GM Anon!

Today we'll be conducting a comprehensive assessment of the major airdrops that have occurred thus far. We'll examine where users have reaped the greatest rewards and explore the emerging challenges within the airdrop landscape.

Despite the anticipation of the largest airdrop season in crypto history, the reality has been somewhat underwhelming, with only users in certain ecosystems experiencing significant returns.

Let's jump right in!

Winners & Losers of Airdrop Season

An indication that the market is evolving in complexity and becoming less straightforward is the current state of airdrops. In this section, we'll rank them from the most favorable to the least and identify which ecosystem the market will likely reflect on as the most successful when this bull market is over. It's probable that the ecosystem with the most successful airdrops will continue to develop a very strong community and outperform for the remainder of this cycle.

🥇First Prize To The King: Bitcoin

Interestingly, it seemed that users fixated on airdrops were searching everywhere except Bitcoin. There are reasons for this phenomenon, most notably the objectively horrendous user experience on Bitcoin. However, this worked in its favor, acting as a barrier that kept many users away and limited user participation. Users holding key emerging NFT collections on Bitcoin, such as Bitcoin Puppets, Quantum Cats, NodeMonkes, and O.P.I.U.M, saw the price of these NFTs appreciate tens of thousands.

Top left to right: NodeMonkes, Bitcoin Puppets. Bottom left to right: Quantum Cats, O.P.I.U.M

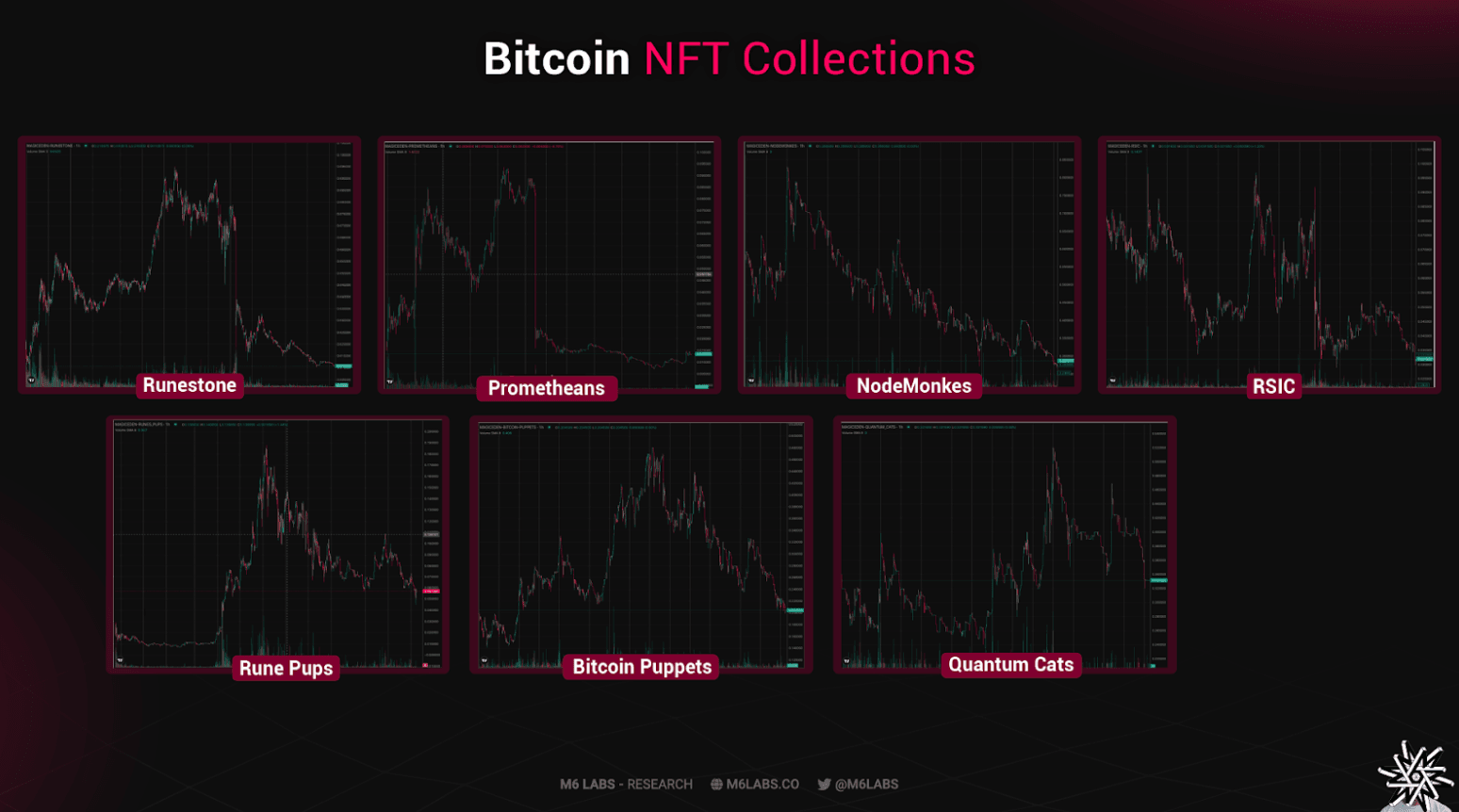

Top left to right: NodeMonkes, Bitcoin Puppets. Bottom left to right: Quantum Cats, O.P.I.U.MMoreover, users holding these NFTs were rewarded with more NFTs. NFTs like Runestones, Runepups, RSIC Metaprotocol, Prometheans and others were airdropped to holders of these collections.

