GM, Anon! Memes such as Wif, Pepe, Floki and others are going parabolic, AI coins are showing no signs of stopping their upward trajectory, and Ethereum has recently seized the spotlight thanks to the groundbreaking "Dencun" upgrade.

Post-Dencun, gas fees on some Ethereum L2s have plummeted to as much as 1 cent! However, let's not forget that an absolutely monumental milestone is looming on the horizon – one that has repeatedly reshaped the very fabric of the crypto universe – Bitcoin halving. Let’s dive in!

Today, we'll delve into:

- The 2017 bull market

- The 2021 bull market

- Narratives shaping the present bull market and how you can profit from them

- The current status of other major L1 networks

- Fundamental architectural variances in L1 design

- What Is the Bitcoin halving?

- Get going with an Xverse Wallet and using the Runes testnet

- Try out the Botanix Lab’s testnet

- Get involved with the B² Network testnet

Bull Markets – Then vs Now

Let's take a moment to look back at the 2017 and 2021 bull runs. Things were different in the crypto world back then compared to what we see today.

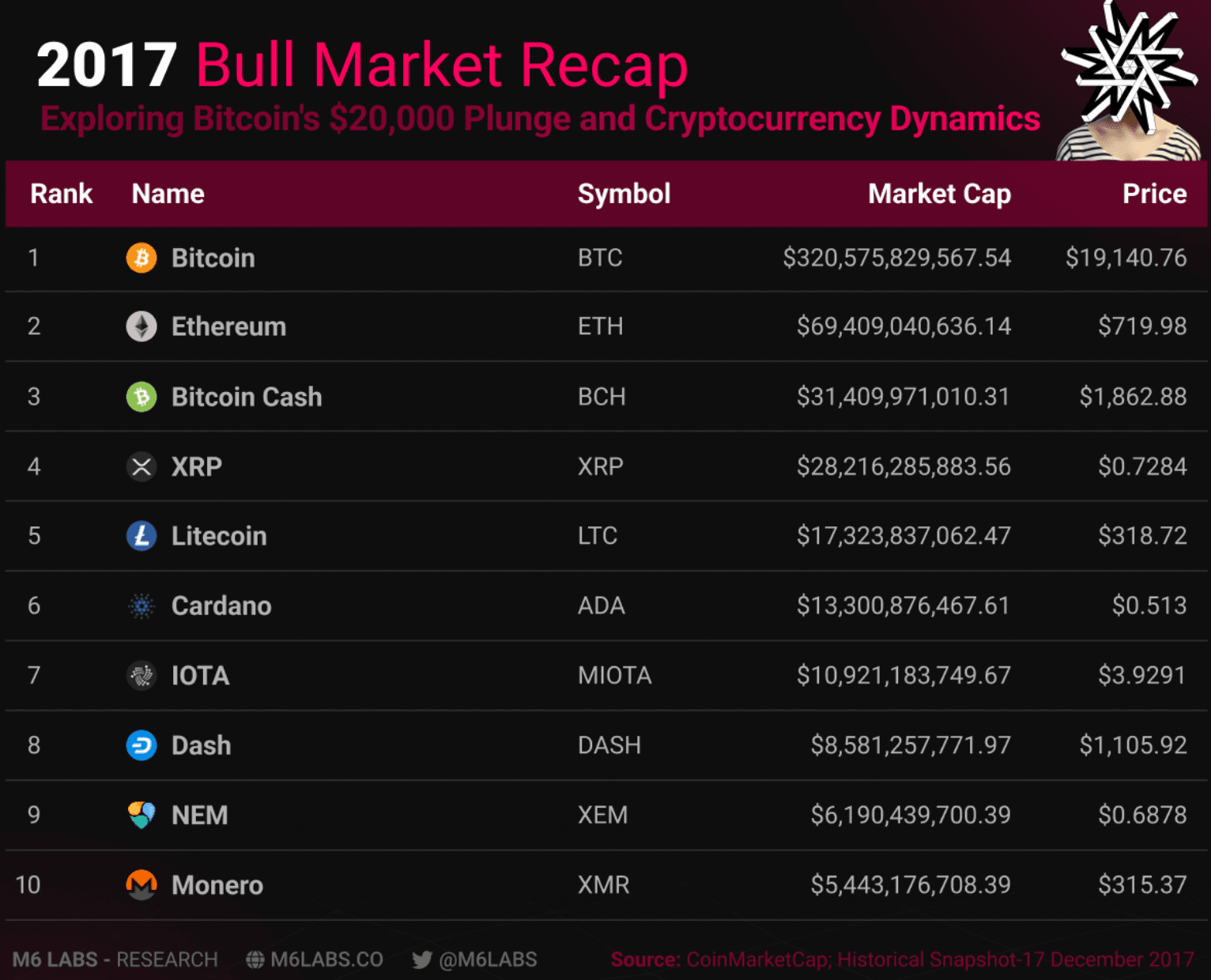

2017 Bull Market

It’s December 17, 2017, and Bitcoin has dropped from $20,000. How many of these coins do you recognize from the top 10? BTC and ETH remain the top 2 coins. But did you notice something?

- No stablecoins

- Three coins were forked from the Bitcoin protocol (Bitcoin Cash, Litecoin, and Dash)

- Bitcoin is at a market cap of $320M, far short of the current $1.4T

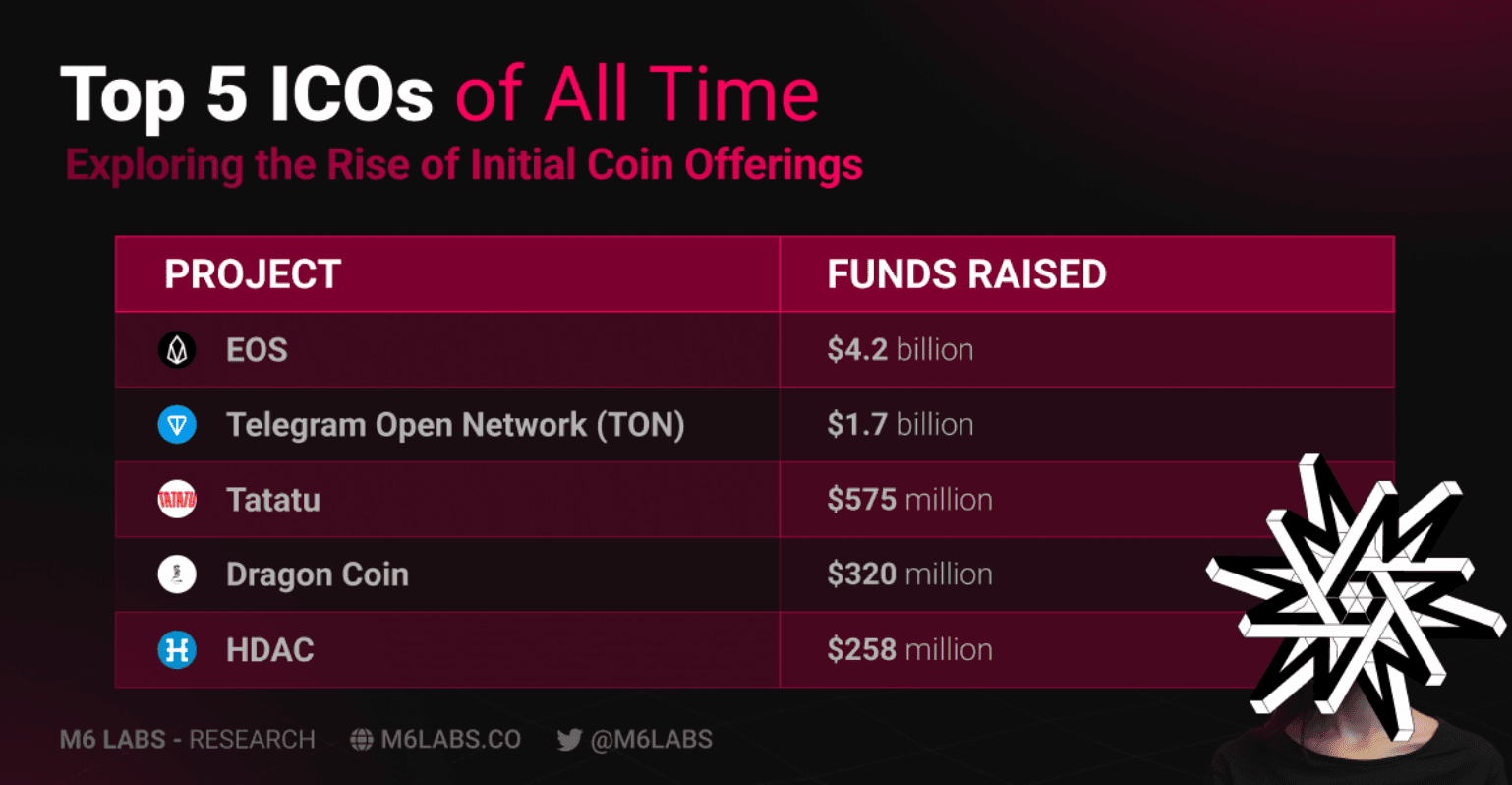

The ICO narrative

The 2017 bull market saw a massive proliferation of Initial Coin Offerings (ICOs) – a revolutionary fundraising mechanism wherein projects issued blockchain-based tokens to the general public in exchange for funds. In 2017, projects raised $5.5B through ICOs, while in 2018, they raised a staggering $14B. Here are the top 5 ICOs:

There were several reasons why ICOs became such a rage, of course. The minimal legal and regulatory red tape allowed projects to easily raise funds and users to participate with minimal hassle.

Unfortunately, this lack of regulatory oversight meant malicious parties could easily scam users for millions. How can we ever forget the infamous BitConnect, which turned out to be one of the largest Ponzi schemes in crypto history, defrauding investors of billions of dollars.

How did the 2017 bull market end?

As you can imagine, regulators soon clamped down on the ICO market. The actual body blow came when China banned ICOs altogether. Back in the day, China was the hotbed of crypto activity and ICOs. Following the ban, the market bubble burst as we entered the 2018-2020 crypto winter.

2021 Bull Market

COVID-19 and Institutional investors barge in

The COVID-19 pandemic catalyzed the 2021 crypto bull market. Fears of government intervention in traditional markets pushed investors towards cryptos for their accessibility and potential to hedge against political risks. Simultaneously, significant institutional investments, exemplified by MicroStrategy's and Tesla's substantial bitcoin purchases, reinforced confidence in the crypto space.

DeFI Summer of 2020

The summer of 2020 marked a transformative period for decentralized finance (DeFi), witnessing explosive growth in total value locked (TVL), which soared from less than $1B to $15B. Key developments included Compound issuing governance tokens, Uniswap's significant trade volumes, and the introduction of unique financial experiments such as rebase tokens.

2021's NFT Boom

The NFT boom of 2021, often dubbed the "NFT Revolution," saw the non-fungible token market explode with over $23 billion in trading volume, propelled by high-profile collections like Cryptopunks and Bored Ape Yacht Club and expanded by innovations in the metaverse and GameFi sectors.

