GM, Anon! It's been quite a week, with ATHs seemingly within reach. However, the market appears to have cooled off a bit. Multiple indicators suggest that we might be overheating. The question now is whether we'll experience a significant pullback or surge to new ATHs before entering a period of market cooldown. Only time will tell. Let's delve into it!

ETFs Drive BTC To New Heights

The ongoing rally is centered around BTC and ETH. Bitcoin's surge is attributed to the performance of the ETF, while Ethereum's rise is fueled by the anticipation of the ETH ETF, ecosystem updates like the Dencun upgrade scheduled for mid-March.

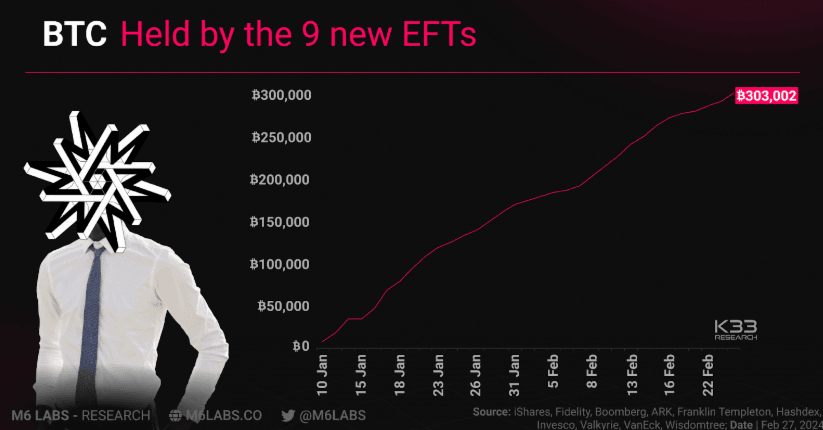

- The newly launched nine U.S. spot bitcoin ETFs have collectively amassed over 300K BTC in assets under management in less than two months since their inception.

- Additionally, total net inflows into these ETFs have surpassed $6B, with daily net inflows exceeding $500M million on Monday alone.

- This significant influx of funds into the bitcoin ETFs reflects growing investor interest in crypto investment vehicles and indicates a substantial increase in institutional adoption of Bitcoin as an asset class.

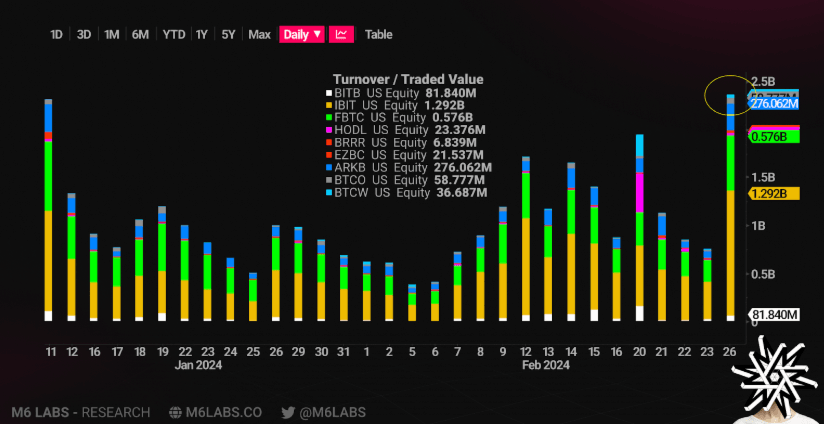

Notably, BlackRock’s $IBIT dominated trading activity, contributing $1.3B to the total volume and marking a 30% increase from its previous record.

