In 2015, Ethereum's introduction of smart contracts laid the foundation for decentralized finance (DeFi), revolutionizing traditional financial systems by enabling trustless and permissionless transactions.

DeFi introduced various revenue-generating strategies, including:

- Yield Farming: Users provide liquidity to DeFi protocols and earn rewards, often as additional tokens.

- Liquidity Mining: Participants supply assets to liquidity pools and receive tokens as incentives, promoting platform liquidity.

- Staking: Investors lock up their cryptocurrency holdings in a protocol to support network operations, earning rewards in return.

- Restaking: Users stake tokens across multiple platforms or layers, enhancing security and earning cumulative rewards.

- Liquid Staking: Allows users to stake assets while maintaining liquidity through derivative tokens, enabling participation in other DeFi activities.

- Decentralized Lending and Borrowing: Platforms facilitate peer-to-peer lending, allowing users to earn interest by lending their assets. Users can borrow assets by providing collateral, enabling access to liquidity without traditional intermediaries.

- Fiat and Crypto-Backed Stablecoins: Stablecoins pegged to fiat currencies, or other cryptocurrencies provide stability and are used in various DeFi applications.

During the emergence of these utilities, the Web3 landscape faced several challenges:

- Fragmented Blockchain Networks: Blockchains operated in isolation with minimal value exchange, limiting interoperability.

- Concentration on Ethereum Layer 1: Most DeFi activity occurred on Ethereum's mainnet, with later adoption on other Layer 1 networks like Solana.

- Complex User Experience: DeFi platforms were primarily used by enthusiasts, featuring complicated interfaces and significant gas fees, hindering broader adoption.

- Limited Real-World Integration: Apart from stablecoins, DeFi had minimal connections to real-world assets and financial systems.

Since then, the crypto space has evolved considerably. Advancements in blockchain interoperability have led to well-connected and chain-abstracted networks. DeFi on Ethereum is transitioning to Layer 2 solutions, enhancing scalability and reducing transaction costs. New revenue strategies have emerged, leveraging these technological advancements to offer more efficient and user-friendly financial services.

This article delves into the renaissance of DeFi, often called DeFi 2.0. It explores the innovative solutions that have emerged in recent years and their implications for the future of decentralized finance.

Understanding DeFi 2.0

DeFi 2.0 builds upon the foundations of DeFi 1.0, introducing enhancements that address previous limitations and expand the decentralized finance ecosystem. Let's explore some key characteristics that define DeFi 2.0:

Cross-Chain Ecosystem

Unlike the Ethereum-centric DeFi 1.0, DeFi 2.0 embraces a cross-chain approach, operating across various Layer 1 and Layer 2 networks. This expansion enhances interoperability and user accessibility. For instance, platforms like Uniswap have deployed on multiple chains, including Ethereum and Polygon, to reach a broader audience.

Integration of Real-World Assets (RWAs)

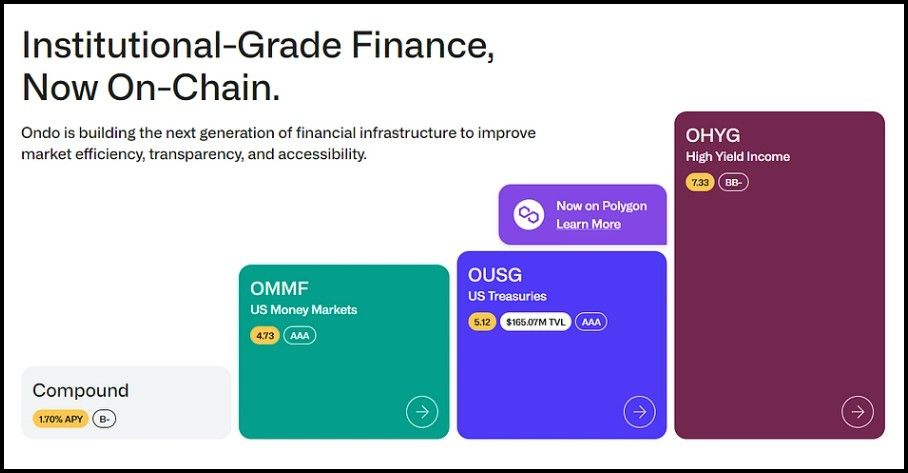

DeFi 2.0 extends beyond stablecoins to incorporate real-world assets such as bonds and real estate into the blockchain ecosystem. Ondo Finance, for example, offers tokenized U.S. Treasury notes, enabling users to invest in traditional financial instruments through decentralized platforms.

