GM, Anon! Welcome to this week's Crypto Market update. The latest market movements feel surreal, with insane price pumps underway, and it's astonishing that the retail sector hasn't even arrived yet. Surprisingly, BTC hasn't crossed the $40K mark, but it seems like it's on track to do so before the year's end, potentially reaching prices of $42K and $45K. Let's dive right in and assess how the market is performing in light of the recent pullback.

Quick note on the BlackRock ETF. On November 15th, BlackRock took a significant step by submitting an S-1 application to the SEC for its Ethereum ETF, specifically targeting the spot market. This S-1 filing is a crucial registration statement that companies must submit to the SEC when seeking to list their ETFs. In summary ETF SOON.

This is just a preview, be sure to check out the full version of this report here.

Get our crypto-native industry insights and research in your inbox, subscribe now.

Alpha Take Of The Week

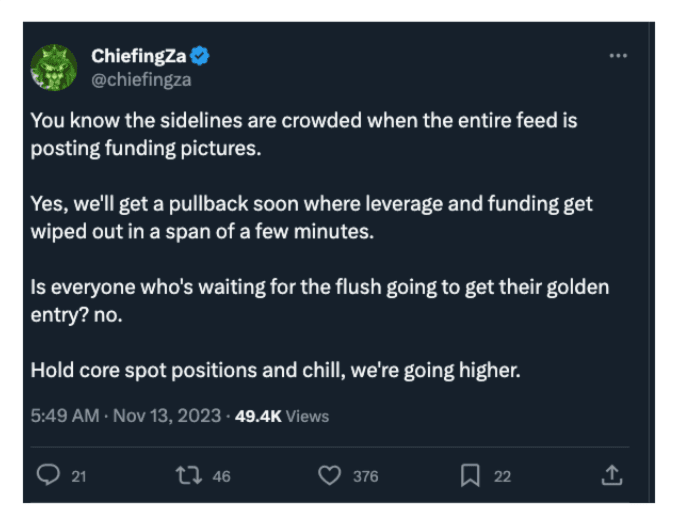

Source

SourceDon’t be scared of pullbacks anon, it’s all part of the game.

Narratives of the Week: Market Cools Off, How Are Things Looking?

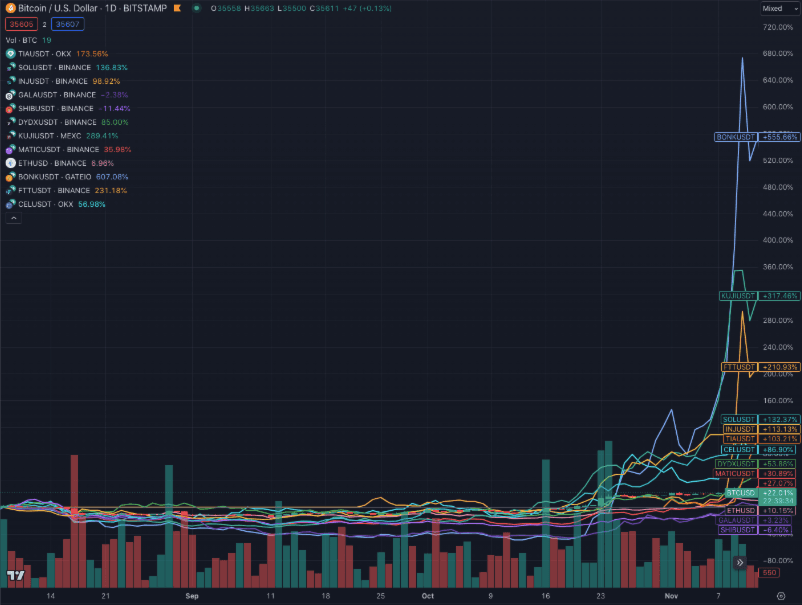

After a few weeks of some pretty crazy price action, the market has taken a few steps back and things are cooling down. Though this isn't true for every coin, $TIA skyrocketed after the market initially showed very little interest in it after the airdrop. Let’s make sense of all the recent chaos and reflect on how some crucial on-chain metrics are looking.

