As the world continues to shift towards digital solutions, the way we send and receive money has remained stuck in the past — bogged down by high fees, long settlement times, and barriers that exclude billions from the global financial system. But what if blockchain technology could bridge that gap? What if the next evolution in payments isn’t just faster and cheaper but smarter and more inclusive?

Enter PayFi. Short for Payment Finance, PayFi is a concept that sits at the intersection of traditional finance and decentralised finance (DeFi).

So, why should you care? Because PayFi could be the key to mass crypto adoption. By integrating blockchain’s transparency and efficiency with DeFi’s financial tools, PayFi aims to offer a seamless payment experience—think real-time settlements, minimal fees, and access to global finance, even for the unbanked.

In this article, we’ll explore what PayFi is, how it fits into the evolving world of DeFi, and why it might just be the most exciting development in crypto payments to date. Let’s dive in.

Would rather watch a video instead? We have you covered:

What is PayFi?

You might be wondering—what exactly is PayFi, and why is it creating such a buzz in the crypto space?

At its core, PayFi is the fusion of payment processing and decentralised finance (DeFi). It leverages blockchain technology to create a faster, more efficient, and cost-effective system for handling financial transactions. But PayFi isn't just about making payments quicker; it’s about unlocking the Time Value of Money (TVM)—a concept in traditional finance that highlights how money available today is worth more than the same amount in the future due to its potential earning power.

PayFi Was First Coined By Lily Liu, President At Solana Foundation. Image via Youtube

PayFi Was First Coined By Lily Liu, President At Solana Foundation. Image via YoutubeIn simpler terms, it enables users to access future cash flows instantly, allowing businesses and individuals to make better use of their funds in real-time.

How Is PayFi Different From Traditional Payment Systems?

Traditional payment systems, like banks and credit card networks, rely on a complex web of intermediaries. This means transactions often take days to settle, especially when crossing borders, and come with hefty fees to cover the costs of middlemen. Plus, these systems are prone to limited accessibility (especially for the unbanked) and a lack of transparency.

PayFi flips this model. By using blockchain technology, it eliminates intermediaries, enabling instant peer-to-peer (P2P) payments with minimal fees. Transactions are settled in real-time, directly on-chain, ensuring transparency, security, and cost efficiency. And since it operates on decentralised networks, anyone with an internet connection can participate—no bank account required.

PayFi’s Role in DeFi and Blockchain Technology

One of the most exciting aspects of PayFi is how it integrates with DeFi and blockchain. While DeFi has already revolutionized lending, borrowing, and staking, PayFi focuses on real-time payments and settlements, bridging the gap between traditional finance and decentralised ecosystems.

