GM and welcome to the latest instalment of M6 Labs' Crypto Market Watch. What a week it’s been, it seems crypto is awakening once again and the greatest bull market in history is beginning. In this comprehensive analysis, we'll delve into the significant advancements, market trends, and promising opportunities that are currently shaping this monumental event.

- It appears that life is returning to the crypto space after a prolonged and challenging period. We are likely to witness price increases heading towards $40K and more in anticipation of the ETF

- NFTs have experienced heightened trading activity and price gains during the recent market rally. However, they still significantly trail behind the overall market performance

- The crypto market is currently experiencing significant growth, with major and large projects such as Solana, Injective, and Rollbit seeing gains of 76%, 75%, and 65% respectively. This indicates that capital is flowing into projects that are considered high-risk but have the potential for high rewards

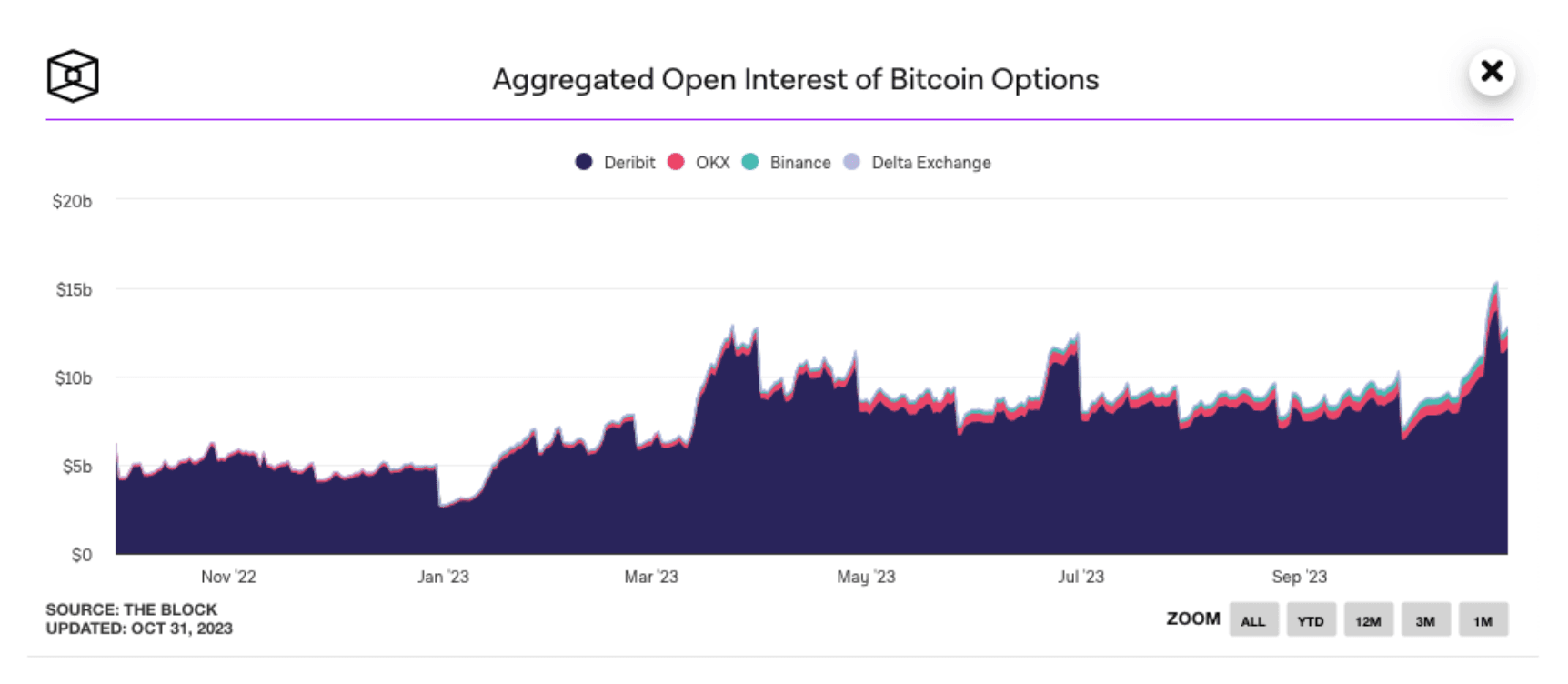

- Spot trading isn't the sole crypto trading method experiencing recent success. Derivatives, particularly BTC options, have been heating up as well. The total open interest for bitcoin options across exchanges reached a record high of $15.37B

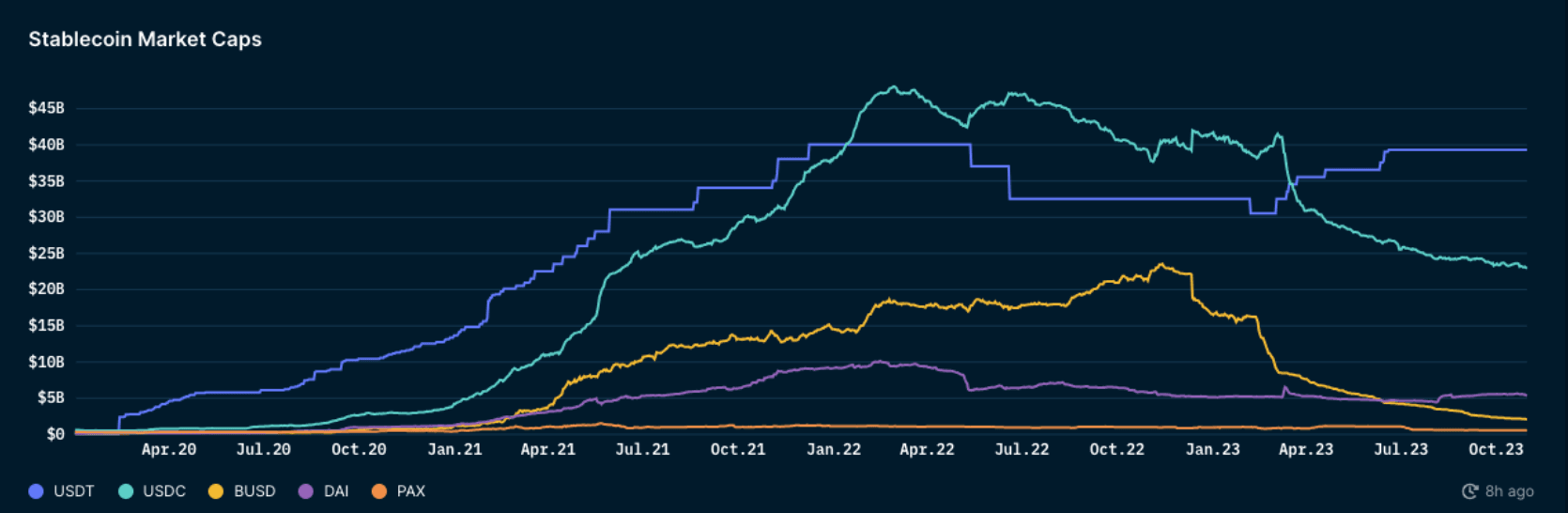

- stablecoins have stopped their decline and have not reached new lows for over three months, signaling a potential reversal in market sentiment

- The DeFi market has rebounded significantly, reaching a three-month high with a TVL of $42B. This resurgence follows a recent low point in February 2021 when TVL was just $35.8B

Narrative of the Week: How Will This Year End?

The currency of financial markets is probabilities, and the key is to stack these probabilities in one's favor while combining them with effective risk management. Given this perspective, let's examine the probabilities for the near future. To start, let's focus on the life of the party: the spot BTC ETF, which has seen significant developments again recently.

Along with Blackrock, Ark, and Van Eck, Valkyrie has also recently updated their spot BTC ETF.

Source:

Source:Alliancebernstein's research arm, Bernstein Research, views the probability of the SEC approving the first spot BTC ETF by January 10th as highly likely, as the SEC has been actively engaging with and responding to edits and comments on ETF applications.

The anticipation for this approval was partly influenced by the SEC's decision not to appeal against the Grayscale verdict, which ordered a reevaluation of its application to convert its bitcoin trust (GBTC) into a spot BTC ETF.

SEC Chairman Gary Gensler has revealed that the SEC is evaluating eight to ten spot ETF applications, while public records show that there are 12 pending applications, including those from prominent firms like Cathie Wood's ARK Investment Management, Blackrock, Bitwise, Wisdomtree, Fidelity, Vaneck, and Invesco.

The ETF is happening, and it's on the horizon. This event has been eagerly anticipated for years, and it's finally arrived. How investors will react to the news following the announcement remains to be seen. Will this result in a "sell the news" event or propel prices to new all-time highs? What is extremely likely is that investors will take positions in the market prior to this event leading to new recent highs for BTC.

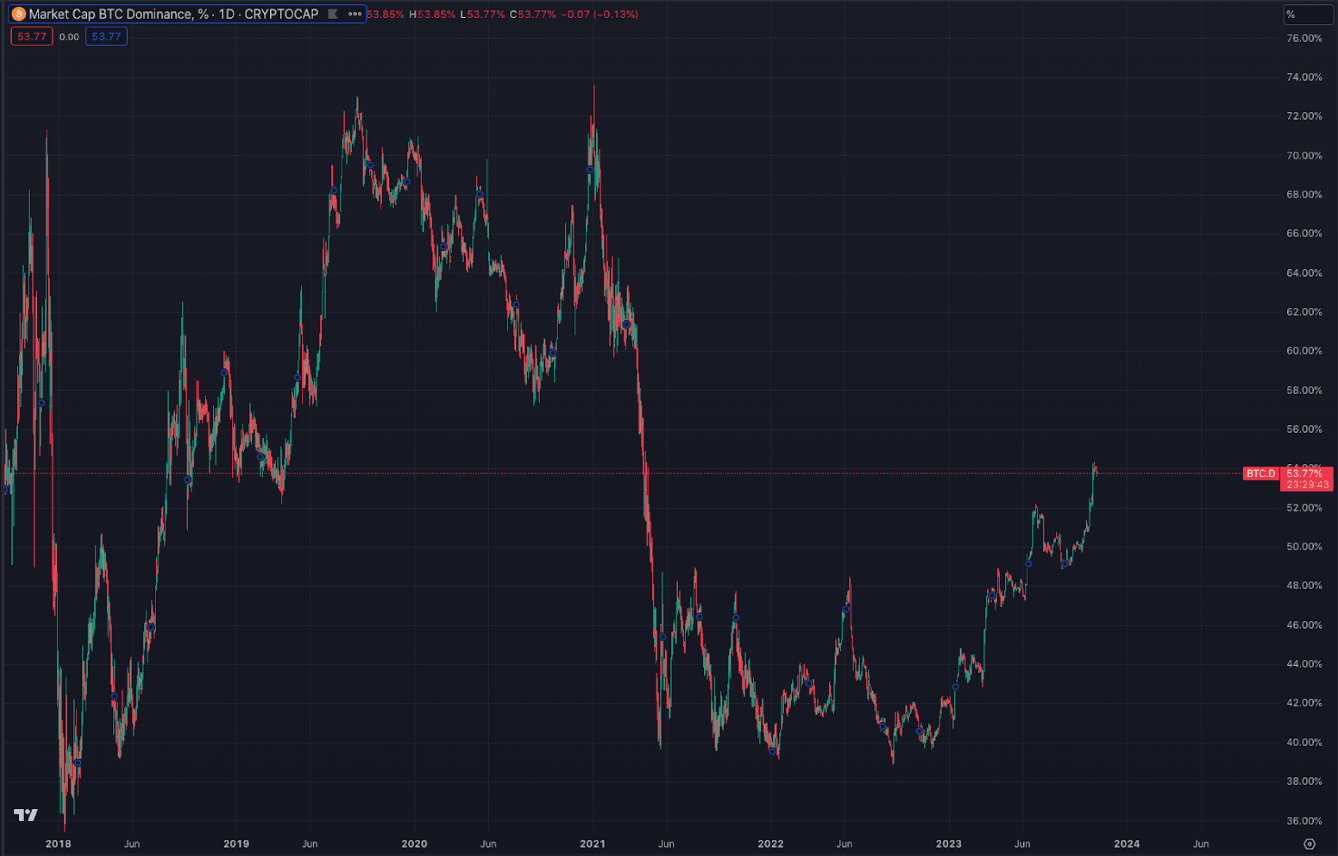

Furthermore, the charts tell us significant moves are occurring. Bitcoin dominance has surged to 54%, signifying a clear preference for Bitcoin over altcoins in anticipation of the ETF approval. Interestingly, the current rise in BTC dominance is reminiscent of the ascent observed in 2018 and 2019, which foreshadowed the 2021 bull market.

