You may have heard quite a bit about "China's Ethereuem" and how an interesting new token was being used in Chinese ICOs. You may also have been interested in the extreme volatility that NEO has exhibited recently. Yet, what is NEO exactly and what was it developed for?

NEO, which was previously called Antshares, was launched in 2014. It was founded by an individual called Da Hongfei and Erik Zhang in Beijing, China. Then, in 2016, the team behind Antshares created Onchain which was meant to provide blockchain solutions.

In June of 2017, Antshares decided to rebrand the company and call it the NEO smart contract economy. They have numerous important partners including the crowdfunding platform WINGS and Microsoft.

The Inspiration Behind NEO

There is a reason that NEO is compared to Ethereum. That is because it was developed with the same purpose in mind. The developers wanted a decentralised platform off of which other applications could be built. These "Dapps" or Decentralised Applications is the whole idea behind Ethereum.

NEO is also significant for another reason. It is the first open source and decentralised cryptocurrency that has been developed and launched in China. They like to see themselves as a distributed network for the smart economy. They are providing a framework for digitization of real world assets and making them available to everyone.

In a similar fashion to Ethereum, NEO makes use of smart contracts which are run on the NEO virtual machine. They plan to eventually release their vision of the "Smart Economy" which many have termed a greatly improved vision for smart contracts.

Building Consensus

Another blockchain operation that NEO implements is Delegated Byzantine Fault Tolerance (dBFT). This is essentially a consensus building method that has better security for blockchains. Other initiatives that have used this technology include Hyperledger and Steller. These bookkeeping nodes reach consensus via delegated voting. There needs to be a 2/3 majority in order to agree on the current state of the blockchain.

The co-founder of Antshares, Erik Iz stated that this form of consensus building was one of the most effective that they have come across after studying the blockchain for years. He claimed that it provided for swift transactions and eliminates the incentive for any attack vectors. There is also a single blockchain version that is present that has no risk of any forks. Even with brute force computing or a large amount of coins, there is no way for an attacker to alter the blockchain.

DAO Type Fund

As we may all know, Ethereum had an Decentralised Autonomous Organisation that raised funding last year. It is probably best known for the massive hack that led to its collapse. Trying to develop a successful version of their own, NEO is attempting a similar fund.

The smart fund will be called the "Nest Fund" and will use the NEO smart contract technology. The aim of the Nest Fund would be to eliminate problems such as high thresholds and low efficiency. Instead of sending an application to withdraw from some organization, individuals can just exit by executing smart contracts. Moreover, it would be entirely democratic and anyone could join irrespective of investment amount.

A Look at NEO Tokens

As with Etheruem, there are two tokens with NEO, GAS and NEO. The NEO tokens are used in block creation, network management and consensus requirements. There are 100 million NEO tokens that were all pre-mined with the creation of the genesis block. An interesting quirk about the NEO token is that the smallest unit is 1. You can't have fractions of a NEO.

As with Etheruem, there are two tokens with NEO, GAS and NEO. The NEO tokens are used in block creation, network management and consensus requirements. There are 100 million NEO tokens that were all pre-mined with the creation of the genesis block. An interesting quirk about the NEO token is that the smallest unit is 1. You can't have fractions of a NEO.

These NEO tokens confer the holder voting rights. Currently, there are about 50 million NEO that are in circulation which were auctioned off during the crowdfunding stage. The remaining 50 million tokens are held by the foundation and will be used by the development team to grow NEO out. In terms of NEO supply growth, this will be capped at 15m tokens.

GAS is what is used in order to power the smart contracts on the NEO ecosystem. There is a total supply of about 11m GAS with total circulation of about 8.5m. GAS is also generated when a new block is mined. There will also be a general reduction in the GAS reward per block by 1 GAS per year. This reduction in reward and corresponding supply will continue until the reward is 1 GAS per block.

The total capped supply of GAS tokens is 100 million and this will be reached in about 22 years at current rates. GAS will be distributed in a proportion that corresponds to the total amount of NEO holdings.

NEO Dapps

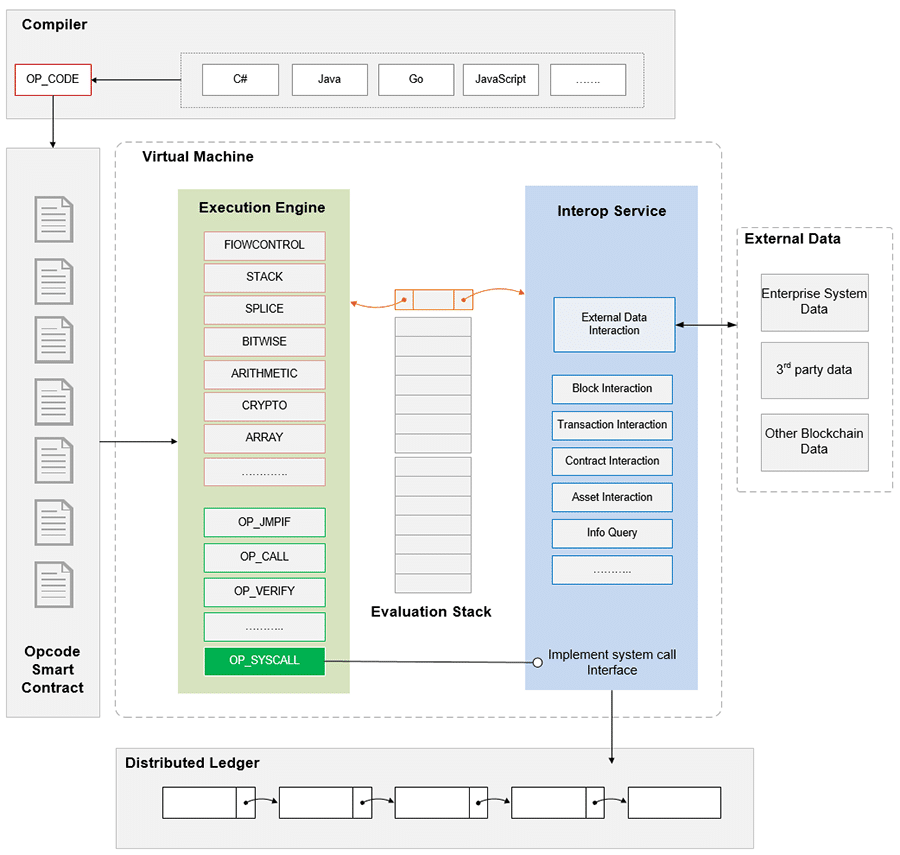

NEO has a universal Lightweight Virtual Machine (NeoVM) which has a number of advantages for the developers. It has high concurrency, certainty and scalability. Another advantage of the NeoVM is that it is compatible with a number of well known coding languages including C++ and Java. With Etheruem, developers will have to learn the official language, Solidity.

NEO also makes use of interesting computer science models in order to solve similar problems to Ethereum. For example, NEO incorporates concurrency and sharding. You can see a graphical representation of the Virtual Machine below.

Source: NEO

Source: NEONEO Prospects

Like with Ethereum, there are a number of use cases for NEO from Smart contracts to digital identities and digitized assets. This is the promise that many see when they consider an investment in NEO.

However, there are a number of limitations that could slow the global adoption of NEO. Given that NEO was a completely home grown Chinese initiative, there are not as of yet a great deal of materials available in English. This has indeed limited the range of where the token can be traded.

However, as more English support is added, it is most likely that more exchanges will add NEO on their platforms. This could indeed lead to greater adoption in Western markets with NEO currently the 8th largest cryptocurrency in the world according to coinmarketcap.