Crypto trading used to mean one thing: coins, tokens, and a handful of major perpetuals. Over time, exchanges started stretching into new territory, first with more derivatives, then with structured products, then with assets that look a lot like traditional finance. Bitget Stock Futures sit in that third category. They take a familiar crypto derivatives wrapper and point it at U.S. equities.

Bitget Stock Futures are USDT-margined perpetual futures contracts designed to give traders synthetic, leveraged exposure to U.S. stocks through tokenized indices. Traders do not own shares. There is no brokerage account involved. Instead, users trade perpetual contracts where the underlying reference is a composite index built from multiple tokenized stock assets that track the same publicly listed company. USDT functions as the quote currency and the settlement currency, so the entire experience stays inside a crypto-native account system.

What you are really getting here is a bridge. On one side, U.S. equities and the news cycle that moves them, earnings, macro data, and sector rotations. On the other side, perpetual futures mechanics, funding, mark price, margin ratio, liquidation, and the order types crypto traders already know. Bitget’s framing places this under its “Universal Exchange” direction, meaning a single venue where crypto-native and traditional-style markets are accessed through the same collateral and interface.

This piece breaks down the product in plain terms. You will see how the underlying index is built, how pricing works, what contract specs matter, how trading hours change the risk profile, where fees fit in, and what traders should actually watch before they put on size. The tone stays neutral because this is a derivatives product. It rewards clarity, not hype.

Before we go any further, understand what crypto futures trading is and how it really works.

From Tokenized Stocks to Stock Futures

Tokenized stocks and stock tokens are typically designed to mirror the price of an underlying listed company. They exist as tradeable instruments on crypto venues and are funded with crypto collateral. They look like “stocks on a CEX,” but they are not shares.

Bitget’s own framing is consistent with the standard market reality: Tokenized stock products do not grant voting rights, do not pay dividends, and do not provide legal ownership of the underlying equity. They are synthetic exposure instruments. The trader is taking price risk, not shareholder status.

This distinction matters because it sets expectations. If you are trading exposure, then your primary concerns become price tracking, liquidity, and execution quality. You are not evaluating corporate actions from an ownership perspective. You are considering how the instrument responds to price changes in the underlying stock, how quickly it reprices, and how it behaves in volatile windows.

How Bitget Extended This Model

Bitget supported stock token exposure as a way to access U.S. equities through crypto collateral. The next logical layer was derivatives. That is where stock futures come in.

Bitget Stock Futures extends the tokenized equity idea in two ways:

- First, they move from spot-style trading to perpetual futures. That introduces leverage, shorting, and funding mechanics.

- Second, they move from single-token dependency to composite indices. Instead of tying the contract to one token or one issuer, Bitget bases the underlying on an index that aggregates multiple tokenized stock assets that track the same company.

This structure fits Bitget’s larger “Universal Exchange” push, which aims to consolidate multiple asset classes into a USDT-based derivatives environment. For a trader, the practical implication is simple. You are trading a perpetual contract that behaves like crypto perps, but its reference price comes from a tokenized stock index.

What Exactly Are Bitget Stock Futures?

Bitget's Perpetual Futures are Based on Tokenized Real-World Asset (Stock) Indices. Image via Bitget

Bitget's Perpetual Futures are Based on Tokenized Real-World Asset (Stock) Indices. Image via BitgetBitget Stock Futures are USDT-margined perpetual contracts that have no expiry date, are settled in USDT, and their profit and loss are denominated in USDT. Margin is posted in USDT. The lifecycle is also the same as a standard USDT-M perpetual futures contract.

A Perpetual Futures Contract, Not a Share Substitute

The key difference lies in the underlying reference. In crypto perps, the underlying is usually one spot market price for BTC, ETH, or another coin, often sourced from multiple exchanges. In Bitget Stock Futures, the underlying is a tokenized stock index.

So, when you trade a pair like AAPL/USDT or NVDA/USDT, you are not trading a regulated stock future, and you are not selling a single token. You are trading a perpetual contract whose reference price is an index built from multiple tokenized representations of the same stock.

Why Bitget Uses Composite Indices

The composite design is a response to the reality of tokenized equity markets. Tokenized stock liquidity can be fragmented across issuers and platforms. If an exchange tied a stock futures contract to one token, price quality could deteriorate during low-liquidity periods or during sudden issuer-specific disruptions.

Bitget’s approach is to derive a composite reference price by sourcing token prices from multiple issuing platforms and exchanges. Bitget can add or remove components based on measurable market conditions such as liquidity and trading activity. Weightings can be adjusted and disclosed over time. This is similar in spirit to how major crypto derivatives platforms compute index prices by aggregating spot exchange feeds.

The intended benefit is a reference price that is less sensitive to single-source distortion.

What Traders Are Actually Betting On

A trader opening a long on NVDA/USDT is betting that the composite tokenized Nvidia index will rise relative to their entry, after costs. A trader opening a short is betting the index will fall. The contract value tracks that index, while the account mechanics are driven by USDT margin, mark price, and funding. This is why the product feels crypto-native even though the reference is equity-linked.

