Ethereum set the benchmark for smart contract execution with the launch of the Ethereum Virtual Machine (EVM). It’s the engine that runs decentralized applications on Ethereum and has become the default virtual machine standard across hundreds of chains.

TL;DR: The EVM is a software environment that executes smart contracts. If that doesn’t ring a bell yet, check out Coin Bureau’s Comprehensive Ethereum Overview before diving deeper.

Part of what made the EVM so widely adopted was its simplicity. It offered a flexible enough foundation to support a variety of use cases—from DeFi and NFTs to DAOs and social applications. For developers, it was a playground. The tooling matured early, documentation spread fast, and a massive developer community formed around it. The EVM didn’t try to be perfect—it just needed to be usable, and it was.

Fast forward to today, and Web3 looks a lot different. Millions of users interact with thousands of applications across dozens of ecosystems. But as the space has matured, the “one-size-fits-all” model is starting to show cracks. The EVM is now at a familiar juncture—still dominant but limited. It’s a general-purpose machine trying to serve increasingly specialized needs.

That doesn’t make Ethereum any less relevant. It’s still the go-to for many projects and continues to push critical upgrades. But when an application demands high-throughput parallelism, fine-grained control over execution, or specialized computation, Ethereum isn’t optimized for that.

This is where Alternative Virtual Machines (AltVMs) come into play. Built from scratch or reimagined from other computing paradigms, AltVMs are designed to do what the EVM can’t—or can’t do well enough.

In this article, we’ll break down what AltVMs are, why they’re gaining traction, explore some of the most prominent examples, and take a closer look at the trade-offs of having multiple VMs in a multi-chain world.

What are AltVMs?

Alternative Virtual Machines (AltVMs) refer to any blockchain virtual machine that isn’t the Ethereum Virtual Machine (EVM). While EVM became the default execution environment for smart contracts, thanks to Ethereum’s early success, AltVMs are now gaining traction as purpose-built alternatives that aim to solve some of the EVM’s structural limitations.

They aren’t trying to replace the EVM outright. Instead, they’re designed to complement it—by introducing execution environments that prioritize specific qualities like speed, scalability, security, or privacy, often tailored for particular types of applications. Here’s what sets AltVMs apart:

Built to Address EVM’s Constraints

AltVMs emerged as a response to the EVM’s shortcomings, such as:

- Sequential execution that limits throughput and scalability.

- High gas fees due to demand and inefficiencies.

- Rigid programming stack that revolves around Solidity and Vyper.

- Limited performance optimization for specialized applications.

- Cross-chain limitations when it comes to interoperability.

Key Features of AltVMs

- Scalability: Many AltVMs use techniques like parallel execution (e.g., Solana’s SVM, FuelVM) to achieve higher throughput.

- Performance: Faster block times and optimized transaction execution make AltVMs ideal for high-frequency use cases.

- Security: Examples like Move VM use resource-oriented programming to prevent common smart contract bugs, while zkVMs (like ZKsync and Polygon zkEVM) offer cryptographic security via zero-knowledge proofs.

- Flexible Programming Languages: WASM-based VMs (e.g., NEAR, Filecoin FVM) let developers use Rust, C++, AssemblyScript, and more—reducing the entry barrier for non-Ethereum devs.

- Modularity: Some AltVMs allow more customization for DApp architecture, letting builders fine-tune performance and design.

- EVM Compatibility: Certain AltVMs like Polygon zkEVM or Neon EVM maintain EVM compatibility, helping developers migrate DApps without abandoning Ethereum tooling.

- Interoperability: While not universal, some AltVM ecosystems work toward better cross-chain support and multi-VM coordination.

Specialization Over Generalization

Unlike the EVM, which is general-purpose by design, most AltVMs are built with a narrower focus. Some are optimized for high-performance apps like trading platforms and games (e.g., Solana’s SVM). In contrast, others prioritize formal verification and security (e.g., Move VM) or enable verifiable computation for privacy and scaling (e.g., zkVMs).

AltVMs represent a modular future where execution environments can be selected or designed based on what an application actually needs—rather than adapting everything to a single virtual machine model.

