The next chapter in blockchain usability is chain abstraction: the idea that users shouldn't need to know which chain they’re on. Just as no one checks which server delivers their email, Web3 users shouldn’t have to think about which network powers their transaction. This principle, outlined in Coin Bureau’s research on interoperability, sets the foundation for a chain-agnostic internet economy.

At the heart of this evolution lies the intent-based model. Users express what they want to do (swap tokens, interact with an app, bridge assets), and decentralized solvers handle how to get it done. But this layer of abstraction requires a strong foundation. That’s where protocols like Wormhole come in. Even when end-users don’t interact with Wormhole directly, it is often the infrastructure quietly enabling these cross-chain operations behind the scenes.

Wormhole acts as a transport layer for the multichain world. It facilitates moving value and data between blockchains securely, sometimes in the form of tokens, other times as general-purpose messages. As the blockchain stack matures, such transport layers must achieve three fundamental goals:

- Break ecosystem silos by allowing liquidity and data to move freely across chains.

- Enable cross-chain composability so decentralized applications can interoperate, no matter where they are deployed.

- Maintain security guarantees that closely match those of the source and destination chains.

In practice, these goals aren’t trivial. Each chain has its own logic, validators, and consensus rules. Yet Wormhole manages to connect over 30 chains, abstracting away the mess for developers and users alike.

This article explains how Wormhole works, why it matters, and how it’s quietly becoming the connective tissue of the blockchain-powered internet.

Key Takeaways

- Wormhole is a cross-chain messaging protocol that enables secure, efficient, and composable communication between 30+ blockchains, powering token transfers, data sharing, governance, and app interoperability.

- Its modular product suite includes Native Token Transfers (NTT), a Token Bridge, Wormhole Settlement and Wormhole Connect, each solving unique cross-chain needs across assets, intents, and user interfaces.

- At the heart of Wormhole’s trust model are 19 independent validators (called the Guardian Network), who verify and sign cross-chain messages to ensure message integrity across chains.

- Wormhole embraces intent-based design, letting users define outcomes while solvers handle routing and execution behind the scenes, enabling faster, gas-abstracted multichain UX.

- The launch of MultiGov empowers governance across chains via aggregated voting, making Wormhole the backbone not just for communication, but for decentralized coordination across networks.

What is Wormhole?

Wormhole is a generic message-passing protocol designed to enable secure and efficient communication across blockchains. It serves as an interoperability layer that allows chains to exchange assets, share data, and interoperate at the application level. In simpler terms, Wormhole is the invisible piping system that lets smart contracts, assets, and messages move freely between otherwise siloed ecosystems.

Think of how the internet works today. You might be browsing a website hosted on a server in New York while sitting in Paris. That distance is irrelevant to the experience, thanks to undersea cables that route data between continents in real time. Blockchain bridges play a similar role, making sure your tokens or data can move from Ethereum to Solana or any other supported chain, regardless of geography or architecture.

Wormhole’s core philosophy builds on this idea. Instead of just enabling asset transfers, it standardizes cross-chain communication by deploying smart contracts on every connected chain. These contracts translate and verify messages between chains, ensuring the source and destination both understand and process the transaction correctly.

Wormhole Was the First Solana-Ethereum Bridge | Image via Wormhole

Wormhole Was the First Solana-Ethereum Bridge | Image via WormholeHowever, all cross-chain systems must confront a fundamental challenge: the oracle problem. Originally articulated by Chainlink, it refers to the idea that blockchains can only fully verify data generated within their own network. Anything coming from outside, such as a message from another chain, requires some form of external trust.

Bridges introducing foreign information implement a trust layer. In Wormhole’s case, this role is filled by a Guardian Network: a group of 19 independent validators that observe and validate messages between chains.

Wormhole’s design isn’t just theoretical; it powers a wide set of products that developers and users interact with daily:

- NTT (Native Token Transfers): A framework that allows tokens to move across chains without wrapping, keeping native properties like governance rights or upgradeability intact. For example, moving AAVE from Ethereum to Arbitrum without converting it to a derivative.

- Token Bridge: A traditional lock-and-mint system for transferring wrapped assets between chains.

- Settlement: An intent-based execution framework where users declare their goal (e.g., swap USDC on Arbitrum for SOL on Solana), and decentralized solvers execute it efficiently across chains.

