There is no way to sugar-coat the fact that crypto prices are down in the dumps, and many of our favourite assets are falling faster than my grandfather falls asleep after a 7 pm dinner. While many of our portfolios may be in the red, as crypto traders, there are ways we can make a profit even in a bear market. So, is short-selling crypto a good idea? Well, that is precisely what we are going to be exploring today.

As someone who was an active trader for years, was a member of competitive trading teams and attended “trading schools”, I have had more than my fair share of mistakes and triumphs over the years. I am happy to be able to bring this article and my experience to our community today, as education is so important in this industry. Far too many influencers are making ridiculous claims about trading and essentially selling the modern-day version of magic beans and snake oil. This article will feature no BS info about crypto trading to help you understand if shorting crypto is right for you.

What is Shorting Crypto?

There are a couple of ways to approach investing and trading, and this goes for stocks, forex, commodities, crypto, and just about any asset that can be found on a chart. Heck, much of the information in this article is as relevant to assets such as gold, corn, cotton, soybeans, or oil as it is to crypto. You name it; if it has a chart, it can be traded and shorted.

While the most common approach to investing is buying something and holding it, hoping it increases in value before you sell it, there are ways that investors and traders can take advantage of falling prices. This is known as short selling or simply shorting. I will use Bitcoin as an example, but this applies to any asset.

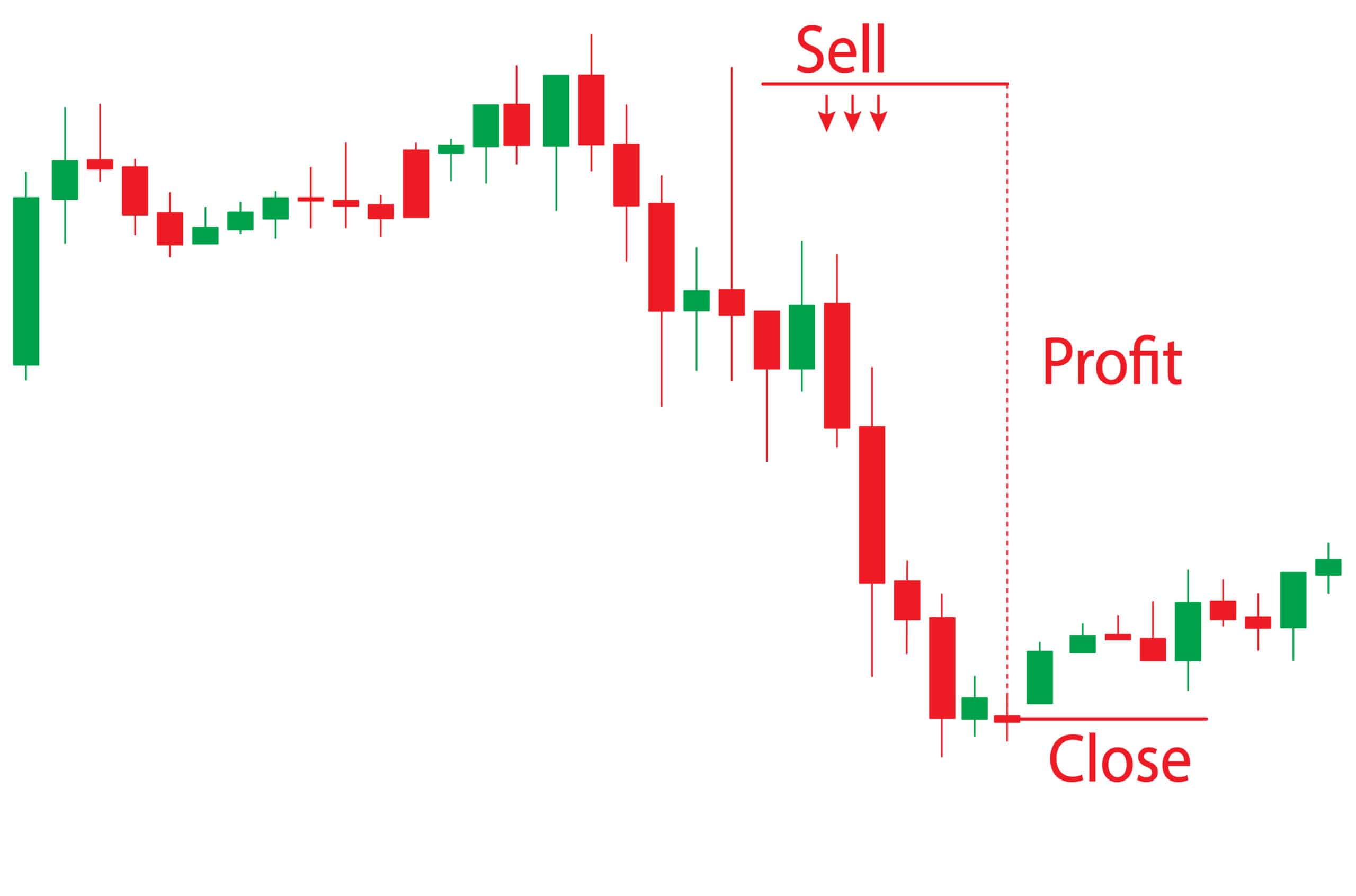

A Look at a Short Trade Example. Image via Shutterstock

A Look at a Short Trade Example. Image via ShutterstockBitcoin shorting is the act of selling the cryptocurrency in the hope that it falls in value, then buying it back at a lower price, or simply cashing out and running laughing to the bank as profit was earned in the price difference between when the sell position was opened and when it was closed.

You know the classic investing mantra, “buy low and sell high,” shorting is essentially that, but in reverse.

Traders can profit from the difference in price movements, so if Bitcoin is at 25k and a trader anticipates it will go lower, they can “sell” at 25k, then close out the position in profit any time Bitcoin price is below 25k (after fees, of course).

