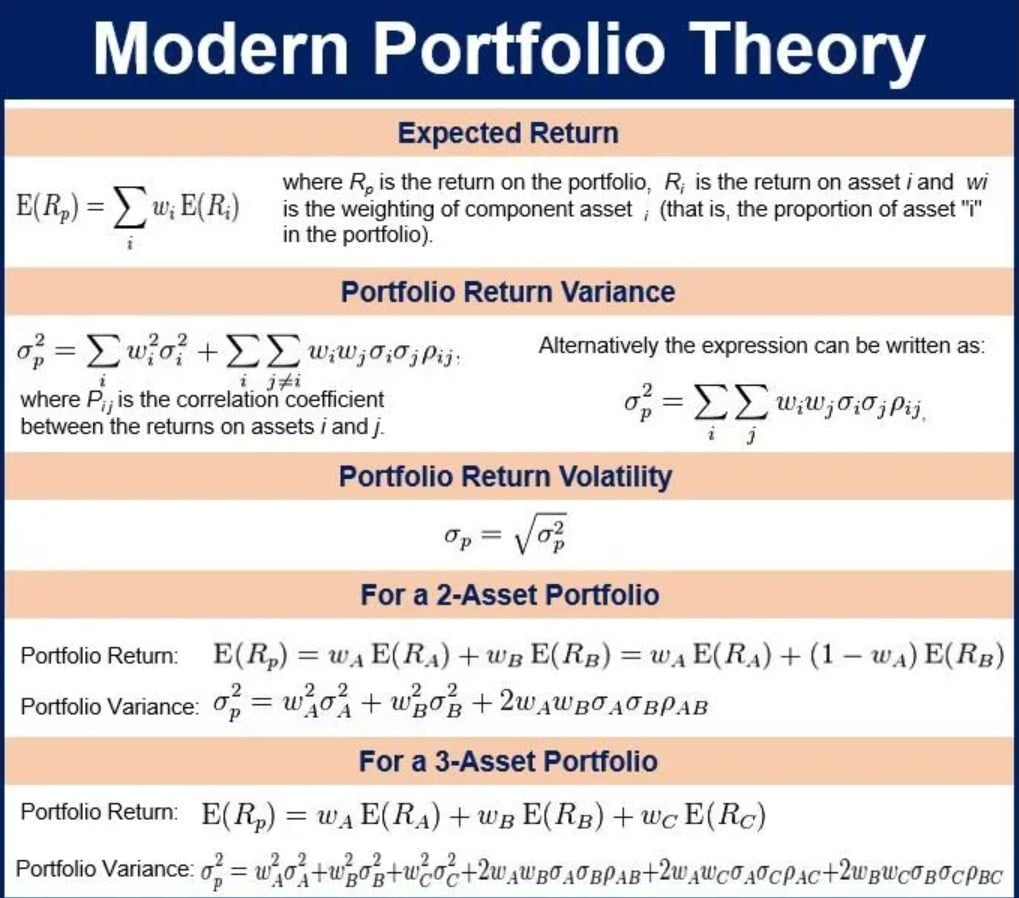

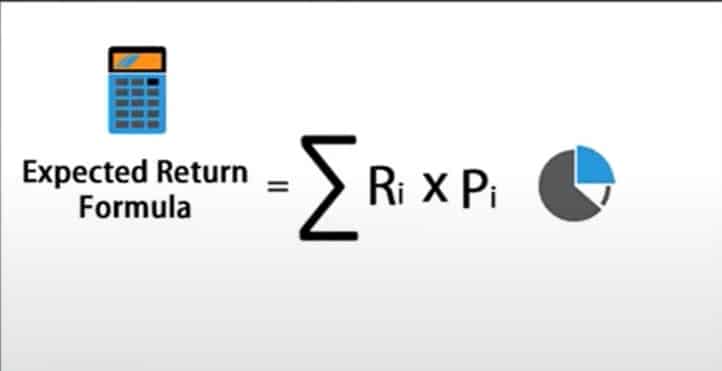

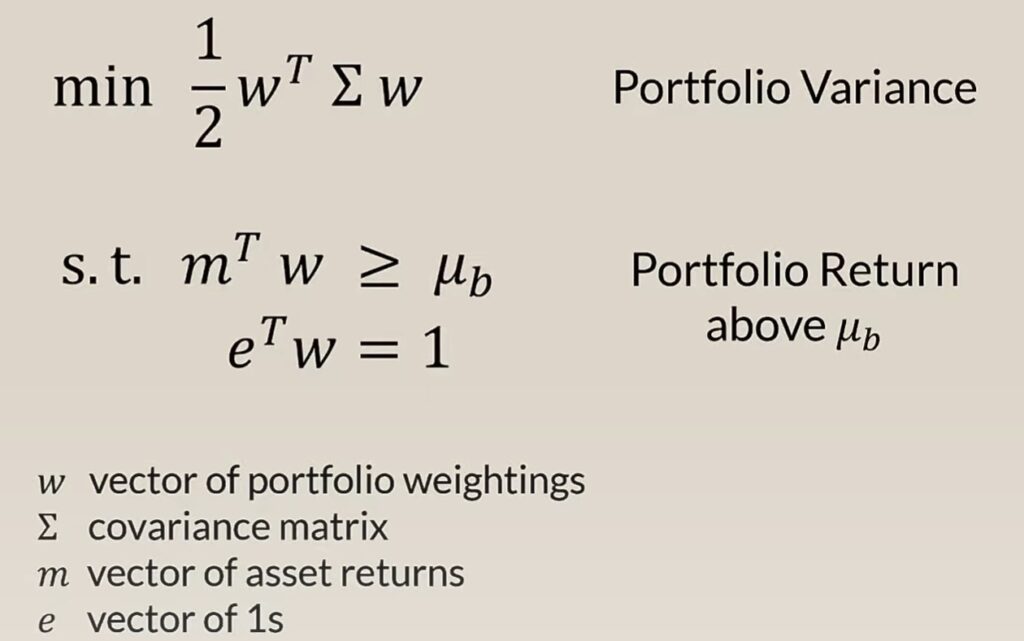

For you math lovers out there, here are the equations used by MPT:

Image via marketbusinessnews.com

Image via marketbusinessnews.comMost investments are traditionally either high risk and high return, or low risk with low return. Markowitz theorized that investors could achieve the best overall results by selecting an optimal mix of the two, based on an assessment of the individual investors’ tolerance to risk.

MPT is primarily used by investors seeking the following outcomes:

- Investors who are risk-averse and looking to construct a diversified portfolio that maximizes returns without taking on high levels of risk.

- Investors trying to construct the most efficient and diversified portfolio using ETFs and stocks.

- Investors looking to build a crypto portfolio with the greatest risk-to-reward ratio that aligns with their risk appetite.

- Investors whose primary concern is minimizing downside risk.

The MPT is for investors who are risk averse, not the type of investor who is more of a gambler, the type who goes all-in at a casino or puts their life savings on Dogecoin or Shiba Inu. MPT is suited to investors who understand the importance of diversification and prefer as little risk as possible for a given level of return. Risk aversion often leads to investors diversifying, investing into multiple separate asset classes such as:

- Stocks

- Bonds

- Fixed Income Equities

- ETFs

- Real Estate

- Precious Metals + Commodities

- Cryptocurrency

In MPT, the acceptable return of the portfolio is calculated as a weighted sum of the returns of the individual assets. If a portfolio contained four equally weighted assets with the expected returns of 5%, 8%, 10% and 5,507% (5,507% is Bitcoin’s highest yearly ROI for the win 😎), the portfolio’s expected return would be:

(5% x 25%) + (8% x 25%) + (10% x 25%) + (5,507% x 25%) = 1,382.5%

To understand how MPT tackles the risk vs reward conundrum, first, we need to understand what risk and reward mean. So, if we have a potential asset, say Bitcoin, there is a potential risk associated with purchasing BTC, and there is also an associated reward.

As investors, we can put a value on risk and reward by calling the reward, “expectation” and the risk, “variance.”

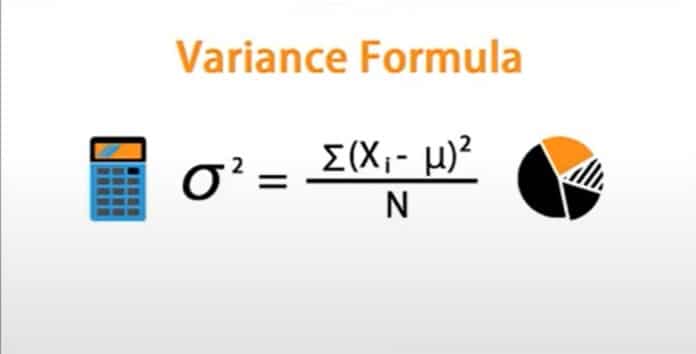

We can calculate variance. Remember that one of the most important aspects of MPT is diversification of assets, so we need to understand the covariance between assets.

To figure this out, we need to think “what do we know about our asset?”

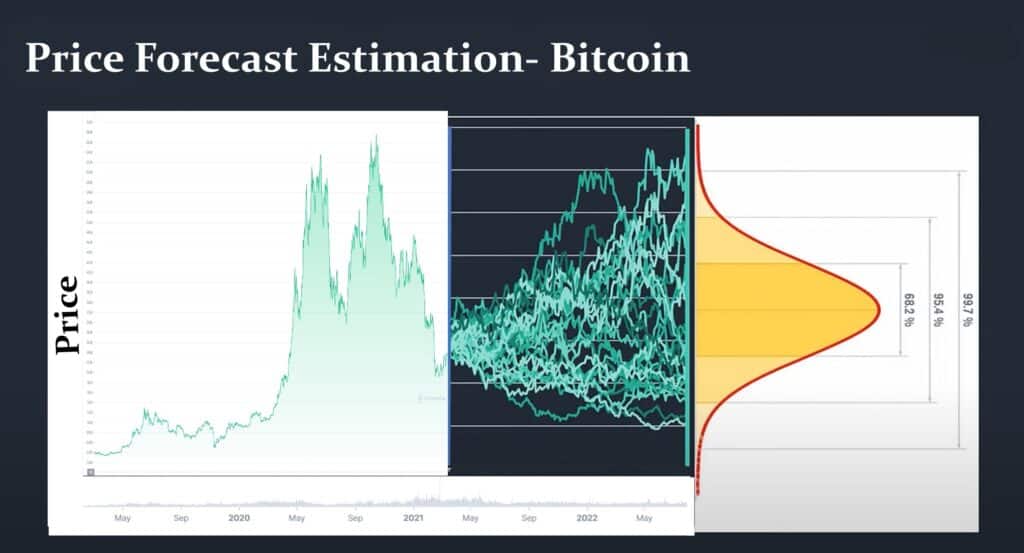

Our asset is Bitcoin, we need to estimate the potential future distribution of returns going forward. We can forecast the likelihood of future price using historical price and projecting potential future price using a standard bell curve:

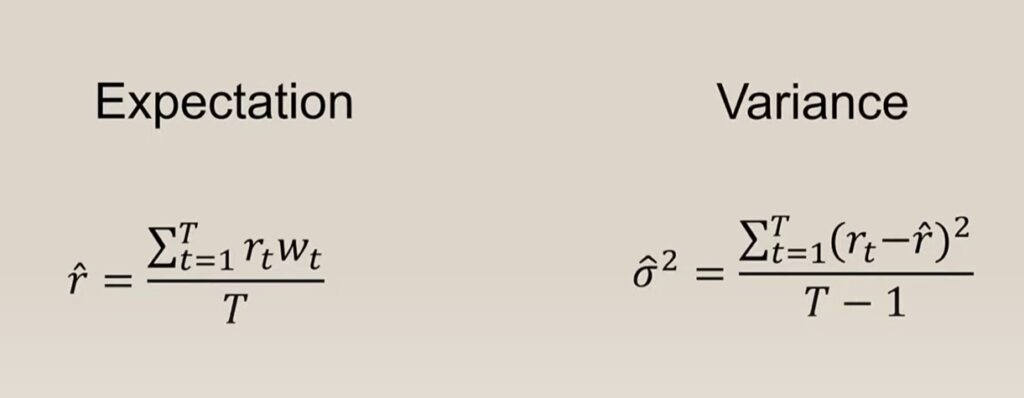

We don’t know how Bitcoin is going to perform going into the future, if we did, we would all be stock-picking genius millionaires. Once the potential distribution is set up as in the diagram above, that gives us theorized expectations of returns, now we have a figure and can use this formula:

We can take the weighted sum of all the probable outcomes for returns, and know the variance of the distribution or how risky the asset is by using this variance formula:

Now, don’t worry if these formulas are making you feel more confused than your first time at a high school dance, fortunately, Harry Markowitz already did all the hard work for us to leech from. You don’t actually need to know how to perform these equations, we are just covering the theory here.

