I have been reading about blockchain technology since 2021. I remember my fascination when reading about Polygon as one of the first Ethereum scaling solutions. Back then, Polygon was an Ethereum sidechain, one of the many scaling solutions that sprung up. The innovation frenzy was about making Ethereum faster and more powerful without sacrificing its unique qualities of decentralization and security.

Sidechains are no longer a novel concept. They are an extensively researched concept in Ethereum, and many sidechain projects operate under Ethereum's umbrella today. I would go so far as to say that in Ethereum specifically, sidechains are an outdated concept, as we have far more efficient scaling solutions in the mix today. Designs like Layer 2 systems, Validium, and sovereign rollups perform better than sidechains.

Ethereum L2 Scaling Solutions Are Vast and Multifaceted | Image via LinkedIn

Ethereum L2 Scaling Solutions Are Vast and Multifaceted | Image via LinkedInHowever, even after this concept has seemingly antiquated in Ethereum, with even Polygon, the most successful sidechain project, migrating to a newer design (read Polygon 2.0), why are we covering this topic at The Coin Bureau?

It is because, to our surprise, the sidechain as a concept is making a comeback. This article will break down sidechains and understand their scalability potential. We will cover the benefits that made it famous in the last cycle and the drawbacks that led it out of style. Finally, we will discuss some recent projects that leverage sidechains, which will give us a peek into how this design may be making a comeback.

What is a Sidechain?

The motivation for a sidechain stems from the scalability trilemma. The trilemma states that a blockchain network has to trade-off between security, decentralization, and scalability, as it is impossible for a network to achieve all three in a single system.

This limitation has inspired several blockchain designs that have employed multi-chain architecture over the years, and a sidechain is one of them.

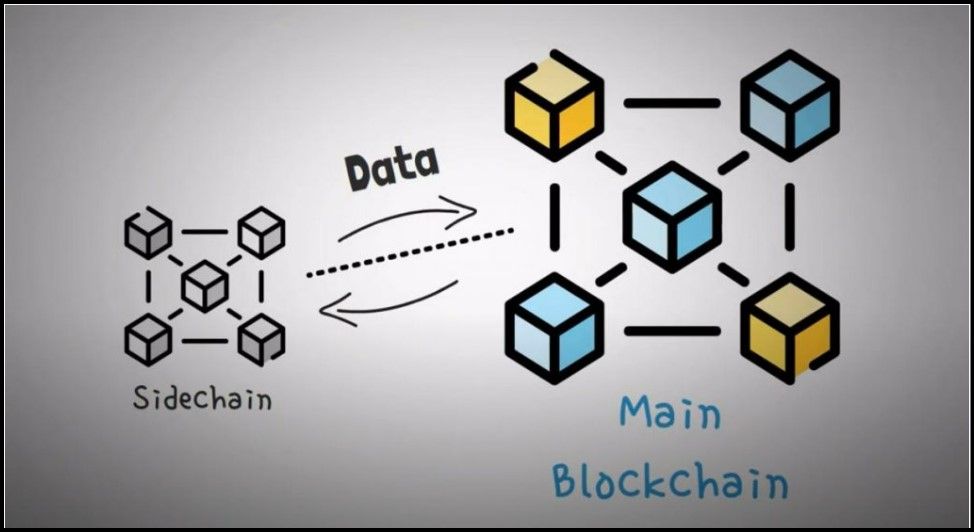

A sidechain is a separate blockchain attached to its parent blockchain using a two-way peg. The connection allows assets from the sidechain to be redeemable on the mainchain and vice versa, enabling the sidechain to operate independently while still being anchored to the mainchain for crypto-economic guarantees.

A Typical Sidechain Design | Source: Whiteboard Crypto

A Typical Sidechain Design | Source: Whiteboard CryptoHere are some key concepts of sidechains:

Two-Way Peg

An asset transfer mechanism is deployed to transfer assets from the mainchain to the sidechain and back, based on a predetermined rate and rules. The pegging ensures that the total supply of the asset remains consistent across both chains.

The interoperability of assets allows moving liquidity between the chains, an essential feature to leverage the sidechain's capabilities. For instance, a sidechain is typically faster and cheaper to use than the mainchain, so it may act as a payment channel for the mainchain, where users settle balances periodically.

Independent Operation

A sidechain is not dependent on its parent for regular operation, allowing it to adopt a different design. The independence to use different consensus rules, block creation processes, and blockchain design means it can offer unique benefits and features to its parent chain. Having unique capabilities that a typical parent chain like Ethereum is incapable of is the main USP of sidechains.