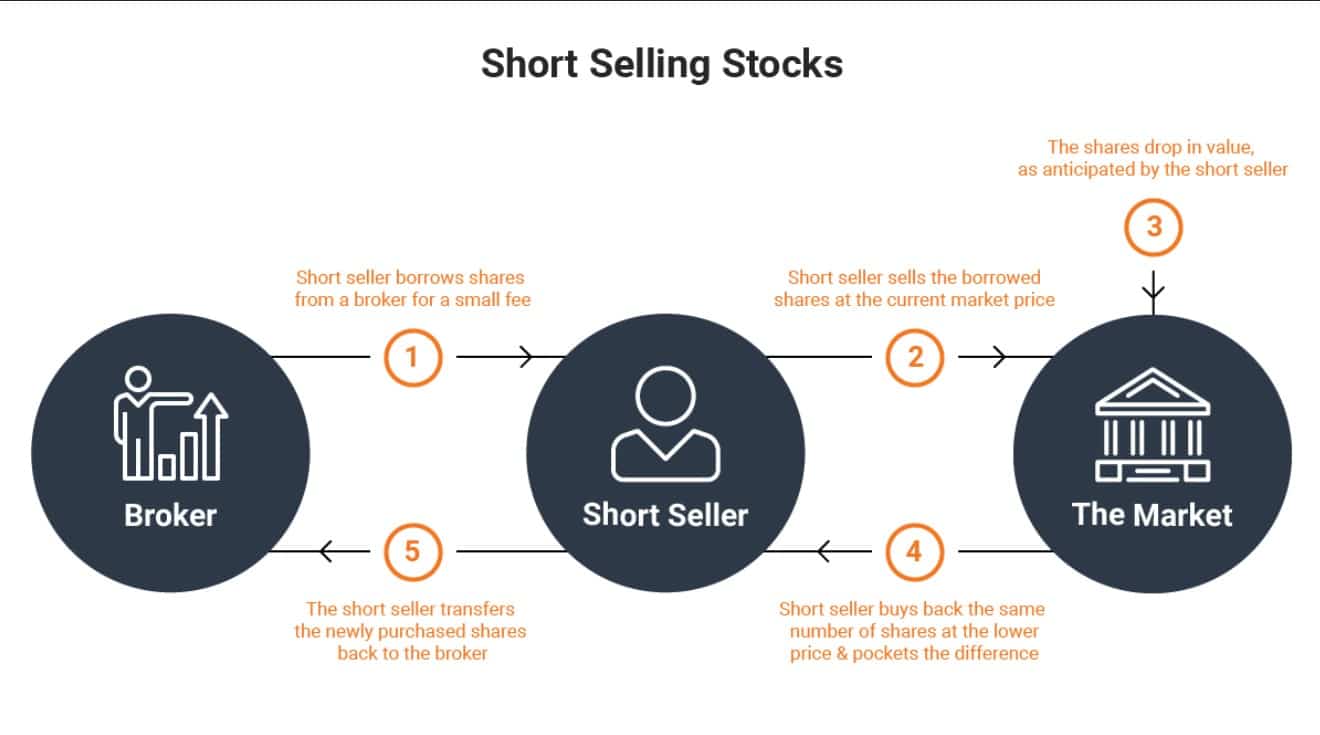

To open a short position, a trader borrows a cryptocurrency and sells it on an exchange at the current price or a specified trigger price. The trader then buys the cryptocurrency later when the position is closed and repays the capital borrowed. If the price has dropped, the trader will make a profit on the difference between buying and selling.

Here is a great visual from DailyFX that explains this. The example is of selling stocks, but the concept is the same for crypto:

Image via DailyFX

Image via DailyFXThis may sound quite complicated, but most of this happens behind the scenes. This happens by a trader simply hitting the “sell” button to open their position, then the “close” button, or setting a profit or loss target to close the position. It all happens with a couple of clicks of a button.

Image via Shutterstock

Image via ShutterstockLet’s look at an example to make sure we fully grasp this concept:

- A trader wants to short one Bitcoin when the market value is 40k. By hitting the sell button, the trader borrows one Bitcoin from the exchange and is looking to close the position at market value later. The trader now holds 1 BTC worth 40k in what is known as an “open,” or “floating” position.

- The price of Bitcoin drops to 30k.

- If the trader had their profit target hit here or closed their trade, that action essentially buys one Bitcoin at this price of 30k and returns it to the broker. Remember that you only owe the broker 1 Bitcoin at market price, so though you borrowed 1 BTC at 40k, you only need to pay back that 1 BTC, which is now only worth 30k (plus trading fees, of course).

- The trader keeps the difference between the sale and purchase price, meaning $40,000 – $30,000= $10,000 profit minus any interest, fees, and not considering leverage.

This is how the most common method of shorting crypto works when trading on margin or the spot market with leveraged instruments. However, there are more advanced methods of shorting crypto using futures, options, and CFDs that work differently. I will mention those later but cannot go into detail here on how it all works without turning this article into a textbook.

Why Short Sell Crypto?

Traders who short Bitcoin or any asset have a bearish view of the market for the time frame they are trading within. It is possible to have a long-term bullish outlook on crypto but anticipate that it will drop in value over the next few minutes, hours, days, weeks, or months. In fact, many traders will have long-term buy trades open as they may feel the asset will be higher in value in a week or month, for example, but may have sell positions over the next few hours or days as they anticipate it may drop before then.

Image via TradingView

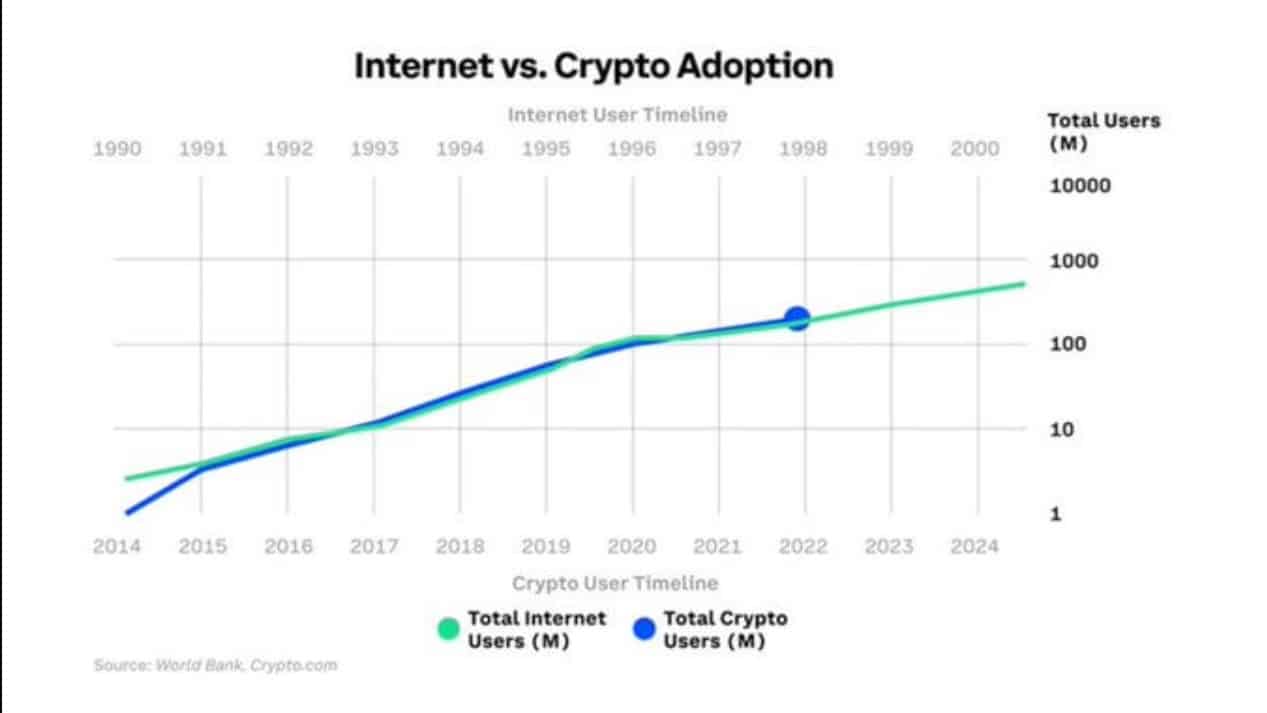

Image via TradingViewIt is essential for traders who intend to short Bitcoin, or any asset, to keep up to date with news and changes in the industry which may affect the price and volatility of the asset. While many traders may short crypto in the short term, it is good to keep in mind that this industry is seeing a lot of growing optimism. Many banks, institutions, and even governments are optimistic about the future of crypto and blockchain, and adoption is rapidly growing.