- Wormhole Connect: A pre-built UI that handles cross-chain transfers, adopted by apps like Portal Bridge, Jupiter Exchange, and PancakeSwap.

- MultiGov: A governance system that lets DAOs and protocols make decisions across multiple chains from a single unified interface.

Together, these tools form a modular, scalable platform that powers a growing ecosystem of cross-chain applications. Wormhole isn’t just a bridge; it’s the transport layer of the multichain internet.

Wormhole Product Ecosystem

Blockchain bridging sounds simple on the surface: move tokens or data from one chain to another. But under the hood, it’s deeply technical. A token’s “identity” can change depending on its path; USDC bridged from Optimism may not be recognized the same as USDC from Base.

Add real users into the mix, who might want to pay fees in one token, bridge a second, and swap into a third, and things get exponentially more complex. Wormhole addresses these challenges with a modular product suite, each tailored to handle specific cross-chain needs across assets, apps, intents, and governance.

Native Token Transfers (NTT)

In the real world, your identity is backed by your government, which records your name, nationality, and a unique identifier like a Social Security Number. When you travel abroad, you don’t bring your identity database with you. Instead, standardized documents like passports let foreign governments verify who you are.

Blockchains work similarly. A token is defined by a smart contract on its origin chain. When bridged to another chain, that contract, and therefore the token’s “identity,” doesn’t exist there. Without context, the destination chain can't verify what the token is or whether it’s authentic.

NTT (Native Token Transfers) solves the identity issue. It’s a framework that allows tokens to move across chains without being wrapped or reissued. Instead, tokens retain their original identity, preserving properties like governance rights, metadata, and supply control. That means no matter which chain a token moves to or how it got there, it remains fully fungible, trackable, and non-duplicable. Total supply is conserved, and tokens arriving via different bridges aren’t treated as separate assets.

This eliminates fragmentation, simplifies cross-chain logic for developers, and improves UX for users who no longer need to worry about “which version” of a token they’re holding.

A growing list of protocols already use NTT to enable seamless multichain functionality:

- Lido, ether.fi, Puffer, Renzo, Stakewise – for cross-chain staking and restaking assets

- Jito, Pike – for multichain liquidity and lending

- Sky (formerly MakerDAO), Mento, Agora – for multichain stablecoins and governance

- Securitize – for real-world asset (RWA) tokenization

- Solana-native apps like Jupiter and Portal are also integrating NTT for smoother user flows.

As token movement becomes more complex, NTT is becoming standard for building natively multichain assets.

Token Bridge (Lock-and-Mint)

Wormhole’s Token Bridge operates on a lock-and-mint model. When a user initiates a transfer, the original token is locked on the source chain, and a wrapped representation is minted on the destination chain. This wrapped token mirrors the original in value, but it isn’t the same asset; it’s a synthetic version. To reverse the process, users burn the wrapped token, triggering the release of the original token back on its home chain.

This system ensures that the token supply remains constant across all chains, preventing duplication or double-spending. It’s a practical and battle-tested approach to cross-chain asset mobility, especially for tokens not designed to be natively multichain.

Many DeFi protocols and DEXs rely on Wormhole’s Token Bridge to support multichain operations:

- Fantom: Used the Token Bridge to deploy Circle’s USDC standard, minting USDC.e on Fantom for cross-chain stablecoin use.

- Threshold Network: Bridges tBTC by locking BTC and minting wrapped tBTC across chains for decentralized Bitcoin liquidity.

- Mayan: Integrates the bridge to power its auction-based swap protocol, locking source tokens and minting equivalents for cross-chain settlement.

- Synonym: Uses the bridge (alongside CCTP) for a multichain lending and borrowing market.

- Aldrin: Bridges its RIN token between Ethereum and Solana for DEX trading.

- Serum: Enables asset transfers from Ethereum to Solana, minting wrapped tokens into its Solana-based DEX environment.

For tokens that don’t yet support NTT or require temporary cross-chain movement, the lock-and-mint bridge is more ideal.

Wormhole Settlement

Wormhole Settlement is a cross-chain asset transfer framework built around intents, a new paradigm where users express what they want, and not how to get it done, even abstracting away the unique gas requirements of the chains involved. Developed in collaboration with Mayan Finance, Settlement combines Wormhole’s messaging layer with Circle’s CCTP to power an abstracted, high-speed, multichain execution layer that removes manual bridging steps entirely.

