Cryptocurrency mining is one of the most fundamental ways to participate in the blockchain ecosystem, powering the networks that underpin decentralized finance and innovation. By validating transactions and securing Proof-of-Work (PoW) networks like Bitcoin, miners play a pivotal role in ensuring the integrity and functionality of these systems. However, this essential process requires significant investment in specialized hardware and energy, making mining a high-stakes endeavor.

Application-Specific Integrated Circuits (ASICs) are purpose-built devices designed to efficiently mine cryptocurrencies by focusing on specific algorithms. While these machines offer unmatched performance, their high cost means miners must carefully evaluate their investments to ensure profitability. This guide introduces ASIC mining, outlining its technical foundations, potential benefits, and associated risks.

Understanding ASIC Mining Technology

Cryptocurrency mining involves validating transactions and adding them to a blockchain ledger, a fundamental operation ensuring the security and integrity of decentralized networks. To profit from mining, participants must deploy substantial computational power to maximize output while minimizing costs.

Types of Crypto Mining

Various hardware solutions are present for crypto mining:

- CPU Mining: Utilizes the Central Processing Unit of a computer. In the early days of cryptocurrencies like Bitcoin, mining was feasible with standard CPUs. However, as mining difficulty increased, CPUs became less efficient.

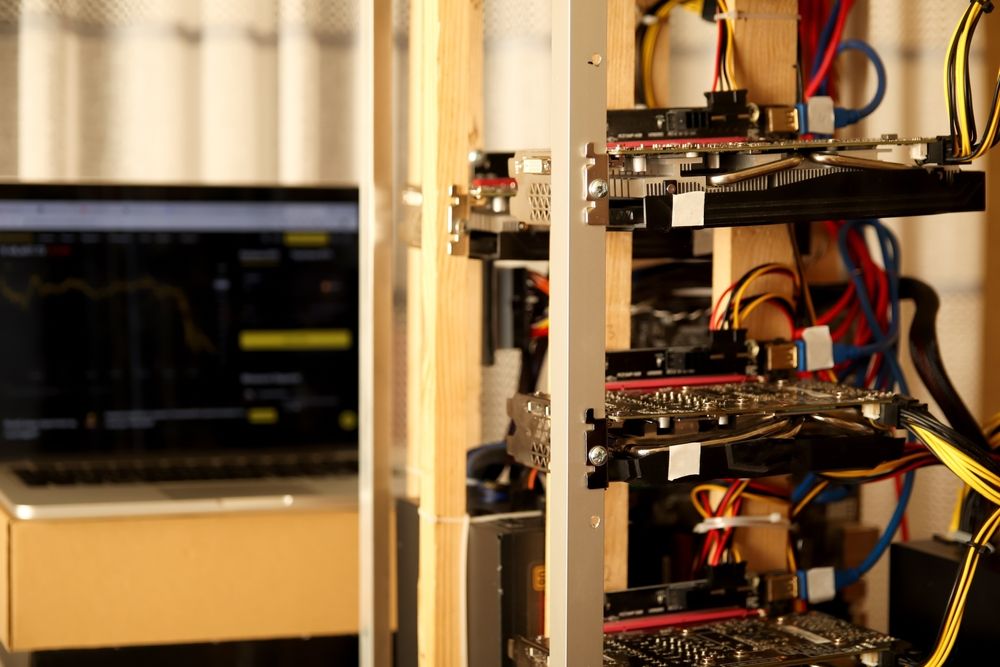

- GPU Mining: Employs Graphics Processing Units, which are more adept at handling the parallel processing required for mining. GPUs offered a significant performance boost over CPUs and became the preferred choice for many miners.

- ASIC Mining: Involves Application-Specific Integrated Circuits designed exclusively for mining. ASICs provide superior performance and efficiency compared to CPUs and GPUs, making them the dominant hardware in networks like Bitcoin.