Source: TradingView

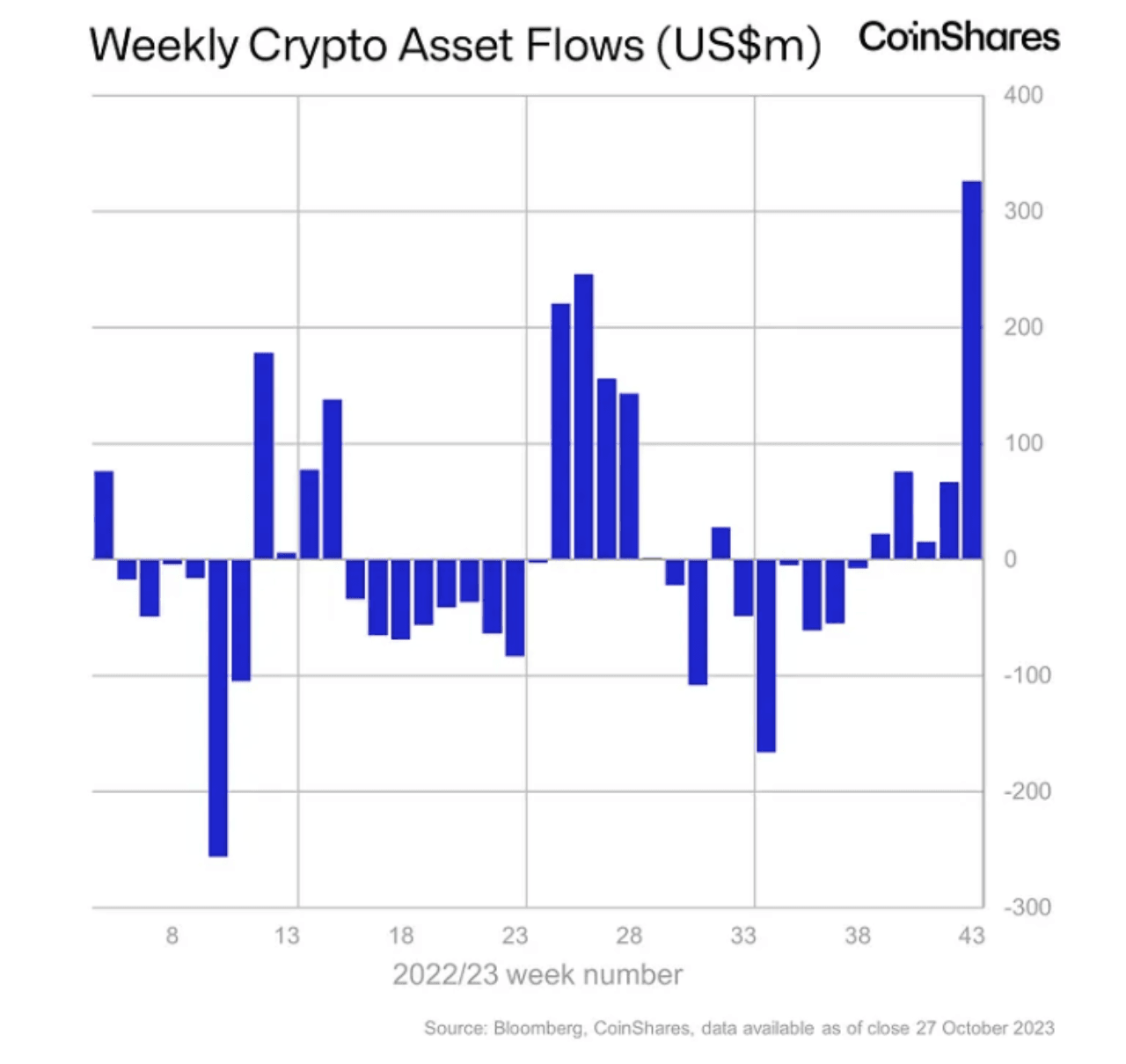

Source: TradingViewCapital Inflows: Investment products tied to digital assets have recorded substantial inflows, totaling $326M, representing the most significant weekly influx since July 2022. BTC spearheaded this surge, commanding the lion's share with $296M, while the recent upswing in Bitcoin's value also attracted an additional $15M into short-Bitcoin investment products.

The growing optimism within the market further catalyzed substantial investments in Solana, accumulating a total of $24M in inflows. However, this optimistic sentiment did not extend to Ethereum, as it witnessed outflows of $6M, bucking the trend of the broader market.

Source: Coinshares

Source: CoinsharesIt appears that capital is returning to the crypto space, as indicated by the monitoring of inflows. The primary focus has been on BTC, while, surprisingly, ETH has underperformed. However, this trend might reverse following the announcement of the ETF. Typically, capital flows from BTC to ETH and then to altcoins after BTC gains dominance and achieves new relative or all-time highs.

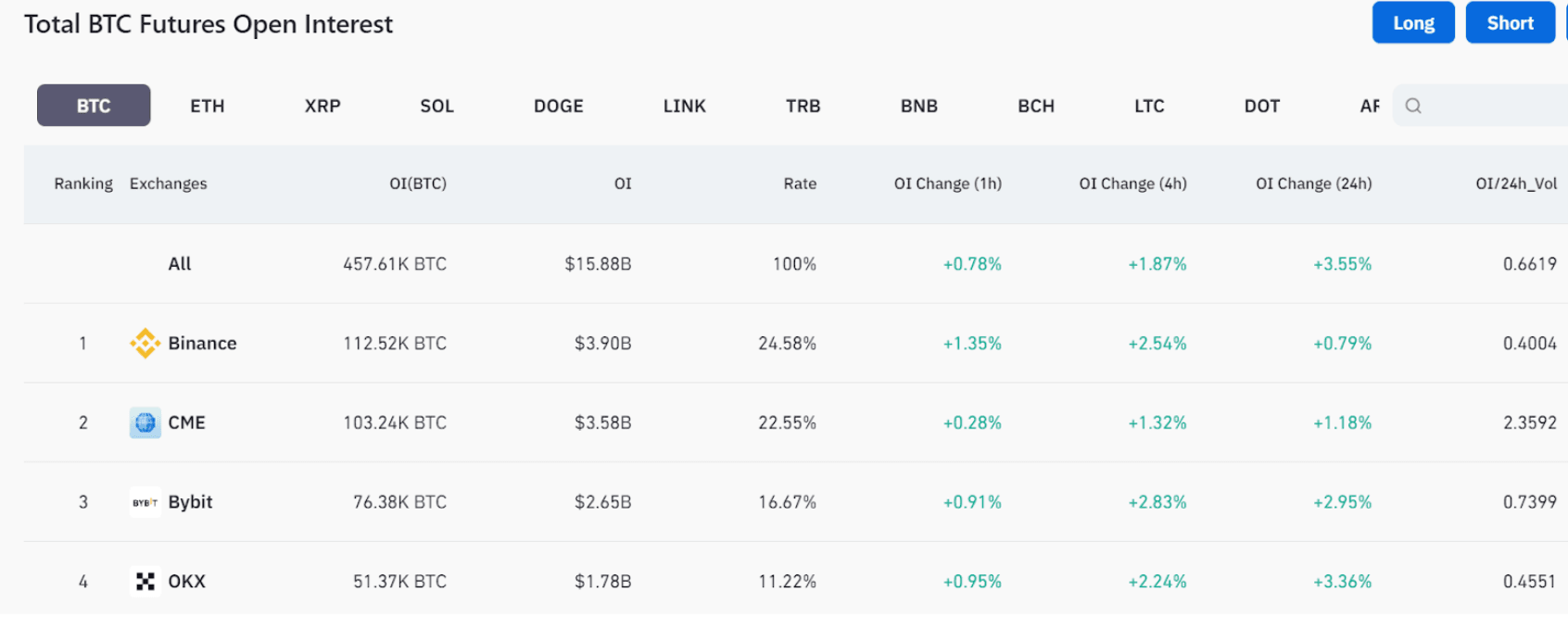

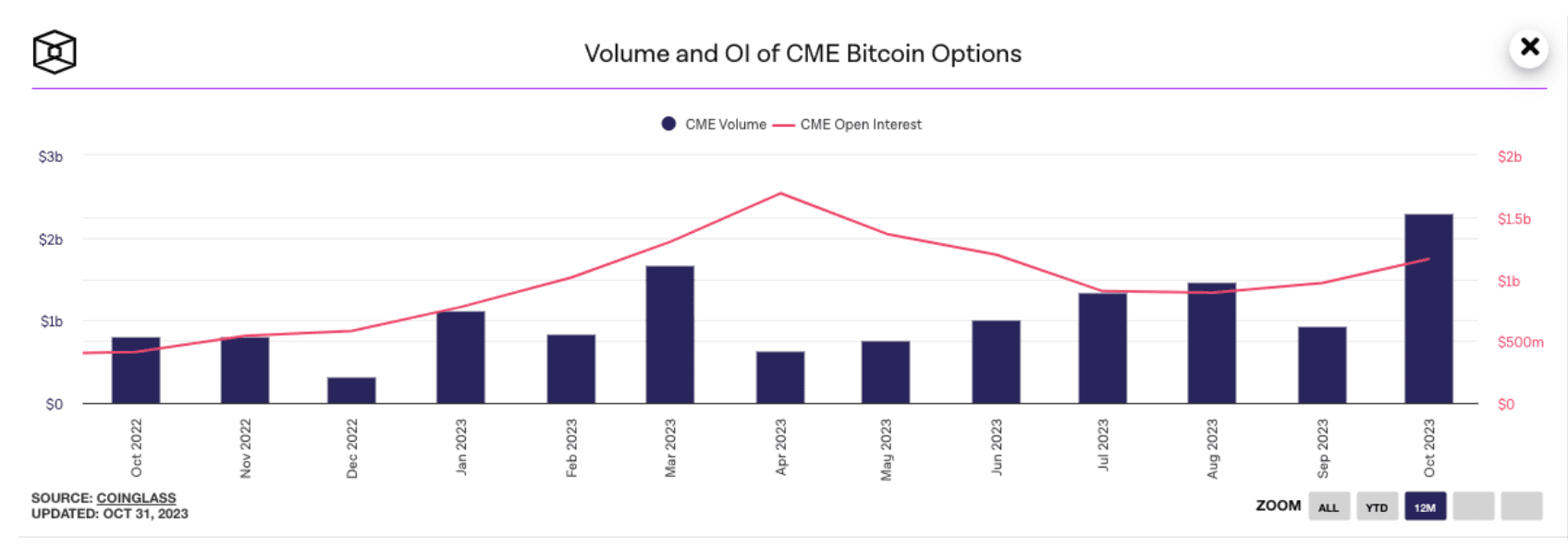

Derivatives & Open Interest: Spot trading isn't the sole crypto trading method experiencing recent success. Derivatives, particularly BTC options, have been heating up as well. The total open interest for bitcoin options across exchanges reached a record high of $15.37B. OKX, in particular, saw its open interest surge to over $1B. Similar patterns were seen on Deribit as well. Similar to the increase in spot trading volumes, the surge in bitcoin options activity is likely due to growing market participation. Monthly bitcoin options volumes are also approaching all-time highs across various exchanges.

