The global financial system has long prioritized profit over sustainability, often at the expense of people and ecosystems. As the consequences of climate change, resource depletion, and financial exclusion become more pressing, a new approach is emerging—Regenerative Finance (ReFi).

Unlike traditional finance, which extracts value, ReFi is designed to regenerate and sustain both ecological and social systems. It leverages blockchain, tokenization, and decentralized finance (DeFi) to create funding mechanisms that align economic incentives with environmental restoration, financial inclusion, and long-term resilience.

In this article, we explore key applications of ReFi, including carbon credit tokenization, circular economy, and universal basic income, alongside the opportunities and challenges shaping its adoption. While ReFi presents a transformative vision for finance, it must overcome hurdles like usability, regulation, and market trust to realize its full potential.

By the end, you’ll understand how ReFi redefines financial systems to support both people and the planet—and what it needs to succeed.

Understanding ReFi

Regenerative Finance (ReFi) is an emerging financial paradigm that prioritizes restoration, sustainability, and long-term resilience beyond traditional economic systems. Unlike conventional finance, which primarily seeks financial returns, ReFi integrates social, environmental, and economic well-being into its core principles. It is designed to repair, replenish, and sustain ecosystems and communities, ensuring that financial activities contribute positively rather than depleting resources.

At its foundation, ReFi draws from regenerative economics, which advocates for an economy that continuously renews and enhances its foundational structures—whether natural ecosystems, social networks, or financial infrastructures. By leveraging Web3 technologies such as blockchain, decentralized finance (DeFi), and smart contracts, ReFi introduces transparent, equitable, and decentralized financial models supporting public goods, climate action, and sustainable development.

ReFi operates under the belief that finance should be less harmful and actively restore and improve the world. This mindset shift enables projects within ReFi to tackle urgent challenges such as climate change, income inequality, biodiversity loss, and financial exclusion. Through circular economy principles, regenerative investments, and ethical financial systems, ReFi fosters an economy that benefits all stakeholders, including the environment.