Besides the tremendous appreciation in the value of these NFTs, users were then airdropped the runes collections of these tokens (note that some of these collections have yet to airdrop runes), which, if sold soon after the halving, translated into even more gains. Notable examples include RSIC.

The highlight of the recent airdrop season on Bitcoin was $PUPS, airdropped to Bitcoin Puppet and O.P.I.U.M holders. This token, initially valued at around $0.03, surged to almost $100 over three months.

Source

SourceSimply by holding and selling at the right times, Bitcoin Puppets minted numerous millionaires. When the market eventually catches up and reflects on this, it is likely that Ordinals will emerge as having been the ultimate alpha, surpassing most Ethereum NFT collections during the heyday of the 2021 bull run in terms of user rewards.

It's worth noting that due to the high friction and low participation in the Bitcoin ecosystem, users holding Ordinals like RSIC and all the OG collections anticipate future airdrops of Runes collections.

Why? Because these communities have proven themselves as long-term holders invested in the ecosystem. New projects and possibly the next $PUPs are likely to allocate to these holders.

The rewards continue, and we're still not even halfway through this bull market. It pays to put in the work and explore places where other users will not, anon.

Source

Source🥈 Second Prize To Solana

Airdrops on Bitcoin weren’t even on most people's radars, but Solana was different. Solana was the wild card that die-hard users of its ecosystem believed would pay off. However, many chose to farm on Ethereum, which made sense due to its liquidity and the provenance of DeFi. Ethereum was seen as a more legitimate use of funds and time, but it seems the real advantage once again was in participating in a system most users had shunned or ignored.

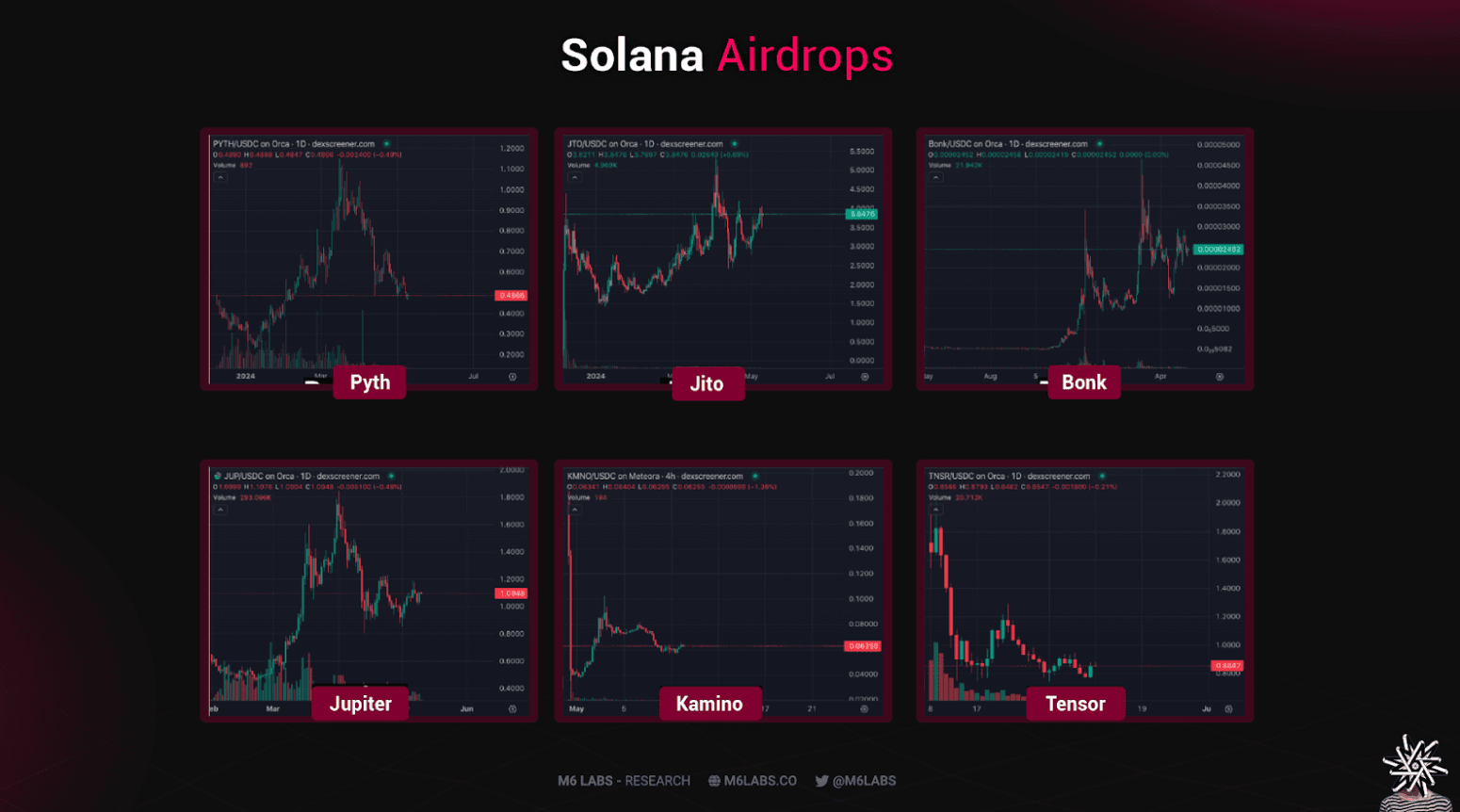

Let’s take a look at the major airdrops so far on Solana:

The Pyth airdrop began on November 20, 2023, to decentralize and strengthen on-chain governance. Gains were much more modest compared to Bonk or Jito, with users seeing a maximum appreciation of 120%, but the token is currently trading close to its initial market price.