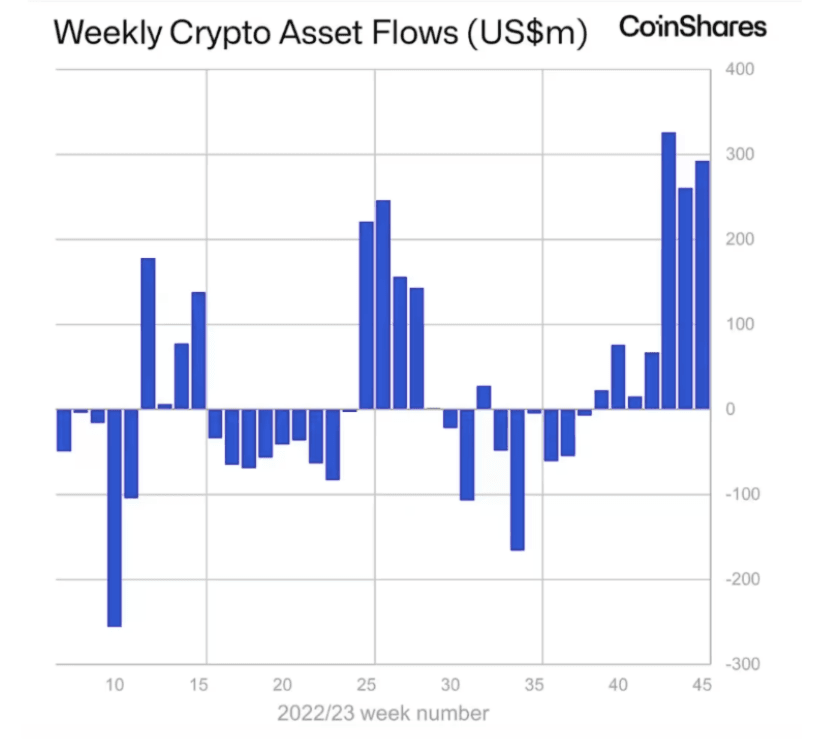

Digital asset investment products witnessed net inflows of $293M last week, bringing the year-to-date inflow to $1.14B. This surge in inflows marks 2023 as one of the years with the third-highest yearly inflows on record, largely driven by the past three weeks, which saw nearly $900M in net inflows.

Source: Coinshares

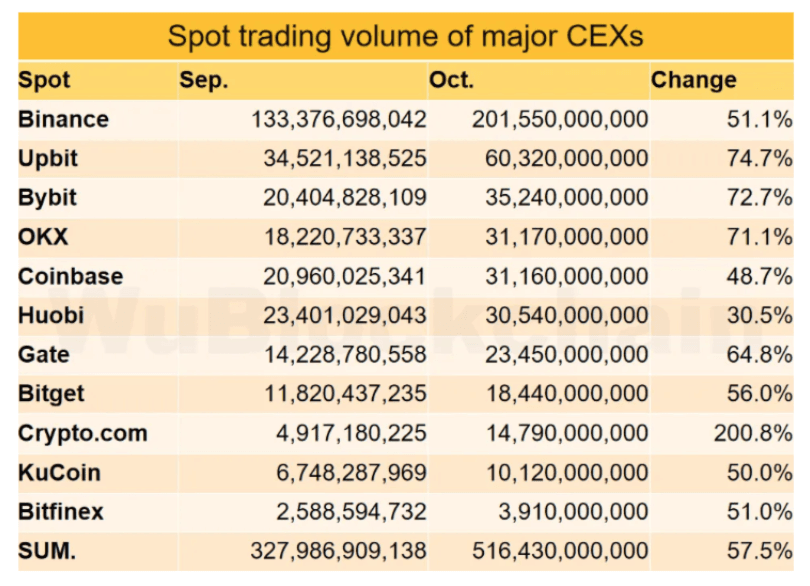

Source: CoinsharesIn October, major crypto exchanges experienced significant increases in both spot and derivative trading volumes, as well as website traffic, indicating continued growth and activity within the crypto market. Spot trading volume on major exchanges rose by 57.5% month-on-month, reaching a new high since April of the same year.

Source: WuBlockchain

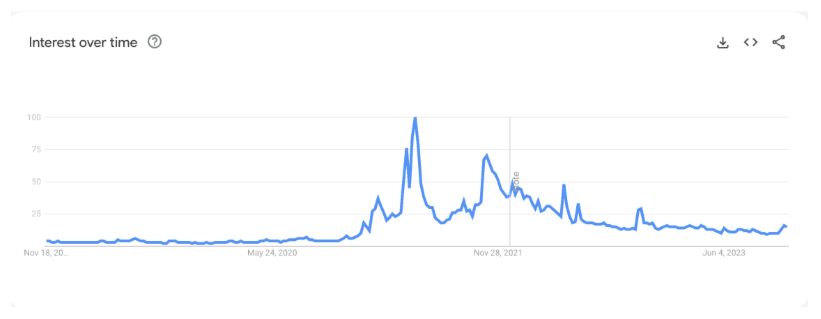

Source: WuBlockchainGoogle trends indicate that retail and general interest is still almost non-existent at the moment. This is likely the very early stages of the bull market and expectations should be managed accordingly.