ASIC Mining

Application-Specific Integrated Circuits (ASICs) are specialized hardware tailored for a singular function—in this case, cryptocurrency mining. Unlike versatile GPUs that handle various tasks, ASICs are engineered solely to execute mining algorithms optimally.

An ASIC Miner | Image via cryptohall24

An ASIC Miner | Image via cryptohall24The competitive nature of cryptocurrency mining necessitates the use of ASICs in specific networks. When a miner adopts ASIC technology, others must follow suit to maintain profitability, as ASICs can outperform general-purpose hardware by a significant margin.

Why Some Networks Allow CPU Mining While Others Require ASICs

The feasibility of mining with CPUs versus ASICs depends on a network's mining difficulty and algorithm design. Networks like Bitcoin have high mining difficulty, making ASICs essential for profitability. Conversely, some cryptocurrencies employ algorithms designed to be ASIC-resistant, maintaining lower difficulty levels that permit CPU or GPU mining.

Comparative Analysis of Mining Hardware

Here's a comparison of CPUs, GPUs, and ASICs across key categories:

| Category | CPU Mining | GPU Mining | ASIC Mining |

|---|---|---|---|

| Cost | Low initial investment | Moderate cost | High upfront cost |

| Efficiency | Low hash rate; high power consumption | Moderate hash rate; better efficiency | High hash rate; optimal efficiency |

| Miner Experience | User-friendly; minimal setup | Requires technical knowledge | Specialized setup; less user-friendly |

| Technical Specs | General-purpose processing | Paralwhich is lel processing capabilities | Custom-built for specific algorithms |

| Supported Networks | Bitcoin, Litecoin, Dogecoin, Zcash | Ethereum Classic, Zcash | Monero |

Here is a list of the best cryptocurrencies to mine.

Evolution of Mining Hardware

The progression of mining hardware reflects the escalating demands for efficiency and performance:

- CPU Mining: Initially, miners used standard CPUs, which were sufficient due to low network difficulty.

- GPU Mining: As competition intensified, GPUs became favorable for their superior parallel processing capabilities, offering higher hash rates.

- FPGA Mining: Field-Programmable Gate Arrays provided a middle ground with better performance than GPUs and lower power consumption.

- ASIC Mining: The quest for maximum efficiency led to the development of ASICs, which, despite their high cost and lack of versatility, deliver unparalleled performance in mining specific cryptocurrencies.

This evolution underscores the dynamic nature of crypto mining, which is driven by technological advancements and the relentless pursuit of profitability.

How Does ASIC Mining Work?

ASIC miners are vital in maintaining the integrity and security of Proof-of-Work blockchain networks. They are engineered to perform a singular function: efficiently solving the cryptographic puzzles that validate transactions and add new blocks to the blockchain.

The Role of ASIC Miners in Solving Complex Cryptographic Puzzles

The Bitcoin network deploys the SHA-256 hashing algorithm, which miners must solve to validate transactions. This process, known as Proof-of-Work (POW), involves miners competing to find a hash value that meets specific network criteria. The first miner to discover a valid hash earns the right to add a new block to the blockchain and receives the associated rewards.

ASIC miners are designed specifically to execute the SHA-256 algorithm with unparalleled efficiency. Their specialized hardware allows them to boost performance per second, which provides ASIC miners with a substantial advantage over general-purpose hardware like CPUs and GPUs, which are not optimized for this specific task.

How ASICs Achieve High Hash Rates

The term "hash rate" refers to the number of hash computations a device can perform per second. Unlike CPUs and GPUs, which are built for versatility and can handle a wide range of computing tasks, ASICs perform a single operation: executing a specific algorithm, such as SHA-256, with maximum efficiency. This focused design enables ASICs to outperform general-purpose hardware in speed and energy consumption.

For instance, a high-end GPU might deliver a hash rate measured in megahashes per second (MH/s). At the same time, a modern ASIC miner can achieve hash rates in the terahashes per second (TH/s) range, representing a thousandfold increase in performance.