Source: The Block

Source: The BlockFurthermore, The Chicago Mercantile Exchange has rapidly climbed to become the second-largest BTC futures exchange by Open Interest, with $3.54B in notional OI. This significant ascent highlights the increasing influence of traditional financial institutions in the crypto space and underscores CME's role as a key player in the crypto derivatives market. CME's growth in open interest, especially in cash-settled futures contracts, reflects a surge in institutional interest in Bitcoin futures and has been accompanied by a 27% rise in Bitcoin prices this month.

Source: Coinglass

Source: Coinglass Source: The Block

Source: The BlockStablecoins: Another promising indication is that stablecoins have stopped their decline and have not reached new lows for over three months, signaling a potential reversal in market sentiment.

Source: Nansen

Source: NansenWhere is DeFi?

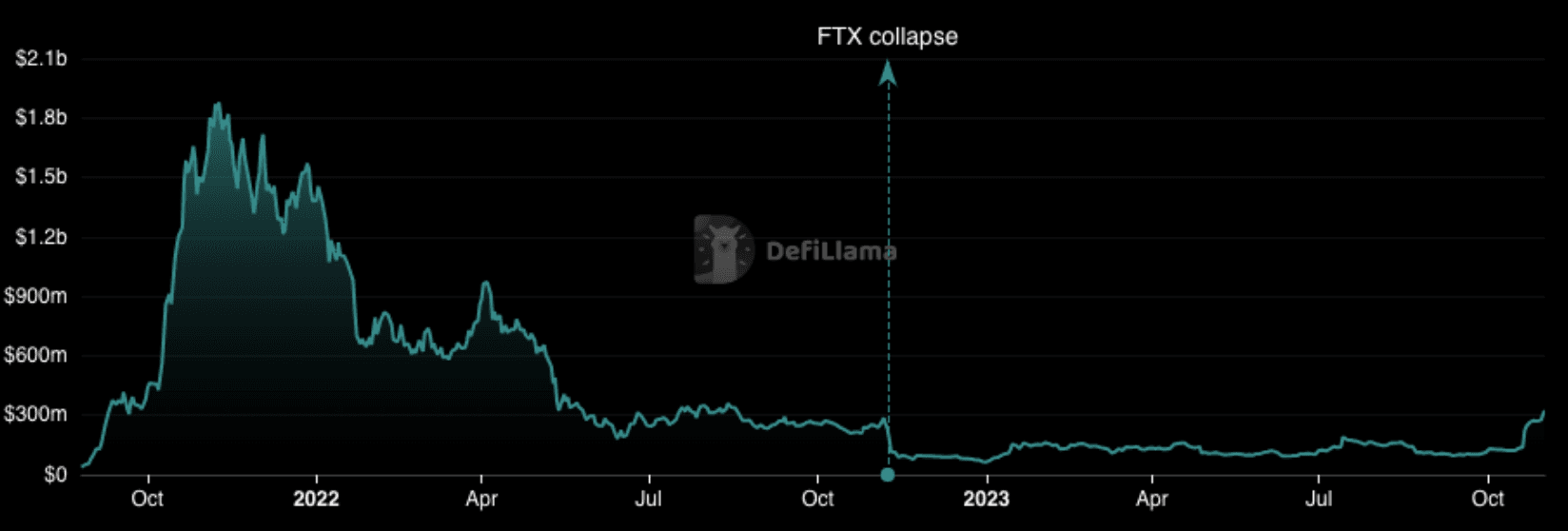

The DeFi market has rebounded significantly, reaching a three-month high with a TVL of $42B. This resurgence follows a recent low point in February 2021 when TVL was just $35.8B.

- The recovery of the DeFi market can be attributed to two key factors. Firstly, rising asset prices, including a notable increase in the price of ETH. Over the past two weeks, ETH has risen from $1,590 to roughly $1,873 contributing to the market's revival. As stated previously, fresh inflows from participants seeking yield through staking and lending have played a role in the market's resurgence.

- Transactional volume within DeFi protocols has reached its highest point since March, with a recorded volume of $4.4B in October.

- Solana's prominent lending protocol, Marinade, has experienced a significant increase in TVL, surging by 120% this month. This growth is attributed to the launch of Marinade's native staking product offering competitive yields. A rival protocol, Jito, also saw a substantial rise of 190% to reach $168M in TVL during the same period.

- On the Ethereum network, capital inflows into platforms such as Enzyme Finance, Spark, and Stader have surged by 37% to 55%. These inflows outpaced the rise in asset prices, indicating increased participation in DeFi activities.

In summary, the DeFi market's recovery is driven by a combination of rising asset prices, increased transactional volume, and fresh capital inflows, with notable growth observed on various blockchain protocols.

Source: DeFiLlama

Source: DeFiLlamaWrapping up: It appears that life is returning to the crypto space after a prolonged and challenging period. We are likely to witness price increases heading towards $40K and more in anticipation of the ETF. Additionally, the Bitcoin halving, an event that has taken on mythological significance despite its diminishing impact, will be the next major event many will have their eye on. Time will ultimately reveal how the markets respond in the medium to long term, but for the short term, conditions appear extremely favorable.

Project Spotlight: Marinade Finance

Solana has undeniably emerged as one of the standout performers in the recent crypto rally. In light of this, let's explore the options available to SOL holders keen on staking their tokens to harness attractive yields. Previously, a popular choice among users was Lido. However, with the conclusion of Sol staking on Lido, users now have the opportunity to leverage protocols like Marinade Finance. It should be noted that Marinade has restricted users from the UK from using its services due to regulatory concerns.

Marinade Finance has impressively persisted in its development journey, even during the bear market, and has introduced noteworthy upgrades and features, including liquid staking. As the Solana ecosystem continues to expand and solidify its position as a prominent player in the forthcoming bullish phase, acquainting oneself with protocols such as Marinade holds the potential for lucrative opportunities.

mSOL: The Liquid Staking Token

- Staking: Marinade enables users to stake SOL tokens, receiving marinated SOL tokens (mSOL) in return, signifying their share of staked SOL and providing access to the broader DeFi ecosystem.

- Versatile Utility: mSOL serves as the liquid staking token bestowed upon users when engaging with the Marinade protocol. It functions as an acknowledgment of their staked SOL tokens, permitting conversion back to staked SOL and the collection of accrued rewards at any time. Crucially, these tokens remain fully fungible within the DeFi landscape, all while appreciating in value alongside SOL staking rewards.

- Value Appreciation: The value of mSOL steadily appreciates with each epoch, a result of rewards being dispensed for the staked SOL within the protocol. Holding mSOL for a year can yield an impressive 7-8% increase in value, rendering it an enticing avenue for passive income.

Benefits of Staking SOL with Marinade

- The protocol operates as a non-custodial solution, ensuring users retain complete control over their assets and associated accounts.

- The protocol affords users the liberty to stake and delay unstaking without incurring additional fees.

- Marinade's governance framework prioritizes active community participation and contributions.

Marinade currently has around $325M locked in TVL, making it one of the largest protocols in the Solana ecosystem. Though TVL has drastically dropped from its ATH, there has been an uptick recently with the surge of SOL. Source: DefiLlama.

Marinade currently has around $325M locked in TVL, making it one of the largest protocols in the Solana ecosystem. Though TVL has drastically dropped from its ATH, there has been an uptick recently with the surge of SOL. Source: DefiLlama.DeFi, L1s & L2s

News

- VanEck predicts Solana will hit $3K

- ProShares launch first short ETH futures ETF

- Unibot exploited

- Taho Wallet opens beta portal waitlist

- Avalaunch terminate partnership with Starsarena

- Fuse launch the first smart wallet for Solana

- Solana has partnered with Amazon Web Services

- Arkham introduce chat rooms

- Andreessen Horowitz planning to target $3.4B for next early-stage funds

- Neo plans Ethereum-compatible sidechain for N3 mainnet interoperability

- Solana adds incubator to boost growth and attract founders from rival chains

- Shuffle to do airdrop

- Renzo announce restaking mechanism that allows everyone to restake through Eigenlayer

- Layer N introduce Nord, Layer N's first exchange-optimized rollup that will go launch a testnet soon

- Floki is venturing into the trillion-dollar RWA market with the launch of TokenFi, positioning itself as a serious DeFi player

- Starknet to handout 50M tokens

- Goldman Sachs views Ethereum's Dencun upgrade, set for the first quarter of 2024, as a significant step toward transforming the blockchain into a scalable settlement layer

- Polygon’s POL token upgrade is now live on Ethereum mainnet

- Astrid Finance exploited and will refund users

- Snowtrace to be discontinued due to Etherscan fees

- UK Treasury releases final proposals for crypto asset regulation

- Stars Arena CEO steps down

- Blockchain startup Etherfuse introduces tokenized bonds in Mexico, targeting retail investors