Based on all this information we’ve gathered, we can work out whether or not we want to hold a certain asset for a potential return, given that level of risk. The level of risk is something that each individual investor needs to choose as everyone has a different risk appetite and depends on things like:

- Time frame - How long are you willing to hold the asset?

- Cash flow - Do you anticipate needing these funds? Are these funds your livelihood or can you afford to lose this amount?

- Age - Investors near retirement age are likely to take less risk as they will be reliant on savings or investment income, not salary income.

- Risk tolerance - Everyone has a different risk appetite.

Because we don’t know what the future price distribution is going to look like, all investors can do is estimate it. We use the expectation formula above, take the summation of all the market returns based on the bell curve, which price projections are largely based on historical price data, and add some kind of weighting. The weight is generally 1 as we weigh all the previous time periods equally. The weight is divided by the total number of time periods.

Then we need to focus on the variance, which is specifically related to how far the asset price has moved from the mean. These are the two key equations that Markowitz used to figure out expectation and variance:

So, to summarize this all up, what MPT aims to do is figure out the maximum risk-adjusted return for a portfolio. It factors in variance/covariance, diversification, previous price history, and the likelihood of future price appreciation using a standard deviation bell curve graph, all broken down into data using mathematical models to calculate outcomes of various portfolios.

Now we get into the next key factor of Modern Portfolio Theory, and that is diversification.

Risk and The Diversified Modern Crypto Portfolio

I would like to tackle the subject of diversification from both the traditional viewpoint and the way it is viewed by Modern Portfolio Theory, as I think both are very important.

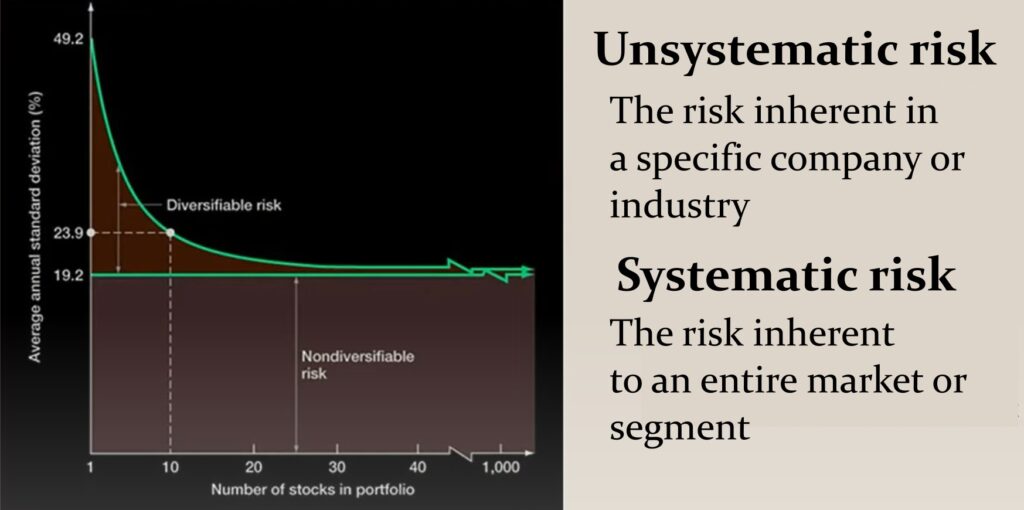

MPT focuses on two main types of risk:

Systematic/Non-diversifiable Risk - The market risk relating to the overall market, such as the stock market, bond market, etc.

Unsystematic/Diversifiable Risk - The idiosyncratic risk related to a particular single investment like a stock or crypto asset.

MPT was created as a way to eliminate idiosyncratic risk, which is the risk that is inherent in a single particular investment due to its unique characteristics. For example, if 100% of your funds are invested in one oil company, you are open to multiple risks such as:

Company Mismanagement Risk - If the company is poorly managed and runs itself into bankruptcy, or fails to earn profit.

Competitive Risk - What is the competition like? Is the company at risk of being surpassed by competing firms?

Environmental Risk - The changing environment can have an impact on the need for oil. Investors are exposed to issues such as supply limitations, weather patterns impacting oil extraction capabilities, spillages, etc.

Political Risk - Global political issues, like the wars in the middle east or the current Russia Ukraine conflict impact oil supply and prices.

Technological Obsolescence Risk - With the search for more efficient energy sources and advancements in wind, solar, and nuclear energy, oil is at risk of being replaced with more efficient sources and technology.

Social Risk - With ESG mandates being pushed and concerns over carbon emissions mounting, greater numbers of people in our society are limiting their use of oil and gas utilization, and demanding governments take action.

Another good example of unsystematic/diversifiable risk is what we saw happen during the pandemic. Airlines were some of the hardest hit stocks, investors who diversified away from only holding stocks in the travel industry were better protected against idiosyncratic risk.

Flight Cancellations from Covid Restrictions Led to Record Drops in Profits for Airline Companies. Image via Shutterstock

Flight Cancellations from Covid Restrictions Led to Record Drops in Profits for Airline Companies. Image via ShutterstockSo, as you can see, investing everything in one company opens an investor up to a very high level of risk, not to mention multiple unknown factors that are nearly impossible to predict or prepare for.

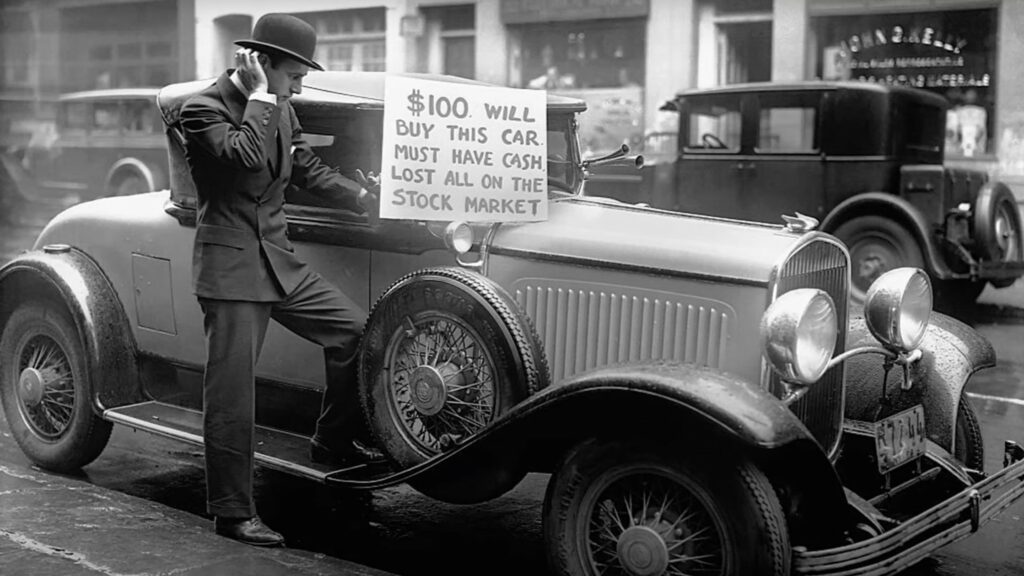

Some investors will feel that they are diversified enough just by investing in different assets within the same asset class, but most would disagree. If your idea of diversification is buying multiple different meme coins, or even being all in on crypto, that isn’t very diversified. You could be like this chap, who invested in who knows how many stocks, but when the entire stock market collapsed in 1929, no stock escaped unscathed:

Bankrupt investor Walter Thornton tries to sell his luxury roadster for $100 cash on the streets of New York City following the 1929 stock market crash. Image via Yahoo Finance

Bankrupt investor Walter Thornton tries to sell his luxury roadster for $100 cash on the streets of New York City following the 1929 stock market crash. Image via Yahoo FinanceModern Portfolio Theory promotes the idea that any given investment’s risk and return characteristics should not be viewed alone but should be evaluated by how it affects the overall risk and return of the entire portfolio. An investor can build a portfolio of multiple assets that will result in similar, or greater returns, but may carry significantly higher risk, which is not ideal.

Let’s take the above example again, but instead of being all in on an oil company, they also invest in solar energy, nuclear energy, property, and Bitcoin, and see how this affects idiosyncratic risk:

Company Mismanagement Risk - Minimized because if the oil company fails, the nuclear energy and solar company may thrive, the property investment will likely not be heavily affected by the failed oil company, and neither will Bitcoin.

Environmental Risk - Minimized because if environmental influences impact oil production, the other companies may be unaffected, or even become more profitable as investors cycle out of oil and into alternative energy companies. Real estate may be largely unaffected by the same environmental risk and Bitcoin's price will similarly likely remain mostly unaffected.

Political Risk - While the war in the middle east and Ukraine will impact the investment in the oil company, the solar and nuclear companies could see positive appreciation amidst the strife, and Bitcoin remains politically agnostic, largely unaffected by political disputes between nations.

Technological Obsolescence Risk - If an investor considers what technology is emerging that could replace oil, by investing in multiple technologies, they are hedging their bet. This is a similar concept as to why I invest in multiple Ethereum competitors and different layer 1 protocols.

There are two likely outcomes for Ethereum: Either Ethereum will remain king of the smart contract platforms thanks to its first-mover advantage and network effects, which is why it is in my portfolio, or another protocol like Cardano, Solana, Avalanche, NEAR, THETA, VeChain etc. many of which have superior technology, could surpass it, or at least chip away at ETH's market share. By investing in more than one, you have a better chance of selecting the winner/winners.