This specialization boosts performance and reduces power consumption per hash, making ASIC miners the preferred choice for serious cryptocurrency mining operations.

Benefits of Using ASIC Miners

In crypto mining, efficiency, profitability and durability are names of the game. Here, we will detail a few major benefits of using ASIC miners.

Efficiency: Faster Computations and Optimized Performance

One of the most significant advantages of ASIC miners is their unparalleled efficiency. Unlike CPUs (Central Processing Units) and GPUs (Graphics Processing Units), which are designed to handle a broad range of computing tasks, ASIC miners are built specifically for one purpose: to perform the complex cryptographic calculations necessary for mining cryptocurrencies.

ASICs are custom-built to solve these calculations much faster than general-purpose hardware. For example, a high-quality ASIC miner can process millions of hashes per second, which is orders of magnitude faster than what a standard GPU can achieve. This increased computational power allows miners to solve blocks quicker, ensuring that they stay competitive in the mining process, especially in highly competitive environments like Bitcoin mining.

The design of an ASIC miner is tailored to optimize every aspect of the mining process. From the architecture of the chip to its power consumption and heat dissipation systems, everything is finely tuned to maximize the performance of the machine in its specific application. In a mining environment, this level of specialization results in a significant boost in overall processing speed and the ability to perform calculations at an efficiency rate far superior to general-purpose systems.

Profitability: Lower Power Consumption and Higher Mining Rewards

Another key benefit of ASIC miners is their enhanced profitability. Mining cryptocurrencies requires substantial computational power, which in turn demands a lot of electrical energy. One of the main challenges for miners is managing the balance between the cost of electricity and the potential rewards of mining. With ASIC miners, miners can achieve a level of power efficiency that is simply unmatched by other hardware options.

ASIC miners are designed to deliver a high hash rate while consuming far less power compared to GPUs and CPUs. This is crucial because mining operations often run 24/7, and electricity is one of the most significant operational costs. While an ASIC miner might have a higher upfront cost, its superior efficiency ensures that the ongoing costs of power consumption remain lower, making it more profitable in the long run. The specialized hardware of ASIC miners also ensures that they can mine more efficiently, solving blocks faster and increasing the likelihood of receiving mining rewards, such as transaction fees and block rewards.

In addition, because ASIC miners are so much more efficient at mining compared to general-purpose hardware, miners are able to scale their operations without facing the same level of diminishing returns. They can increase their hash rate without dramatically increasing their energy consumption, which is a key factor in maximizing profitability.

Selecting the Optimal ASIC Miner is Crucial for Maximizing Profitability. Image via Shutterstock

Selecting the Optimal ASIC Miner is Crucial for Maximizing Profitability. Image via ShutterstockDurability: Designed for Continuous Operation

Cryptocurrency mining is a demanding, round-the-clock operation that requires equipment capable of withstanding long hours of continuous use. ASIC miners are designed with this in mind. Unlike general-purpose hardware that might overheat or degrade quickly under the constant load of mining operations, ASIC miners are built to handle high-intensity work over extended periods.

ASIC miners are constructed with high-quality components and have built-in mechanisms to manage heat generation, which is a major concern in the mining industry. Many of these devices feature advanced cooling systems, such as fans, heat sinks, and in some cases, liquid cooling solutions. This ensures that the miners can operate smoothly without overheating, which could lead to system failures and expensive repairs.

Moreover, ASIC miners are often designed for easy maintenance and long-term durability. They are built to last for years, with regular firmware updates to optimize performance and keep the machines running efficiently. This makes them a more reliable and sustainable option for miners looking to establish long-term operations.

Drawbacks of ASIC Mining

While there are numerous benefits to be had, ASIC mining comes with a few drawbacks. In fact, the very factors that make ASICs so powerful also contribute to certain limitations and challenges.