Security

A sidechain may maintain a two-way peg as a security feature as well. In case of anomalies in the sidechain, the peg will enable users to redeem their assets on the stable mainchain. The mainchain may also help reinforce the sidechain's security using various mechanisms, which we will cover later in the article.

How Sidechains Operate

A sidechain essentially operates as an independent blockchain with some special guarantees or connections with another, typically larger chain. There is no standard for how sidechains operate. Instead, a sidechain is a spectrum of chains that share some design principles. Let's explore what these principles are.

Asset Transfer Between Mainchain and Sidechain

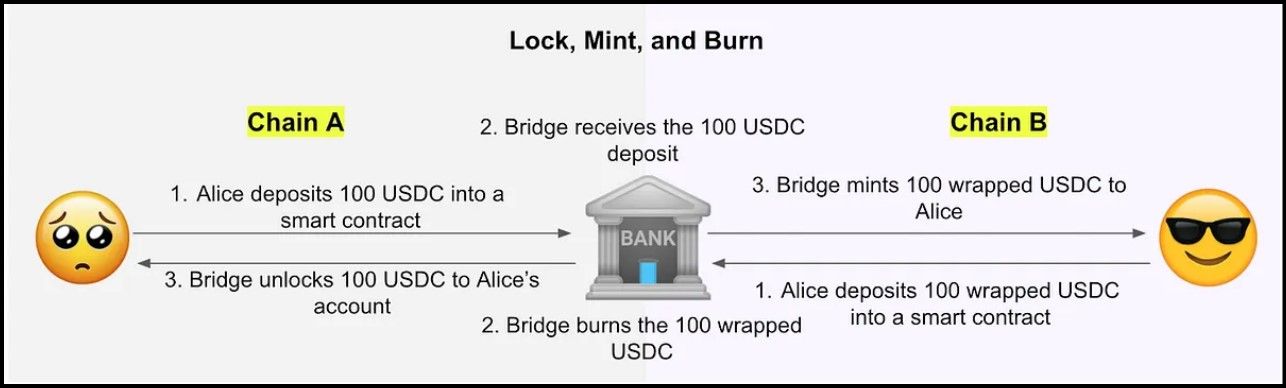

Asset transfer between a mainchain and a sidechain is a fundamental mechanism that enables the interoperability of these two blockchain networks. This process typically involves locking the asset on the mainchain and creating or releasing an equivalent asset on the sidechain, and vice versa. Here's a detailed look at how this transfer mechanism works and its implications for blockchain ecosystems:

Locking and Minting Assets

- Locking the Asset on the Mainchain: To transfer assets to the sidechain, the user initiates a transfer of that asset to a dedicated smart contract on the mainchain.

- Locking the Asset: The smart contract locks the asset, and the mainchain records this transaction.

- Issuance on the sidechain: The sidechain observes the mainchain activity constantly. When a smart contract notices this locking event, effectively proving that the assets are locked in the designated location, it mints an equivalent amount of assets. It sends it to the user's address on the sidechain.

These assets pegged to a token on another chain are called synthetic assets. Synthetic assets are an essential element of cross-chain asset transfers. For assets like ETH, its supply is out of our control; if burned, we lose such assets permanently. Synthetic assets ensure the movement of canonical crypto assets across chains without necessitating its burn on the source chain.

The Two-Way Peg Works Like a Cross-Chain Bridge | Image via Medium

The Two-Way Peg Works Like a Cross-Chain Bridge | Image via MediumRedeeming Synthetic Assets

Redeeming the original asset on the source chain involves reversing the locking process. So, the synthetic asset is sent back to the smart contract that created it, which then burns it, creating an event on the sidechain. Then, the smart contract on the source chain picks on this event and releases the original asset to its previous address.

Smart Contracts and Functionality

Sidechains offer a flexible platform for deploying advanced smart contracts and functionalities beyond the limitations of mainchains. Sidechains drive scalability and efficiency improvements across blockchain ecosystems by enabling more complex transactions and innovative applications.

- Flexible Smart Contracts: Sidechains can support a more comprehensive array of programming languages and custom standards, allowing developers to implement sophisticated smart contracts tailored to specific use cases. They facilitate multi-stage transactions and integration with oracles, essential for applications like decentralized finance (DeFi), where contracts must respond to real-world data.