What Are the Most Prominent AltVMs?

Not all virtual machines are built the same. While the Ethereum Virtual Machine (EVM) still dominates the landscape, several AltVMs are redefining what’s possible by rethinking performance, programming models, privacy, and interoperability. Below are the most widely adopted and technically influential AltVMs today and the projects building around them.

Solana Virtual Machine (SVM)

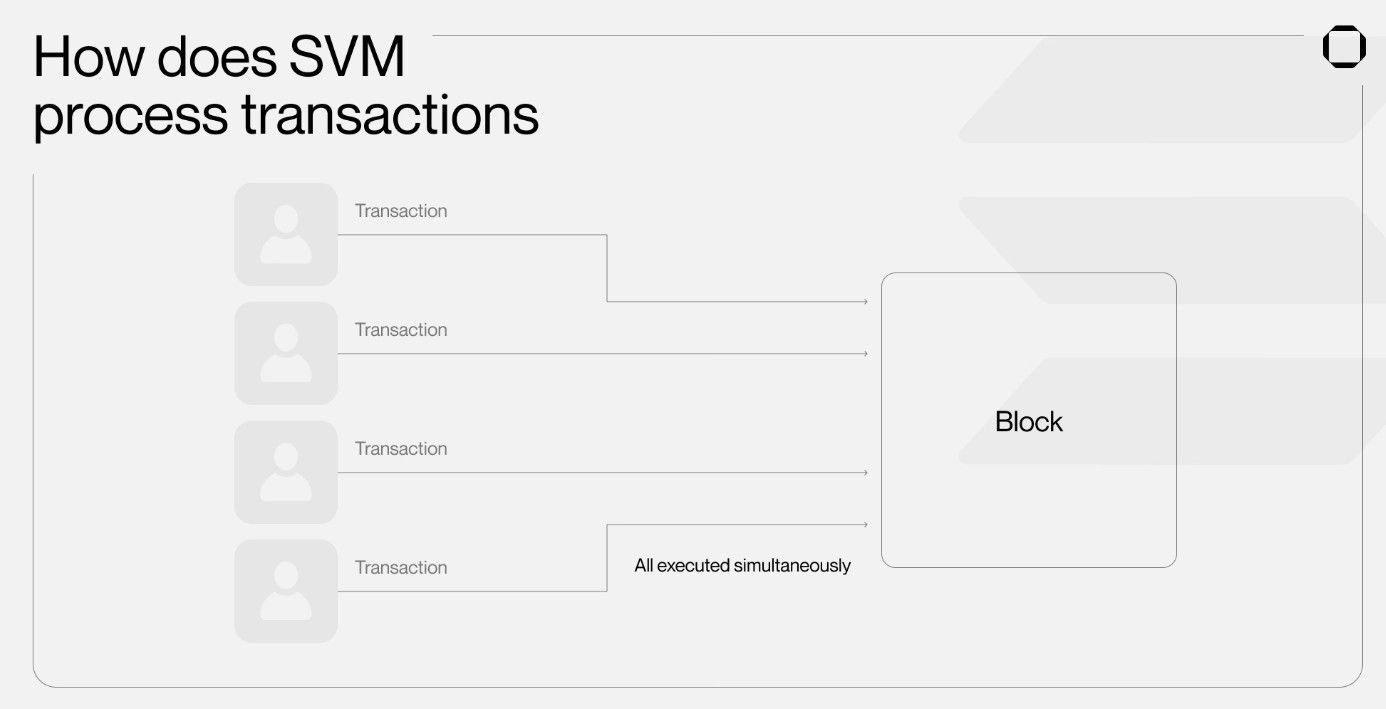

The Solana Virtual Machine (SVM) serves as the execution environment for smart contracts on the Solana blockchain. Unlike traditional VMs, SVM utilizes a parallel processing model, allowing simultaneous transaction execution. This design enables Solana to handle thousands of transactions per second, significantly enhancing scalability and reducing congestion. Developers can write smart contracts in Rust, C, and C++, which are then compiled into BPF bytecode for efficient execution by the network's validators.

