When it comes to blockchain, speed and efficiency are everything. But what if I told you that the order of transactions in a block isn’t necessarily set in stone? What if certain participants—like miners and validators—could reshuffle transactions for their own financial gain? This is where Maximal Extractable Value (MEV) comes into play, an often misunderstood yet highly controversial mechanism that has both helped and harmed the crypto ecosystem.

First coined as Miner Extractable Value, MEV refers to the additional profit that miners (or now validators in proof-of-stake systems) can extract by reordering, including, or excluding transactions from a block. Some view it as a necessary component of market efficiency, while others see it as an invisible tax on users, making DeFi trading more expensive and unpredictable.

MEV is particularly rampant on Ethereum, where decentralized finance (DeFi) thrives. Here, sophisticated actors—known as MEV searchers—use advanced bots to detect profitable transaction patterns and execute complex strategies like front-running, sandwich attacks, and arbitrage. The result? A cutthroat environment where only the fastest and most well-resourced players stand to benefit.

But MEV isn’t exclusive to Ethereum. Any blockchain that allows public mempools and smart contract execution is vulnerable to MEV exploitation. Even with Ethereum’s shift to proof-of-stake and upgrades like EIP-1559, MEV remains a pressing issue—one that continues to shape the economics of blockchain networks.

So, is MEV a necessary evil, or can it be tamed? And most importantly—how does it affect you as a trader, investor, or validator? In this guide, we’ll break down everything you need to know about Maximal Extractable Value, from how it works to its risks and benefits for users.

What Is Maximal Extractable Value (MEV)?

At its core, Maximal Extractable Value (MEV) is the maximum amount of value that a block producer—whether a miner in proof-of-work (PoW) or a validator in proof-of-stake (PoS)—can extract by reordering, including, or excluding transactions within a block. In simple terms, MEV is the extra profit that can be made beyond standard block rewards and gas fees by manipulating transaction sequencing.

MEV vs. Miner Extractable Value vs. Priority Fees

The term MEV originally stood for Miner Extractable Value, as it was first observed in proof-of-work systems like Ethereum before its transition to proof-of-stake. Miners had the power to pick and order transactions, which allowed them to front-run trades, arbitrage price discrepancies, and extract additional value. But since Ethereum’s Merge replaced miners with validators, the term has evolved to Maximal Extractable Value, reflecting that this phenomenon is not exclusive to mining and persists in proof-of-stake networks.

While MEV may sound similar to priority fees, they serve different purposes. Priority fees (also known as tips) are extra fees users willingly pay to speed up their transactions. In contrast, MEV extraction is often involuntary—users don’t choose to have their transactions reordered, front-run, or manipulated for someone else’s gain.