This model reflects the future of Web3 interoperability. As described earlier in the article, intents are transforming how users interact with blockchains. Instead of bridging tokens, swapping assets, and switching networks step-by-step, users will increasingly specify a final goal like “I want to go from stETH on Ethereum to JUP on Solana” and let off-chain agents called solvers fulfill the request.

Solvers act as liquidity routers. They monitor for user intents, front the necessary capital, and handle the routing, bridging, and swapping behind the scenes. Users receive their destination token instantly, while the solver completes the backend settlement using Wormhole messaging and token standards like NTT and CCTP. This design ensures faster UX and more flexible capital deployment, without waiting on finality before asset delivery.

Settlement currently supports Ethereum, Arbitrum, Optimism, Base, Polygon, Avalanche, Solana, Sui, and Unichain. It’s already integrated with protocols such as Mayan, Portal, and Synonym, and is increasingly being used by market makers, DeFi platforms, and institutional players.

How It Works: Three Layers of Settlement

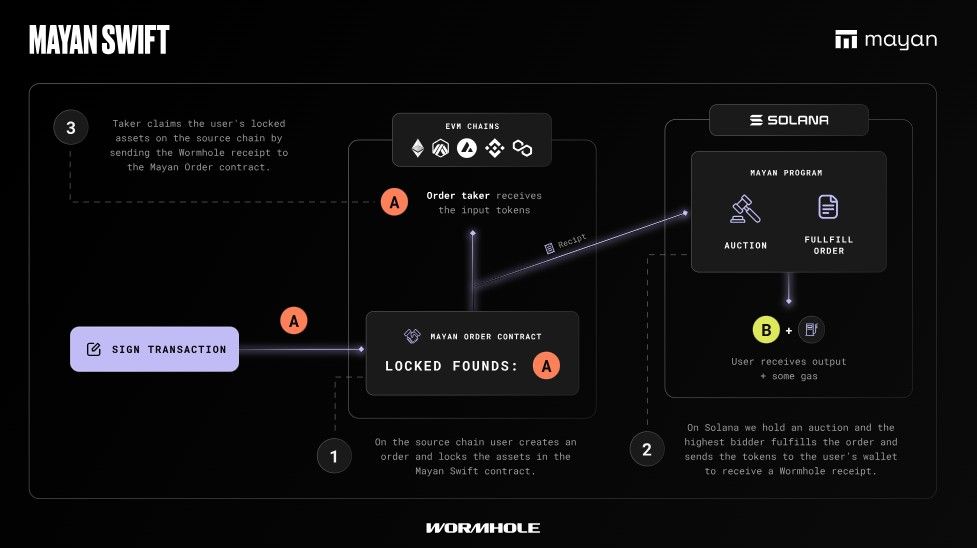

Mayan Swift: Implements competitive on-chain auctions on Solana. Users lock their source asset and define the target output. Solvers bid to fulfill the request, and the winning bid triggers a Wormhole message signed by Guardians, enabling fulfillment on the destination chain. Final settlement completes when the solver proves delivery and claims the locked funds.

The Diagram Illustrates Settlement’s Auction Process on Solana | Image via Wormhole Blog