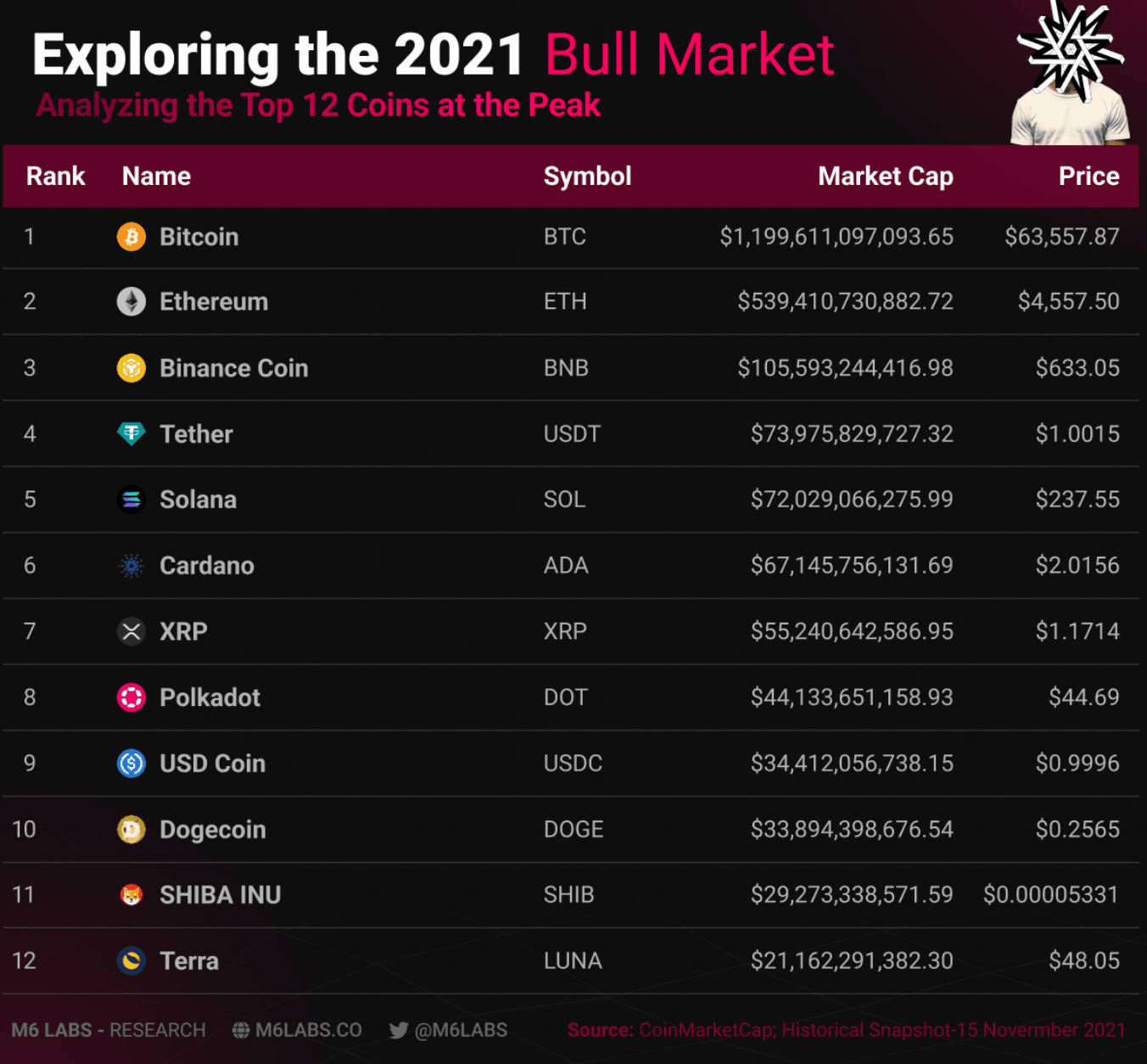

All of this culminated in a spectacular run with many expecting Bitcoin to break $100k. Unfortunately, that didn’t happen and this snapshot is from November 15, 2021 – around the peak of the second bull market.

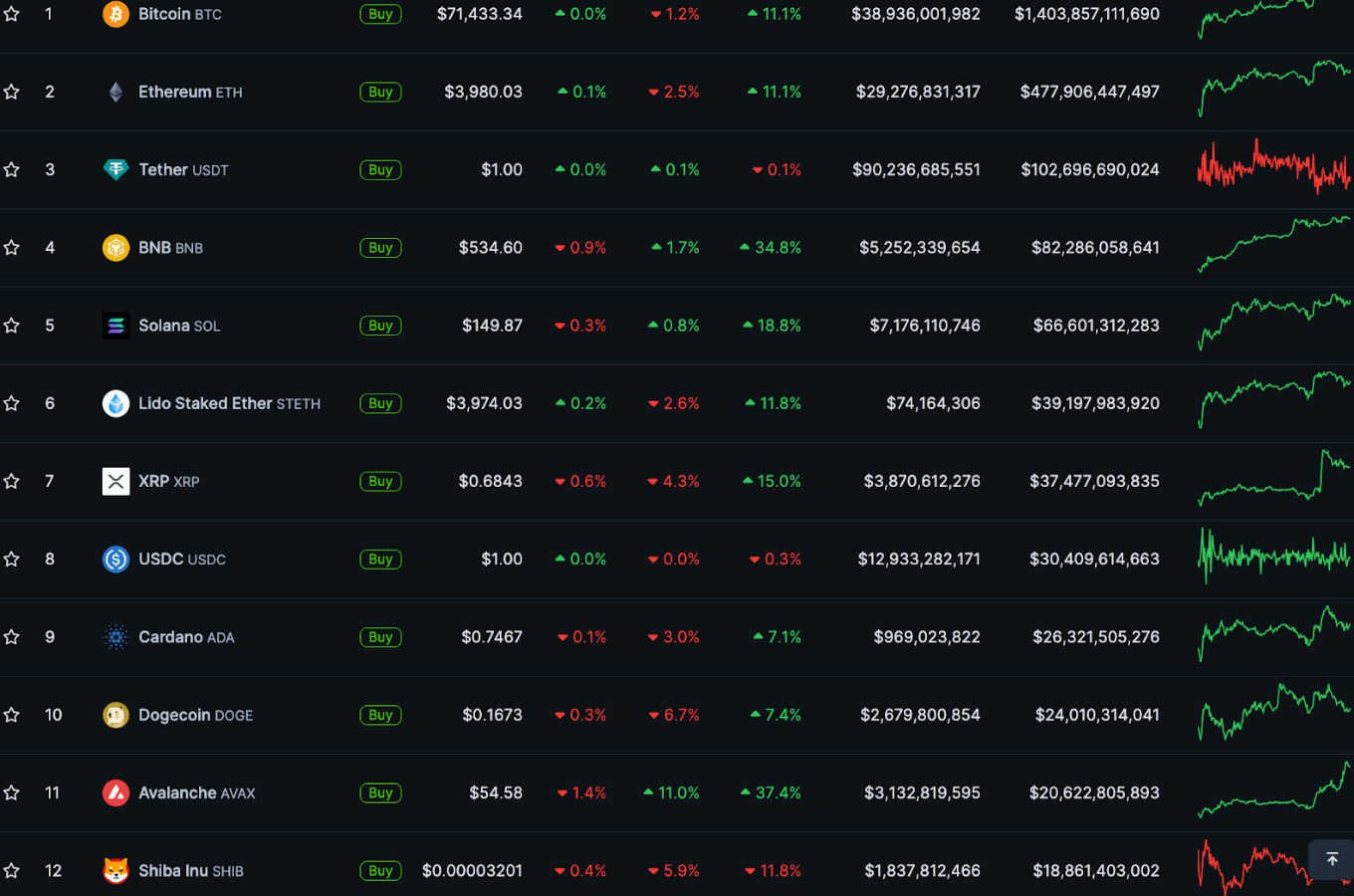

Alright, we might have bent the rules a tad. But we had to extend the top 10 to “top 12” to include Terra. Here are some observations:

- We have 2 stablecoins in the top 10 – USDT and USDC

- We have two memecoins in the top 11 - DOGE and SHIB

- We have a host of “Ethereum Killers” in the top 10 – Binance coin, Solana, Cadano, Polkadot and Terra

How did the 2021 bull market end?

The market became oversaturated and overpriced, leading to a series of catastrophic events that fueled the 2021-2023 crypto winter. Key incidents included the Terra Crash, the bankruptcy of Three Arrows Capital, a widespread "crypto contagion," and, ultimately, the collapse of FTX. However, it must be noted that even before the Terra crash, the price was on a steady downward slump.

2024-2025 Bull Market

Let’s delve into the trends shaping this bull market and explore some opportunities you can leverage. With a plethora of developing narratives and unreleased tokens on the horizon, there is still time for you to participate and earn thousands.

Firstly, let's examine the top 10 coins to get a sense of the prevailing trends.

Interestingly, many of 2021's top performers are still among the top 10, including SOL, XRP, BNB, and Doge. However, we're witnessing the emergence of a new major player in the form of Lido Staked ETH, and Avalanche making strides toward the top 10 as well.

Crypto narratives are the prevailing ideas, beliefs, and stories that drive the perception and valuation of cryptos. These narratives can influence market trends, investment sentiment, and the broader adoption of blockchain technologies.

It's frequently the narrative that propels a project's evaluation and token price to new heights, rather than its tokenomics or even the presence of a functioning product, as evidenced by numerous memecoins.

In 2024, several key crypto narratives are shaping the landscape and will likely remain the dominant narratives well into 2025.

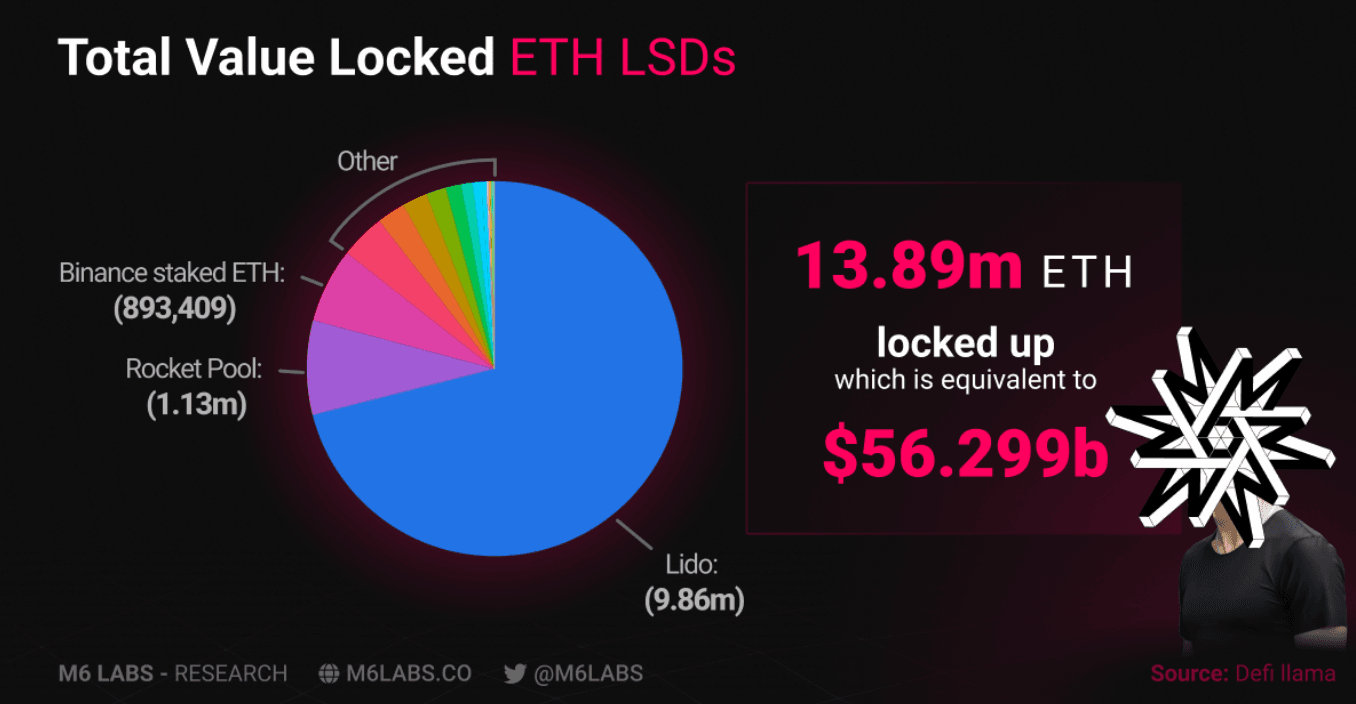

Liquid Restaking Tokens (Eigenlayer) & Liquid Staking Derivatives

LRTs, led by Eigenlayer, and LSDs mark significant advancements in the crypto sphere, focusing on boosting capital efficiency and network security.