- Speed and Efficiency: Sidechains significantly enhance transaction speeds by reducing block times and implementing scalable solutions like sharding. This results in faster confirmations and lower transaction fees, making them useful for high-frequency trading, gaming, and micropayments. For example, while Bitcoin's mainchain processes block every 10 minutes, sidechains like the Liquid Network achieve much quicker block times.

- Experimentation and Innovation: Developers use sidechains to pilot new technologies and protocols without risking the mainchain's stability. This sandbox environment fosters innovation, enabling the testing of novel consensus algorithms and interoperability solutions. Sidechains also support custom DeFi platforms and advanced privacy solutions, providing secure environments for decentralized exchanges and confidential transactions.

In conclusion, sidechains empower blockchain ecosystems with enhanced capabilities, driving the adoption of blockchain technology by making it more accessible, scalable, and versatile. As they evolve, sidechains will continue to play a crucial role in expanding blockchain's potential and fostering cross-chain interoperability.

Consensus Mechanism

Sidechains can use a different consensus mechanism from the mainchain. For instance, while the mainchain might use Proof of Work (PoW), the sidechain could use Proof of Stake (PoS) or other consensus algorithms to validate transactions and create blocks. This flexibility allows for experimentation with different technologies and performance optimizations that might not be feasible on the mainchain.

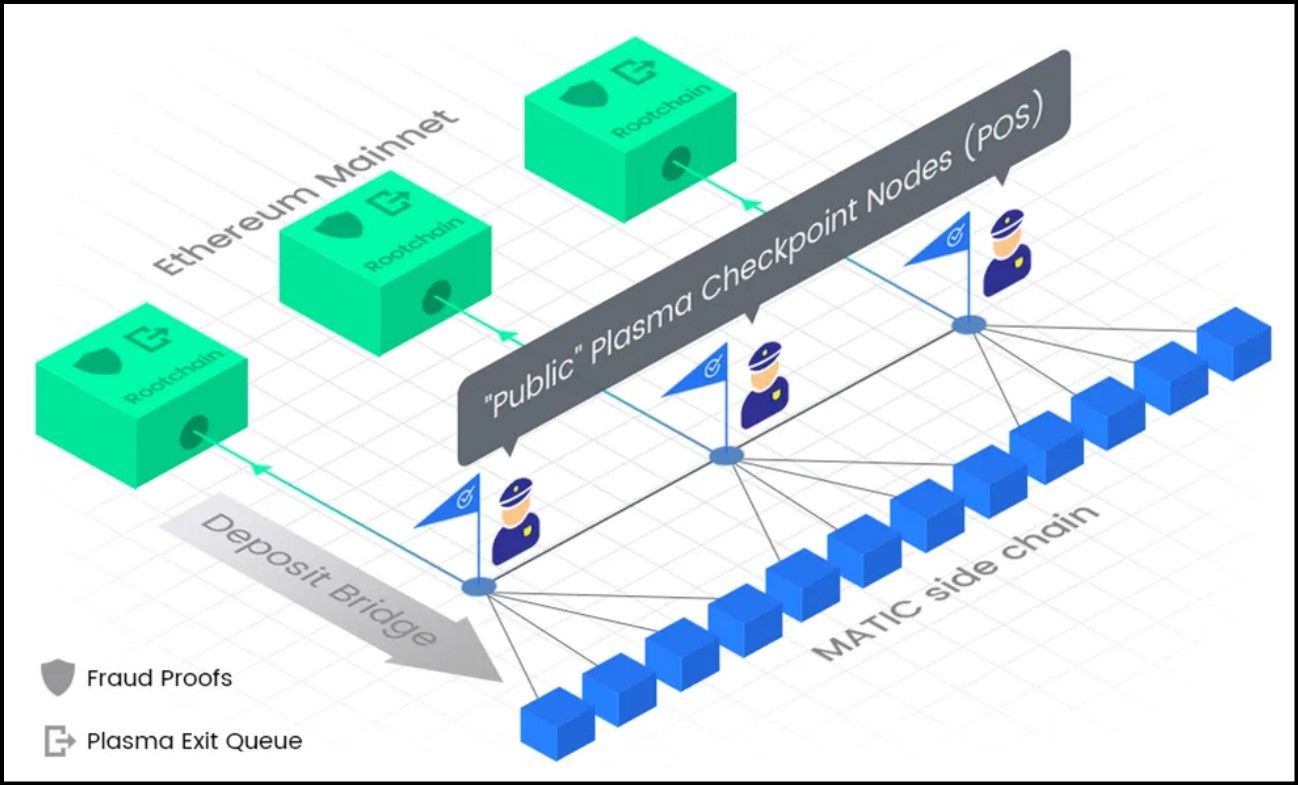

Security and Checkpointing

The mainchain plays a crucial role in reinforcing the security of a sidechain in a blockchain ecosystem. Although sidechains are designed to operate independently, they can leverage the robustness and security features of the mainchain in several ways. Here's a comprehensive explanation of how the mainchain helps to reinforce the security of the sidechain:

Anchoring

Anchoring involves periodically recording the state of the sidechain onto the mainchain. Anchors can include crucial information like the latest block hashes or other state data. The anchoring process provides a verifiable reference point on the mainchain, which can validate the state of the sidechain.

Anchoring sidechain states on the mainchain exposes any malicious attempts to alter its history by comparing it to records stored in the mainchain. This linkage acts as a deterrent against fraud and helps in conflict resolution.

Checkpointing

Checkpointing is similar to anchoring but often involves saving more detailed information, like full blocks or transaction histories, from the sidechain onto the mainchain. These checkpoints serve as secure backup points that the sidechain can reference in case of disputes or anomalies.

How Checkpoints Work in Sidechains | Image via Medium

How Checkpoints Work in Sidechains | Image via MediumCheckpointing on the mainchain adds an additional layer of security by providing a reliable and tamper-proof record of the sidechain's operations. It also assists in the rollback process if malicious activity is detected.

Cross-Chain Consensus Mechanisms

Some sidechains also deploy cross-chain consensus mechanisms where validators or miners from the mainchain are involved in securing the sidechain. Here are two examples of cross-chain consensus mechanisms:

- Merge Mining: It allows miners to simultaneously secure the main and side chains using the same computational work. The process helps the sidechain inherit some security properties of the mainchain.

- Federated Validators: In a federated model, a group of pre-approved validators (often the same entities that validate the mainchain) is tasked with maintaining the sidechain. This model relies on the reputational and operational trust of the federated validators. Since these validators are often part of the mainchain's ecosystem, they have a vested interest in maintaining integrity and security.

Conclusion

The security reinforcement provided by the mainchain to sidechains is multifaceted and critical to the reliable operation of sidechains. Whether through anchoring, cross-chain consensus, validation, redundancy, or economic incentives, the mainchain offers robust mechanisms that enhance the overall security and trustworthiness of sidechains. This symbiotic relationship allows sidechains to innovate and scale while leveraging the foundational security properties of their mainchains.

Sidechains vs. Parachains

A parachain is an application-specific data structure that can be validated by the validators of the Relay Chain, operating in parallel to enhance transaction processing and scalability within the Polkadot and Kusama networks. While typically structured as blockchains, parachains are not restricted to this form.

They benefit from the network's overall security and can communicate with other parachains via the XCM format. Parachains are managed by collators, who maintain the parachain's full node, retain necessary information, and produce new block candidates for Relay Chain validation. The incentivization of collators varies by parachain and does not necessarily require staking or owning the native token unless specified by the parachain.

Key differences between sidechains and parachains include:

- Design Purpose: Sidechains offload specific transactions from a main chain, whereas parachains operate alongside a main chain within a larger network.

- Integration: Sidechains are more independent from the main chain, while parachains are tightly integrated with the Polkadot network, leveraging its governance system and cross-chain interoperability.

- Customization: Sidechains have limited customization and functionality, often restricted to certain types of transactions. In contrast, parachains are highly customizable and optimized for specific use cases, offering greater flexibility and power for developers.

New Sidechain Solutions

Sidechains initially gained traction as a solution to Ethereum's scalability issues, offering a way to offload transactions from the congested mainchain and process them more efficiently on a separate, parallel chain. This approach immediately boosted transaction speeds and reduced costs, making sidechains popular during Ethereum's growth surge. Projects like Polygon epitomized this success, becoming prominent players in the blockchain space.

However, as the blockchain landscape evolved, so did the technology to scale Ethereum. More advanced mechanisms like rollups have emerged, overshadowing sidechains regarding efficiency and security. Rollups process transactions off-chain but post minimal data on-chain, leveraging Ethereum's security while dramatically increasing throughput. This shift in focus is evidenced by Polygon's transition from its original sidechain model to adopting the Validium framework in its Polygon 2.0 roadmap, signaling a broader industry move towards these more sophisticated scaling solutions.

