Ever wondered how people buy and sell Bitcoin, Ethereum, or other cryptocurrencies on the spot without waiting days or weeks? That’s where spot trading comes into play. It’s all about buying or selling digital assets at the current market price—no delays, no future promises, just instant ownership. The idea is simple: see a price you like? Grab it. Think the market's about to dip? Sell it off right away.

Unlike more complex trading options like futures or margin trading (which sound like something from a financial textbook), spot trading offers something simple—if you buy it, you own it. No contracts, no expiry dates, just real crypto in your wallet, ready to move however the market does. That immediacy makes it a favorite for traders who want to react quickly to market changes.

Over the years, crypto spot trading has become increasingly popular. With more exchanges and trading platforms making it easy to dive in, spot trading is now one of the go-to ways for people to get started in crypto. Whether you’re a first-timer buying your first Bitcoin or a seasoned trader shifting positions based on market trends, spot trading offers the flexibility to jump in and out whenever the moment feels right.

In this spot trading guide, we’ll walk you through everything you need to know—from the basics of how it works to highlight the best crypto spot trading platforms.

What is Spot Trading in Crypto?

Spot trading in cryptocurrency refers to the buying and selling of digital assets at their current market prices for immediate delivery. This trading method is characterized by its straightforwardness, allowing traders to exchange cryptocurrencies directly without the complexities associated with contracts or future commitments. When a trader engages in spot trading, they take ownership of the actual assets they purchase, which can then be held or sold at a later time.

In essence, spot trading involves executing transactions "on the spot," meaning that both the asset and payment are exchanged immediately upon agreement. For example, if a trader buys Bitcoin (BTC) at a market price of $60,000, they receive their BTC instantly in their digital wallet, while the seller receives the equivalent amount in their chosen currency. This immediacy is one of the primary attractions of spot trading, as it allows for quick transactions and real-time market engagement.

Spot Trading Refers To Buying and Selling of Crypto At Market Prices. Image via Shutterstock

Spot Trading Refers To Buying and Selling of Crypto At Market Prices. Image via ShutterstockDifference Between Spot Trading and Other Types of Trading

Spot trading is distinct from other trading methods such as futures and margin trading. In futures trading, participants enter contracts to buy or sell an asset at a predetermined price at a future date. This means that traders do not own the underlying asset until the contract is fulfilled. Conversely, in spot trading, ownership is transferred immediately upon transaction completion.

Margin trading allows traders to borrow funds to increase their buying power, which introduces leverage into the equation. While this can amplify profits, it also significantly increases risk; losses can exceed the initial investment. Spot trading does not involve leverage, making it generally less risky compared to margin trading.

How Spot Trading Differs from Derivatives and Margin Trading

The key differences between spot trading and derivatives (like options or futures) lie in ownership and risk exposure. In spot trading, traders own the actual cryptocurrencies they buy, allowing them to hold or utilize these assets as they see fit. In contrast, derivatives involve contracts based on the price movements of an asset without transferring ownership of the actual asset itself.

Additionally, since spot traders do not use borrowed funds, their potential losses are limited to their initial investment. This contrasts sharply with margin traders who can face significant losses due to leveraged positions.

Key Features of Spot Trading in Crypto

Let's analyze some of the key features that define spot trading.

Instant Settlement and Ownership Transfer

One of the most significant features of spot trading is instant settlement. When a trader executes a spot trade, the transaction is completed "on the spot," meaning that the transfer of assets occurs immediately. For instance, if a trader buys Bitcoin (BTC) at the current market price, they receive the BTC in their digital wallet right away, while the seller receives their payment instantly. This immediate ownership transfer allows traders to hold or use their assets without delay, contrasting sharply with other trading methods like futures or options, which involve contracts for future delivery.

Trading Pairs in Spot Trading

Trading pairs are crucial in spot trading, as they represent the two assets being exchanged. For example, in a BTC/USDT pair, BTC is the base currency being bought or sold against Tether (USDT), which acts as the quote currency. Understanding trading pairs is essential for executing trades effectively, as they determine how one cryptocurrency can be exchanged for another. Popular pairs often include major cryptocurrencies like Bitcoin and Ethereum (e.g., BTC/ETH) or stablecoins like USDT (e.g., USDT/BTC). The choice of trading pair can significantly affect liquidity and price volatility.