- BNB launch BNB Safe Wallet

- Stelo Labs is sunsetting

- Timeless aunch their V2

- Nym to launch NymVpn

- Argent to prioritize Starknet development, discontinues zkSync Era

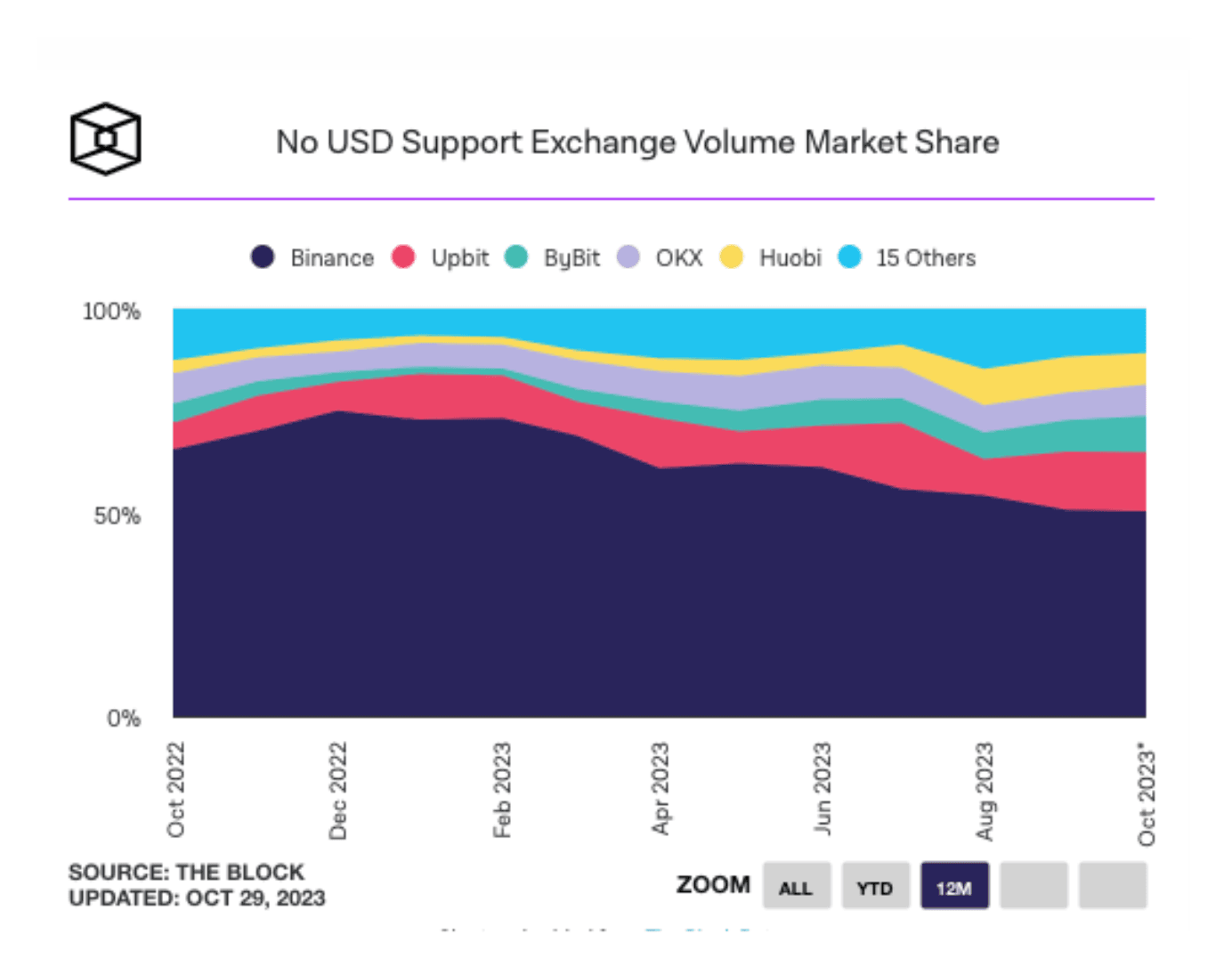

Binance has seen a significant decline in its market share: Dropping from 74% in December 2022 to 50% in the current month, despite the recent crypto surge. Several factors, including executive exits, regulatory challenges, and legal charges, have contributed to Binance's decline in market share.

Source: The Block

Source: The Block

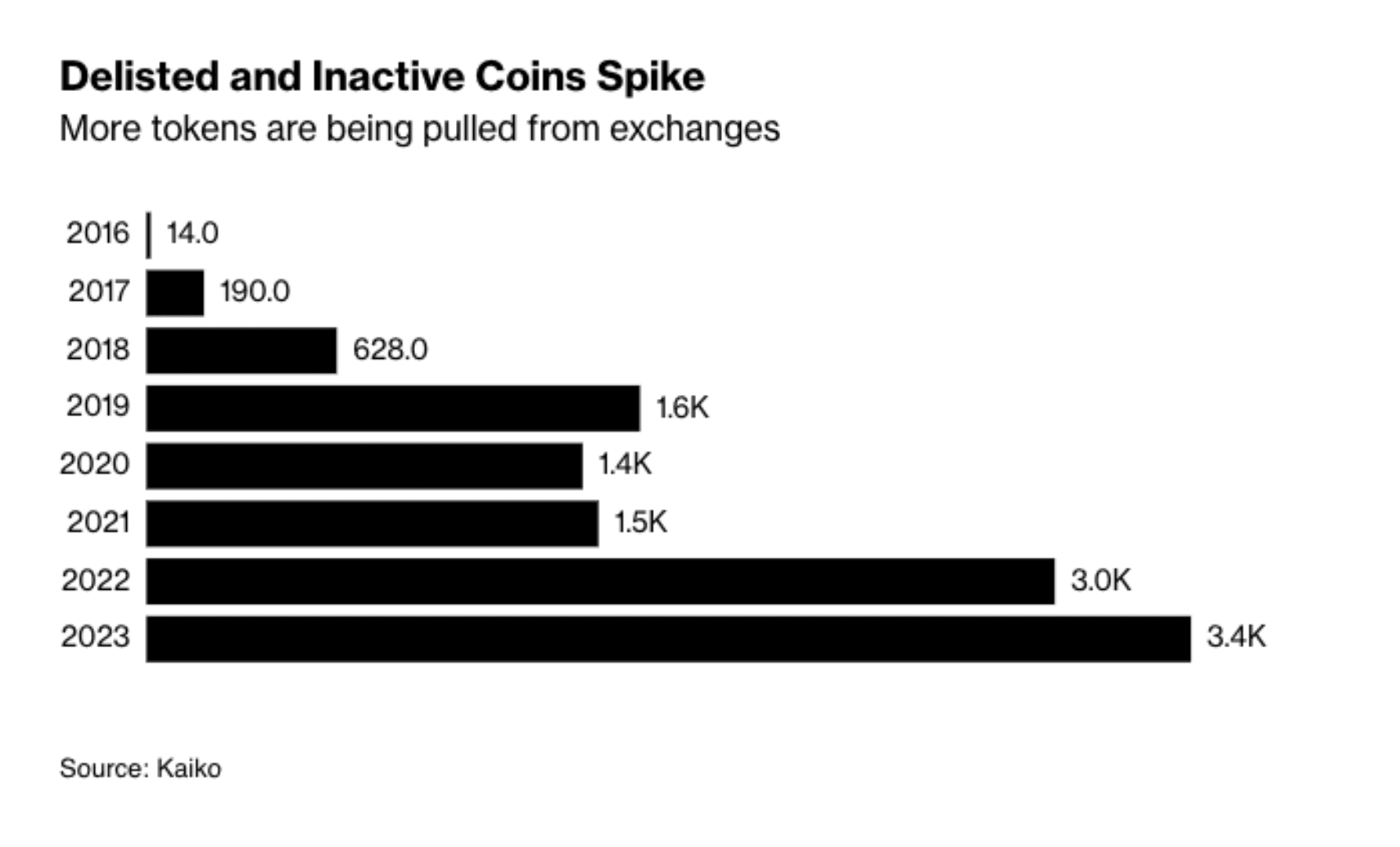

Crypto delistings from exchanges are on the rise: More than 3,400 tokens have been dropped this year, marking a record pace for delistings. Major exchanges like Coinbase and Binance have been actively delisting tokens, with Coinbase delisting 80 pairs in October, the highest monthly delisting count since at least 2021.

Source: Kaiko

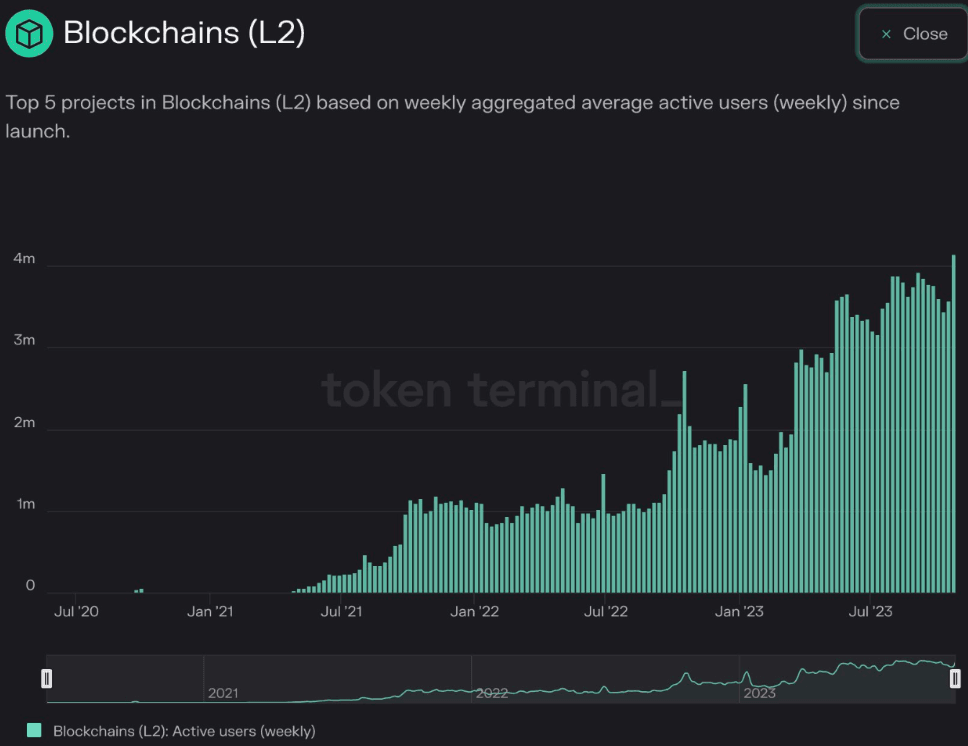

Source: KaikoActivity Increasing: Weekly active wallets on L2s continue to hit all-time highs. This indicates that most protocols are moving or deploying their products on L2s instead of mainnet, and that user activity is increasing.