This leads to long-term short-sell positions or investments carrying a higher degree of risk as Bitcoin’s price has appreciated substantially on a longer time horizon, and many feel it will continue its long-term upwards price trajectory over time.

Bitcoin has been crowned as the best-performing asset class of the past decade. Its popularity and adoption are increasing faster than the growth of the internet in the early 90s.

Image Source: @TheCryptoLark on Twitter.com

Image Source: @TheCryptoLark on Twitter.comThis leads to many investors believing that a long-term bet on Bitcoin dropping in value may not be the soundest investment choice, as this is often compared to betting against the internet in the 90s. This, of course, is not investment advice and is only my opinion and the opinions of many traders and investors. If you are a crypto skeptic and do not believe in the long-term potential of blockchain innovation, you are not alone. Many crypto-critics happily invest and trade in ways that will profit if the crypto market crumbles; only time will tell the outcome.

Eight Ways to Short Bitcoin and Other Cryptocurrencies

There are many ways for investors and traders to capitalize on the price of Bitcoin and digital assets going lower. Some are quite straightforward, such as shorting on the spot or margin market, while others can be more complex such as accessing binary options trading, CFDs or Inverse ETPs. Let’s cover some of these below:

Margin Trading

The most common way to short Bitcoin is through a cryptocurrency trading platform such as Binance or OKX that supports margin trading. This way is common as it gives traders access to leverage and makes it easy to understand and execute trades.

Margin trading is also the most widely featured trading type available on most cryptocurrency exchanges. Margin trading allows investors and speculators to “borrow” money from a broker to make a trade. Crypto exchanges offer anywhere between 1x leverage up to 125x leverage.

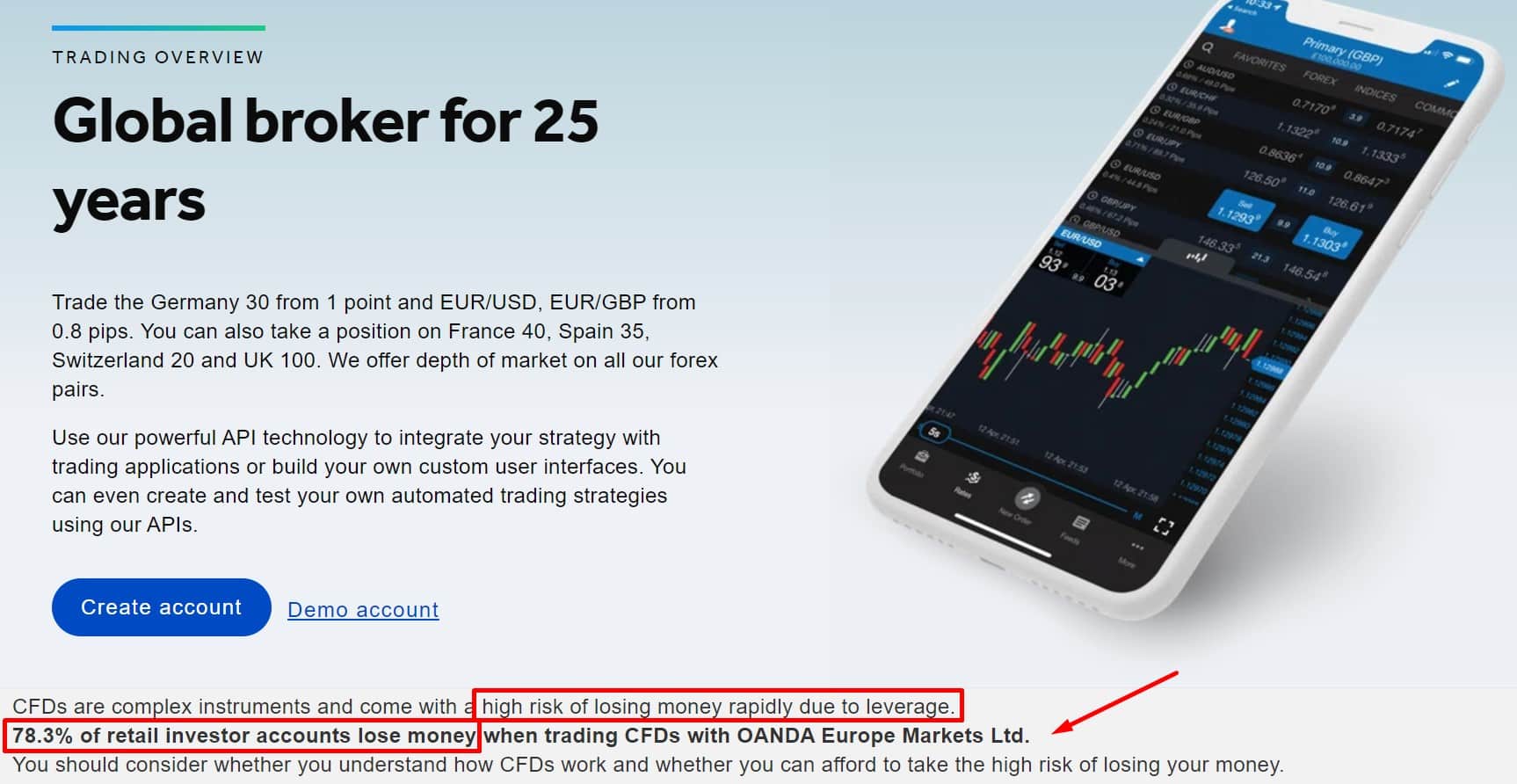

Safety Notice ⚠️: The use of high leverage is extremely risky, and the majority of traders lose funds. High leverage can result in the loss of a trader’s entire capital. Margin trading is so risky that by law, many regulated brokerages must have a disclaimer informing traders that over 70% of traders who use margin lose funds. However, many believe this number to be as high as 90%.

Example of a Typical Risk Disclaimer That Can be Found on Many Brokerage and Exchange Sites. Image via Oanda

Example of a Typical Risk Disclaimer That Can be Found on Many Brokerage and Exchange Sites. Image via OandaSee the 90-90-90 rule, which states that 90% of traders lose 90% of their money in 90 days. Leverage is a tool best used by professional traders with a proven successful trading strategy and track record. Most professional traders may utilize 3x or 5x leverage at most, and 100x leverage is considered irresponsible by many professional traders and is one of the largest criticisms against crypto exchanges for offering such dangerous products to inexperienced traders.

Due to the risks associated with high leverage, exchanges such as Coinbase have stopped offering margin trading altogether, and Kraken capped it to 5x in what was likely a move to avoid regulatory scrutiny and protect inexperienced traders from getting wrecked.