With so many Digital Assets, it is Impossible to Know Which Ones will Succeed and Which Ones will Fail. Image via Shutterstock

With so many Digital Assets, it is Impossible to Know Which Ones will Succeed and Which Ones will Fail. Image via ShutterstockSocial Risk - As the world jumps on the “I hate oil” bandwagon, whether you agree or disagree, you can protect yourself by investing in other energy sources. It is very unlikely that pressure will mount to ban every form of energy, but even if the world goes crazy and wants to ban oil, nuclear, and solar energy, that is unlikely to affect your real-estate investment as severely as the stocks in these industries.

This is, of course, quite a simplified example, and issues in one industry can have a severe knock-on effect on other markets, which should be taken into consideration.

For example, I grew up in a city whose population was comprised mainly of folks who worked in the oil and gas industry. When the oil industry struggled and layoffs were rife, the housing market in that city was also severely negatively affected. So, in that scenario, property and oil companies were heavily correlated. But if you own a house in California but invest in a northern Canadian oil company, the two will have a significantly lower correlation.

That is the traditionally understood concept of diversification and highlights its importance. When discussing MPT, it comes as a surprise to many that the term diversification isn’t just about diversifying asset classes but also accounts for covariance and correlation.

Correlation

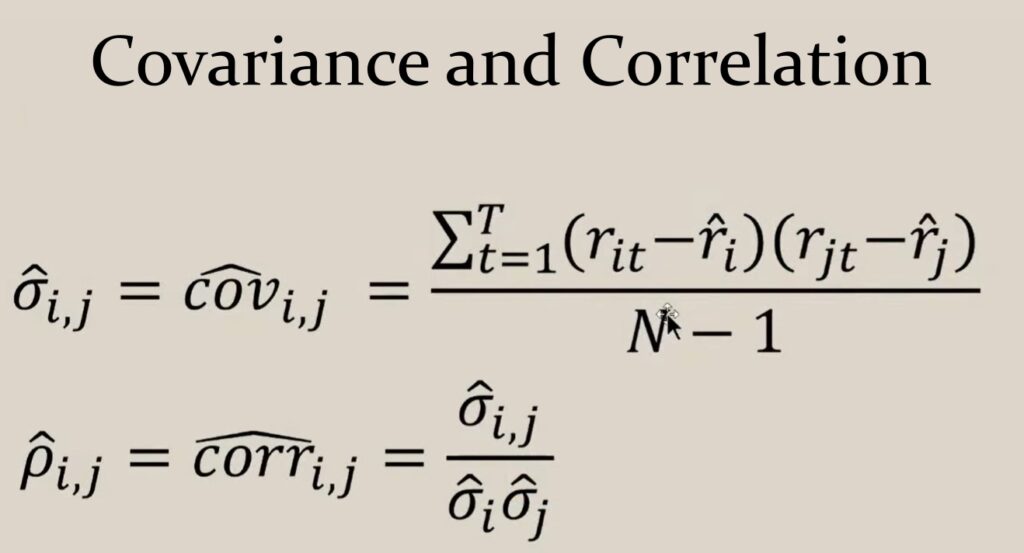

Here is the textbook equation for the MPT approach to diversification in terms of covariance and correlation

And again, because the math formula above is like huh? 🤨

I’m gonna break it down in a way that I can understand it. If you have two assets that are performing completely differently, like these two:

Ethereum Classic has Been Performing Well Leading up to the Ethereum Merge While Bitcoin has Been Dropping. Images via CoinMarketCap

Ethereum Classic has Been Performing Well Leading up to the Ethereum Merge While Bitcoin has Been Dropping. Images via CoinMarketCapOne asset has been performing well, while one hasn’t been so hot. What we are trying to do with MPT is understand the correlation between the assets over the same time period.

In this example, Ethereum Classic has been on an incline while Bitcoin has seen negative price action, we can see that these two have been highly uncorrelated with regards to how they have performed relative to one another.

If we take the same Ethereum Classic asset that has been doing well as we lead up to the Ethereum merge, and look at another crypto asset Cosmos, which has also been performing well, we can see a closer correlation between the two.

Images via CoinMarketCap

Images via CoinMarketCapWe don’t need a degree in math to take a look at those two charts and see that there is a higher level of correlation, but we can use the formulas identified by Markowitz if we want a more exact mathematical approach.

When discussing correlation, it helps to look outside of the cryptocurrency space for uncorrelated assets. It is very difficult to identify projects/companies/commodities/assets within one asset class that are uncorrelated, and when non-correlation does exist within one asset class, it is often short-lived.

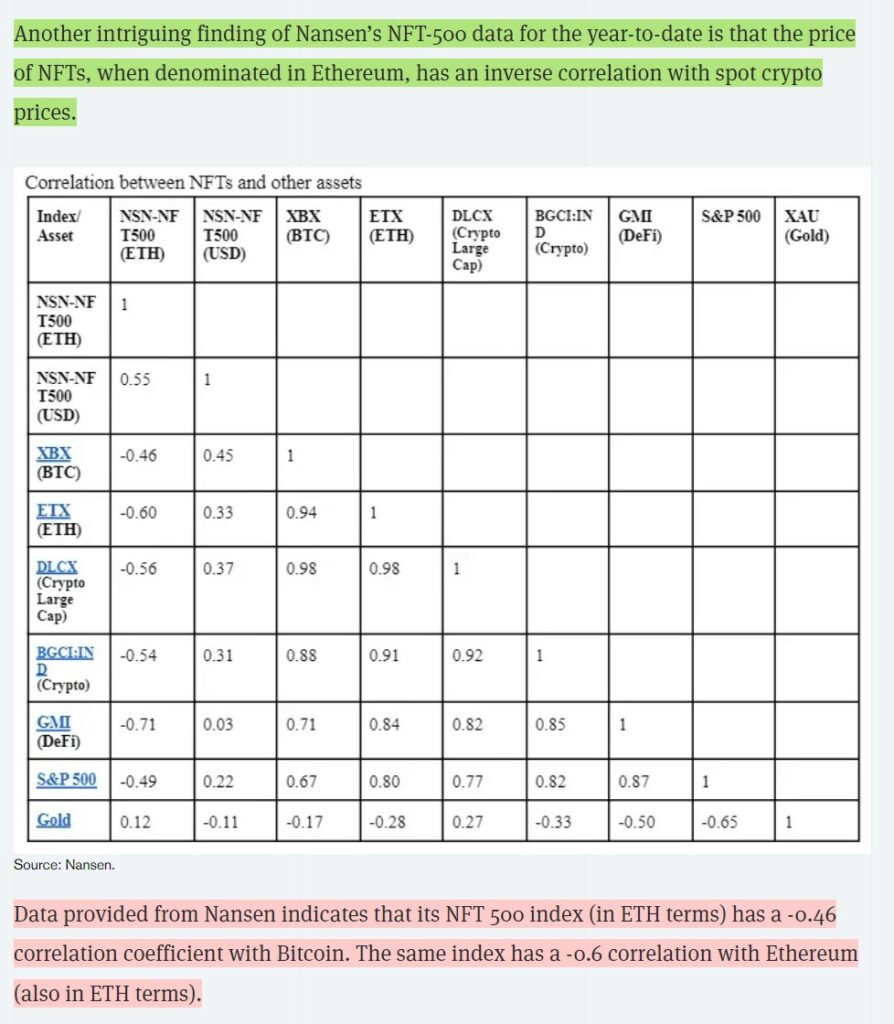

Here is an exception: If we focus purely on crypto, we have seen a high level of uncorrelation in the sectors of NFT, Metaverse and GameFi projects when compared to pure cryptocurrency projects. As crypto markets were plummeting, NFTs and Metaverse projects continued to do very well for a short period of time before they succumbed to the negative market enthusiasm and sentiment, consequently collapsing with the rest of the crypto market.

Nansen Report Shows Non-Correlation Between Crypto and NFT Projects. Source Nansen

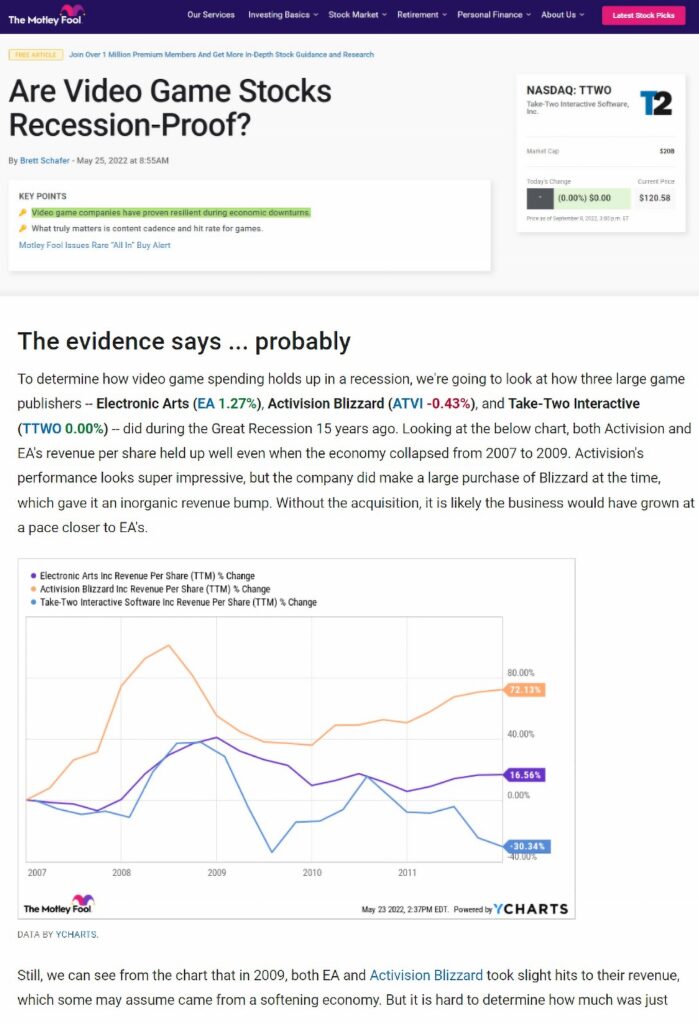

Nansen Report Shows Non-Correlation Between Crypto and NFT Projects. Source NansenGameFi projects are an interesting exception and have the potential to buck the correlation trend between crypto projects for the long term, and it makes sense. Regardless of price action and what is going on in the macroeconomic environment, people still want to play games.

During tough economic times, people look for an escape, a distraction, and entertainment, which video games and media provide for many. This is why gaming stocks will often perform better than average during turbulent times and market downturns as people are content to stay home and game.

Video Game Stocks Historically Perform Well During a Recession. GameFi Projects will likely Experience a Similar Trend. Image via The Motley Fool

Video Game Stocks Historically Perform Well During a Recession. GameFi Projects will likely Experience a Similar Trend. Image via The Motley FoolGameFi projects also have an additional attractor, and that is the potential to earn income. If unemployment is high and people lose their jobs, they won’t be investing in Bitcoin, but they may turn to GameFi to play games and earn an income, so there is a level of uncorrelation there.

It is a good defense against risk to consider assets that can be “recession-proof,” or ones that will be affected the least during a recession.

Art is another interesting outlier; fine art has traditionally performed well during periods of high inflation as the wealthy look to ditch their cash and purchase items that store value. Many investors will often turn to alternative investments such as art, and even things like wine and whisky to adequately diversify and invest in uncorrelated assets.

