When Bitcoin first emerged in 2009, it promised a new way to transact—peer-to-peer, borderless, and without the need for banks or intermediaries. But while Bitcoin offers a level of pseudonymity, it’s far from private. Every transaction is permanently recorded on the blockchain, visible to anyone with an internet connection. This means that, with the right tools, anyone can trace a transaction back to its sender, potentially exposing personal financial details.

So, how do you keep your transactions private in a system designed for transparency? Enter crypto mixers—specialized services designed to break the link between your crypto transactions, making them nearly impossible to trace.

Also known as crypto tumblers, crypto mixers shuffle transactions from multiple users, mixing it up before redistributing it in a way that obfuscates the transaction trail. This makes it significantly harder for blockchain analysts, law enforcement agencies, or even hackers to track the movement of funds.

For some, this level of privacy is a necessity—whether to protect financial details from prying eyes, operate in oppressive regimes, or simply maintain a sense of autonomy in a digital world where surveillance is becoming the norm. But, as you might expect, this enhanced privacy comes with its fair share of controversy.

So, what exactly are crypto mixers and how do they work? Let’s dive in.

What Are Crypto Mixers?

If you’ve ever heard the phrase "crypto is anonymous," you might be surprised to learn that this isn’t entirely true. While crypto addresses don’t directly reveal their owners’ identities, every transaction is permanently recorded on the blockchain, creating a public, traceable ledger of all activity. This means that, with the right tools, anyone can follow the flow of funds and potentially link transactions back to real-world identities.

This is where crypto mixers—also known as cryptocurrency tumblers—come into play. These services are designed to enhance financial privacy by breaking the link between a sender and a recipient, making it difficult to trace the origin of funds.

Crypto Mixer. Image via Chainalysis

Crypto Mixer. Image via ChainalysisDespite being used for legitimate use cases, crypto mixers have also been associated with illicit activities, such as money laundering and black market transactions. This has led to increased regulatory scrutiny, with governments cracking down on mixers they believe are facilitating financial crimes.

That said, it’s important to recognize that privacy itself is not illegal—crypto mixers are simply tools, and like any tool, their legality and ethical use depend on how and where they are used.

How Do Crypto Mixers Work?

So, how does the process actually work? Let’s break it down step by step.

Step-by-Step Process of a Crypto Mixer

- User Sends Crypto to a Mixer

- Let’s use BTC as an example.

- The user deposits their BTC into a mixing pool, a large transaction batch that will soon be blended with others.

- Some mixers allow users to set delays to further disguise patterns.

- Let’s use BTC as an example.

- Mixer Blends Transactions

- The mixer combines the deposited BTC with Bitcoin from other users.

- This creates a pool of mixed funds, effectively severing the link between the original sender and the receiver.

- The mixer combines the deposited BTC with Bitcoin from other users.

- Multiple Wallet Addresses Are Used

- Instead of sending the Bitcoin straight back, the mixer distributes funds to multiple wallet addresses, making tracking even harder.

- Some mixers allow users to specify multiple receiving addresses to further obfuscate the trail.

- Instead of sending the Bitcoin straight back, the mixer distributes funds to multiple wallet addresses, making tracking even harder.

- Bitcoin is Redistributed to the Recipient

- After the chosen delay, the user receives different BTC, minus a small mixing fee.

- The new coins come from various sources, making it nearly impossible to determine the original sender.

- After the chosen delay, the user receives different BTC, minus a small mixing fee.

- Transaction Trail is Broken

- Once the mixing process is complete, blockchain analysis tools struggle to link the sender to the receiver, enhancing transaction privacy.