Source: Google Trends

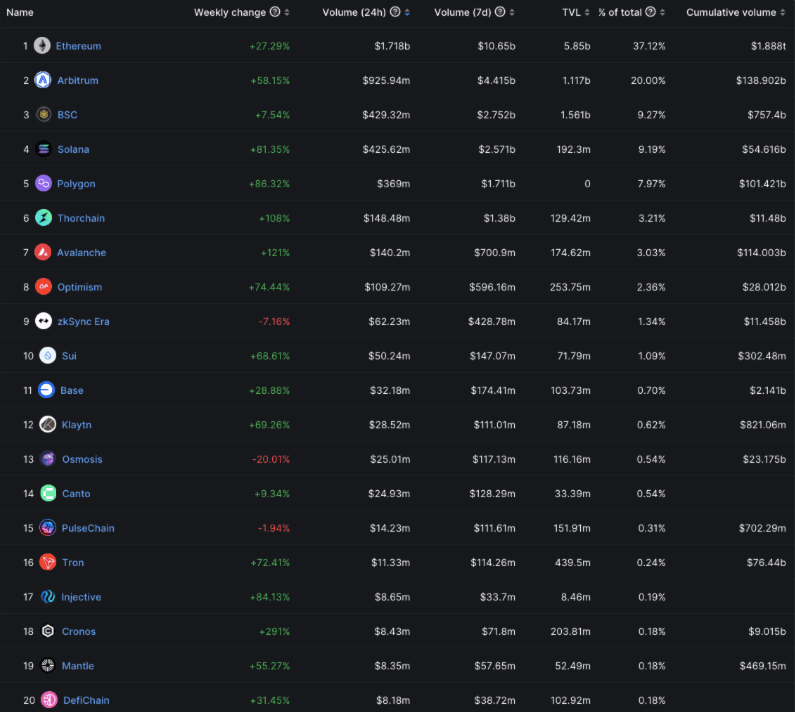

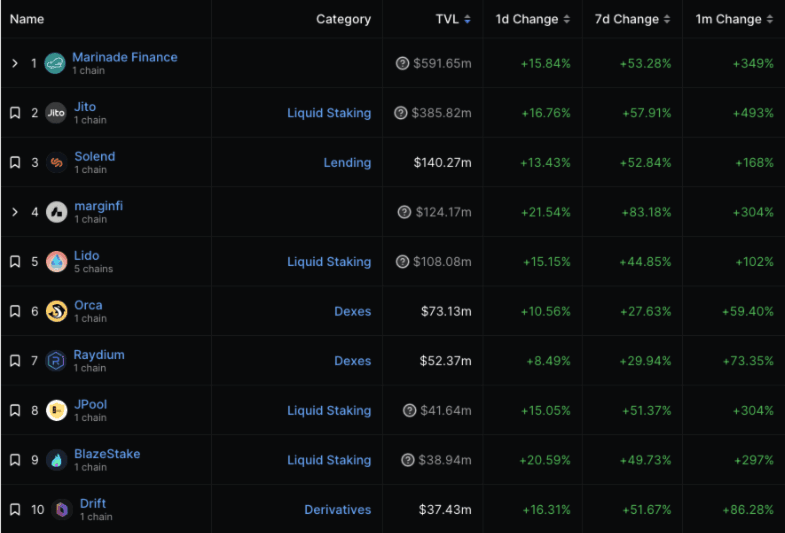

Source: Google TrendsVolume across most chains has increased in the last 7 days significantly. Some of the best performers include Solana, Polygon, Thorchain, and Avalanche amongst others.

Source: DeFiLlama

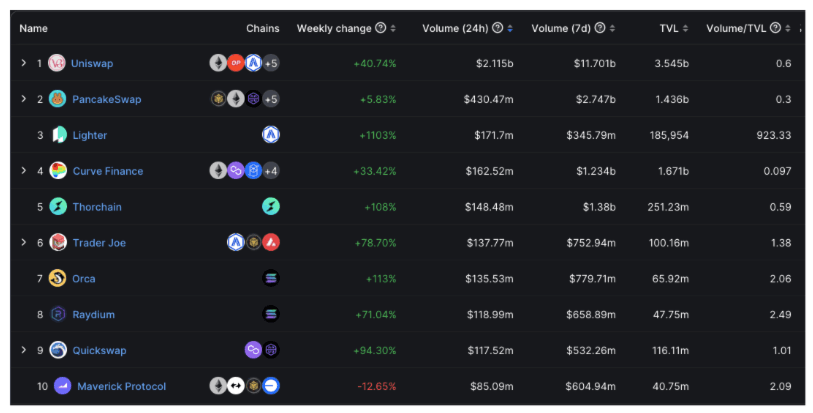

Source: DeFiLlamaVolume across all the most popular DEXs is up significantly. Solana native DEXs such as Orca and Raydium are worth noting. Solana has been one of the best performers in this recent surge.