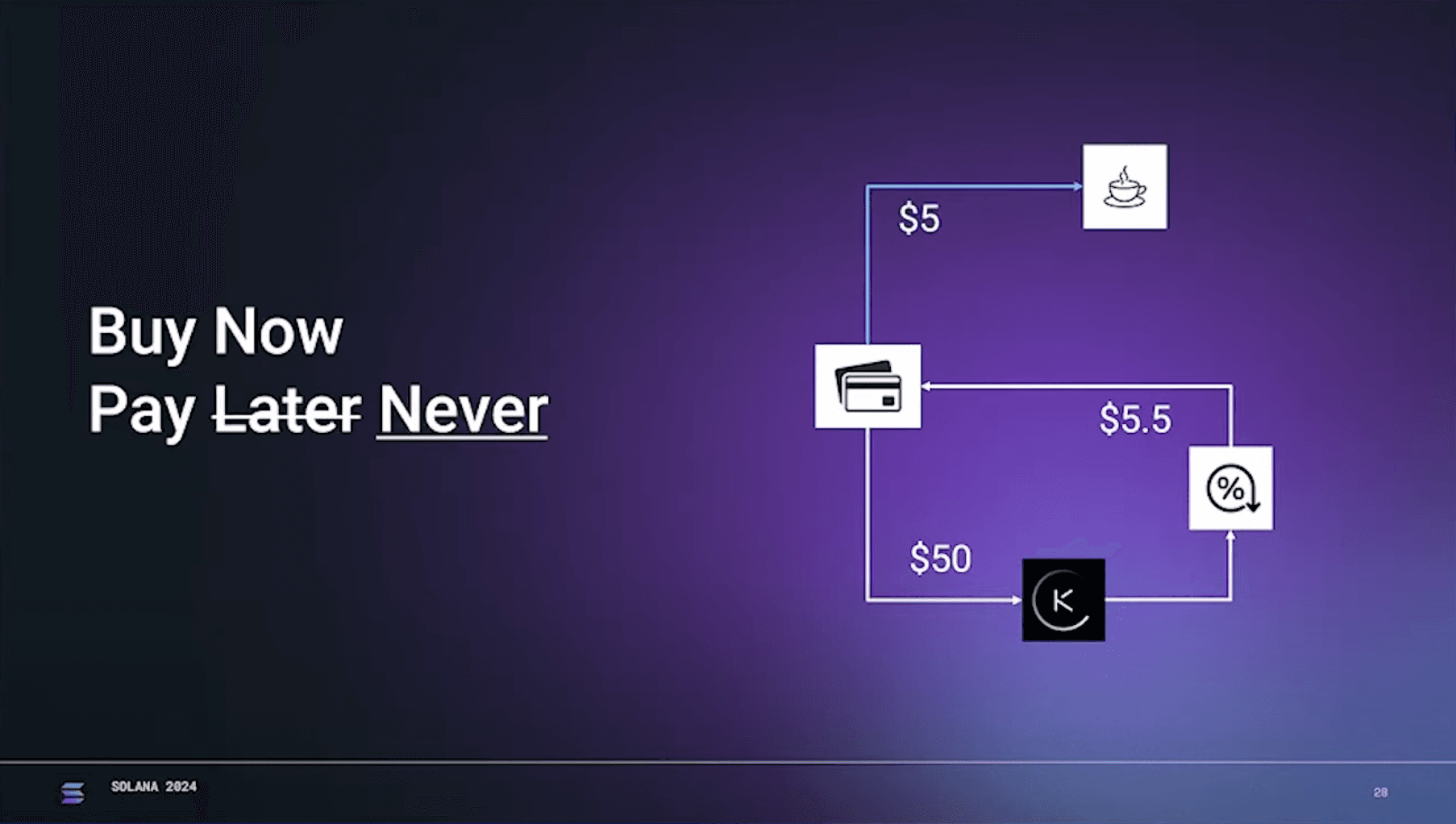

It also plays a key role in bringing real-world assets (RWAs) on-chain, enabling things like “Buy Now, Pay Never”—where interest from staked assets covers the cost of purchases.

“Buy Now, Pay Never” Model. Image via Youtube

“Buy Now, Pay Never” Model. Image via YoutubeThe Evolution of Digital Payments and PayFi’s Role

Digital payments have come a long way since the early days of online banking and credit card transactions. From swiping magnetic stripes to tapping phones on contactless readers, each innovation aimed to make payments faster, more secure, and more convenient. Yet, despite these advances, the global payments ecosystem remains riddled with inefficiencies—slow settlement times, high fees, and barriers that exclude billions from participating in the financial system.

Traditional Payment Gateways

Traditional payment gateways—think Visa, MasterCard, or PayPal—operate on a centralised infrastructure. When you make a payment, the transaction passes through several intermediaries: payment processors, acquiring banks, issuing banks, and often currency exchanges if it’s a cross-border payment. Each of these layers adds time delays, fees, and potential points of failure.