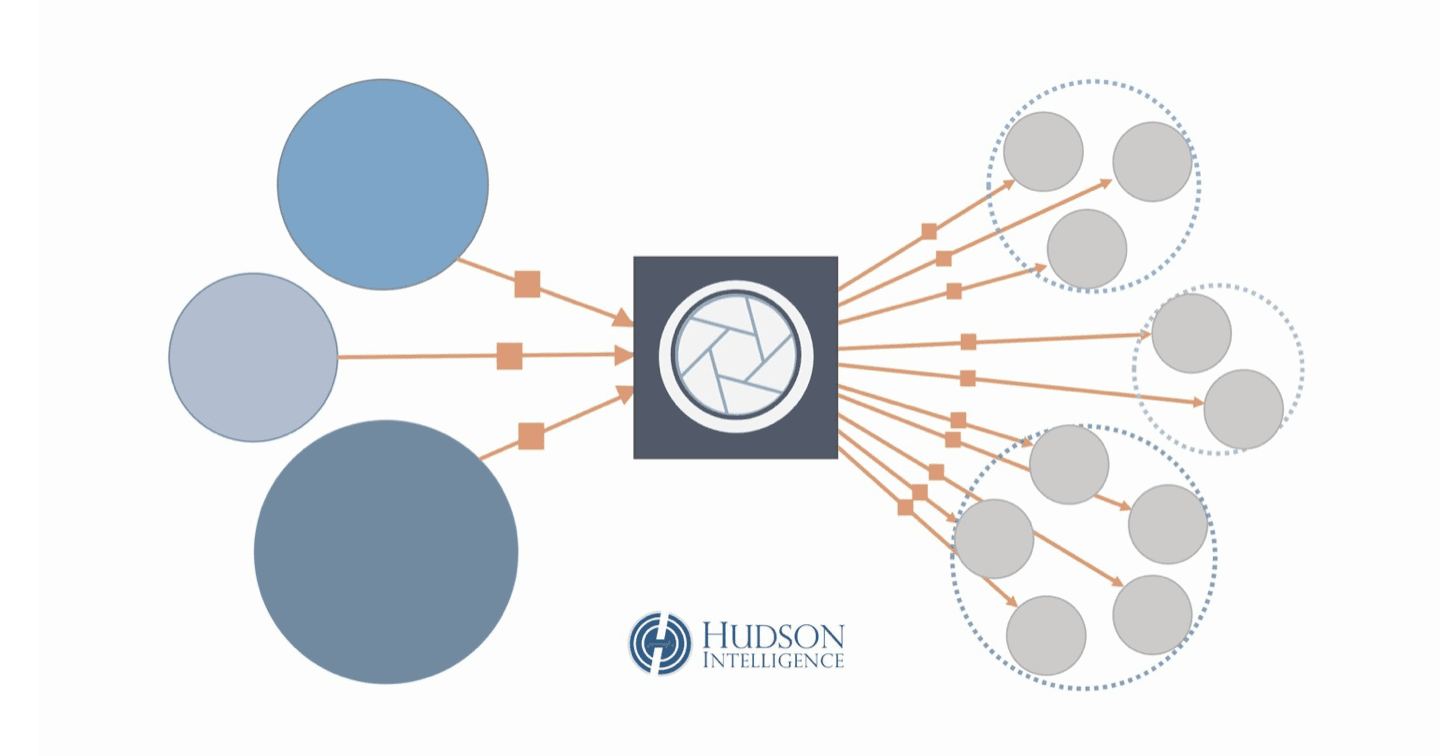

Crypto Mixer Inner Workings. Image via FraudInvestigation

Crypto Mixer Inner Workings. Image via FraudInvestigationThe Role of Multiple Wallet Addresses

A key feature of crypto mixers is their ability to break transactions into multiple outputs. Instead of sending one lump sum to a single wallet, a mixer can:

- Split crypto into smaller portions and send them at different times.

- Route funds through several addresses, further increasing anonymity.

- Randomize transaction amounts so there’s no clear pattern.

This technique ensures that even advanced blockchain forensic tools struggle to link transactions back to their original owner.

Example of a Bitcoin Mixer in Action

Let’s say Alice wants to send 1 BTC to Bob without leaving a clear trail. Here’s what she does:

- Alice deposits 1 BTC into a crypto mixer.

- The mixer combines her BTC with coins from hundreds of other users.

- The mixer waits several hours or days before redistributing the funds.

- Bob receives 0.3 BTC from one wallet, 0.4 BTC from another, and 0.3 BTC from a third—all completely unlinked to Alice’s original transaction.

Now, even if someone tries to trace Alice’s transaction, they’ll hit a dead end. The BTC Bob received could have come from anywhere in the mixer’s pool, making it impossible to establish a direct connection.

Types of Crypto Mixers

Not all crypto mixers are built the same. While they all aim to obscure the transaction trail, the way they operate can differ significantly. Broadly speaking, crypto mixers fall into two main categories—centralised and decentralised. Each comes with its own advantages, trade-offs, and risks, so let’s break them down.

There Are Two Types of Crypto Mixers. Image via WhiteBoardCrypto

There Are Two Types of Crypto Mixers. Image via WhiteBoardCryptoCentralised Mixers

Centralised mixers, as the name suggests, are operated by third-party services that take custody of users' Bitcoin, mix it with other deposits, and then return ‘clean’ BTC to the intended recipient.

How Do Centralized Mixers Work?

- Users send crypto to the mixer’s designated wallet address.

- The mixer pools the funds together with other users' deposits.