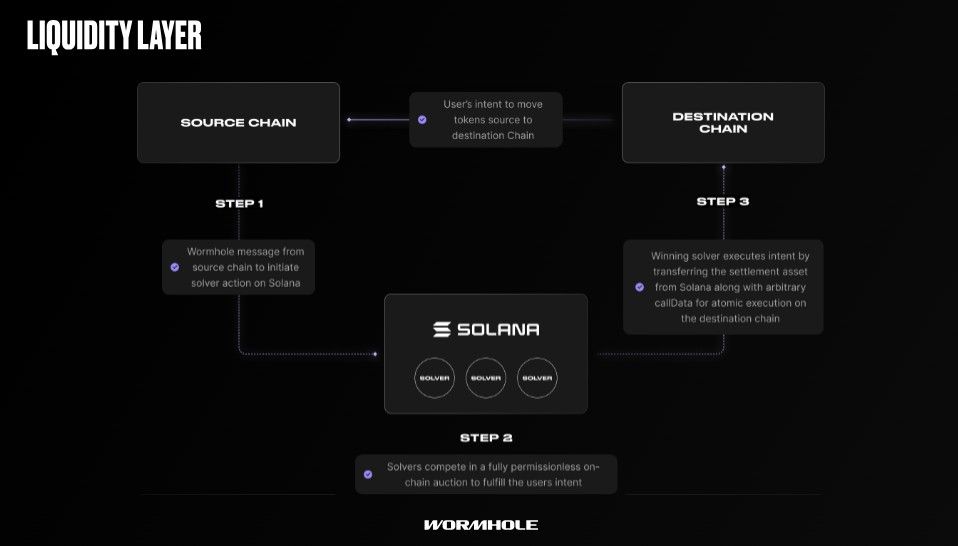

The Diagram Illustrates Settlement’s Auction Process on Solana | Image via Wormhole BlogWormhole Liquidity Layer: Uses Solana as a central coordination hub. Solvers mint and burn assets using Wormhole NTT or CCTP instead of pre-deploying liquidity on every chain. This system improves capital efficiency and execution speed while introducing slashing mechanisms for missed deadlines.

Wormhole Liquidity Layer Manages Settlement Coordination | Image via Wormhole Blog

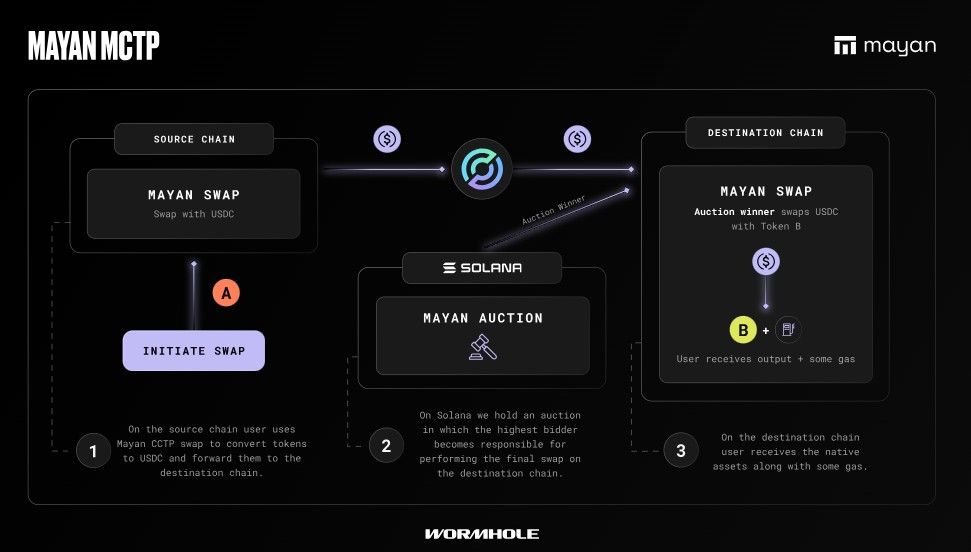

Wormhole Liquidity Layer Manages Settlement Coordination | Image via Wormhole BlogMayan MCTP: A fallback built on Circle’s CCTP, allowing any-to-any token transfers with added composability. While slower (~15 mins), it ensures robustness when Swift or the Liquidity Layer is unavailable.

Mayan MCTP Kicks In When Swift or the Liquidity Layer are Unavailable | Image via Wormhole Blog

Mayan MCTP Kicks In When Swift or the Liquidity Layer are Unavailable | Image via Wormhole BlogSettlement was officially launched in February 2025 as part of Wormhole’s Era4 roadmap, delivering the performance and abstraction needed for the next generation of multichain DApps. It is already powering cross-chain perps, DeFi bridges, prediction markets, and large-scale institutional asset flows—paving the way for intent-driven, chain-agnostic finance.

Wormhole Connect

Wormhole Connect is a pre-built bridge UI widget that developers can drop straight into their Dapps without building a custom interface from scratch. It abstracts away the complexity of cross‑chain transfers, wallets, gas management, and UI concerns.

Wormhole Portal User Interface | Image via Wormhole

Wormhole Portal User Interface | Image via WormholeSeveral major platforms have adopted Wormhole Connect to power their proprietary bridges:

- Portal Bridge, Wormhole’s official transfer interface

- Jupiter Exchange, enabling zero-slippage swaps bridging ETH, WETH, and WBTC from Ethereum to Solana via Wormhole Connect.