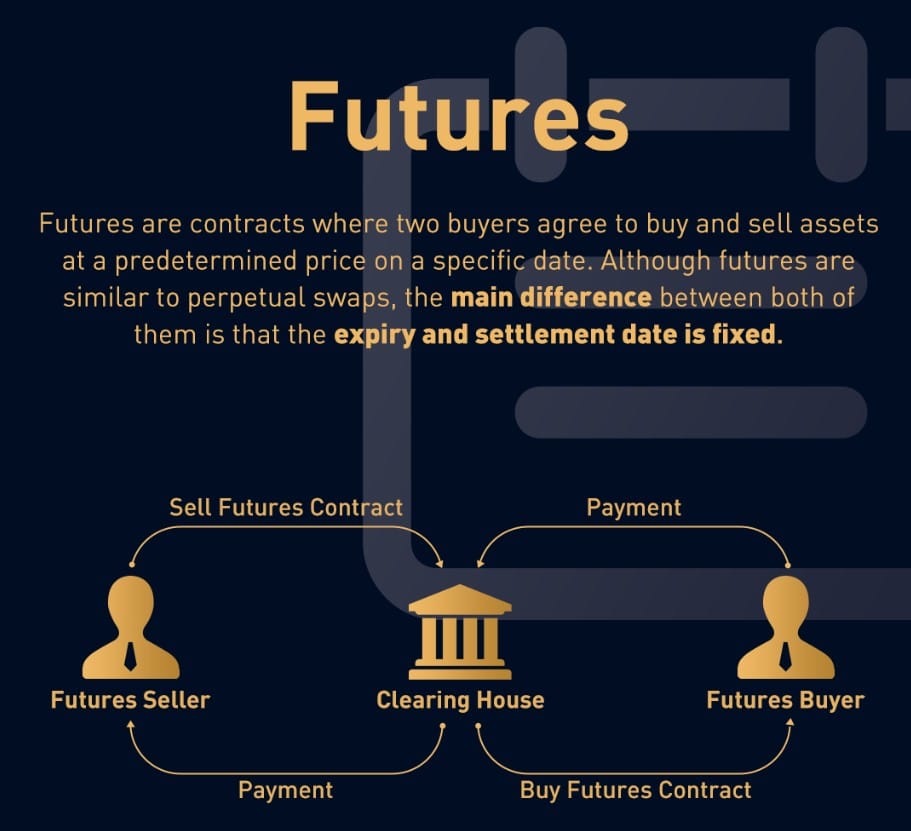

Futures Market

Futures are another popular tool for traders to long or short their favourite crypto assets. In a futures trade, a buyer agrees to purchase a security contract that specifies when in the future and at what price point the security will be sold.

Instead of trying to explain it, here is a great graphic from Bybit Learn that sums it up nicely:

Image via Bybit

Image via BybitWhen a trader buys a futures contract, they are betting that the security price will rise, ensuring they can get a good price on it at a future date. When traders sell a futures contract, it is a prediction that the asset will decline in price.

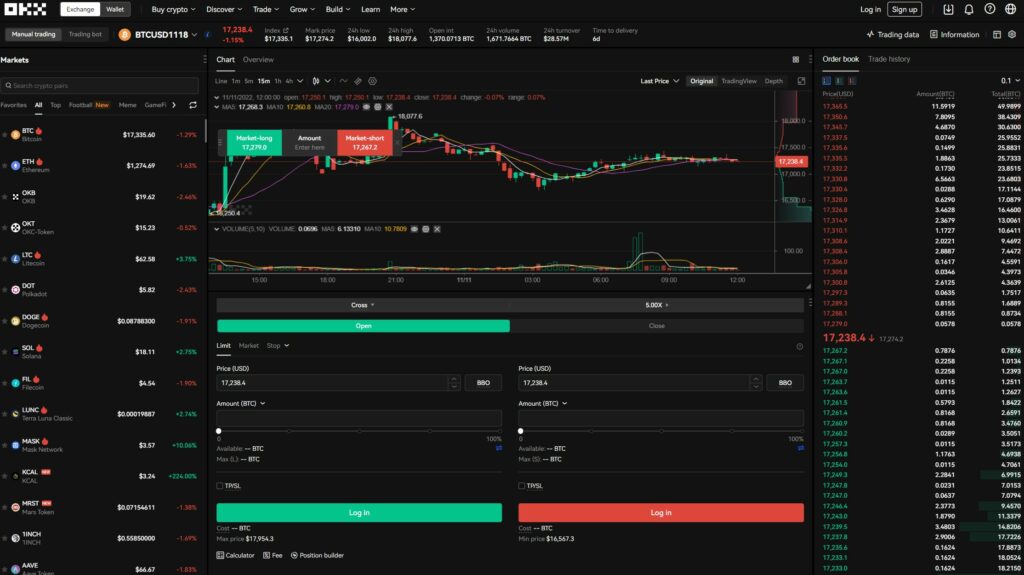

Here is a look at the Futures trading interface on the popular exchange OKX:

A Look at the OKX Futures Trading Screen

A Look at the OKX Futures Trading ScreenFutures trading is available on most of the major exchanges. If you want to understand more about trading futures and how it works, Investopedia has a great article that covers the ins and outs of Futures Trading.