High Upfront Costs for Hardware

One of the most significant barriers to entry for using ASIC miners is the high initial cost of purchasing the hardware. Unlike general-purpose computers or GPUs, which can be repurposed for other tasks if mining is no longer profitable, ASIC miners are custom-built for a single function: cryptocurrency mining. This specialization drives up the cost, with high-end models often running into the thousands of dollars.

For many individuals or small-scale miners, this steep upfront investment can be a major deterrent. While the increased efficiency of ASIC miners does allow for a potentially higher return on investment (ROI), it can take months or even years for miners to recover their initial costs depending on market conditions, such as the price of the cryptocurrency being mined or mining difficulty. Additionally, ASIC miners typically have a shorter lifespan compared to general-purpose hardware, meaning the investment may lose value faster due to technological advancements or market changes.

For those just starting in cryptocurrency mining, these high costs can make it difficult to compete with larger, more established mining operations that have already made substantial investments in ASIC mining equipment.

Limited to Specific Cryptocurrencies

Another drawback of ASIC mining is the limitation in terms of the cryptocurrencies that can be mined. ASIC miners are highly specialized machines, built to mine specific types of coins, such as Bitcoin (BTC), Litecoin (LTC), and other proof-of-work (PoW) coins. Each type of cryptocurrency requires its own unique mining algorithm, and ASIC miners are optimized for just one or a few of these algorithms.

For example, a Bitcoin ASIC miner is specifically designed to mine Bitcoin using the SHA-256 algorithm. If you were to attempt to mine a different cryptocurrency that uses a different algorithm, your ASIC miner would not be suitable. In contrast, general-purpose hardware like CPUs and GPUs can mine a wide range of cryptocurrencies, allowing miners to switch between different coins based on market trends or profitability.

This lack of flexibility can be a major disadvantage, especially when market conditions shift or if a coin undergoes a change in its underlying mining algorithm. For instance, when Ethereum transitioned from proof-of-work to proof-of-stake (a process known as "The Merge"), GPU miners were forced to find alternative coins to mine. ASIC miners, however, are tied to specific networks, and miners cannot easily shift to mining different types of digital assets if their primary cryptocurrency becomes less profitable or is no longer mineable with their hardware.

Environmental Concerns Due to High Energy Usage

One of the most significant criticisms of ASIC mining, and cryptocurrency mining in general, is its environmental impact. ASIC miners, while incredibly efficient in terms of computational power, often consume a tremendous amount of electricity. Mining operations running multiple ASIC miners can draw massive amounts of power, leading to concerns about the ecological footprint of large-scale mining farms.

The energy usage of ASIC miners has been a point of contention, particularly in regions where electricity is generated from non-renewable sources such as coal or natural gas. The high power consumption contributes to increased greenhouse gas emissions, exacerbating global warming and environmental degradation.

For miners who are conscious of their environmental impact, the reliance on ASIC miners presents a dilemma. While there are efforts to move towards renewable energy sources for mining operations, such as solar or hydroelectric power, these solutions are not universally accessible. This means that many miners continue to rely on electricity from non-renewable sources, further increasing the environmental burden.

How to Choose the Best ASIC Miner

Selecting the optimal Application-Specific Integrated Circuit (ASIC) miner is crucial for maximizing efficiency and profitability in cryptocurrency mining. Key factors to consider include:

Hash Rate

The hash rate measures a miner's computational power, indicating how many calculations it can perform per second. A higher hash rate increases the likelihood of successfully mining blocks and earning rewards. For instance, as of December 2024, a minimum hash rate of 130 TH/s is recommended to ensure competitiveness and cost-effectiveness in current market conditions.

Energy Efficiency

Energy efficiency, expressed in joules per terahash (J/TH), determines the electricity consumption relative to the miner's performance. Lower J/TH values signify better efficiency, reduced operational costs, and higher profitability. For example, the Bitcoin Miner S21 XP Hyd. Offers an efficiency of 12 J/TH, resulting in a lower bitcoin production cost than less efficient models.