- PancakeSwap, which embeds the Connect widget to enable users to bridge assets across EVM chains like Ethereum, BNB Chain, Arbitrum, and Base

Under the hood, Connect leverages the Wormhole SDK and abstracts messaging, route discovery (including support for NTT, Portal, and CCTP routes), gas handling, and cross‑chain confirmations. It offers customizable theming and configuration options for developers to control supported chains, token lists, network mode, and appearance.

Wormhole Architecture

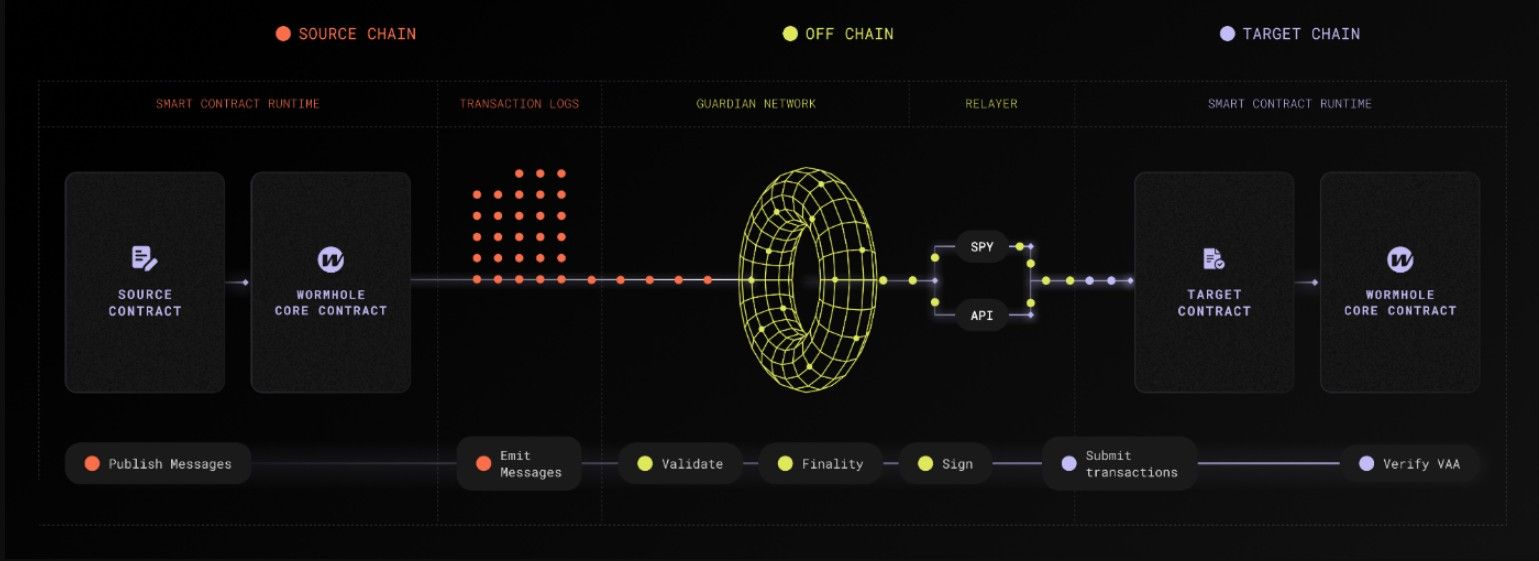

Wormhole operates through a carefully designed interplay between on-chain contracts and off-chain infrastructure. On-chain components are deployed across each supported blockchain and are responsible for packaging, emitting, and verifying cross-chain messages. These contracts act as the interface between applications and Wormhole's messaging layer.

Wormhole Architecture | Image via Wormhole Docs

Wormhole Architecture | Image via Wormhole DocsThe actual transport, however, is handled off-chain. A decentralized network of validators, known as Guardians, observes these on-chain messages, signs them, and relayers transport them across networks. These off-chain components ensure that messages are securely transported, verified, and delivered to the destination chain, making Wormhole’s messaging system both secure and highly scalable.