Bitcoin's Resurgence

Meanwhile, the Bitcoin network has experienced a resurgence in sidechain development, thanks to its Segregated Witness (SegWit) and Taproot upgrades. These upgrades have unlocked new capabilities, making Bitcoin smarter and more flexible. SegWit improved transaction efficiency and capacity, while Taproot enhanced Bitcoin's scripting capabilities, enabling more complex transactions and privacy features. These advancements have opened the door for developing Layer 2 solutions on Bitcoin, many of which leverage sidechain technology. By integrating Bitcoin's strong security and decentralization with sidechain functionalities, these new solutions aim to bring scalable, smart contract-like capabilities to the Bitcoin ecosystem.

New Sidechains on Bitcoin

The SegWit and Taproot upgrades have fundamentally transformed Bitcoin's ability to support more sophisticated applications and scaling solutions. Here's how these upgrades set the stage for the new wave of Bitcoin-based sidechains:

SegWit (Segregated Witness)

- Transaction Efficiency: SegWit separates signature data from transaction data, reducing the size of transactions and allowing more transactions to fit into each block. This not only increases the transaction throughput but also lowers fees and mitigates the risk of malleability attacks.

- Flexibility: By changing the way data is stored, SegWit makes it easier to build additional layers on top of Bitcoin, facilitating the creation of more complex sidechain architectures.

Taproot

- Enhanced Scripting Capabilities: Taproot introduces more advanced scripting abilities, enabling complex conditional payments and the ability to combine multiple transactions into a single, more private transaction.

- Privacy Improvements: Transactions that utilize Taproot look like any other transactions on the blockchain, enhancing privacy and reducing the visibility of complex smart contract executions.

Leveraging these upgrades, several Bitcoin-based L2 solutions have emerged, each employing unique sidechain mechanisms to extend Bitcoin's functionality:

Rootstock (RSK)

- Merge Mining: Rootstock employs a merge-mining strategy, where Bitcoin miners can simultaneously mine both Bitcoin and RSK blocks using the same computational power. This process allows RSK to inherit Bitcoin's security while operating its sidechain.

- Smart Contracts: Rootstock supports Ethereum-compatible smart contracts, bringing the flexibility and programmability of Ethereum to the Bitcoin network. This integration allows developers to deploy decentralized applications (Dapps) on a platform secured by Bitcoin's robust mining infrastructure.

Liquid Network

- Federated Sidechain: The Liquid Network operates as a federated sidechain, where a consortium of trusted entities (functionaries) oversees the network's operations. This model provides faster transactions and more efficient asset transfers while maintaining high security.

- Confidential Transactions: Liquid enhances Bitcoin's capabilities by offering confidential transactions, where the transaction amounts are hidden from public view, thus improving privacy without compromising the security and transparency of the network.