NFTs could potentially fill this role in the crypto space, but we do not have enough historic data to know if this will be the case. Though NFTs are taking a thrashing now, it is logical to assume that assets like Bitcoin and NFTs will decrease their correlation levels in the future.

Understanding correlation is very important because investors often think that as long as they are diversified into different asset classes, they are sufficiently diversified and that should be okay, but we know this is not true. During the past year, to the surprise of many investors, Bitcoin and the NASDAQ have been incredibly correlated despite being completely different asset classes. Bitcoin has also had periods of high correlation with the S&P 500 as well:

Image via Seeking Alpha

Image via Seeking AlphaThis correlation has been happening due to investment firms treating equities and Bitcoin as both “risk on” assets, meaning Bitcoin and equities are experiencing similar treatment in terms of buying and selling habits.

If an investor feels they are diversified because they hold both Bitcoin and tech stocks, the high correlation shows that the performance outcome will be similar to if they only held one or the other.

It is important to understand that correlation trends are always evolving and changing. Just because two assets are highly correlated now, that does not mean they will always be.

For Bitcoin’s first decade or so, it was highly praised as being uncorrelated with both gold and stocks, a perfect investment vehicle for additional diversification. That trend has recently changed as some investors see Bitcoin as falling under the same risk profile as tech stocks.

This is a narrative that goes against many people’s fundamental beliefs about Bitcoin and the opinion that Bitcoin should be considered as a store of value, treated more similarly to gold or digital property vs being considered risky and similar to tech stocks. I agree with this and believe that Bitcoin should be one of the least risky investments, a role that may someday be realized. MicroStrategy’s Michael Saylor explains why Bitcoin is the Apex property of the human race, something that most people do not understand yet.

There is a good chance that the current correlation between BTC and equities will end once firms and institutions understand the importance of Bitcoin as an inflation hedge and store of value.

You may find our article comparing Bitcoin to Gold as an inflation hedge interesting where we dive into the correlation and performance between the two. We have a similar article on Bitcoin vs. Stocks.

Alright, I want to go back to this chart showing Bitcoin and Ethereum Classic:

Am I saying that according to Modern Portfolio Theory that you need to pick a winning and losing crypto or stock/asset to be properly diversified and identify non-correlated assets?

No, of course not. Investors don't typically purposely choose to pick a losing asset just to make their portfolio less diversified. This is an optimization issue. Given a number of assets with estimated returns, variances and covariances, in a portfolio, investors want to choose the weightings of each asset to maximize return while minimizing variance.

The weightings are key in this strategy. An investor would allocate say 5% to one asset, 10% for another etc. based on maximizing expected return and minimizing variance.

Sounds great, saying all these fancy words and explaining these concepts, but how do we do that?

I’m glad you asked.

It’s super easy, all you need to do is solve the quadratic programming problem using Lagrange Multipliers like so:

Oh sorry, is that not easy? No kidding! Seriously, my math is so bad that I gave up helping my nephew with math problems before he even started school. At the age of three, he asked me how many skittles we could eat after we fed all the yucky yellow ones and only some of the yucky green ones to the dog, and it was at that point that I knew I was done for when it came to future help on math homework.

So, let’s break this down again without the math jargon. As discussed, portfolio variance is what we are trying to minimize, that is the objective function of the top equation. The bottom constraints are basically saying that I am looking for a return above this level, for example, I am looking for a return above 10%. The bottom line in the second equation is just showing the weightings of each asset, in this scenario, each is equally weighted at 1. Now that we know the numbers to plug in, we can solve the equation.

As far as solving the equation goes, I feel really bad that I made you read through all that and am just now telling you this: You don’t need to know how to do ANY of this to create a portfolio for yourself in line with Modern Portfolio Theory. I mentioned that many leading investors and firms use this theory, do you really think they all sit down with pencils and papers and work all this out themselves?

Of course not, how time-consuming! The internet can be a wonderful thing, and wouldn’t you know that there just so happen to be plenty of apps and tools created specifically to simplify this task.

Here is a Modern Portfolio Theory builder app on Google Play

Free portfolio optimization web API: portfoliooptimizer.io

And I am sure you will be able to find others if you just search “Modern Portfolio Theory Builder.”

The Efficient Frontier

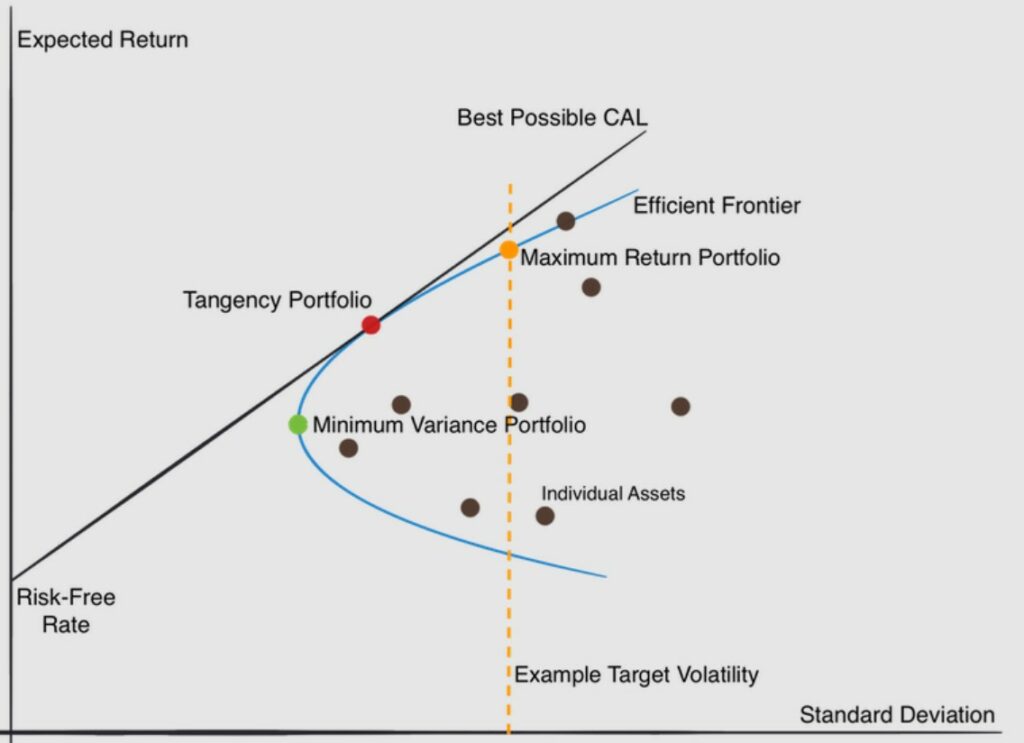

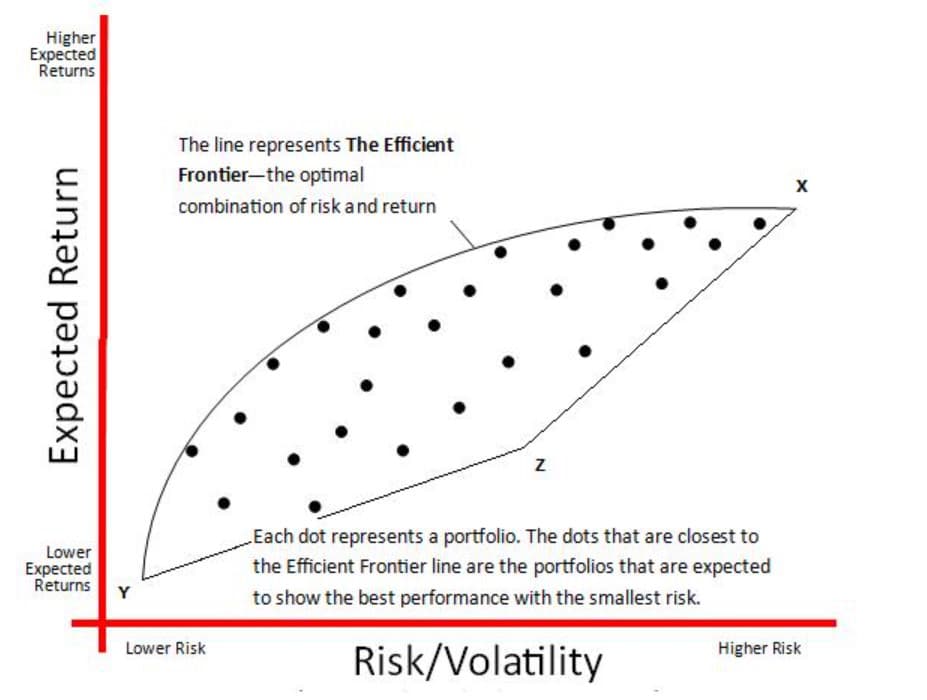

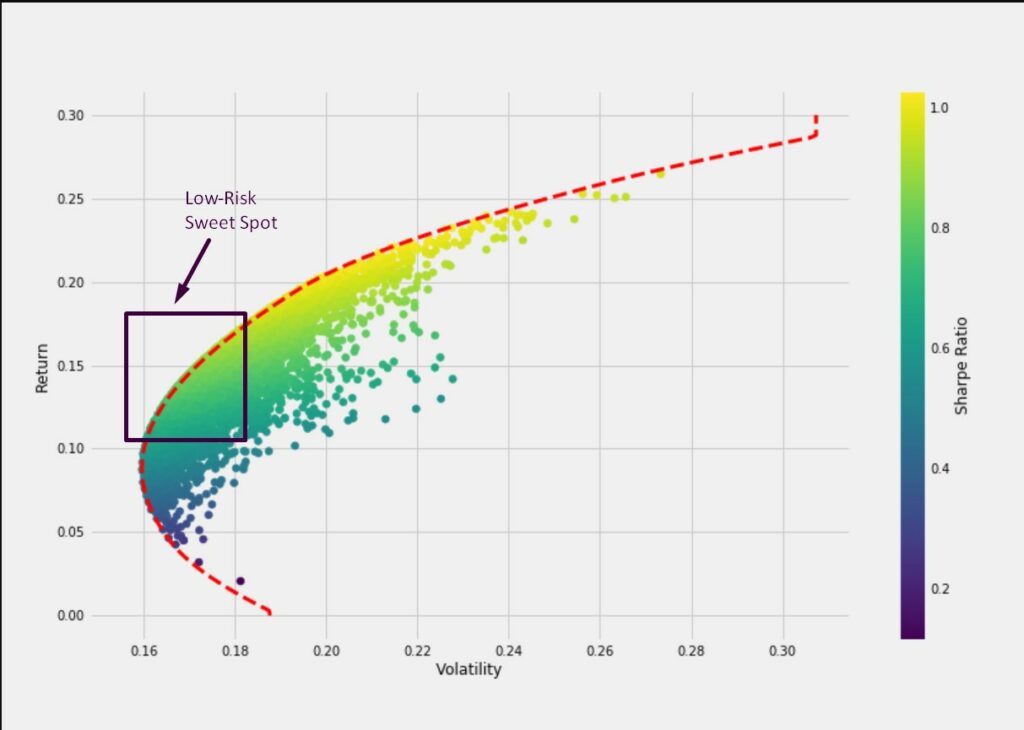

In Modern Portfolio Theory there is something called the Efficient Frontier, which is important to understand. It is a graph that highlights the optimal investment portfolios that occupy the “efficient” parts of the risk-return spectrum.