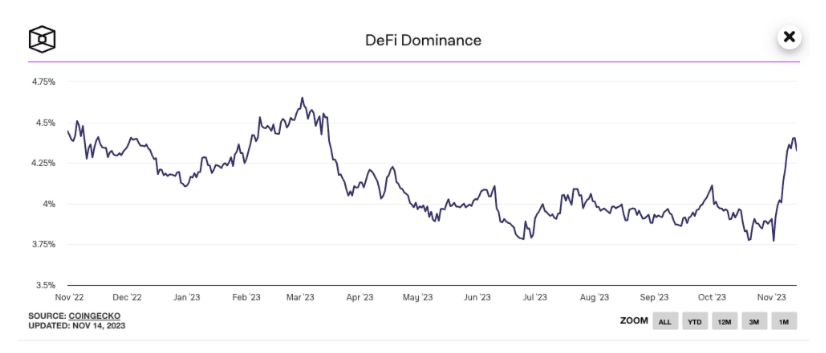

DeFi dominance is rapidly climbing with the increased activity and volume across most chains.

Source: The Block

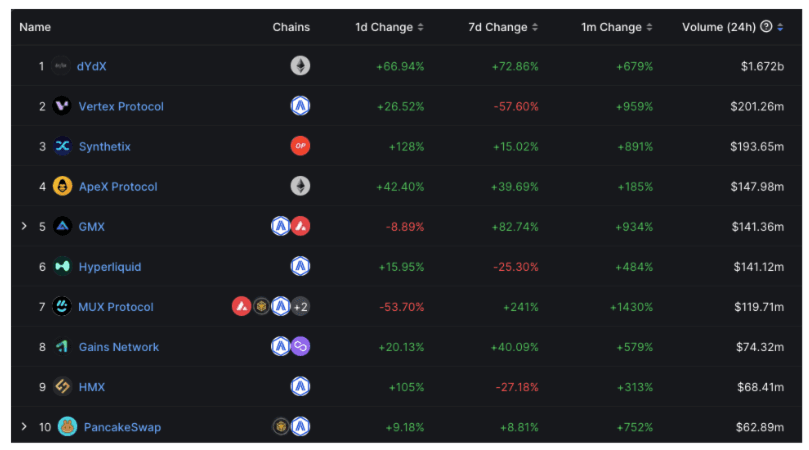

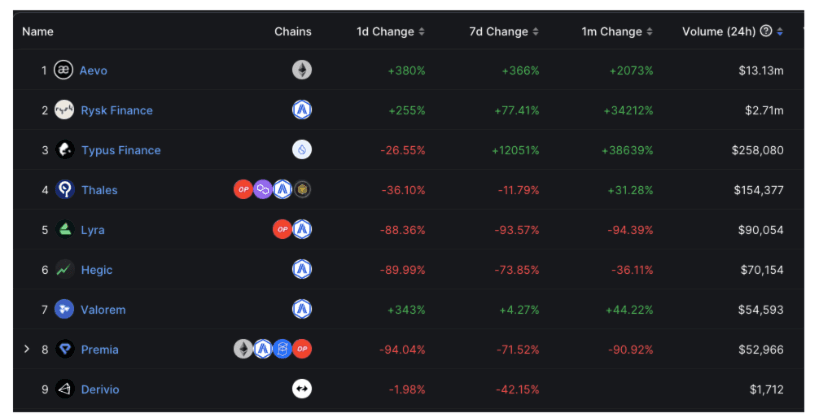

Source: The BlockDerivatives platforms have seen a noticeable increase in user activity, while many options protocols have surprisingly seen a drop in user volume, with Aevo, Rysk Finance, and Typus Finance being the exceptions.

Derivatives Platforms. Source: DeFiLlama

Derivatives Platforms. Source: DeFiLlama Top options platforms. Source: DefiLlama.