How Validators and Miners Extract Value from Transactions

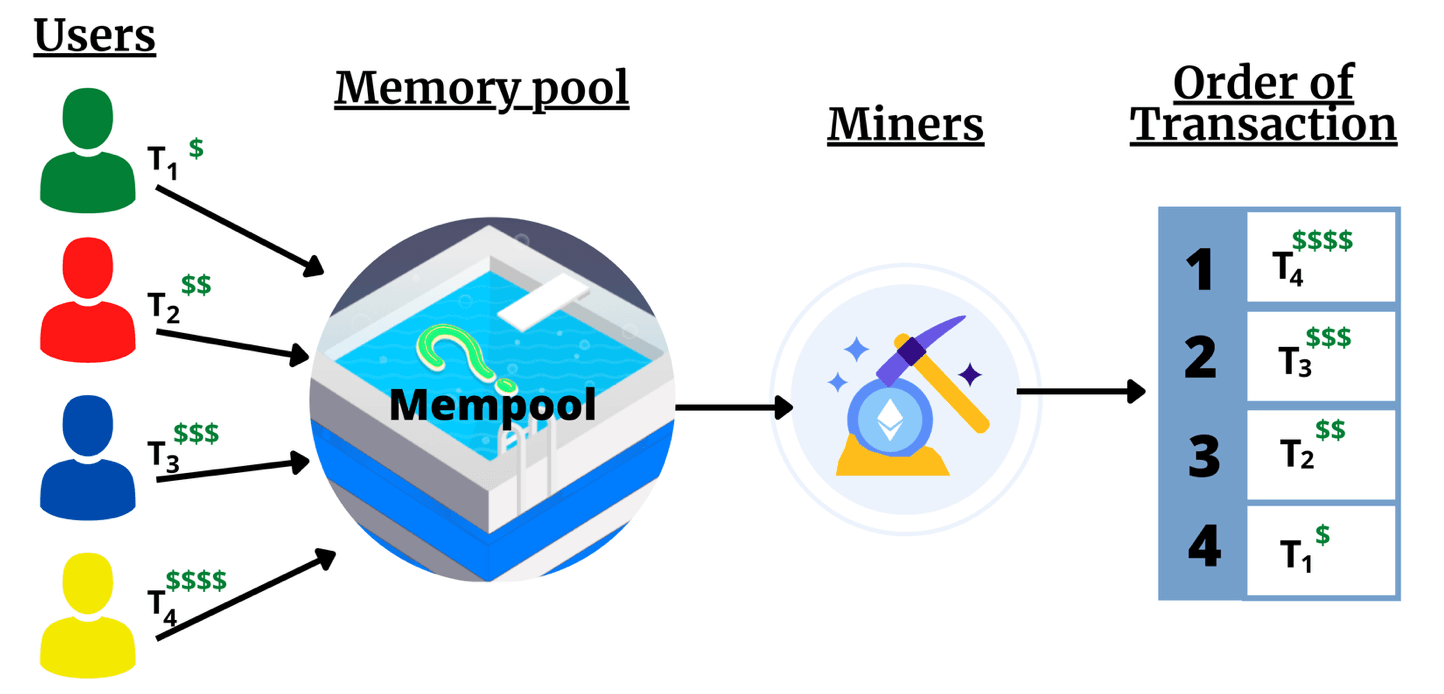

MEV exists because of how block production works. Before transactions are confirmed on a blockchain, they first enter a public waiting area known as the mempool. Here, transactions compete for inclusion based on gas fees, but they can also be strategically ordered or manipulated by miners or validators.

This ability to influence transaction sequencing is why MEV is sometimes described as an "invisible tax" on DeFi users—one that often benefits the well-resourced at the expense of everyday traders.

How MEV Works in Blockchain Transactions?

To understand MEV in action, we need to take a closer look at how transactions are processed on a blockchain. Unlike traditional financial systems where transactions are settled in a fixed sequence, blockchains operate more like an auction—where the highest bidders can jump the queue, manipulate transaction placement, and extract extra value from unsuspecting users.

MEV Inner Workings Example. Image via Etherworld

MEV Inner Workings Example. Image via EtherworldMEV thrives in this environment because block producers—whether miners in PoW or validators in PoS—have the power to reorder, include, or exclude transactions from a block. This seemingly minor ability has led to an entire industry of automated bots and searchers who aggressively hunt for MEV opportunities.

The Role of Validators & Miners in MEV

At the heart of every blockchain transaction is a simple question: Who decides which transactions get confirmed first?

- In proof-of-work blockchains like pre-Merge Ethereum, miners controlled this process. Since mining was an energy-intensive competition, miners naturally prioritized transactions that paid the highest gas fees, but they could also engage in MEV extraction by placing their own transactions ahead of others.

- In proof-of-stake blockchains like modern Ethereum, the power to order transactions has shifted to validators, who are selected based on their staked ETH. While PoS reduces some inefficiencies of PoW, it does not eliminate MEV, and validators continue to extract value from users through similar methods.

This means that whether through mining or staking, the entities responsible for producing blocks have the ability to manipulate transactions for financial gain.

MEV and Transaction Ordering

Since transactions don’t automatically process in the order they were submitted, transaction sequencing is a lucrative game. MEV searchers—who are independent participants scanning the mempool—use sophisticated bots to identify valuable transactions and reorder them for profit.

Some of the most common ways this is done include:

Front-running

Front-running occurs when an MEV bot detects a high-value trade about to be executed and jumps ahead by submitting the same trade with a higher gas fee. This forces the victim to pay a worse price, allowing the attacker to profit from the price movement.

For example, if a trader is about to buy a large amount of ETH on a decentralized exchange (DEX), an MEV bot will spot the transaction in the mempool, buy ETH first, and sell it back at a higher price, leaving the original trader with a worse deal.

Back-running

Back-running is the opposite of front-running. Instead of placing a transaction before a profitable trade, the MEV bot places its transaction immediately after to capitalize on the price impact.

If someone makes a large purchase on Uniswap, pushing up the token price, an MEV bot will immediately sell into the price increase, making an easy arbitrage profit.