More Than Just Sustainability: A Holistic Approach

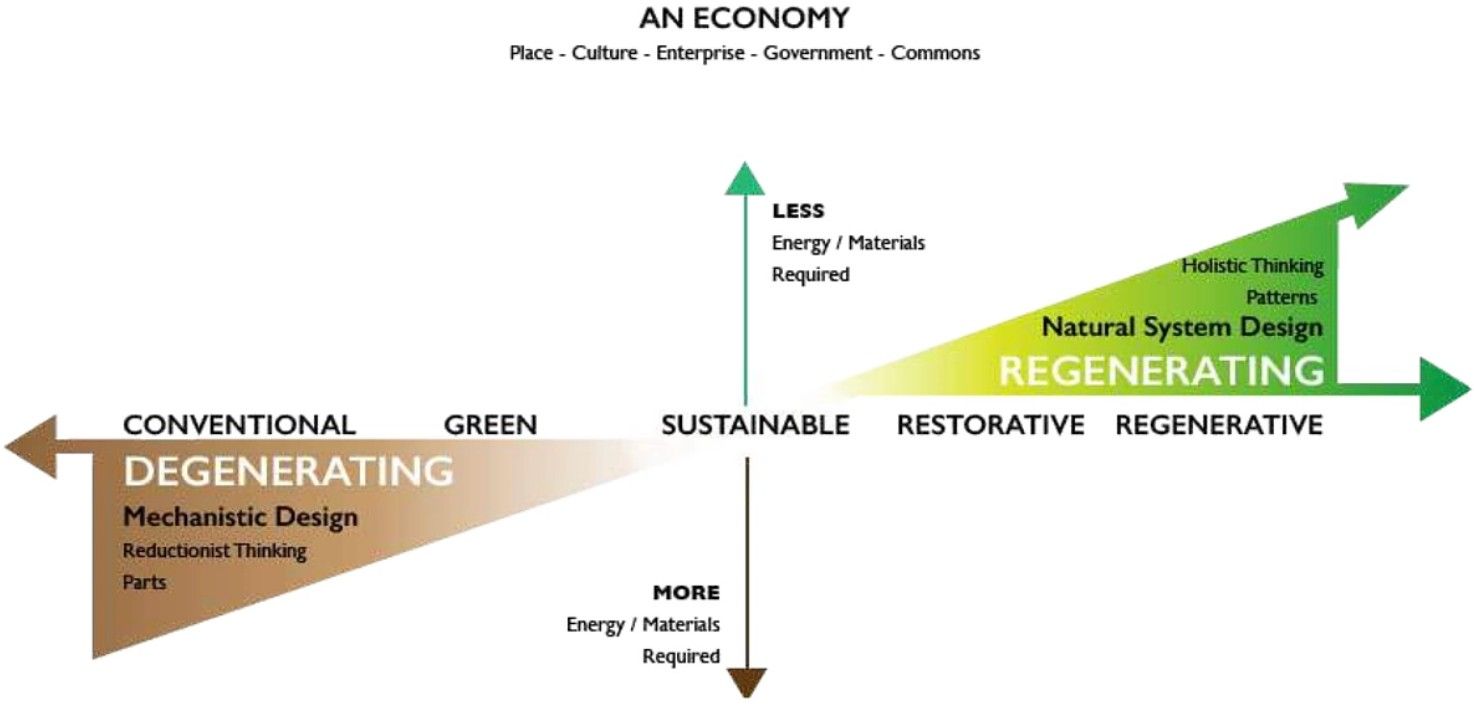

Sustainability focuses on reducing harm and ensuring that economic activities do not deplete resources beyond their regeneration ability. While this is necessary, ReFi takes it further by actively rebuilding and replenishing used systems.

- Sustainability = Maintaining Balance – The goal is to ensure that resources are used responsibly so that they last.

- Regenerative Finance = Strengthening Systems – The focus shifts to repairing and expanding resources, ensuring that they improve over time rather than simply being sustained.

For example, sustainable agriculture seeks to minimize soil degradation, while regenerative agriculture restores soil health, enhances biodiversity, and improves long-term productivity. Similarly, in finance, sustainable investing avoids funding harmful industries, whereas ReFi proactively finances projects that regenerate the environment and communities.

Regenerative Economics Go Beyond Sustainability By Seeking To Restore Used Resoures | Image via CoinGecko

Regenerative Economics Go Beyond Sustainability By Seeking To Restore Used Resoures | Image via CoinGeckoAlignment with Economic Regeneration

Economic regeneration involves revitalizing economies by making them more resilient, equitable, and sustainable. ReFi plays a crucial role in this process by:

- Reinforcing Local Economies – Supporting community-driven finance models, such as cooperative banking and decentralized lending, which help strengthen local financial ecosystems.

- Investing in Regenerative Infrastructure – Funding projects that enhance natural capital, such as reforestation, clean energy, and sustainable agriculture, which provide long-term economic and environmental benefits.

- Mitigating Systemic Risks – Unlike traditional finance, which often overlooks long-term externalities, ReFi incorporates climate risk, social impact, and ecosystem health into financial decision-making.

By prioritizing long-term stability over short-term gains, ReFi contributes to economic resilience, ensuring that financial and ecological systems grow stronger over time.

| Feature | Regenerative Finance (ReFi) | ESG Investing | Impact Investing |

|---|---|---|---|

| Primary Goal | Actively restore and regenerate ecosystems and economies | Reduce environmental and social harm | Generate measurable positive impact alongside financial returns |

| Approach | Uses Web3, DeFi, DAOs, and tokenized assets for transparent and scalable regeneration | Encourages corporate responsibility but operates within traditional finance frameworks | Allocates capital to high-impact projects, but often through centralized investment vehicles |

| Scope | Holistic, focusing on environmental, social, financial, and systemic regeneration | Primarily corporate-focused, ensuring businesses meet ESG standards | Selective investments in businesses or projects that meet impact criteria |

| Economic Philosophy | Regenerative economics, circular economy, and decentralized governance | Sustainable capitalism | Purpose-driven investment strategy |

| Innovation Focus | Blockchain-based financial solutions, decentralized lending, smart contracts | Policy and corporate governance changes | Funding mission-driven enterprises |

Summary

Regenerative Finance is not just an alternative investment strategy—it is a new way of structuring financial systems. By embedding regeneration into its foundations, ReFi offers a scalable, decentralized, and impactful approach to finance that can reshape economies for long-term sustainability and prosperity. Unlike traditional financial models that extract value, ReFi aims to give back—not just to investors but to society and the planet as a whole.