- Liquid staking innovations enable tokens to be restaked across multiple networks, optimizing capital allocation and enhancing network security.

- LSDs increase liquidity by allowing staked assets to be leveraged in DeFi activities, unlocking the potential of immobilized assets and driving efficiency within the DeFi ecosystem.

- Position yourself to profit from the upcoming Eigenlayer airdrop by getting involved with some of the largest LRT projects by using these referral codes for:

DeFi Levels Up

DeFi builders have continued to refine products, transforming the crypto landscape. Once, liquidity across chains was fractured, and transitioning between ecosystems was unthinkable. Now, users can bridge across different ecosystems and L2s at a fraction of the cost and previously unthinkable speeds.

- Wormhole and Polyhedra recently announced their airdrop and there’s still time to explore tokenless bridges such as:

- Additionally, advanced DeFi products have emerged, including Aevo, a high-performance options and perpetual trading platform, and Hyperliquid, a specialized DEX focusing on perpetuals. Use this link to get involved with Aevo.

- Another newcomer, Ethena, backed by substantial industry capital, has introduced its stablecoin backed by native yield generated by complex mechanisms involving staked ETH.

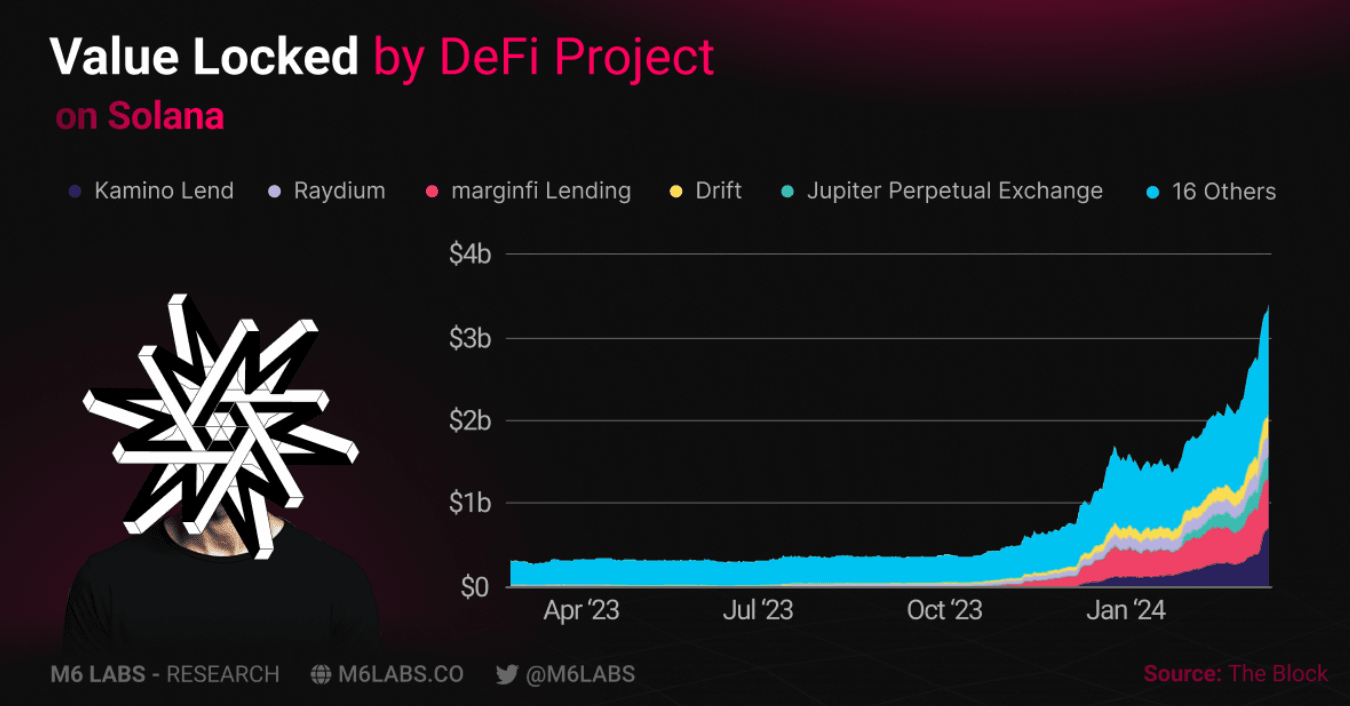

- Moreover, DeFi has expanded on chains like Solana, where impressive products like MarginFi and Kamino are being rolled out.

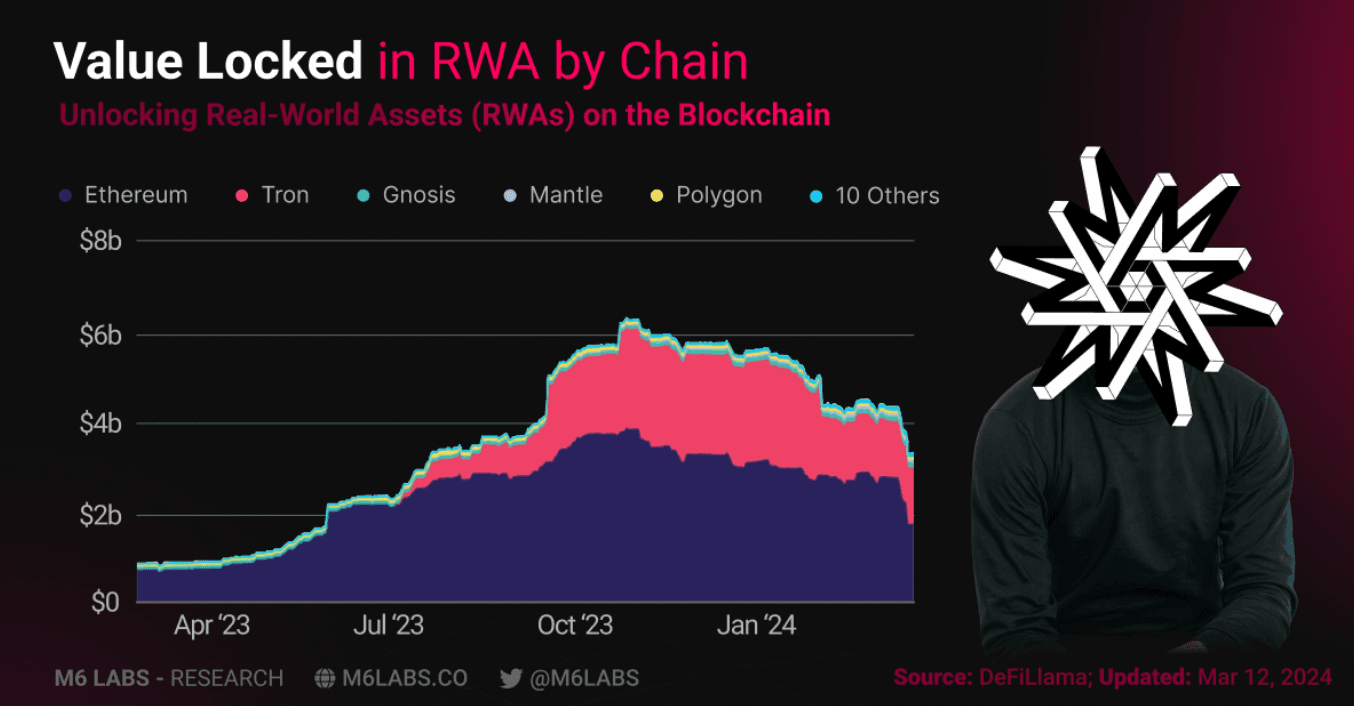

One of the latest advancements in the field of DeFi is the tokenization of real-world assets (RWAs).

- This innovation enables individuals to purchase shares of high-value assets like real estate, gold, and art through digital tokens on the blockchain.

- Traditional finance firms are investing in gold and U.S. Treasury bonds, embracing the tokenization of RWAs.

- Experts predict that the tokenized assets market will reach $16T by 2030, indicating significant growth potential in the future.

Artificial Intelligence

Crypto projects that focus on AI have made significant progress, with the emergence of functional products accompanied by intricate ecosystems in the market. Some examples include:

- Bittensor (TAO) offers self-contained economic markets called subnets, incentivizing task completion with TAO tokens. Built on Subtensor using Polkadot's Substrate SDK.

- Fetch.ai (FET) provides scalable blockchain infrastructure utilizing machine learning and smart contracts across industries like logistics, energy, and finance.

- Ocean Protocol (OCEAN) enables decentralized data sharing for AI, supporting applications in predictive analytics, image recognition, and natural language processing.

- SingularityNET (AGIX) operates a marketplace for AI services, promoting decentralized AI development and data privacy.

Decentralized Physical Infrastructure Networks (DePIN)

DePin pioneers blockchain's expansion into physical infrastructure, offering decentralized solutions to real-world challenges. By leveraging blockchain's transparency and security, DePin projects streamline logistics and energy distribution.

- Grass, a Wynd Network initiative, exemplifies DePin's potential, allowing individuals to sell unused internet bandwidth to corporations, creating a symbiotic digital ecosystem.

Blockchain Modularity

The shift towards modular blockchain designs represents a significant evolution in the technology's architecture, aimed at enhancing both scalability and flexibility.

- By compartmentalizing various elements of the blockchain into separate, distinct components, this approach allows for more targeted improvements and upgrades, thereby addressing some of the most pressing challenges faced by traditional blockchain systems.

- In regards to modular blockchains, the recent standouts are Celestia and Dymension, which have seen impressive developments and price action.

Alternative Ecosystems

The emergence of alternative ecosystems has been a notable feature of this bull market.

- After years of development, numerous L1s and L2s have experienced significant technological advancements, specialization, and the influx of liquidity into their ecosystems.

- The rise of other L1s such as Sui, NEAR, Aptos, Sei, Injective, Solana, and BNB has led to a substantial increase in user engagement. These platforms are witnessing the development of various applications spanning gaming, DeFi, gambling, NFTs, RWAs, and more.