Sandwich Attacks

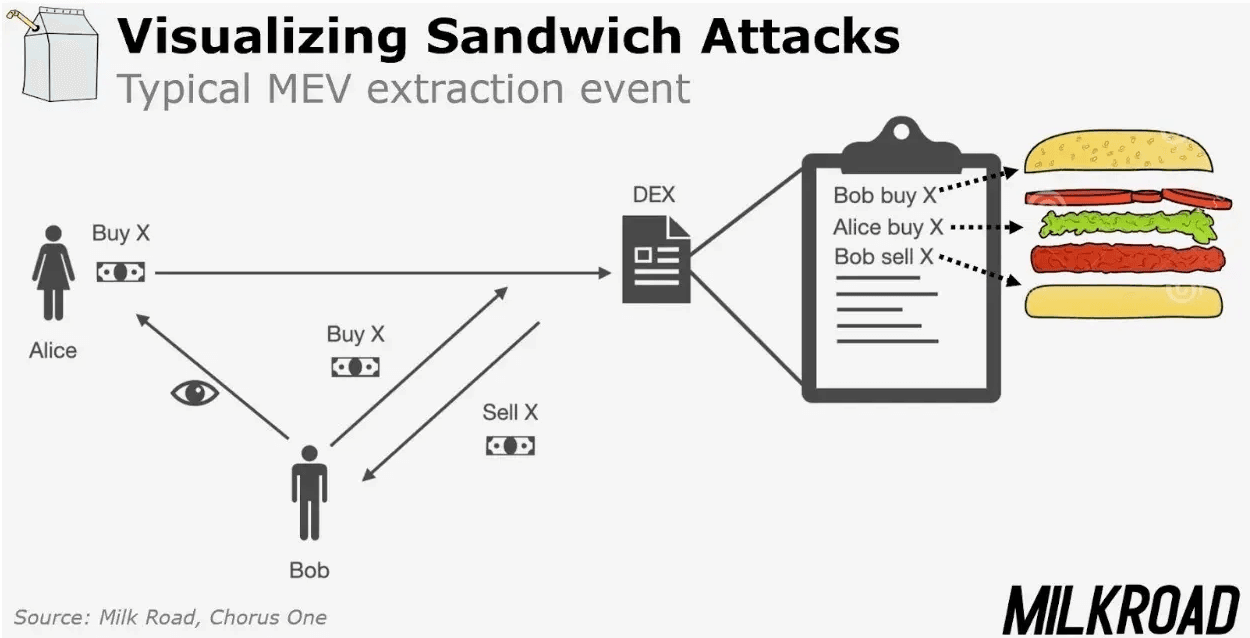

A sandwich attack is a combination of front-running and back-running, designed to exploit price slippage in DEX trades.

Suppose a trader places a large buy order for a token. An MEV bot will:

- Front-run by buying the token first, driving up the price.

- Let the victim’s transaction execute at the now-higher price.

Back-run by selling the token at a profit, leaving the trader with a worse execution price.

Visualizing Sandwich Attacks. Image via Milkroad

Visualizing Sandwich Attacks. Image via MilkroadSandwich attacks are particularly harmful to retail traders, as they inflate token prices and force users to pay more or receive fewer tokens than expected.

Types of MEV Strategies

Beyond transaction ordering attacks, MEV searchers deploy a variety of tactics to extract profit from blockchain activity. Here are some of the most notable:

Arbitrage

Arbitrage is one of the more benign forms of MEV, as it helps keep prices consistent across decentralised exchanges.

If ETH is trading at $1,600 on SushiSwap and $1,620 on Uniswap, an MEV bot can buy ETH on SushiSwap and sell it on Uniswap, pocketing the difference.

This strategy benefits the overall market by ensuring that token prices remain in sync across platforms.

Liquidations

Liquidations occur in DeFi lending protocols like Aave and MakerDAO, where users borrow against collateral. If the collateral falls below the required threshold, it can be liquidated to repay the lender.

An MEV bot detects a borrower’s loan about to be liquidated and rushes to submit a liquidation transaction first, earning a fee from the protocol.

While liquidations maintain stability in lending markets, they also drive up gas fees and make borrowing riskier for users.

Sandwich Trading

As mentioned earlier, sandwich trading is a malicious form of MEV that targets retail traders on decentralised exchanges.

If a user tries to buy $50,000 worth of UNI tokens, an MEV bot will front-run the trade, buy UNI first, push up the price, let the trader buy at the inflated price, then sell UNI back for a profit.