One of the highlights among major Solana airdrops was Jito (JTO), which distributed tokens on December 7, 2023. The airdrop was praised for rewarding almost 10,000 users with thousands in tokens, even giving the "little guy" a chance. Some criticized the airdrop for being skewed against users with large deposits, but overall, most were satisfied with its execution. Notably, Jito put the Solana ecosystem on the map, although JTO continues to hover around its launch price.

Moving on, the memecoin BONK airdropped 50% of its supply on December 25, 2022, skyrocketing 3,600% in one week and rewarding Solana Saga phone buyers with a staggering 10,400% price gain, turning $300 into $500,000 for some users. Solana Saga phones were in high demand, and BONK further bolstered the legitimacy of the Solana ecosystem.

Following Bonk, Jupiter (JUP), a major DEX on Solana, conducted its "Jupuary" airdrop in January 2024. The token has performed well and is currently trading at over 100% of its launch price.

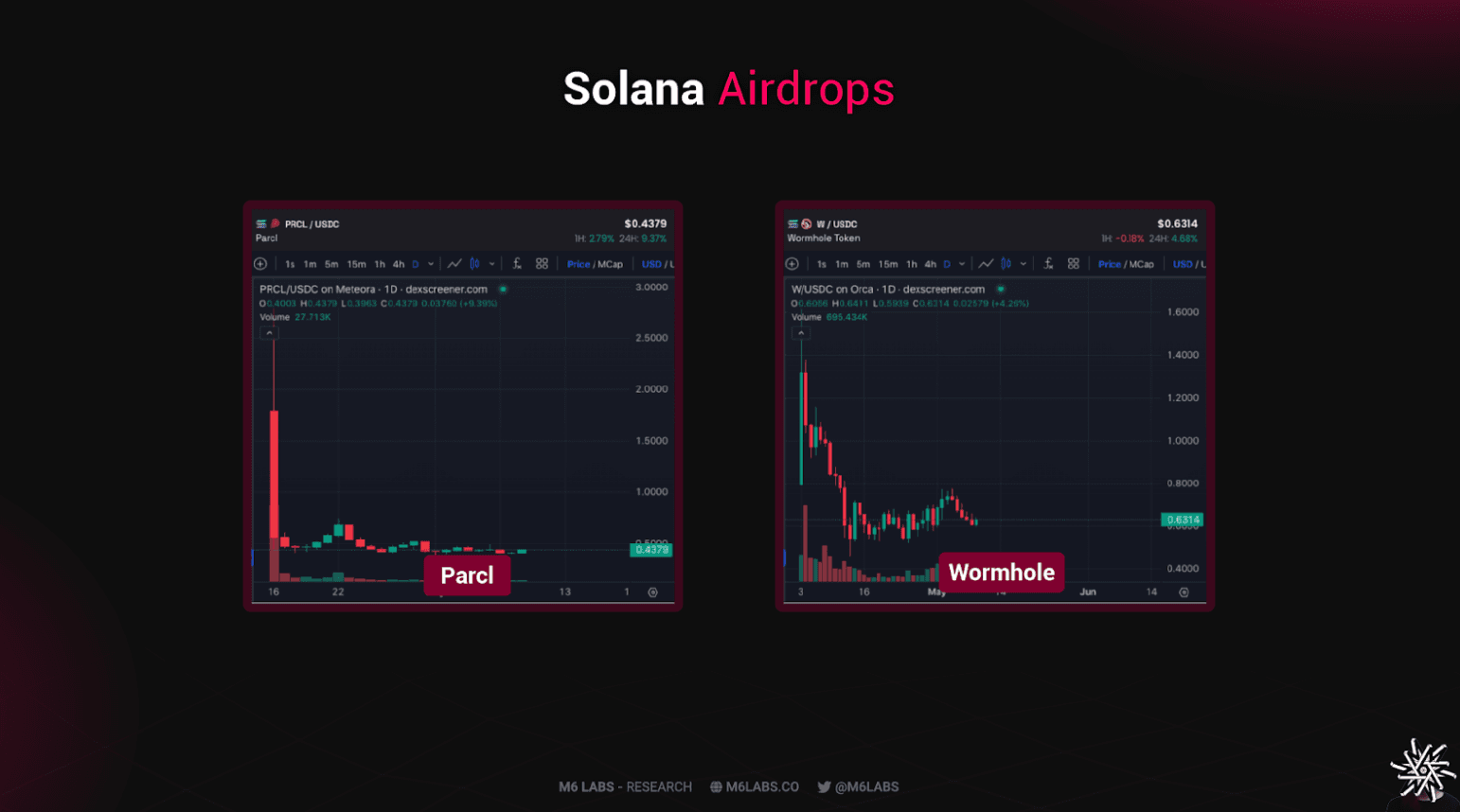

The recent launches and airdrops of Parcl, Tensor, and Kamino all fell rather flat. While there's a possibility these tokens may gain traction in the future, the rewards offered failed to meet users' expectations, and the subsequent price appreciation post-airdrops was underwhelming. For many users, the reward for locking up capital for months didn't seem worth it.