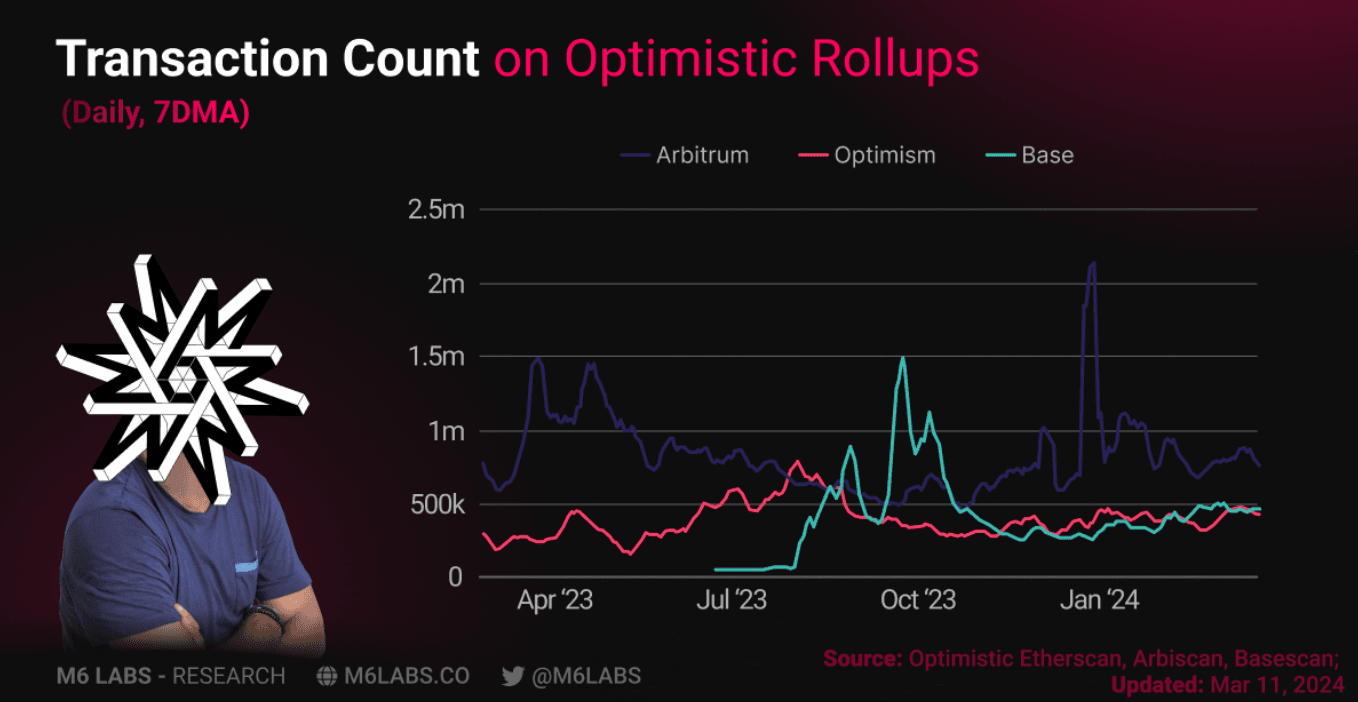

- L2 solutions like Optimism, Blast, Arbitrum, and Base have witnessed a surge in applications and user activity. Many of these ecosystems have incentivized users with airdrops and rewards.

NFTs & Gaming

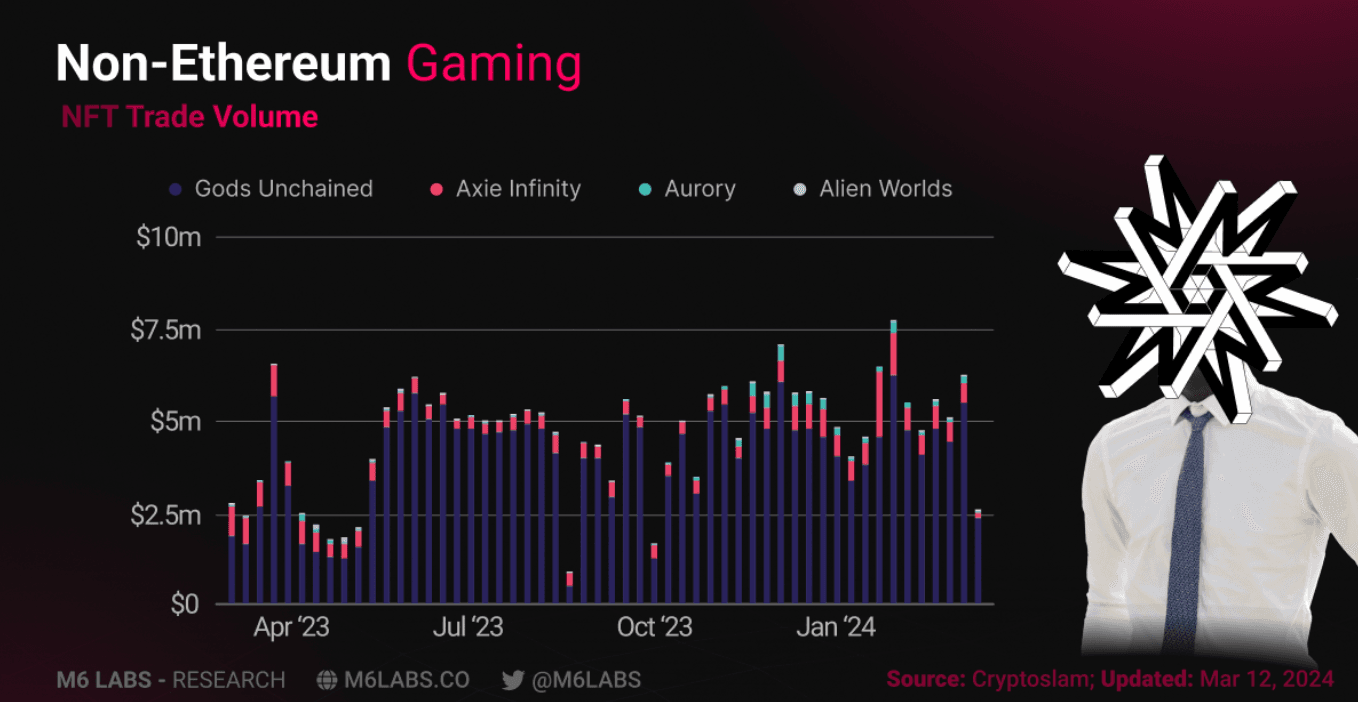

A notable development in the NFT world this cycle has been the emergence of NFTs on alternative blockchains like Solana, seen in collections such as Mad Lads, and on Bitcoin with ordinal collections like NodeMonkes.

- These collections have gained significant volume and traction, surpassing most major Ethereum collections.

- On Ethereum, standout collections include Azukis and Pudgy Penguins.

- In the gaming sector, the rise of Pixels on Ronin and Heroes of Mavia has been remarkable.

- A redemption story of this cycle seems to be Pixelmon, which has undergone a complete turnaround from its disaster launch during the previous cycle.

Other Major Trends

Other major trends that have emerged include the rise of SocialFi. Protocols such as Friend.tech, Farcaster, and Lens are experimenting with technologies that fuse crypto and social media to benefit creators and users.

Another significant development is the rise of Telegram trading bots like Maestro, Unibot, and the beloved Banana Gun Bot, favored by traders for features enabling early entries and ease of use.

Memecoins are here to stay and are increasingly gaining unimagined momentum. Coins like Pepe, Bonk, and Dogwifhat have significantly influenced the crypto landscape. The upcoming Berachain, built from the ground up with high-level memetics, reflects the increasing significance of memecoins in the crypto space.

Additionally, GambleFi is another noteworthy development—decentralized gambling platforms built on blockchains, offering transparent and secure betting experiences through smart contracts for fair outcomes and efficient transactions.

How to capitalize on these narratives? Explore one or two deeply, then transition into projects you believe have potential as the bull market unfolds.

The State Current State Of Other L1s

Retail Sentiment

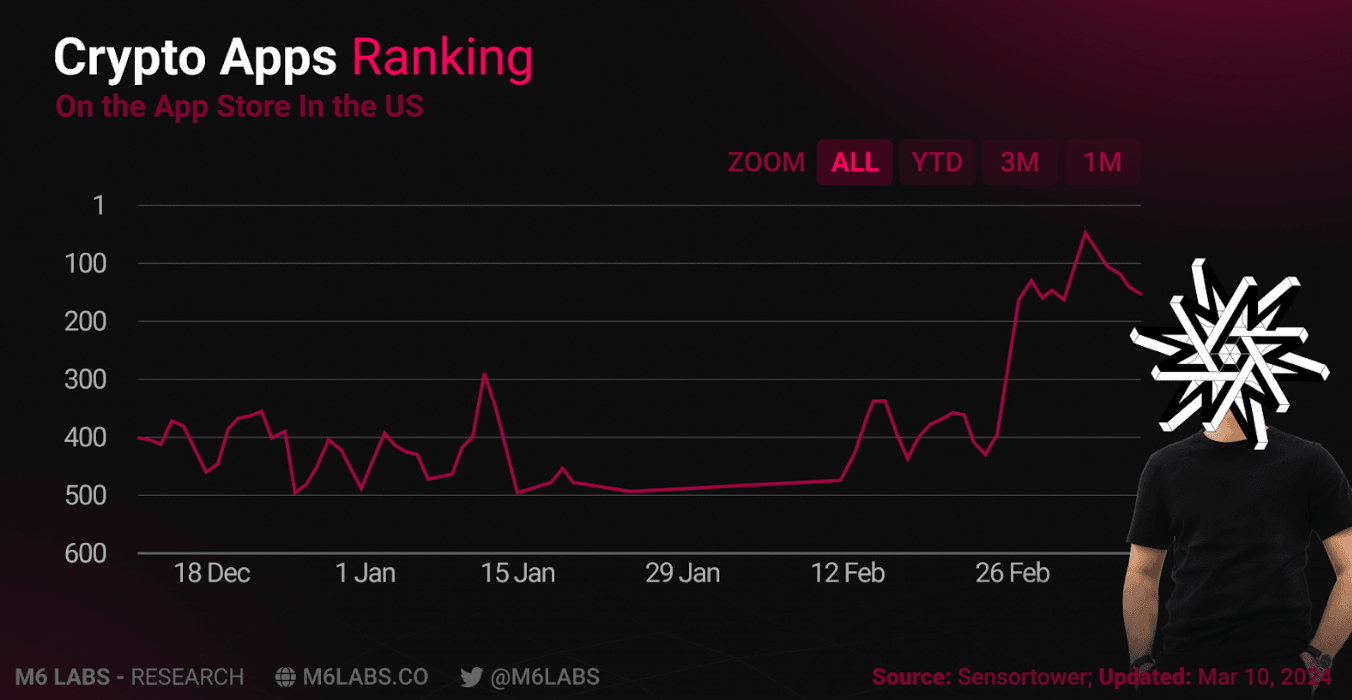

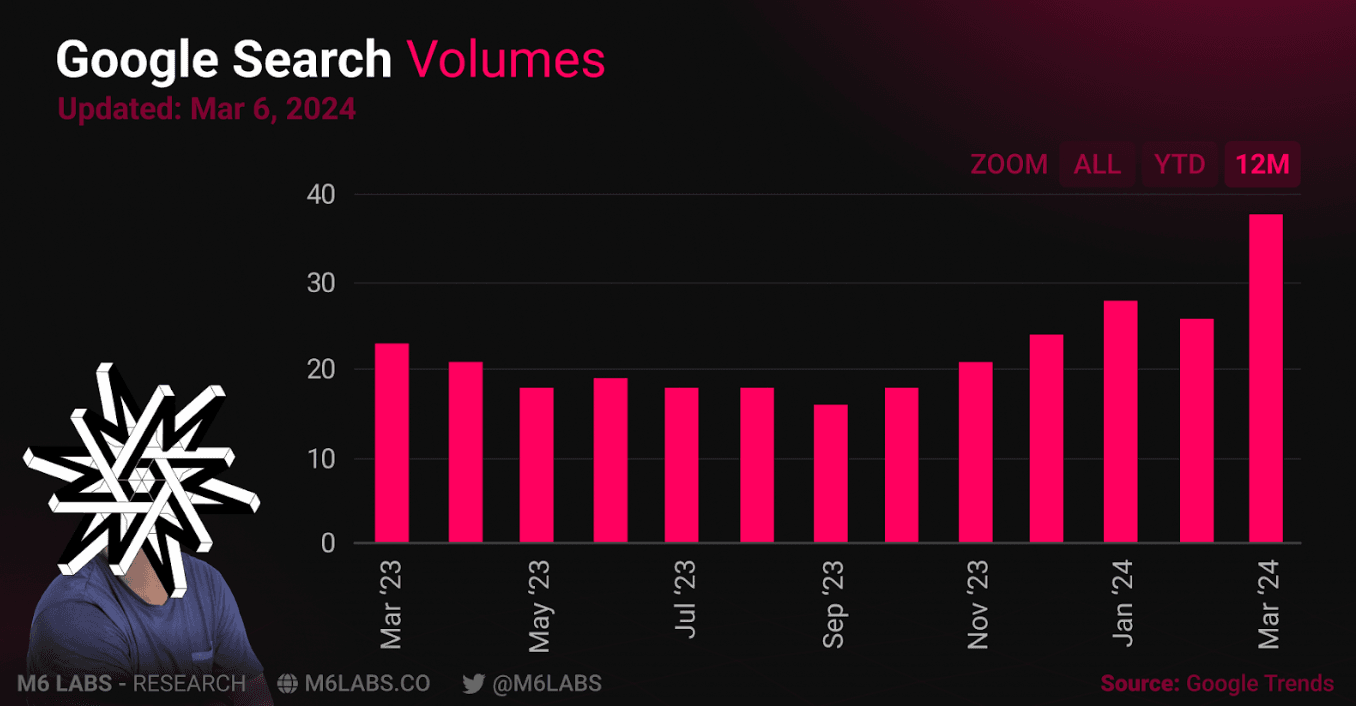

And just like that, indicators such as Google searches and the rankings of crypto apps on the App Store are all signaling the return of retail interest. Have you noticed your family members and coworkers chatting about crypto again? It's a familiar pattern – crypto fades from the spotlight, only to bounce back when least expected.