Chain Abstraction for Improved User Experience

Chain abstraction simplifies user interactions by managing complex processes behind the scenes. Users can specify their desired actions without involving themselves in underlying technicalities like gas fees. Projects like Particle and Omni are at the forefront of implementing chain abstraction, enhancing the overall user experience.

Community-Driven Governance

DeFi 2.0 emphasizes inclusive governance models that involve the broader community, not just governance token holders. This approach fosters a more democratic decision-making process, ensuring diverse voices contribute to the protocol's development and direction.

Enhanced Liquidity Solutions

Efficient liquidity management is a hallmark of DeFi 2.0. Liquidity flows seamlessly across ecosystems, providing adequate liquidity even for niche chains or projects. An example is sDAI, a synthetic asset representing DAI across multiple chains, facilitating smoother value transfer and utilization.

To illustrate the evolution from DeFi 1.0 to DeFi 2.0, here's a comparison table highlighting key differences:

| Attribute | DeFi 1.0 | DeFi 2.0 |

|---|---|---|

| Ecosystem Scope | Primarily Ethereum Layer 1 | Cross-chain, including Layer 2 solutions and various Layer 1 networks |

| Asset Integration | Limited to cryptocurrencies and stablecoins | Incorporates real-world assets like bonds and real estate |

| User Experience | Complex interfaces with high gas fees | Improved UX through chain abstraction, reducing complexity and transaction costs |

| Governance Model | Decision-making dominated by governance token holders | Community-driven governance involving a broader participant base |

| Liquidity Management | Liquidity often siloed within individual chains, leading to inefficiencies | Enhanced liquidity solutions with seamless cross-chain flow, ensuring accessibility even for niche projects |

These advancements mark a significant progression in the DeFi landscape, aiming to create a more inclusive, efficient, and user-friendly decentralized financial ecosystem.

Core Innovations in DeFi 2.0

DeFi 2.0 represents a transformative phase in decentralized finance. Building on the foundations of its predecessor, it introduces innovations that redefine how users interact with blockchain-based financial systems. These advancements are not just technological improvements; they enable greater accessibility, efficiency, and integration with the broader Web3 ecosystem. By addressing key limitations of DeFi 1.0, such as liquidity inefficiencies, user experience challenges, and limited real-world asset integration, DeFi 2.0 unlocks new possibilities for decentralized applications (DApps) and their users.

In this section, we’ll explore the groundbreaking projects that exemplify the core innovations of DeFi 2.0. These projects showcase the characteristics of this new era and highlight their significance for the evolution of Web3, paving the way for a more interconnected, scalable, and user-friendly ecosystem. Let’s dive into the innovations driving this renaissance in decentralized finance.

Improved Liquidity Mechanisms – Olympus DAO

Olympus DAO is a liquidity management project tackling fundamental challenges in DeFi related to liquidity, token price stability, and long-term value accrual. Here's an overview of the problems they're addressing and their approach:

- Liquidity Dependence on Mercenary Capital: Many DeFi projects rely on liquidity mining incentives to bootstrap liquidity. This creates "mercenary capital," where liquidity providers (LPs) earn rewards and then withdraw their liquidity once incentives dry up, leaving protocols vulnerable.

- Over-Reliance on Centralized Stablecoins: Stablecoins like USDT and USDC dominate the DeFi space, but their value is tied to centralized, fiat-backed systems. This introduces centralization risks and reliance on traditional financial institutions.

- Lack of Protocol-Owned Liquidity (POL): Most DeFi protocols do not own their liquidity and must continuously pay for it. This is unsustainable in the long term.

- Value Accrual and Sustainability: DeFi protocols often focus on short-term incentives and token distribution rather than building systems for long-term value and sustainability.