The graph contains a set of portfolios that satisfies the condition that no other portfolio exists with a higher expected return but has the same standard deviation of return (ie., the risk)

Image via quantpedia.com

Image via quantpedia.comEach dot represents a differently weighted portfolio, and the one that sits closest to the area on the curve that lines up with an investor's target risk (the yellow line) along the curve is the most optimized portfolio for that investor.

Where this comes into play is that we have already defined our risk appetite above and have a general idea of how much risk we want to expose ourselves to, now what is the highest return we can get for that level of risk?

Portfolios that are below the efficient frontier curve are sub-optimal as they are not performing well enough for the amount of risk, while portfolios that cluster further to the right of the efficient frontier are also sub-optimal because they have a higher level of risk for the defined rate of return, and are likely outside of the investors comfort zone.

The Efficient Frontier is basically a graph used to find the sweet spot or “Goldilocks” zone.

The key takeaways are:

- The efficient frontier shows investment portfolios that offer the highest expected return for a specific level of risk.

- The standard deviation of returns in a portfolio measures investment risk and consistency in earnings.

- Lower covariance between portfolio securities results in lower portfolio standard deviation.

- Successful optimization of the return vs risk parameters should place a portfolio along the efficient frontier line.

- Optimal portfolios that meet Efficient Frontier parameters often exhibit a higher degree of diversification.

This is all a fancy way of saying the efficient frontier rates portfolios on their scale of return versus risk. The compound annual growth rate (CAGR) of an investment is commonly used as the return component while standard deviation (annualized) shows the risk metric.

Another Look at the Efficient Frontier Concept. Image via Source: mbaknol.com

Another Look at the Efficient Frontier Concept. Image via Source: mbaknol.comReturns are dependent on the investment combination of assets that make up a portfolio. An asset’s standard deviation is synonymous with risk. Investors who use this method seek to fill a portfolio with assets offering high returns with a combined standard deviation that is lower than the standard deviation of individual assets in the portfolio.

The lower the covariance between assets, the lower the standard deviation. If the mix of optimizing return verse risk is successful, the portfolio will line up along the efficient frontier line.

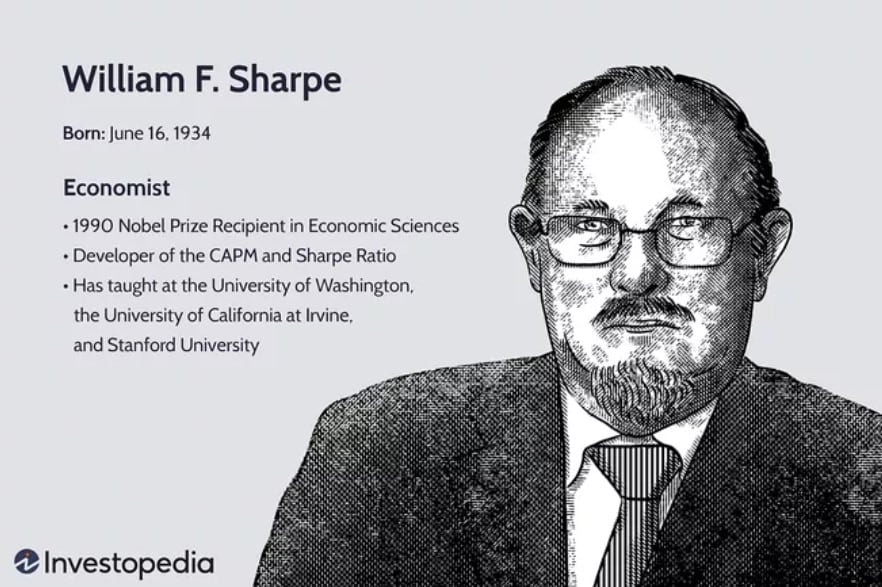

The Sharpe Ratio and Cryptocurrencies

To kick this section off, here is Investopedia’s definition of the Sharpe Ratio:

“The Sharpe ratio compares the return of an investment with its risk. It's a mathematical expression of the insight that excess returns over a period of time may signify more volatility and risk, rather than investing skill.”

Economist William Sharpe proposed the Sharpe ratio way back in 1966, and to this day it remains a cornerstone concept for investing. Here are the key takeaways to know before diving into how we can relate this to cryptocurrency and Modern Portfolio Theory:

- The Sharpe ratio divides a portfolio's excess returns by a measure of its volatility, assessing the risk-adjusted performance.

- Excess returns are returns that are above an industry benchmark or the "risk-free" rate of return.

- The calculation can be based on historical returns or forecasted growth.

- A higher Sharpe ratio is better when comparing similar portfolios.

Image Source: Investopedia

Image Source: InvestopediaThe Sharpe ratio is one of the most widely used methods for measuring risk-adjusted relative returns, such as the risk-adjusted returns we can identify from using Modern Portfolio Theory, which is why these two concepts complement each other so brilliantly.

The Sharpe ratio can be used to evaluate a portfolio’s risk-adjusted performance, regardless of the investment strategy being used.

This is useful in determining to what degree excess historical returns were achieved with excess volatility/risk. While excess returns are measured in comparison with an investing benchmark, the standard deviation formula measures volatility based on the variance of returns from their mean.

In its simplest form, here is the formula for the Sharpe ratio:

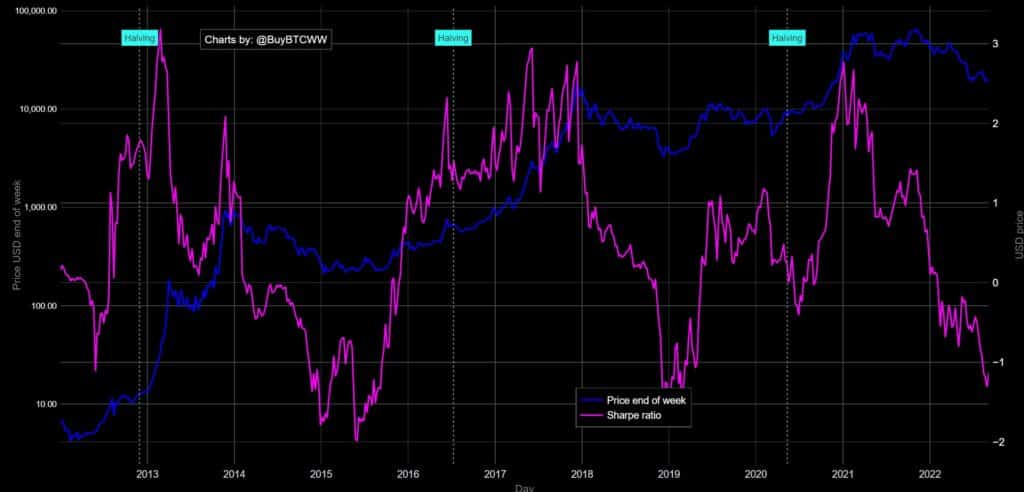

Again, instead of doing the math ourselves to figure out the Sharpe ratio of crypto assets, thanks to websites like buybitcoinworldwide, we can see Bitcoin’s historic and current Sharpe ratio as it updates in real-time:

Image via buybitcoinworldwide

Image via buybitcoinworldwideTo interpret the Sharpe ratio, generally, Sharpe ratios above 1.0 are considered acceptable, 2 is very good, and 3 is amazing. We can see that Bitcoin spends about half its time with a Sharpe ratio of 1 or higher, even reaching 3 for sustained periods.

On the flip side, crypto is known for its high-risk and volatility, and we can see that Bitcoin also spends some time under 1, which is suboptimal, but not detrimental. Negative values correspond with negative returns on investment, so we don’t want to be there.

The Sharpe ratio measures the return that exceeds the risk-free interest rate. It is calculated by subtracting the risk-free rate from the portfolio’s ROI, most often using U.S Treasuries or other AAA bond yields as a proxy for the risk-free rate of return. Then, divide the result by the standard deviation of the portfolio’s excess return.

This information helps investors determine if higher returns accrue from savvy investment decisions, or from assuming excessive risk.

Images via Shutterstock.

Images via Shutterstock.Two portfolios may have comparable beneficial returns, but the Sharpe ratio identifies which portfolio took on more risk. The Sharpe ratio provides a benchmark that investors can use to compare different financial assets despite their differences in volatility or returns, standardizing each dollar earned per unit of risk.

So, what exactly does the Sharpe ratio reveal about crypto’s risk-adjusted returns?

Surprisingly, the Sharpe ratio for many of our favourite digital assets shows clearly that per unit of variance, the risk is not nearly as high as mainstream headlines would have you believe.

Crypto Isn’t the Devil that Mainstream Media Would Have You Believe. Image via CoinTelegraph

Crypto Isn’t the Devil that Mainstream Media Would Have You Believe. Image via CoinTelegraphBitcoin’s Sharpe ratio, prior to the current dismal markets in 2022, actually showed the opposite of the “high-risk” stereotype. Graphs showing BTC’s Sharpe ratio highlighted that it was riskier not to have some investment exposure to Bitcoin, as it performed so well and had a favourable ratio.

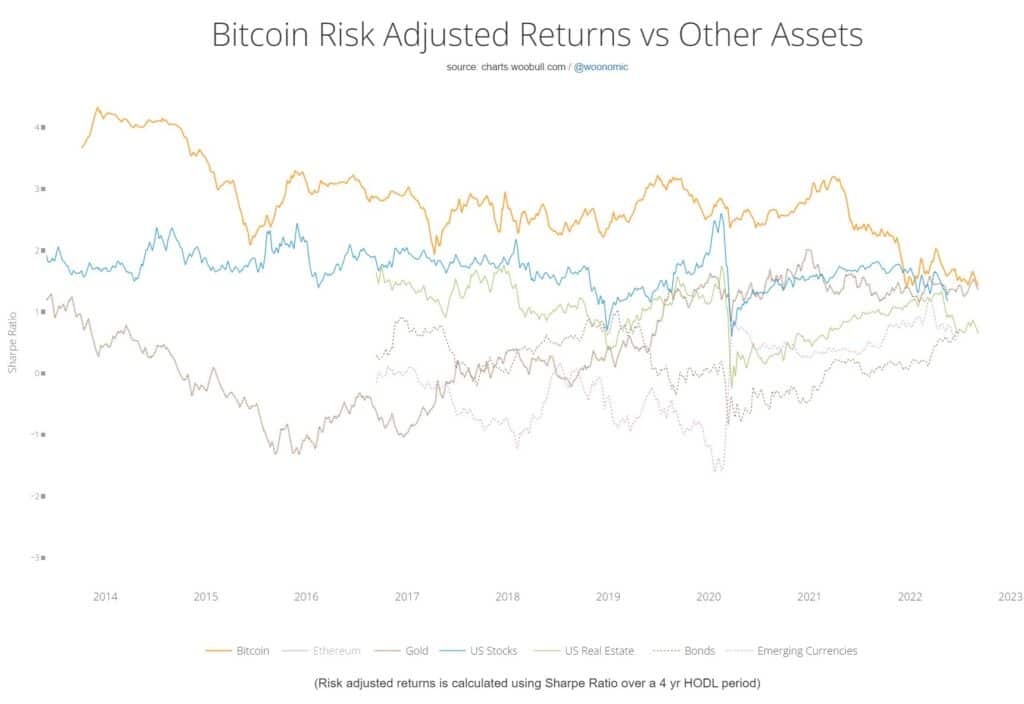

I really like this chart programmed by financial forecaster and analyst Willy Woo that shows Bitcoin’s Sharp ratio over 4 years vs 6 other assets. This chart shows that since its inception, Bitcoin has been beating the pants off of other asset classes.