If you've been following our updates, you've likely been allocating your assets since last year, and I bet you've seen some impressive returns! If you've missed out so far, don't worry; there are still plenty of gains to be made as this bull market is just gaining momentum. However, be mindful of sharp pullbacks in the short term that can easily wipe out leveraged positions – those deep wicks show no mercy!

The L1 Race

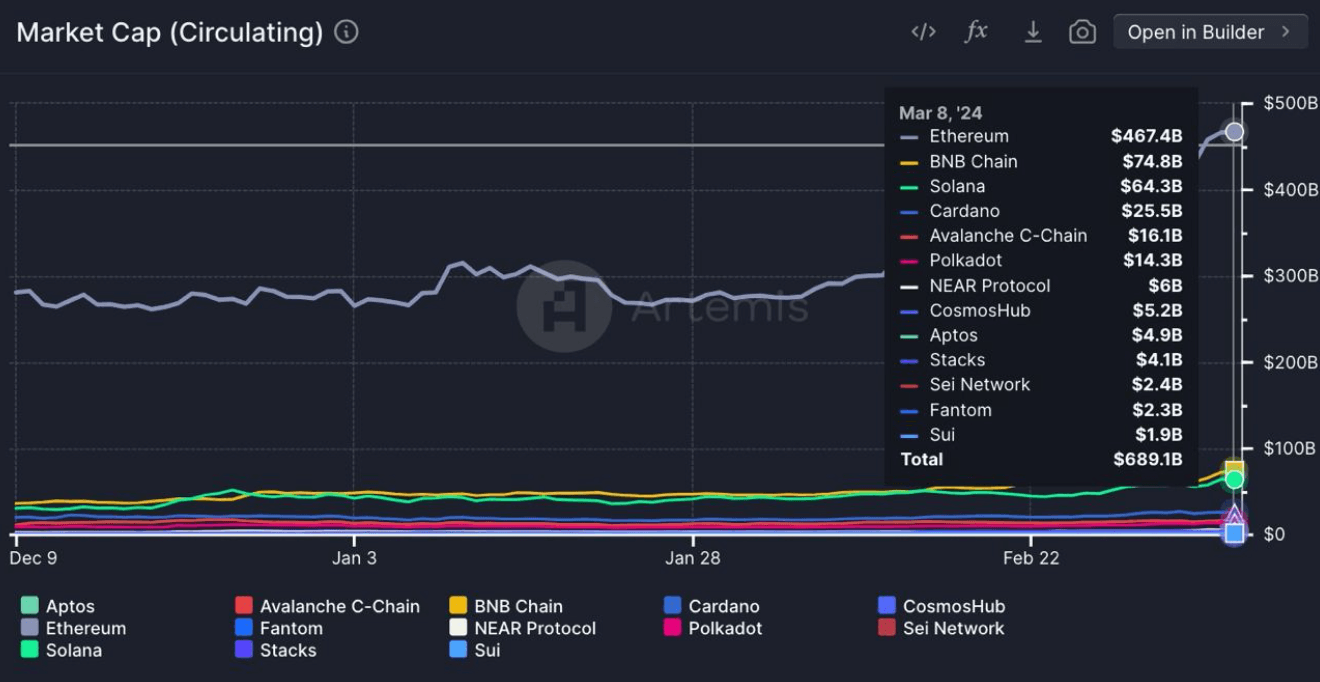

Ethereum continues to maintain its position as the dominant L1 in terms of circulating market cap. However, other chains like BNB and Solana have been gaining traction as users flock to these networks attracted by their lower costs.

Source: Artemis

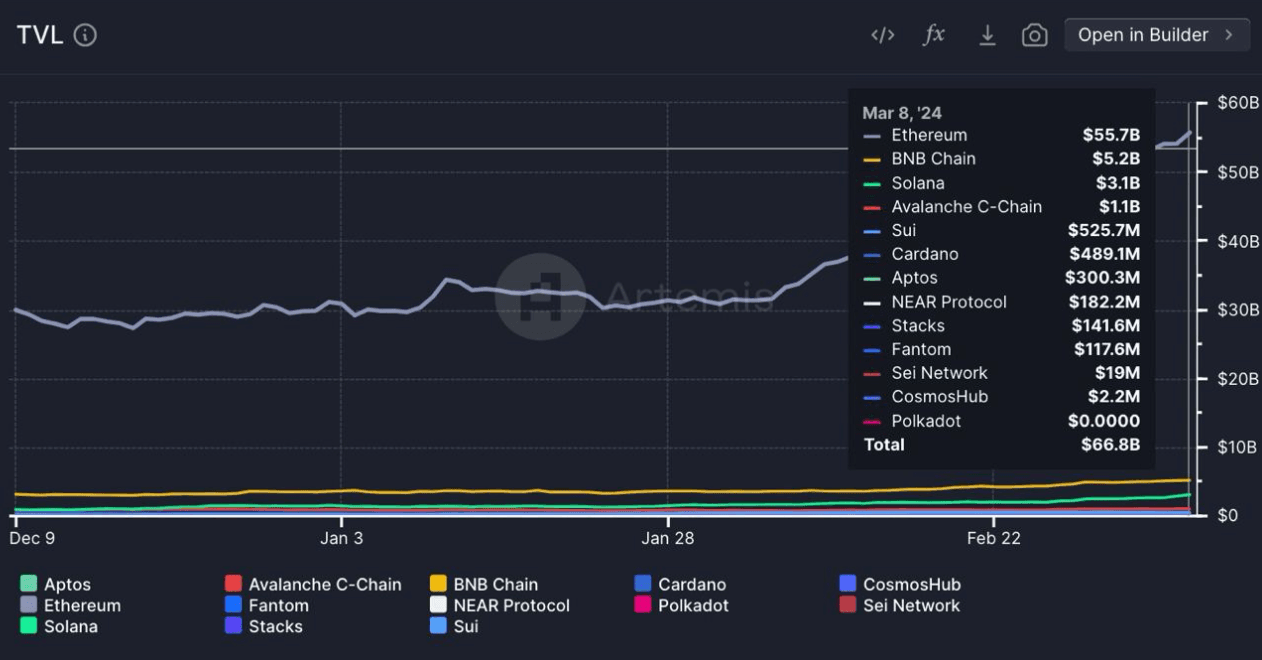

Source: ArtemisThe overwhelming majority of TVL remains within Ethereum, significantly overshadowing other chains. An intriguing development to monitor will be how this evolves as the bull market progresses. Will other chains manage to capture a portion of the TVL?

Source: Artemis

Source: ArtemisAmong the newcomers, NEAR, Avalanche, and Fantom have shown remarkable returns, fueled by increased short-term usage translating into rising market caps. Fantom, in particular, experienced a significant price surge last week, with notable whale wallets such as 0xdf89a69a6a6d3df7d823076e0124a222538c5133 allocating nearly $7M to purchasing Fantom. This suggests that whales are anticipating significant shifts towards these alternative L1 networks.

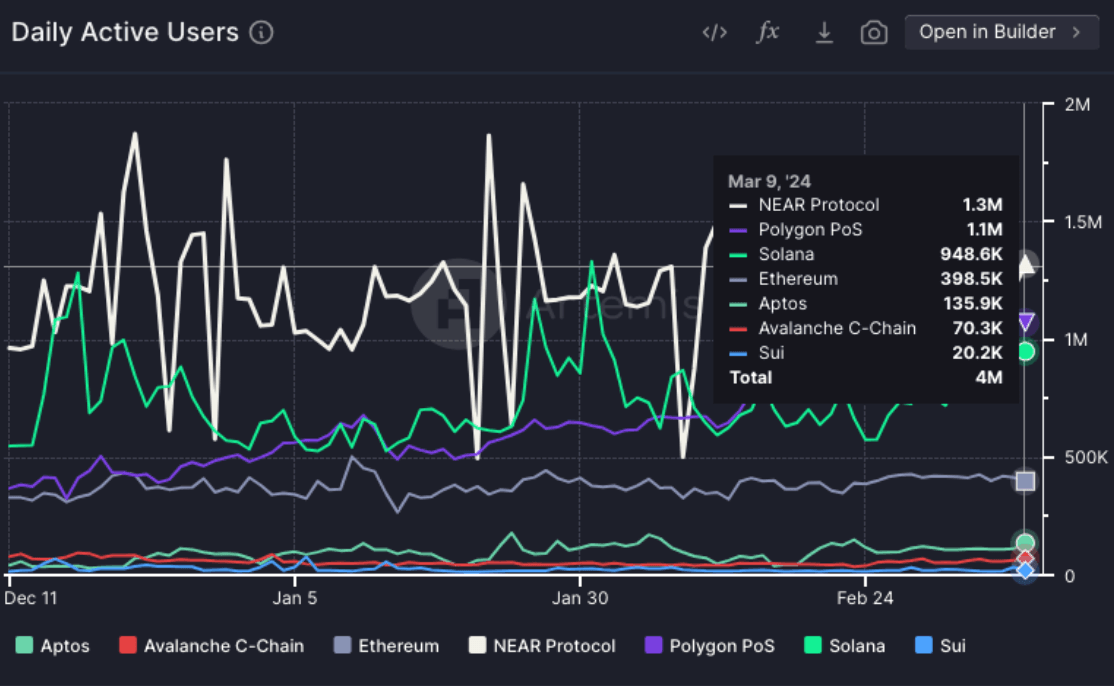

Interestingly, NEAR has experienced a surge in daily active users, surpassing all other L1 protocols. Protocols like Aurora and Ref Finance have been successful in attracting users, while initiatives such as NEAR Crowd have been incentivizing active participation.