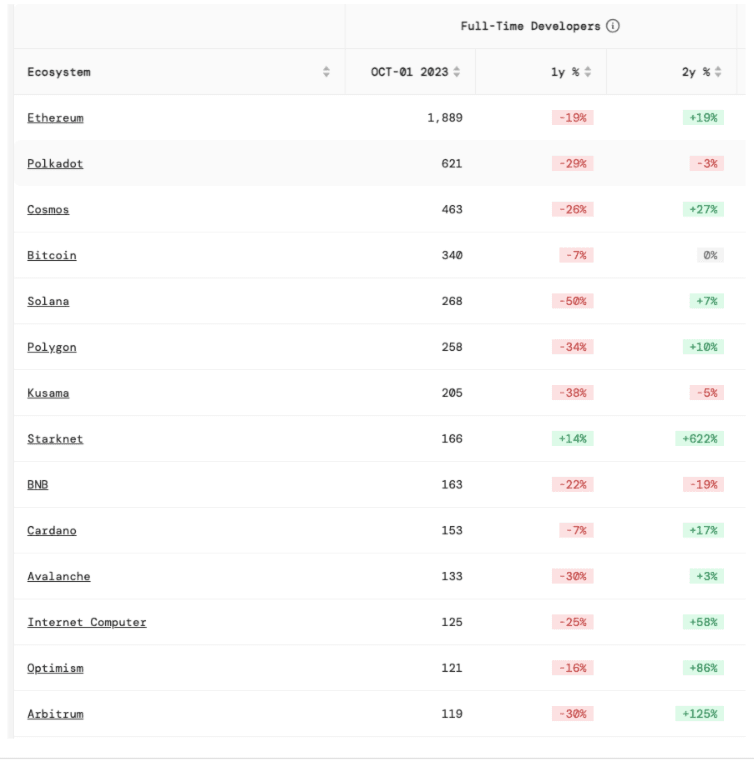

Top options platforms. Source: DefiLlama. Full-time developer activity across all chains has seen a noticeable decrease in numbers. This is concerning, but it is possible this metric picks up as capital flows back into the market and protocols begin releasing new products and grow their teams once again.

Source: Developer Report

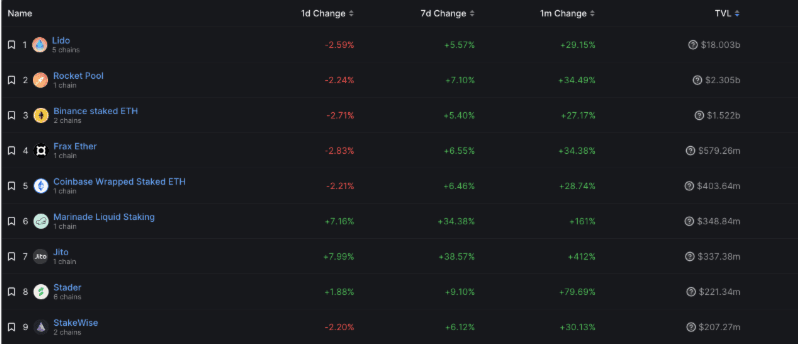

Source: Developer ReportLiquid staking continues to dominate the DeFi market, with the entire LST market being valued at around $26B. Most protocols have experienced inflows in the last 7 days, but have experienced a slight downtick since the market cooled off.

Source: DeFiLlama

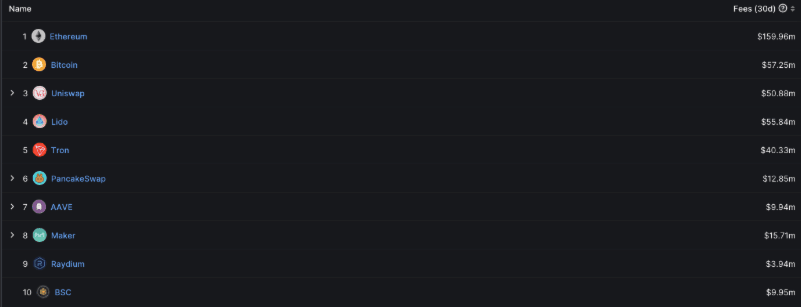

Source: DeFiLlamaThe amount of fees being generated by protocols and chains over the last 30 days has experienced a surge. Uniswap has experienced a noticeable increase since the introduction of its fee switch on certain pools.

Source: DeFiLlama

Source: DeFiLlamaIn summary, critical metrics that are indicative of the market's overall health are mostly positive, suggesting growth and renewed interest in the market. Currently, this activity appears to be limited to experienced crypto users with a higher risk tolerance, while retail investors have yet to join the market.

Project Spotlight: Ondo Finance

The recent developments involving Ondo Finance and Axelar are significant for several reasons, so Ondo Finance is in the spotlight this week!

- USDY Stablecoin: USDY is a stablecoin backed by short-term U.S. treasuries and bank demand deposits. This backing by real-world assets adds a layer of security and stability to the coin, differentiating it from other stablecoins that may not have such strong backing.

- Cross-Chain Functionality and Security: By partnering with Axelar, Ondo Finance can manage USDY supply across different blockchain networks. This is done through a "burn-and-mint" mechanism, which ensures that tokens remain native to each network and mitigates the risks typically associated with wrapped assets. This functionality is crucial for maintaining the integrity and stability of the token across various platforms.

DeFi, L1s & L2s

News

- Ether.fi 's liquid staking token, eETH, has gone live on mainnet. Currently, only whitelisted users can mint eETH. ether.fi will continue to whitelist more users to mint over the upcoming days.

- Ondo Finance has established a partnership with Axelar to create a short-term US Treasury bill-backed yield-bearing stablecoin.

- Uniswap Labs has made over $1M in the 27 days since turning on the 0.15% fee switch for the Uniswap Protocol last month

- Tensor reveals snapshot of holders for potential airdrop.

- Baby Shark Universe is coming to Sei.

- Aave resumed business as usual following security concerns.

- Opyn co-founders step down.

- Near Foundation partners with Eigen Labs.