Ethereum On The Move

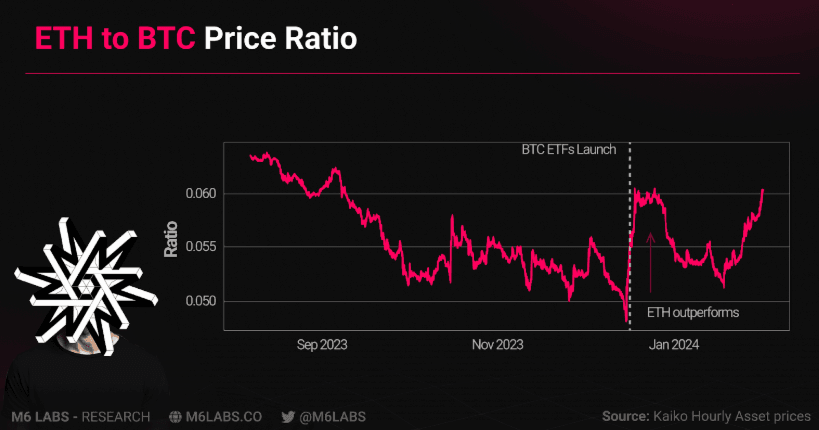

Moving onto the dynamics between BTC and ETH. The ETH/BTC ratio serves as a key indicator of their performance relative to each other.

- Monitoring this ratio is crucial for optimizing gains and determining the allocation of portfolios, among other factors.

- Last week, the ratio surged to its highest level since early January as ETH briefly surpassed $3k for the first time since April 2022.

- Beta plays associated with ETH are anticipated to excel in the upcoming weeks as ETH maintains its upward trajectory.

Let’s take a look at one particular ETH beta play that could perform extremely well in the weeks ahead.

Arbitrum ETH Beta Play

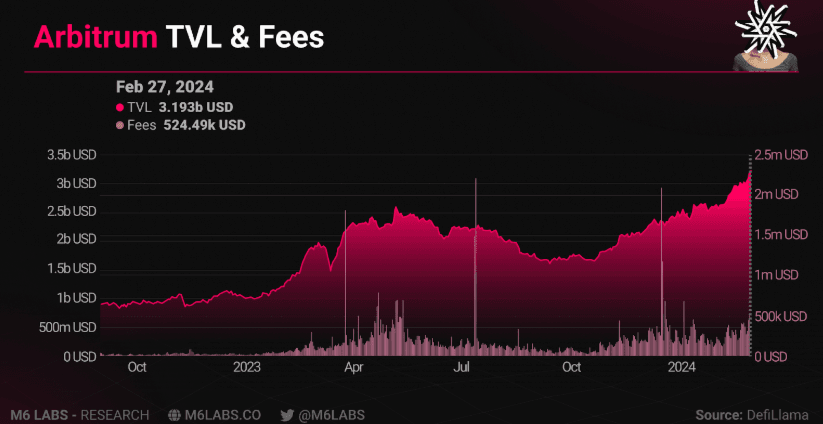

Arbitrum has emerged as a dominant player in the L2 landscape, seeing its TVL grow dramatically. The platform's dynamic environment is characterized by innovation and expansion.

- Arbitrum leads the L2 realm with a TVL of about $3B, capturing roughly 50% of the market share and positioning itself as the fourth-largest blockchain network.

- This growth is fueled by contributions from various projects like Hyperliquid and Pendle.

- Scalability is a key feature, with Arbitrum boasting an average Transaction Per Second rate of 14.52, demonstrating its capacity to handle significant transaction volumes.

- The ecosystem remains vibrant and evolving, with ongoing initiatives such as the introduction of Rari Chain, support for custom gas tokens on the Orbit platform, and the migration of projects like Kinto to Arbitrum.

- ARB could see new highs in the coming weeks.

- However, it's worth noting that some are concerned about the planned unlocks in March potentially leading to substantial selling pressure.

- Nonetheless, considering key metrics, it appears that ARB is poised to manage the selling pressure and potentially reach all-time highs.