SVM Supports Transaction Parallel Processing | Image via Squads

SVM Supports Transaction Parallel Processing | Image via SquadsIt’s built for performance from the ground up, anchored by two core innovations:

- Proof of History (PoH): A cryptographic timekeeping system that allows validators to agree on the order of events without waiting for each other.

- Sealevel Parallel Execution: Unlike the EVM, which processes transactions individually, Sealevel allows multiple non-conflicting transactions to be processed simultaneously, massively boosting throughput.

These design choices allow the SVM to support thousands of transactions per second with low latency and low fees.

Projects using SVM:

- Solana: The home of the SVM, Solana leverages it to support high-speed trading, gaming, and NFT applications.

- Eclipse: A modular L2 that integrates the SVM to offer high-performance execution on Ethereum.

- Soon: A consumer-friendly app chain built on SVM for social apps and payments.

- Sonic: A zk chain being developed with SVM execution on a zkEVM-compatible base.

Check out our comparison of EVM with SVM.

Move VM

The Move VM is a virtual machine designed for the Move programming language, emphasizing safety and flexibility. Move introduces a resource-oriented programming model, ensuring digital assets are managed with strong guarantees against duplication or accidental loss. This approach enhances security, particularly in handling assets and executing complex transactions. Beyond that, the Move VM introduces:

- Transaction Parallelization: Each transaction declares what data it touches, making it easier to process many transactions simultaneously without conflicts.

- Linear Types: These prevent the double-spending of assets and enable safe composability by design.

Move VM-Based Aptos and Sui Ecosystems are Growing Rapidly | Image via Medium

Move VM-Based Aptos and Sui Ecosystems are Growing Rapidly | Image via MediumProjects using Move VM:

- Aptos: Focused on parallel execution and sub-second finality with Move at its core.

- Sui: Designed around object-centric data structures and horizontal scalability.

- Movement Labs: Bringing Move to modular stack environments and experimenting with Move outside L1s.

CosmWasm

CosmWasm is a WebAssembly (Wasm) -based smart contract platform tailored for the Cosmos ecosystem. It enables developers to write multi-chain smart contracts in Rust, which are then compiled to Wasm for execution. CosmWasm's design facilitates interoperability among various blockchains within the Cosmos network, promoting a modular and extensible approach to decentralized application development. Two key features set it apart:

- Wasm Runtime: Offers a sandboxed, high-performance execution environment.

- IBC Compatibility: CosmWasm contracts can communicate across chains in the Cosmos network using Inter-Blockchain Communication (IBC), making cross-chain logic native.

CosmWasm Supports IBC, Enabling Seamless Access to the Cosmos Ecosystem | Image via CosmWasm

CosmWasm Supports IBC, Enabling Seamless Access to the Cosmos Ecosystem | Image via CosmWasmProjects using CosmWasm:

- Skip Protocol: Builds MEV and blockspace tooling with CosmWasm on Cosmos SDK chains.

- Stride: Uses CosmWasm to power liquid staking contracts across IBC-enabled zones.

- Secret Network: Extends CosmWasm with encrypted execution for privacy-preserving smart contracts.

Cairo VM

The Cairo VM is a virtual machine designed to facilitate the execution of computational integrity proofs, particularly for zero-knowledge rollups. It allows for offloading complex computations from the main blockchain, enhancing scalability and reducing on-chain congestion. Cairo's architecture is optimized for generating succinct proofs, enabling efficient verification of large computations. Unlike the EVM, Cairo is designed to generate proofs efficiently using:

- ZK-STARKs: A type of zero-knowledge proof that’s fast, scalable, and doesn't rely on the trusted setup.

- Algebraic Execution Model: Programs written in Cairo are translated into constraints that can be proven and verified, enabling scalable execution with cryptographic integrity.

The Lifecycle of a Cairo Program | Image via Medium

The Lifecycle of a Cairo Program | Image via MediumProjects using Cairo VM:

- Starknet: The primary ZK rollup using Cairo, optimized for scalability without compromising decentralization.

- Paradex: A Starknet-native perpetual DEX that benefits from Cairo’s low-latency, high-throughput ZK infrastructure.