- After a specified delay, the mixer sends different cryptos to the user’s provided withdrawal address.

- The original sender’s transaction trail is severed, making it difficult to trace.

Risks of Centralised Mixers

While centralised mixers provide a user-friendly way to anonymize transactions, they come with some serious risks:

- Trust Issues – Users must place full trust in the mixer, hoping it doesn’t log transactions or keep records. If the service is compromised or pressured by authorities, this information could be exposed.

- Exit Scams – Some centralised mixers have vanished overnight, taking users’ crypto with them. Without oversight, there’s little recourse if a mixer decides to disappear.

- Government Scrutiny – Regulators and law enforcement agencies have cracked down on centralised mixers. Services like Helix and Bitcoin Blender were shut down, while Tornado Cash faced sanctions from the U.S. Treasury for allegedly facilitating illicit transactions.

- Potential Blacklisting – Some exchanges flag mixed crypto as ‘tainted’, making it difficult to deposit funds after they’ve gone through a mixer.

In short, while centralised mixers offer simplicity, they require a significant amount of trust—something that goes against the very ethos of crypto. That’s where decentralised mixers come in.

Decentralised Mixers

Decentralised mixers remove the third-party risk by relying on open-source protocols that allow users to mix their Bitcoin without trusting an intermediary.

How Do Decentralized Mixers Work?

Unlike centralised services, decentralised mixers use smart contracts and cryptographic techniques to mix crypto directly between users. One of the most popular methods is CoinJoin, an approach pioneered by Bitcoin developer Gregory Maxwell.

Here’s how it works:

- A group of users looking to mix their Bitcoin coordinate a joint transaction.

- Instead of each person making an individual transaction, they combine their BTC into one large transaction.

- Once complete, everyone receives the exact amount they put in—but since multiple senders are involved, it’s nearly impossible to tell who sent what to whom.

Advantages of Decentralized Mixers

- Trustless Privacy – Since users mix their funds directly with others, there’s no need to trust a third party. The process is fully transparent and verifiable.

- Harder to Shut Down – Unlike centralised mixers, decentralised ones don’t have a single point of failure. There’s no company or website to take down.

- Lower Risk of Exit Scams – Because there’s no middleman holding funds, users aren’t at risk of losing their crypto to a rogue operator.

Drawbacks of Decentralised Mixers

- Requires Technical Knowledge – Decentralised mixing protocols can be more complex to use than plug-and-play centralised services.

- Not Fully Anonymous – If not used properly, some mixing techniques can still be traced.

Use Cases: Why Do People Use Crypto Mixers?

While crypto mixers are often associated with illicit activities, the reality is that they serve a much broader audience. From privacy-conscious individuals to activists operating in hostile environments, there are plenty of legitimate reasons why someone might want to obscure their financial footprint.

That said, crypto mixers remain a controversial tool—one that is both valued for its privacy-enhancing capabilities and scrutinized for its potential misuse. Let’s break down the key reasons why people turn to these services.

Crypto Mixers Are Used for Various Reasons. Image via Chainalysis

Crypto Mixers Are Used for Various Reasons. Image via ChainalysisPrivacy-Conscious Users Seeking Anonymity

In an era where financial transactions are increasingly tracked, many users simply want to keep their crypto dealings private. While crypto isn’t inherently anonymous, crypto mixers add an extra layer of obfuscation, ensuring that personal spending habits don’t end up in the wrong hands.

Consider this: would you want every purchase you make to be visible on a publicly accessible ledger? Whether you’re donating to a cause, paying for a service, or moving funds across wallets, crypto mixers help keep transactions confidential.

Journalists, Activists, and Individuals in Oppressive Regimes

For some, financial privacy isn’t just a preference—it’s a matter of personal safety. In countries where governments monitor and restrict financial activity, using a crypto mixer can be a lifeline for freedom.

- Journalists and whistleblowers use mixers to receive payments for their work without fear of retaliation.

- Political activists rely on them to fund movements without authorities freezing their assets.

- Citizens in oppressive regimes use mixers to protect themselves from surveillance and potential persecution.

In such cases, crypto mixers are a tool for financial self-sovereignty, ensuring that individuals can transact freely without undue scrutiny.

Protecting Personal Financial Transactions

Not all use cases involve high-stakes political situations—sometimes, it’s simply about personal financial security.

- High-net-worth individuals may not want the world to know how much crypto they hold and become a target for hackers or extortionists.

- Businesses might want to keep supplier payments confidential to avoid competitors gaining insights into their operations.

- Everyday users may just prefer to keep their spending habits off the public record for general privacy reasons.