Instant Settlement and Ownership Transfer is a Key Feature of Spot Trading. Image via Shutterstock

Instant Settlement and Ownership Transfer is a Key Feature of Spot Trading. Image via ShutterstockPrice Determination Through Supply and Demand

The prices in spot trading are determined by supply and demand dynamics within the market. When more traders want to buy an asset than sell it, prices tend to rise; conversely, when more traders wish to sell than buy, prices fall. This real-time price adjustment reflects market sentiment and can be influenced by various factors including news events, technological advancements, or regulatory changes. Traders often analyze these fluctuations using technical analysis tools to make informed decisions about when to enter or exit trades.

Spot Market Liquidity

Liquidity refers to how easily an asset can be bought or sold in the market without causing significant price changes. In spot trading, high liquidity is crucial as it allows traders to execute large orders quickly without impacting the asset's price significantly. Major cryptocurrencies typically exhibit higher liquidity due to their popularity and trading volume on exchanges. Conversely, lesser-known altcoins may have lower liquidity, leading to wider spreads between buying and selling prices. Traders should consider liquidity when choosing which assets to trade to ensure they can enter and exit positions efficiently.

Order Types in Spot Trading

Spot trading platforms offer various order types that cater to different trading strategies. Common order types include:

- Market Orders: Executed immediately at current market prices.

- Limit Orders: Set at a specific price; executed only when that price is reached.

- Stop-Limit Orders: Combines stop orders with limit orders for more controlled trades.

- Trailing Stop Orders: Adjusts automatically based on market movements to protect profits.

These order types enable traders to implement diverse strategies tailored to their risk tolerance and market outlook. Don't worry, we will be taking a deeper dive into these up ahead for better understanding.

Best Crypto Spot Trading Platforms

Choosing the right platform for spot trading can make a huge difference. The best platforms offer a combination of user-friendly interfaces, a wide range of cryptocurrencies, competitive fees, and robust security measures.

Below are some of the top crypto spot trading platforms currently available.

Binance

Binance is Known for its Extensive Asset Selection and Liquidity. Image via Binance

Binance is Known for its Extensive Asset Selection and Liquidity. Image via BinanceBinance, launched in 2017, is the world’s largest centralized crypto exchange by trading volume of over $12 billion, known for its extensive asset selection and liquidity. It supports over 380 cryptocurrencies and offers more than 1,200 trading pairs, providing users with ample trading opportunities.

Binance caters to both beginners and advanced traders through multiple interfaces and features, such as spot, margin, and futures trading. With competitive fees and incentives for users holding its native BNB token, Binance remains a popular choice globally despite regulatory challenges in some regions.

Bybit

Bybit Offers a User-Friendly Interface and Competitive Spot Trading Fees. Image via Bybit

Bybit Offers a User-Friendly Interface and Competitive Spot Trading Fees. Image via BybitBybit, founded in 2018, is a fast-growing centralized crypto exchange initially focused on derivatives but now offering robust spot trading services. The platform supports 500+ cryptocurrencies and provides access to over 600 trading pairs. Known for high liquidity, Bybit consistently maintains a 24-hour trading volume exceeding $4 billion.

With a user-friendly interface and competitive spot trading fees for both makers and takers, Bybit appeals to both beginners and advanced traders. While accessible in many regions, Bybit is restricted in the U.S. due to regulatory limitations.

Kraken

Kraken is Known for its Focus on Security, Regulatory Compliance, and Diverse Trading Options. Image via Kraken

Kraken is Known for its Focus on Security, Regulatory Compliance, and Diverse Trading Options. Image via KrakenKraken, founded in 2011, is a well-established centralized exchange known for its focus on security, regulatory compliance, and diverse trading options. As per CoinGecko, Kraken supports 290 cryptocurrencies and offers 761 trading pairs, catering to both retail and institutional investors.

The exchange shows a 24-hour trading volume exceeding $690 million, ensuring high liquidity for seamless trading. Kraken provides a range of services, including spot trading, margin trading, and staking. With competitive fees, advanced tools, and fiat support, it appeals to both beginners and experienced traders.

We have a detailed review of Kraken here for you to check out.

BloFin

BloFin has a User-Friendly Interface, Appealing to Traders at all Experience Levels. Image via BloFin

BloFin has a User-Friendly Interface, Appealing to Traders at all Experience Levels. Image via BloFinBloFin, launched in 2019, is a centralized exchange providing both spot and futures trading. According to CoinGecko, it supports 235 cryptocurrencies and offers 239 trading pairs, ensuring diverse market opportunities for users. The platform maintains a 24-hour trading volume of over $12 million, indicating solid liquidity for smooth trade execution. BloFin focuses on user security by collaborating with partners like Fireblocks and aims to offer competitive fees and a user-friendly interface, appealing to traders at all experience levels.