How Regenerative Finance Works

ReFi is more of a guiding philosophy than a rigid financial framework. Unlike DeFi, which operates on clear technical standards like smart contracts and blockchain-based protocols, ReFi is built around fundamental principles that can be applied across multiple sectors. Its implementation varies based on the economic vertical—climate finance, social impact investing, regenerative agriculture, or decentralized governance.

The core idea behind ReFi is that financial systems should restore, sustain, and grow society's economic, social, and environmental fabric. Instead of focusing solely on financial profits, it introduces mechanisms that regenerate resources and create long-term resilience. The following principles define how ReFi operates.

Sustainability: Moving Beyond Minimizing Harm

Sustainability is a key pillar of ReFi, but it goes beyond simply avoiding environmental damage—it seeks to actively rebuild, restore, and strengthen natural systems. This includes funding:

- Renewable energy projects that replace fossil fuels.

- Regenerative agriculture initiatives that improve soil health and biodiversity.

- Eco-friendly technologies that reduce carbon emissions and environmental waste.

Unlike traditional green finance, which often focuses on mitigating harm, ReFi’s goal is net positive impact—ensuring that financial capital contributes to ecological renewal rather than mere conservation.

Holistic Approach: Addressing Interconnected Systems

ReFi considers the broader interdependence of economic, environmental, and social systems. Traditional finance often isolates these elements, focusing on short-term economic gains without factoring in long-term social or environmental consequences.

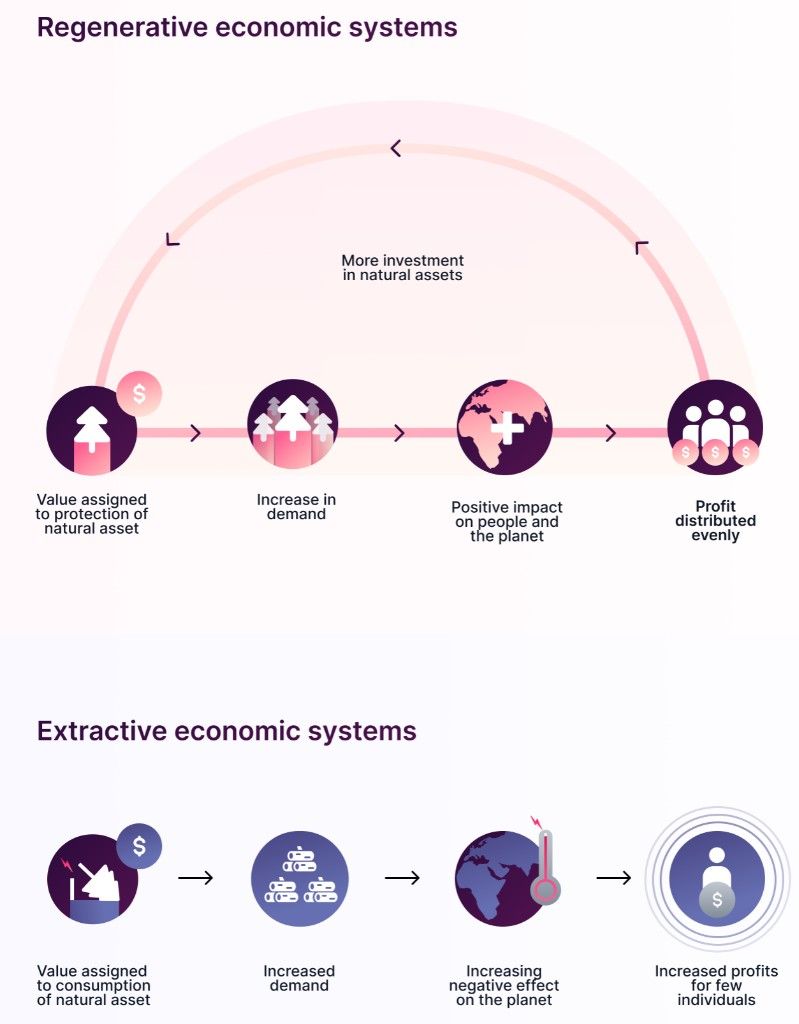

ReFi Considers The Net Cost of Any Economic Activity And Includes That In Business Strategy | Image via Toucan

ReFi Considers The Net Cost of Any Economic Activity And Includes That In Business Strategy | Image via ToucanFor example, an investment in a mining project might generate high returns, but what are the downstream effects on local communities, ecosystems, and economic stability? ReFi ensures that financial decisions consider all these factors, creating a balanced and regenerative economic cycle.