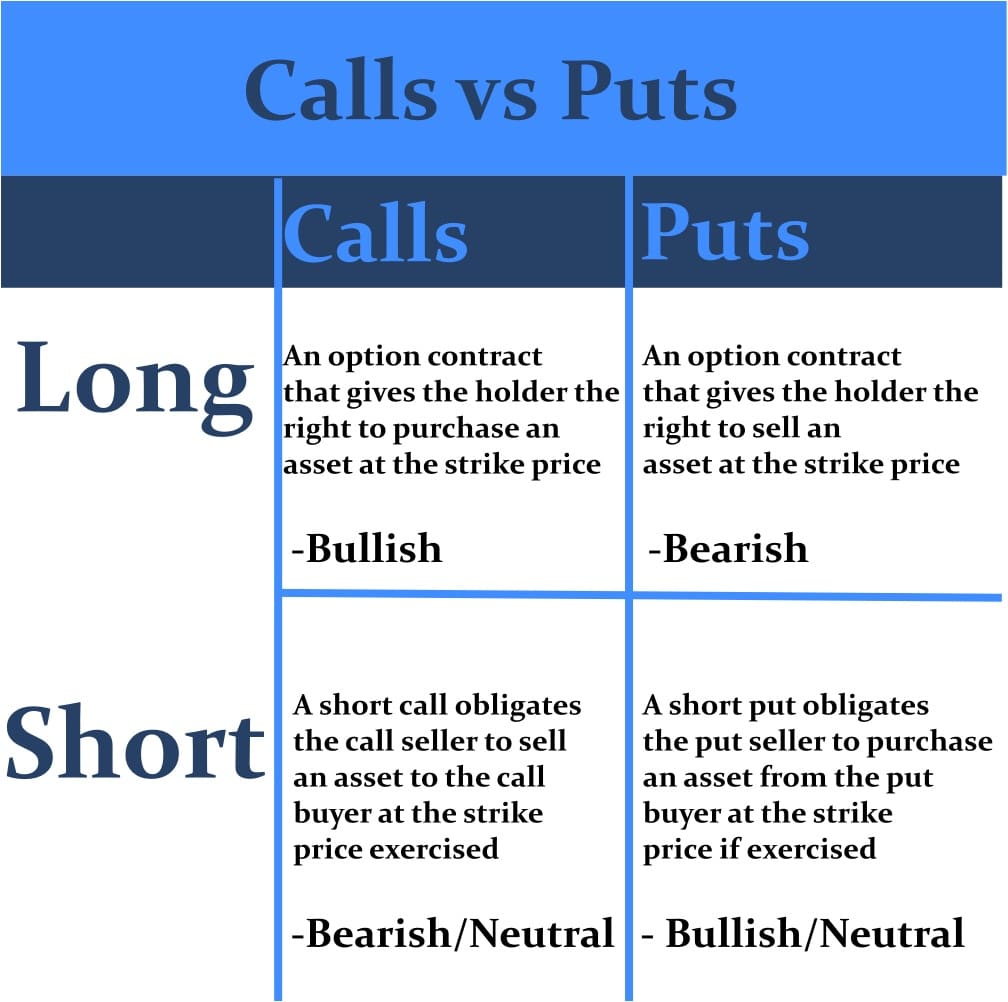

Binary Options Trading

Binary Options provide traders with what are known as put and call options, enabling them to be long or short Bitcoin and other assets. When a trader wants to short an asset, they will place a put order, and if they are long or bullish on an asset’s price, they will place a call order. This means that a trader would be aiming to be able to sell the currency at today’s price, even if the price drops or rises later on.

Several exchanges offer Binary Options trading, though it is important to note that this type of trading is considered higher risk. One of the advantages of options over futures is that traders can limit their losses by choosing not to sell their put options, leading to the losses being limited to the price that the trader paid for them. One of my favourite platforms for options trading is OKX.

If you want to learn more about Options Trading, Guy has a fantastic video where he covers that:

Prediction Markets

Prediction Markets are, as the name implies, a way for traders to predict the outcomes of events. Traders can place bets and guess whether the price of an asset will appreciate or depreciate due to the outcome of an event, events created by users of the platform, or the platform itself.

A popular example of this was during the US elections. FTX had a predictions market where traders could long or short assets by predicting whether or not Trump would win the election. With prediction markets, traders can profit if they correctly predict if an asset will decline or increase by a certain margin or percentage, and then another trader can take the opposite side of the bet.

If this sounds like something you would be interested in, check out our article on the Top 7 Crypto Prediction Markets.

Short-Selling Assets

This strategy is akin to “timing the market” or “buying low and selling high”. This is where traders will sell off an asset at a price they are happy with, wait for the price to drop, and then buy the tokens again.

Ah, Looks so Easy in Hindsight. Image via TradingView

Ah, Looks so Easy in Hindsight. Image via TradingViewThe risk here is that if the price does not adjust as a trader expects, they can lose a lot of money. They also risk selling too early and missing out on gains, or buying assets falling in price, often referred to as “catching a falling knife”, resulting in purchasing at prices that price may never recover.

Let’s look at an example of when this wouldn’t have been a good strategy.

A trader buys Ethereum at $300 and sells it at $500 with the expectation of buying back once ETH dips back below $500. Instead, the price of Ethereum continues climbing to $1,000, $2,000, $3,000 etc. and never drops back down below $500. This trader missed out on thousands in profit, and if they want to buy back into ETH, it will be at a much higher price point.

Before attempting this strategy, it is important to note that historically speaking, for both stocks and cryptocurrency trading, traders who try to time the market using this strategy have been shown to underperform simple buy-and-hold strategies on average significantly. Therefore, this technique is best for those who are experts in technical and sentiment analysis and have a profound understanding of market cycles and trends and a good understanding of the asset class.

If you are interested in learning technical analysis, be sure to check out our article on How to Perform Technical Analysis or Guy’s three-part video series on performing TA:

Bitcoin CFDs

A CFD stands for contract for difference. It is a financial market that pays out money based on the price differences between the open and closing prices for settlement. Bitcoin CFDs are similar to Bitcoin futures, in that they are bets on a cryptocurrency’s future price. Traders can purchase a CFD that predicts that the value of an asset will decline which is another method to short Bitcoin.

One of the advantages here is that CFDs are settled in fiat, so traders don’t need to worry about owning or storing Bitcoin or other digital assets.

CFDs have a more flexible settlement tenure than futures, which utilize predetermined settlement dates. Also, some CFD markets will allow traders to enter into a contract based on Bitcoin’s performance relative to other fiat currencies or other crypto assets.