If you're totally new to crypto trading, then take a look at our guide before you decide to explore any platform for crypto trading.

How the Underlying Index Works

Bitget's Futures Index Refers The Price of Tokenized Stocks. Image via Bitget

Bitget's Futures Index Refers The Price of Tokenized Stocks. Image via BitgetIf you want to trade this product responsibly, the index is the engine. Bitget sources token prices from multiple issuing platforms and exchanges. The platform can dynamically add or remove components depending on liquidity, trading activity, and other measurable conditions. The index is intended to serve as a broad reference price for “tokenized Apple” or “tokenized Nvidia,” rather than a single, narrow venue.

This design echoes how crypto indices are built. Perpetual futures indices often use several large spot exchanges to compute an index, then apply additional filters to reduce manipulation risk. The principle is the same: diversify feeds so one distorted venue does not dominate the reference price.

Weighting Logic and Adjustments

Bitget states that index components can be weighted according to factors such as market share, liquidity, and trading volume. That means the index is not necessarily an equal-weight average of every token source. More liquid, more actively traded components can carry greater influence. From a trader’s perspective, weighting matters because it changes which venues influence the mark price most. In a normal crypto perp, this is why traders monitor which spot exchanges feed the index and how the index responds to volatility spikes.

Bitget may adjust index weightings from time to time and disclose those updates. Traders should treat index documentation as part of the product spec, not as background reading.

Mark Price, P&L, and Liquidation Inputs

The composite index price is used as the mark price reference for unrealized P&L and liquidation calculations. That is a big deal.

In leveraged derivatives, liquidation is usually driven by the mark price, not the last traded price. Mark price reduces liquidation triggers from transient wicks and shallow order book prints. In Bitget Stock Futures, the mark price is anchored to the composite index, not to one exchange’s token.

That means:

- Unrealized P&L is marked against index-based pricing.

- Margin ratio and liquidation thresholds react to index movement.

- Funding mechanics use the relationship between the contract price and the index reference.

Funding as the Anchor Mechanism

Perpetual futures need a mechanism to keep the contract price close to the underlying reference. That mechanism is funding.

The funding rate is influenced by the difference between the price of perpetual futures and the spot price. This fee is paid between investors holding long and short positions. In a bullish market, the funding rate is positive and tends to increase over time, meaning that long traders pay the fee to short traders. Conversely, in a bearish market, the funding rate is negative, and short traders pay the fee to long traders. It's important to note that this fee is not charged by the exchange; instead, it is exchanged directly between traders to help align trading prices with the spot index. The direction of the funding rate, whether positive or negative, determines which group pays the fee.

Typically, when the funding rate is positive, it signals a bullish trend, and long positions will pay the funding fee to short positions. In contrast, when the funding rate is negative, indicating a bearish trend, short positions will pay the funding fee to long positions.

Funding fees on Bitget are updated every eight hours at 8:00 AM, 4:00 PM, and 12:00 AM (UTC+8). Traders who hold positions at these times will either pay or receive a funding fee. Bitget calculates these fees continuously to facilitate smooth trading, though there can be slight delays in fee collection and payment due to ongoing trades. For example, if a trader opens or closes a position at 07:00:05, they may still be subject to the funding rate. Therefore, it's essential to be aware of your trading timing.

Core Contract Specifications

Looking Inside the USDT-Margined Perpetual Contracts. Image via Metana.io

Looking Inside the USDT-Margined Perpetual Contracts. Image via Metana.ioOnce you understand the index and pricing, the contract specs become meaningful instead of decorative.

Contract Type and Settlement

Bitget’s U.S. stock futures are USDT-margined perpetual contracts. They are typically denoted as AAPL/USDT, TSLA/USDT, NVDA/USDT, META/USDT, and other similar pairs.

Key settlement facts:

- Margin is posted in USDT.

- P&L is in USDT.

- Settlement is in USDT.

- There is no expiry date.

This is important because it means your entire risk and performance are measured in USDT terms.

Leverage limits

Bitget supports up to 25x leverage on many U.S. stock futures pairs. This is notably lower than the maximum leverage on major crypto perps, which can reach far higher levels on some venues and pairs. The lower cap reflects the product’s profile and the fact that the reference market is equity-linked.

For traders, the headline leverage number is less important than the liquidation distance it implies. 25x leverage means a small adverse move can wipe out margin if position sizing is aggressive. Even “small” equity moves can be large in a leveraged context, especially around earnings.

Isolated Margin Mode Only

Bitget stock futures can currently be traded only in isolated margin mode. That means each position’s margin is ring-fenced. Margin allocated to one position is not shared with another position.

This matters for risk control. An isolated margin reduces the chance that one position’s drawdown consumes your entire futures wallet. It also means you must actively manage margin per position, rather than relying on a cross pool to absorb fluctuations.

