Privacy coins emerged as a response to transparent blockchains that record every transfer on a public ledger. Monero is a leading example: a privacy-focused cryptocurrency where confidentiality is mandatory by default and fungibility ensures each unit is interchangeable. Unlike Bitcoin’s transparent ledger (pseudonymous but publicly traceable), Monero hides sender, recipient, and amount using stealth addresses, ring signatures, and RingCT.

Monero’s approach aims to provide cash-like privacy in digital form while remaining permissionless and open source. We will take a look at the project’s design goals and ecosystem to understand the privacy coin better.

Quick Verdict

Monero is a privacy-focused cryptocurrency that makes every transaction confidential by default. It hides the sender, receiver, and amount using advanced cryptography, giving users cash-like privacy in digital form while remaining decentralized, permissionless, and open source.

Monero at a Glance

| Launch Date | April 2014 |

|---|---|

| Symbol | XMR — used across the ecosystem |

| Consensus | Proof-of-Work |

| Privacy | Mandatory and default via stealth addresses, ring signatures, and RingCT |

| Block Time | ~2 minutes |

| Current Supply | ~18.4 million XMR from the main emission, with ongoing tail emission thereafter |

| Key Feature | Untraceable, unlinkable transactions by default |

Monero vs. Other Cryptocurrencies

Readers often want to know how Monero compares before digging into the technicals. At a glance, Monero emphasizes private-by-default payments, whereas most major networks are transparent by default and rely on optional tools for privacy. The notes below frame the key differences with links to official project documentation.

Most Major Networks are Transparent by Default and Rely on Optional Tools for Privacy. Image via Freepik

Most Major Networks are Transparent by Default and Rely on Optional Tools for Privacy. Image via FreepikMonero vs. Bitcoin

- Privacy: Bitcoin uses a public ledger where addresses are pseudonymous; Monero hides sender, recipient, and amount by default.

- Traceability: Bitcoin transactions are publicly traceable; Monero transactions are designed to be untraceable via stealth addresses, ring signatures, and RingCT (see Moneropedia).

- Supply model: Bitcoin has a fixed cap of 21 million (see FAQ). Monero employs tail emission of 0.6 XMR per block after main emission to sustain miner incentives.

- Mining: Bitcoin mining is ASIC-dominated (see mining hardware). Monero’s RandomX favors CPUs to encourage broader participation.

| Attribute | Bitcoin | Monero |

|---|---|---|

| Privacy model | Transparent by default (pseudonymous) | Private by default |

| Traceability | Publicly traceable transactions | Designed to be untraceable via stealth addresses, ring signatures, RingCT |

| Amounts visible on-chain | Yes | Hidden (RingCT) |

| Privacy setting | Optional/third-party tools | Mandatory and default |

| Supply model | Fixed cap 21,000,000 | Tail emission 0.6 XMR/block after main emission |

| Consensus / mining | PoW (SHA-256) — ASIC-dominated | PoW — CPU-friendly |

| Typical block time | ~10 minutes | ~2 minutes |

| Fungibility | Weaker (history visible; “taint” possible) | Stronger (history hidden by default) |

Monero vs. Zcash and Other Privacy Coins

Zcash offers optional privacy via shielded transactions; Monero’s privacy is mandatory by default.

Dash uses CoinJoin-style mixing (user-level coordination) rather than Monero’s base-layer cryptography.

| Feature | Monero | Zcash | Dash | Bitcoin |

|---|---|---|---|---|

| Privacy by default | Yes (base layer) | No (opt-in shielded) | No (user-level CoinJoin) — Docs | No — FAQ |

| Type of privacy | Stealth addresses, ring signatures, RingCT | Zero-knowledge proofs (Sapling/Orchard shielded pools) — Technology | CoinJoin-style mixing (formerly “PrivateSend”) | None at base layer |

| Amounts hidden | Yes (RingCT) | Yes (in shielded tx) | No | No |

| Sender hidden | Yes (ring signatures) | Yes (in shielded tx) | Partial (depends on mixing) | No |