Cost and Return on Investment (ROI)

Assess both the initial purchase price and the potential ROI. While high-end ASIC miners deliver superior performance, their elevated costs necessitate careful ROI analysis, considering current cryptocurrency prices, mining difficulty, electricity expenses, and fluctuating hardware costs based on region and demand. Balancing upfront costs with expected earnings is essential to ensure a profitable investment.

Investing in ASIC Mining Requires Thoroughly Evaluating Associated Costs. Image via Shutterstock

Investing in ASIC Mining Requires Thoroughly Evaluating Associated Costs. Image via ShutterstockDurability and Reliability

The longevity of an ASIC miner affects long-term profitability. Consider models known for robust construction and reliability under continuous operation. Antminer and MicroBT are brands known for durability. Selecting a reliable miner minimizes downtime and maintenance costs.

Manufacture Support and Reputation

A manufacturer's reputation and customer support quality are vital. Companies with a history of producing dependable miners and offering prompt customer service can significantly enhance the mining experience, especially when technical issues arise. Research user reviews and industry feedback can provide insights into a manufacturer's reliability. Ensure the manufacturer provides customer support in your region.

Algorithm Compatibility

Ensure the ASIC miner supports the specific cryptocurrency algorithm you intend to mine. ASIC miners are typically designed for particular algorithms (e.g., SHA-256 for Bitcoin); using an incompatible miner will result in inefficiency or inability to mine the desired cryptocurrency.

Environmental Considerations

Factors such as operating temperature, noise levels, and cooling requirements impact miner performance and suitability for your location. Some ASIC miners generate significant heat and noise, necessitating appropriate infrastructure to manage these aspects effectively. Additionally, ambient conditions like high temperatures can affect miner stability and efficiency.

Top ASIC Miners for Bitcoin Mining

- Bitmain Antminer S21 XP Hyd: This model, priced at $14,474 and expected to ship in Q4 2024, delivers a hash rate of 473 TH/s and a power efficiency of 12 J/T.

- Bitmain Antminer S19j Pro+: Known for its balanced performance and efficiency, it's a popular choice among miners.

- MicroBT WhatsMiner M50S: Offers robust performance, making it a reliable option for sustained mining operations.

Where to Buy ASIC Miners

- Manufacturer Websites: Purchasing directly from manufacturers like Bitmain ensures authenticity and access to the latest models.

- Authorized Distributors: Platforms such as ASIC Marketplace offer a variety of miners with customer support.

- Reputable Retailers: Online retailers like Amazon provide a range of ASIC miners, though verifying seller credibility is essential.

Thorough research and consideration of these factors will guide you toward an ASIC miner that aligns with your mining objectives and financial goals.

Is ASIC Mining Worth the Investment?

Investing in ASIC mining requires thoroughly evaluating associated costs, potential benefits, and market dynamics to determine its viability. Its profitability is incredibly individualistic, depending on several region-specific factors.

Cost-Benefit Analysis of ASIC Mining

Costs:

- Hardware Investment: ASIC miners entail a significant initial expenditure, with prices varying based on performance and brand.

- Supporting Infrastructure: Expenses include cooling systems, physical space, and maintenance to ensure optimal operation.

- Energy Consumption: Electricity costs are a major operational expense, heavily influenced by regional energy prices.

Benefits:

- High Efficiency: ASIC miners offer superior hash rates and energy efficiency compared to general-purpose hardware, enhancing mining profitability.

- Increased Profit Margins: Optimized performance leads to higher returns, potentially offsetting initial and operational costs.

Impact of Cryptocurrency Volatility on Profitability

Cryptocurrency prices are inherently volatile, directly affecting mining revenues. For instance, Bitcoin's price fluctuations can significantly impact miners' earnings.

- Revenue Fluctuations: Mining rewards' value varies with market prices; miners may need to liquidate more assets during downturns to cover expenses, reducing net profits.