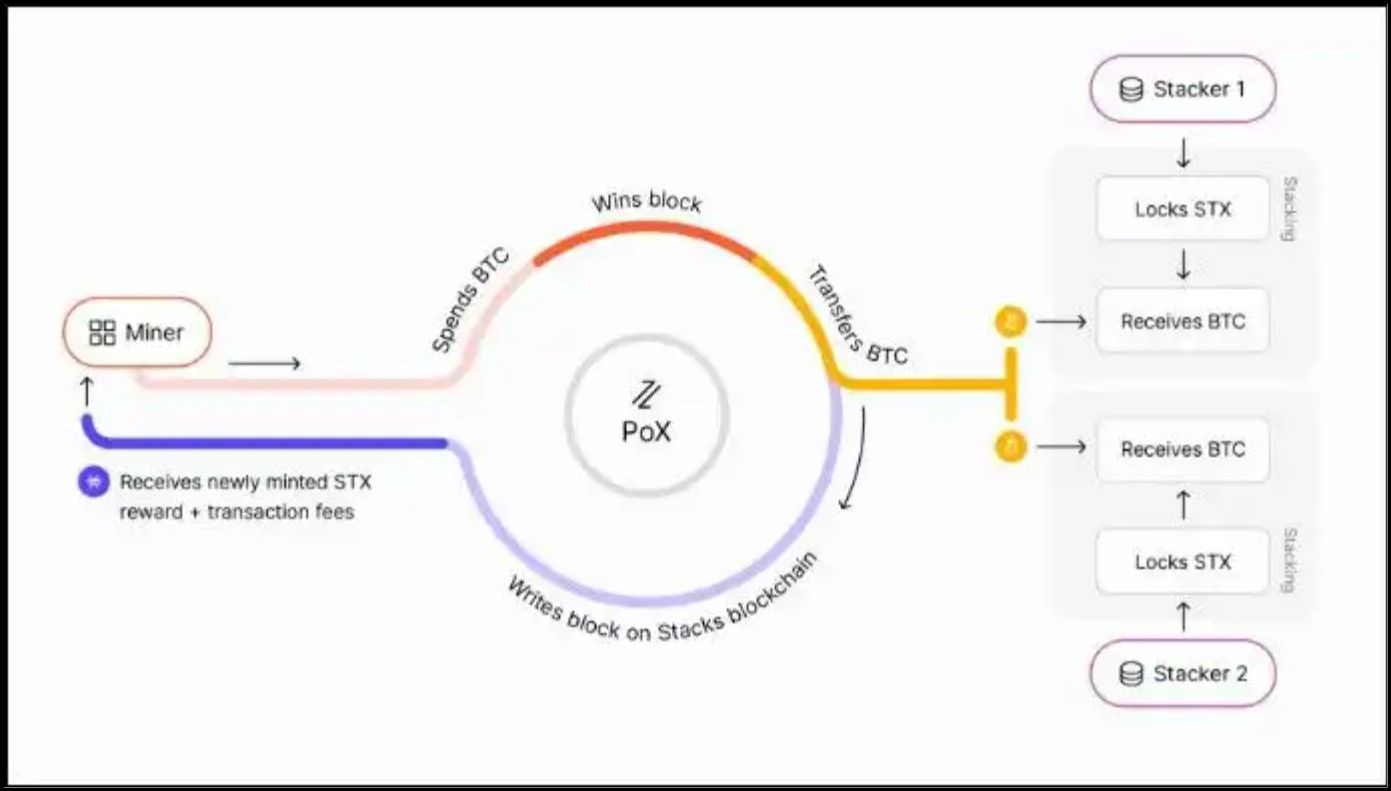

Stacks

- Unique Consensus Mechanism: Stacks introduces a novel consensus mechanism called Proof of Transfer (PoX), which anchors its sidechain to Bitcoin by requiring participants to transfer Bitcoin as proof of work. This connection ensures that Stacks benefits from Bitcoin's security while operating independently.

- Smart Contract Layer: Stacks provides a separate layer that enables smart contract functionality, allowing developers to build decentralized applications that can interact with the Bitcoin blockchain through Clarity, a secure smart contract language designed specifically for Stacks.

Proof of Transfer in Stacks

Proof of Transfer in StacksThe SegWit and Taproot upgrades have significantly enhanced Bitcoin's capacity to support sophisticated Layer 2 solutions, including sidechains that leverage Bitcoin's unparalleled security and decentralization. Rootstock, Liquid Network, and Stacks exemplify how these developments expand Bitcoin's capabilities, ushering in a new era of scalable, smart contract-enabled applications. As blockchain technology evolves, sidechains will likely play a pivotal role in bridging the gap between scalability and decentralization.

Closing Thoughts

Throughout this article, we’ve explored the transformative role of sidechains in the blockchain ecosystem. Initially, sidechains gained popularity within the Ethereum network as a solution to scalability issues, allowing for faster and more cost-effective transactions. However, as more advanced technologies like rollups have emerged, Ethereum's reliance on sidechains has diminished, prompting even major projects like Polygon to transition to newer frameworks.

Meanwhile, Bitcoin’s ecosystem has seen a resurgence in the use of sidechains following the significant SegWit and Taproot upgrades. These enhancements have enabled Bitcoin to support more complex and efficient Layer 2 solutions. We examined how platforms like Rootstock, Liquid Network, and Stacks are leveraging these upgrades to enhance Bitcoin's capabilities, offering scalable and secure environments for advanced applications and smart contracts.

Sidechains continue to be a vital innovation in the blockchain space, providing unique advantages in terms of scalability, security, and functionality. They represent a crucial bridge between the need for high-speed, low-cost transactions and the foundational principles of decentralization and security. As blockchain technology evolves, sidechains will likely play an essential role in expanding the horizons of what decentralized networks can achieve. Staying informed about these developments is key for anyone interested in the future of blockchain, as sidechains offer a glimpse into the potential for more flexible and powerful blockchain solutions.