| Recipient hidden | Yes (stealth addresses) | Yes (in shielded tx) | Partial (depends on mixing) | No |

| Opt-in privacy | Not needed (default) | Required (use shielded addresses) | Required (initiate CoinJoin) | External tools only |

| Supply model | Emission + 0.6 XMR/block tail | Fixed cap (with halving schedule) | Capped supply with emissions — Dash Docs | 21M cap — FAQ |

| Consensus / mining | PoW | PoW (Equihash) | PoW (X11) — ASICs | PoW (SHA-256) — ASICs |

Monero vs. Ethereum

Ethereum prioritizes a transparent, smart-contract platform for programmable finance (DeFi, NFTs, applications).

Monero’s niche is private value transfer on the base layer; Ethereum focuses on computation and contracts, leaving privacy to optional tools or L2s.

Understanding Monero: The Basics

Monero is a cryptocurrency designed for privacy by default, meaning every transaction is private unless the user chooses otherwise. If you’re new to the concept, think of the difference between paying with cash versus a public bank transfer: cash leaves no public trail, while bank transfers do. Monero aims to provide cash-like privacy in digital form, while remaining a decentralized, open-source network.

Monero’s Privacy is on by Default, unlike Systems where Privacy is Optional. Image via Monero

Monero’s Privacy is on by Default, unlike Systems where Privacy is Optional. Image via MoneroWhat Makes Monero Unique

Monero’s privacy is on by default, unlike systems where privacy is optional and must be enabled per transaction. This approach underpins fungibility, the idea that each unit is interchangeable with any other. In everyday terms, a $10 bill is accepted anywhere, regardless of where it has been; the same principle should apply to money on a blockchain.

On transparent blockchains, however, coins can carry visible histories, leading to “tainted” funds that some services may refuse. Monero prevents this by combining techniques described in the official resources:

- Stealth addresses (one-time addresses that keep recipients private),

- Ring signatures (which hide the true sender among decoys), and

- RingCT (which conceals the amounts).

Core Purpose and Value Proposition

Monero’s core goal is to protect users from unwanted surveillance, financial censorship, and capital controls, similar to how cash protects everyday privacy in the physical world. This matters to individuals (e.g., private purchases or donations), and to organizations such as nonprofits or suppliers operating in competitive markets. Because of fungibility, every XMR is treated equally, removing the risk that a coin’s visible history could affect its acceptance.

How Does Monero Work? The Technology Behind Privacy

At a high level, Monero hides three things in every transaction: who sent it, who received it, and how much was sent. It achieves this with a set of cryptographic techniques that work together by default, so users don’t have to “turn on” privacy.

Monero Hides Three Things in every Transaction: Who Sent it, Who Received it, and How much was Sent. Image via Shutterstock

Monero Hides Three Things in every Transaction: Who Sent it, Who Received it, and How much was Sent. Image via ShutterstockStealth Addresses

Monero uses stealth addresses, which are one-time public keys generated for each payment to keep recipients private. When you publish a standard Monero address, the sender derives a unique, single-use destination using your public keys; the payment appears on-chain only at that derived address, not your published one. Your wallet’s private view key scans the blockchain to detect outputs that belong to you, while the private spend key authorizes spending them. This design explains why one public address can safely receive many private transactions without revealing a linkage between them.

Ring Signatures

To hide the sender, Monero uses ring signatures, which allow a signer to prove authorization as one of many possible signers without revealing which one. Each transaction input is mixed with decoy inputs of similar characteristics, forming a “ring” that obscures the true source. Because all ring members are valid possibilities, outside observers cannot identify the real signer. Ring signatures were introduced with the CryptoNote protocol.

RingCT (Ring Confidential Transactions)

Monero conceals amounts using RingCT (Ring Confidential Transactions), which became mandatory on the network in January 2017. RingCT hides transfer values while still allowing nodes to verify that no extra coins are created, using cryptographic range proofs.