Social Impact and Equity: Building Inclusive Financial Systems

A core tenet of ReFi is economic inclusion—ensuring that financial resources flow toward underrepresented and underserved communities. It directs investments toward:

- Affordable housing and healthcare for low-income populations.

- Financial inclusion initiatives that provide banking access to unbanked communities.

- Education and workforce development programs that create sustainable livelihoods.

By prioritizing equity, ReFi ensures that prosperity is distributed rather than concentrated in the hands of a few. Many ReFi initiatives integrate Decentralized Autonomous Organizations (DAOs) to allow community-driven governance, ensuring that local populations have a direct say in financial decisions.

Long-Term Thinking: Resisting Short-Term Profit Maximization

Traditional finance often prioritizes immediate returns over long-term sustainability. This has led to:

- Resource depletion due to overexploitation.

- Market instability caused by speculation-driven economic cycles.

- Economic crises fueled by short-term risk-taking.

ReFi counters this by shifting financial incentives toward long-term resilience. Investors, institutions, and businesses are encouraged to look beyond quarterly profits and focus on projects that will generate lasting economic, social, and environmental value over years or decades.

Accountability and Transparency: Enabling Trust Through Web3

A major challenge in traditional financial systems is the lack of transparency in capital allocation. ReFi integrates blockchain technology and smart contracts to ensure real-time funds tracking and automated enforcement of sustainable commitments.

For instance, investors in carbon credit markets can use tokenized assets on the blockchain to verify that their contributions genuinely support reforestation projects. Similarly, impact reporting tools can track how investments improve social and environmental conditions, eliminating greenwashing and ensuring accountability.

Community Engagement: Empowering Local Decision-Making

ReFi is not top-down like traditional finance, where large institutions dictate where capital flows. Instead, it embraces participatory finance, where communities play a key role in decision-making.

- DAOs and community-governed funds are often used to democratize capital allocation.

- Local stakeholders can determine priorities, ensuring projects reflect actual needs rather than investor speculation.

- By incorporating on-the-ground knowledge, ReFi ensures that solutions are locally relevant and impactful.

This principle makes ReFi fundamentally different from traditional finance, which often overlooks grassroots perspectives in favor of centralized decision-making.

Circular Economy Principles: Redefining Resource Use

ReFi integrates circular economy models, which promote waste reduction, resource efficiency, and continuous reuse. Instead of the traditional linear model of extraction → consumption → disposal, ReFi focuses on:

- Recycling and repurposing materials to minimize waste.

- Supporting businesses that prioritize repairability instead of planned obsolescence.

- Funding regenerative production methods that replenish natural resources rather than depleting them.

By aligning finance with circular economy principles, ReFi creates economic systems that generate wealth while also preserving and enhancing natural resources.

Circular Economics And ReFi Are Complementary Concepts | Image via Wisetekmarket

Circular Economics And ReFi Are Complementary Concepts | Image via WisetekmarketReFi is not a fixed protocol but a flexible set of principles that can be applied across industries, from climate finance and impact investing to Web3-based community funding models. It introduces a systemic shift—where finance serves as a tool for restoration, resilience, and long-term prosperity rather than short-term exploitation.

The Role of Blockchain and DeFi in ReFi

Blockchain and DeFi can serve as the technological backbone of regenerative finance, enabling financial models that are transparent, decentralized, and impact-driven. While ReFi is a broad concept, blockchain provides the infrastructure to track and verify its impact, and DeFi supplies the financial mechanisms that make regenerative initiatives viable.

Blockchain: The Foundation for Transparency and Trust

Blockchain ensures that ReFi initiatives operate with integrity, accountability, and efficiency by offering:

- Transparency and Traceability: Immutable ledgers track financial flows, ecological assets, and impact metrics, eliminating greenwashing and ensuring authenticity.

- Tokenization of Assets: Real-world assets such as carbon credits, biodiversity credits, and renewable energy certificates can be fractionalized and traded, enhancing liquidity and accessibility.

- Digital Measurement, Reporting, and Verification (dMRV): Blockchain enables automated, verifiable tracking of environmental and social impact, removing reliance on opaque third-party reports.

- Smart Contracts for Automation: Self-executing agreements facilitate fund disbursement, carbon offsetting, and incentive distribution, reducing bureaucracy and increasing efficiency.