Arbitrum TVL & Fees

Arbitrum TVL & FeesBlast The Next Big Thing

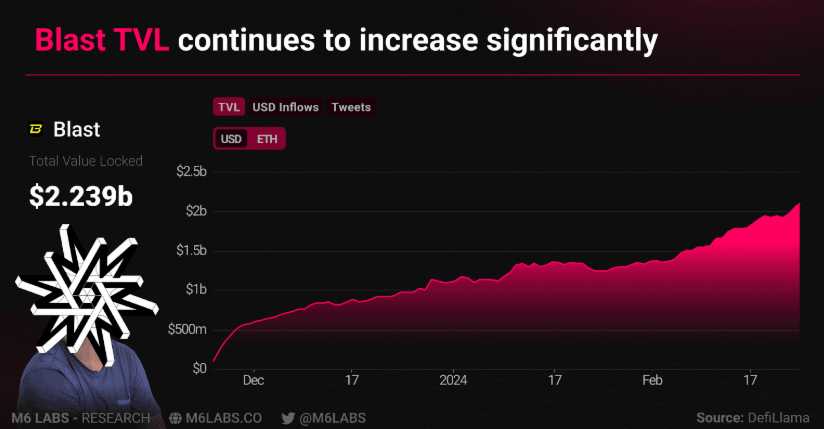

Blast’s mainnet launched on the 29th of Feb, unlocking a staggering $2B in funds, encompassing both Ether and stablecoins.

- Renowned for its native yield offerings for Ether and stablecoins, Blast has drawn the participation of over 3,000 protocols through its "Big Bang" contest.

- Winners of this contest, along with future Blast mainnet protocols, are slated to receive 50% of the community airdrop.

- Since its launch on November 20, Blast has seen a cumulative total of over $2B in crypto assets deposited. With the mainnet launch imminent, protocols integrated with Blast stand poised to entice users and capital, positioning Blast as the second-largest L2 network by total locked value.

- Be sure to check out how to profit from these developments in the section on Blast further down in this letter.

Blast TVL Continues to Increase Significantly

Blast TVL Continues to Increase SignificantlyBitcoin Staking Revolution

Babylon has announced the launch of its highly anticipated testnet. This latest advancement opens doors for participants eager to explore the realm of Trustless Native Bitcoin Staking.

- With backing from Binance Labs, Babylon is introducing a groundbreaking platform allowing users to stake their Bitcoin directly for PoS blockchains, eliminating the reliance on third-party custody or bridge solutions.

- Participation in the Babylon Testnet not only provides firsthand experience but also offers the chance to secure the coveted Bitcoin Staking Pioneer Pass NFT, granting early access to this innovative staking solution.

Source

SourceLiquid Staking Redfines DeFi

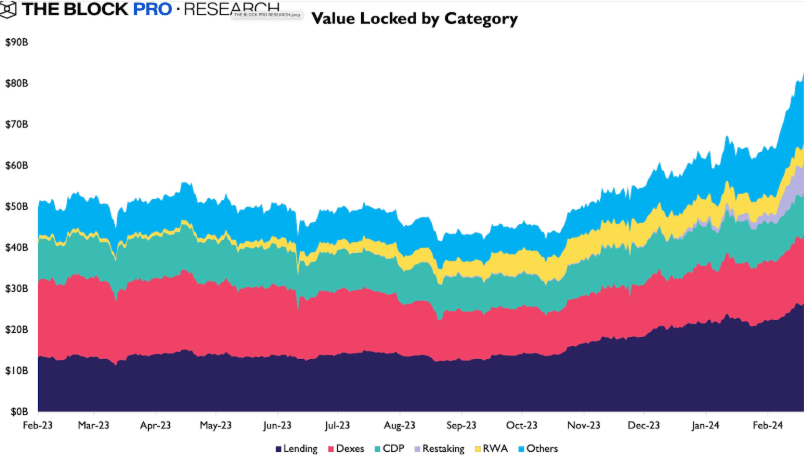

In comparing the current state of the market to that of 2021, a significant shift is evident: Dexs and lending platforms once accounted for most activity in DeFi, liquid staking has emerged as the leading category, accounting for roughly $60B of a roughly $140B industry.