Additional Privacy Layers

Transaction data sizes and fees were significantly reduced by Bulletproofs (and the later Bulletproofs+ optimization), contributing to faster verification and smaller transactions on average. Network-layer privacy has also improved with Dandelion++, which helps obfuscate the origin of transactions as they propagate. Monero’s community continues to iterate via the Monero Research Lab. For details, see Moneropedia on Bulletproofs and Dandelion++.

Transaction Speed and Confirmation

Monero targets an average block time of ~2 minutes, so 5–10 blocks equate to roughly 10–20 minutes of confirmations for typical settlement comfort, depending on your risk tolerance. Throughput is designed for base-layer reliability rather than high TPS, with adaptive limits that can accommodate bursts via dynamic block sizing.

How a Monero Transaction Works (Step-by-Step)

At a glance, a Monero payment privately ties together the sender, recipient, and amount using default cryptography. The wallet constructs the transaction, hides the true sender with a ring signature, delivers funds to a one-time stealth address, and conceals the value with RingCT. The recipient’s view key then detects the payment without exposing their main address.

A Ring Signature Mixes the Sender’s Real Input among Decoys. Image via Shutterstock

A Ring Signature Mixes the Sender’s Real Input among Decoys. Image via Shutterstock- User creates a transaction with inputs, outputs, and a chosen ring size.

- A one-time stealth address is generated for the recipient.

- A ring signature mixes the sender’s real input among decoys.

- The amount is encrypted via RingCT (so observers see no value).

- Nodes/miners validate correctness (no double-spend) without learning details.

- The recipient’s wallet scans the chain using the view key and finds the output.

Example: send 0.5 XMR; the wallet will typically show it as received quickly, while many services consider it settled after ~5–10 blocks (~10–20 minutes), depending on risk tolerance.

Security and Risk Considerations

Monero’s privacy and security arise from layered design choices at both the consensus and network levels. These offer strong protections in typical use, but like any system, they have limits. The points below summarize how the network stays secure, where privacy can still leak, and what users can do to reduce risk in practice.

Back up your View Key and Spend Key Securely, as Losing them can Permanently Affect Access to Funds. Image via Shutterstock

Back up your View Key and Spend Key Securely, as Losing them can Permanently Affect Access to Funds. Image via ShutterstockNetwork Security

- Proof-of-Work using RandomX is designed to favor general-purpose CPUs, reducing the risk of specialized hardware dominating hashpower and helping resist 51% attacks.

- Open-source development and community review subject the codebase to continuous scrutiny through the Monero Project repositories and research channels.

- P2Pool enables decentralized, non-custodial mining pools, improving miner distribution and lowering single-pool dependence.

Privacy Limitations

- Privacy can be weakened by timing correlation and network-layer leaks (e.g., linking a transaction to an IP address during broadcast).

- Dandelion++ helps obfuscate the origin of transactions as they propagate across the network.

- Kovri explored I2P-based routing to further separate transactions from user network identities (an area of ongoing community interest and research).

- Keeping wallets updated and ensuring proper node syncing helps you benefit from the latest protocol and wallet-level privacy improvements.

Best Security Practices

- Prefer official wallets (GUI/CLI) from the downloads page and consider full-node verification via the node-running guides in Moneropedia.

- To preserve privacy, many users avoid KYC exchanges that can link identity to on-chain activity; consider peer-to-peer options where lawful and appropriate.

- Back up your view key and spend key securely (offline, with redundancy), as losing them can permanently affect access to funds.

The History and Origins of Monero

Monero’s roots lie in CryptoNote, a privacy-focused protocol introduced in the CryptoNote whitepaper series (2012–2013). The first live implementation was Bytecoin (2012), which showcased ring signatures and one-time addresses. Monero emerged in 2014 as a community-led effort to refine this design for robust, default-on privacy; background and guiding principles are outlined in the project’s overview and public roadmap.