This results in:

- Higher costs for unsuspecting traders.

- Increased price volatility.

- Reduced trust in DeFi markets.

MEV in the Ethereum Ecosystem

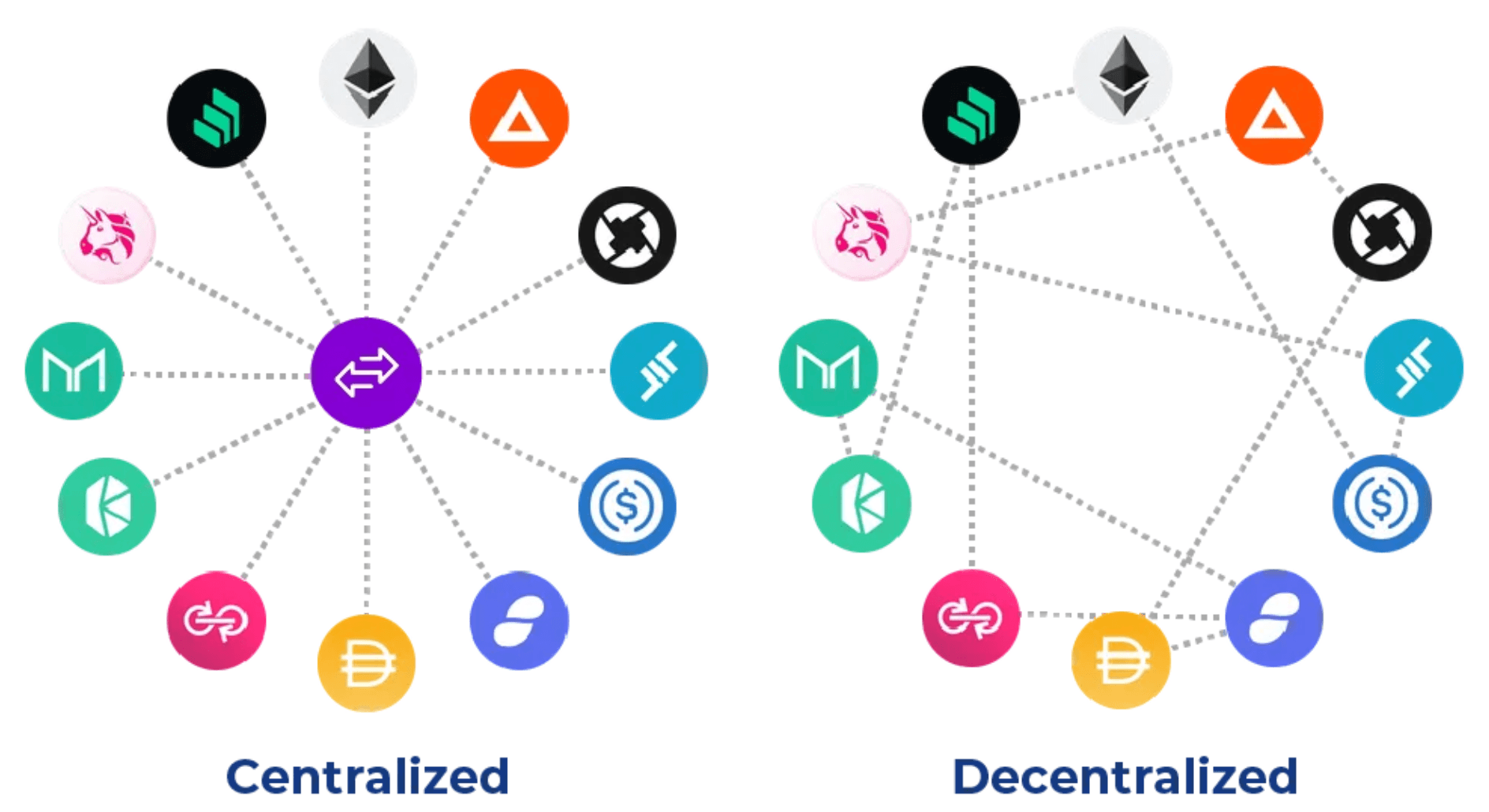

Ethereum is ground zero for Maximal Extractable Value. As the leading smart contract platform, Ethereum has the highest volume of DeFi activity, making it a lucrative playground for MEV searchers and validators looking to extract additional profit. From DEX trades and lending liquidations to NFT mints and arbitrage opportunities, Ethereum’s open and permissionless nature has made MEV an unavoidable part of the network’s economics.