Source: Token Terminal

Source: Token TerminalBlue Chip Overview

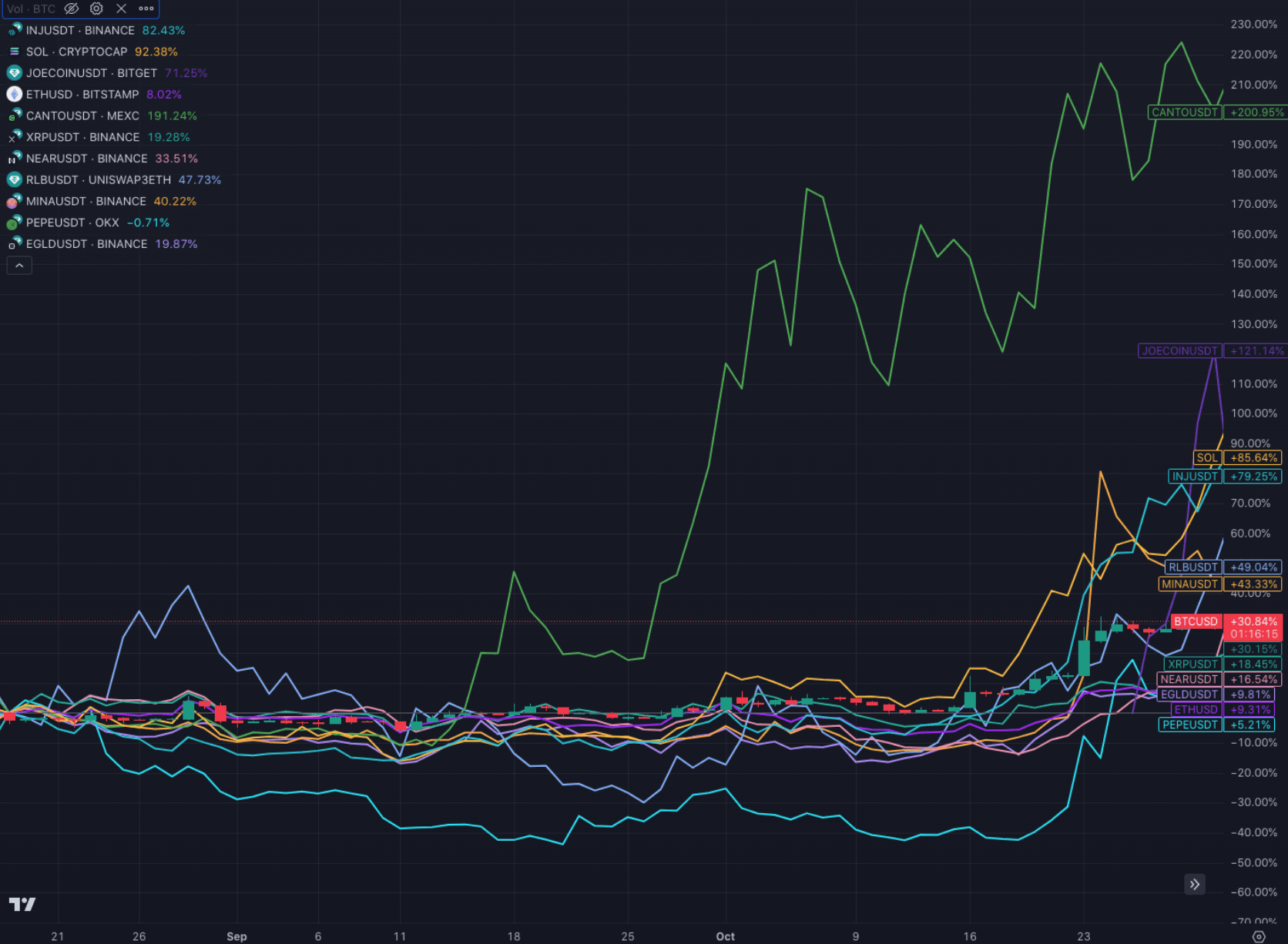

The crypto market is currently experiencing significant growth, with major and large projects such as Solana, Injective, and Rollbit seeing gains of 76%, 75%, and 65% respectively. This indicates that capital is flowing into projects that are considered high-risk but have the potential for high rewards.

Additionally, other coins such as CANTO, MINA and NEAR continue to perform very well, while gains made by other coins like RLB, PEPE, and MANA suggest that investors are willing to take on more risk in search of higher returns.

Furthermore, the growth of multichain RWA Hashnote, with a TVL growth of 373.51%, being one example, indicates that it is likely the new bull cycle will see new major and bluechip protocols emerge offering stiff competition to the well-established big players such as Maker, Compound and Aave.

Source: TradingView

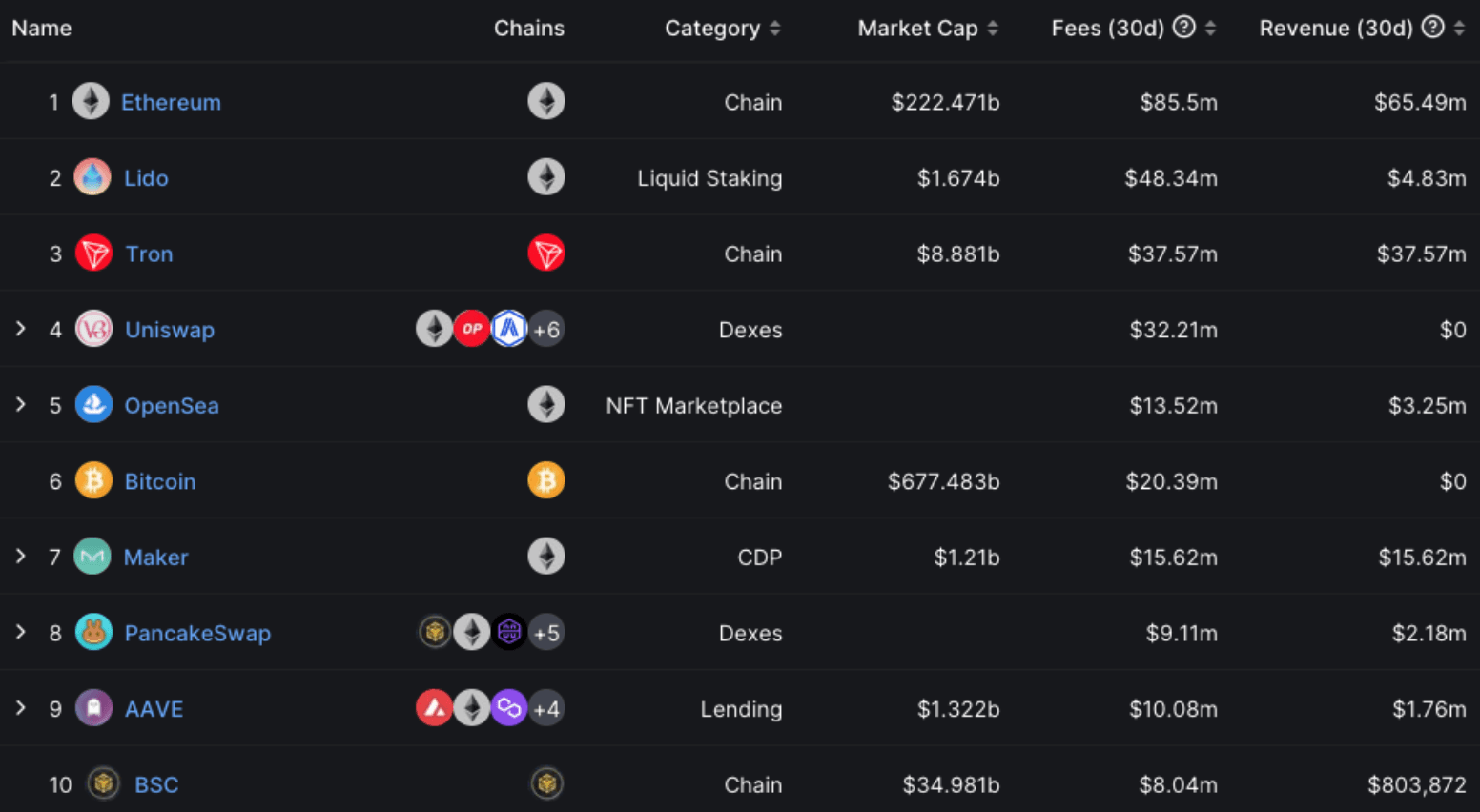

Source: TradingViewRevisiting Protocol Revenue: An essential gauge of a protocol's vitality lies in the fees it generates, particularly if that is its intended revenue model. As expected, Ethereum leads the way, but it's worth highlighting the presence of Tron and OpenSea in this context.

Source: DeFiLlama

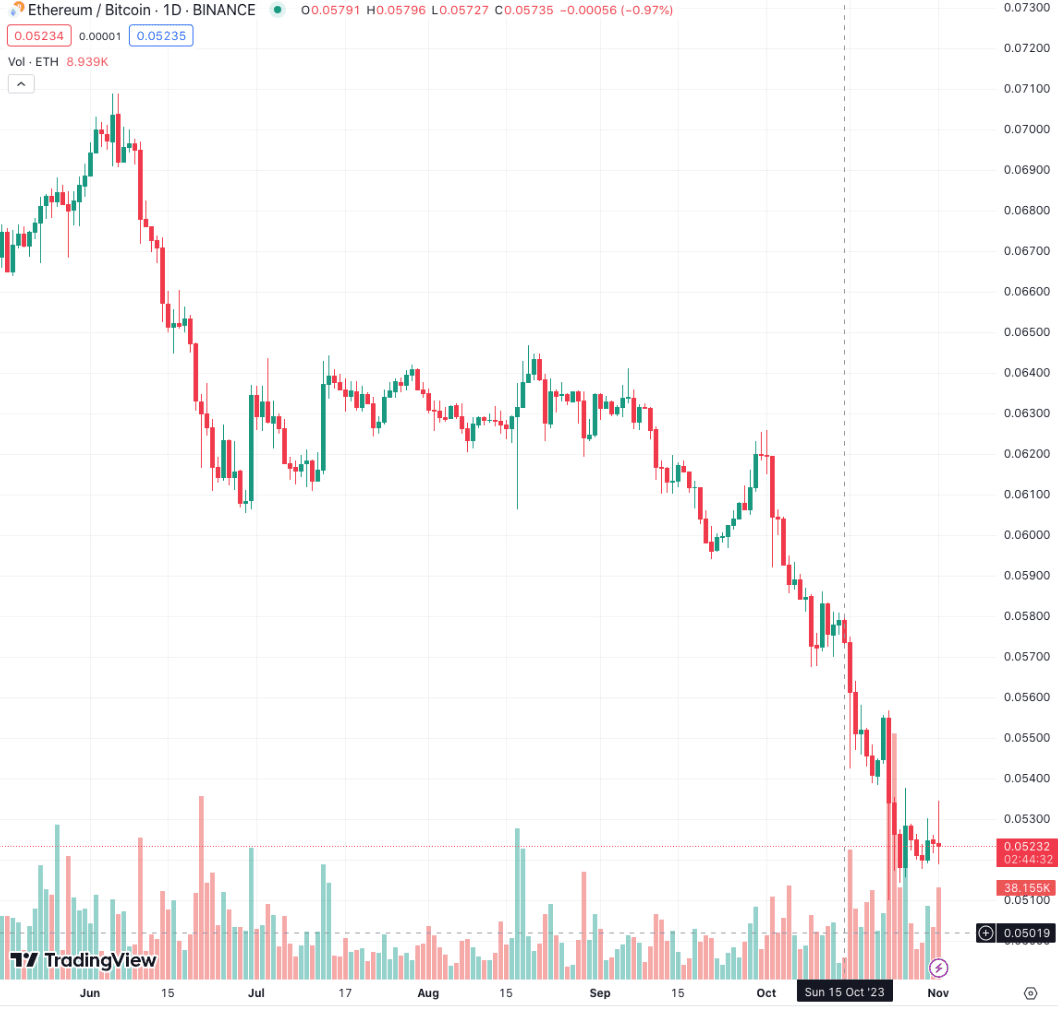

Source: DeFiLlamaETH/BTC: ETH continues to bleed out against BTC. It is unlikely there will be a full-blown altcoin season till this trend reverses.