KuCoin

KuCoin is Known as “The People’s Exchange” for its Accessibility and Broad Range of Crypto Assets. Image via KuCoin

KuCoin is Known as “The People’s Exchange” for its Accessibility and Broad Range of Crypto Assets. Image via KuCoinKuCoin, launched in 2017, is a centralized exchange known as “The People’s Exchange” for its accessibility and broad range of crypto assets. According to CoinGecko, KuCoin supports just over 800 cryptocurrencies and offers around 1,200 trading pairs, making it one of the largest exchanges in terms of asset diversity.

With a 24-hour trading volume exceeding $600 million, KuCoin ensures ample liquidity for seamless trades. The platform provides various services, including spot, margin, and futures trading, as well as staking and lending options. KuCoin’s user-friendly interface and competitive fee structure make it popular among both beginners and advanced traders.

OKX

OKX is Popular Among Traders Seeking Diversity and Advanced Tools. Image via OKX

OKX is Popular Among Traders Seeking Diversity and Advanced Tools. Image via OKXOKX, founded in 2016, is a leading centralized crypto exchange known for its broad range of trading services, including spot, margin, and futures trading. According to CoinGecko, OKX supports 300 cryptocurrencies and offers over 600 trading pairs, making it popular among traders seeking diversity.

With a 24-hour trading volume of over $1.6 billion, it ranks among the top exchanges for liquidity and market activity. OKX also provides advanced tools such as DeFi integration, staking, and lending, catering to both beginners and seasoned traders.

Uniswap

This Decentralized Exchange Facilitates Peer-to-Peer Trading without Intermediaries. Image via Uniswap

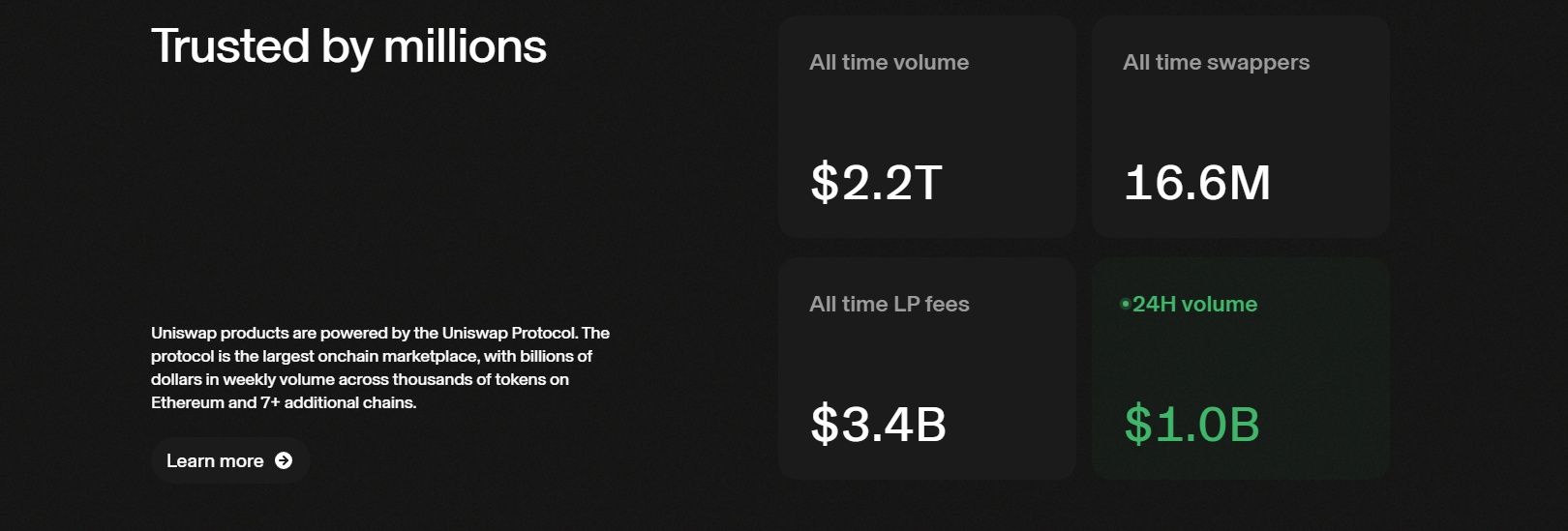

This Decentralized Exchange Facilitates Peer-to-Peer Trading without Intermediaries. Image via UniswapUniswap, launched in 2018, is a decentralized exchange (DEX) built on the Ethereum blockchain, facilitating peer-to-peer trading without intermediaries. According to CoinGecko, the V2 version of Uniswap supports over 2,800 cryptocurrencies and offers around 4,300 trading pairs, giving users a wide range of assets to trade.