Ethereum is Ground Zero for Maximal Extractable Value. Image via Cointribune

Ethereum is Ground Zero for Maximal Extractable Value. Image via CointribuneWhile MEV exists on other blockchains, Ethereum’s high transaction volume, public mempool, and reliance on gas fees have made it the most targeted network for MEV extraction. Let’s explore how Ethereum’s architecture, EIP-1559, and the transition to proof-of-stake have shaped the evolution of MEV.

Ethereum’s Role in MEV

To understand why Ethereum is so heavily affected by MEV, we need to look at how transactions are processed.

- Public Mempool – Ethereum’s transactions are visible to everyone before they are included in a block. This transparency allows MEV searchers to scan for profitable transactions and manipulate the order for their benefit.

- Smart Contract Complexity – Unlike Bitcoin, which has limited scripting capabilities, Ethereum’s Turing-complete smart contracts create a wide range of opportunities for MEV, from DEX arbitrage to liquidation bidding wars.

- High Gas Fees – Since Ethereum operates as a competitive fee market, users often pay higher gas fees to get their transactions included faster. MEV searchers exploit this by outbidding regular users and forcing them into worse trade executions.

As a result, Ethereum’s DeFi ecosystem has become a battleground where MEV bots and validators compete to extract value at the expense of unsuspecting traders.

The Impact of EIP-1559 on MEV

Ethereum’s EIP-1559 upgrade, implemented in August 2021, changed Ethereum’s fee structure, aiming to make gas fees more predictable and reduce fee volatility. But did it help reduce MEV? Not quite.

Before EIP-1559, Ethereum relied on a first-price auction system, where users would bid for block space by offering higher gas fees. MEV searchers exploited this by aggressively outbidding others to secure profitable trades.

EIP-1559 introduced a base fee mechanism, which automatically adjusts gas prices based on network congestion. This change:

- Reduced sudden gas fee spikes, making transaction costs more stable.

- Introduced a fee-burning mechanism, which permanently removes some ETH from circulation.

- Did not eliminate MEV—searchers simply adapted their strategies by focusing on priority fees (tips paid to validators for faster transaction inclusion).

While EIP-1559 made Ethereum’s fee structure more predictable, it did not fundamentally solve MEV. Instead, it shifted the focus toward off-chain MEV extraction methods like Flashbots and private transaction pools.

MEV in Proof-of-Stake (PoS) vs. Proof-of-Work (PoW)