Monero Emerged in 2014 as a Community-led Effort to Refine a Design for Default-on Privacy. Image via Shutterstock

Monero Emerged in 2014 as a Community-led Effort to Refine a Design for Default-on Privacy. Image via ShutterstockCryptoNote Foundation

The CryptoNote whitepaper formalized untraceable transactions via ring signatures, forming the foundation Monero builds on today. Bytecoin (2012) provided the first production testbed for CryptoNote features.

From Bitmonero to Monero

Monero launched in April 2014 as Bitmonero, a community fork of Bytecoin, and shortly after adopted the name Monero (Esperanto for “coin”). Development and stewardship shifted to a community Core Team operating under decentralized, volunteer-driven governance.

Developers & Community

Monero’s maintenance transitioned from Riccardo Spagni (fluffypony) to other maintainers in 2019 as part of broader decentralization. Contributions come from hundreds of developers across the ecosystem, with funding coordinated through the Community Crowdfunding System and research advanced by the Monero Research Lab; community grants are also supported by the MAGIC Monero Fund.

Key Events & Upgrades

Major milestones include Bulletproofs in October 2018 (reducing typical transaction sizes and fees) and RandomX in November 2019 (CPU-friendly proof of work). Monero continues with regular network upgrades on a public roadmap, and the community convenes at the annual MoneroKon conference.

Monero’s Supply and Economics

Monero’s monetary policy combines a preset emission curve for the early years with a small, perpetual tail emission that funds miners indefinitely. This design aims to keep the network secure long term without relying on fees alone, while base parameters like a ~2-minute block time determine how quickly new coins are created and confirmations accrue.

Monero’s Main Emission Produced Roughly 18.4 million XMR before Switching to Tail Emission. Image via Freepik

Monero’s Main Emission Produced Roughly 18.4 million XMR before Switching to Tail Emission. Image via FreepikCurrent and Total Supply

Monero’s main emission produced roughly 18.4 million XMR before switching to tail emission. The schedule is defined by the protocol’s emission rules and documented in the tail emission specification; confirmation timing follows the block target of ~2 minutes.

Tail Emissions & Ongoing Inflation

After main emission completion, the protocol pays a constant 0.6 XMR per block via tail emission. At a ~2-minute target, that’s ~0.3 XMR per minute, creating a modest, declining inflation rate that helps secure miners’ incentives over time; unlike Bitcoin’s fixed cap, which eventually relies primarily on fees.

Fair Launch & Distribution

Monero began as a fair launch, with no pre-mine, no ICO, and no founders’ reward. These details are outlined in the project’s overview and in community documentation about its origins.

Price History & Market Performance

Note: The CoinGecko ticker above auto updates.

Monero has spent 2025 in a strong uptrend with sharp mid-year swings.

From a Jan. 1, 2025, close of $195.40 to Nov 6, 2025, at $359.29, XMR rose ~83.9% YTD, lifting market cap from $3.60 billion to $6.63 billion. The year’s peak close was $417.72 on May 25, putting Nov. 6 ~14% below that high, while the YTD low close was $190.72 on Jan. 10 (XMR is ~88% above that level).

Volatility clustered around two episodes:

- Late April–May rally: Massive intraday swings (e.g., April 28 high hit $339.19) drove closes up to the May 25 top ($417.72) before a quick pullback (May 28 close $347.32).

- October shock and rebound: After a steep -13.9% day on Oct. 10 ($342.27 → $294.82 close-to-close) and an intraday low of $268.75, XMR recovered into November; from Oct 10 → Nov 6 it advanced ~21.9% and finished October higher (Oct. 1 close $314.32 vs. Oct. 31 close $334.77).

Volume spiked on stress/rally days (notably April 28 and Oct. 10), while quieter uptrends (e.g., September) saw more moderate turnover. Net-net, 2025 to date shows a constructive higher-lows structure, a still-moderate drawdown from May’s peak, and a momentum reset in October that has, so far, resolved upward into November.

This historical context is informational only and not investment advice.