The platform operates through automated market maker (AMM) protocols, where users trade against liquidity pools rather than a traditional order book. Uniswap’s 24-hour trading volume of around $1 billion, reflecting its importance in the DeFi ecosystem. With no central authority or registration required, Uniswap allows anyone with an Ethereum wallet to trade or provide liquidity.

We have a detailed review of Uniswap for you.

PancakeSwap

Users can Trade Cryptocurrencies Directly Through Automated Market Maker Pools. Image via PancakeSwap

Users can Trade Cryptocurrencies Directly Through Automated Market Maker Pools. Image via PancakeSwapPancakeSwap, launched in 2020, is a decentralized exchange (DEX) operating on the BNB Chain. It allows users to trade cryptocurrencies directly through automated market maker (AMM) pools without intermediaries. As per CoinGecko, PancakeSwap V2 supports 2,600 cryptocurrencies with access to just over 3,800 trading pairs, offering a broad range of assets.

Its 24-hour trading volume exceeds $54 million, reflecting strong activity within the platform. Users can also participate in yield farming, staking, and lotteries, making PancakeSwap a central player in the DeFi space. With no account registration required, it enables easy access to liquidity pools using any compatible crypto wallet.

Check out our detailed review of PancakeSwap.

How to Start Spot Trading in Crypto

Getting started with spot trading in cryptocurrency can seem daunting, but the process is straightforward when broken down into manageable steps. In this section, we will walk you through setting up your account, funding it, and executing your first trades.

Step 1: Choose a Cryptocurrency Exchange

The first step in starting your spot trading journey is selecting a reliable cryptocurrency exchange. Each platform we talked about has its unique features, fees, and supported cryptocurrencies, so it’s essential to choose one that aligns with your trading goals.

Step 2: Create an Account

Once you've selected an exchange, the next step is to create an account. This typically involves the following:

- Visit the Exchange Website: Go to the exchange's official website or download its app.

- Sign Up: Click on the "Sign Up" or "Register" button.

- Provide Personal Information: Enter your full legal name, email address, phone number, and date of birth.

- Verify Your Email: After submitting your information, check your email for a verification link and click on it to activate your account.

- Complete KYC Verification: Many exchanges require a Know Your Customer (KYC) process for security reasons. This may include uploading a government-issued ID and a selfie to confirm your identity.

Step 3: Link a Payment Method

After setting up your account, you need to link a payment method to fund your trading activities. Most exchanges accept various payment methods, including:

- Bank Transfers: A common method for depositing fiat currency.

- Credit/Debit Cards: Quick and convenient for instant deposits.

- Cryptocurrency Transfers: If you already own cryptocurrencies, you can transfer them to your exchange wallet.

Make sure to check the fees associated with each payment method, as they can vary significantly between exchanges.

Getting Started With Spot Trading is a Straightforward Process. Image via Shutterstock

Getting Started With Spot Trading is a Straightforward Process. Image via ShutterstockStep 4: Deposit Funds

With your payment method linked, you can now deposit funds into your exchange account. Navigate to the deposit section of the platform and follow the instructions provided. Ensure that you deposit sufficient funds to cover any trades you plan to make, along with potential transaction fees.

Step 5: Select a Trading Pair

Once your account is funded, you're ready to start trading. Navigate to the marketplace section of the exchange and select the cryptocurrency you wish to trade. Trading pairs are typically formatted as [BASE/QUOTE], such as BTC/USD or ETH/BTC. Choose the pair that aligns with your trading strategy.

Step 6: Place Your Order

After selecting a trading pair, it's time to place an order:

- Choose Order Type: Decide whether you want to place a market order (executed immediately at current market prices) or a limit order (executed only when the price reaches a specified level).

- Enter Amount: Specify how much of the cryptocurrency you wish to buy or sell.

- Confirm Order: Review all details before confirming the order.

Step 7: Monitor Your Investment

After executing your trade, monitor your investment regularly. Keep an eye on market trends and news that may affect cryptocurrency prices. Most exchanges provide tools for tracking portfolio performance and analyzing price movements.

Step 8: Secure Your Assets

Finally, consider how you will store your cryptocurrencies after purchasing them. While exchanges offer wallets for convenience, it's often safer to transfer assets into a personal wallet—either hardware or software—for enhanced security.

Spot Trading Strategies for Crypto Traders

This section covers two primary strategies: the buy and hold and day trading strategies, providing insights into how each works and their respective benefits and risks.

Buy and Hold Strategy

The buy-and-hold strategy is a long-term investment approach where traders purchase cryptocurrencies with the intention of holding them for an extended period, regardless of short-term price fluctuations.