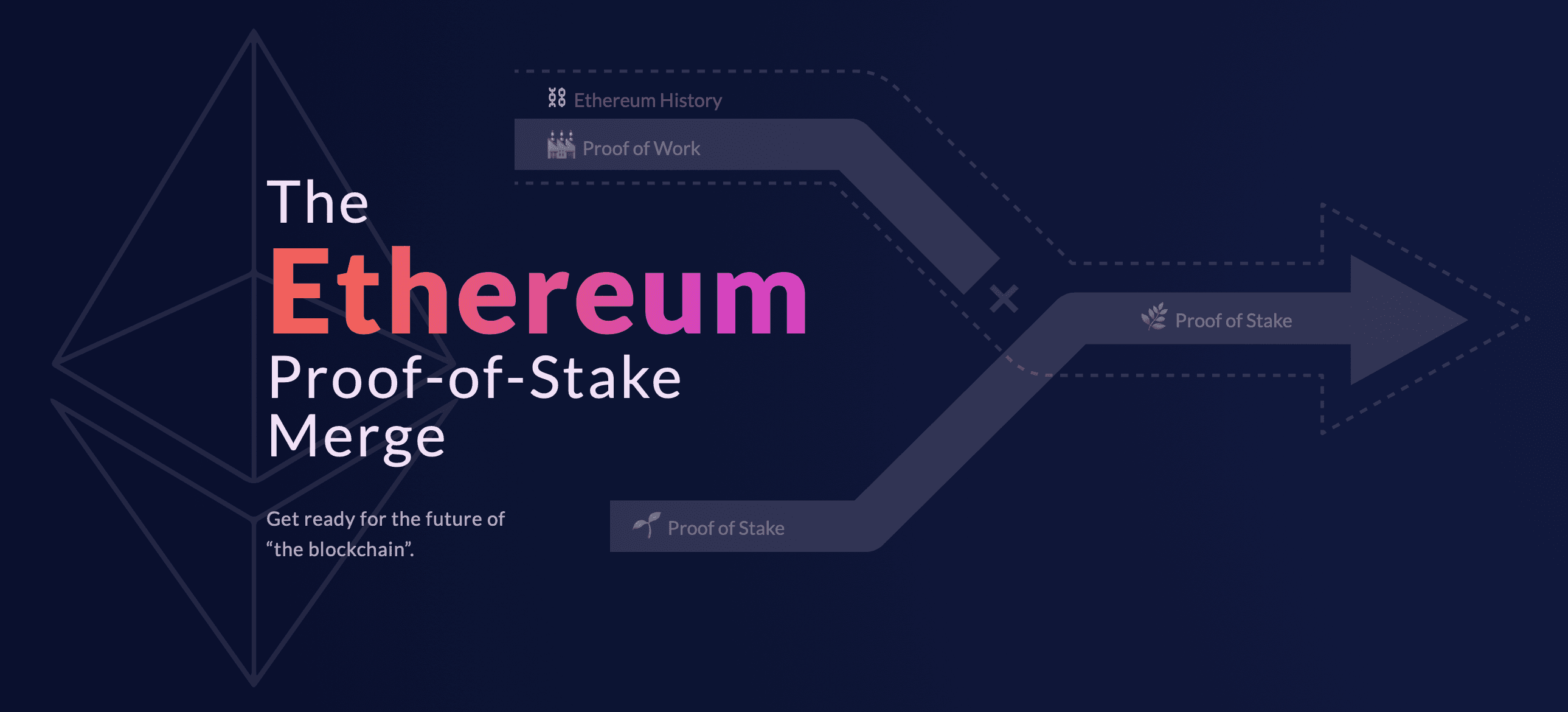

Ethereum’s Merge in September 2022 replaced proof-of-work mining with proof-of-stake validation, fundamentally changing the way blocks are produced. But did it reduce MEV?

Ethereum Merge Took Place Back in 2022. Image via EthMerge

Ethereum Merge Took Place Back in 2022. Image via EthMergeNot exactly—PoS simply changed who benefits from MEV.

MEV in Proof-of-Work

- In PoW, miners competed to solve cryptographic puzzles, with the fastest miner winning the right to produce the next block.

- Miners could reorder transactions for MEV, but the process was randomized, as no single miner could predict when they would win a block.

- The MEV game was largely dominated by searchers, who bribed miners with high gas fees to include their transactions.

MEV in Proof-of-Stake

- In PoS, block production is no longer based on computational power, but on the amount of ETH staked.

- Validators are randomly selected to propose blocks, which introduces predictability—a validator knows in advance when they will be able to propose a block.

- This advance knowledge creates new MEV risks, as validators can collude with searchers to maximize extraction.

Because of this, Ethereum’s shift to PoS has actually consolidated MEV power into larger validator pools. Some key concerns include:

- Validator Centralisation – Large staking pools dominate block production, giving them a greater ability to extract MEV.

- Off-Chain MEV Deals – Validators and searchers now engage in private MEV transactions, making it harder to monitor and regulate extraction.

- Censorship Concerns – Some MEV relay services, such as Flashbots, have been criticized for censoring transactions that do not comply with regulatory standards.

To mitigate these risks, Ethereum researchers are exploring solutions like Proposer-Builder Separation (PBS), which would separate block-building responsibilities from validators, reducing their direct influence over MEV extraction.

Risks & Challenges of MEV

While MEV has been hailed as a mechanism that improves market efficiency in certain cases, its downsides are hard to ignore. Many MEV strategies involve manipulating transaction ordering at the expense of regular users, making DeFi trading more expensive and unpredictable. In the worst cases, MEV can lead to network congestion, increased gas fees, and centralisation risks.

Ethereum’s public mempool and permissionless smart contract execution make it highly susceptible to MEV exploitation. Here, we explore some of the biggest challenges posed by MEV, from front-running bots to validator centralisation.

While MEV Has Certain Upsides, Its Downsides Are Hard To Ignore. Image via Shutterstock

While MEV Has Certain Upsides, Its Downsides Are Hard To Ignore. Image via ShutterstockFront-Running & Sandwich Attacks

One of the most well-known MEV risks comes from predatory bots that engage in front-running and sandwich attacks, both of which exploit Ethereum’s transparent transaction processing system.