However, Wormhole stood out as a notable success among recent airdrops. Many participants received tokens simply by interacting with the bridge. Despite its strong start, Wormhole's token performance has been lackluster since its launch. Nevertheless, speculation persists that staking Wormhole could potentially lead to an eventual Monad airdrop, fueled by the close relationship between the teams involved.

A common theme throughout airdrop farming is that as an ecosystem gains traction and the userbase increases, the rewards then diminish dramatically. In summary, the clear winner for Solana users was receiving the Bonk or Jito airdrop.

🥉 Third Prize To Everyone But Ethereum

It was a close tie between listing Solana-based airdrops and airdrops such as Celestia in second place. However, Solana took second place due to the impact these airdrops had on the ecosystem.

They sparked a memecoin and mass airdrop farming season, leading to an influx of liquidity and users flocking to Solana after these airdrops. This suggests that enormous growth is on the horizon for Solana this cycle.

Meanwhile, modular blockchains like Celestia saw impressive gains during their launches but still have underdeveloped ecosystems. We have yet to see these ecosystems fully blossom and mature. Time will tell how they perform in this cycle.

Celestia's airdrop, which took place as part of its TIA token launch, was announced on September 26, 2023. The TIA token is integral to Celestia's modular blockchain, used for data availability services, governance, and securing consensus via proof-of-stake. In the airdrop, 6% of the total 1B TIA supply was allocated to eligible users, including contributors to public goods and research linked to Celestia, early adopters of Ethereum L2 solutions like Arbitrum and Optimism, and stakers in the Cosmos ecosystem.