Arbitrum Stylus

Arbitrum Stylus is an innovative virtual machine that extends the capabilities of the Arbitrum ecosystem by enabling developers to write smart contracts in both traditional languages like Rust and C, alongside Solidity. This flexibility allows for utilizing existing codebases and libraries, fostering a more inclusive and versatile development environment.

Arbitrum Stylus Allows Running Rust Contracts Alongside Solidity Contracts | Image via Github

Arbitrum Stylus Allows Running Rust Contracts Alongside Solidity Contracts | Image via GithubKey features:

- Multi-language Support: Write contracts in high-performance languages and compile them to WASM.

- Nitro Upgrade: Built on top of Arbitrum Nitro, which introduced fraud-proof compression and faster execution.

- Interoperability with Solidity Contracts: WASM contracts can call EVM contracts and vice versa, enabling modular development.

Projects using Stylus:

- Arbitrum One and Nova: The main Arbitrum chains integrating Stylus to broaden developer access.

- Orbit Chains: Customizable L3s built on Arbitrum, with Stylus support for low-latency, multi-language smart contracts.

zkVMs

zkVMs are virtual machines designed to execute smart contracts with integrated zero-knowledge proof capabilities. They enable the creation of privacy-preserving applications by allowing computations to be verified without revealing underlying data. This approach enhances confidentiality and security in decentralized applications.

Polygon is One of the Most Popular zkVM Chain | Image via Mirror

Polygon is One of the Most Popular zkVM Chain | Image via MirrorThey’re built to optimize for proof generation and verifiability:

- EVM-Compatible zkVMs: These replicate EVM logic within a ZK context, enabling existing dApps to migrate with minimal friction.

- ZK-Native zkVMs: Purpose-built environments that don’t rely on EVM design assumptions, resulting in faster, cheaper proof generation.

Projects using zkVMs:

- zkEVM (Polygon, Scroll): Aim to bring Ethereum compatibility to ZK rollups, offering secure execution with lower gas costs.

- Scroll: A zkEVM chain focused on staying bytecode-equivalent to Ethereum, with ongoing optimizations for developer tooling and zk circuit performance.

These AltVMs represent a significant evolution in blockchain technology, each addressing specific challenges and opening new possibilities for decentralized applications. By leveraging these specialized virtual machines, projects can achieve enhanced performance, security, and interoperability tailored to their unique requirements.

Challenges of Having Multiple VMs

AltVMs bring innovation, but they also introduce complexity. As the blockchain ecosystem experiments with multiple execution environments, several friction points have become more visible at the developer and user levels. Below are some of the significant challenges emerging from this fragmented landscape.

1. Fragmentation & Ecosystem Silos

Challenge: Each VM operates within its own technical and social ecosystem—different languages, tools, developer communities, and liquidity pools. This fragmentation makes collaboration harder and slows down adoption.

What it looks like in practice:

- Developer friction: Developers need to learn multiple stacks—Solidity for EVM, Move for Aptos/Sui, Cairo for Starknet—which increases onboarding time and cognitive load.

- Liquidity division: DeFi protocols built on CosmWasm (like Stride) can’t natively tap into EVM liquidity without bridges or wrappers.

- Tooling duplication: Tools like Foundry (EVM) or Sui CLI have to be built and maintained independently. Auditing frameworks, testing environments, and SDKs are often non-transferable across VMs.

2. Security Complexity

Challenge: Each virtual machine introduces its own attack surface, runtime behavior, and risk model. The more execution environments there are, the more effort is needed to secure them all.

Examples:

- Cross-VM exploits: Interacting across VMs (e.g., CosmWasm smart contracts communicating with a Move VM chain) opens up new bugs or trust assumptions.

- Specialized audits: A contract safe on one VM may have vulnerabilities in another. Auditors must understand the nuances of each VM’s language, runtime, and behavior.

3. Interoperability Overhead

Challenge: Connecting different VMs requires bridges, relayers, and off-chain infrastructure, which adds latency, costs, and new trust assumptions.

Real-world issues:

- Bridging delays: Transferring assets between Solana (SVM) and Ethereum (EVM) through Wormhole introduces time delays and fees.