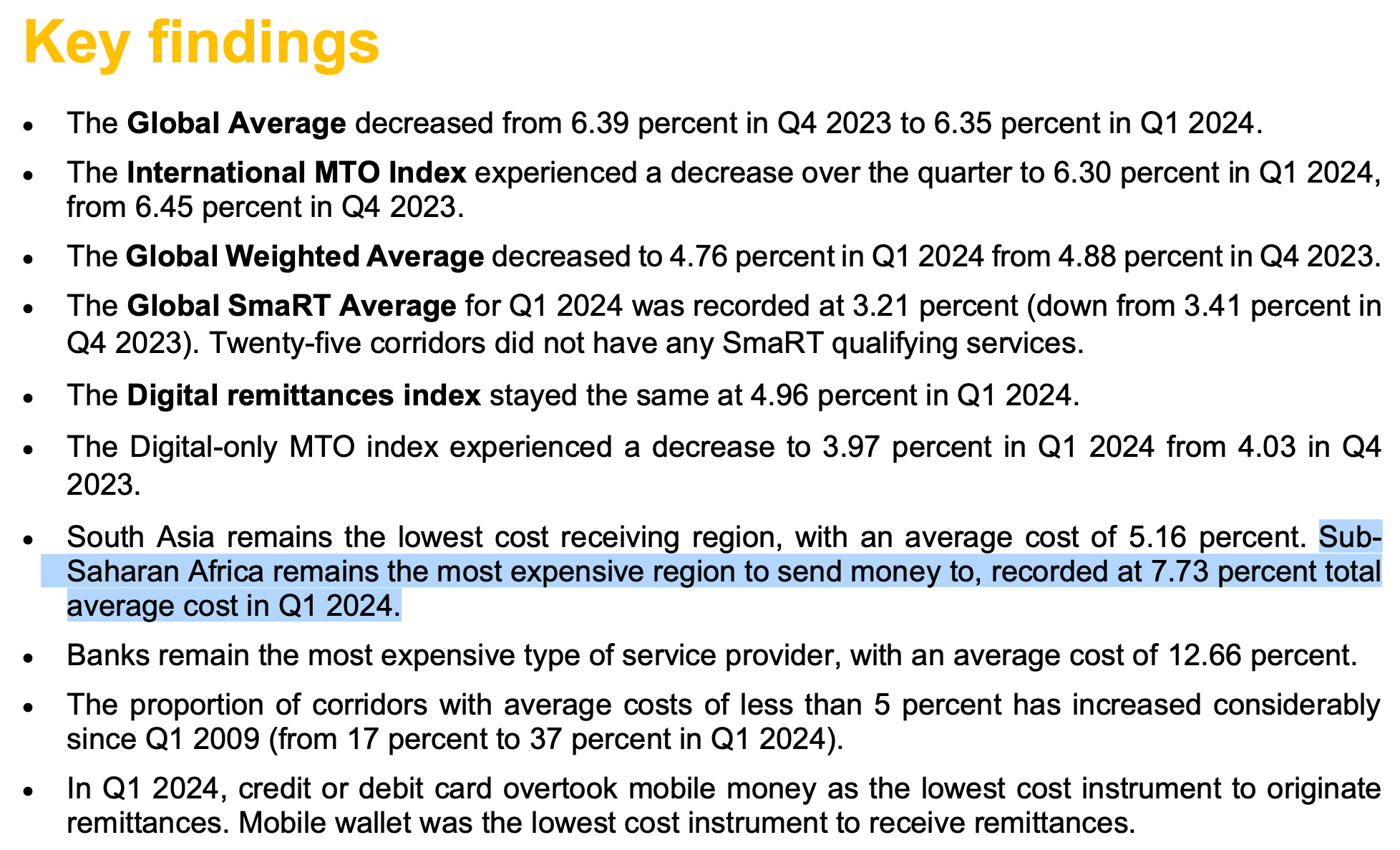

Take cross-border remittances, for example. A simple international wire transfer can take 3-5 business days to clear and comes with an average fee of 6.35%, according to the World Bank. And that’s not even considering hidden costs like unfavorable exchange rates or pre-funding requirements for banks.