- South Korean crypto exchange Bithumb is reportedly planning an IPO on Kosdaq in the second half of 2025, with Samsung Securities chosen as its underwriter

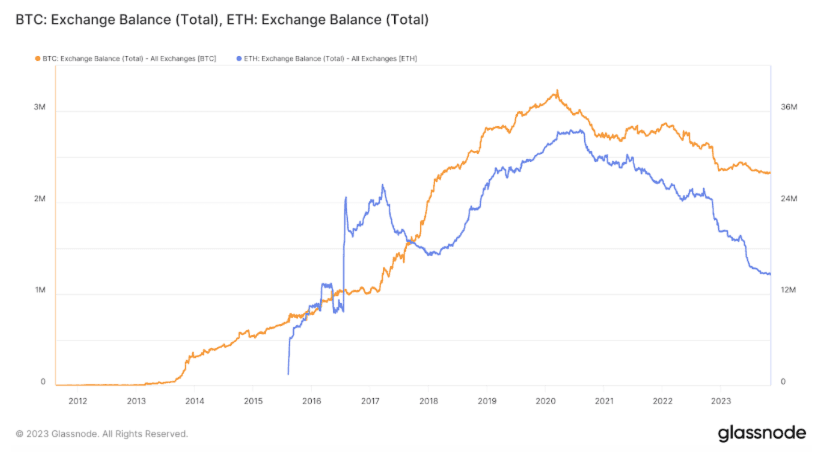

There has been a notable decline in BTC and ETH holdings on exchanges: This development highlights users' growing caution about prolonged asset storage on these platforms, likely stemming from recent hacking incidents, particularly evident following the FTX crash

Source: Glassnode

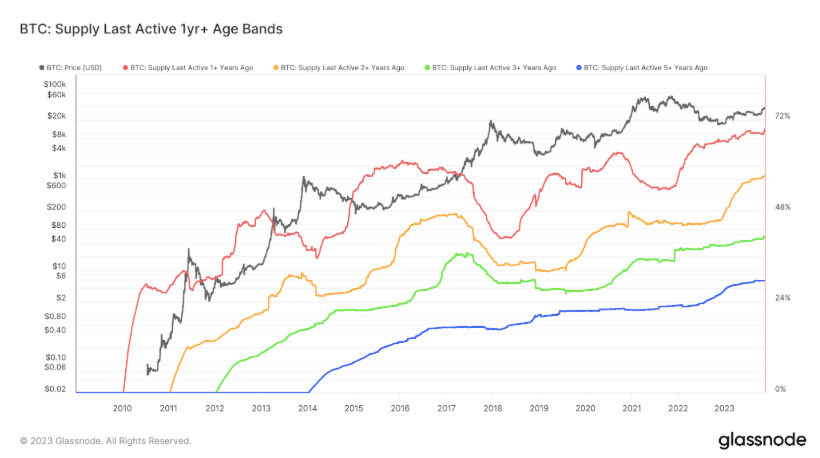

Source: GlassnodeRecent data analysis has revealed that around 70% of the Bitcoin supply has remained inactive for over a year, reaching an all-time high in terms of dormancy. This trend is not limited to a single cohort but is observed across various timeframes, with 57% of the supply untouched for over two years, 41% for three years, and even 30% for over five years.

Source: Glassnode

Source: GlassnodeBlue Chip and Majors Overview

Solana

Solana has exceeded expectations by delivering an impressive return of approximately 312.76% since its June lows. The Solana ecosystem has demonstrated exceptional performance across various metrics, with notable gains in the gaming and NFT sectors, exemplified by collections like Mad Lads. Furthermore, at one point Grayscale’s Solana Trust (GSOL) was trading at around 283% premium compared to the spot SOL price, it has since pulled back in the recent cool down though.

Moreover, the top 10 protocols on Solana have experienced significant appreciation, accompanied by surges in both volume and liquidity. Two noteworthy tokens are Orca and Marinade which have appreciated +348% and 166% respectively.

Source: DeFiLlama

Source: DeFiLlamaCelestia has emerged as one of the recent standout performers, defying initial expectations. Over the past week, TIA has experienced a remarkable appreciation of approximately 152%, despite a subdued start following the airdrop, during which its price traded within a narrow range for a period. Many anticipate that this token will continue to reach new highs, with a strong possibility of securing a position among the top 50 or even the top 20 cryptos during the upcoming bullish market cycle.

- CEL the native utility crypto of the now-defunct Celsius Network, witnessed a substantial rise of 128% in the last 30 days, reaching levels not seen since April.

- LUNA recently surged by 35% in a single night and is poised to re-enter the top 100 cryptos by market capitalization.

- HEX increased by over 160% in the past month. It's worth noting that HEX founder Richard Heart is facing securities fraud charges by the SEC.

- Shiba Inu has experienced a 10% surge in its price over the past week, showing notable growth since October.