Source: Artemis

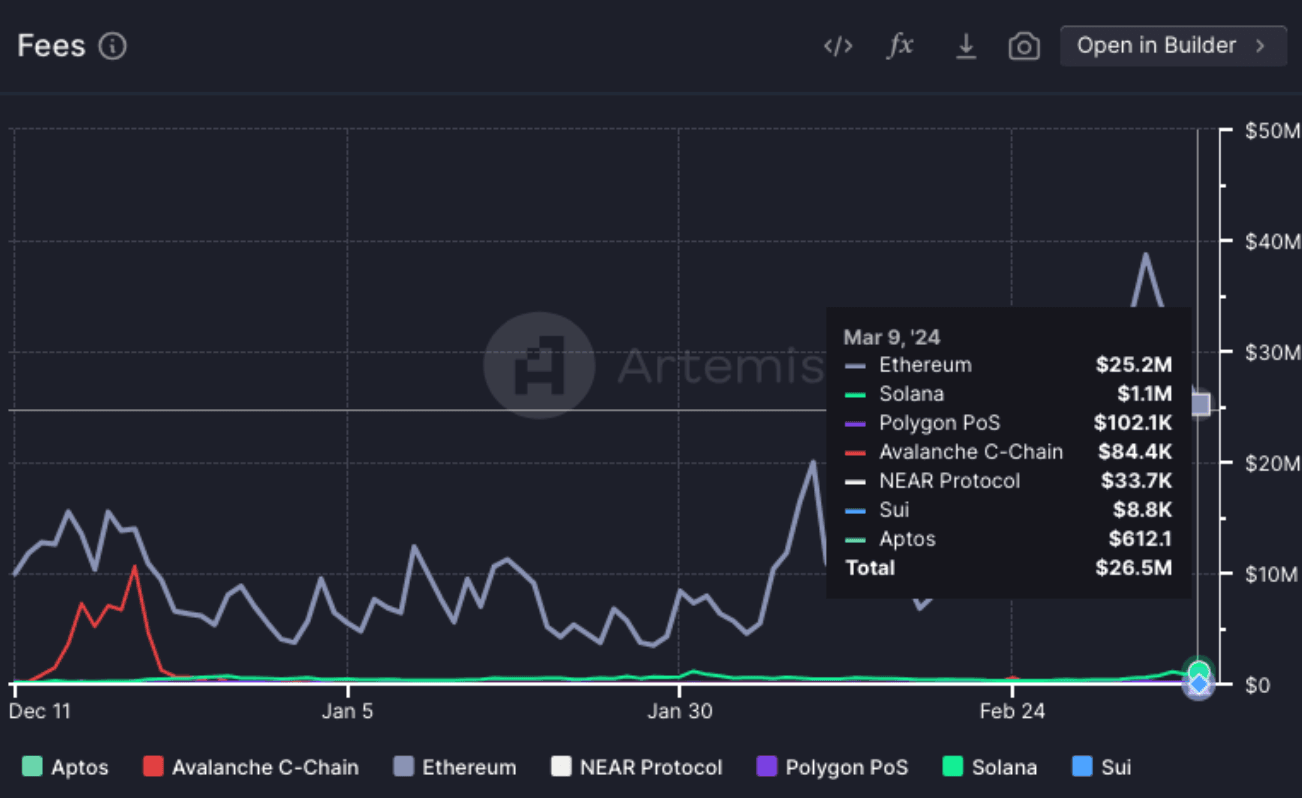

Source: ArtemisIn terms of fees, Ethereum remains the most profitable blockchain, followed by Solana. Fees play a crucial role in assessing the viability of a blockchain, as they indicate its profitability, largely driven by user activity.

Despite the growth in usage of other L1s and their protocols, it's notable that fees continue to remain relatively low across the board. This phenomenon suggests that while there may be increased adoption and utilization of alternative L1s, they have yet to reach the same level of demand as Ethereum, which maintains its dominance in terms of generating fees due to its extensive user base and network effects. It will be interesting to see how fee dynamics evolve over time as competition among L1s intensifies and user preferences shift.

Source: Artemis

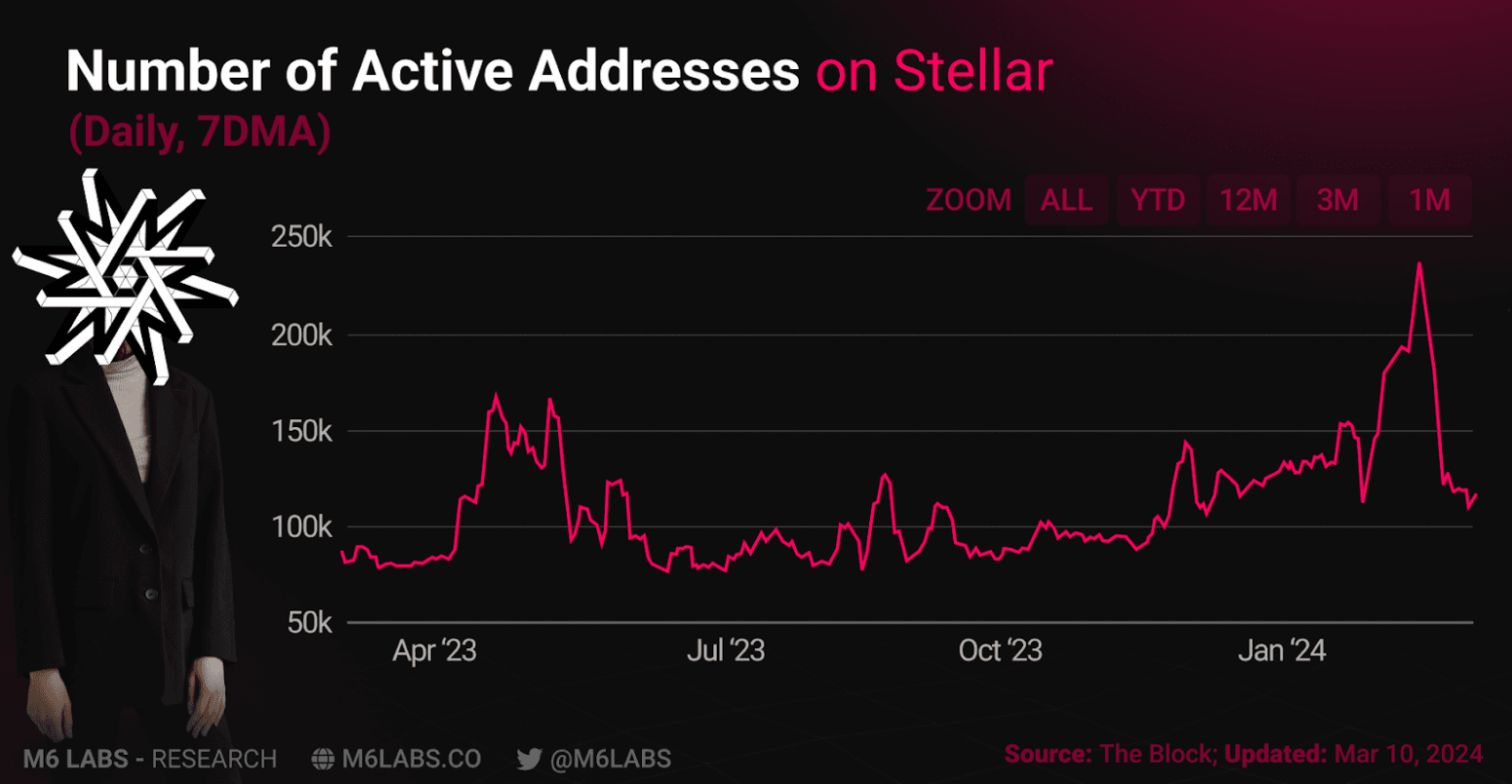

Source: ArtemisChecking in on Stellar, one of the classic L1s, we observe a significant uptick in active addresses. The rollout of protocols within its ecosystem, such as Band Protocol and Soroban, is expanding the functionality of the Stellar ecosystem and providing users with numerous options to experiment and participate in its growing list of activities.

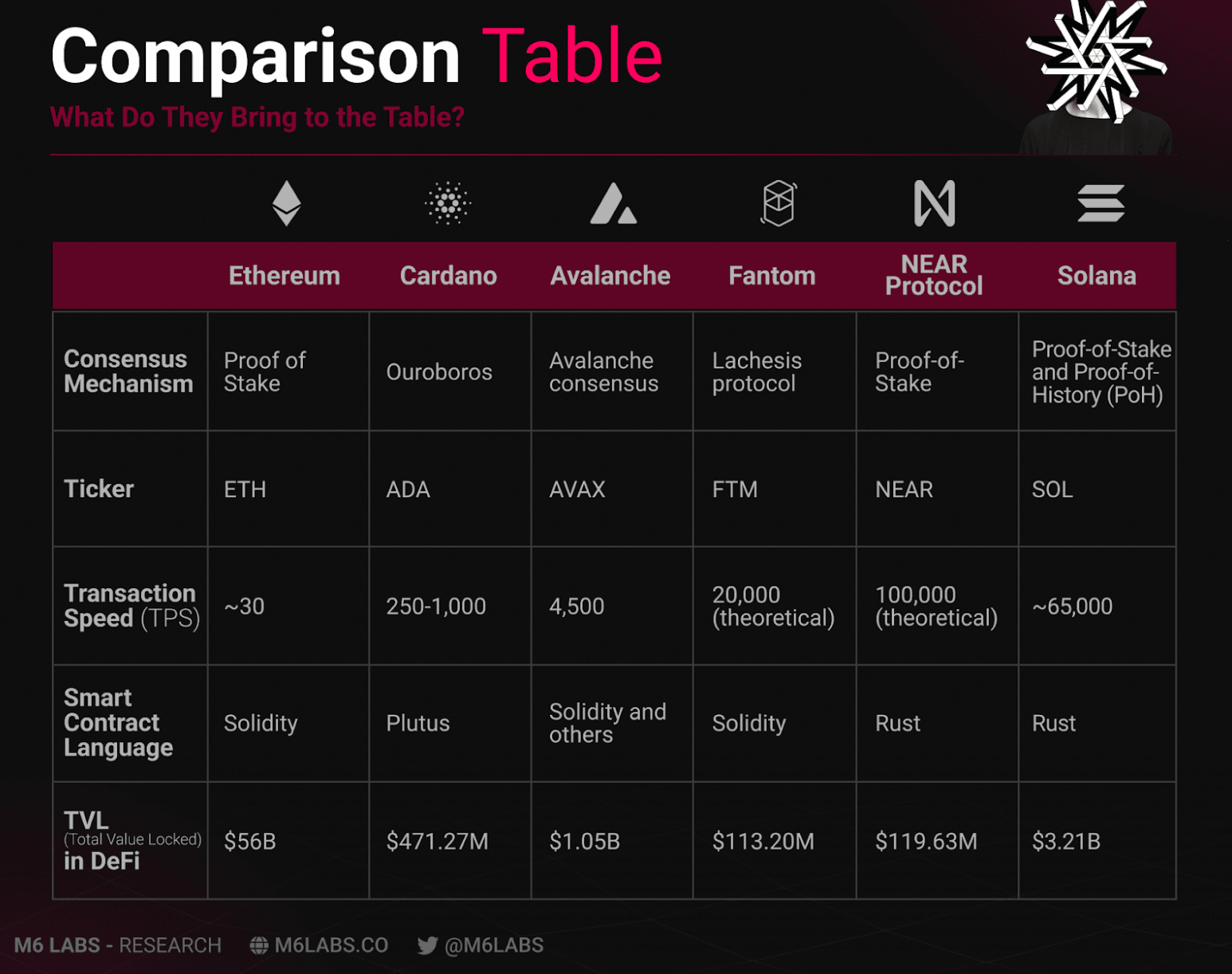

Comparing L1s: What Do They Bring to the Table?

Ethereum

- As the pioneer of smart contract platforms, Ethereum has set the standard for decentralized applications and cryptocurrencies. It's known for its robust developer community and the vast ecosystem of dApps, DeFi products, and more.