Fees Can Get Close to 8% in Some Regions. Image via World Bank

Fees Can Get Close to 8% in Some Regions. Image via World BankHow PayFi Leverages Blockchain for Financial Transactions

So, what makes PayFi’s approach so groundbreaking? It all boils down to how it utilizes the core strengths of blockchain technology:

- Decentralisation: Unlike traditional payment networks controlled by banks and corporations, PayFi operates on decentralised blockchains. This means no single point of failure and open access for anyone with an internet connection.

- Real-Time Settlement: Traditional payments often rely on delayed settlement processes. PayFi, on the other hand, uses blockchain's ability to process transactions instantly, often settling payments within seconds, regardless of borders or time zones.

- Transparency and Security: Every PayFi transaction is recorded on a public, immutable ledger. This eliminates fraud risks and improves trust between parties, as all payments are verifiable in real-time.

- Programmable Money: Perhaps one of PayFi’s most powerful features is its use of smart contracts. These self-executing contracts allow for automated payment flows, such as splitting payments between multiple parties or enabling complex financing models without intermediaries.

How PayFi Works?

Now that we understand what PayFi is and the role it plays in the evolving payments landscape, let’s dive into how it actually works.

PayFi Leverages Blockchain’s Decentralised Architecture. Image via Shutterstock

PayFi Leverages Blockchain’s Decentralised Architecture. Image via ShutterstockKey Features of PayFi

1. Decentralised Payment Processing

- Unlike traditional payment systems that rely on centralised intermediaries (banks, payment processors, etc.), PayFi enables peer-to-peer (P2P) transactions directly on the blockchain. This removes the need for middlemen, significantly reducing transaction costs and settlement times. Every transaction is processed through decentralised nodes, ensuring that payments are both trustless and censorship-resistant.

2. Secure and Transparent Transactions

- PayFi leverages blockchain’s immutable ledger to ensure every transaction is secure and transparent. Since each payment is recorded on-chain, there’s no room for manipulation or fraud. Both parties in a transaction can verify the payment in real-time, fostering trust without relying on centralised authorities.

3. Instant Peer-to-Peer (P2P) Payments

- One of PayFi’s biggest advantages is real-time settlement. Traditional cross-border payments can take days to process, but with PayFi, funds can be transferred globally within seconds. By eliminating intermediaries and leveraging blockchain’s native settlement layers, PayFi ensures that payments are both fast and efficient, even across different time zones and jurisdictions.

4. Low-Cost Cross-Border Payments

- Cross-border transactions through traditional financial systems are notoriously expensive, often saddled with multiple layers of fees—from currency conversion to intermediary charges. PayFi drastically reduces these costs by enabling direct blockchain-based payments, often for a fraction of a cent.

5. Automated Payments:

- Imagine a system where payments can be split between multiple parties automatically, or where funds are only released once certain conditions are met. Smart contracts make this possible, removing the need for manual oversight and reducing the risk of errors.

6. Cross-Chain Compatibility:

- Many PayFi platforms are cross-chain compatible, enabling payments to be made across different blockchains without users needing to manually bridge assets. This ensures a smoother user experience and broadens the potential reach of PayFi solutions.

Benefits of PayFi in Financial Transactions

PayFi offers real, tangible benefits that could redefine how we approach payments and financial transactions. From drastically reducing costs to enhancing security and speeding up transactions, let’s break down the key benefits that make PayFi stand out.

PayFi Offers Multiple Benefits Over TradiFi. Image via Shutterstock

PayFi Offers Multiple Benefits Over TradiFi. Image via ShutterstockLower Transaction Fees and Cost Efficiency

One of the most immediate and impactful benefits of PayFi is the significant reduction in transaction fees.

In traditional finance, sending money—especially across borders—can be expensive. Payment processors, banks, and other intermediaries each take a cut, leading to cumulative fees that often surpass 6% for international remittances. Even simple credit card transactions can rack up 2-3% in fees, not to mention hidden costs like currency conversion charges.