If you come from cross-margin crypto perps, this is an adjustment. Your margin allocation becomes part of your strategy.

Funding Intervals and Mechanics

Funding is charged periodically, commonly every four hours. The rate can be positive or negative. The actual behavior depends on the relationship between the futures price and the underlying index.

Funding is not a fee in the traditional sense. It is a transfer between longs and shorts. That said, for an individual trader, it behaves like a cost or a credit depending on the position direction and funding sign. If you plan to hold positions beyond short intraday windows, funding becomes a real variable in expected performance.

Order Types and Control Tools

Bitget’s futures interface supports standard order types used in crypto derivatives, including limit, market, and trigger orders. Traders can set take-profit and stop-loss parameters when placing orders or adjust them later.

A futures product is only as usable as its control tools. In practice, traders want:

- Fast order placement

- Reliable stop triggers

- Clear liquidation price display

- Real-time margin ratio

- Transparent mark price

Bitget’s interface is built to resemble standard futures workflows, so the learning curve is more about the underlying market behavior than the UI.

Trading Hours, Holidays, and Suspensions

Bitget Stock Futures Run On A 24/5 Schedule. Image via Freepik

Bitget Stock Futures Run On A 24/5 Schedule. Image via FreepikThis is where many crypto-native traders get caught out because they assume 24/7 behavior. Bitget’s stock futures trade on a 24/5 schedule. They close on weekends and on specific public holidays that broadly align with U.S. market closures. On normal weekdays, trading runs continuously. This gives global traders access across time zones, including outside U.S. cash market hours. That can be valuable when major news breaks after the closing bell or before the opening bell.

What Changes When Trading is Suspended

During designated suspension windows, Bitget typically:

- Freezes the index and mark prices

- Suspends funding

- Blocks new order placements

- Allows cancellation of existing unfilled orders in many cases

- Does not execute liquidations during the suspension window

The most important implication, however, is gap risk. The underlying reference market can move while the futures market is closed. When trading resumes, the index and contract price may adjust quickly, leaving traders exposed to jumps that cannot be managed in real time.

Practical risk planning around closures

If you hold positions through a closure, you are accepting the possibility of a jump on reopen. This is not automatically bad. It is simply a different risk profile.

A practical way to think about it:

- Intraday traders may prefer to flatten positions before closure windows.

- Swing traders may hold, but they usually reduce leverage and increase margin buffers.

- Event traders may choose to hold if their view is tied to a scheduled catalyst, but they should treat reopening behavior as part of the plan.

A few context-based risk habits traders often adopt around closures:

- Reduce leverage before weekends if your position is sensitive to headlines.

- Add margin if the liquidation distance is tight.

- Avoid relying on tight stops right before a suspension, because stops cannot protect you during a closed window.

Supported U.S. Stock Futures

Perpetual Pairs Extend to Companies Like Alphabet, Apple and Amazon. Image via Shutterstock

Perpetual Pairs Extend to Companies Like Alphabet, Apple and Amazon. Image via ShutterstockWith mechanics clear, the next question is what you can actually trade. Bitget launched stock futures with high-profile U.S. equities such as Apple, Alphabet, Amazon, Meta, McDonald’s, Tesla, Nvidia, and Circle-related instruments. The exchange has expanded to at least 25 U.S. stock perpetual futures pairs, with many supporting up to 25x leverage.

The selection pattern is straightforward. These are liquid, widely followed stocks that tend to dominate retail attention and headlines. Mega-cap technology, AI-linked leaders, major consumer brands, and other high-volume names typically lead the list.

Why Liquidity and Attention Matter

A derivatives product needs volume. Even with a robust index, contract usability depends on execution quality.

Liquid markets tend to offer:

- Tighter spreads

- Less slippage

- More stable funding behavior

- More predictable risk around liquidations

Bitget’s focus on prominent equities is consistent with building reliable markets early.

Listing updates over time

Bitget has indicated that supported stock futures and index components may be updated as market conditions and issuer coverage evolve. Traders should treat the available list as a living set rather than a fixed roster.

Bitget Stock Futures vs Traditional U.S. Stock Futures

Bitget Stock Futures vs Traditional U.S. Stock Futures. Image via Bitget

Bitget Stock Futures vs Traditional U.S. Stock Futures. Image via BitgetTraditional U.S. stock or equity index futures are exchange-listed contracts traded on regulated venues such as CME or ICE. They operate under regulatory oversight, use clearinghouses, and have standardized contract specifications. Access typically requires a brokerage account, margin approval, and compliance checks.

Bitget stock futures are synthetic derivatives settled in USDT. They reference tokenized indices rather than regulated cash equities or official equity index futures. They are governed by Bitget’s platform rules and terms of service, and access can vary by jurisdiction. This does not automatically make them “better” or “worse.” It makes them different. They prioritize accessibility and crypto-native workflows, while trading off the regulatory infrastructure and protections associated with traditional futures venues.