How Olympus DAO is Addressing These Problems

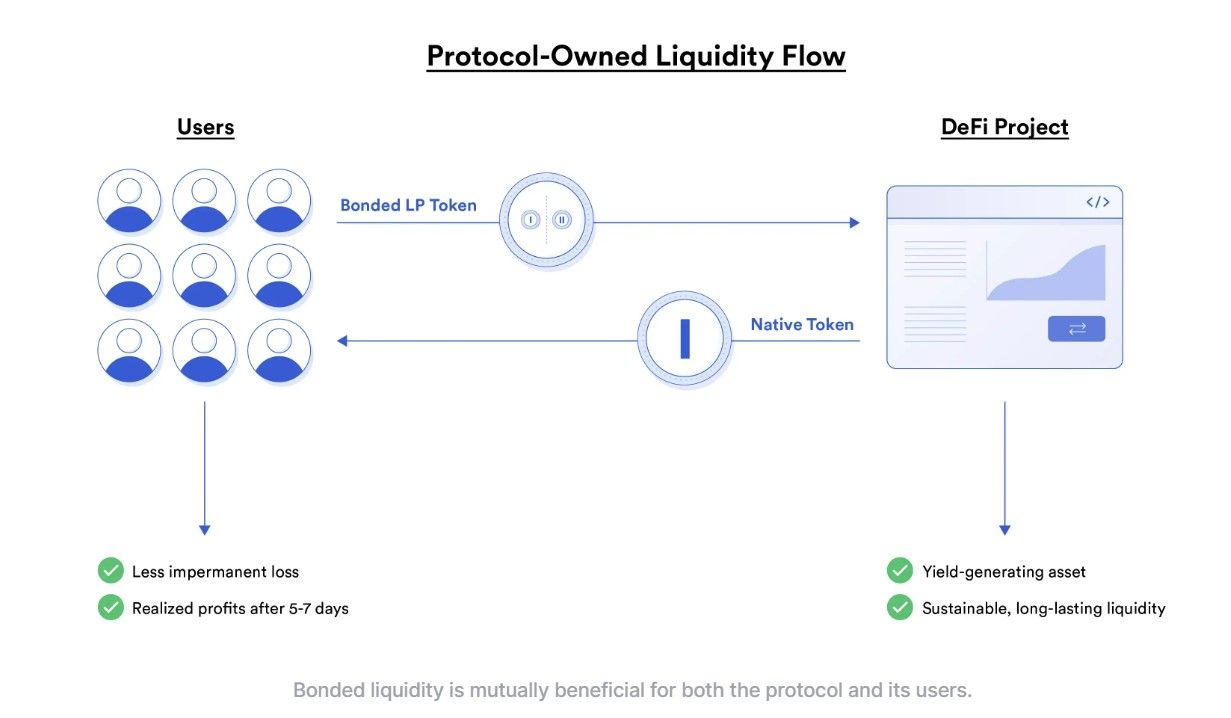

- Introduction of Protocol-Owner Liquidity (POL): The DAO uses a bonding mechanism to acquire its own liquidity. When a new project launches its token on a major DEX with a prominent token pair like ETH or USDC, users supply liquidity by locking a pair or the token to receive LP tokens.

Olympus DAO lets users sell their LP tokens for $OHM tokens at a discount, bonding the LP tokens to the protocol. The bond ensures optimum liquidity is always present in the trading pool, and the discount encourages users to sell their LP tokens. - Creating a Decentralized Reserve Currency: The $OHM token, native to Olympus DAO, is a crypto-backed currency. It is not a stablecoin but a reserve currency backed by a cocktail of crypto assets in Olympus treasury. The token aims to maintain its intrinsic value through treasury management without being tied to a specific fiat currency.

- Value-Backing Mechanism: The treasury holds assets like DAI, ETH, and LP tokens to back the value of $OHM. Each $OHM is overcollateralized, meaning the treasury holds more assets than the total circulating supply, ensuring a floor price for $OHM.

- Rebasing and Staking: Olympus DAO incentivizes long-term holding through staking. Stakers receive rebasing rewards, which increase their $OHM balance over time. This mechanism aligns with Olympus's goal of creating a store of value.

- Reducing Reliance on Centralized Stablecoins: By creating $OHM as a decentralized reserve asset, Olympus aims to reduce dependence on centralized stablecoins and create a currency native to the crypto ecosystem.

Chainlink Illustrates how Olympus DAO addresses POL

Chainlink Illustrates how Olympus DAO addresses POLThe differences between $OHM and centralized stablecoins like USDC:

| Aspect | Centralized Stablecoin (e.g., USDC) | $OHM |

|---|---|---|

| Pegged to Fiat? | Yes | No |

| Issuer | Centralized Entity (e.g., Circle) | Decentralzied Protocol |

| Backing | Fiat Reserves (centralized) | Crypto Assets (diversified & decentralized) |

| Censorship Risk | High | Low |

| Value Fluctuation | Minimal | Free-Floating |

Key Takeaways

The key takeaway of Olympus DAO is that it aims to create a sustainable, decentralized reserve currency ($OHM) while solving critical challenges in DeFi, such as dependence on mercenary capital, over-reliance on centralized stablecoins, and lack of Protocol-Owned Liquidity (POL). By owning its liquidity and backing $OHM with a diversified treasury, Olympus DAO establishes a self-sustaining and resilient financial ecosystem that prioritizes long-term stability and decentralization over short-term incentives.