- Despite its innovations, Ethereum has faced several criticisms for its low scalability and high gas fees. However, the platform is currently working on several updates (such as protodanksharding via Dencun) to fix these issues going forward. Regardless, Ethereum already has a rich ecosystem of L2 networks.

Cardano

- Positioned as a more energy-efficient and research-driven alternative to Ethereum. The platform distinguishes itself with a strong academic foundation, where all developments undergo rigorous peer review.

- Cardano's scalability and transaction speeds are noteworthy, with a theoretical capability to handle around 250-1000 transactions per second.

- Cardano employs a staking-related consensus algorithm called “Ouroboros.” Cardano's adoption lags behind Ethereum's, partly due to the less familiar Haskell-based smart contract language.

Avalanche

- Avalanche has adopted a novel approach of splitting tasks into three chains. The X-Chain handles the creation and management of assets.

- The C-Chain is used to make smart contracts and supports things like ERC-20 tokens, dApps, and NFTs.

- The P-Chain organizes the network's validators and helps set up specialized blockchains known as subnets.

- The subnets allow developers to create customizable private blockchains tailored to specific regulatory or geographical requirements.

- It can reportedly process a staggering 4500 transactions per second without sacrificing decentralization.

- This modular structure enhances its interoperability with other blockchains, positioning Avalanche as a strong contender in the race to surpass Ethereum in smart contract functionality.

Fantom

- Fantom is a layer-1 blockchain known for its high scalability and low costs, primarily due to its Lachesis consensus mechanism, which ensures quick transaction finality.

- This makes it suitable for DeFi applications requiring fast and reliable transactions. Unlike Ethereum, which faces scalability issues, Fantom's unique approach involves using separate blockchains and sidechains to reduce overload and maintain efficiency in dApps.

- Its native token, FTM, is used for staking, governance, and transaction fees, contributing to Fantom's growing popularity as a versatile blockchain solution.

NEAR Protocol

- NEAR Protocol enhances scalability and speed with its NightShade sharding mechanism, dividing the network into smaller, manageable segments for parallel processing.

- This approach boosts transaction throughput while maintaining security.

- NEAR also caters to developers by supporting multiple programming languages and introduces user-friendly features like readable account names.

- Progressing towards a fully sharded network, NEAR's state sharding segments the blockchain's entire state, promising improved scalability as the network grows.

Solana

- Solana is a high-performance blockchain platform founded in 2017, designed to support scalable applications and dApps through a unique hybrid consensus model combining proof of history (PoH) and proof of stake.

- This innovative approach allows Solana to process over 65,000 transactions per second, aiming to surpass traditional blockchains in speed and efficiency while maintaining low costs.

- The network supports a broad spectrum of applications, from DeFi platforms to NFT marketplaces, making it a versatile foundation for decentralized solutions.

What Is The Bitcoin Halving?

Bitcoin halving events cut the block reward for miners in half, thereby reducing the rate at which new bitcoins are introduced into circulation. This mechanism is fundamental to Bitcoin's economic model, designed to control circulation supply.

The next halving is expected to go down on April 17, 2024. Post-halving, the mining block reward will be halved from 6.25 BTC to 3.125 BTC. So, how will this impact prices?

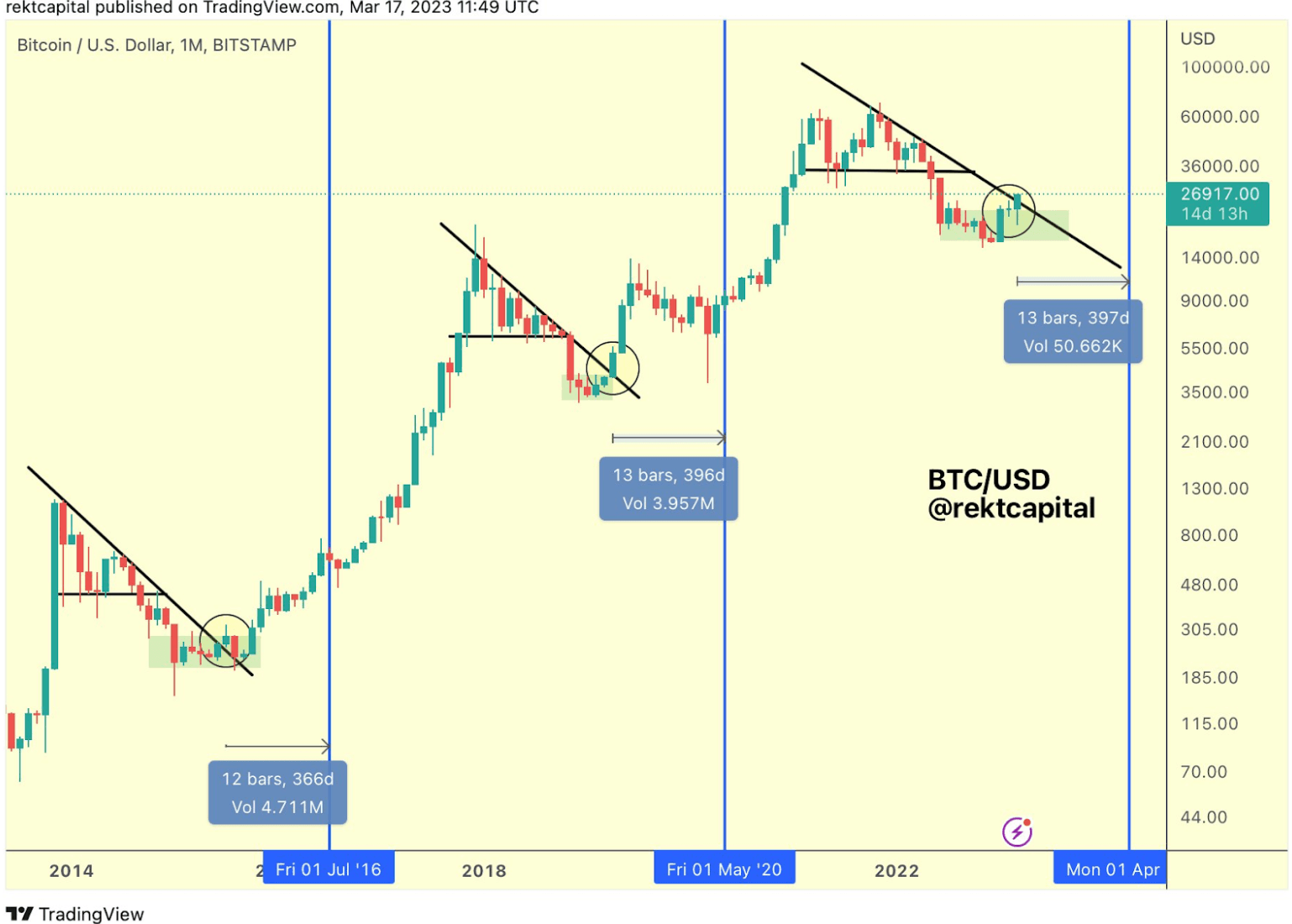

Historical Impact of Bitcoin Halvings

Historically, Bitcoin halvings have been precursors to notable price increases. This trend is primarily attributed to the anticipation and realization of reduced Bitcoin supply growth, which, coupled with sustained or increasing demand, leads to upward pressure on prices.

To date, there have been three major Bitcoin halvings:

- First Halving (November 2012): The block reward was reduced from 50 BTC to 25 BTC. This event was followed by a significant price increase, with Bitcoin's value rising from around $12 to over $1,100 in the following year. However, the market was much smaller and less mature at the time, making it more susceptible to large fluctuations.

- Second Halving (July 2016): The reward dropped from 25 BTC to 12.5 BTC. Again, the price saw a notable increase in the months following the halving, climbing from approximately $650 to peak at around $2,800 in mid-2017 before continuing to escalate to nearly $20,000 by the year's end, partly fueled by a growing retail and institutional interest in cryptocurrencies.

- Third Halving (May 2020): This reduced the block reward to 6.25 BTC. The price was around $8,600 at the time of the halving and experienced significant volatility thereafter, crossing $60,000 in April 2021. This rally was attributed to increased institutional adoption, economic uncertainties, and a surge in retail investor interest in cryptos.

Each halving has contributed to a reduction in the rate of new Bitcoin entering circulation, which, in theory, could increase scarcity and drive up the price if demand remains steady or grows.

How Are Things Looking Pre-Halving?

Whales are picking up BTC

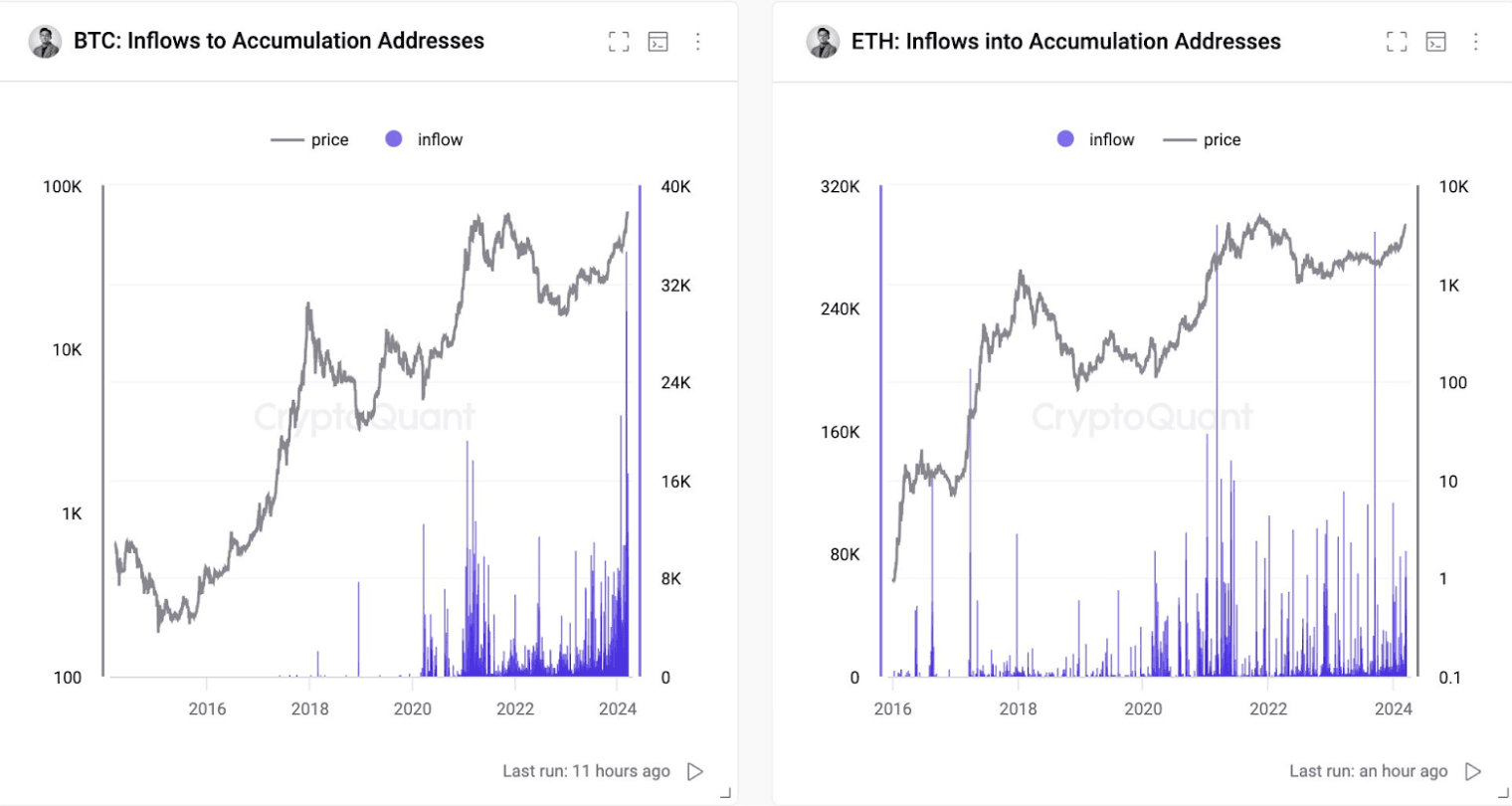

Whales have started accumulating bitcoins.