A detailed comparison can help traders understand what they are trading and what they are not.

Side-by-Side Overview

| Dimension | Bitget Stock Futures | Traditional U.S. Stock Futures |

| Underlying | Composite index of tokenized stock assets | Regulated stock or equity index |

| Settlement | USDT cash settlement | Fiat cash or physical settlement |

| Access | Crypto exchange account, USDT collateral | Brokerage account, approvals |

| Trading hours | 24/5 with closures | Exchange-defined sessions |

| Leverage profile | Up to 25x on many pairs | Margin-based, often lower |

| Regulation | Platform governance and restrictions | Regulated market infrastructure |

Stock Futures vs Standard Crypto Perpetuals on Bitget

Stock Futures and Standard Crypto Perpetuals on Bitget Differ In a Few Key Areas. Image via Shutterstock

Stock Futures and Standard Crypto Perpetuals on Bitget Differ In a Few Key Areas. Image via ShutterstockEven if you never touch traditional markets, you still need to understand the difference between these and Bitget’s normal crypto perps.

The Familiar Parts

Bitget Stock Futures use the same broad perpetual futures logic crypto traders already know:

- USDT margin

- Perpetual contracts with no expiry

- Funding to align prices

- Mark price for P&L and liquidations

- Standard order types

If you have traded BTC/USDT or ETH/USDT perps before, the workflow will feel familiar.

The Parts that Change Your Behavior

The key differences stem from the underlying market’s rhythm and the product constraints:

- Trading is 24/5, not 24/7.

- Leverage caps are lower than major crypto perps.

- Isolated margin only.

- Event risk is more equity-driven, including earnings, guidance, and macro releases.

A trader who tries to run their usual crypto perp playbook without adjusting for closures and equity catalysts can get caught on the wrong side of a gap or a volatility spike.

A Simple Mental Model

Crypto perps often trade around crypto-native catalysts. Stock futures trade around equity-native catalysts, but with crypto perp mechanics. That hybrid nature is the whole point, and it is also the main risk.

Fees, Discounts, and Stock Token Promotions

Bitget Recently Announced 90% Cut on It's Trading Fees. Image via Shutterstock

Bitget Recently Announced 90% Cut on It's Trading Fees. Image via ShutterstockBitget imposes two types of transaction fees on futures trades: maker fees and taker fees. The specific rate varies depending on the type of futures contract, perpetual or delivery.

A maker provides liquidity by placing orders and typically pays a lower fee. In contrast, a taker removes liquidity by filling orders and generally pays a higher fee. Below are the standard fee rates for both types of futures (using USDT-margined perpetual futures as an example). Please note that actual rates may vary based on official announcements.

Perpetual futures:

- Maker fee: 0.02%

- Taker fee: 0.06%

Delivery futures

- Maker fee: 0.015%

- Taker fee: 0.05%

It is available to regular and VIP users alike. Bitget has highlighted this promotion as part of its push to increase activity in the stock futures segment, particularly around earnings seasons when volatility and trading volume tend to spike. The exchange recently launched a limited-time campaign cutting stock futures trading fees by 90%, reducing the effective rate on all stock futures pairs to 0.0065% per trade.

Fee reductions matter most for traders who:

- Trade frequently

- Run tight risk limits where costs eat edge

- Use market orders often

- Hedge and rebalance regularly

A low-fee environment makes it easier for active strategies to survive.

Stock Token Promotions and the Broader Fee Narrative

Alongside stock futures campaigns, Bitget also promoted zero-fee trading on over 100 stock tokens for a limited time and highlighted longer-term “0-gas” trading for stock tokens.

This is consistent with the idea that Bitget wants users to treat tokenized equities as a native part of the platform, not as a side feature. Spot-style equity exposure and derivative-style equity exposure can coexist, with USDT as the common denominator.

How to Start Trading Bitget Stock Futures

Signup, Setup Your Account, Fund Your Wallet And Start Trading on Bitget. Image via Bitget

Signup, Setup Your Account, Fund Your Wallet And Start Trading on Bitget. Image via BitgetStep 1: Account and Security Setup

Before you trade futures, your account security & setup are part of your risk management.

The typical setup includes:

- Completing identity verification, if required in your region

- Enabling two-factor authentication

- Using anti-phishing codes where available

- Setting withdrawal protections, like whitelists, if you use them

Futures trading can be fast-moving, and you do not want account risk layered on top of market risk. Always be cautious of common cryptocurrency scams and stay aware of them.

Step 2: Funding the futures wallet

Bitget stock futures are USDT-margined. That means you need USDT in your futures wallet.

The usual flow:

- Deposit USDT or deposit another supported asset

- Convert if needed

- Transfer to the USDT-M futures wallet

Traders should be conscious of how much they transfer. An isolated margin reduces spillover, but your futures wallet is still the base pool you draw from when allocating position margin.