Source: TradingView

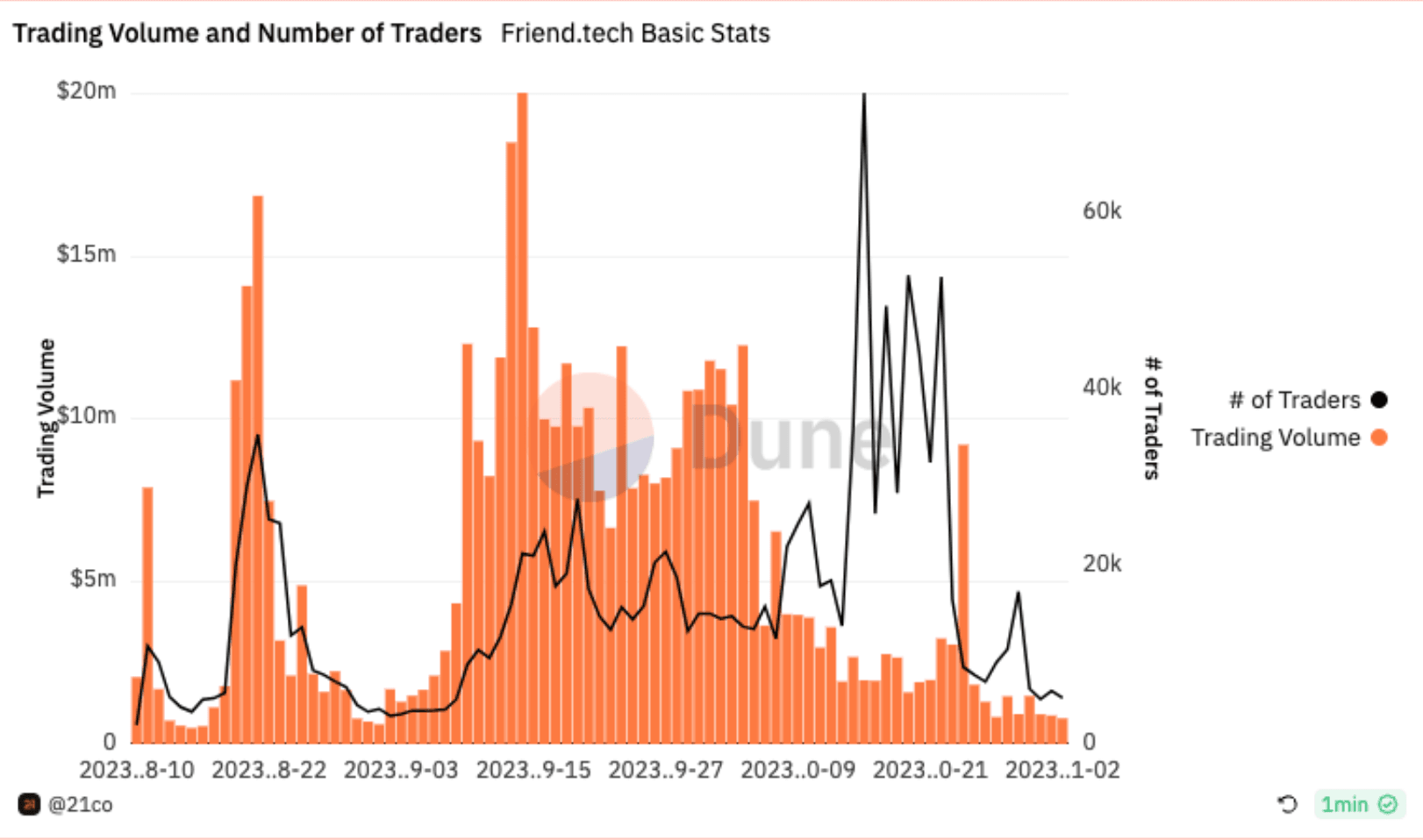

Source: TradingViewUpdate on SocialFi: Friendtech and Starsarena were prominent protocols in the socialfi space in recent months. However, it appears that this narrative and trend are dwindling, with user activity and volume experiencing a sharp decline.

Friendtech’s number of traders and volume have declined dramatically in the last month. Source: Dune.

Friendtech’s number of traders and volume have declined dramatically in the last month. Source: Dune.Degen Corner

Numerous recently launched coins, including Aardvark, CAESAR, MOG, BITCOIN, CRESO, MLP, and REKT have amassed substantial degen smart money holdings.

Although older memecoins like Floki and Pepe have witnessed notable price increases recently, they remain significantly below their all-time highs. This resurgence suggests a renewed interest in these highly speculative assets

Ether.fi is introducing native Ethereum Restaking via eETH on EigenLayer. Users can earn points by staking eETH, engaging with the protocol, and completing quests. EigenLayer will distribute points to native stakers, with 100% of benefits going to eETH stakers without deductions.

Aevo, a derivatives L2 app chain for options and perpetuals trading on the OP stack, has merged with Ribbon following approval by a DAO vote. $RBN token holders can convert to $AEVO, which will function as the governance token. The token generation event is set for January 2024, and staking $AEVO for three months offers benefits like discounts, rewards multipliers, and early access.

Try out Saga’s incentivized testnet, Pegasus.

Be sure to mint the latest free NFTs on Scroll to increase your chances of qualifying for the future airdrop. Follow this thread and this official guide from Scroll.

Hyperliquid’s points program began on the November 1st. Be sure to check it out.

Nerbbot introduced a useful feature for effectively tracking whale movements on any tokens. Try it out to stay ahead of the curve.

Real Smurf Cat has experienced both inflows and outflows, with substantial degen smart money holdings being positioned in the project.

JOE hit an all-time high and is considered a degen smart money favorite.

SPX has been a part of the new meme trio along with JOE and Real Smurf Cat, degen attracting smart money buys and significant attention.

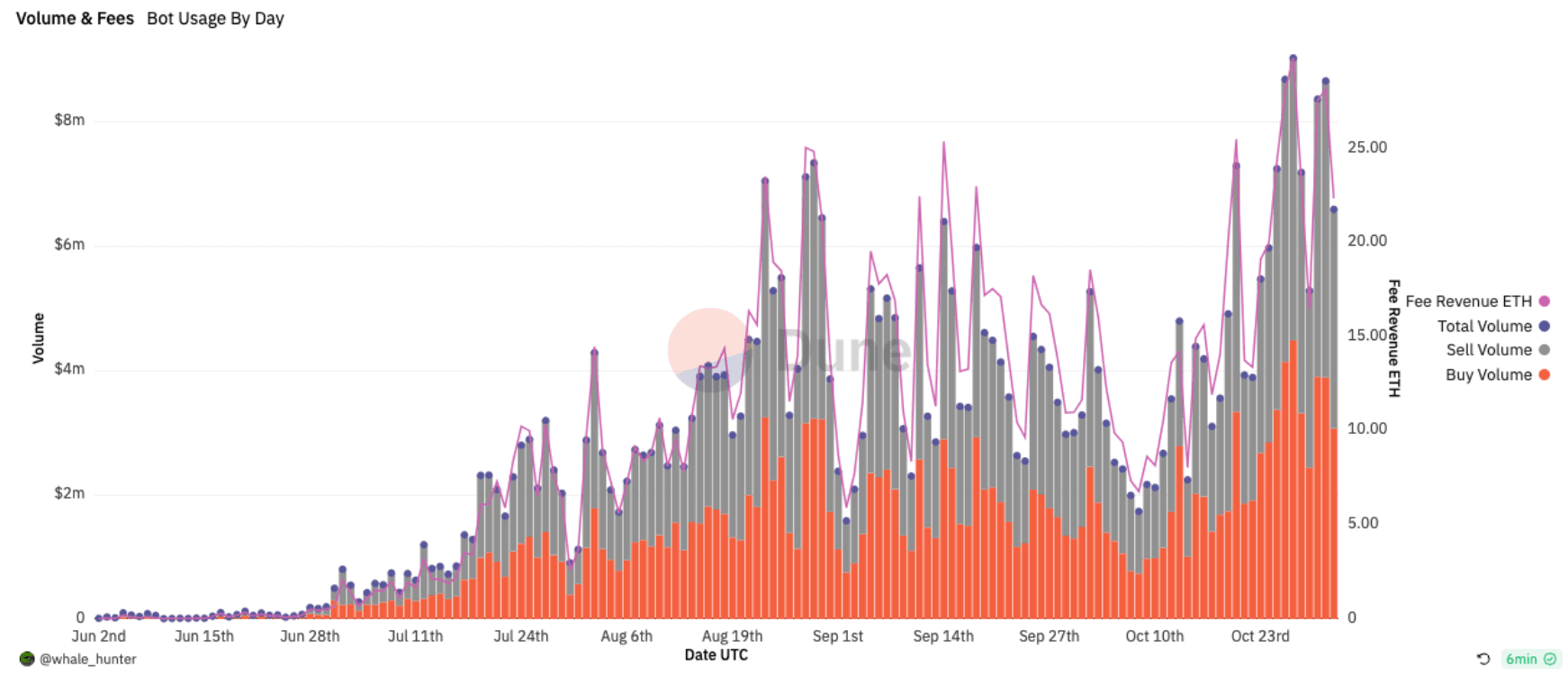

Banana Gun Bot continues to climb in usage, volume and fees generated. Many anticipate this Telegram bot will overtake its competitors in the market. Many are accumulating the token in hopes of the price appreciating greatly.

Source: Dune

Source: DuneNFTs & Gaming

News

- Frame announce they will be powered by Arbiturm’s Nitro Stack

- Opensea introduce Shipyard, an open-source collection of Solidity contracts for NFT creators

- Sup comic enters stores, Bitmap: Fragments Of The Machine

- Steve Aoki to drop digital sneakers for Stepn

- Axie Infinity’s Sky Smash has integrated Axie Experience Points

- ArcadeDao has launched

- Alpha 3.0 game update of Chain of Alliance redefines blockchain RPGs with season-based leaderboards and exciting additions

- Async Art is winding down

- NFT Paris launches loyalty token

- Acolytes, Oxmons derivatives, are coming

- Animoca Brands acquires Azarus to bring streaming to Web3 games

- Blockchain will be standard for gaming in Asia: Bandai Namco exec

- Innovative game, NFT Gaul, has public playtest this week

- NEOM investment fund proposes $50M to invest in Animoca Brands

- GameShift beta is live

- Nearcon23 is taking place 7th-10th, be sure to attend this 4-day journey featuring many industry figures

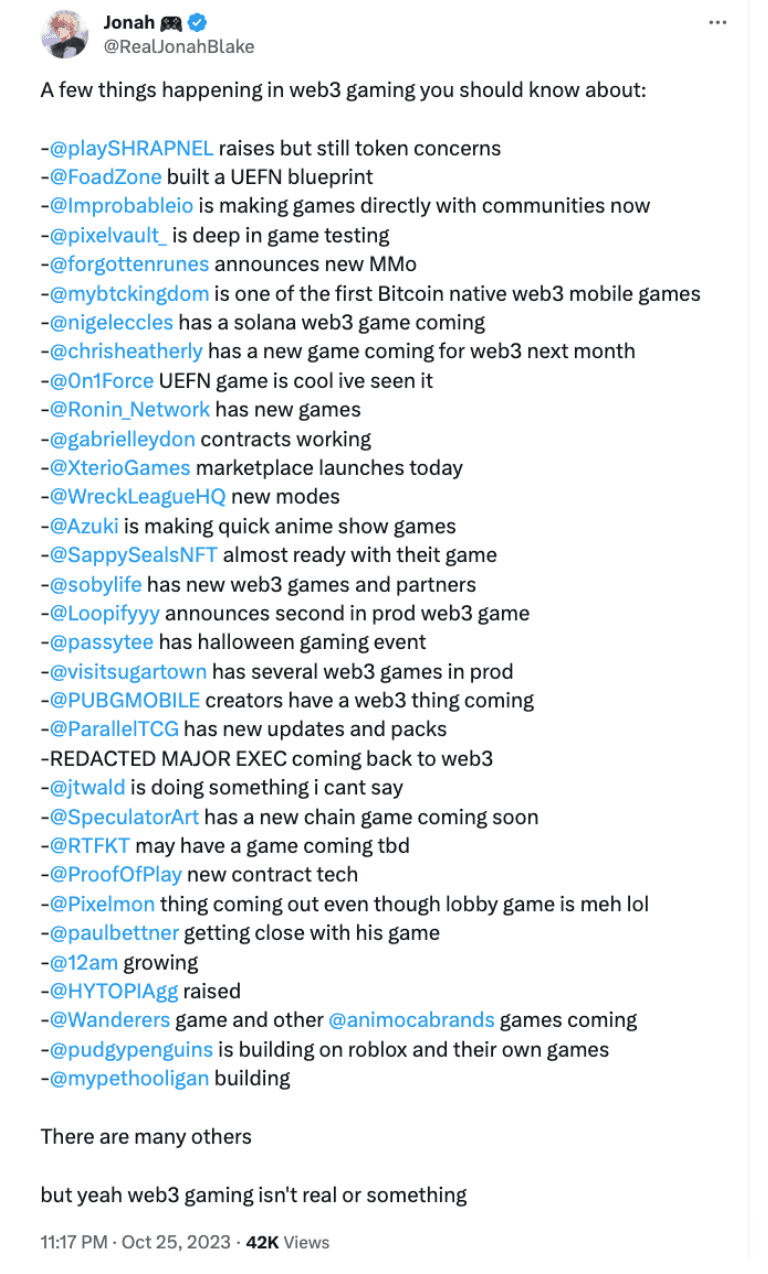

A great summary of gaming developments in Web3 gaming by Jonah.