- This transformation underscores a fundamental evolution in DeFi preferences and strategies among investors and users.

- Liquid staking's ascent to the forefront reflects a growing recognition of its benefits, such as enhanced liquidity and the ability to earn rewards while maintaining exposure to the underlying asset.

Liquid staking total market cap. Source: DefiLlama

Liquid staking total market cap. Source: DefiLlamaRestaking Revolution

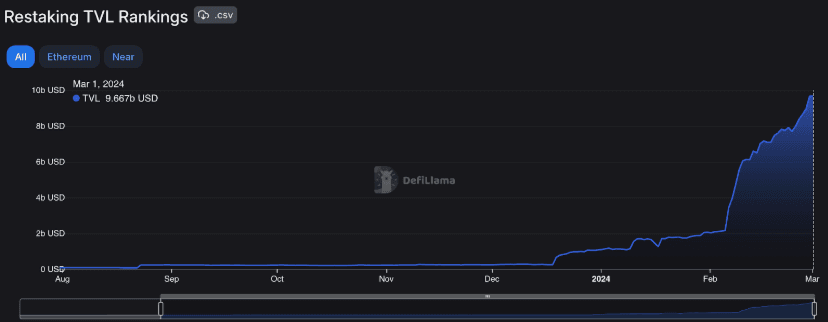

Furthermore restaking is revolutionizing the DeFi landscape, with Eigenlayer spearheading the movement by allowing ETH stakers to simultaneously secure multiple blockchains.

- The TVL in restaking protocols has experienced a remarkable surge, skyrocketing from $2.16B to over $7B.

- Projects like EigenDA, AltLayer, and Lagrange are contributing to EigenLayer’s ecosystem, while other liquid restaking protocols, such as ether.fi and Puffer, have also gained traction, accumulating close to $4B in TVL.

- Many have expressed concerns over the viability and security of staking long-term, but for the present time, it seems this will be one of the major sectors in the DeFi sector.

Restaking is expanding its share of the DeFi market.

Restaking is expanding its share of the DeFi market.Restaking isn't limited to Ethereum alone; other protocols are also adopting similar mechanisms for their ecosystems. Cosmos has witnessed the emergence of Persistence, while Solana is making strides in this direction following the success of liquid staking protocols like Jito, Marginfi, and Marinade.

MarginFi recently unveiled YBX, a yield-bearing stablecoin collateralized by liquid staking tokens such as jitoSOL, mSOL, bSOL, and LST. This stablecoin's yield is generated from the LSTs planned to launch within the next couple of weeks.

Kelp DAO Unlocking EigenLayer’s Potential

Kelp DAO is a leading liquid restaking protocol, that introduced Kelp Earned Points (KEP), representing EigenLayer points earned through restaking.

- This innovative move created on-chain opportunities for users to leverage EL Points directly. Previously, users could only utilize EL Points through WhalesMarket.

- With KEP, the process became seamless and equitable, unlocking new rewards for active restakers. The KEP claiming process operated on a weekly cycle initially, transitioning to fortnightly as the system matured.

- Eligibility for claiming KEP included rsETH holders, Pendle position holders, Uniswap, and Curve position holders on Mainnet, with plans to expand to other chains and DeFi opportunities in the future.

- This expansion aimed to provide more users with access to KEP tokens and unlock the full potential of EigenLayer Points.

Bitcoin Restaking

BounceBit, a novel Bitcoin restaking protocol, just successfully raised $6M in seed funding and has accumulated over $545M in TVL, signaling strong investor confidence and growing interest in this innovative approach being brought to Bitcoin.

- Co-led by Blockchain Capital and Breyer Capital, BounceBit's seed funding round attracted a diverse group of investors, including CMS Holdings, Bankless Ventures, NGC Ventures, and others.