PayFi cuts out the middlemen. By leveraging blockchain’s decentralised architecture, transactions occur directly between parties, eliminating the need for banks, payment processors, and clearinghouses. This significantly reduces costs, often bringing fees down to fractions of a cent.

For instance, using PayFi solutions built on high-performance blockchains like Solana—which boasts sub-$0.01 transaction fees—users can send funds globally without worrying about excessive charges.

Enhanced Security and Fraud Prevention

Security is a major concern in the world of digital payments, with fraud, chargebacks, and unauthorized access costing businesses billions annually.

At its core, PayFi relies on blockchain’s immutable ledger, which records every transaction in a tamper-proof manner. Once a payment is confirmed and added to the blockchain, it can’t be altered or deleted.

Additionally, cryptographic encryption ensures that sensitive data remains secure throughout the transaction process, offering a level of transparency and integrity that traditional systems struggle to match.

Unlike traditional payment gateways that often store user data in centralised databases—making them prime targets for hacks—PayFi platforms use decentralised networks, minimizing single points of failure.

Smart contracts also play a vital role in fraud prevention. These self-executing contracts ensure that payments are only processed when specific conditions are met, eliminating the risk of chargebacks and unauthorized withdrawals.

Speed and Scalability

Slow transaction times can be a major bottleneck. PayFi eliminates this issue by delivering lightning-fast, scalable payment solutions.

Traditional banking systems often take 3-5 business days to process cross-border payments due to the involvement of multiple intermediaries and compliance checks. Even domestic transfers can experience delays during weekends or holidays.

PayFi offers real-time settlements, enabling funds to be transferred across the globe within seconds. By leveraging high-speed blockchains, transactions can be completed almost instantly, regardless of geography or time zones. For example, Solana’s 400ms block times and capacity for over 65,000 transactions per second (TPS) make it one of the most scalable solutions for PayFi applications.

Use Cases of PayFi in Crypto and Finance

PayFi is already reshaping financial transactions across multiple sectors. From e-commerce to DeFi, here’s how PayFi is making an impact.

PayFi Has Multiple Real World Use Cases. Image via Shutterstock

PayFi Has Multiple Real World Use Cases. Image via ShutterstockE-Commerce and Online Transactions

PayFi empowers merchants to accept crypto payments directly, eliminating the need for traditional payment processors. Transactions settle instantly on the blockchain, with lower fees and no intermediaries. Smart contracts manage payments securely and transparently, ensuring merchants receive funds without delays.

With reduced fees and real-time settlements, PayFi enhances the e-commerce experience for both merchants and customers. It also opens global markets to underbanked regions, allowing merchants in developing countries to reach international customers and accept crypto payments seamlessly.

Cross-Border Payments and Remittances

Traditional cross-border payments are often slow and expensive, involving multiple banks and intermediaries. PayFi streamlines this process, enabling real-time, peer-to-peer payments using stablecoins and cryptocurrencies. This removes hidden fees and drastically reduces costs.

Benefits for Freelancers, Businesses, and Expatriates include:

- Freelancers can get paid directly in crypto with lower fees and instant access to funds.

- Businesses simplify B2B payments, paying suppliers and contractors across borders without delays or high banking fees.

- Expatriates sending remittances home benefit from lower costs and faster transactions, ensuring families receive more money without long wait times.

DeFi Lending and Borrowing

PayFi integrates with DeFi protocols to offer real-time lending and borrowing. Smart contracts automate loan approvals, disbursements, and repayments, enabling users to access funds instantly while reducing reliance on traditional banks.

Challenges and Risks of PayFi

While PayFi offers numerous advantages, it’s not without its challenges. From navigating complex regulations to ensuring security and driving adoption, several hurdles stand in the way of its widespread implementation.

PayFi Faces Numerous Challenges. Image via Shutterstock

PayFi Faces Numerous Challenges. Image via ShutterstockRegulatory Uncertainty

One of the most significant challenges PayFi faces is navigating the regulatory gray areas surrounding decentralised payments. Many governments are still formulating policies on how to regulate blockchain-based financial systems, especially those facilitating cross-border transactions and stablecoin settlements. Regulatory inconsistencies across countries create uncertainty for PayFi platforms, making global adoption more complex.