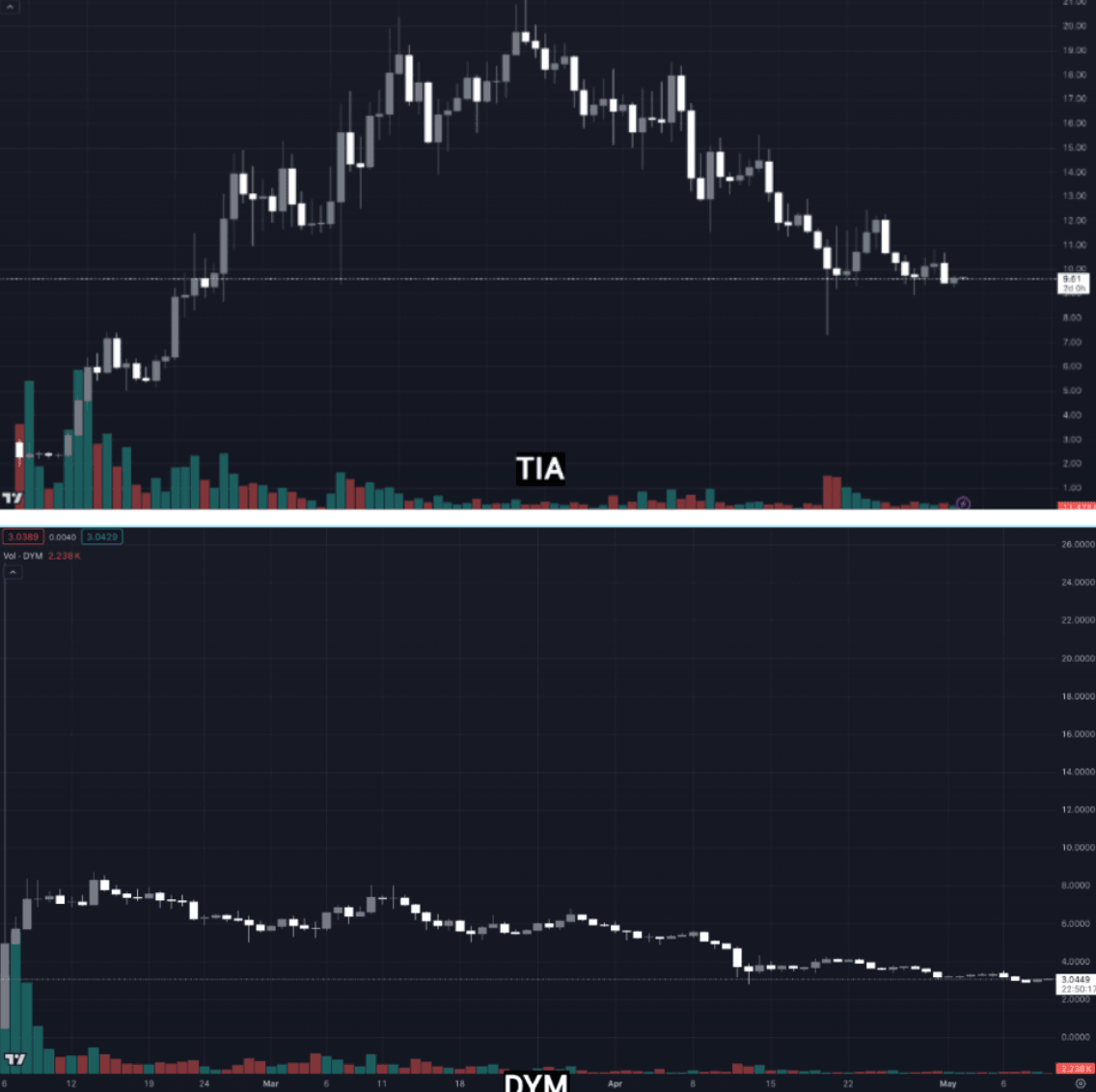

Celestia is currently trading at around $9.61, which is approximately four times its launch price. This is a notable achievement for active users, especially for those who used multiple wallets, allowing them to receive thousands of dollars worth of tokens. Users were encouraged to stake these tokens on Cosmos, with rumors of future airdrops. The more tokens that were staked, the more airdrops users would be eligible for in the future.

Within the Cosmos ecosystem, a "staking meta" emerged, with numerous individuals staking their ATOM, INJ, and TIA to qualify for these potential rewards.

However, despite the anticipation, the actual frequency and size of these airdrops have been limited. For many participants, this has translated into a missed opportunity, and the Cosmos ecosystem has experienced a notable decline from its peak activity seen in December and January.

So far, TIA stakers have been or will be rewarded with multiple airdrops, among which Dymension (DYM) stands out as one of the most significant. Initially launched at around $5, it's currently trading at $3.

Other notable airdrops include Movement (MOV), Saga (SAGA), Altlayer (ALT), Manta Network (MANTA), and more. While there's speculation about a possible airdrop from Berachain to TIA stakers, it remains largely speculative for now. It's worth mentioning that, apart from DYM, none of the received airdrops have amounted to substantial values.

Similar to the incentives offered to TIA stakers, DYM stakers were recently rewarded through the NIM airdrop. In March 2024, the NIM Network announced an airdrop for DYM stakers and certain NFT holders, distributing 90 million NIM tokens to qualifying participants. Dubbed the "Genesis Rolldrop," this airdrop rewarded DYM stakers and holders of NFTs from games such as Parallel, Pirate Nation, and Pudgy Penguins.

WTF Is Going On With Ethereum & L2s

The outlook for Ethereum ecosystem airdrops isn't promising. Despite expectations for a breakout equivalent to $PUPs, such an event has yet to materialize.