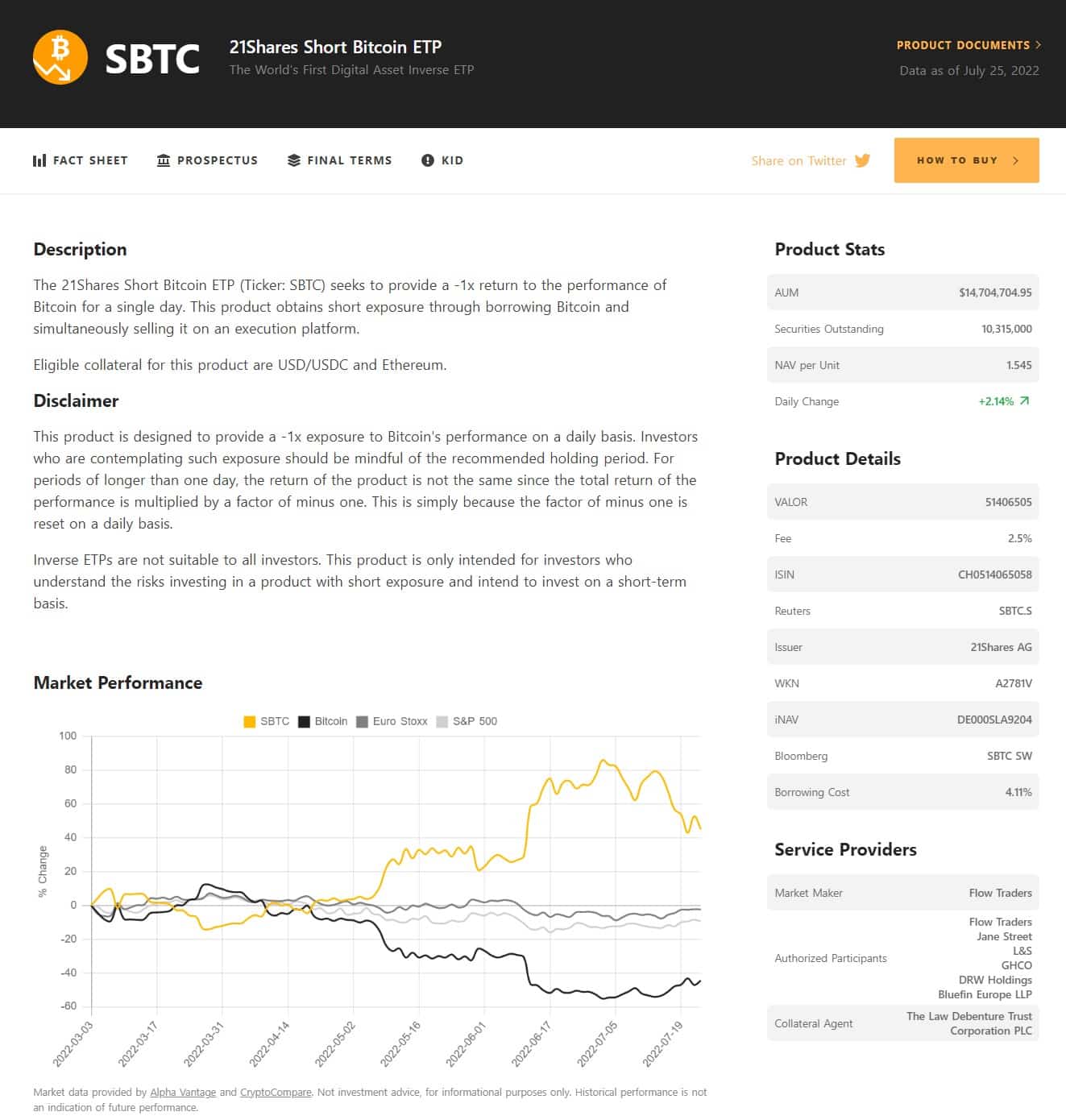

Inverse Exchange-Traded Products

Inverse Exchange-Traded Products or Inverse ETFs are where investors can put fiat down in an investment product in anticipation that an underlying asset’s price will decline. They are similar to futures contracts and use them in conjunction with other derivatives to produce returns, but are offered by brokerages and trading firms.

These are regulated tradeable markets that are issued by investment firms and brokerages and cannot be found on basic cryptocurrency exchanges.

Residents of the US can look into the ProShares Short Bitcoin Strategy ETF (BITI), Canadian investors can invest in the BetaPro Bitcoin Inverse ETF, and European investors can consider the 21Shares Short Bitcoin ETP.

21Shares Short Bitcoin ETP. Image via 21shares.com

21Shares Short Bitcoin ETP. Image via 21shares.comCrypto ETPs and ETFs are becoming so popular for investors looking to both long or short crypto that there are now dozens of different investment products available.

Leveraged Tokens

Of all the mentions on the list, this is one of my favourite options for longing or shorting crypto assets with access to safe-ish amounts of leverage, while removing the complexities and risks of margin trading.

Image via Binance

Image via BinanceMany popular crypto exchanges such as Binance, KuCoin, Huobi and Gate.io offer what are known as leveraged tokens. These are tokens that trade on the spot market and provide traders with exposure to 2x, 3x or 5x leverage. The advantages of these leveraged tokens are that they trade on the spot market, as mentioned, and there is a reduced risk of liquidation and margin calls.

Each platform uses different ticker symbols for its leveraged tokens. To use Gate.io as an example, traders can go long on Ethereum by finding the token symbol:

ETH5L- meaning 5x leverage long Ethereum

And to go short, they would select the token symbol:

ETH5S- meaning 5x leverage short Ethereum

Pros and Cons of Shorting Crypto

Short selling can be very lucrative for skilled (or lucky) traders. However, it should only be undertaken by experienced traders with a proven profitable trading strategy. At the same time, the short ETPs are best suited for investors allocating funds they can afford to lose and have strong convictions for believing that crypto assets will be of lower value in the future.

-

High-profit potential.

-

Hedge against long positions.

-

The ability to profit even when an asset is decreasing in value.

-

Investors can access inverse ETPs and ETFs with a negative outlook on the future of cryptocurrencies.

-

Limited capital is required if accessing margin/leverage.

-

Multiple platforms are available to trade, and crypto is the only market that can be traded 24/7.

- High likelihood of losses.

-

Using leverage can significantly magnify losses. Traders can lose the entire value of their accounts.

-

Popular assets such as Bitcoin and Ethereum have seen astronomical gains in price over the long term, leaving many investors with longer-term short positions with heavy losses.

-

Short squeezing and unpredictable market conditions can amplify losses.

How to Short Bitcoin

Understand Bitcoin

This goes for any asset class. To be a successful trader, you need to understand the industry and the asset class, along with the micro and macro-economic events that are likely to impact price. Price history should be studied to find patterns and strong areas of support and resistance to where the price is expected to be attracted. Things like Bitcoin's 4-year cycles and the evolving regulatory landscape should also be well understood.

Choose How you Want to Short Bitcoin

Be sure to thoroughly understand the methods stated above to choose which market or investment vehicle is most suitable for you. Education is vital; ensure you understand the risks associated with each method and which one best suits your trading style. Margin and Leveraged tokens are the most common as they are the most convenient, easy-to-understand, and most widely accessible. The ETP products are generally aimed at investors as opposed to traders, fund and portfolio managers but are perfectly suitable for retail investors.

Manage Risk

This one is important! Trading can, and often does, result in the trader losing everything. Be sure you understand risk, especially if choosing to use high margin. Be sure to use responsible risk management, set your stop losses, trading setups should almost always utilize a positive risk-to-reward ratio, and never trade with more money than you can afford to lose. It is recommended that traders understand and study effective risk management strategies before trading with live funds.

Open Your Position

Once you have all your sentimental and technical analysis performed, are confident in your trade setup, and have deployed a proper risk management strategy, this is when traders execute their trade. Once the trade is open, it is essential to keep an eye on news events and industry developments that can impact the asset's price.

Risks and Factors to Consider Before Shorting Crypto

Trading or investing in any asset carries risk as there is always a chance of losing funds. However, our beloved crypto market carries a higher risk than any other asset class due to its regulatory nature and smaller market capitalization, which leads to significantly more volatile swings and changes in price that are difficult to anticipate.

Crypto is Risky! There is a Reason Traditional Investors Often Label Crypto Investors as “degenerates.” Image via Shutterstock

Crypto is Risky! There is a Reason Traditional Investors Often Label Crypto Investors as “degenerates.” Image via ShutterstockMany traditional markets such as forex and commodities are far more predictable than crypto, making movements easier to anticipate and these assets easier to trade. This is because they are influenced by macro and micro-economic events that are often known beforehand as traders and investors know about upcoming interest rate announcements, earnings reports, employment figures, etc.

Most of these asset classes have decades of historical data available for study, enabling traders and investors to make better-informed predictions of how these asset classes are likely to respond to economic events.

Cryptocurrency markets are far less predictable and do not follow many of the known trends of traditional markets. The lack of history also makes it unclear how they are likely to react to certain economic conditions. As a result, cryptocurrency is a new tradable landscape that traders need to learn how to navigate.

Crypto is Volatile

Most avenues to short crypto are based on derivatives. These derivatives are based on crypto asset pricing, and fluctuations in price have a domino effect on traders’ gains and losses. If you have never analysed stock/commodity/real estate/forex prices, then you may not know that crypto assets are unique in terms of volatility.