- Market Trends: Recent surges in Bitcoin's value, such as surpassing $100,000, can enhance profitability, but reliance on market highs is speculative.

Future Expectations

- Technological Advancements: Ongoing development of more efficient ASICs promises improved performance and reduced energy consumption, potentially lowering operational costs.

- Market Valuation: The increasing adoption of cryptocurrencies suggests a potential for higher valuations, which could enhance mining profitability.

- Competitive Landscape: Large-scale mining operations benefit from economies of scale, which makes it challenging for individual miners to remain competitive.

Setting Up Your ASIC Miner

Step-by-Step Guide to Setting Up and Starting an Individual Bitcoin Mining Operation

Step 1: Assess Feasibility and Plan

- Evaluate Costs: Calculate the total cost of ASIC hardware, electricity, cooling, internet, and space.

- Tip: Use mining calculators (e.g., WhatToMine) to estimate potential returns.

- Common Mistake: Underestimating electricity costs. Always consider regional electricity tariffs.

- Location Planning: Choose a space with proper ventilation and a stable electricity supply.

- Consider regions with cheap electricity and a cooler climate to reduce cooling needs.

Step 2: Purchase Equipment

- ASIC Miner: Buy a high-efficiency ASIC miner like Bitmain Antminer S19 or MicroBT WhatsMiner M50.

- Common Mistake: Buying outdated models that might not remain competitive.

- Power Supply Unit (PSU): Ensure compatibility with your ASIC miner's power requirements.

- Cooling System: Set up adequate cooling (e.g., fans or air conditioning) to prevent overheating.

- Network Setup: A stable and fast internet connection is crucial.

Step 3: Set Up the Mining Rig

- Physical Assembly:

- Place the ASIC miner in a well-ventilated location.

- Connect the PSU to the miner and a power outlet.

- Use ethernet cables to connect the miner to your internet router.

- Cooling and Noise Control:

- Ensure that cooling systems are operational.

- Common Mistake: Neglecting noise levels. ASIC miners can be loud, so noise-dampening setups may be needed.

Step 4: Install Mining Software

- Select Mining Software: Choose software compatible with your ASIC miner, such as CGMiner or BFGMiner.

- Common Mistake: Using incompatible or unverified software. Always download from official sources.

- Configuration:

- Enter your Bitcoin wallet address in the software to receive payouts.

- Configure the software with your mining pool credentials.

Step 5: Join a Mining Pool

- Select a Pool: Popular options include F2Pool, Antpool, and Slush Pool.

- Tip: Compare pool fees, payout methods, and reputation.

- Connect to the Pool: Input the pool's server details and your credentials in the mining software.

Step 6: Start Mining

- Run the Miner: Power on the ASIC miner and start the mining software.

- Monitor Performance: Use the software’s dashboard to track hash rate, power consumption, and payouts.

Step 7: Maintain and Troubleshoot

- Routine Maintenance: Clean dust from the miner and ensure fans are working efficiently.

- Common Issues and Fixes:

- Overheating: Improve cooling or reduce miner workload.

- Network Disruptions: Restart your router and ensure stable internet.

- Low Hash Rate: Check software configurations and ensure the miner operates correctly.

Technical Skills Needed

- Hardware Knowledge: Ability to assemble and troubleshoot basic computer hardware.

- Networking: Understanding of IP settings and router configurations.

- Mining Software: Familiarity with mining software installation and configuration.

- Basic Electrical Safety: Awareness of safe electrical connections and load management.

Step 8: Optimize Operations

- Monitor ROI: Regularly calculate profitability considering electricity costs and Bitcoin price.

- Upgrade Hardware: Invest in newer ASIC models to stay competitive as technology advances.

Step 9: Avoid Common Mistakes

- Skipping Feasibility Checks: Overestimating profitability without considering costs.