Source

SourceState of NFTs

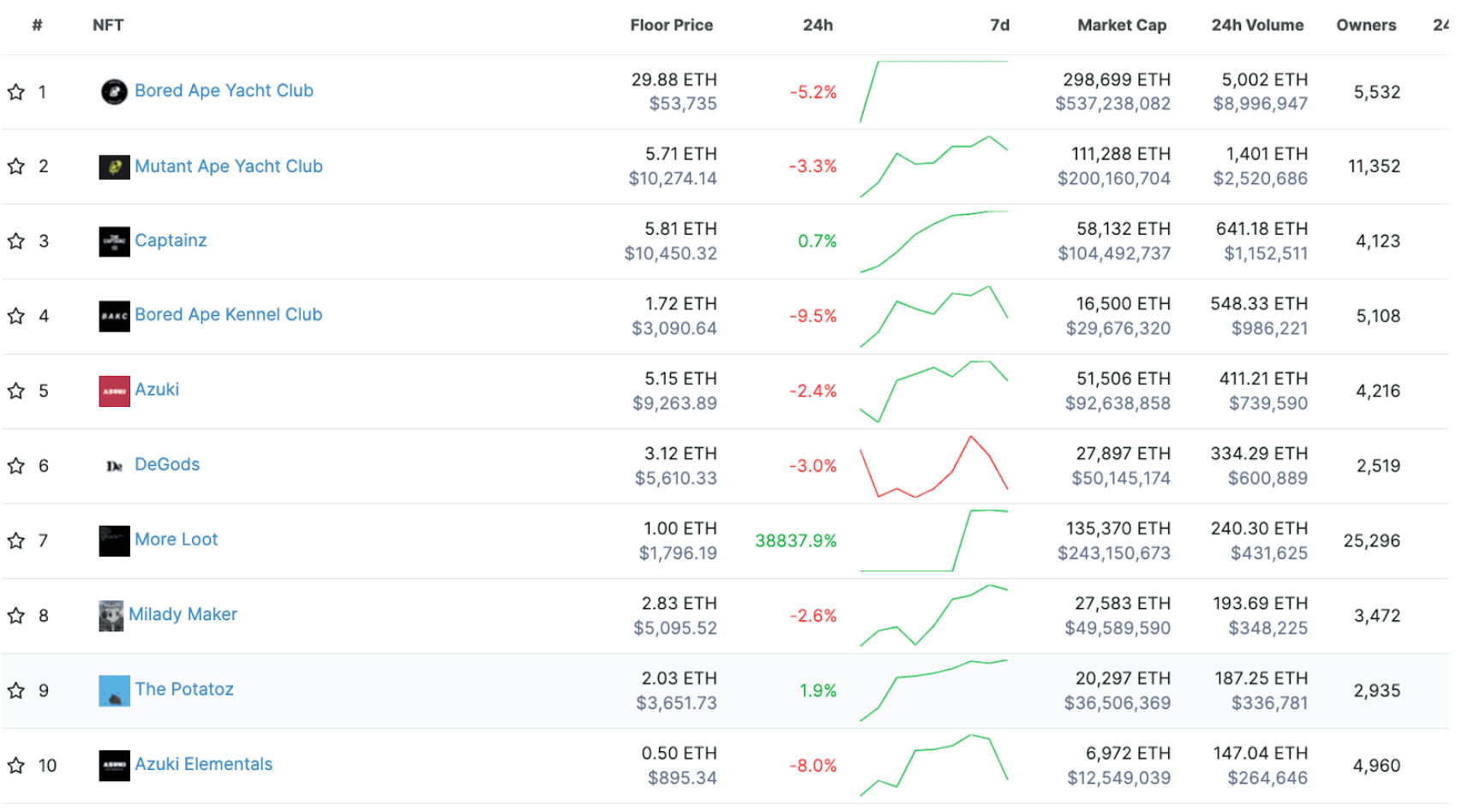

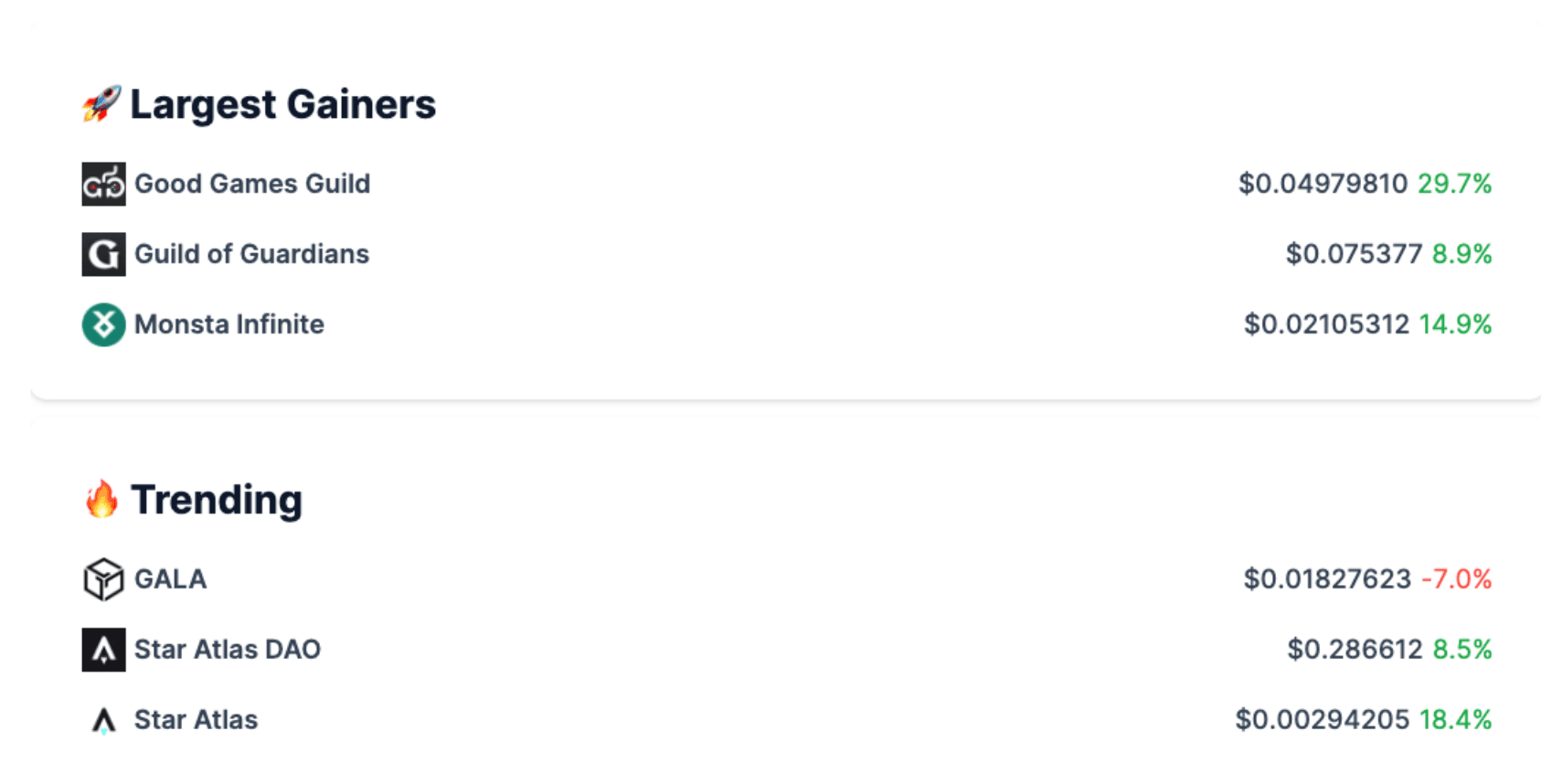

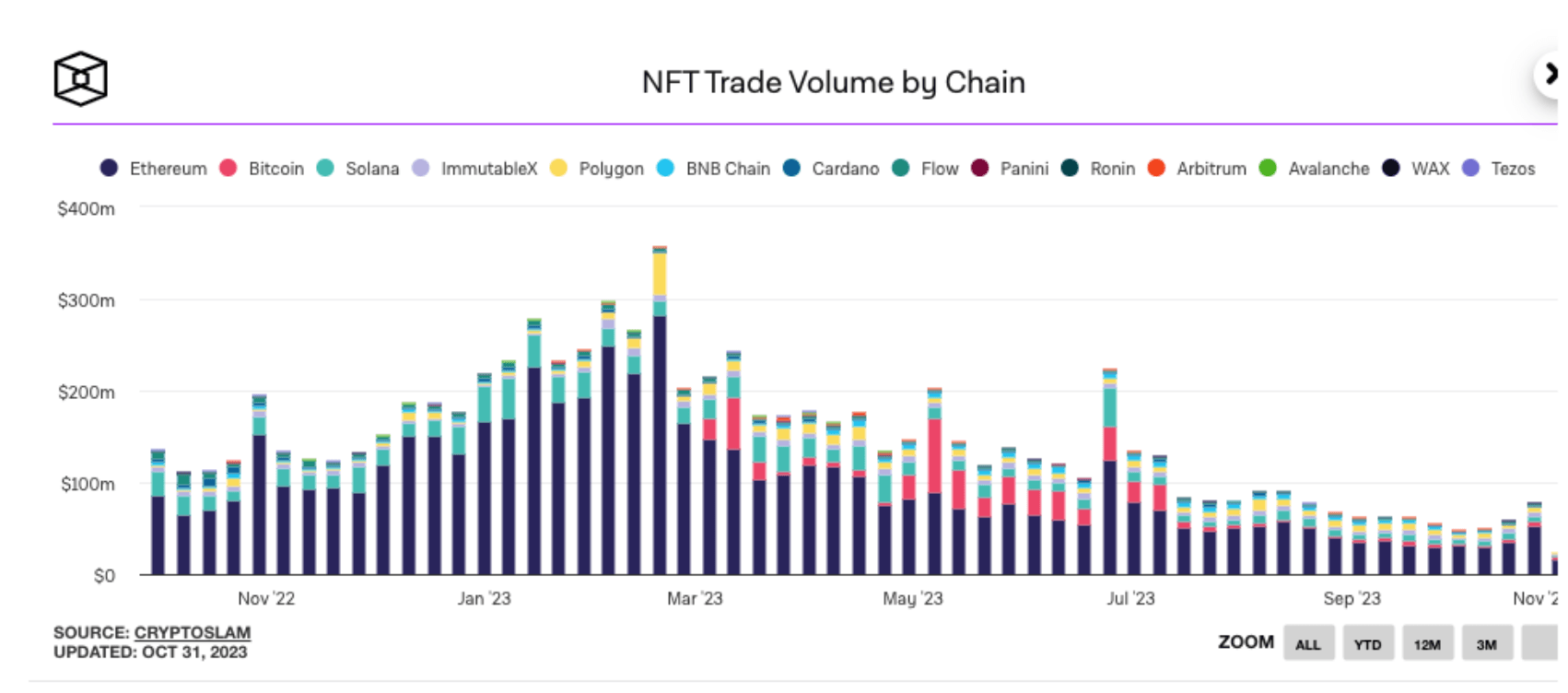

NFTs have experienced heightened trading activity and price gains during the recent market rally. However, they still significantly trail behind the overall market performance. Many projects and companies appear to be revisiting their strategies and long-term goals in anticipation of the next bull market. The traditional concept of NFTs and their practical applications are expected to undergo significant expansion to provide enhanced benefits to users. One prominent emerging trend is the integration of traditional NFTs with the gaming industry.