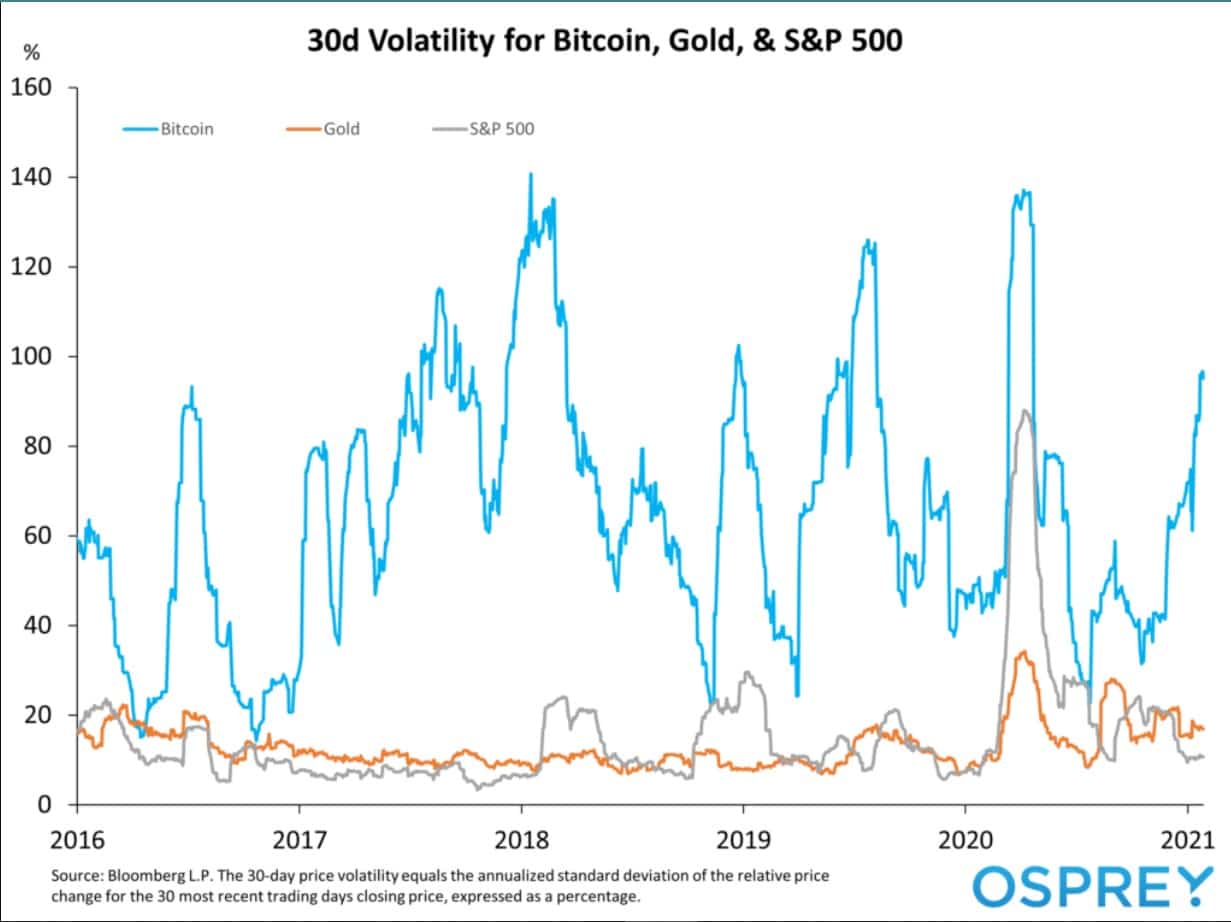

As an example, take a look at Bitcoin’s 30d volatility vs gold and the S&P 500:

Image via Osprey

Image via OspreyAnd remember that Bitcoin is the least volatile crypto asset.

As crypto traders, we are used to regular changes in price of 10% or more in a single day. Movements like these are almost unheard of in other asset classes. It is a big deal if a stock index moves one percent in a day, let alone the 10%+ movements like we see in crypto on a daily basis. This makes crypto trading riskier than other assets, but with that risk comes the potential for higher reward, which is what attracts traders to this industry.

Image via cryptonews

Image via cryptonewsHave you ever heard the legitimate complaint from job seekers about not being able to get a job because they do not have any experience, and they cannot get any experience because they cannot get a job? And around it goes...

This also happens in crypto and is one of the largest factors contributing to the volatility. The extreme volatility is part due to the small market cap. Market cap refers to the amount of money invested in an asset class. For example, gold has a market cap of 11 trillion dollars, and Bitcoin is 440 billion at the time of writing. Let’s take a look at why that is important.

Pretend that gold is a large lake - 11 trillion dollars is the amount of water in the lake.

Pretend Bitcoin is a small puddle, with only 440 billion dollars representing the water.

Pretend $100,000 is a rock the size of a grapefruit. This $100,000 is the amount of money a trader is looking to use to buy that asset.

Throw that rock into the lake, and it will cause minimal disruption. The water level will barely rise from displacement. It will be so insignificant that those standing on the shore will not even notice the rise in water level or any waves or splashes from the stone cast into the water on the other shore.

Now throw that same-sized rock into a puddle, and all hell breaks loose. Water will splash up over the edges, the water level will rise noticeably, and everyone looking at the puddle will see the disruption.

This works similar to how a large trade will affect the gold vs Bitcoin market. Nobody will notice half a billion dollars being added to or drained from an 11 trillion-dollar asset class, but half a billion will certainly disrupt a market with under a trillion dollars invested.

So, to go back to the “can’t get a job” analogy. Because crypto is so volatile, many investors don’t want to get involved, resulting in the market cap remaining small. The small market cap results in extreme volatility, which makes investors not want to get involved, so just like our job seeker, around and around it goes.

It is expected that as more investors realize Bitcoin’s potential, and once a spot Bitcoin ETF is approved in the United States, the amount of institutional money that may pour into Bitcoin may significantly reduce its volatility and the asset may start behaving more like indices or commodities.

Lack of History

Compared to other assets, Bitcoin has only been around for just over a decade, meaning there is not enough sufficient historical data to help investors make sufficient educated decisions on price behaviour or trends.

Crypto Assets Lack the Historical Data Many Investors Rely on to Make Informed Decisions. Image via Shutterstock

Crypto Assets Lack the Historical Data Many Investors Rely on to Make Informed Decisions. Image via ShutterstockThe lack of history is a deterrent, as many investors and traders may study weeks, years, or even decades of historical price data to make informed investment decisions.

Regulatory Status is Unclear

This is another case similar to the cannot get a job without experience and cannot get experience without a job scenario. Because crypto is deemed so risky, volatile, and a speculative asset class, it is unclear to the authorities how it should be regulated. And because crypto remains unregulated, it remains risky and volatile as investors cannot get involved in an unregulated asset, which again leads to Bitcoin and cryptocurrency’s market cap remaining generally small, contributing to the risk and volatility. It’s like the world’s most complex merry-go-round.

The absence of regulatory oversight means that exchanges can get away with shenanigans and offerings that are not allowed across regulated markets. We see this with things like exchanges offering high levels of leverage and many rumours of wash trading and exchanges front running their customers, adding to the already high levels of risk associated with crypto trading.

Crypto Exchanges that Allow Short Selling

This is not an exhaustive list, but some of the popular exchanges that allow short selling are:

Bitfinex

Short Selling Crypto: Closing Thoughts

One of the main advantages that traders have over investors is that investors mainly make money when prices go up and lose money when prices go down, as opposed to traders who can make money on the way up or down by short selling. This is not including investors who invest in inverse products, which isn’t a very common investment vehicle.