- Decentralized Autonomous Organizations (DAOs): Blockchain supports community-driven governance, ensuring local stakeholders have a voice in decision-making for regenerative projects.

DeFi: Financial Infrastructure for Regenerative Investments

DeFi expands access to capital for ReFi initiatives by replacing traditional banking intermediaries with decentralized protocols. Key contributions include:

- Decentralized Lending and Borrowing: Enables capital flow to sustainable projects without reliance on centralized banks.

- Novel Funding Mechanisms: Tools like quadratic funding and retroactive public goods financing support projects that provide broad social and environmental benefits.

- Liquidity for Regenerative Assets: Decentralized exchanges (DEXs) allow the seamless trading of tokenized ecological assets, creating sustainable financial markets.

- Yield Generation for Sustainability: Users can earn staking rewards by funding carbon removal projects, conservation efforts, or social enterprises.

- Financial Inclusion: DeFi removes barriers to access, enabling underbanked communities to participate in regenerative economic activities.

ReFi represents an evolution of DeFi, retaining its core principles of decentralization, accessibility, and transparency but with a sharper focus on sustainability and long-term impact. Together, blockchain and DeFi can create a regenerative financial system that prioritizes economic prosperity without compromising social and environmental well-being.

Key Applications of Regenerative Finance

As a theoretical framework, ReFi can have endless applications. New ideas will keep emerging, innovating this space, but the following key applications stand out:

- Tokenized Ecological Assets

- Carbon credits, biodiversity credits, and renewable energy certificates are tokenized and traded on blockchain networks.

- dMRV (digital Measurement, Reporting, and Verification) improves transparency and prevents double counting.

- Projects: Toucan, Nori, KlimaDAO, Flowcarbon.

- Ecological Accounting

- Moves beyond just carbon tracking to holistic ecological benefits like biodiversity, soil health, and community impact.

- Creates new frameworks for measuring ecological impact and sustainability.

- Micro-lending

- Provides decentralized loans to small-scale borrowers who lack access to traditional finance.

- Lowers costs and improves access to regenerative agriculture funding.

- Projects: EthicHub supports regenerative farmers through cross-border lending.

- Universal Basic Income (UBI)

- Implements crypto-based UBI programs to provide recurring income to disadvantaged groups.

- Helps establish financial stability and community-driven economies.

- Projects: Worldcoin

- Local Currencies

- Supports community-focused digital currencies to boost local economies.

- Helps reduce transaction fees and improve financial inclusion in underserved areas.

- Example: Celo’s cREAL stablecoin, pegged to the Brazilian real.

- Conservation Finance

- Uses tokenized assets to finance conservation efforts, making nature protection more sustainable.

- Creates tradable digital assets representing restored or conserved ecosystems.

- Example: The Ocean Foundation focuses on blue carbon conservation.

- Renewable Energy Financing

- Funds renewable energy projects via tokenization and DeFi mechanisms.

- Allows smaller investors to participate in clean energy financing.

- Project: Energy Web Token supports decentralized energy markets.

- Community Development

- Empowers local communities with decentralized governance and finance tools.

- Funds sustainable land use and ecological restoration efforts.

- Project: Regen Network supports community-led sustainability initiatives.

- Decentralized Green Bonds

- Issues blockchain-based green bonds to finance eco-friendly projects.

- Offers faster transactions and greater transparency in green financing.

- No-Loss Gambling

- Allows users to participate in lottery-style games where funds are pooled and invested, ensuring no losses.

- Projects: PoolTogether, HaloFi.

- Public Goods Funding

- Uses Web3 crowdfunding models to finance both real-world and digital public goods.

- Allows community-driven decision-making in funding allocation.

- Example: Gitcoin funds open-source software and public projects.

These projects exemplify how ReFi can penetrate all industries and businesses to regenerate and distribute value back to communities and the planet.

Benefits and Challenges of Regenerative Finance

These are the key benefits of ReFi:

- Environmental Benefits

- Supports ecosystem restoration, regenerative agriculture, water conservation, and carbon offsetting.

- Tokenization of ecological assets like carbon credits helps fund sustainability projects.

- Includes blue carbon initiatives that protect coastal and marine ecosystems.

- Social Impact and Financial Inclusion

- Expands financial access to marginalized communities.

- Implements micro-lending platforms, Universal Basic Income (UBI), and local currencies to foster economic stability.

- Strengthens community-driven economic models.