The End-to-End Flow

Wormhole facilitates cross-chain communication through a four-step pipeline:

- Source Chain: The process begins when a smart contract called Emitter interacts with the Wormhole Core Contract, publishing the cross-chain message in the blockchain’s transaction logs. These logs contain critical metadata like the sender’s address, message payload, and a sequence number to ensure ordering and traceability.

- Guardian Network: The message doesn’t move itself. 19 Guardians monitor transaction logs by running full nodes of all connected chains. Each Guardian independently identifies and verifies the message. When more than two-thirds agree on the validity, they collectively sign a packet called a Verifiable Action Approval (VAA). This VAA is like a cryptographically signed certificate confirming that a valid message was emitted.

- Relayers: The signed VAA is then fetched by relayers, an off-chain services that transport the VAA to its intended destination chain. Relayers don’t have special privileges; they merely act as messengers. Anyone can run one, and multiple relayers can service the same message, ensuring high availability.

- Target Chain: The target contracts on the destination chain consume the VAA. They call the Wormhole Core Contract to verify the signature and authenticity of the message. Once validated, the contract executes the desired logic: minting a wrapped token, updating application state, or triggering a governance action.

This architecture separates message trust (handled by Guardians) from message transport (handled by relayers), enabling Wormhole to offer composable, secure, and highly flexible multichain messaging.

The Guardian Network

At the heart of Wormhole’s security model is the Guardian Network, a peer-to-peer network 19 independent validators. It functions as a quorum-based oracle layer, responsible for validating and signing cross-chain messages transmitted via Wormhole.

Each Guardian operates full nodes for every chain that Wormhole connects to, ensuring direct, trustless access to the source chain’s transaction logs. When a cross-chain message is emitted, each Guardian independently reads the logs and verifies the message. This network allows Wormhole to be modular and chain agnostic, adding any network simply requires the Guardians to run its full node and sign messages in its format.

Once at least two-thirds of Guardians, or 13 out of 19, approve the message, they collectively sign the multisig VAA contract. Leading node providers in the industry operate the Guardian Network.

Guardian Network is technically an off-chain and trusted component. So Wormhole introduces transparency through a tool called Spy. It allows monitoring the network’s activity in real-time, so anyone can check the messages they’re sending.

Wormhole’s Future

Wormhole’s evolution reflects the broader trajectory of cross-chain interoperability—starting with token transfers and growing into a modular framework for a chain-agnostic internet economy.

- Era 1 (2020–2021) marked the beginning, with the launch of the first bridge between Solana and Ethereum.

- Era 2 (2021–2024) expanded the vision. Wormhole introduced arbitrary messaging. The protocol scaled to over 30 supported networks and shipped NTT, Connect and Portal. Wormhole enabled liquidity mobility for leading applications like Uniswap, Lido and Pyth.

- Era 3 (2024–2025) saw major UX upgrades, faster swaps, integrated relaying, and a redesigned SDK. Era 3 set the stage for the next leap: intent-based transfers with Wormhole Settlement.

MultiGov – Multichain Governance

Wormhole’s Era4 has commenced with the unveiling of MultiGov: a multi-chain governance framework designed to collaborate W stakers spanning different chains.

The W token is already delegated and staked across Ethereum, Solana, Base, Arbitrum, and Optimism. MultiGov enables aggregating votes from all token holders regardless of where their assets reside.

MultiGov follows a hub-and-spoke model:

- Proposals are created on a designated hub chain

- Token holders can vote on spoke chains. Wormhole’s VAAs will aggregate votes from all chains for collective decision-making.

- Votes are checkpointed to prevent double-counting and finalized on the hub

- Once approved, proposals can trigger cross-chain execution, such as upgrades or contract changes, across multiple networks

The infrastructure is fully modular and upgradeable, with vote tracking handled through Tally, a leading on-chain governance provider.

Closing Thoughts

Wormhole has come a long way from its origins as a simple lock-and-mint token bridge. Today, it offers a comprehensive suite of cross-chain infrastructure, from low-level messaging and token standards to fully integrated user interfaces like Wormhole Connect. It embraces chain abstraction and intent-based interoperability, showing a keen understanding of Web3’s evolving direction toward seamless, automated, and chain-agnostic experiences.

And with the launch of MultiGov, Wormhole is not just connecting blockchains, it’s building the governance fabric for a truly collective internet economy that spans them all.