- Inadequate Cooling: Neglecting proper airflow, leading to overheating and hardware damage.

- Misconfigurations: Incorrect wallet or pool details can result in lost payouts.

Following these detailed steps and avoiding common pitfalls, you can successfully establish and maintain a profitable individual Bitcoin mining operation.

Risks and Challenges of ASIC Mining

While ASIC mining offers the potential for substantial rewards, it comes with significant risks and challenges that miners must carefully evaluate.

Market Risks

- Hardware Obsolescence:

- The rapid pace of technological advancements can render ASIC miners obsolete within a few years.

- Newer, more efficient miners often outperform older models, reducing their profitability and resale value.

- Mitigation: Regularly monitor industry trends and plan for hardware upgrades.

- Cryptocurrency Price Volatility:

- Mining profitability is directly tied to highly volatile cryptocurrency prices.

- A sudden drop in Bitcoin’s price can make mining unprofitable, as operational costs may exceed mining rewards.

- Mitigation: Maintain a financial buffer to sustain operations during market downturns.

Regulatory Challenges

- Legal Restrictions:

- Some countries have imposed strict regulations or outright bans on cryptocurrency mining due to concerns over energy consumption and environmental impact (e.g., China’s mining crackdown).

- Mitigation: Research local regulations before setting up a mining operation and consider relocating to mining-friendly regions.

- Tax Compliance:

- Mining income is often subject to taxation, which varies significantly across jurisdictions.

- Failure to comply with tax laws can lead to penalties or legal consequences.

- Mitigation: Consult with a tax professional to understand reporting requirements and optimize tax strategies.

Security Threats

- Attacks on Mining Farms:

- Mining farms are attractive targets for hackers seeking to disrupt operations or steal cryptocurrencies.

- Physical theft of ASIC hardware is another risk, particularly in large-scale operations.

- Mitigation: Invest in robust physical and cybersecurity measures, including surveillance systems and firewalls.

- Distributed Denial-of-Service (DDoS) Attacks:

- Mining pools and farms may be targeted by DDoS attacks, disrupting operations and reducing profitability.

- Mitigation: Work with a reliable internet service provider and implement DDoS protection measures.

Operational Challenges

- High Energy Costs:

- The electricity consumption of ASIC miners is substantial, and costs vary depending on location.

- Mitigation: Opt for regions with low electricity rates or explore renewable energy sources.

- Cooling and Maintenance:

- Overheating and wear-and-tear can lead to frequent maintenance and downtime.

- Mitigation: Ensure proper cooling systems and schedule regular maintenance checks.

- Competition:

- Mining is highly competitive, with large-scale farms often dominating the network hash rate.

- Mitigation: Evaluate the scalability of operations and explore niche cryptocurrencies with lower competition.

Closing Thoughts

ASIC mining represents a fascinating intersection of technology, economics, and strategy within the cryptocurrency industry. Throughout this guide, we’ve explored the essential components of mining operations, from understanding the technology behind ASIC miners to assessing costs, profitability, and risks.

Key insights include:

- Efficiency and Profitability: ASIC miners are unparalleled in executing specific algorithms efficiently, making them a staple in competitive mining environments like Bitcoin.

- Challenges and Risks: From high initial costs and regulatory uncertainty to security threats and market volatility, mining requires careful planning and risk management.

- Predictability: Despite its complexities, mining offers a predictable framework for calculating potential returns based on variables like hash rate, power costs, and network difficulty.

The current surge in demand for cryptocurrency, driven by late 2024’s bullish market and increasing adoption, has renewed interest in mining as an investment opportunity. With Bitcoin and other cryptocurrencies breaking new price ceilings, the incentives for participating in mining have never been more substantial. This latest bull run has reignited conversations about the sustainability of mining practices and the role of individual miners versus large-scale operations in securing the network.

While ASIC mining demands significant time, money, and technical expertise, it remains an attractive proposition for those willing to conduct thorough due diligence.