Cryptocurrency markets are famously volatile, with prices often swinging wildly in just minutes or hours. In this environment, one simple word has become a mantra for many investors: HODL. What began as an internet typo has since turned out to be a powerful mindset and long-term strategy.

In this guide, we’ll break down what HODLing means, its origins, when it works best, and how to determine if it’s right for your crypto journey.

Key Takeaways

- HODL means holding your crypto assets long-term, regardless of market volatility—it's a mindset built on conviction, not chasing quick profits.

- The term "HODL" originated from a 2013 forum typo and has evolved into a widely embraced investment philosophy in the crypto world.

- HODLing is most effective for strong assets like Bitcoin and Ethereum, especially when market trends or fundamentals support long-term growth.

- Blindly HODLing weak or speculative tokens can be risky—research and periodic portfolio reviews are essential to avoid heavy losses.

- Security is key: use hardware wallets, store your seed phrases safely, and regularly monitor your holdings and the broader market.

Understanding HODL

HODL is a term born from a simple typo but has evolved into one of the most iconic phrases in the crypto world. It stands for “Hold On for Dear Life”, and today, it represents a mindset as much as a meme, the idea of staying committed to your crypto assets no matter how wild the market swings.

Unlike traditional “holding” in finance, where investors buy and wait based on financial reports or forecasts, HODLing is emotionally charged. It’s about conviction, not just calculation. Many who HODL believe that cryptocurrencies like Bitcoin or Ethereum will rise significantly over time, and they choose not to sell, even during crashes.

So what exactly is HODL?

- Meme: It began as a joke, which was a drunken typo on a Bitcoin forum in 2013, but quickly became a viral meme within the crypto community.

- Mindset: It reflects the belief that time in the market is more powerful than trying to time the market.

- Strategy: For many, HODL is a deliberate investment choice to accumulate and hold through cycles with a long-term view.

From a misspelled word on a forum to a global investing philosophy, HODL’s journey has been anything but typical. To understand where it all began, let’s take a quick look at its origin story.