- Founded by Jack Lu, formerly a partner at NGC Ventures, BounceBit distinguishes itself by operating at the asset level rather than the protocol level, offering unique solutions in the Bitcoin restaking space.

- BounceBit's proof-of-stake Layer 1 network supports assets like BTC, Binance's BTCB, and its native token, enhancing participation and chain security within the ecosystem.

- With plans to launch BounceClub and the BounceBit App Store, the project aims to expand its ecosystem and provide users with a range of decentralized applications and tools tailored to their needs.

Crypto Guides & Opportunities

Incentivized Testnets

Incentivized testnets are test networks where participants are rewarded with tokens or other incentives for actively engaging in testing, validating, and providing feedback on the functionality, security, and performance of a blockchain or cryptocurrency project. These incentives motivate users to participate and contribute to the development and improvement of the network before its mainnet launch.

Participation in incentivized testnets has attracted huge airdrop rewards in the past. Projects like Binance Smart Chain and Aptos rewarded their testnet participants with huge airdrops. Many other projects in their testnet phase have confirmed token allocations for testnet users.

The best incentivized testnets to take part in are:

1.Berachain

Berachain is a Tendermint-based EVM-compatible Layer 1 blockchain that powered by a Proof of Liquidity consensus model.

Berachain employs a tri-token model which includes:

🐻 $BERA: A native token for paying transaction fees

🐝 $BGT: A governance token to drive liquidity supply from users

🍯 $HONEY: A native Stablecoin

Berachain has raised a total of $42M and is backed by some huge VCs, including Polychain Capital. Berachain’s public testnet was launched in January 2024 and is currently ongoing.

Testnet Guide

a) Add Berachain testnet to your Metamask using the following credentials:

- Network: Berachain Artio

- RPC URL: https://artio.rpc.berachain.com/

- Chain ID: 80085

- Currency symbol: BERA

- Block explorer URL: https://artio.beratrail.io/

b) Claim testnet tokens

- Go to Berachain faucet

- Enter your wallet address

- Click on the "Drip tokens"

- You’ll need to claim tokens a few times

c) Swap

- Go to BEX page

- Connect wallet

- Swap $BERA to $stgUSDC

d) Swap

- Go to BEX page

- Connect wallet

- Swap $stgUSDC to $HONEY

e) Pool

- Go to BEX webpage

- Connect wallet

- Add liquidity to a pool

f) Trade

- Go to Berachain perpetuals

- Connect wallet

- Open any long or short trade

g) Galxe

- Go to Berachain Galxe page

- Log in with your wallet

- Complete social tasks

- Take the quiz (Answers: C D D D A )

2. X1 Network(OKX)

X1 is a ZK-powered layer 2 that connects the OKX and Ethereum communities. X1 is developed using the Polygon SDK. The mainnet launch is scheduled for Q1 2024. Most likely, the listing will take place on many top CEXs, including OKX. Binance did huge airdrops for Binance Smart Chain, and OKX is likely to follow the trend.

Testnet Guide

a) Add X1 & Sepolia networks to Metamask

- Go to Chainlist X1 Testnet

- Connect your wallet

- Add X1 Testnet network

b) Mint $OKB testnet tokens

- Go to OKX faucet

- Connect your wallet

- Mint OKB test tokens on Sepolia network

- Get OKB from X1 testnet

c) Get some testnet ETH from Sepolia faucet

- Go to Alchemy Sepolia faucet

- Paste wallet address

- Request testnet tokens

d) Bridge ETH

- Go to OKX Bridge

- Bridge test tokens from Sepolia to X1

- Bridge test tokens from X1 to Sepolia

e) Galxe Quests

- Go to Galxe OKX page

- Connect your wallet

- Claim OATs

3. Axiom

Axiom is a protocol that allows smart contract developers to access historical data from Ethereum and then perform intensive computations off-chain. Axiom provides a secure and efficient way to access Ethereum’s historical data without additional trust assumptions in smart contract applications.