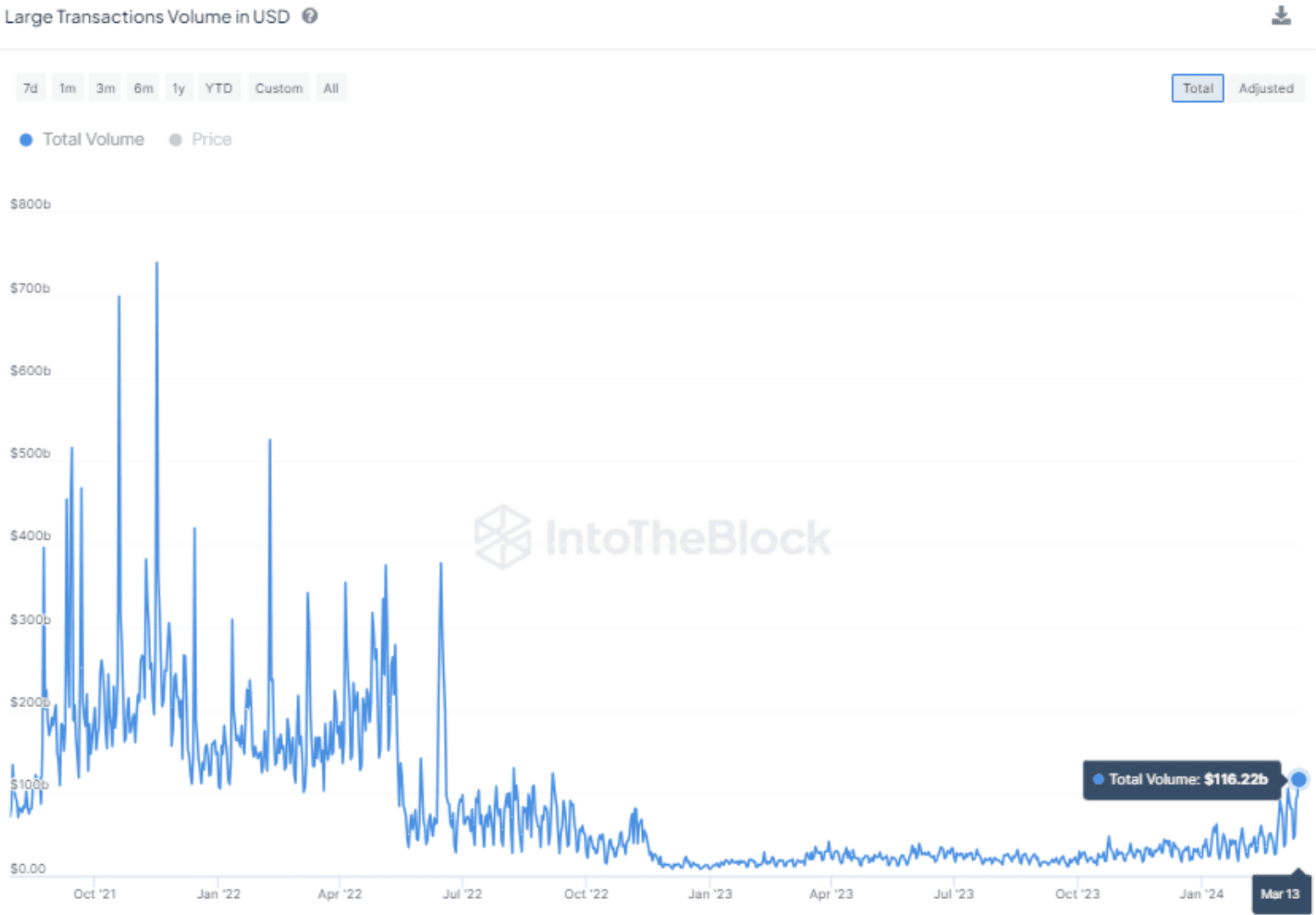

Bitcoin has seen a notable increase in transaction volume, reaching $116.2B. This represents a significant rise from the $10B to $20B range typical during the bear market for transactions exceeding $100,000. This surge suggests that whales are becoming more active, driving transaction volumes to levels not seen since August 2021.

In fact, it looks like users prefer accumulating BTC over ETH.

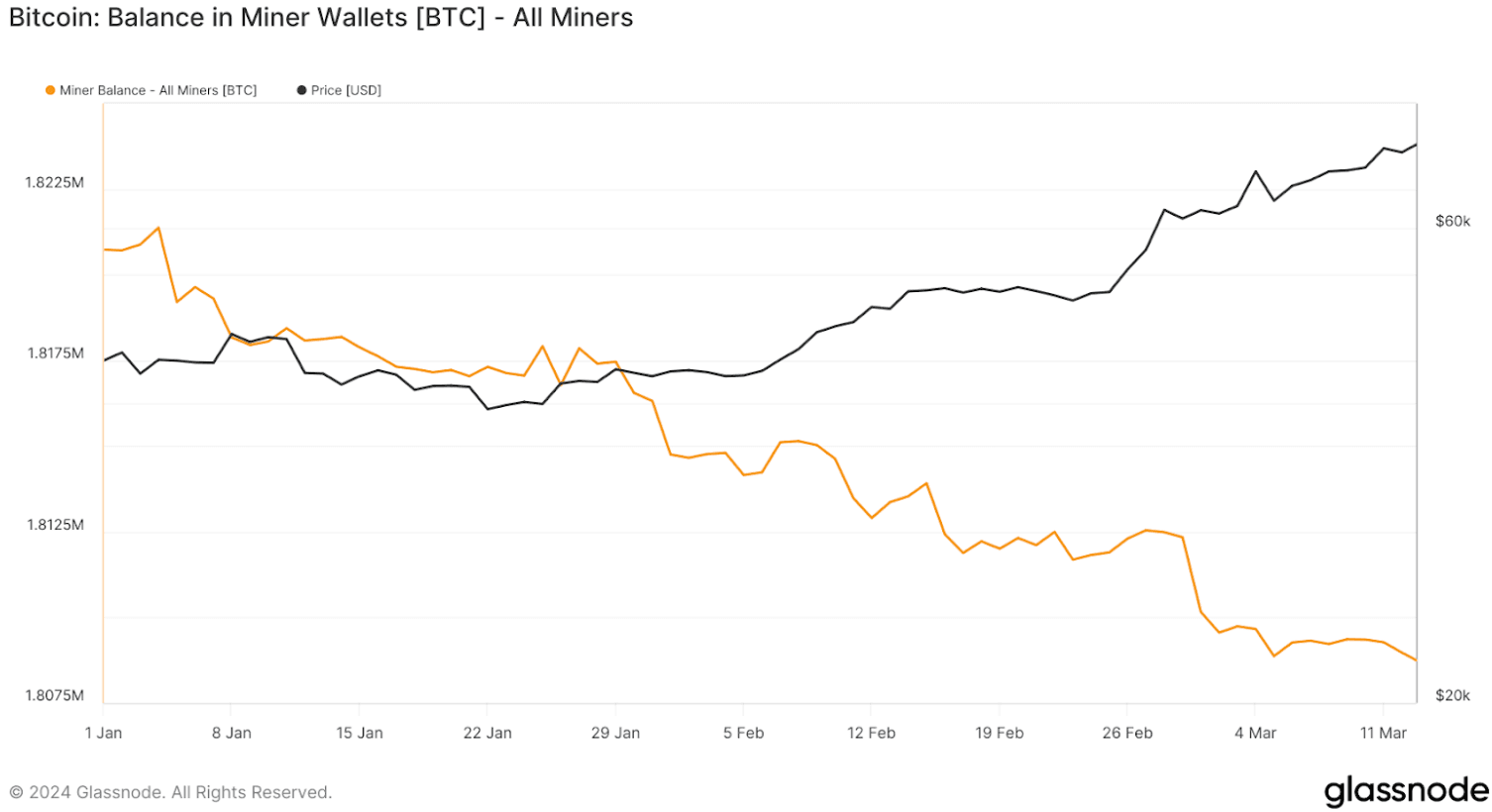

Miners are selling

Miners are busy pocketing some profits. As per Glassnode, “miner balance” has dipped from 1.82M bitcoins to 1.808M since the start of the year.

Bitcoin Ecoystem Updates & Opportunities

Runes

The Runes Protocol is a new approach to tokenization on the Bitcoin network, developed by Casey Rodarmor, that aims to revolutionize the process.

Unlike traditional models such as BRC-20 and ORC-20, Runes uses Bitcoin's UTXO-based system to make the creation and management of tokens simpler. It allows multiple tokens to be stored in a single UTXO, which reduces network congestion and improves efficiency.

Scheduled for launch in late April, Runes has created a buzz among the community, inspiring various projects and initiatives like RSIC and Rune Mania Miner, all designed to capitalize on the market's anticipation for Runes. The launch strategy involves minting the initial ten tokens directly or participating in airdrops through pre-mining projects.

Xverse Wallet is making preparations for the launch of the Runes fungible token standard by adding testnet support.

- Xverse users can now engage with Runes tokens and applications on testnet, with the intention of providing support for mainnet upon deployment.

- The inclusion of Runes support is a significant stride in accommodating the dynamic landscape of Bitcoin and its accompanying protocols.

- Get an Xverse wallet and follow this handy video guide to start using the Runes testnet.

Bitcoin L2 Solutions

Bitcoin Layer 2 protocols are innovative solutions developed atop the Bitcoin blockchain to tackle its inherent scalability issues. By processing transactions off the primary blockchain, these protocols significantly enhance scalability, speed up transactions, and lower costs.

Examples of such L2 solutions include the Lightning Network, Rootstock, Stacks, Liquid Network, and various rollups. These technologies not only offer better programmability but also extend the functionalities of Bitcoin.

Despite facing challenges like potential centralization and routing problems, L2 solutions are pivotal in promoting broader adoption and fostering innovation within the Bitcoin ecosystem. Additionally, many of these protocols are exploring interoperability with the Ethereum Virtual Machine, paving the way for the next wave of innovation.

Botanix Labs is developing a decentralized Layer 2 solution on Bitcoin, merging EVM's ease with Bitcoin's security.

- Users can connect MetaMask wallets to generate Bitcoin deposit addresses, enabling direct transfers from exchanges.

- It targets both Ethereum Layer 2 users and native Bitcoin users, offering DeFi opportunities.

- Botanix ensures low fees and prioritizes decentralization. It estimates Bitcoin's DeFi market could be three times larger than Ethereum's.

- Check out this great interview Aylo conducted with their founder, Willen S.

The B² Network is another Layer 2 solution for Bitcoin that uses a rollup protocol to guarantee security through a challenge-response mechanism.

- To ensure security, B² Network utilizes zero-knowledge proofs and Taproot Commitments. Additionally, B² Rollup conducts fraud proof confirmation and supports a decentralized sequencer.

- With these advancements, B² Network is poised to lead Bitcoin's application scenarios.

- B² Network facilitates DeFi, NFT, and SocialFi applications within the Bitcoin ecosystem.

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space