Community Driven Governance

As DeFi 2.0 emerges within the Web3 ecosystem, governance structures have evolved from centralized models to decentralized autonomous organizations (DAOs), empowering communities to steer project development and decision-making. This shift has introduced several key dynamics:

1. Transition from Centralized Control to Community Ownership

In the early stages of DeFi, project decisions were often made by a select group of promoters and early stakeholders. Today, DAOs distribute governance power across the community, fostering a sense of collective ownership. For instance, MakerDAO, the organization behind the DAI stablecoin, operates as a DAO where MKR token holders participate in governance decisions, ensuring that control is decentralized and community-driven.

2. Empowering Users through Voting Mechanisms

DAOs enable users to engage directly in governance through on-chain voting, enhancing transparency and inclusivity. In MakerDAO, MKR token holders can vote on critical parameters such as stability fees and collateral types, directly influencing the protocol's operations. This participatory model ensures that those invested in the system have a say in its governance.

3. Increased Transparency and Accountability

On-chain voting and open proposal discussions inherent in DAOs promote transparency, as all actions are recorded on the blockchain. This ledger of decisions and discussions holds participants accountable and allows the community to audit processes openly. OlympusDAO, for example, utilizes on-chain governance to manage its protocol, ensuring that all governance actions are transparent and verifiable.

4. Alignment of Incentives

DAOs are structured to align the interests of participants with the long-term success of the project. Many projects implement vote-escrowed tokens (veTokens), where users lock their tokens for a specified period to gain voting rights. This mechanism encourages sustained engagement and deters short-term speculation. For instance, CurveDAO requires users to lock CRV tokens to obtain veCRV, essential for participating in governance and aligning voting power with long-term commitment.

5. Fostering Strong Communities

DAOs incentivize active community participation through bounties, rewards, and recognition, cultivating a robust and engaged user base. By rewarding contributions, DAOs like OlympusDAO encourage members to actively participate in the project's development and governance, strengthening the community's cohesion and commitment.

The evolution from centralized governance to DAO-driven models in DeFi 2.0 signifies a maturation of the ecosystem, emphasizing decentralization, transparency, and community empowerment. Projects like MakerDAO and OlympusDAO exemplify these principles, showcasing the potential of DAOs to create more resilient and inclusive financial systems.

Chain Abstraction and Cross-Chain Ecosystem

Initially, decentralized finance (DeFi) was predominantly confined to Ethereum's mainnet. Over time, the ecosystem expanded with the emergence of Layer 2 solutions and various Layer 1 blockchains like Solana, Sui, and Polygon, each cultivating its own DeFi landscape. Today, these ecosystems are interconnected through cross-chain technologies and chain abstraction, enhancing user experience and protocol efficiency.

Challenges Addressed by Chain Abstraction

Chain abstraction simplifies user interactions across multiple blockchain networks by addressing several key challenges:

- Navigating Multiple Blockchains: Previously, users had to manually switch between different networks, each with its own interface and requirements, leading to a complex and fragmented experience.

- Fragmented Liquidity and User Base: Assets and users were dispersed across various ecosystems, resulting in inefficiencies and limited access to liquidity.

- Managing Multiple Wallets and Gas Tokens: Users needed separate wallets and native tokens for transaction fees on each network, complicating asset management.

- Cross-Chain Composability: Developers faced difficulties creating decentralized applications (dApps) that could operate seamlessly across blockchains.

- Developer Efficiency: The lack of standardized tools led to redundant efforts, hindering innovation and scalability.

Role of Chain Abstraction Projects

Projects like Omni, Across, and Particle have been instrumental in implementing chain abstraction, thereby enhancing DeFi 2.0:

- Omni: Omni Network focuses on chain abstraction by providing a frontend SDK that applications can integrate, allowing users to interact with multiple Layer 2 solutions without manual network switching. This approach minimizes overhead for Layer 2 integrations and maintains user-friendly interactions.

- Particle: Particle Network offers solutions that abstract the complexities of cross-chain interactions. These solutions enable users to access decentralized applications on any chain without bridging or managing multiple gas tokens, streamlining the user experience and promoting broader adoption.