Axiom recently raised $20 million in a Series A funding round led by Standard Crypto and Paradigm.

Testnet Guide

a) Add Sepolia network to Metamask and Claim testnet ETH

- Go to Alchemy Sepolia faucet

- Paste your wallet address

- Claim testnet ETH

b) Axiom

- Go to repl.axiom.xyz

- Connect your wallet

- Click on "Test circuit"

- Click on “Generate keys”

c) Complete steps

- Stay on repl.axiom.xyz

- Click on "Generate proof"

- Click on "Send Axiom query"

- Confirm transaction

d) Axiom log

- Stay on repl.axiom.xyz

- Check the left Log

- If there are no error alerts, then everything is good.

4. Metis

Metis is a layer 2 network built on Ethereum to reduce gas fees and improve scalability. Metis raised $6M from OKX Ventures and others.

Testnet Guide

a) Add Metis to Metamask

- Go to Metis testnet

- Connect wallet

- Add Metis network

b) Claim testnet tokens

- Go to Metis testnet

- Connect your wallet

- Claim Test Tokens

- Another option is to request $METIS test tokens via TG BOT

c) Interact with Enki

- Go to ENKI testnet

- Connect wallet

- Mint & Stake.

- Swap $seMETIS for $eMETIS

- Mint & Stake

- Claim rewards

d) Claim ENKI

- Go to ENKI faucet

- Enter the wallet number

- Select token $ENKI

- Click Drip

e) Stake ENKI

- Go to ENKI staking page

- Connect wallet

- Select $ENKI

- Select the number of tokens

- Stake

5. Pryzm

Pryzm is a Cosmos-based protocol that pioneers a layer 1 blockchain solely focused on tokenizing and exchanging future yield. Their ambitious roadmap aims to revolutionize multiple sectors, including LSDs, yield tokenization, proof of liquidity and liquid governance.

Pryzm has announced that it will airdrop 20% of the supply (200m tokens) to the community this year. Snapshot is taken every week

Testnet Guide

a) Install Keplr Wallet

- Go to keplr.app

- Click “Download” and install the Keplr browser extension

- Set up a new wallet

- Add the Pryzm network directly from the “Add More Chain” section

b) Claim testnet $PRYZM

- Go to testnet.pryzm.zone/faucet

- Connect your Keplr wallet

- Click “Request Tokens”

- Repeat to get more tokens

c) Swap

- Go to testnet.pryzm.zone/swap and swap test tokens.

- More swaps = more points.

d) Add liquidity

- Go to testnet.pryzm.zone/pools

- Provide liquidity and earn points

e) Liquidity bonding

- Go to testnet.pryzm.zone/pryzm/bond

- Bond your tokens for yield

f) Pulsetrade

- Go to testnet.pryzm.zone/pulsetrade

- Schedule future token trades

g) Flowtrade

- Go to testnet.pryzm.zone/flowtrade

- Set up recurring/DCA trades

h) Staking

- Go to testnet.pryzm.zone/gov

- Stake $PRYZM and participate in governance

6. Taiko

Taiko is a decentralized protocol utilizing ZK-Rollup technology to scale Ethereum's capabilities while closely mirroring its technical and non-technical aspects. It achieves this through a layer-2 architecture that is decentralized, permissionless, and secure, supporting all ZK-EVM opcodes.

Taiko has secured $22m in funding from leading venture capitalists, including Sequoia and GSR.