- The recent performance of Dydx has been nothing short of remarkable. With the launch of version 4, it has seen tops of nearly 2x.

- FTT stands out as one of this week's top performers, registering a staggering 240% increase in value, driven by news speculating about the potential restart of FTX. While the viability of this option remains uncertain, users are taking the gamble.

- Matic has appreciated around 86% since October, and the ecosystem has seen a dramatic increase in activity, especially with gaming.

Degen Corner

- Useful testnets and betas that users can check out include Fantom Sonic Open Testnet, ibMEV beta, and Synonym Testnet.

- $BONK has appreciated almost 2000% since October.

- Smart money made significant investments in tokens like GROK after a dip caused by negative news related to the token after ZachXBT revealed that the project was created by an account associated with scams.

- STARBASE, a new launch, attracted $64k in smart money investments but retained only 16% of investors.

- Notable new launches include Possum, Dogeai, and Mubi, each receiving $220k+ in smart money investments, with Possum offering upfront yield on LSTs and Mubi acting as a bridging project.

- The new launch of AI.com attracted $72k in smart money interest but sold most of its holdings.

- Key smart money holdings remain consistent with BANANA, GROK, Real Smurf Cat, BITCOIN, JOE, PEPE, RLB, OLAS, and SPX, with no newer projects having significant smart money holdings except for PAAL, which stands out with over $1mm in smart money holdings.

NFTs & Gaming

News

- LootRush releases update to allow users to list NFTs securely for rent.

- EverQuest, Call of Duty vets unveil metaverse game Avalon.

- PancakeSwap release NFT gaming marketplace.

- Phantom Galaxies launches in early access on Epic Games Store and Steam.

- Aptos Foundation is partnering with Seoul Land, a leading South Korean amusement park and media group.

- Gaming keys giant G2A launches 'Geekverse' NFT marketplace.

- Disney to launch NFT Platform in partnership with Dapper Labs.

- Immutable announce zkEVM Testnet Regenesis.

- NHL breakaway hockey NFT collectibles platform opens to the public.

- 'Mutant Ape Planet' NFT developer pleaded guilty in $3M fraud.

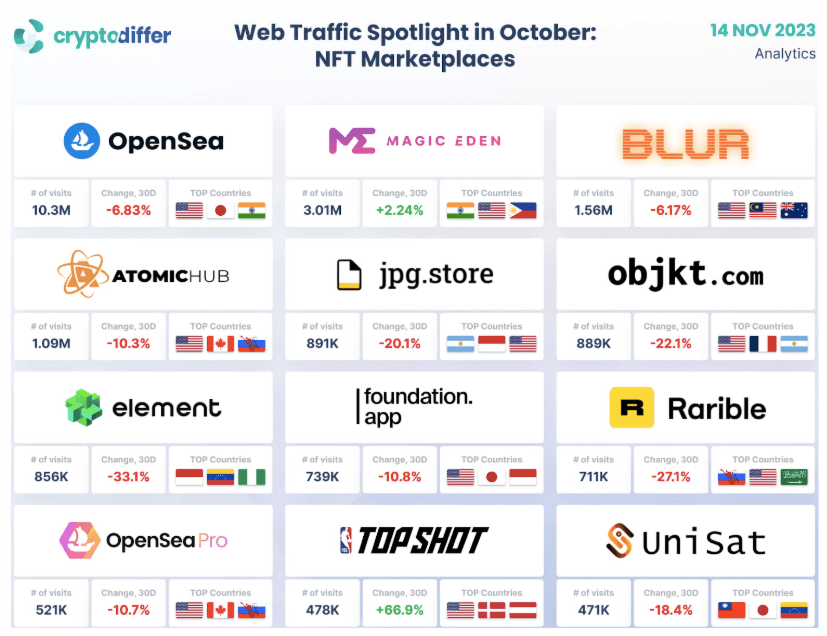

Traffic to NFT-related sites have experienced a slump in the last 30D. Only Magic Eden and Top Shot experiencing an increase in volume.

Source: Cryptodiffer

Source: CryptodifferBlue Chip Overview

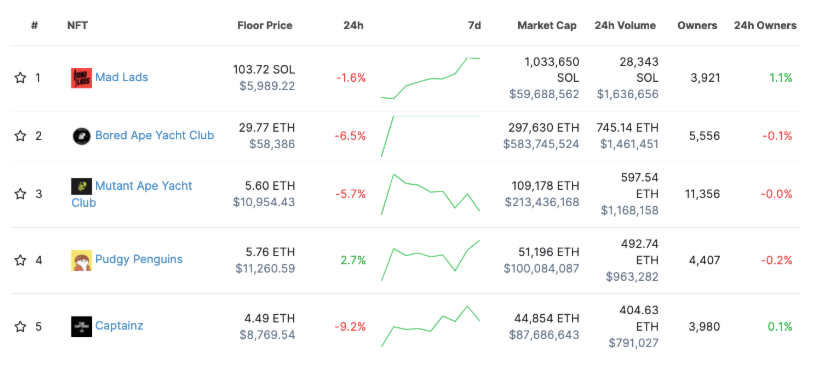

Traditional NFTs have been on a steady ascent, mirroring the overall market's upward trend. In an unexpected twist, Mad Lads has dethroned Bored Ape Yacht Club from its top position in terms of trading volume.