PayFi platforms must also grapple with traditional financial compliance frameworks like KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. Striking a balance between decentralisation and regulatory compliance is tricky. While some PayFi solutions integrate KYC processes, others face challenges in meeting strict financial oversight, potentially leading to regulatory pushback or legal barriers.

Security Vulnerabilities

While smart contracts automate PayFi transactions, they are not immune to vulnerabilities. Coding errors or loopholes can be exploited, leading to loss of funds or unauthorized access. High-profile DeFi hacks and exploits have highlighted the importance of robust smart contract auditing—a necessity for PayFi platforms to maintain trust and security.

Adoption Barriers

Despite PayFi’s benefits, adoption remains a hurdle. Many merchants and consumers are hesitant to embrace crypto payments due to:

- Price volatility of cryptocurrencies

- Limited understanding of blockchain technology

- Concerns over security and regulatory clarity

Even with stablecoins and more user-friendly interfaces, skepticism around crypto payments persists, slowing PayFi adoption.

Future of PayFi

As PayFi continues to gain traction, its future looks promising, especially in the evolving world of decentralised finance (DeFi). With rapid advancements in blockchain technology and shifting financial landscapes, PayFi is poised to play a pivotal role in shaping how we handle payments in the years to come.

PayFi's Future Is Bright If It Can Overcome It's Challenges. Image via Shutterstock

PayFi's Future Is Bright If It Can Overcome It's Challenges. Image via ShutterstockInnovations in Payment Technology

The future of PayFi will likely focus on improving efficiency, accessibility, and security within decentralised payment systems. Key developments may include:

- Cross-chain interoperability, allowing seamless payments across multiple blockchain networks without manual conversions.

- Advanced privacy features like zero-knowledge proofs to ensure user data protection while maintaining transaction transparency.

- More intuitive user interfaces that simplify crypto payments for mainstream users, bridging the gap between traditional and decentralised systems.

Will PayFi Replace Traditional Payment Systems?

While PayFi may not fully replace traditional payment systems anytime soon, it’s positioned to significantly disrupt them. With its faster settlements, lower fees, and borderless capabilities, PayFi offers a compelling alternative to legacy systems, particularly for cross-border transactions, remittances, and DeFi services.

As regulatory clarity improves and blockchain adoption grows, PayFi could become a mainstream option for businesses and consumers seeking efficient and transparent payment solutions.

Traditional banks are also taking notice. Many are exploring ways to integrate blockchain into their services, with some even experimenting with their own blockchain-based payment networks. Others are partnering with PayFi platforms to stay competitive and offer faster, cheaper services to their customers.

That said, the decentralised nature of PayFi challenges the centralised model of traditional banking. As PayFi continues to evolve, banks will need to adapt—either by embracing decentralised technologies or by developing hybrid models that combine the strengths of both systems.

Closing Thoughts

PayFi is rapidly redefining how we think about payments and financial transactions. By bridging the gap between traditional finance and DeFi, PayFi introduces a more efficient, transparent, and cost-effective system that offers real-time settlements, lower fees, and greater accessibility. It addresses long-standing inefficiencies in global payments while unlocking new possibilities like instant cross-border transactions, innovative lending models, and expanded financial inclusion.

The significance of PayFi in the DeFi ecosystem continues to grow as more platforms and users recognize its potential to streamline complex payment processes and reduce reliance on traditional intermediaries. As blockchain technology advances and regulatory clarity improves, PayFi is well-positioned to become a core component of the global financial infrastructure.

Staying informed about PayFi’s developments is crucial as the space evolves rapidly. Whether you’re a crypto enthusiast, a business owner, or someone exploring new financial technologies, understanding PayFi’s role in reshaping the payment landscape will help you stay ahead in this dynamic and transformative sector.