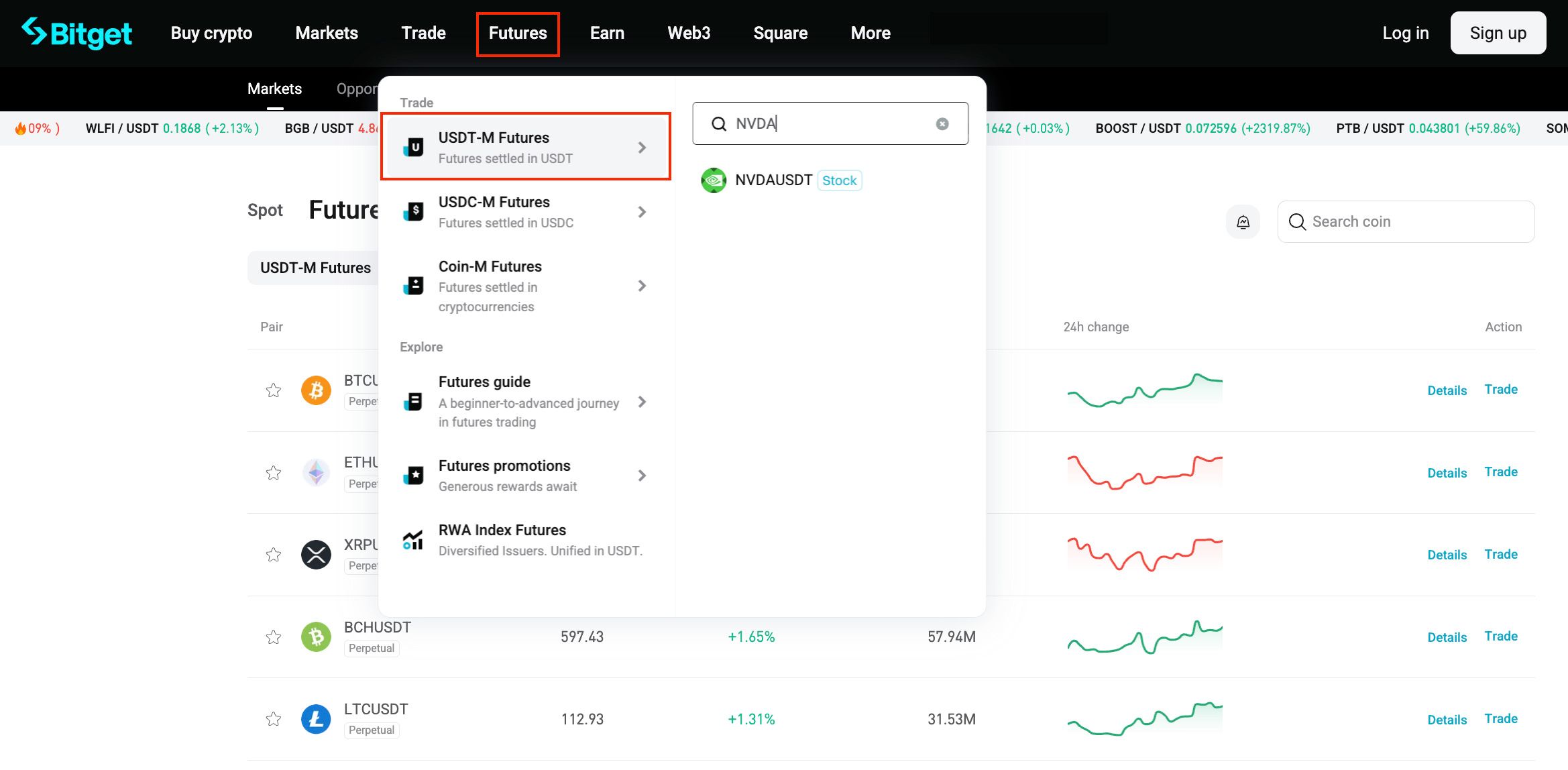

Step 3: Finding the Stock Futures Markets

On the Bitget web or app interface, users go to the Futures section and choose the Stocks or Stock Futures tab. There, pairs like TSLA/USDT or NVDA/USDT appear with price, funding, and other contract details.

- This is also where traders should check:

- Current funding rate

- Mark price behavior

- Leverage limits for that pair

- Any trading hour notes or holiday schedules

Step 4: Configuring Leverage and Isolated Margin

Once you select a contract, you choose leverage and confirm isolated margin mode. Since stock futures are isolated, the main decision is how much margin to allocate to that position.

A simple risk planning rule many futures traders use is to decide liquidation distance first, then choose leverage and size that produces that distance. The reverse approach, max leverage first, usually ends badly.

Step 5: Placing orders and setting exits

Bitget supports standard order types such as limit, market, and trigger orders. Traders can set stop-loss and take-profit levels either at order creation or after entry.