This strategy is grounded in the belief that, over time, the value of certain cryptocurrencies will increase significantly. Benefits include:

- Simplicity: It requires less active management compared to other trading strategies, making it ideal for beginners.

- Potential for High Returns: Historically, many cryptocurrencies have experienced substantial long-term growth, rewarding patient investors.

- Reduced Transaction Fees: Fewer trades mean lower transaction costs, which can eat into profits.

How to Spot Promising Crypto Projects

To effectively implement this strategy, traders should conduct thorough research on potential investments. Key factors to consider include:

- Technology and Use Case: Evaluate the underlying technology and practical applications of the cryptocurrency.

- Team and Development Community: A strong team with a proven track record can indicate a project's potential for success.

- Market Sentiment and Adoption Rates: Analyze community engagement and adoption metrics to gauge future growth prospects.

Potential Risks in Holding Volatile Assets

While the buy and hold strategy can yield significant returns, it also carries risks:

- Market Volatility: Cryptocurrencies are notoriously volatile; prices can drop sharply, leading to potential losses.

- Long-Term Commitment: Holding assets for extended periods may expose investors to market downturns without immediate recourse.

Buy and Hold and Day Trading Are Two Popular Strategies. Image via Shutterstock

Buy and Hold and Day Trading Are Two Popular Strategies. Image via ShutterstockDay Trading Strategies for Spot Trading

Day traders buy and sell cryptocurrencies based on real-time market analysis. They often use technical indicators to identify trends and make quick decisions. The goal is to "buy low and sell high" within short time frames, taking advantage of price fluctuations.

Risk Management Strategies

Effective risk management is crucial in day trading due to the inherent volatility of cryptocurrencies. Traders often employ:

- Stop-Loss Orders: Setting predetermined exit points helps limit potential losses by automatically selling assets when prices fall below a certain level.

- Position Sizing: Determining the appropriate amount to invest in each trade based on overall capital helps mitigate risks.

How to Read Market Signals

Successful day traders utilize various tools and indicators:

- Technical Analysis Tools: Indicators such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands help identify entry and exit points.

- Market Sentiment Analysis: Understanding overall market sentiment through news events or social media trends can provide insights into potential price movements.

Common Mistakes to Avoid in Crypto Spot Trading

Navigating the world of crypto spot trading can be challenging, and avoiding common pitfalls is essential for long-term success. If you can watch out for the following, you might be good:

1. Overtrading and Emotional Trading

One of the most prevalent mistakes is overtrading, which often stems from emotional decision-making. Traders may feel compelled to make frequent trades in response to market fluctuations, leading to increased transaction fees and potential losses. It's crucial to stick to a well-defined trading plan and avoid impulsive decisions driven by fear or greed.

2. Not Doing Proper Research on Trading Pairs

Entering trades without adequate research on trading pairs can result in poor investment choices. Understanding the fundamentals of the cryptocurrencies involved, their market trends, and liquidity is vital for making informed decisions.

3. Ignoring Market Trends and News

The cryptocurrency market is highly influenced by news and trends. Ignoring significant developments—such as regulatory changes, technological advancements, or major partnerships—can lead to missed opportunities or unexpected losses. Staying informed through reliable news sources is essential.

4. Failing to Diversify and Mitigate Risk

Investing all funds into a single asset increases risk exposure. Failing to diversify across different cryptocurrencies can lead to substantial losses if one asset underperforms. Implementing risk management strategies, such as setting stop-loss orders and diversifying your portfolio, can help protect your investments.

What is Spot Trading in Crypto: Closing Thoughts

Spot trading in cryptocurrency offers numerous advantages, making it an appealing choice for both novice and experienced traders. Its immediate settlement feature allows for quick ownership transfer, enabling traders to capitalize on market opportunities without delay. The simplicity of trading pairs and the ability to execute trades based on real-time supply and demand dynamics further enhance the appeal of spot trading.

However, success in spot trading requires a solid understanding of effective strategies and risk management practices. Whether you choose to adopt a buy-and-hold strategy for long-term gains or engage in day trading for short-term profits, it's essential to conduct thorough research, stay informed about market trends, and diversify your investments to mitigate risks.

Whatever your spot trading plans are, remember to approach the market with caution and discipline. By implementing sound trading strategies and maintaining a focus on risk management, you can navigate the volatile cryptocurrency landscape more effectively. Embrace the opportunities that spot trading provides, and equip yourself with the knowledge and tools necessary for responsible trading. With careful planning and execution, you can maximize your potential for success in this dynamic market.