L2 Disappointments

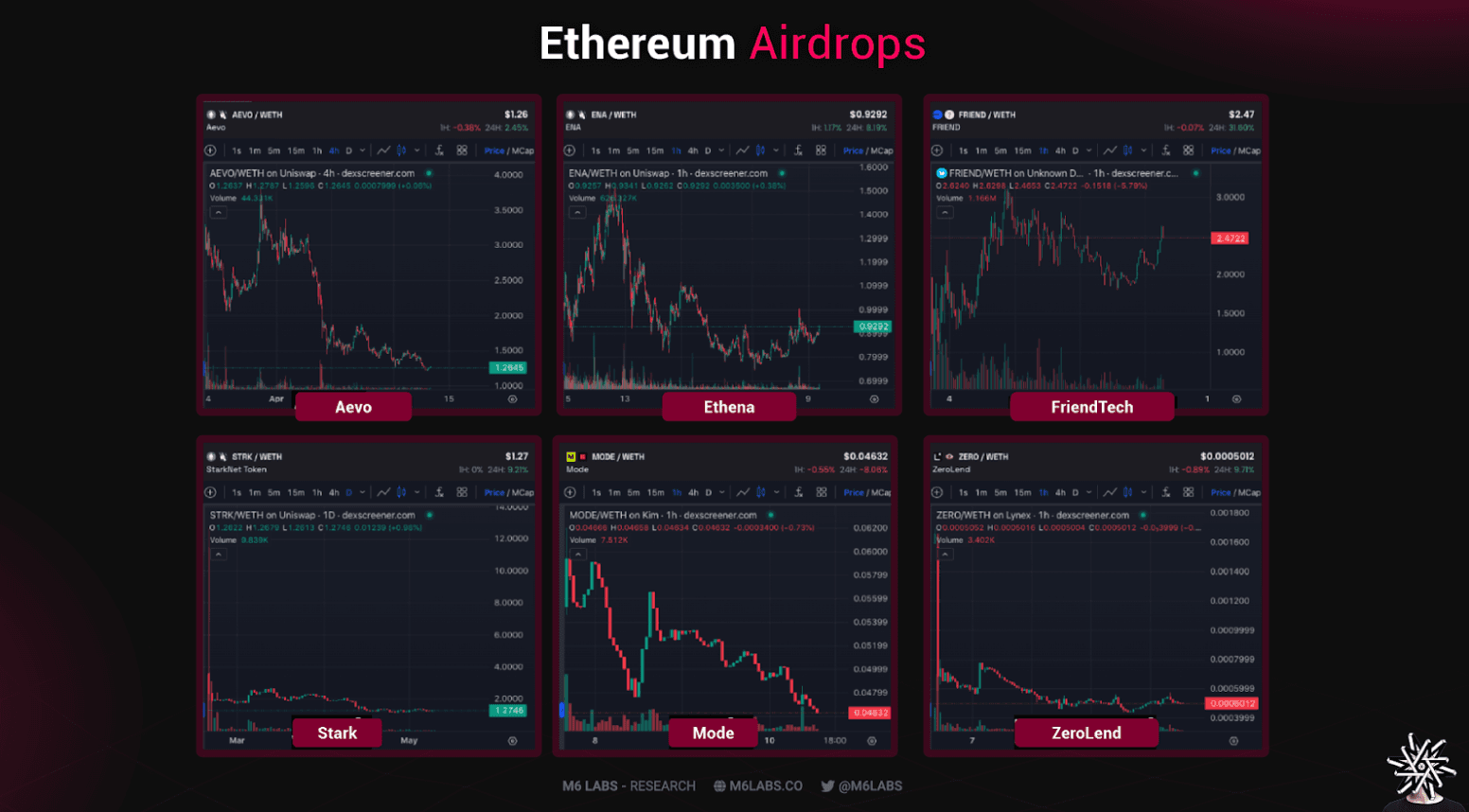

There were several highly anticipated airdrops on Ethereum across various sectors, notably in the L2 solutions domain. Stark stood out as one of the most eagerly awaited airdrops, sparking significant anticipation in the previous cycle.

However, the tokenomics and community management strategies surrounding this airdrop encountered initial hurdles. A controversial statement from one of the main team members, who referred to airdrop participants as "e-beggars," ignited controversy. Moreover, criticism emerged regarding the eligibility criteria for the Starknet airdrop.

Many users expressed frustration over what they perceived as arbitrary requirements, particularly the mandate for accounts to hold at least 0.005 ETH during a specific snapshot in November 2023. Consequently, numerous active participants on the Starknet platform found themselves excluded from the airdrop. While Stark attempted damage control by making adjustments to the airdrop criteria, the negative impact lingered. The enthusiasm surrounding this L2 solution plummeted, with the token experiencing significant underperformance.

Next up is Blast. Overall, Blast's rapid ascent in the L2 solution landscape underscores the importance of innovation, community building, and strategic partnerships in driving user engagement and adoption in the DeFi space.

One of the standout features of Blast's airdrop campaign is its gamified approach, which aims to make the process of earning and distributing tokens more engaging for users. This gamification includes referral codes, social media interactions, and a "super spin" lottery draw, incentivizing user participation and engagement in a more interactive manner than traditional airdrop models.

Despite the many positives, Blast has encountered various challenges and controversies, such as inquiries into its holding contract mechanisms, the structure of its native yield, and recent security breaches on affiliated platforms. Additionally, it has faced criticism akin to other chains and protocols, particularly concerning the perceived favoritism towards users farming with significant amounts within its ecosystem.

Moving on, Mode, a new L2 blockchain network within Optimism's Superchain ecosystem, witnessed a sharp decline in its token price following its airdrop. The native token, which started trading at over 14 cents, plunged by over 63% within seven hours to 5 cents. This pattern echoes similar trends seen in recent token genesis events like Kamino, Renzo, Parcl, Wormhole, and FriendTech. Despite early adopters locking significant value within Mode, most protocols on the network experienced a dramatic drop in TVL.

Following the disappointment of L2 airdrops, the next one we'll be discussing is Ethena.

Luna 2.0?

Ethena Labs conducted an airdrop of its ENA tokens, distributing $450 million worth among eligible wallets, with the largest recipient receiving nearly $2M worth of tokens.

Concerning its token, It experienced a decent initial pump but has since stabilized and has entered a ranging phase. Ethena's USDe synthetic dollar, launched earlier, has seen significant growth and generated debate in the crypto community due to its high-yield strategy.

Despite criticisms regarding favoritism toward large wallets, the ENA token's trading and market capitalization surged after the airdrop. Additionally, Ethena introduced its Season 2, incorporating Bitcoin as collateral and announcing partnerships with MakerDAO, Pendle Finance, and Mantle Network.

Restaking Drama

Next up is the hugely hyped EigenLayer airdrop. Where do we start with this one?! This protocol had almost singlehandedly revived interest in DeFi on Ethereum. Though the token isn't tradeable yet, once the airdrop criteria and user allocations were revealed, this was an enormous blow for the Ethereum ecosystem. Despite some revisions of the criteria and increased user allocations, EigenLayer hasn't been able to shake off the sour taste left in many users' mouths.

Despite high expectations, the announcement of the token's non-transferability and regional restrictions led to backlash from the community. Other concerns revolved around the uncertainty regarding token distribution and the reliance on third-party platforms for deposits. This backlash reflects a broader trend of disappointment with points-based incentive systems in the crypto community, signaling a potential decline in their popularity and effectiveness as a user acquisition strategy.