Source: charts.woobull.com

Source: charts.woobull.comThis chart shows us that not just Bitcoin, but also Ethereum have outperformed stocks, real estate in the US, bonds, gold, and emerging currencies. Not bad despite the fact that news headlines seem determined to make crypto out to be the worst thing since processed cheese slices that are so chemically engineered that they cannot even legally be called cheese. (Yes, those do exist!)

And it isn’t just those of us in the crypto community that are privy to this trend either. Two business school professors, Dr. Aleh Tsyvinski, Arthur M. Okun Professor of Economics at the Yale School of Management, and Dr. Yukun Liu of the Simon School of Business at the University of Rochester cited these trends in a paper on the risks and returns of cryptocurrency that was published by Oxford University’s Review of Financial Studies and had this to say:

“We find that the standard deviation of coin market returns decreased significantly from the first half to the second half of the sample period. The figure in the Internet Appendix shows a significant decrease in the volatility of the coin market returns over time.”

Then further concurred:

“We documented a high return but with a lot of volatility. Does the high return compensate for the high volatility? This is called the Sharpe ratio, which measures the performance of an asset by adjusting for risk.

Surprisingly, we found that cryptocurrency’s Sharpe ratio shows that the return is higher than the risk implied by its volatility. It’s higher than the Sharpe ratio for stocks and bonds, but not drastically so. There have been asset classes and trading strategies with Sharpe ratios that are either the same or similar to cryptocurrencies. So if you just look at return versus volatility, cryptocurrency looks more or less normal.”

Dr. Tsyvinski summarized that if you believe, as an investor, that Bitcoin (or any crypto asset based on personal bias and risk profile) will perform as well as it has historically, then you should hold 6% of your portfolio in that asset. If you believe that it will do half as well, then hold 4%. If you think it will do much worse, Dr. Tsyvinski still feels investors should hold 1%.

How to Diversify Away Risk in Crypto Portfolios?

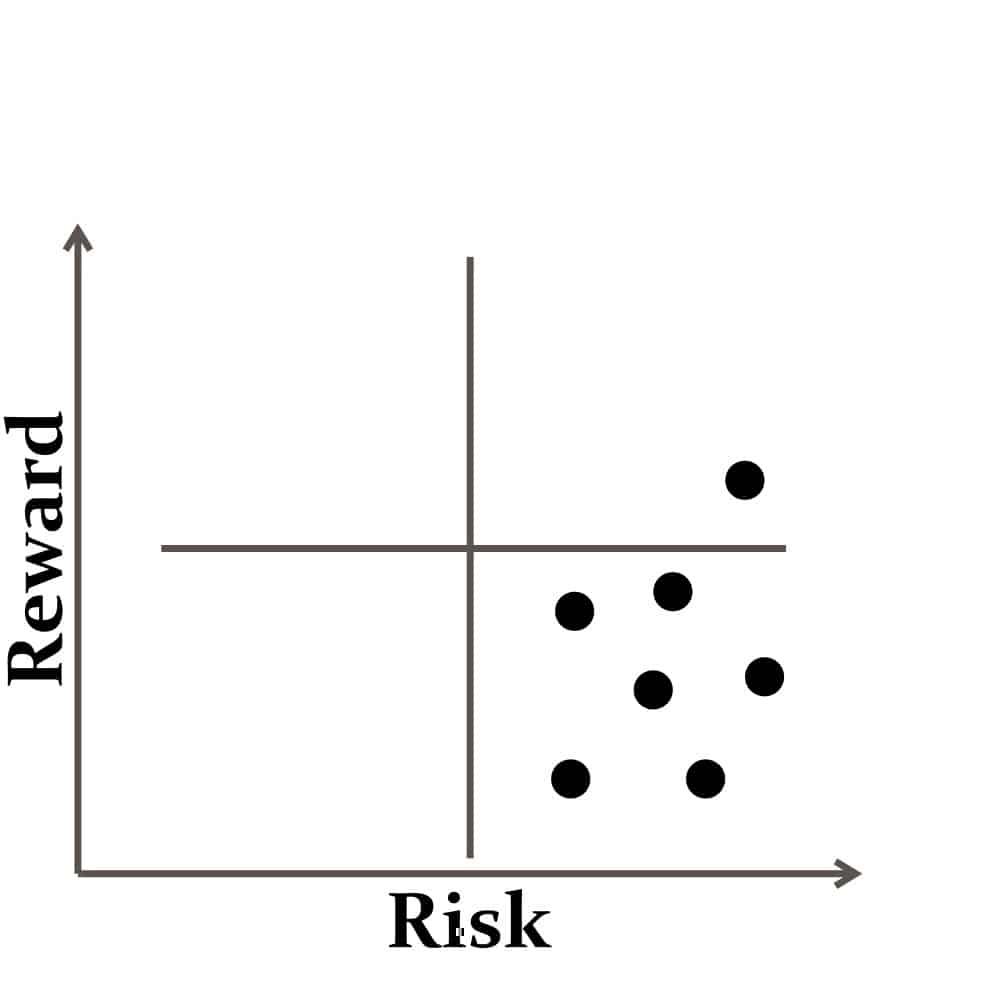

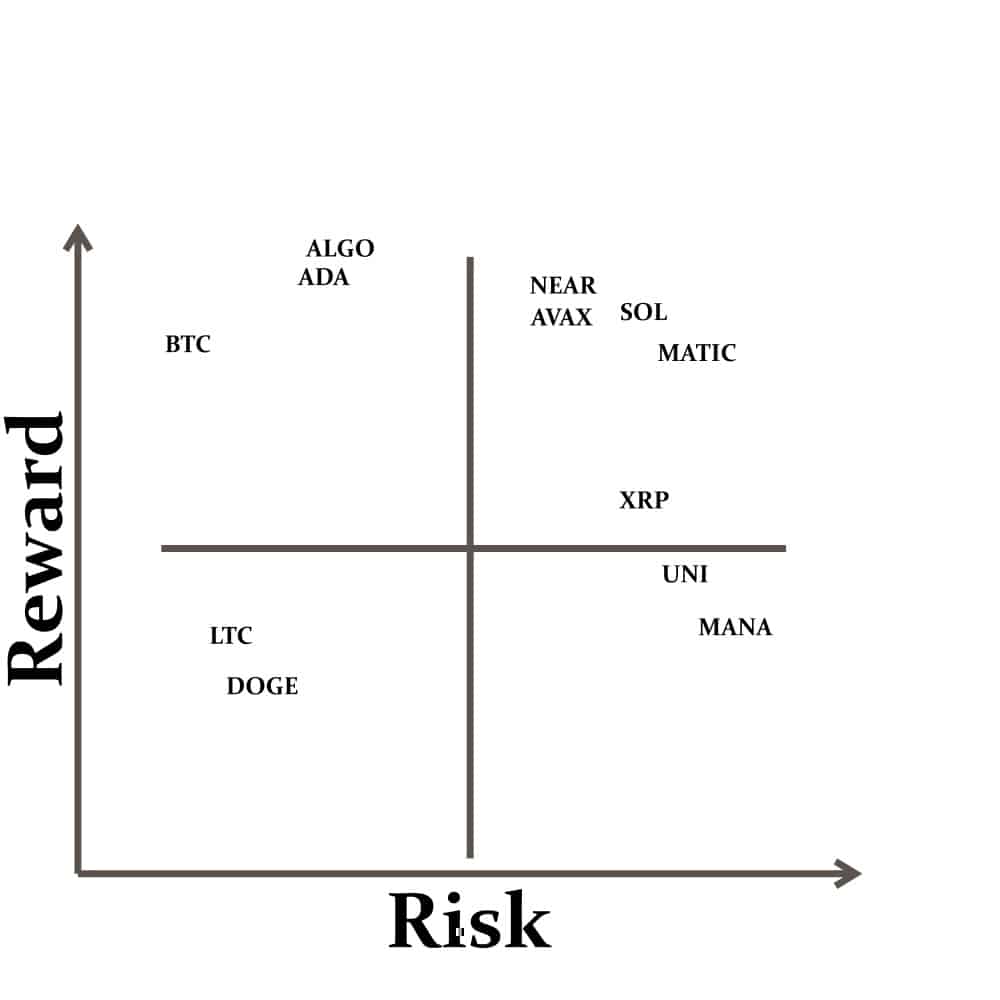

This all comes down to the balancing act between risk and reward. When practicing MPT, or any investment approach, it can be a useful exercise to chart a simple graph of risk/volatility and expected return, and place dots on the chart representing the crypto projects that make up your portfolio, or the ones you are interested in. This can show how heavily weighted your portfolio is towards one side.

If your risk-to-reward graph ends up looking like this:

Then this may be too risky if you are trying to put together a conservative portfolio, and also shows that you may not be earning as high as a return as you would like for so much exposure to risk.

If the graph ends up like this:

Then it may be too conservative if you are okay taking on higher levels of risk for higher reward.

Determining the risk vs reward for crypto needs to be analysed a bit differently from how one analyses risks in traditional investments. With stocks, for example, a simple small diversification play could be something like holding a bank stock for one American bank, and one UK bank, diversifying by location. But as many cryptocurrencies are decentralized without a company or team behind them, and are location agnostic, we have to think in different terms.

For crypto, I consider the following factors when assessing risk:

Centralization Risk - The more centralized a network or project is, the more risk it faces as there are fewer validators or miners that could become compromised, manipulated, or could coordinate a 51% attack. Centralized projects often have a public CEO/team that can be targeted by attackers and regulators, or succumb to human errors or malpractices.

Safe plays in this category are projects like Bitcoin, Monero, Cardano, Litecoin, Ethereum (pre-merge), and I hate to say it, but even Dogecoin and many others are sufficiently decentralized.

Riskier assets in this category would be Solana, XRP, and XLM as they are highly centralized with companies behind them.

If you are wondering why I consider Cardano less risky than Solana from a centralization standpoint as they both have centralized foundations behind them, it is because the Cardano network itself is one of the most decentralized networks in existence with approximately 852,000 delegators on its blockchain and over 3,000 stake pool operators, while Solana only has approximately 1,800 validator nodes. Solana’s token distribution is also heavily distributed towards investors and VCs, increasing token distribution centralization risk.

If you want to learn more about which cryptocurrencies are the most decentralized, Guy put together a great video where he covers that here:

Regulatory Risk - Not all assets are seen in a favourable light by regulators. Is the crypto a security? A commodity? Was there a token sale where the company promised profits? If so, that project could come under regulatory scrutiny. Regulators have cracked down on privacy coins, resulting in exchanges delisting coins like Monero and Zcash, and the SEC recently labelled 9 cryptocurrencies as securities: AMP, RLY, DDX, XYO, RGT, LCX, POWR, DFX and KROM, resulting in these being delisted from Coinbase and Binance US.