Testnet Guide

a) Add Taiko and Sepolia networks to your Metamask

- Go to Chainlist

- Connect your wallet and add both Taiko and Sepolia networks

b) Claim testnet tokens (Holesky ETH)

- Go to Holesky Faucet

- Log in

- Enter your wallet address

- Claim $ETH

c) Claim Testnet Tokens (Holesky HORSE

- Go to Taiko faucet

- Copy and paste your wallet into the tab

- Confirm

d) Bridge

- Go to Katla bridge

- Connect wallet

- Bridge $ETH to Taiko Katla

e) Swap

- Go to Taiko swap page

- Connect your wallet in Taiko Network

- Swap ETH to Horse

- Swap ETH to USDC

f) Liquidity pool

- Go to Taiko pools

- Click on the "New Position" button

- Select (ETH-USDC) pair and choose 0.05% Full Range rater

- Enter providing amount

- Approve USDC and add liquidity

g) Gaming task

- Go to Crypto Rumble

- Connect wallet

- Mint hero

- Play 3 different games

- Choose a different boss each time

- Set the game to AutoBattle mode and just wait

h) Galxe quests

- Go to Taiko Galxe page

- Connect wallet

- Complete simple tasks

- Answers for quiz C - A - C - D - C

7. Fuel

Fuel network is building the fastest modular execution layer for the modular blockchain stack. Fuel will use Celestia’s data availability layer to deliver the security and scalability together with a seamless experience for developers. Fuel raised $81,5М from Blockchain Capital, Spartan, and other VCs.

Testnet Guide

a) Fuel wallet

- Go to Fuel Wallet

- Back up your recovery phrase.

- Choose a password

b) Sepolia network

- Go to Chainlist Sepolia testnet

- Connect your wallet and add Sepolia network

c) Request testnet tokens

- Go to Fuel Network faucet

- Request testnet tokens

d) Request Sepolia ETH

- Go to Sepolia faucet

- Signup or Login

- Paste Metamask Address & Claim

e) Bridge

- Go to Fuel bridge

- Connect MetaMask & Fuel Wallet

- Enter ETH amount & Deposit

f) Fuel Art

- Go to Fuel art

- Connect Wallet & Sign In

- Mint an NFT

- Create your own NFT

g) Ecosystem

- Go to Fuel Network ecosystem

- Try out the Dapps.

h) Guild & Discord

- Join Guild

- Join Discord

Other Incentivized Testnets

Other testnets not highlighted in this article are:

- Mind

- Espresso

- Avail

- Nibiru

- Lava Network

- Nulink

- Kinto

Testnet Actions to Airdrop Farming $BLAST

Gear up for the Blast airdrop by completing testnet tasks before the Ethereum layer 2 network, developed by the Blur team, launches its mainnet was on Feb 29. Blast, known for its unique native yields and a vibrant ecosystem with over 3,000 protocols from the "Big Bang" competition, has already secured $2 billion in crypto assets. With the mainnet debut imminent, Blast is set to become a leading layer 2 network. Join the excitement and be part of this transformative crypto event.

Dive into the Blast platform's ecosystem by participating in a variety of testnet tasks. This not only offers a deep understanding of the platform but also positions you for potential $BLAST token airdrops.👇

Configuring Your Wallet for Blast Network

Begin by integrating the Blast Sepolia network into your wallet. Follow the instructions at https://support.metamask.io/hc/en-us/articles/360043227612-How-to-add-a-custom-network-RPC using these parameters:

- Network Name: Blast Sepolia

- RPC URL: https://rpc.ankr.com/blast_testnet_sepolia

- Chain ID: 168587773

- Currency Symbol: ETH

- Block Explorer URL: https://testnet.blastscan.io/

Securing Testnet ETH for Blast Sepolia

Access testnet ETH through the faucet at https://faucet.quicknode.com/blast/sepolia.

Participating in Testnet Activities for a Chance at $BLAST Token Airdrop

Maximize your potential to receive the $BLAST token airdrop by engaging in various activities on the Blast Sepolia Testnet:

- Zap: With access code 1337Z, mint USDB, launch tokens, and complete missions at https://testnet.zap.tech/.

These activities not only enhance your understanding of the Blast ecosystem but also provide an opportunity to earn $BLAST tokens through potential airdrops.