Source: CoinGecko

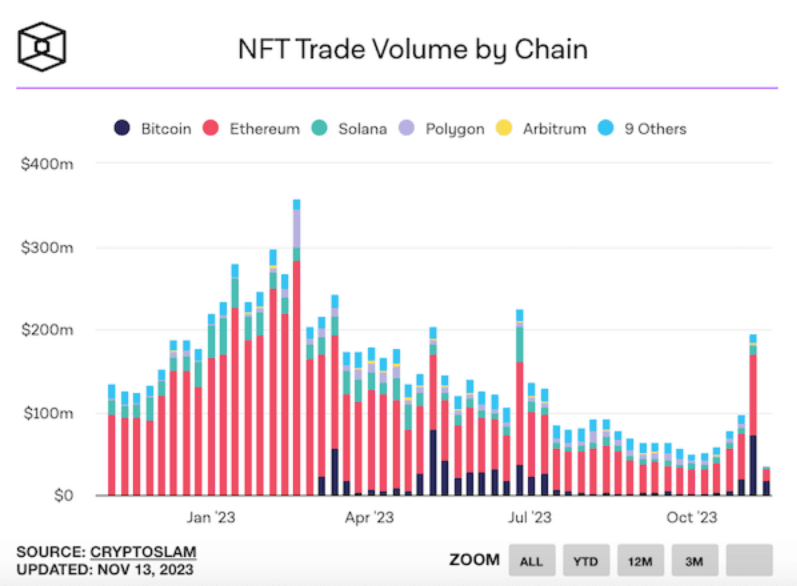

Source: CoinGeckoEthereum maintains its stronghold on trading volume, while it's worth highlighting the noticeable surge in Bitcoin's trading volume. The growing trend of NFTs on the Bitcoin network appears to be a lasting and significant development.

Source: The Block

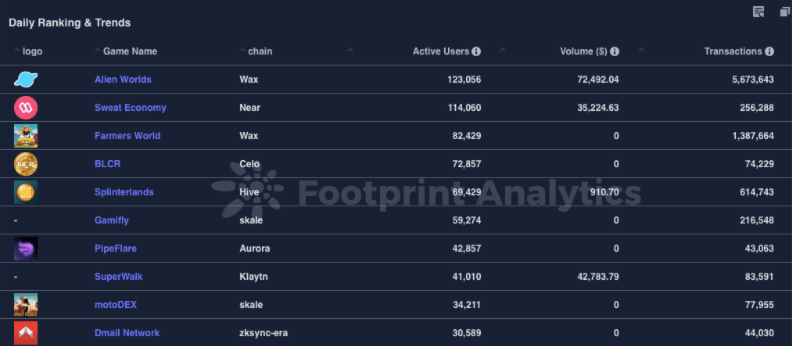

Source: The BlockAlien Worlds has garnered significant attention from users as an NFT metaverse game, residing primarily on the WAX blockchain. It's worth noting that this intriguing game also offers functionality on other blockchain networks, including Ethereum and BNB Smart Chain.

Top NFT Games. Source: Footprints

Top NFT Games. Source: FootprintsDegen Corner

- Genopets has introduced a significant update, featuring a new racing mini-game, an in-app shop, and enhanced meal and toy options.

- Pixelmon has exciting news to share as they unveil a strategic partnership with Horizen Labs Venture, the same company behind the successful ApeCoin launch. For NFT owners, this partnership may bring exciting benefits and opportunities in the future.

- CryptoSlam has introduced an innovative NFT-related solution called SlamAI, providing users access to their vast web3 data reservoir.

- Splinterlands has announced the official release date for Land-based gameplay in their 1.5 update. While this launch is just the beginning of their broader plans, landowners will have the opportunity to stake cards on their plots, enabling them to harvest Grain, SPS tokens, and research points.

- Gods Unchained is streamlining their login process by adopting the Immutable Passport in late November/early December. Players will need to use this new login method, which simplifies sign-in without requiring passwords or reCAPTCHA. Signup for a passport here.

- The gaming sector continues to sizzle this week, showcasing impressive performances from tokens like ILV (+36%), IMX (+45%), PRIME (+48%), RON (+30%), and MC (currently migrating to BEAM, with a +80% gain).

- NFTFi, a platform for NFT lending on Ethereum, has witnessed remarkable growth, boasting a substantial TVL increase of 103.14%.

Enjoyed this preview? Be sure to check out the full version of this report here!

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space