Regulation Fears Weigh on Privacy Coins. Image via Coin Telegraph

Regulation Fears Weigh on Privacy Coins. Image via Coin TelegraphRegulatory crackdowns are a large risk, the riskiest assets to hold in this category are privacy coins, and any project that had a company conduct a private sale where the team brazenly/stupidly suggested, hinted at, or promised returns. The least risky assets in this category are Bitcoin and Ethereum. Bitcoin more so as there is zero company behind it and Bitcoin was one of the few cryptocurrency projects that did not conduct an initial token sale.

Company Risk - Is there a company behind the project? Is it run by a DAO? Or not run by anyone at all and is in the hands of a community? This is an important consideration as projects like Polygon, Solana, Avalanche, Cardano, and XRP have companies behind them. These companies face the same risk of mismanagement that we described above, and if there is a team behind the project, that means there are people who can be corrupt, coerced, disappear, or get sued.

Look no further than the Ripple lawsuit which has been suppressing the price of XRP for years, or projects like Squid token, whose founders just ran off with funds. This is a massive risk. The least risky plays here are Bitcoin, as there is nobody that can be sued, no company behind it, and nobody controls the network that can manipulate it. I never consider memecoins as good investments, but even coins like Dogecoin and Shiba Inu are less risky in this category as the creators of both walked away from the project, Shiba’s founder even went as far as following in the footsteps of Satoshi Nakamoto and completely disappeared, leaving the project to the community.

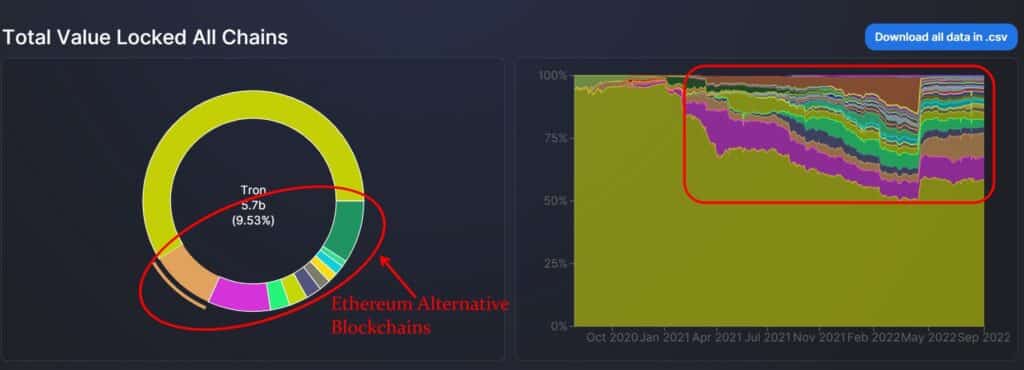

Competitive Risks - Competition is fierce in the crypto space. Just like when investing in traditional companies, there is competitive risk among crypto projects. This is especially true among layer 1’s, as networks like Cardano, Avalanche, NEAR, Solana, and others are competing for similar market share.

If you bet on the wrong horse, and your project fails to its competition, that is a risk that should be considered. There is also risk with the likes of Cosmos and Polkadot, will there be one interoperability winner? What if you choose the wrong one? Then we get into DeFi DEXs where the competition is even more fierce, the likes of Uniswap, SushiSwap, DODO, etc., which DEX will reign supreme, and will a new DEX come along with next-generation technology and surpass the current competition?

The Competition Between ETH Alternative Layer 1s is Tight. Image via DeFi Llama

The Competition Between ETH Alternative Layer 1s is Tight. Image via DeFi LlamaThe least risky plays here are Bitcoin, as it has no real competition in its use case as a store of value, and Ethereum, as it has pretty much solidified its position as the king of smart contract platforms…for now. Ripple XRP could also be seen as low risk for this category as it is winning the payment token race by a large margin, though the project is exposed to high regulatory risk. The highest risk here are other layer 1’s, DeFi platforms, Metaverse projects, payment tokens etc.

Technological Obsolescence Risk - This is a big one and very difficult to predict as nobody knows what technological innovations are going to sprout up over the next 10, 20, or 50 years. This is purely opinion based, but for me, the most advanced projects are of least risk here. For layer 1 networks, this would be the likes of Cardano and Algorand. These two projects are the most advanced networks to date from a pure cryptographic standpoint, true 3rd generation blockchain networks advancing the crypto space.

If you want to know why these two projects are considered by many, to be the most advanced, we dive into that in our Algorand review and Cardano Deep Dive.

Outside the layer 1 space, I would consider Polygon the least risky layer 2 scaling solution as they are already the current leader in the space by a considerable margin and advancing ZK-rollup technology. Vitalik Buterin himself feels that ZK-rollups will likely be the future of scaling technology.

Image via TheBlock

Image via TheBlockFor payment tokens, XRP in my opinion would be the least risk from a technological obsolescence perspective as they created a payment system blockchain that is nearly unrivalled and unmatched, and already being adopted. Ripple has very few competitors even attempting to dethrone it as an international payment rail network.

The highest risk in this category would be older networks that use inferior tech, and possibly any Proof-of-Work tokens IF Proof-of-Stake proves in time to be superior, the jury is still out on that.

Bitcoin maxies are going to hate me for this, but Bitcoin is actually the largest risk in this category. Because it was the first and BTC is over a decade old, technology has advanced far in recent years, and we know that Bitcoin is not the fastest nor the cheapest. If the lightning network and layer-2 solutions fail to improve Bitcoin, the grandfather token could be replaced by something better, stronger, faster, etc.

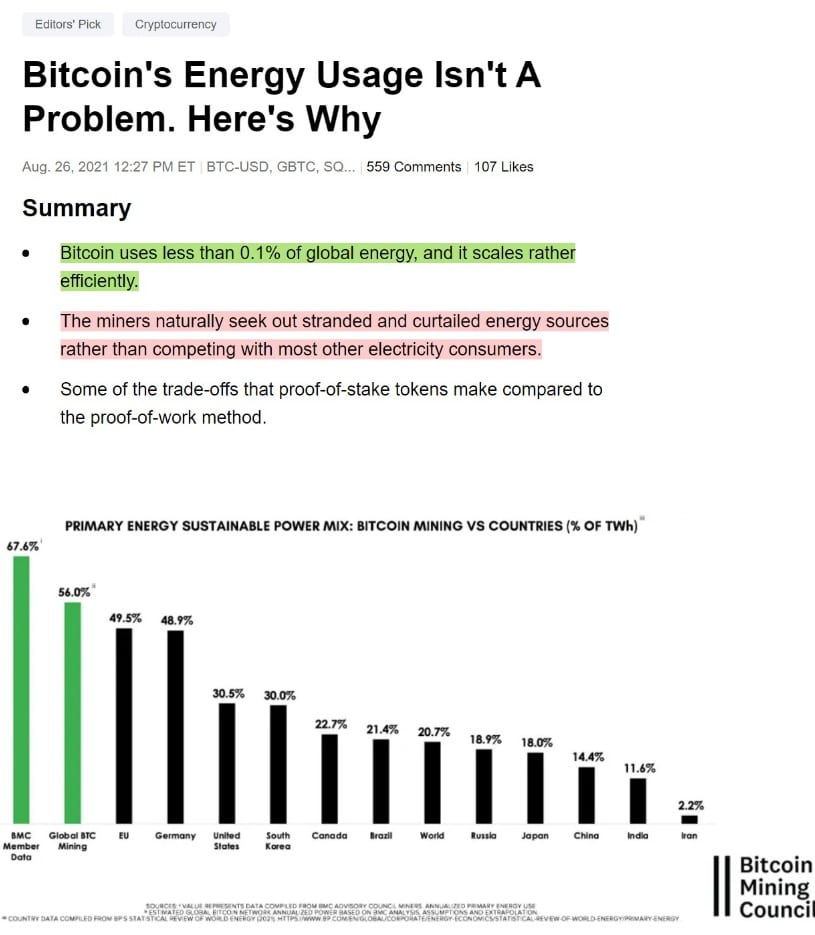

Societal Risk - Unfortunately, there has been a vicious smear campaign going on against Bitcoin and its energy consumption. Bitcoin and other Proof-of-Work cryptos have been getting blasted over their impact on the environment from “woke” misinformed individuals who only read headlines without bothering to dive into statistics or understand the macro 360-degree holistic perspective.

Sure Chad, it’s fine for you to hang Christmas lights, use a clothes dryer, run a gaming PC, and drive an SUV, but it's not okay for billions of people with no access to a bank or financial system and no way to store wealth or fight inflation to better their lives by using Bitcoin. Your Christmas lights and refusal to hang dry clothes like we’ve done for thousands of years since cavemen first started wearing loincloths is definitely more important.

Anyway, sorry about that rant. You can find out more about why Bitcoin energy use is overblown FUD in our article on Bitcoin energy use, alternatively, Guy also put together a fantastic video covering that here:

Regardless of whether this narrative is true or not, if society deems that Bitcoin is a threat and we don’t need it, that could push regulators to ban it. We have already seen a vote to ban Bitcoin mining happen in European parliament that did not pass, but it was close, and US officials are currently accusing Bitcoin mining of being a threat to their sustainability efforts while ignoring the fact that the traditional financial industry and the gold industry are some of the largest perpetrators against sustainability efforts.

Funny how governments conveniently target the asset that is posing the largest risk to their wealth and control over the monetary system, while ignoring assets that the central banks hold in their balance sheets like gold. I'm sure it is just a coincidence.

Bitcoin Uses Less Than 0.1% of Global Energy and Primarily Uses Renewable Sustainable Energy Sources, so Why All the Hate? Images via The Bitcoin Mining Council and Seeking Alpha

Bitcoin Uses Less Than 0.1% of Global Energy and Primarily Uses Renewable Sustainable Energy Sources, so Why All the Hate? Images via The Bitcoin Mining Council and Seeking AlphaIf people remain misinformed about Bitcoin’s use cases and massive potential to make the world a better place and continue to believe media headlines, there is a real risk that Bitcoin mining could be banned. The safer plays here would be the likes of Algorand, Cardano, Ethereum post-merge, Solana, and any PoS network.

I am sure if you spent more time thinking about it, you could come up with some more pertinent risks. Once we have our risks identified with the crypto assets we are interested in investing in, it helps to plot them on a risk-reward chart as we discussed above. Note that this is very biased and individualized, each investor needs to assess the risks they feel are most pertinent and weigh them based on severity to come up with their own conclusion. Here is how I would rank a handful of crypto assets:

For me, I place company risk, regulatory risk, and centralization risk higher than societal or technical obsolescence risk. For me, though Bitcoin is riskier from those points, it carries much less risk, in my opinion, than something like MATIC, NEAR, SOL, AVAX etc, as they have a single point of failure risk that comes in the form of being largely influenced by centralized companies, have more centralized networks, and team members that can be targeted by regulators or become malicious actors.

The reason I consider a DEX like Uniswap as high risk is due to things like extremely high competition and technology risk, as we already see more advanced next-generation DEXes like DODO improving the DEX space with better technology. Metaverse plays like MANA and SAND are also high risk as these projects are so early in their infancy, competition is high, and the technology has not caught up with metaverse ambitions yet.