One of my biggest gripes is that countless YouTubers, websites, social media groups, and adverts lead inexperienced traders to think that trading is easy, anyone can do it, and you can make a fortune trading from your phone overnight. Of course, if it were as easy as they would have you believe, everyone would be sitting poolside sipping margaritas while trading from our phones.

Don’t be fooled; there is a reason why most professional traders have a setup that looks something like this:

Doesn’t Look So Easy to Me. Image via Shutterstock

Doesn’t Look So Easy to Me. Image via ShutterstockIn my days of more active trading, I saw dozens of ridiculous posts daily of people showing their 1000% profits by trading, often using nothing but their phones. Any professional Wall Street trader will tell you that this is not feasible nor possible to sustain.

Anyone making those sorts of profits has either scored a couple of lucky trades, is using insanely high amounts of leverage which will lead to blown accounts, and are cherry-picking results likely from demo accounts. It is a sad reality that over 90% of traders fail and lose money and that trading has become an extremely predatory industry where conmen prey on new and unsuspecting traders.

Run the other way if you see a “trader” posing in front of a Lambo and throwing hundred-dollar bills in the air. Career traders are not influencers, and influencers are not traders. If a trader has turned into an influencer, it is most likely because they failed as a trader and need another way to make money.

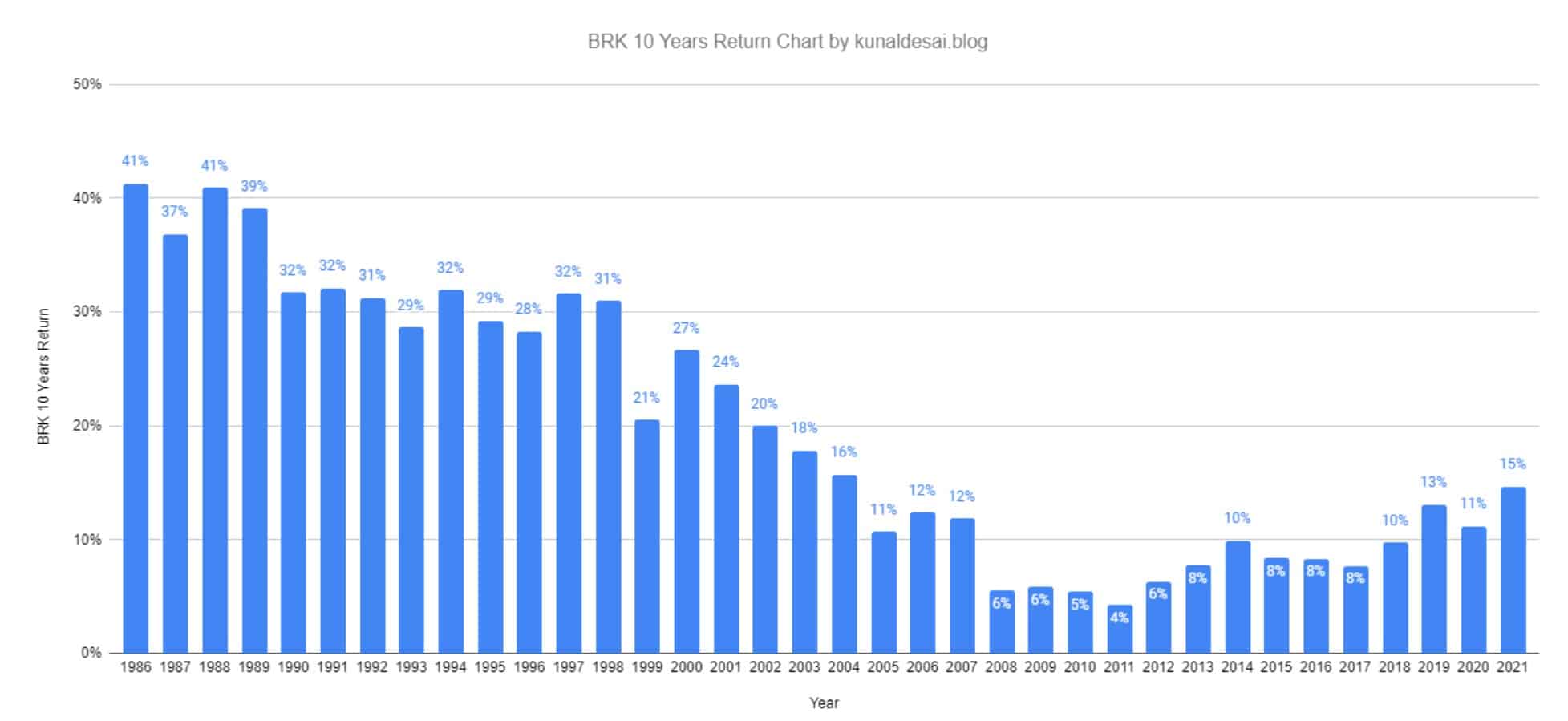

It is valuable to keep in mind that some of the best traders in the world, asset and portfolio managers who earn millions a year in salary and work for the biggest firms on Wall Street shoot for 10-30% per year. Warren Buffett, who is often considered the best trader/investor of all time, has consistently made a historical average of 20-30% per year for decades. Traders need to seriously consider whether they can realistically outperform the “Oracle from Omaha” for a sustained duration before they dedicate their lives to the craft.

Buffett’s Berkshire Hathaway Yearly ROIs. Image via kunaldesai.blog

Buffett’s Berkshire Hathaway Yearly ROIs. Image via kunaldesai.blogIt is important to have realistic expectations when going into trading and understand that becoming a millionaire overnight is improbable at best. It also helps first to consider the amount of funds you can allocate to trading. Traders generally need a 6-figure trading account or a long time horizon to build a small account to make trading worthwhile, as 10% profit per year on a 500-dollar trading account isn't enough to survive.

Also, keep in mind that these professional traders who are happy with 10%-30% per year often have access to tools, research teams, analytical charts and more that retail traders do not have, which is one of the reasons we are referred to as "dumb" money. Many retail traders believe they can outperform a billion-dollar hedge fund with an army of analysts watching charts around the clock and state-of-the-art analytical tools. I'm not saying it is impossible, as some traders make it, but it is incredibly difficult. For every crypto trader who bought Bitcoin at 500 dollars and became a millionaire, thousands of others have lost money.

I am not saying all this to put you off trading. I am just trying to provide realistic expectations as there are too many people shilling trading as an easy way to make money as they want you to use their sign-up affiliate link or sign up for their course or something they are trying to promote. If these people are making so much money trading, why do they need your money?

Any successful long-term trader will tell you that trading takes years of research, dedication and practice and that it is high stress, high risk, and not a way to get rich quick. Trading can be highly lucrative and a fantastic career if you feel you can become part of the few traders who actually make it in the game. I always recommend starting with a demo account, researching trading strategies, backtest strategies, and scrolling through historical price action, searching for patterns and trends. It is a good idea only to risk live money once you have proven that you can be profitable on a demo account for a sustained period.