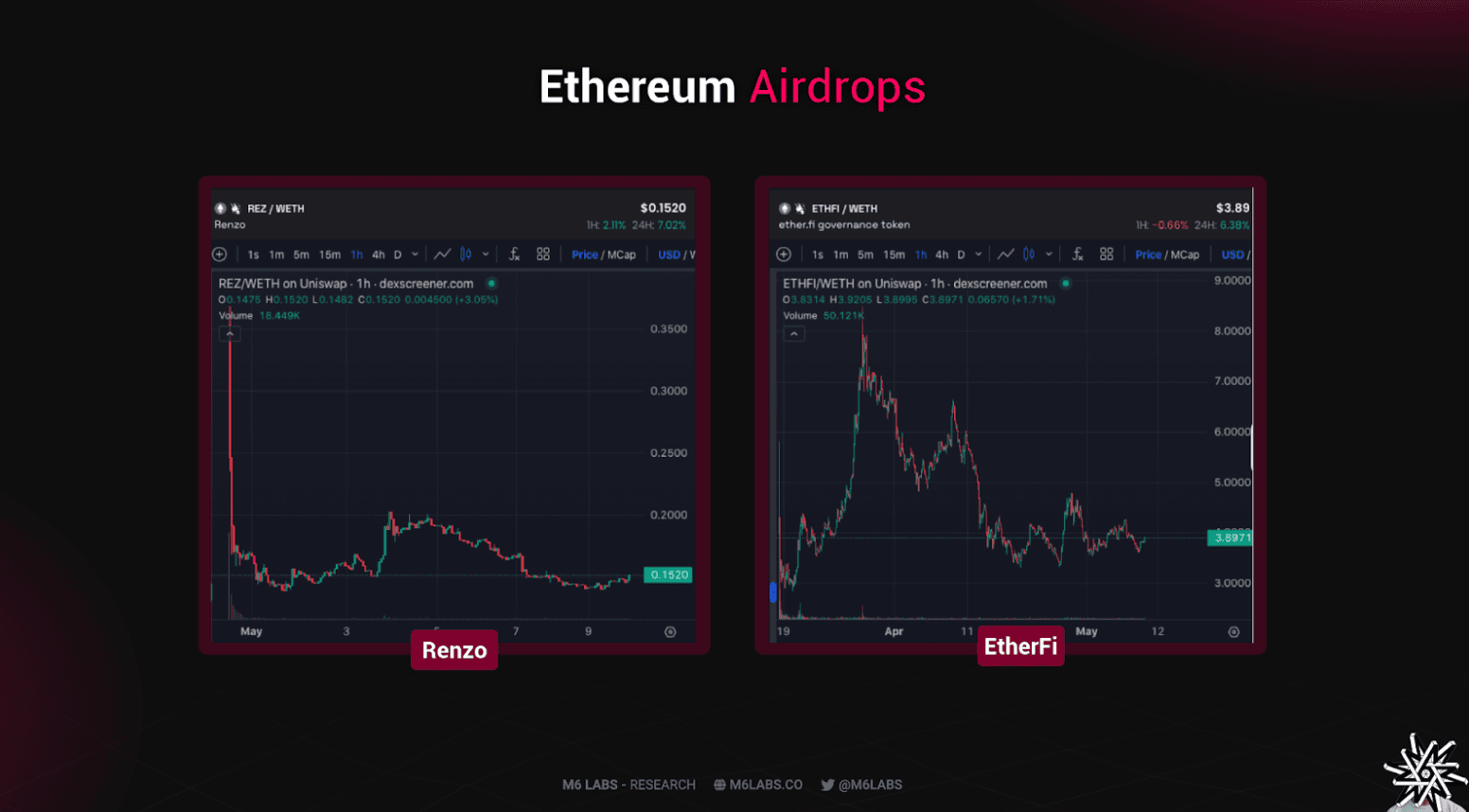

The situation wasn't helped by the launch of Renzo or EtherFi. EtherFi is an ETH liquid restaking protocol that enables users to natively restake ETH with EigenLayer. Renzo, on the other hand, is a Liquid Restaking Token (LRT) and Strategy Manager for EigenLayer. Renzo's initial announcement of the REZ token airdrop faced criticism from the community, particularly regarding the distribution favoring Binance launch pool participants and the team over other users.

In response to the backlash, Renzo adjusted the airdrop details, moving the claim date and modifying the tokenomics to allocate more to the community. On the other hand, EtherFi also faced challenges with its airdrop plan. Within 24 hours of unveiling the plan, EtherFi updated its eligibility checker to increase token allocation for smaller depositors based on community feedback. Both tokens have experienced significant declines following their airdrops. However, EtherFi did see a notable exit pump, with its price declining substantially from its all-time highs, while Renzo has faced a less favorable situation.

Other Notable Letdowns

Other noteworthy mentions that were disappointing include ZeroLend which saw substantial liquidity enter its ecosystem but following its airdrop, the token has severely underperformed. Meanwhile, the Aevo token launch and airdrop drew mixed reactions from users. While the project distributed $95 million worth of AEVO tokens, equivalent to a $3.2 billion valuation, some users were dissatisfied with their token allocations and high Ethereum gas fees for claiming.

The friend.tech token launch and airdrop gained substantial attention but drew criticism due to a 98% drop in token value. Since then, the token has recovered somewhat and is performing decently, albeit not meeting the expectations of many. Limited liquidity and user complaints contributed to the token's rollercoaster ride, with concerns about the claims process and market stability. Despite the plunge in value, there were improvements in liquidity and the number of holders, offering hope for recovery.