Using Monero: Practical Applications

Monero is used much like digital cash: you choose a wallet, receive XMR to your address, and send when needed, with privacy enabled by default. For newcomers, the project’s downloads page and user guides are the best starting points.

Centralized Exchange Availability Varies by Region. Image via Shutterstock

Centralized Exchange Availability Varies by Region. Image via ShutterstockReal-World Use Cases

Individuals use Monero for personal privacy (e.g., paying a consultant without exposing past transactions), organizations for supplier payments in competitive markets, and nonprofits for NGO donations without donor lists being publicly traceable. Because transactions are private by default, Monero is also valued for censorship-resistant payments and cross-border transfers where financial surveillance or capital controls are a concern. See Accepting Monero for merchant basics.

Choosing a Wallet

Official desktop options are the GUI and CLI wallets. Popular third-party choices include:

- Cake Wallet

- MyMonero (announced sunsetting on Jan 6, 2026)

- Feather (desktop)

- Edge (mobile)

- Monerujo (Android)

For hardware, Ledger integrates with the Monero GUI; Trezor supports Monero via third-party wallets (not in Trezor Suite). The community has also explored Kastelo as an open-source hardware initiative. Pick based on a security vs convenience trade-off: full-node desktop + hardware keyflow at the high-security end; lightweight mobile at the convenience end.

Be sure to read up on our top 8 wallet picks to store Monero, and our head-to-head analysis of Trezor and Ledger.

Buying, Selling & Storing XMR

Centralized exchange availability varies by region. Examples where XMR remains available include KuCoin and Bitfinex. Notable changes: OKX delisted XMR trading pairs in Jan 2024; Binance delisted XMR on Feb 20, 2024; Kraken removed XMR in the EEA (regional restrictions apply elsewhere).

For peer-to-peer options, see Bisq (active XMR trading) and the Monero-focused Haveno project (currently no mainnet instance per FAQ).

For storage, prefer cold wallets (hardware or air-gapped) and understand view keys/spend keys; advanced users can employ offline signing.

How to Send/Receive Your First Transaction

In the GUI wallet, follow How to make a payment: ensure your node/wallet is synced, paste the recipient address, enter the amount, and send. Share your receive address (or QR) to get paid.

Common pitfalls: Not waiting for 5–10 blocks of confirmation, sending while your wallet is still syncing, or mis-handling backups—always secure your mnemonic seed and private keys, and consider a view-only wallet for monitoring (guide).

Mining Monero: Decentralization & Accessibility

Monero relies on proof-of-work mining to secure the network, but with design choices that aim to keep participation accessible to everyday hardware. This helps distribute hashpower and reduce reliance on specialized machines or single large pools. For basics, see our primers on Monero mining and proof of work.