- Transparency and Traceability

- Blockchain technology ensures real-time verification of transactions and ecological impact.

- dMRV (Digital Measurement, Reporting, and Verification) enhances trust in sustainability metrics.

- Provides traceability for green products and ecological credits.

- New Funding Mechanisms and Market Potential

- Moves beyond venture capital with quadratic funding and retroactive public goods funding.

- Taps into markets like voluntary carbon credits, microfinance, and climate finance.

- Tokenization of Real-World Assets (RWAs) expands investment opportunities.

- Community Empowerment and Decentralized Governance

- DAOs (Decentralized Autonomous Organizations) enable local communities to control decision-making.

- Encourages grassroots participation in funding and sustainability projects.

- Long-Term Thinking and Sustainability

- Moves away from short-term profit models toward regenerative economic structures.

- Encourages financial institutions to fund projects with long-term social and environmental value.

- Democratized Investment and Lower Costs

- Tokenization lowers the barrier to entry for investors.

- DeFi platforms provide cost-efficient alternatives to traditional finance.

- Efficiency and Automation

- Smart contracts automate funding, impact verification, and compliance.

- Reduces bureaucracy and ensures automated positive actions, such as carbon offsetting.

- Global Accessibility and Flexibility

- Enables cross-border coordination for climate and financial inclusion efforts.

- ReFi tools are adaptable and can be customized for different economic needs.

Despite the benefits, ReFi faces many challenges:

- Public Reputation

- DeFi is still developing, and many of its financial models are built for-profit, speculation, and value extraction rather than regeneration.

- ReFi needs to differentiate itself by prioritizing sustainability over speculation and embedding true regenerative principles to build credibility and trust.

- Usability

- User experience remains a barrier—many ReFi platforms are complex, limiting broader adoption.

- The rise of Real-World Assets (RWAs) and Decentralized Physical Infrastructure Networks (DePINs) could enhance ReFi’s practical impact by making decentralized infrastructure and asset tokenization more accessible.

- Integrating these technologies effectively could improve ReFi’s usability, scalability, and adoption across different sectors.

- Over-Financialization

- Risk of ReFi becoming another speculative financial market, leading to the exploitation of ecological and social assets.

- Needs strong governance models to prevent financialization from undermining regenerative goals.

- Commercialization

- Balancing profitability with genuine impact remains a challenge.

- The decline in Web3 venture funding limits growth, requiring alternative funding mechanisms beyond speculative investments.

- Regulation

- Regulatory uncertainty makes it difficult for ReFi projects to operate securely in areas like carbon credits, microfinance, and decentralized governance.

- The lack of clear legal frameworks can slow adoption and create compliance risks.

- Measuring Impact

- Standardized impact measurement is lacking, making it hard to quantify success and attract serious institutional funding.

- Reliable data sources and frameworks are needed to validate environmental and social impact claims.

- Ideological Dichotomy

- A divide exists between pragmatists, who want to integrate ReFi with traditional finance, and ideologues, who push for full decentralization and alternative models.

- This fragmentation can slow progress and collaboration.

- Ecological Asset Volatility

- Carbon credits, biodiversity credits, and other tokenized assets can be highly volatile, discouraging risk-averse investors.

- Mechanisms for stability and long-term value preservation are needed.

- Market Trust in On-Chain Ecological Credits

- Blockchain-based ecological credits must prove their legitimacy to gain mainstream acceptance.

- Needs robust verification mechanisms to build investor and regulatory trust.

Final Thoughts

Regenerative Finance (ReFi) is more than an alternative financial model—it represents a shift in how value is created, distributed, and sustained. By embedding regeneration into financial systems, it challenges the status quo of profit-driven markets and offers a framework where economic activity strengthens both communities and ecosystems.

The potential of ReFi extends beyond theory. Tokenized ecological assets, decentralized funding mechanisms, and community-driven governance models are already in motion, proving that finance can align with sustainability. However, realizing this vision requires more than technological innovation. ReFi must overcome regulatory uncertainty, usability barriers, and skepticism surrounding blockchain-based solutions.

The future of finance depends on the choices made today. Supporting regenerative projects, advocating for transparent financial models, and rethinking investment priorities can drive meaningful change. As ReFi continues to evolve, it has the capacity to reshape global finance into a system that prioritizes long-term well-being over short-term gain. Whether it becomes a cornerstone of the future economy depends on how effectively it bridges ideals with practical implementation.