Possible Heroes On The Horizon

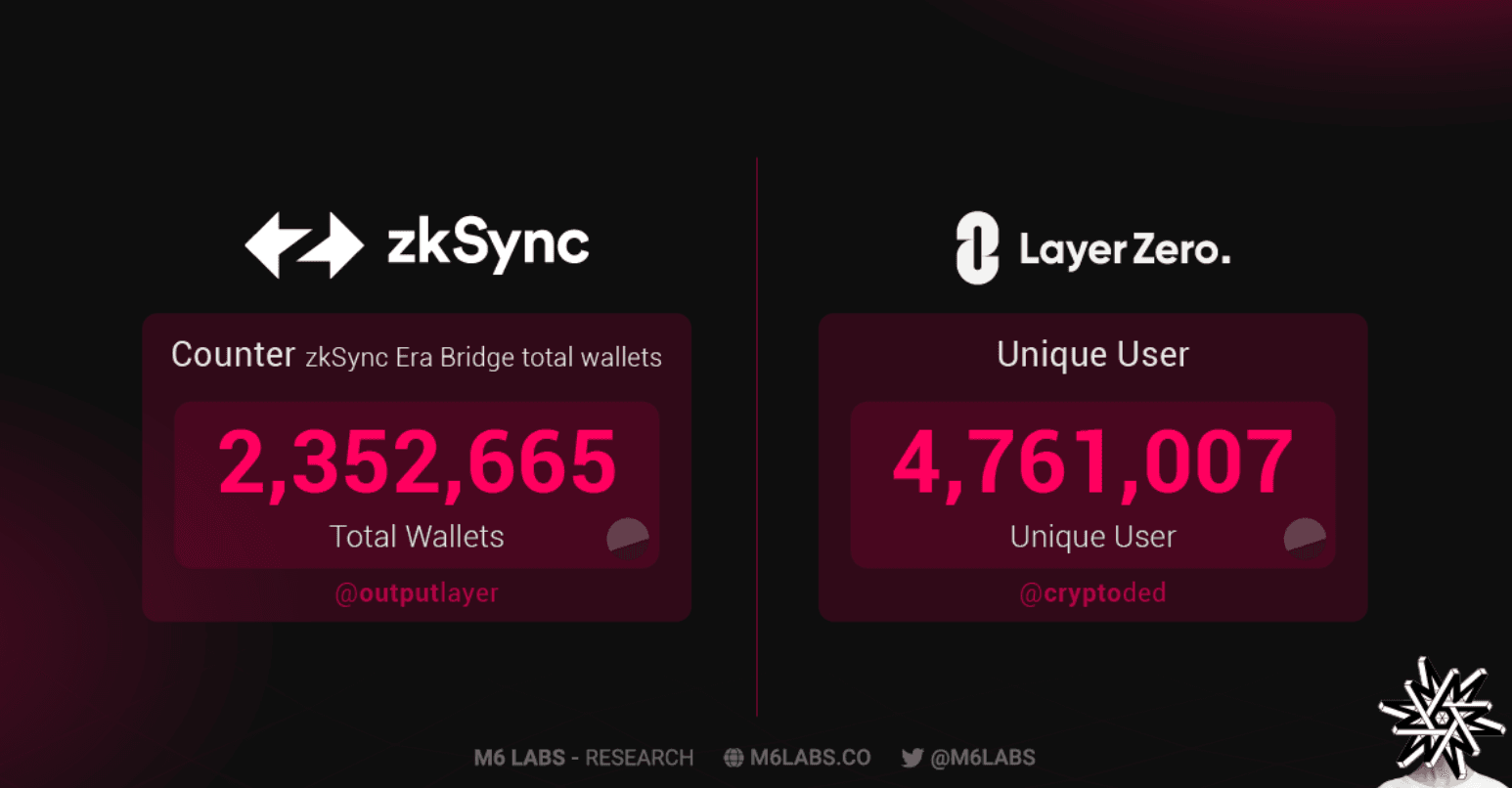

In summary, airdrops on Ethereum have largely been disappointing so far. The spotlight has now shifted to LayerZero and zkSync, with hopes that they could reignite enthusiasm and hype within the Ethereum ecosystem.

However, a closer look at the data suggests that these protocols may not be able to reward the majority of users. Instead, there's a growing trend indicating that users with substantial liquidity will reap the most rewards.

This trend reflects a broader shift in the DeFi landscape, where platforms often prioritize users with larger holdings, leaving smaller participants with limited opportunities for rewards. While LayerZero and Zksync hold promise in addressing Ethereum's scalability challenges, their ability to distribute rewards fairly across a diverse user base remains uncertain.

Closing Reflections

Airdrops continue to play a major role in the crypto ecosystem, driving community engagement and rewarding loyalty across various blockchains. From the explosive gains of Bitcoin's ordinal airdrops to the strategic deployments on Solana, it's clear that airdrops can create immense value.

However, it's equally evident that the landscape is shifting. The early windfalls that attracted the masses to these campaigns are evolving into more sophisticated mechanisms, raising questions about sustainability and long-term impact.

While these airdrops have minted many a millionaire and sparked widespread enthusiasm, they also underscore a growing complexity in their execution and reception. It's apparent that not all airdrops are created equal, and the broader implications of their design and distribution are becoming a crucial conversation in the community.

That's a wrap for today, anon!

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space