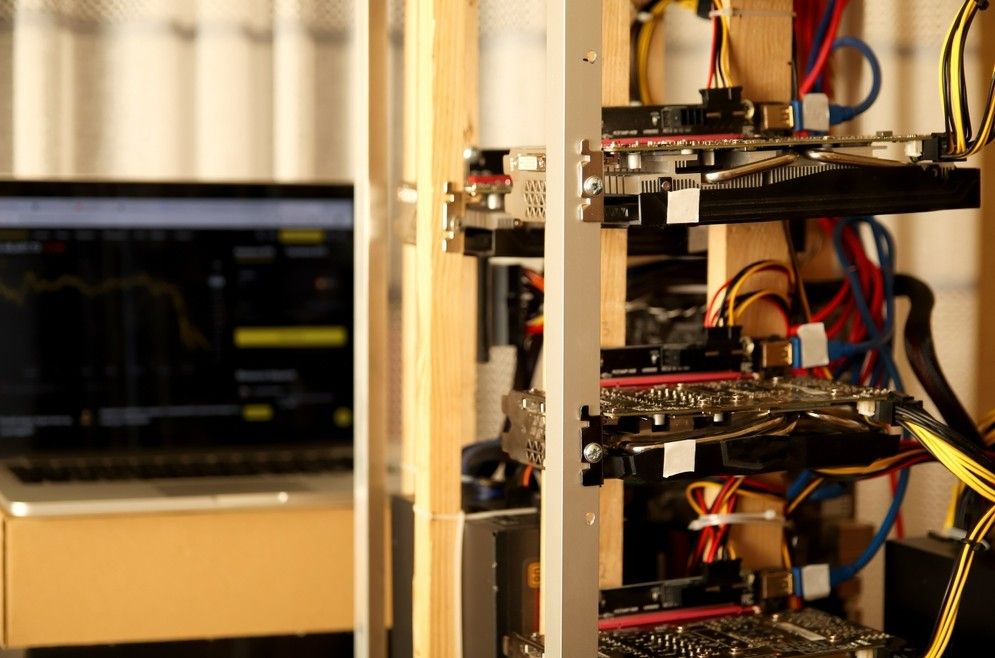

Monero Relies on Proof-of-Work Mining to Secure the Network. Image via Shutterstock

Monero Relies on Proof-of-Work Mining to Secure the Network. Image via ShutterstockProof-of-Work Mechanics

Miners validate blocks and earn rewards according to the network’s proof-of-work rules. Monero’s approach emphasizes practicality: many users can participate with consumer CPUs, which supports broader decentralization. Efficiency depends on hardware and configuration; the mining overview explains the fundamentals and links to community resources.

RandomX Algorithm

Introduced in 2019, RandomX is optimized for CPUs (and works on GPUs), using memory-hard techniques to make ASIC advantages uneconomical. This anti-ASIC focus encourages wider participation, even home mining, and helps avoid hashpower concentration in specialized facilities.

Dynamic Block Sizes

Monero uses an adaptive block size mechanism to handle temporary demand spikes while discouraging spam via penalties. This helps keep fees and confirmation times more predictable for typical use. See block size and block for how blocks can grow when needed and contract as activity normalizes.

Network Updates & Development Philosophy

Monero evolves through regular network upgrades (consensus changes activated at set block heights), coordinated openly via the public roadmap and the core repository. The goal is pragmatic privacy: iterate safely, reduce implementation risk, and adopt research once it’s production-ready.

Ongoing Innovations are Investigated by the Monero Research Lab. Image via Freepik

Ongoing Innovations are Investigated by the Monero Research Lab. Image via FreepikRegular Protocol Upgrades

Upgrades are regularly scheduled (historically on a roughly semi-annual cadence) and announced well in advance on the roadmap. Proposed changes are developed and reviewed in the open through the project’s codebase referenced above, and accompanying discussions.

Major Technological Milestones

- Bulletproofs (2018) significantly reduced typical transaction sizes and fees.

- RandomX (2019) reinforced ASIC resistance by optimizing PoW for general-purpose CPUs.

Ongoing innovations are investigated by the Monero Research Lab and integrated when they meet security and usability standards.

Is Monero Legal? Common Concerns & Misconceptions

At a high level, most countries regulate service providers (exchanges, custodians) under AML/CFT laws rather than outlawing user possession of crypto. Where Monero runs into friction is exchange listing: licensed venues often avoid privacy coins to meet supervisory expectations and risk controls, even if retail ownership is not expressly prohibited. Popular media view seems to skew against illicit use only, whereas ground realities are based on real world statistics rather than subjective opinions. This leaves the privacy coin market in a very tricky zone. Let's break it down.

Monero’s Legality Depends on Jurisdiction.

Monero’s Legality Depends on Jurisdiction.Legal Status by Jurisdiction

United States: Crypto ownership/use is generally lawful; businesses dealing in crypto are treated as MSBs and must register and implement BSA/AML programs under FinCEN. There is no federal ban on Monero, but listing is a business/compliance decision, evidenced by major platforms that have removed XMR in some markets (e.g., Binance; Kraken (EEA)).