Traditional NFTs. Source: CoinGecko

Traditional NFTs. Source: CoinGecko Gaming Tokens. Source: CoinGecko

Gaming Tokens. Source: CoinGeckoVolume: Weekly volumes for art and collectibles NFTs on Ethereum have been rising since early October, coinciding with ETH's price rally, indicating some renewed interest. However, weekly volumes are still not significantly higher than they were in late August, suggesting that NFTs are primarily benefiting from the rising value of the assets they are priced in, rather than experiencing a major resurgence in activity.

Source: The Block

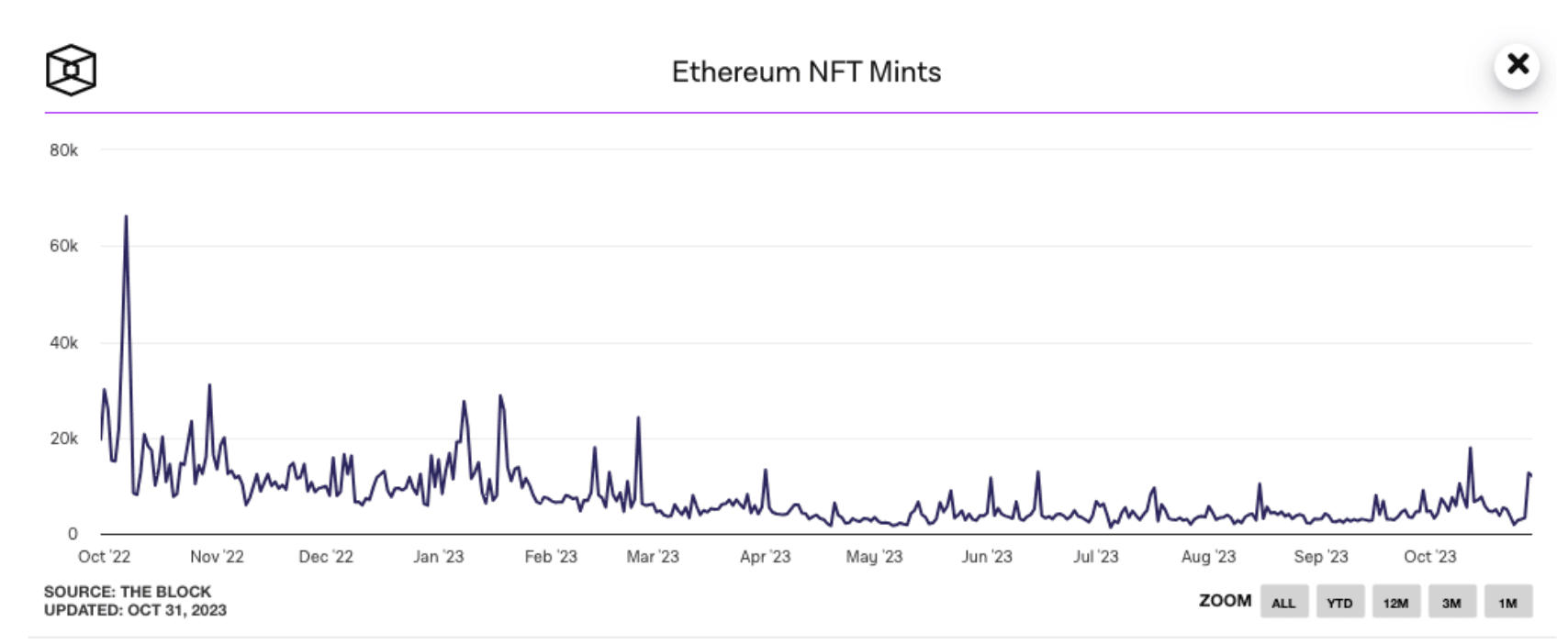

Source: The BlockMints: NFT mints on Ethereum have seen an uptick coinciding with the recent uptrend in volumes and trading.

Source: The Block

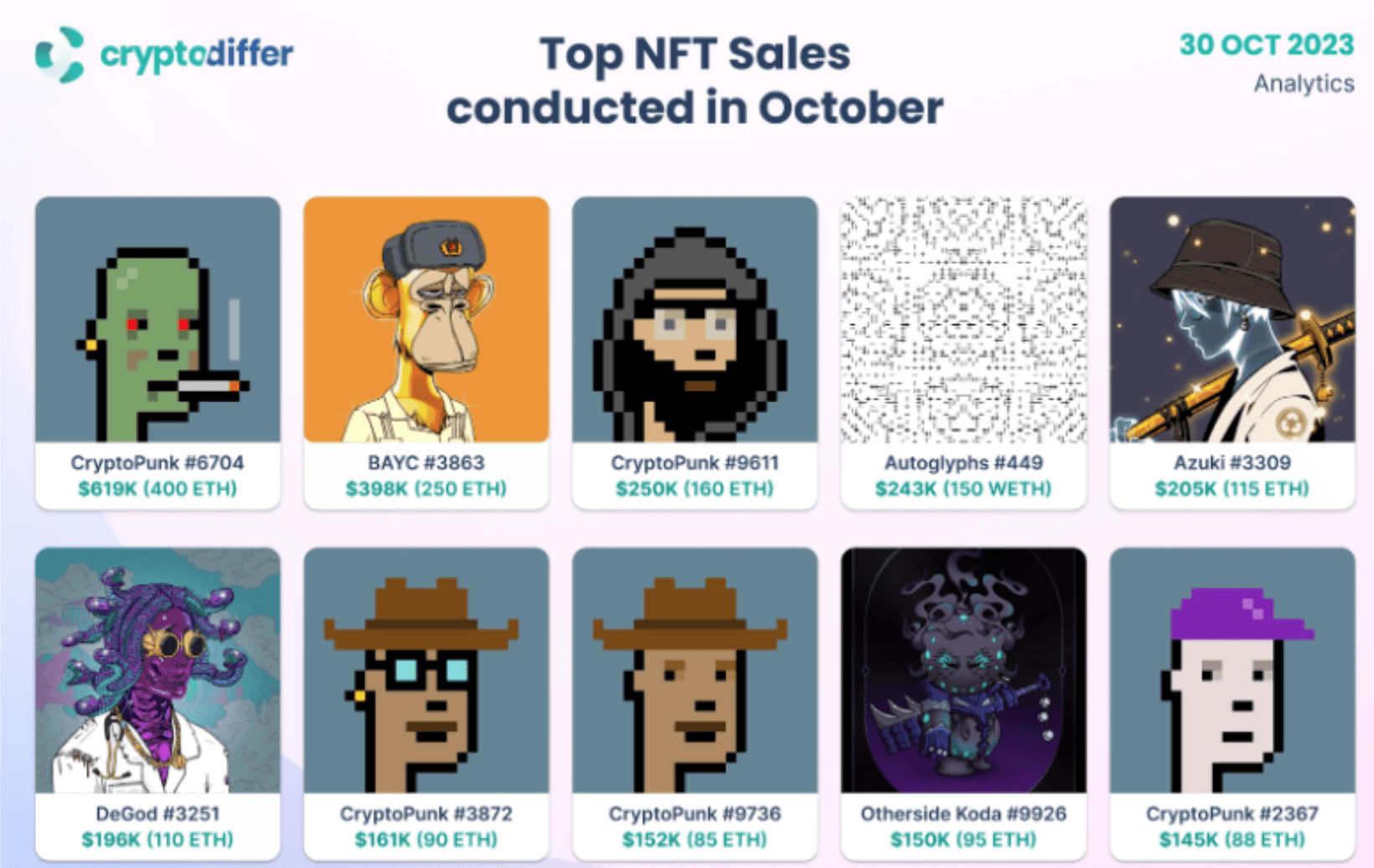

Source: The BlockSome noticeable sales this month that are worth noting: It’s evident that blue chip collections still hold a lot of value for NFT collectors.

Source: CryptoDiffer

Source: CryptoDifferProject Spotlight: Wreck League

Wreck League introduces a unique concept where players use NFT-minted parts to construct mechs for real-time player-versus-player (PvP) fighting game competitions. Unlike traditional fighting games with predefined characters, each mech is crafted and owned by its creator, allowing for over 1.5 quadrillion possible mech combinations.

- Players have the freedom to assemble, disassemble, and customize mechs using the 10 distinctive NFT parts. This customization results in mechs with unique visual appearances and play styles, enhancing their performance in various game events and tournaments.

- Season 1 of Wreck League features a collaboration with Yuga Labs, integrating Bored Ape Yacht Club, Mutant Ape Yacht Club, Bored Ape Kennel Club, and Kodas into the game. Holders of these collections can claim a free Founders Mech.

- Wreck League offers a AAA-quality real-time PvP fighting game experience with cross-play functionality on mobile and PC. Players compete in events and tournaments using their custom mechs, with valuable on-chain rewards at stake.

Image via Wreck League

Image via Wreck LeagueDegen Corner

Earn ETH with mint.fun and their referral rewards.

Embed a Zora mint page onto your own website or platform to earn mint referral rewards.

ImgnAI, a crypto-based project enabling users to create AI-generated art, has gained entry into Nvidia's Inception Program. Following this announcement, the project's native token, $IMGNAI, has exhibited a favorable response, with its value surging by as much as 34%.

Maison Margiela offers a free Web3 Multiplayer Mint Game, where players can enter a code, confirm, and play to try and mint various numbers, with the challenge of resetting the counter after each successful mint.

The collectibles market is projected to reach a value of $1T by 2033, with stamps representing one of the largest segments at 8%. On Thursday, the German postal service released its inaugural stamp featuring a digital twin. Dive into this thread to learn how to partake in this trend.

Preregister to play Metalcore a PvPvE shooter on Immutable zkEVM.

Farcana is a blockchain-based gaming metaverse that allows players to earn Bitcoin through a unique form of Game-fi called Play to Hash (P2P). Sign up here to experience the Farcana Beta.

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space