Front-Running: Beating Traders to the Punch

Front-running happens when an MEV bot detects a valuable transaction in the mempool and quickly places its own trade with a higher gas fee. The goal is to get processed first, allowing the bot to benefit from the price movement before the original trader’s order is executed.

Example:

- A trader submits an order to buy 100 ETH on Uniswap.

- An MEV bot spots the pending transaction and submits its own buy order with a higher gas fee.

- The bot’s order gets processed before the trader’s, pushing the ETH price higher.

- The trader ends up buying at a worse price, while the bot sells at a profit.

Sandwich Attacks: Exploiting Slippage

A sandwich attack is an even more aggressive form of front-running, where the attacker places two transactions around the victim’s trade—one before to drive up the price and one after to cash in on the inflated value.

Example:

- A trader submits an order to buy $50,000 worth of UNI tokens.

- An MEV bot front-runs the trade by placing a buy order first, causing the price of UNI to rise.

- The trader’s order executes at a higher price, giving them fewer UNI tokens than expected.

- The bot immediately sells the UNI at a profit, leaving the trader at a loss.

Sandwich attacks are particularly damaging to retail traders, as they inflate token prices, reduce liquidity, and create an unfair trading environment.

While front-running and sandwich attacks are common in DeFi, they are not the only risks associated with MEV. One of the biggest concerns is how MEV extraction is shifting power to a small group of validators, raising centralisation risks.

Maximal Extractable Value. Image via TheWealthMastery

Maximal Extractable Value. Image via TheWealthMasteryCentralisation Risks & Validator Cartels

With Ethereum’s transition to proof-of-stake, MEV extraction has become even more concentrated among large validator pools. This centralisation is concerning for several reasons:

- Validator Cartels and Off-Chain MEV Deals

- In PoS, validators know in advance when they will be responsible for proposing a block.

- This allows them to collude with MEV searchers, negotiating off-chain deals to extract maximum value.

- This privatization of MEV makes the process less transparent and harder to regulate.

- In PoS, validators know in advance when they will be responsible for proposing a block.

- Large Staking Pools Dominate MEV

- Because MEV is so profitable, large staking pools have an advantage—they can invest in better infrastructure to detect MEV opportunities and extract higher profits.

- Over time, this discourages solo validators and pushes more ETH into centralised staking providers, reducing Ethereum’s decentralisation.

- Because MEV is so profitable, large staking pools have an advantage—they can invest in better infrastructure to detect MEV opportunities and extract higher profits.

- Permissioned Mempools & Censorship Risks

- Some validators use private mempools (such as Flashbots MEV-Boost) to process transactions without exposing them to the public mempool.

- While this helps prevent front-running, it also introduces censorship risks, as certain transactions may be filtered out based on external regulations or validator preferences.

- For example, after the Tornado Cash sanctions, some MEV relay services began censoring certain transactions, raising concerns about Ethereum’s censorship resistance.

- Some validators use private mempools (such as Flashbots MEV-Boost) to process transactions without exposing them to the public mempool.

Large Staking Pools Are a Real Problem in the Ethereum Ecosystem. Image via Vestinda

Large Staking Pools Are a Real Problem in the Ethereum Ecosystem. Image via VestindaNegative Impact on Users

For the average Ethereum user, MEV extraction often results in a worse trading experience, higher gas fees, and failed transactions. Some of the most significant drawbacks include:

- Increased Gas Fees

- MEV searchers engage in bidding wars to outcompete each other for profitable transactions.

- This artificially drives up gas prices, making all transactions on Ethereum more expensive, even for users who are not involved in DeFi trading.

- MEV searchers engage in bidding wars to outcompete each other for profitable transactions.

- Failed Transactions

- MEV bots often target the same profitable trades, leading to multiple competing transactions trying to execute the same strategy.

- If a bot is outbid or loses the race, its transaction may fail.

- MEV bots often target the same profitable trades, leading to multiple competing transactions trying to execute the same strategy.

- Reduced Trust in DeFi

- Retail traders often suffer losses due to sandwich attacks and front-running, making DeFi less accessible to casual users.

- As MEV extraction becomes more sophisticated, trading on DEXs becomes riskier, potentially pushing users toward centralised exchanges where MEV risks are lower.

- Retail traders often suffer losses due to sandwich attacks and front-running, making DeFi less accessible to casual users.