- Across: The Across Protocol facilitates efficient cross-chain value transfer, allowing users to move assets seamlessly between networks. By providing fast and cost-effective bridging solutions, Across enhances liquidity and ecosystem user engagement.

Significance in DeFi 2.0

The integration of chain abstraction in DeFi 2.0 has led to:

- Simplified User Experience: Users can interact with dApps without concerning themselves with underlying blockchain complexities, fostering greater participation.

- Unified Liquidity Pools: Assets can move freely across networks, creating more robust and accessible liquidity pools.

- Enhanced Cross-Chain Composability: Developers can build chain-agnostic applications, promoting innovation and reducing redundant development efforts.

- Improved Developer Efficiency: Standardized tools and environments enable developers to focus on creating value-added features rather than dealing with cross-chain integration challenges.

By addressing these challenges, chain abstraction projects are pivotal in advancing DeFi 2.0, contributing to a more interconnected, efficient, and user-friendly decentralized financial ecosystem.

Integration of DeFi with the Real World

Integrating real-world assets (RWAs) into decentralized finance (DeFi) is a hallmark of DeFi 2.0. This approach bridges traditional finance with blockchain technology to offer innovative investment opportunities.

Tokenization of Real-World Assets

Tokenization involves converting physical assets into digital tokens on a blockchain, enhancing accessibility and liquidity.

- Ondo Finance: It specializes in tokenizing U.S. Treasury notes, allowing investors to gain exposure to government bonds through blockchain-based tokens.

- Real Estate and Art: Platforms like Propy and Swarm facilitate the tokenization of real estate and art, enabling fractional ownership and democratizing access to high-value assets.

- Nexus Mutual: Provides coverage against risks specific to the DeFi ecosystem, such as smart contract failures and exchange hacks, enhancing investor confidence.

- Ethena Finance Issues USDe, a stablecoin that accrues interest from staked ETH. Thus, holders have a stable asset that accrues interest over time.

- Spark Protocol's sDAI: Introduces sDAI, a tokenized representation of DAI deposited in the Dai Savings Rate (DSR). Users earn interest on their holdings while maintaining liquidity, as sDAI can be transferred, staked, or used in other DeFi applications.

These integrations signify a pivotal evolution in DeFi, merging traditional financial instruments with blockchain technology to create a more inclusive and efficient financial ecosystem.

Ondo Finance Offers Tokenized Money Market Products | Image via CoinGecko

Ondo Finance Offers Tokenized Money Market Products | Image via CoinGeckoKey Takeaways

DeFi 2.0 represents a well-rounded and inclusive evolution of decentralized finance. It adits the predecessor's limitations by introducing improved liquidity mechanisms, community-driven governance, chain abstraction, and real-world asset integration. These innovations create a more interconnected and user-friendly ecosystem, bridging the gap between traditional finance and blockchain while fostering greater accessibility and scalability. By prioritizing inclusivity, efficiency, and real-world relevance, DeFi 2.0 broadens its appeal beyond crypto enthusiasts, setting the stage for mass adoption and a more sustainable decentralized economy.

Benefits and Risks of DeFi 2.0

Benefits:

- More Efficient Markets and Greater Liquidity: Enhanced liquidity mechanisms allow assets to flow freely across ecosystems, reducing inefficiencies and ensuring even niche projects have access to sufficient liquidity.

- Better User Experience and Greater Accessibility: Chain abstraction and simplified interfaces make DeFi 2.0 easier for users to navigate, broadening its appeal beyond tech-savvy enthusiasts.

- Real-World Solutions: Integration with real-world assets like tokenized bonds and real estate provides tangible financial solutions and expands the scope of DeFi applications.

- Lower Costs and More Variety of Products: Layer 2 solutions reduce transaction fees, while the multi-chain ecosystem offers a broader range of financial products tailored to diverse user needs.

- Varied and More Efficient Opportunities to Enhance Yield: Innovations like yield-bearing stablecoins and vote-escrowed tokens enable users to optimize returns flexibly and efficiently.

Risks:

- Real-World Products Are Untested and Operate in Regulatory Grey Areas: Tokenized real-world assets face untested market dynamics and regulatory scrutiny, posing legal and operational risks.

- Non-enthusiasts still Do Not Find Crypto Useful: Despite improved UX, crypto's complexity and perceived risks may deter mainstream users who see limited value in DeFi services.

- Cross-Chain Vulnerabilities: The interconnected nature of DeFi 2.0 increases the risk of exploits and cascading failures if one network or protocol is compromised.