The Origin of the Term

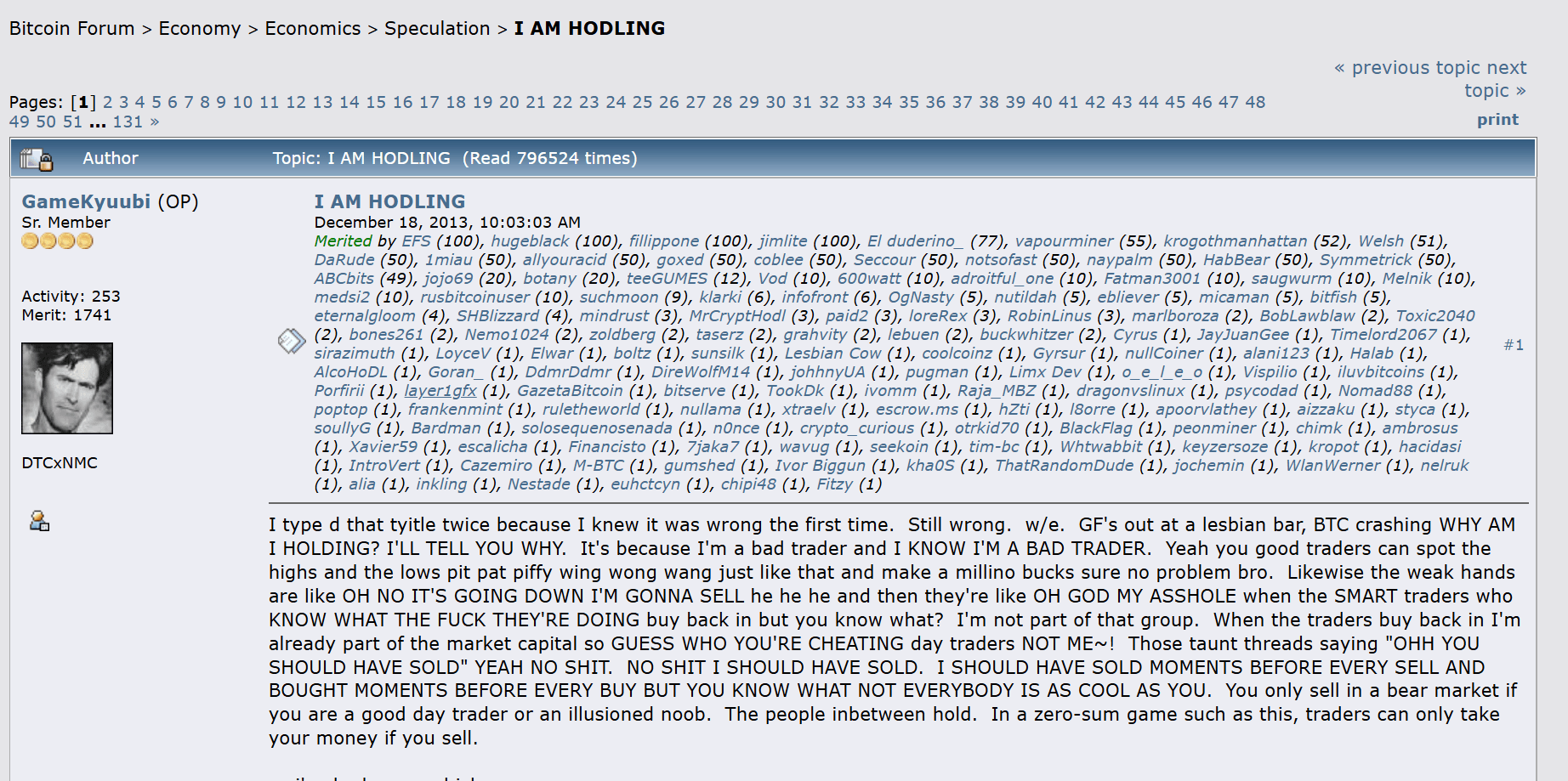

The word “HODL” first appeared on Dec. 18, 2013, in a post on the BitcoinTalk forum by a user named GameKyuubi. The post was titled, in all caps, “I AM HODLING.” It was a passionate, slightly drunken message about the user’s decision to hold onto their Bitcoin instead of trying to trade it during a sharp price drop.

A Screenshot of BitcoinTalk forum User's Post From Which HODL Was Discovered. Image via BitcoinForum

A Screenshot of BitcoinTalk forum User's Post From Which HODL Was Discovered. Image via BitcoinForumThe post wasn’t polished, and the word “holding” was misspelled as “hodling.” But that accidental typo struck a nerve with the community. It quickly spread across crypto forums, memes, and social media.

Over time, it became more than a joke. The community embraced it, even turning it into a backronym: “Hold On for Dear Life.” HODL turned into a rallying cry and a symbol of resilience for those who refused to sell in panic during downturns.

What started as a late-night rant became a defining motto of crypto culture, and a surprisingly powerful investment strategy.

HODL as a Crypto Investment Strategy

While it started as a joke, HODL has matured into a serious long-term investment strategy embraced by millions. It focuses on staying invested in promising crypto assets through market ups and downs, rather than trying to time every move.

Long-Term Holding Philosophy

HODLing is built on a few key ideas.

- Belief in the tech: Many HODLers are in it for the long haul because they believe in the future of blockchain and decentralization.

- Time beats timing: Instead of guessing when prices will rise or fall, HODLers trust that staying invested over time leads to better results.

- Mental strength: Holding during market crashes takes patience and emotional control. This mindset is often summed up by the term “diamond hands.”

For example, early Bitcoin believers who held on through the 2014 and 2018 crashes saw their assets grow exponentially in later years. The same goes for early Ethereum adopters who stuck through the chaos and volatility.

This approach isn’t just about profits, it’s about conviction. It’s what separates those who exit early in panic from those who stay in and grow over time.