Strategies to Mitigate MEV Risks

As MEV extraction has grown into a multi-billion-dollar industry, efforts to mitigate its negative effects have become a key focus for Ethereum developers, traders, and protocol designers. While completely eliminating MEV is nearly impossible, several strategies have emerged to reduce its impact, improve transaction fairness, and protect users from predatory attacks.

There Are Multiple Strategies to Mitigate MEV Risks. Image via Shutterstock

There Are Multiple Strategies to Mitigate MEV Risks. Image via ShutterstockMEV Protection Tools & Services

One of the most significant developments in MEV mitigation is the rise of private transaction pools and off-chain relays designed to prevent front-running, sandwich attacks, and unnecessary gas bidding wars.

Flashbots: Reducing MEV Through Private Auctions

Flashbots is an independent research and development organization that created MEV-Boost, a tool that allows validators to outsource block-building to specialized builders. The idea behind Flashbots is to move MEV away from public gas wars and into a private, permissionless auction system that prevents harmful transaction reordering.

How it works:

- Users and traders submit transactions through the Flashbots relay instead of the public mempool.

- Validators accept transaction bundles based on sealed-bid auctions, meaning searchers compete to extract MEV without driving up gas fees for ordinary users.

- Winning bundles are included in blocks without exposing them to public frontrunning bots, reducing the likelihood of sandwich attacks and gas price manipulation.

While Flashbots has reduced some of MEV’s most harmful effects, it also introduces concerns about centralisation and censorship. Because a significant percentage of Ethereum validators now rely on Flashbots, there is growing concern that private transaction relays could lead to validator cartels and selective transaction inclusion.

MEV-Blocker and Other Private Transaction Networks

Beyond Flashbots, other tools like MEV-Blocker aim to protect users from harmful MEV extraction by routing transactions through trusted private networks. These services help users:

- Avoid frontrunning and sandwich attacks by keeping transactions hidden from public mempools.

- Ensure fair execution of DeFi trades without paying unnecessary gas fees to outcompete MEV bots.

- Receive MEV rebates by redistributing a portion of extracted value back to users instead of letting validators and searchers keep all the profits.

While private transaction pools offer a major step forward in protecting users, they are not a perfect solution, as they depend on trusted intermediaries and could potentially lead to censorship risks if validators start rejecting certain transactions.

User Best Practices for Avoiding MEV-Related Losses

While developers and protocols work to mitigate MEV risks, traders and DeFi users can also take steps to reduce their exposure to MEV attacks.

1. Use Private Transactions to Avoid Public Mempools

- When making large DeFi trades, users should submit transactions via Flashbots or MEV-Blocker to prevent frontrunning bots from detecting their orders.

- Some wallets, such as MetaMask and MEV-protected wallets, now allow users to send private transactions directly to validators, reducing MEV exposure.

2. Set Slippage Tolerance Carefully

- Many MEV attacks exploit high slippage tolerance in DEX trades.

- Users should set slippage as low as possible to prevent sandwich bots from artificially inflating token prices before executing their trade.

- On platforms like Uniswap and SushiSwap, adjusting slippage settings can significantly reduce vulnerability to MEV bots.

3. Avoid Trading During High-Activity Periods

- MEV activity spikes during volatile market conditions when gas fees are high.

- By avoiding peak trading times, users can reduce the risk of being targeted by MEV searchers.

4. Use DEX Aggregators for Better Execution

- Aggregators like 1inch split trades across multiple exchanges to find the best price and avoid sandwich attacks.

- These platforms help reduce the impact of MEV by making trades harder to predict and manipulate.

Closing Thoughts

MEV remains one of the most complex and unavoidable aspects of blockchain transactions. It plays a dual role—on one hand, improving market efficiency through arbitrage and liquidations, and on the other, creating unfair advantages for well-resourced participants at the expense of everyday users.

Ethereum’s shift to proof-of-stake has changed who benefits from MEV, but it has not removed the risks of front-running, sandwich attacks, and validator centralisation. Private transaction pools, MEV-resistant DEXs, and protocol-level innovations like Proposer-Builder Separation are emerging as key solutions, but they come with trade-offs, particularly around centralisation and censorship risks.

As MEV strategies continue to evolve, so must the tools and best practices that users adopt. Those looking to protect themselves from predatory MEV tactics should explore private transaction services like Flashbots, use MEV-aware DEX aggregators, and adjust trade settings to minimize exposure.

MEV is here to stay—but by understanding its mechanics and adopting the right strategies, users, developers, and validators can work toward a fairer and more efficient blockchain ecosystem.