When placing exits, the context matters. Equity-linked markets can move sharply around scheduled events. Stops need room. Tight stops can become market orders in volatility. Wide stops need a smaller size. You cannot escape the trade-off. You just choose which side of it you can tolerate.

Who Are Bitget Stock Futures For?

Bitget stock futures are primarily intended for experienced and sophisticated traders who need leveraged exposure to global equity markets alongside their crypto assets. They are also used by traders who want to short the market or hedge their existing spot positions against potential downturns, using a single USDT-based account.

These products are specifically designed for users comfortable with higher risks, including high volatility and the potential for liquidation, and who do not require the regulatory protections of traditional, licensed brokerage firms. Bitget's copy trading feature also makes it accessible to beginners who choose to mirror the strategies of professional traders. This product is not aimed at every crypto user. It is aimed at a specific profile.

Directional traders who want equity exposure in USDT terms

Some traders want to take views on U.S. equities but prefer a crypto derivatives environment. They want USDT settlement. They want the futures interface. They want leverage and shorting. Bitget stock futures are designed for that. The trader can express a view on an equity name through a perpetual contract, without needing a brokerage or dealing with fiat rails.

Hedgers and portfolio balancers

If a trader holds tokenized stock exposure, hedging becomes relevant. A trader can use a short stock futures position to offset downside risk. Even if the hedge is imperfect, it can reduce portfolio drawdowns during sudden equity moves.

Hedging is rarely “free.” Funding and execution costs matter. But for some traders, paying a known cost is better than absorbing an unknown drawdown.

Arbitrage and dislocation traders

Because the underlying index aggregates multiple token sources, there can be periods where tokenized stock prices diverge across venues. Traders who track dislocations may attempt to exploit differences between component prices and the futures contract’s composite reference.

This is advanced and depends on liquidity, speed, and fee structure. It is not for casual users.

The experience requirement

Because these are leveraged derivatives tied to tokenized equity markets, they are best suited to traders who understand:

- Futures mechanics

- Mark price vs last price

- Funding behavior

- Liquidation risk

- Event risk around earnings and macro releases

- Gap risk due to 24/5 trading

If those concepts are unfamiliar, the right move is to learn them before trading size.

Risks, Limitations, and Regulatory Context

Risks & Limitations of Trading on Bitget. Image via Platinum Pro

Risks & Limitations of Trading on Bitget. Image via Platinum ProCrypto futures are high-risk investments due to significant price volatility and the potential for total capital loss, particularly when using leverage. Regulatory uncertainty further contributes to market instability, making safe navigation difficult. This section should not be treated as a disclaimer. It should be treated as the product reality.

Leverage risk and speed of loss

Leverage compresses error. A small adverse move can become a large percentage loss. In equity markets, moves that seem normal can become fatal at high leverage.

This is amplified around:

- Earnings releases

- Guidance changes

- Unexpected headlines

- Macro data surprises

- Central bank decisions

If you trade equity-linked futures, you are trading the news cycle.

Index construction and component risk

Bitget’s composite index approach reduces single-source risk, but it introduces index maintenance considerations. If a component token issuer loses liquidity, faces technical issues, or experiences disruptions, the index may behave differently than expected. Bitget can adjust components and weights over time to reflect market conditions.

Traders should understand that “tracking” here is mediated through tokenized markets. It is not the same as directly referencing official equity prints.

24/5 closures and gap risk

The product does not trade 24/7. Closures create risk windows where you cannot act. Liquidations are typically not executed during suspension, but that does not remove risk. It defers it. When trading reopens, prices can gap, and P&L can jump.

Ownership and rights

These contracts do not confer legal equity ownership. There are no voting rights. No dividends. No shareholder claims. Exposure is synthetic.

Jurisdictional restrictions

Bitget notes that access can be restricted in certain jurisdictions based on local derivatives regulations. Traders need to confirm eligibility in their region and follow platform rules. The prohibited countries include:

Canada, Crimea, Donetsk, Luhansk, Cuba, Hong Kong, Iran, North Korea, Singapore, Sudan, the United States (including the following U.S. Territories: Puerto Rico, Guam, U.S. Virgin Islands, American Samoa and the Northern Mariana Islands and the following U.S. Minor Outlying Islands Baker Island, Howland Island, Jarvis Island, Johnston Atoll, Kingman Reef, Midway Islands, Navassa Island, Palmyra Atoll and Wake Island), Iraq, Libya, Yemen, Afghanistan, the Central African Republic, the Democratic Republic of the Congo, Guinea-Bissau, Haiti, Lebanon, Somalia and South Sudan.