HODL vs Trading

While both HODLing and active trading are common approaches in crypto, they serve very different goals and require different mindsets. Below is a simple comparison to help clarify the contrast:

| Aspect | HODL | Active Trading |

|---|---|---|

| Goal | Long-term wealth growth | Short-term gains and profits |

| Timeline | Months to years (or longer) | Minutes, hours, days, or weeks |

| Risk Exposure | High volatility, long-term upside | High short-term risk, requires fast action |

| Emotional Demand | Requires patience and self-control | High stress, constant market tracking |

| Skill Requirement | Basic – patience and access | Advanced – technical analysis, quick reflexes |

| Best Used When | Bull markets or for long-term belief | Sideways or highly volatile short-term markets |

Active trading can be demanding. It requires constant monitoring, rapid decision-making, and emotional resilience. Over time, many traders shift to HODLing to reduce pressure and simplify their investment approach. For those with long-term conviction in a project or the broader crypto market, holding offers clarity and focus, without the need to predict every market move.

Next, we'll examine when HODLing is most effective and the conditions that support a long-term holding strategy.

When HODLing Makes Sense

HODLing is not a one-size-fits-all strategy. It performs best under specific market conditions and with the right mindset.

Bull Markets

In strong upward trends, long-term holders benefit from sustained momentum. As prices climb, media coverage and investor confidence increase, reinforcing the decision to stay invested. Many of the biggest gains in crypto history came from holding through entire bull cycles, not trying to time individual peaks.

Bear Markets

Downturns test conviction. During market crashes or crypto winters, HODLers need to stay calm and focused. Panic selling often locks in losses, while holding through the decline may allow investors to recover when markets rebound. Dollar-cost averaging during bear markets can also lower the average entry price, strengthening long-term gains.

Read our guide and make your crypto portfolio strong, even when the market is down.

Reading the Blockchain: On-Chain Indicators for Smarter HODLing

The beauty of crypto is that its ledger is public. Surfacing and interpreting on-chain data lets long-term investors test their conviction with hard numbers instead of vibes.

| Indicator | What it Tells You | How HODLers Can Use It |

|---|---|---|

| HODL Waves / Coin Age Bands | Percentage of coins that haven’t moved for 1 yr+, 2 yr+, etc. | Rising “older” waves signal strong holder conviction; falling waves hint at distribution. |

| Realized Cap vs Market Cap | Dollar value at which each coin last moved. | If market cap < realized cap, the market is under water—historically a long-term buy zone. |

| Dormancy & ASOL (Average Spent Output Lifespan) | Average age of coins being spent. | Low dormancy = newer coins moving (retail churn); spikes can flag old hands exiting. |

| Exchange Net Flows | Coins moving onto or off exchanges. | Sustained outflows usually align with accumulation phases; inflows often precede sell-offs. |

| MVRV Z-Score | How far price is above/below realized value. | Helps identify overheated tops (take-profit alerts) and deep value bottoms (accumulation). |

Emotional Readiness and Timing

HODLing requires the ability to manage stress and resist reacting to short-term price movements. It's most effective when paired with a strong belief in a project’s fundamentals, such as real-world adoption, developer activity, and consistent upgrades.

The ideal conditions for HODLing include:

- Clear long-term goals (e.g., retirement, savings, or future diversification)

- High tolerance for volatility and slow returns

- Trust in blockchain innovation or specific ecosystems

- A willingness to stay informed without chasing the market

But while HODLing can be powerful under the right conditions, it's not without its flaws. Holding blindly, without proper evaluation or strategy, has its serious risks, especially in a market known for hype, scams, and rapid change.

Let’s look at where HODLing can go wrong.

Risks and Criticism of HODLing

While holding through volatility can be a smart strategy, it's not without downsides. HODLing can backfire when applied without context or caution. Here's where things can go wrong.

Drawbacks of Blind Holding

Missing out on profitable exits by holding through market peaks and failing to realize gains when prices are high is one of the most basic fears of blind holding. But some of the other drawbacks include:

- Ignoring market cycles, leading to deeper losses during downturns and missing opportunities to rebalance or exit before significant declines.