- Governance Challenges in DAOs: Community-driven governance can be slow, fragmented, or influenced by large token holders, potentially leading to inefficiencies or misaligned incentives.

- Liquidity Risks: While liquidity is more accessible, over-reliance on cross-chain solutions and synthetic assets can create systemic risks, especially during market downturns.

Future of DeFi 2.0

DeFi 2.0 is shaping up to be a transformative force in the financial world, with innovations that not only address the limitations of its predecessor but also offer unprecedented opportunities for growth. Let’s explore the potential paths forward for DeFi 2.0 and the critical developments that will shape its future.

Integration with Traditional Finance: Bridging Decentralized and Centralized Finance

One of the most exciting prospects for DeFi 2.0 is its increasing integration with traditional finance (TradFi). While DeFi has already introduced innovations like tokenized real-world assets (RWAs) and decentralized lending, the future holds even more potential for bridging the gap between decentralized and centralized financial systems.

Tokenization of assets is a key area where DeFi 2.0 could enhance the traditional financial landscape. The integration of traditional assets, such as stocks, bonds, and real estate, on the blockchain allows for broader accessibility, fractional ownership, and more efficient trading. Projects like Ondo Finance are already working on tokenizing U.S. Treasury bonds, opening the door for retail investors to participate in government debt markets. Similarly, tokenized real estate platforms could allow individuals to invest in properties worldwide, breaking down the barriers of geographic location and high investment thresholds.

Scaling Solutions: Role of Layer 2 Protocols in Expanding DeFi Adoption

As DeFi grows, one of its most significant challenges has been scalability. Ethereum, the leading platform for decentralized applications, has faced issues with high gas fees and slow transaction times, particularly during periods of congestion. The rise of Layer 2 (L2) solutions is playing a pivotal role in scaling DeFi 2.0 and driving wider adoption.

Layer 2 protocols, such as Optimism, Arbitrum, and zk-rollups, offer solutions that allow DeFi platforms to operate more efficiently by processing transactions off the main Ethereum chain, significantly reducing fees and increasing transaction speeds. This improvement opens up DeFi to a broader audience, including users who were previously deterred by high costs and slow processing times. As Layer 2 solutions continue to evolve, we can expect them to handle increasingly complex DeFi transactions, further expanding the ecosystem's capacity.

Interoperability between Layer 1 and Layer 2 networks is another critical component of scaling. The future of DeFi 2.0 will involve a more interconnected ecosystem where users can seamlessly interact across multiple chains, without worrying about high fees or fragmented liquidity. The development of projects that facilitate cross-chain communication, like Omni and Across, will make it easier for users and developers to navigate and optimize DeFi experiences, driving deeper engagement and innovation.

Evolving Use Cases: Exploring Potential Applications Beyond Financial Services

While DeFi's primary focus has been on financial services, DeFi 2.0 is paving the way for broader applications across a variety of sectors. As the technology matures and becomes more user-friendly, we can expect to see decentralized solutions disrupting industries such as healthcare, supply chain management, and even gaming.

Healthcare could see significant benefits from blockchain-based solutions. For example, decentralized health records could give patients greater control over their medical data while ensuring privacy and security. Furthermore, tokenized insurance products could enable more customized, transparent, and efficient policies, driven by smart contracts and decentralized platforms.

Supply chain management stands to gain from the transparency, traceability, and efficiency that blockchain can offer. DeFi 2.0 could facilitate decentralized supply chains, ensuring real-time tracking of goods and automated contract execution without the need for intermediaries. This would reduce fraud, lower costs, and enhance the overall efficiency of global trade.

Final Thoughts: Unlocking the Future of Finance with DeFi 2.0

DeFi 2.0 marks a significant leap forward in the decentralized finance ecosystem, introducing key advancements like improved liquidity mechanisms, community-driven governance, chain abstraction, cross-chain ecosystems, and real-world asset integration. These innovations address many of the challenges faced by its predecessor, making DeFi more inclusive, efficient, and accessible to a broader audience. As space evolves rapidly, it holds immense potential to redefine financial systems and bridge the gap between traditional and decentralized economies.

If you're intrigued by the opportunities DeFi 2.0 offers, now is the perfect time to explore projects shaping this new era. Stay informed about the latest developments to make informed decisions and capitalize on this transformative movement.

Learn how to invest in DeFi projects and understand blockchain technology better with our in-depth guides. Begin your journey into the world of decentralized finance today!