How Market News and Earnings Affect Stock Futures

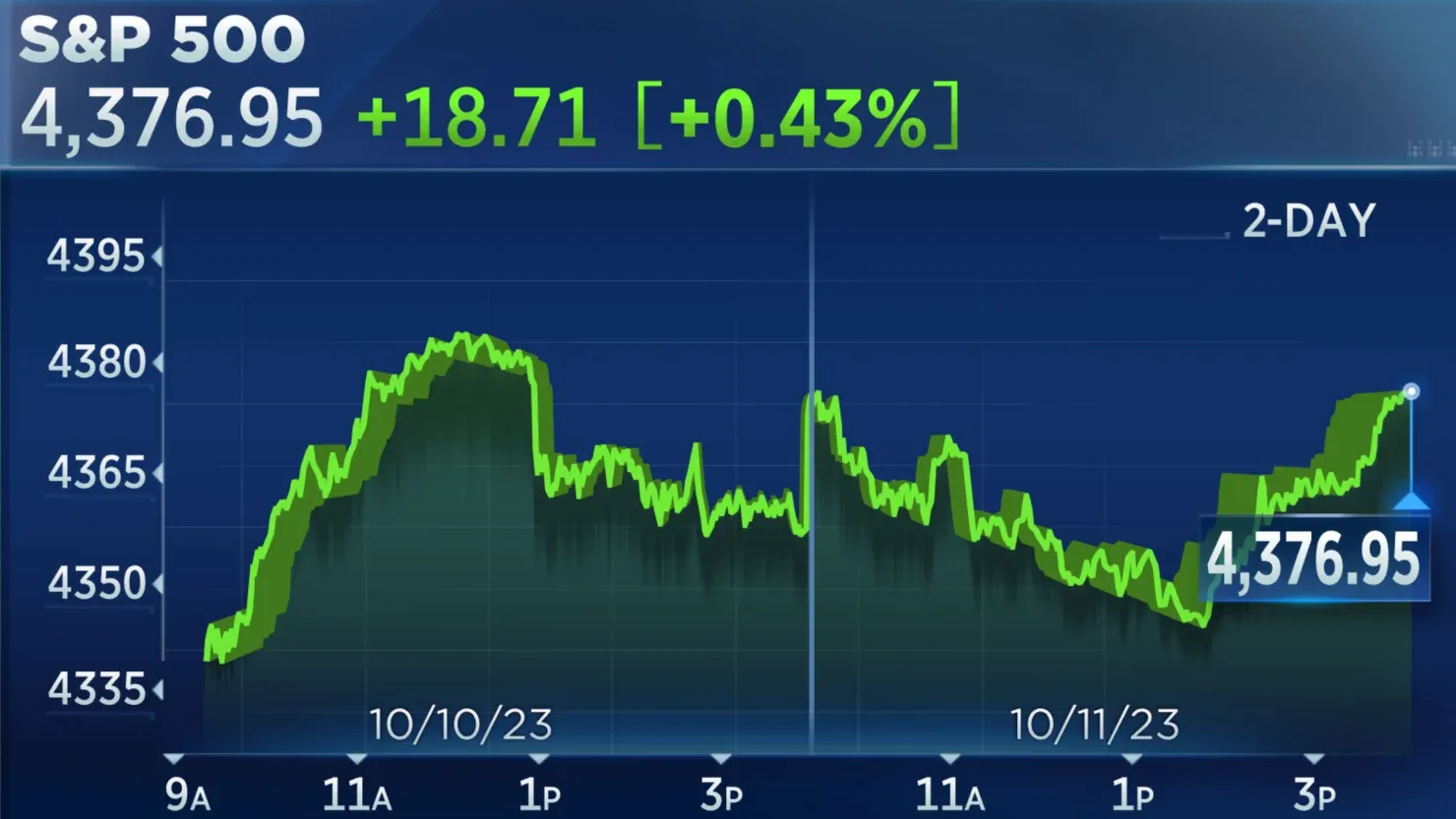

Market News and Earnings Affect Stock Futures Prices. Iamge via CNBC

Market News and Earnings Affect Stock Futures Prices. Iamge via CNBCMarket news and earnings reports have a great impact on stock futures by increasing volatility and influencing market sentiment, often leading to a high correlation with traditional equity markets, especially during risk-off periods. Crypto stocks and their futures are treated similarly to traditional risk assets by investors, meaning they react to the same macroeconomic and company-specific drivers. All equity-linked contracts live and die by catalysts.

Earnings as a volatility engine

Quarterly earnings can move major stocks sharply, especially when guidance surprises. Stock futures react to that. Liquidity and volatility often concentrate around report times, and the price can move in steps rather than smoothly. In crypto markets, traders are used to big moves around events. In equities, the difference is that many events are scheduled, and expectations are priced in through analyst forecasts, options markets, and forward guidance narratives. The reaction can be violent when reality diverges from expectation.

Macro data and policy shifts

Inflation data, interest rate decisions, and central bank communication can move equities broadly. Growth stocks and tech names are often sensitive to rate expectations. That sensitivity can translate into stock futures volatility. The 24/5 trading schedule lets global traders react outside U.S. cash market hours. That flexibility can be useful, but it also means overnight positioning risk becomes part of the normal cycle.