In traditional finance, banks don’t publish every transaction on an open ledger—yet in crypto, that’s exactly how things work. Mixers offer an alternative for those who value financial discretion.

Illicit Activities

Of course, it would be naive to ignore the darker side of crypto mixers. Because they obscure transaction history, they have been used for:

- Money laundering – Criminals attempt to ‘clean’ stolen or illicit funds by cycling them through mixers.

- Dark web transactions – Mixers have historically been linked to illicit marketplaces, allowing users to transact anonymously.

- Sanctions evasion – Some groups have used mixers to bypass financial restrictions imposed by governments.

This is precisely why governments and regulators have taken an increasingly aggressive stance on mixers.

Risks and Legal Implications of Crypto Mixers

While crypto mixers can provide an extra layer of financial privacy, using them isn’t without significant risks. From scams and security concerns to legal gray areas and regulatory crackdowns, there are several factors users should consider before diving in.

Crypto Mixers Have Faced Significant Regulatory Crackdowns From Regulators. Image via WhiteBoardCrypto

Crypto Mixers Have Faced Significant Regulatory Crackdowns From Regulators. Image via WhiteBoardCryptoLet’s take a closer look at the key risks and legal implications associated with using crypto mixers.

Risks of Using Crypto Mixers

1. Scams and Fraudulent Mixers

One of the biggest risks of using a crypto mixer is falling victim to a fraudulent service. Since mixers operate in a semi-anonymous environment, there have been cases where operators simply vanish with users’ funds—a classic exit scam.

Some mixers claim to provide privacy but secretly log transactions, potentially exposing users if the data is leaked or handed over to authorities. This defeats the entire purpose of using a mixer in the first place.

2. Possibility of Deanonymization

While mixers provide a high level of privacy, they are not foolproof. With advancements in blockchain analytics, law enforcement agencies and on-chain analytics firms have become increasingly capable of identifying mixed transactions.

For example, if a user mixes BTC and then immediately deposits it onto a centralised exchange, that exchange may flag the transaction as suspicious and freeze their funds.

3. High Transaction Fees

Mixing services often charge fees ranging from 0.5% to 7%, depending on the service. While this may not seem like much, frequent use can add up quickly, making it an expensive method for privacy.

Some decentralized mixing protocols offer lower fees but may require more technical expertise to use effectively.

Legal Considerations of Crypto Mixers

Regulators worldwide have taken an increasingly aggressive stance on crypto mixers due to their potential use in money laundering, terrorism financing, and sanctions evasion. While not all mixers are illegal, their use can put individuals in legal gray areas, depending on where they reside.

1. Anti-Money Laundering (AML) Regulations

Many countries have strict AML laws that require financial services—including crypto-related ones—to identify their users. Because mixers intentionally obscure transaction history, regulators view them as potential enablers of illicit activity.

For example:

- In the U.S., FinCEN (Financial Crimes Enforcement Network) considers mixers "money transmitters," requiring them to comply with AML regulations.

- Some jurisdictions, such as the EU, have proposed laws that could make mixing services illegal or require strict compliance with KYC (Know Your Customer) requirements.

2. Government Crackdowns on Privacy Tools

Several high-profile mixers have been sanctioned, shut down, or seized by law enforcement agencies:

- Tornado Cash was sanctioned by the U.S. Treasury in 2022 after being accused of facilitating over $7 billion in illicit transactions, including funds stolen by North Korean hackers.

- Blender.io, another popular mixing service, was blacklisted for similar reasons.

- ChipMixer, a long-running Bitcoin mixer, was shut down by authorities in 2023.

Governments argue that such actions are necessary to combat illicit finance, but privacy advocates see them as an attack on financial autonomy.

Closing Thoughts

Crypto mixers stand at the crossroads of financial privacy and regulatory scrutiny. On one hand, they provide a valuable tool for individuals seeking greater anonymity, whether for personal security, financial discretion, or protection against oppressive regimes. On the other hand, their association with illicit activities has made them a prime target for governments and regulators worldwide.

As blockchain analysis tools become more sophisticated, the effectiveness of mixers may decline—but so too will the ability of authorities to enforce outright bans on decentralized privacy tools. The cat-and-mouse game between privacy advocates and regulators is far from over.

For users, the key takeaway is to tread carefully. While mixers can enhance privacy, they also come with risks, from scams and regulatory crackdowns to the possibility of deanonymization. If you’re considering using one, it’s crucial to understand the legal landscape in your country, choose a trusted service, and implement additional privacy practices to minimize exposure.

As always, do your own research before engaging with any service that promises anonymity—because when it comes to crypto, knowledge is your best defense.