- Holding through project failures or black swan events, which can result in assets becoming worthless if the underlying project collapses or is abandoned.

- Lacking a basic understanding of market cycles and failing to use on-chain data or macroeconomic analysis to inform decisions, resulting in passive losses as prices fall below cost.

- Falling into cognitive traps and mythologized slogans (e.g., "holding guarantees success") that discourage critical reassessment of one’s investment strategy.

- Exposure to extreme price volatility can erode portfolio value rapidly in the absence of active risk management.

- Tying up capital in underperforming or non-viable projects, missing out on better opportunities elsewhere.

- Increased emotional and psychological stress from watching investments decline without a plan to mitigate losses.

- Overlooking tax implications, as holding without a clear exit strategy can complicate tax reporting and potentially increase liabilities when eventually selling.

Not All Coins Are Meant to Be HODLed

Blindly applying the HODL strategy to every cryptocurrency can be risky, especially when it comes to low-utility tokens or projects with questionable fundamentals.

Risk of Holding Low-Utility or Rug-Pulled Tokens

Many utility tokens have limited real-world use, often restricted to a single platform or ecosystem. If the platform fails to gain traction or the utility is not in demand, the token’s value can plummet. Worse, some projects are outright scams, known as "rug pulls", where developers hype a token, attract investor funds, and then disappear with the money, leaving holders with worthless assets.

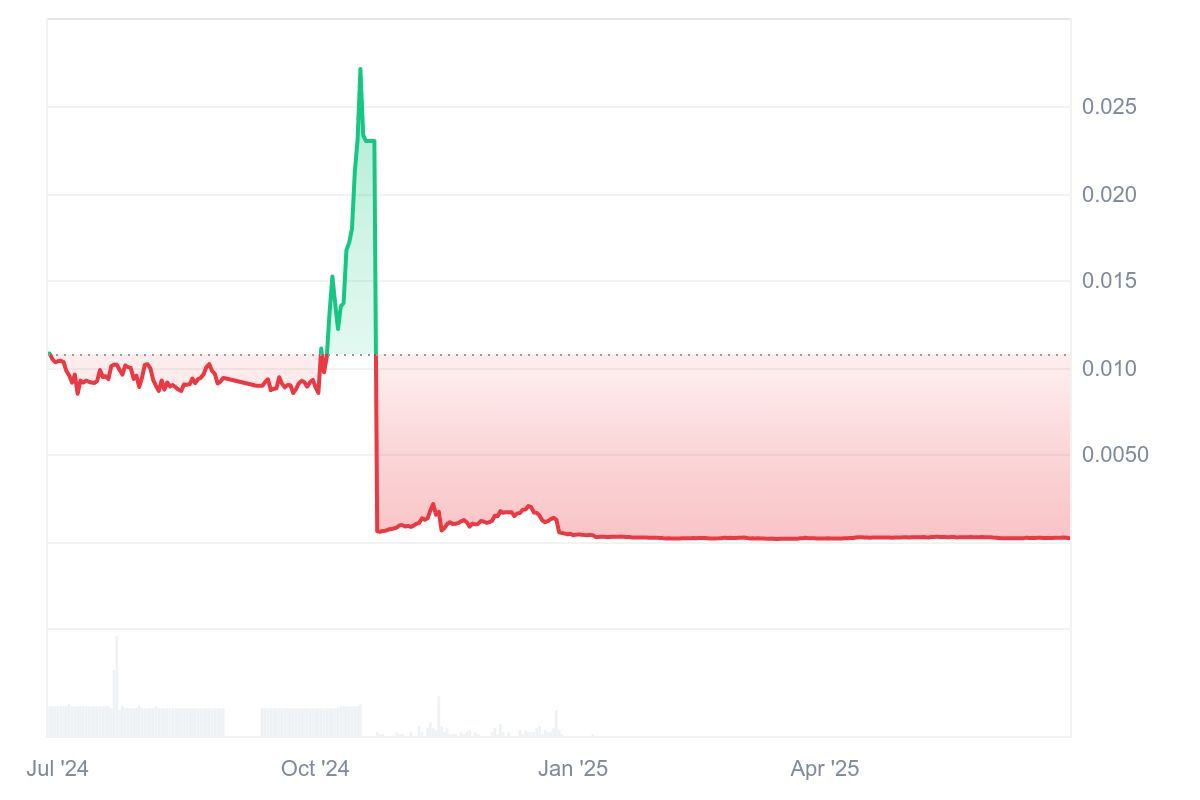

Example:

The Squid Game (SQUID) token is a notorious case. Developers capitalized on the Netflix series’ popularity, raised millions, and then drained liquidity pools, causing the token’s value to crash to nearly zero in minutes.

SQUID Token Collapse Chart. Image via CoinmarketCap

SQUID Token Collapse Chart. Image via CoinmarketCapInvestors who blindly HODLed SQUID without evaluating its legitimacy lost almost everything.

Importance of Evaluating Fundamentals

To avoid such pitfalls, it’s crucial to conduct fundamental analysis before deciding to HODL. This involves assessing the project’s technology, team, market position, community engagement, and on-chain activity. A project with strong fundamentals is more likely to survive market cycles and deliver long-term value, while weak or scammy projects often collapse, leaving HODLers with significant losses.

HODL in Broader Financial Context

The term HODL was not born after the crypto phenomenon happened; it has roots in classic investing strategies.

In traditional finance, “buy and hold” is a time-tested approach. Investors purchase shares in companies they believe in and hold them for the long haul, ignoring short-term market noise. This strategy has produced some of the world’s wealthiest investors.

Warren Buffett, one of the most successful investors of all time, is famous for his “buy great companies and never sell” philosophy. He looks for assets with strong fundamentals and holds them for decades, letting compounding work its magic. HODLers share this mindset, betting that crypto’s best days are ahead.

How Stock Market Investing Differs Due to Crypto’s High Volatility and Market Maturity

- Volatility: Crypto markets are far more volatile than stocks. Double-digit daily swings are common.

- Market Maturity: Stocks are backed by established companies; most cryptocurrencies are still experimental.

- Regulation: Stock markets are heavily regulated; crypto is the Wild West.

- Information Asymmetry: Crypto is more susceptible to hype, rumors, and misinformation.

Despite these differences, HODLers play an equally important role in shaping market sentiment and stability.

HODLers and Market Sentiment

In the crypto market, price swings are sharp. But HODLers, the ones who go through it all, help stabilize the market during downturns. Their steady hands can slow sell-offs and preserve confidence when others are rushing for the exits.

Take the 2020 COVID crash, for example. Bitcoin dropped below $4,000 in March, triggering fear and widespread selling. But long-time holders didn’t budge. Instead, they doubled down. By the end of 2020, Bitcoin had surged past $28,000, rewarding those who stayed the course.

This tells us that there are two kinds of investors in the world: those with Paper Hands and a few with Diamond Hands.

“Diamond Hands” vs “Paper Hands” Terminology

Diamond Hands

These are investors who, like the steadfast HODLers during the 2020 crash, hold their assets through extreme volatility and market downturns, refusing to sell under pressure. Their commitment is often celebrated in the crypto community as a sign of strength and conviction.

Paper Hands

In contrast, paper hands describe those who sell their assets at the first sign of trouble. For instance, during the same 2020 crash, many investors with paper hands sold their Bitcoin at a loss, missing out on the significant gains that followed when the market recovered.

These phrases are no longer just internet jokes; in fact, they reflect the emotional resilience HODLing requires. In many ways, HODLers form the cultural backbone of crypto, fueling morale with memes, mantras, and a shared belief that time in the market beats timing the market.

Community and Culture

The crypto community is well-known for its vibrant meme culture and supportive online presence. During turbulent times, HODL memes and slogans like “We’re all gonna make it!” (WAGMI) circulate widely on platforms such as Twitter and Reddit. For example, after the 2020 crash, these memes and messages of encouragement helped many investors stay calm and stick to their strategies, fostering a sense of unity and collective resilience.