The reason I place Cardano and Algorand as being less risky than other layer 1’s like Solana comes down to the fact that the Cardano and Algorand networks are more advanced and backed by peer review research, making them less risky from a competitive and technological standpoint, and because the companies behind Cardano and Algorand work within academia and government institutions, exposing them to less regulatory risk.

Using a similar risk/reward chart like the one above, investors can keep coming up with crypto projects that they are interested in, plot them on the chart, and then go about selecting their portfolios in two ways to adequately diversify risk:

- Select an equal number of projects from each quadrant and weigh them in your portfolio appropriate to how far they deviate from your desired risk tolerance and reward goals. For example, something far on the risk end or low on the return end should make up a smaller percentage in your portfolio than the projects in the top left quadrant that are low risk and high reward.

- Keep identifying projects until there is an adequate number near the center, then invest equal weightings in all the projects that sit in that area.

Again, I need to reiterate that this is a method to consider for how to build the crypto portion of your overall investment portfolio. Being invested in crypto only is not diversified, no matter how many different crypt projects you hold. Investors who follow MPT will perform a similar analysis with each asset class they are invested in, weighing up risks vs rewards for stocks (comparing companies), precious metals (comparing gold, silver, platinum, copper etc), ETFs, and even real estate (comparing single-family homes, dual dwellings, apartments, industrial, commercial real estate, location, etc.)

The importance of diversifying outside of crypto is clear. As we have seen, the entire crypto market behaves very similar and is highly correlated in terms of trending bullish or bearish. For example, even though projects like Vechain and Theta are two completely different projects that are very dissimilar in function, utility, and use cases, they are both considered “risk on” assets, along with the rest of the crypto market, and are both subject to the same ebbs and flows of market activity. When Bitcoin is down, nearly every crypto project is down and vice versa.

Here is a visual showing this. On the left is Theta and Vechain in 2021, on the right is Theta and Vechain in 2022. Look correlated to you? Notice the peaks and dips happen during the same time frame then the stark drop-off is nearly identical after April 2022.

Chart Source: CoinMarketCap

Chart Source: CoinMarketCapA Low-Risk Crypto Portfolio

We can use all the information in this article to make a low-risk portfolio based on the Modern Portfolio Theory, looking to maximize the Sharpe ratio on the Efficient Frontier. Now it is important to clarify that this is not financial advice, nor my personal advice, Modern Portfolio Theory simply looks at historical data and shows us information and trends, nothing more than that.

As discussed, there are different risk factors such as technological risk, societal risk, company risk, centralization risk etc. that exist within each crypto project. It is up to the investor to decide which of those risks is most significant and weigh those in accordance with their beliefs. Plot a handful of cryptocurrencies on the risk/reward graph as we did earlier to select your basket of interested crypto assets.

Once you have your handful of assets and figured out what percentage of your portfolio you want to be allocated to each asset, or perhaps you choose to weigh them equally, it is time to use a tool to find the Sharpe ratio and plot it onto a chart that shows the Efficient Frontier.

Each dot can represent portfolios made up of the same assets at different weightings or can show portfolios made up of different assets. A low-risk portfolio should fall within the shown area on the Efficient Frontier, which should line up with your pre-determined risk tolerance shown at the bottom x-axis. This shows a healthy return with low levels of volatility. Anything above and to the right of the square is increasing in risk, and below the square, especially where the curve bends at the bottom is now in “inefficient frontier” territory and you definitely want to avoid that.

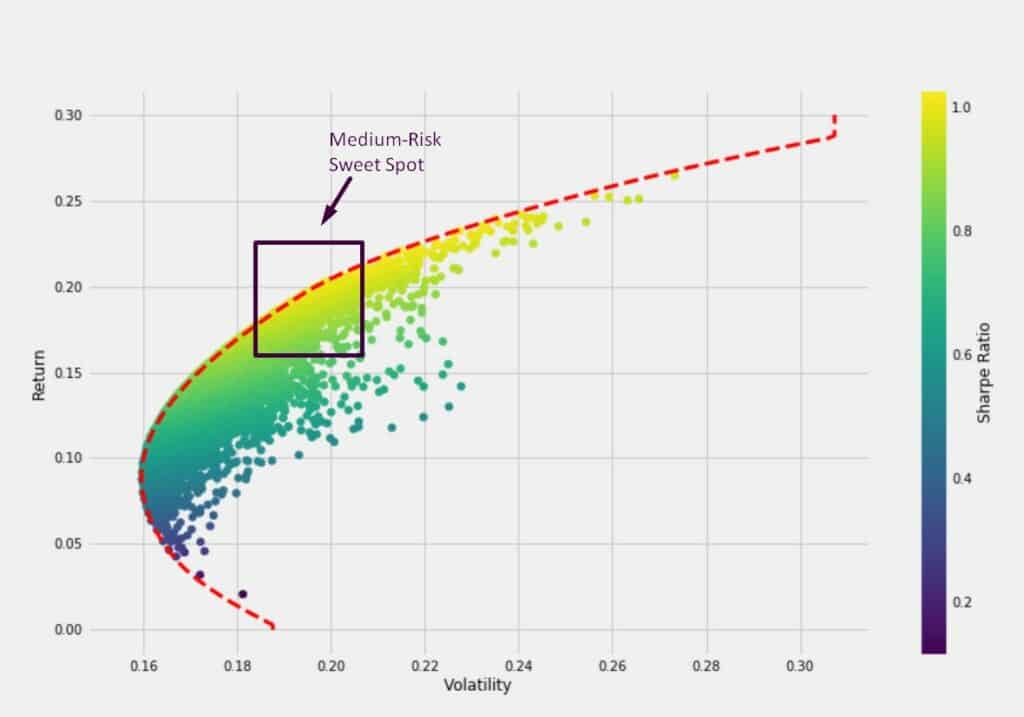

A Medium Risk Crypto Portfolio

A medium-risk crypto portfolio can be approached in one of two ways. Going back to the risk and reward graph, an investor could equally weight allocations and select tokens that all fall in the medium risk area, or they can combine some low-risk and high-risk projects to create an overall medium risk portfolio.

A medium-risk portfolio would sit around here on the Efficiency Frontier curve using the Sharpe Ratio:

A portfolio that falls in this area will experience higher volatility/risk, but also higher returns.

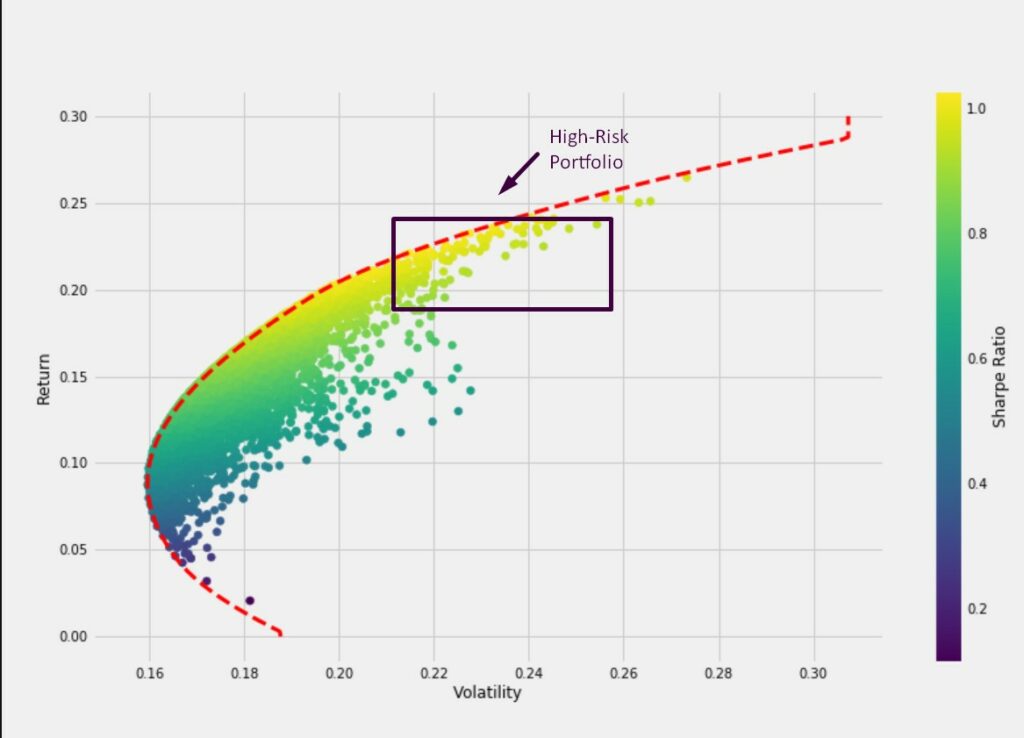

A High-Risk Crypto Portfolio

Yee haw, now we get into some high-risk plays. There are a few different ways to add some high-risk plays or, “fliers” into your portfolio. An investor could simply select a bunch of tokens that fall into the high-risk area of the risk/reward chart, which would likely fall someplace around here on the Efficiency Frontier:

This would expose the entire portfolio to an immense amount of risk, but also high reward if each token is given equal weighting.

Another way to add some risk to a portfolio would be to select predominantly medium-risk projects, then pepper in one or two higher-risk plays with lower weightings. This significantly lowers risk, while still providing some exposure to upside price potential. I personally keep about 5% of my total portfolio in projects I consider higher risk such as some GameFi and Metaverse projects.

Limitations in Modern Portfolio Theory

Now, MPT is not without its drawbacks and harsh critics. The most serious criticism is that MPT evaluates portfolios based on variance, not downside risk. Meaning that two portfolios that have the same level of variance and returns, being considered equally desirable through the MPT lens, could differ in that one could be exposed to a risk of small frequent losses while the other could have unlikely, but severe declines. Investors would prefer frequent small losses rather than catastrophic declines.

Because of this, variations of MPT have been created that are considered an improvement such as the post-modern portfolio theory that minimizes downside risk rather than variance.

Another downside is that MPT focuses on historic data regarding risks and volatility, and we know that past results are not indicative of future performance.

Conclusion

There are multiple ways to approach cryptocurrency investing, with no real “one size fits all,” solution. The Modern Portfolio Theory is a popular approach to portfolio building that has been used by some of the most prestigious investors and firms for decades as a baseline for how to construct a portfolio.

Where MPT really shines is that it can provide an emotionless, non-biased portfolio construction based on statistics, previous history, and mathematics.

In this article, we looked at how you can use previous price history for a purely data-driven rational approach to portfolio building, or, because many crypto projects do not have much in terms of price history to go by, we also looked at a more psychological/biased based approach based on our personal assessments of risk and future speculation. I also like to take the more psychological and speculative approach because let’s be honest, crypto investing isn’t always rational. (Just look at how a single Tweet from Elon Musk can send Dogecoin to the moon). Because of that, sometimes investors want a bit of leeway for speculation and moonshots.

If you want to dive deeper into this topic, please feel free to check out friend of the channel, and one of Guy’s and my own favourite YouTubers Benjamin Cowen. He is a brilliant crypto analyst who holds a PhD in Engineering and has a background in Computational Mathematics and Programming. He often covers Modern Portfolio Theory and has an MPT playlist, as well as conducts some of the highest quality technical and on-chain analysis.

To close up, Modern Portfolio Theory or Post-modern Portfolio Theory can help construct a well-performing portfolio with as little exposure to risk/volatility as possible and is well suited for the more serious investor.