The practical outcome for traders

If you trade these contracts, you are trading both direction and timing. The same thesis can win or lose depending on when you enter relative to the catalyst window. That is why position sizing and margin buffers matter as much as your directional view.

Strategy Ideas and Risk Management Principles

Strategy Ideas and Risk Management Principles For Bitget Crypto Stock Futures. Image via Strawman

Strategy Ideas and Risk Management Principles For Bitget Crypto Stock Futures. Image via StrawmanCrypto stock futures strategies allow traders to profit from both rising and falling markets, with key approaches including hedging to offset spot market risks and various speculation techniques like scalping, day trading, and trend following. Our goal here is not to hand out “winning strategies.” The goal is to show how traders typically use these instruments and what they must control.

Event-driven positioning

Traders often position around earnings announcements, major product launches, or macro releases. The attraction is obvious: volatility creates opportunity. The danger is also obvious: volatility creates liquidation risk.

A practical approach many event traders use:

- Reduce leverage relative to normal intraday setups

- Size positions assuming slippage

- Use wider stops or a smaller size, rather than tight stops with a large size

- Avoid holding high leverage in known closure windows

Thematic exposure and sector rotation

Some traders use stock futures to express a theme, such as AI leadership, mega-cap tech strength, or consumer cyclicals. This can look like holding a position across multiple sessions, adjusting as funding and volatility change.

In that context, traders must monitor:

- Funding costs over time

- Liquidity conditions during off-peak hours

- Exposure concentration across correlated names

Relative-value trades

Relative-value strategies include going long one stock futures contract and shorting another, aiming to capture a spread move rather than a pure directional move.

This can reduce broad market exposure, but it adds complexity:

- Two legs to manage

- Two funding streams

- Correlation risk if both legs move together

- Execution risk if one side fills worse than the other

Hedging tokenized stock exposure

If a trader holds stock tokens, a corresponding short futures position can reduce downside exposure. The hedge ratio is rarely perfect, but it can still reduce drawdowns during sharp declines.

Core risk management habits

Risk management is not a checklist you do once. It is the method you use every time you place an order.

A few context-based habits that matter for stock futures:

- Decide liquidation distance before deciding on leverage

- Keep margin buffers larger around earnings and macro releases

- Treat weekend and holiday closures as risk events

- Track funding if you hold positions beyond intraday windows

- Avoid letting one position dominate your futures wallet exposure

Bitget’s Universal Exchange Vision and Future Outlook

Bitget’s Universal Exchange Vision. Image via Shutterstock

Bitget’s Universal Exchange Vision. Image via ShutterstockBitget frames stock futures as part of its broader “Universal Exchange” direction. The idea is to bring traditional-style assets and crypto-native derivatives into a single trading venue, unified by USDT settlement and a common interface.

Why the “One Platform” Angle Matters

For traders already operating in crypto, friction is often the biggest barrier to trading traditional assets:

- Brokerage onboarding

- Funding with fiat

- Regional restrictions

- Different market hours and interfaces

- Separate risk systems

Bitget’s model reduces those frictions by keeping everything in a CEX futures environment. You deposit USDT, choose a contract, and trade with perpetual mechanics.

The Role of Tokenized Indices in That Vision

The index structure is what makes stock futures feasible in a tokenized ecosystem. By pulling multiple token sources and weighting them, Bitget can construct a reference price that is designed to be more stable than a single issuer feed. If tokenized real-world assets continue to expand, index-based derivatives could become a common way to express exposure while managing fragmented liquidity.

The constraint that will not go away

Regulatory developments around tokenized securities and crypto derivatives will remain a key factor. Availability can vary by jurisdiction. Product terms can change. Traders should treat platform updates and documentation as part of their ongoing research.

Are Bitget Stock Futures Worth Exploring?

Bitget Stock Futures provide a means to trade the price action of leading U.S. stocks through perpetual, USDT-settled contracts based on tokenized indices. For traders already fluent in crypto futures mechanics, the product is conceptually familiar. You are still working with margin, funding, mark price, and liquidation discipline. The difference is that the catalyst engine is equity-driven, and the trading schedule is 24/5.

Bitget has also positioned fees as a major adoption lever through campaigns like the limited-time 90% fee reduction down to 0.0065% per trade on stock futures pairs. Lower fees can significantly alter the viability of active strategies, particularly for frequent traders and hedgers.

At the same time, these contracts remain leveraged derivatives without equity ownership rights or the regulatory infrastructure associated with traditional futures exchanges. They introduce additional layers of risk tied to index construction, tokenized liquidity fragmentation, and suspension windows around weekends and holidays.

For an experienced trader who wants U.S. equity exposure inside a USDT-based derivatives environment, Bitget Stock Futures can be a practical tool. For a trader who is new to futures mechanics or who treats leverage casually, this product can punish mistakes quickly. The best way to approach it is the same way you approach any derivatives market: understand the spec, respect the mechanics, size conservatively, and treat risk control as the strategy’s foundation.