This community-driven morale boost can make it easier for individuals to maintain their conviction and avoid panic selling during market downturns.

HODLing Tools and Wallet Options

Holding crypto long-term requires more than just patience—it demands proper tools and secure storage. Choosing the right wallet can make the difference between protecting your assets and putting them at unnecessary risk.

Best Wallets for Long-Term Holding (Cold vs Hot Storage)

Cold Storage (Offline, Most Secure):

- Ledger Nano S Plus/X: Compact hardware wallets offering offline, multi-currency storage with high security and support for thousands of coins.

- Trezor Model One: User-friendly hardware wallet with advanced security, open-source technology, and support for thousands of tokens.

- Trezor Model T: A hardware wallet featuring a color touchscreen, USB-C, and broad cryptocurrency compatibility for easy, secure management.

- Coldcard MK4: Bitcoin-focused hardware wallet known for robust security features and air-gapped transaction signing.

- Material Bitcoin: Metal card for storing seed phrases, fire and water-resistant, providing analog, hack-resistant backup for wallet access.

Hot Storage (Online, More Convenient):

- MetaMask: A Popular browser extension wallet for Ethereum and ERC-20 tokens, widely used for DeFi and NFTs.

- Trust Wallet: Mobile wallet supporting a broad range of cryptocurrencies with an easy-to-use interface.

- Exodus: A Desktop and mobile wallet offering multi-asset support and built-in exchange features for convenience.

For additional excellent options, please refer to our article on best crypto wallets.

How to Securely Store Coins and Manage Private Keys

Security starts with good habits. Here’s what you must do:

- Use Hardware Wallets: For significant holdings, always use a hardware wallet.

- Back Up Your Seed Phrase: Write down your recovery phrase and store it in multiple secure locations.

- Never Share Your Private Keys: Treat them like the keys to your bank vault.

- Enable Two-Factor Authentication: Add an extra layer of security to your accounts.

- Regularly Update Software: Keep your wallet firmware and apps up to date to protect against vulnerabilities.

Keeping Track of Assets Over Long Holding Periods

Long-term holding works best when you stay on top of your portfolio. These habits help you protect your assets and stay informed.

Use a Portfolio Tracker

Apps like CoinStats, Delta, or Blockfolio (now part of FTX) let you monitor all your holdings in one place. You can track price changes, set custom alerts, and view performance across multiple wallets and exchanges. Most of these tools also allow automatic syncing, so your portfolio stays updated without manual input.

Don’t worry, we have the top 10 portfolio trackers for you.

Set Regular Check-Ins

Mark a calendar reminder every month or quarter. Use that time to review your holdings, rebalance if needed, check for any wallet updates, and make sure your backup methods are still secure. These routine check-ins help prevent mistakes and keep you aligned with your long-term goals.

Follow the Right Channels

Stay connected to the projects you’ve invested in. Follow official Twitter accounts, join Discord servers, and read reliable crypto news sites. Watching what’s happening in the space helps you act early if a coin forks, faces a security issue, or changes direction.

If you still have any questions about building a portfolio, take a look at this article by The Coin Bureau.

With the right tools and mindset, HODLing can be a rewarding strategy, but is it right for you?

Final Thoughts: Is HODLing Right for You?

HODLing works for people who genuinely believe in the long-term potential of crypto, not just the price, but the technology and the ecosystem behind it. It’s a strategy built on conviction, patience, and emotional control. But like any strategy, it comes with trade-offs. Holding blindly or sticking with poor-quality assets can hurt more than help.

Before you decide to HODL, ask yourself a few simple questions:

Do you see crypto and blockchain still growing years from now?

- Can you stay calm when prices drop 50% in a week?

- Will you research the projects you’re investing in?

- Are you thinking in terms of years, not months?

If your answer is yes, HODLing might be a good fit. Just make sure you're also diversifying, staying informed, and checking in on your portfolio regularly. HODL is all about staying ready, staying smart, and staying in the game.