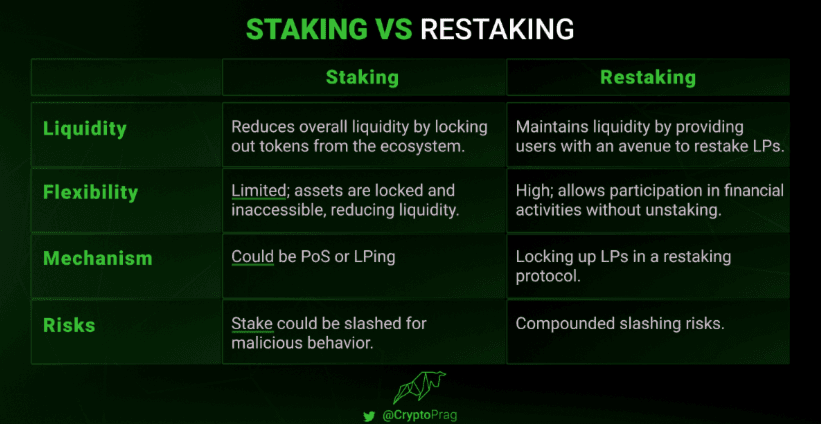

Staking vs Restaking – Learn the Differences

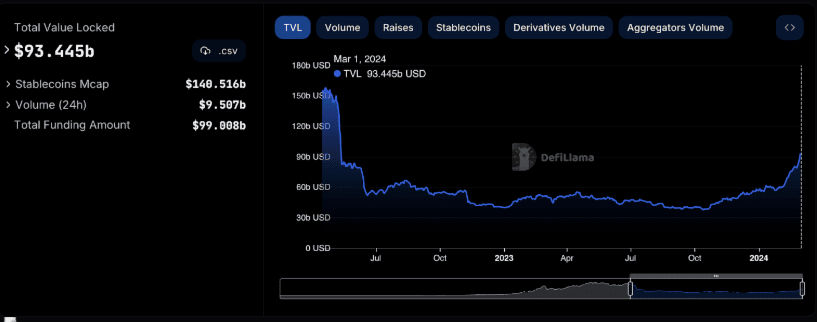

Restaking has become one of the hottest narratives in crypto this past year. In fact, it won’t be a stretch to say that restaking is singularly responsible for boosting TVL in DeFi.

As per DeFiLlama, the TVL in DeFi has jumped from $56.58B to $93.45B – almost doubling in valuation. Specifically regarding Restaking, the overall TVL has jumped from $1.1B to $9.667B.

EigenLayer alone accounts for $9.65B - making it the third-largest protocol by TVL in the DeFi sector behind Lido and Aave.

So, what exactly is the difference between staking and restaking? Let’s take a look.

What is Staking?

Staking is the practice of locking up tokens within the coin’s ecosystem. It is mainly done for one these two reasons:

- Staking is the foundational element of PoS blockchains, where validators lock up a certain amount of the blockchain's native tokens as a form of security deposit.

- Users may also stake their tokens to add liquidity in various DeFi protocols and earn yield.

The primary appeal of staking lies in its ability to provide a passive income stream to token holders, who can delegate their tokens to validators and earn rewards in return.

What is Restaking?

Restaking, on the other hand, introduces a second layer of utility and potential rewards for staked assets. It allows the previously staked tokens to be used again in a different platform or program, essentially "restaking" them to leverage additional decentralized protocols. This process enhances the utility of staked assets and opens up new avenues for earning rewards.

Despite its benefits, restaking is not without risks, primarily stake centralization and compounded slashing.

- Centralization occurs as validators offering higher APYs attract more delegations, leading to a concentration of network control.

- Compounded slashing introduces higher penalties for validators' misconduct due to additional conditions from restaking protocols, thus adding layers of risk to the restaking process.

Examples of restaking protocols:

- EigenLayer on Ethereum.

- Persistence One has introduced restaking to the Cosmos Ecosystem. Persistence One has also published a blog to explain the differences between Ethereum and Cosmos restaking.

Comparative Analysis: Staking vs Restaking

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space