Japan: Licensed exchanges operate under the FSA with JVCEA self-regulation. Japan had banned privacy coins in 2018 leading to a wider ban outside of the US. Monero is thus not on the JVCEA “Green List” of widely handled assets, and Japanese licensed exchanges do not list XMR at present, making access effectively unavailable via domestic regulated venues.

South Korea: VASPs are supervised by FSC/KoFIU; domestic exchanges removed privacy coins including Monero and have kept them off-list under AML expectations.

Australia: AUSTRAC supervises providers under AML/CTF law. Multiple Australian exchanges delisted Monero (e.g., CoinSpot), and availability on licensed platforms remains limited. The Australian ban on privacy coins also tightens the privacy-focused crypto space for users in that region.

Bottom line: Across these markets, ownership is generally not banned, but regulated exchanges often do not list XMR; so practical access is constrained by compliance choices rather than blanket prohibitions.

Exchange Restrictions

Why do exchanges restrict Monero? Privacy coins obscure counterparties and amounts, creating KYC/AML assurance gaps that are harder to reconcile with licensing, monitoring, and audit expectations. As a result, several large venues publicly delisted XMR as discussed above.

Legitimate Use Cases for Privacy

While there are legal hurdles with privacy coins, there are lawful reasons to keep finances confidential (e.g., salaries, donations, supplier pricing). Monero offers cash-like privacy for users in jurisdictions where personal use is allowed, while regulated providers must still meet their AML/CTF obligations. So, this leaves a thin line between the right to privacy and misuse of that privacy for illegal activities, leading to a rather tightened control.

The Criminal-Use Narrative

Media coverage often highlights illicit usage, but law-enforcement reporting provides a more nuanced view: Monero is the most commonly used privacy coin, yet Bitcoin remains the dominant asset in criminal ecosystems overall. Europol notes increased privacy-coin usage in certain darknet/ransomware contexts, while also emphasizing continued reliance on traceable assets and the growing toolkit of seizure, sanctions, and investigative methods.

Monero as an Investment

Monero’s value tends to reflect demand for private digital payments, expectations about protocol upgrades, and broader crypto-market conditions.

Exchange Support and Pricing can Shift as Platforms Adapt to Compliance. Image via Freepik

Exchange Support and Pricing can Shift as Platforms Adapt to Compliance. Image via FreepikPrice Drivers & Catalysts

Monero’s price is primarily influenced by privacy demand (concerns about data leaks, blacklisting, and surveillance), the cadence of network upgrades and research, and broader macro privacy narratives that make default confidentiality more salient to users and merchants.

On the market side, XMR typically participates in Bitcoin-led cycles; liquidity and sentiment often improve when BTC draws fresh capital, especially around structural catalysts like the U.S. approval of spot Bitcoin ETFs in January 2024, which expanded mainstream access to crypto exposures.

For forecasts, CoinCodex’s long-term table for 2025 shows a range $349.25–$483.31 with an average ~$406.42 (Nov–Dec breakdown), and their model’s short-term target cites ~$397.47 by Dec. 8, 2025. For 2026, the same page’s Investment Calculator implies a potential ~61.65% 1-year ROI by Oct. 6, 2026 (model-based, not guaranteed).

Investment Risks

Exchange support and pricing can shift as platforms adapt to compliance: recent Binance, OKX, and Kraken (EEA) actions illustrate liquidity risk. Globally, FATF virtual-assets standards (incl. the travel rule), FinCEN BSA/AML expectations in the U.S., and the EU’s MiCA licensing regime shape VASP obligations. Competition from other privacy tools (e.g., Zcash) can also influence perceived utility. Crypto assets remain volatile and sometimes thinly traded; U.S. readers can review Investor.gov risk guidance.

Where to Trade and Hold

Availability varies by jurisdiction, as we discussed earlier; many users consider peer-to-peer venues where lawful, such as Bisq. The Monero desktop GUI/CLI support robust self-custody; advanced users can implement offline signing and view-only wallets for monitoring. Secure backups of your seed and keys remain essential.

This is informational only and does not constitute investment advice.