- State inconsistencies: Hybrid chains like Fluent (EVM + SVM) risk race conditions if updates to different VMs aren’t atomic.

- Trusted relayers: Protocols like IBC (used by CosmWasm) rely on relayers whose honesty is assumed, adding a soft governance layer that can be exploited.

4. Economic Inefficiencies

Challenge: Specialized VMs require different infrastructure, split liquidity pools, and complicate user experience with fragmented gas economies.

Examples:

- High validator costs: Running a Solana validator requires powerful GPU hardware, while Ethereum nodes demand ample storage and bandwidth. Running both is expensive and limits validator participation.

- Gas token fragmentation: Users must manage different tokens—ETH, SOL, APT, ATOM—to interact across VMs.

- Liquidity mining inefficiencies: Protocols must incentivize liquidity separately on each VM, reducing capital efficiency (e.g., Uniswap on EVM vs. Orca on SVM).

5. Centralization Risks

Challenge: Some VMs prioritize performance or ZK capabilities at the cost of decentralization, introducing new vectors for control.

Examples:

- Hardware bottlenecks: Solana’s GPU-heavy validator requirements reduce the pool of eligible participants, skewing toward well-funded operators.

- Prover centralization: zkVMs like Scroll and Polygon zkEVM rely on a small group of high-performance provers—if these entities collude or fail, network liveness is at risk.

- Governance capture: Move VM’s development is still largely led by the Aptos and Sui core teams, raising concerns around decision-making centralization.

6. User Confusion

Challenge: For non-technical users, the experience of using different VMs can feel fragmented, inconsistent, and even risky.

UX examples:

- Wallet fatigue: Users must juggle multiple wallets—MetaMask for EVM, Phantom for SVM, Martian for Move VM.

- Security assumptions: A user might wrongly assume that Move’s strict resource logic applies on EVM chains, leading to behavioral mismatches and mistakes.

- Gas estimation errors: Transaction costs behave differently across VMs. For instance, FuelVM’s UTXO-style model is not intuitive to users coming from EVM-based chains.

Mitigation Strategies

To address these growing pains, ecosystems and infrastructure providers are working on ways to bridge the VM gap without sacrificing performance or safety.

| Strategy | Description |

|---|---|

| Unified Standards | Frameworks like LayerZero and Polygon AggLayer aim to connect VMs at the messaging and asset layers. |

| Shared Security Models | Systems like EigenLayer propose using restaking to provide cross-VM validation with unified trust assumptions. |

| Abstraction Layers | Account abstraction (e.g., ERC-4337) helps hide complexity by standardizing user interactions across chains. |

| Modular Execution | Projects like Celestia and EigenDA separate execution (VM) from consensus, enabling more flexible coordination among diverse VMs. |

The Balancing Act

Having multiple VMs is a double-edged sword. On one side, they unlock execution models that Ethereum wasn’t built for—parallelism, privacy, zero-knowledge verification, and more. On the other hand, they increase fragmentation, overhead, and the need for coordination.

The future likely won’t be a single-VM world. Instead, the winning architectures will balance specialization with interoperability, making it easier for users and developers to move between ecosystems without friction.

Final Thoughts

This article explored what Alternative Virtual Machines (AltVMs) are, why they’ve emerged, and how they differ from the Ethereum Virtual Machine. We also looked at some of the most prominent AltVMs and the trade-offs in operating a multi-VM ecosystem.

Looking ahead, it’s clear that the future of Web3 won’t revolve around a single VM. Instead, we’re moving toward a modular, multi-VM world—where different execution environments specialize in different tasks. That makes chain abstraction technologies increasingly important. They’re the connective tissue that can keep user experiences intuitive, even as the underlying infrastructure becomes more diverse.

Yes, building and interacting across different VMs comes with real overhead. Developers have to learn new languages and security models. Users face steeper learning curves and wallet fragmentation. But the upside—a more performant, flexible, and privacy-aware blockchain stack—is already starting to show its value.

This shift represents a broader maturity in the space: not everything needs to fit the same mold. And that’s a sign of real progress.