In today's edition, we're focusing on the exciting developments within TON (The Open Network).

With its seamless integration with Telegram, TON is positioned uniquely in the DeFi space, offering a range of applications that are starting to catch fire with investors and users alike.

In this issue, let's explore the network's impressive growth, dive into its technological innovations, and look at what the future might hold for this platform.

TON Growth

TON has experienced tremendous traction over the past month. The native token Toncoin has jumped from $4.62 to $5.87 this past week. In fact, TON reached its all-time high of $7.63 on April 11, 2024. Overall, TON has grown by 187% this past year.

Source: CoinGecko

Source: CoinGeckoLet’s look at its DeFi ecosystem.

Source: DeFiLlama

Source: DeFiLlamaOf course, a TVL of $204.55M is nothing impressive. However, the growth certainly is. Since March 1, TON’s DeFi TVL has grown almost 20X over the past two months.

TON is uniquely positioned due to its association with the popular messaging app Telegram. This connection provides TON with instant access to Telegram's user base of over 900 million monthly users, setting it apart from other blockchain projects, which often need help with initial user acquisition.

Plus, its deep integration with Telegram allows users to perform cryptocurrency transactions directly within the messaging app, leveraging Telegram's native wallet.

So, what else does TON have going for it apart from the Telegram connection? Let’s take a look.

Technological Foundations and Innovations

TON is designed as a multi-blockchain system, which significantly enhances its scalability and processing capability. This architectural choice allows for parallel processing across multiple chains, facilitating rapid block validations and transactions.

Such a design is critical for handling large volumes of transactions simultaneously, which is a common scenario given Telegram's extensive user base.

The network utilizes a Proof of Stake (PoS) consensus mechanism integrated with Byzantine Fault Tolerance (BFT), providing robust security against malicious attacks while maintaining efficiency. This choice of consensus mechanism ensures that the network remains environmentally sustainable, reducing the computational power (and thus energy consumption) required compared to traditional Proof of Work systems.

TON Features:

- Ease of Use: The ease of use is unparalleled, as it leverages an interface familiar to millions, reducing the intimidation factor often associated with blockchain technology.

- TON Payments: This feature supports microtransactions by processing them off-chain for lower fees, with final settlements executed on the blockchain. This capability is particularly beneficial for everyday transactions among Telegram users.

- TON DNS: This service simplifies interactions within the network by assigning human-readable names to accounts and smart contracts, akin to the Domain Name System on the traditional internet.

- TON Storage: Provides a secure, decentralized file storage solution, which hashes files on the blockchain for enhanced security and permanence.

- TON Proxy: Supports decentralized VPNs and networks similar to TOR, enhancing user privacy and deploying censorship-resistant applications.

- TON Services: Offers a framework for developers to deploy applications and smart contracts on TON, complete with user-friendly interfaces for easier interaction with DApps.

Toncoin ($TON)

TON’s native coin, Toncoin, facilitates various actions within the network, including transactions, payments, and interactions with DApps. Toncoin serves as the primary medium for transaction fees and acts as the foundational currency for the network’s smart contracts.

This integration positions Toncoin as a central element in TON's decentralized economy, enabling everything from voting in governance decisions to participating in the development of new applications.

$TON is utilized across multiple functions on the Toncoin blockchain, serving as a foundational asset for various activities:

- Transaction Fees: $TON is essential for processing transactions on the Toncoin blockchain. Users must use $TON to pay for transaction fees, similar to Ethereum users paying gas fees with $ETH. This applies to most transactions on the network and facilitates smooth operations across blockchains.

- Data Storage and Domain Names: Beyond transactions, $TON is used to pay for data storage on the blockchain. Purchasing blockchain-based domain names is also required, expanding its utility in managing digital assets and services on the network.

- Network Governance: $TON serves as a governance token, enabling holders to vote on critical proposals that determine the direction and development of the Toncoin network. For instance, a notable governance action taken by the community was voting to freeze $TON in inactive mining wallets, which impacted the token's supply and governance dynamics.

- Staking: Like other proof-of-stake blockchains, Toncoin allows token holders to stake their $TON to support network operations and validate transactions. Staking $TON not only helps secure the network but also rewards participants with additional $TON tokens, incentivizing engagement and investment in the network's health and growth.

Now that we have you orientated with the fundamentals of TON, let’s dive into what’s in the works for this awakening titan.

Emerging TON Ecosystem

TVL on TON is experiencing a surge, with 2024 shaping up to be the year that solidifies TON's position as a significant player in the DeFi space. Currently, TON's DeFi TVL stands at around $205M, but we anticipate significant growth ahead. With this momentum, TON could potentially break into the top 10 cryptos for DeFi in the coming months.

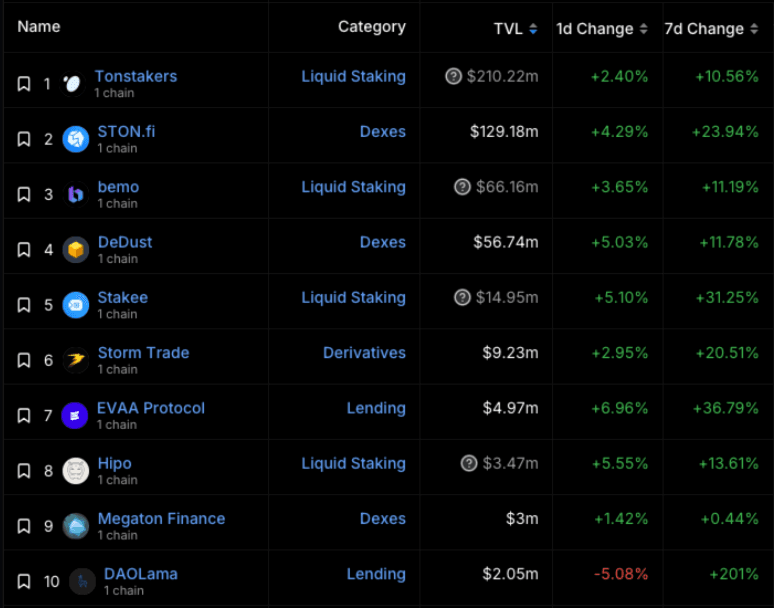

Examining the top 10 apps on DefiLlama, we observe that all of them are exclusive to TON. Unlike many other chains, apps such as Uniswap, Aave, and other major players have yet to expand to TON. This presents a vast opportunity for early adopters within the ecosystem to capitalize on its growth potential.

Top 10 protocols on the TON network: Source.

Top 10 protocols on the TON network: Source.Getting Started

Before we delve into exploring the ecosystem, why not download a TON wallet to participate?

Choose from Wallet In Telegram, Tonkeeper, MyTonWallet, or check out this list for more options.

Here’s an overview to get you going

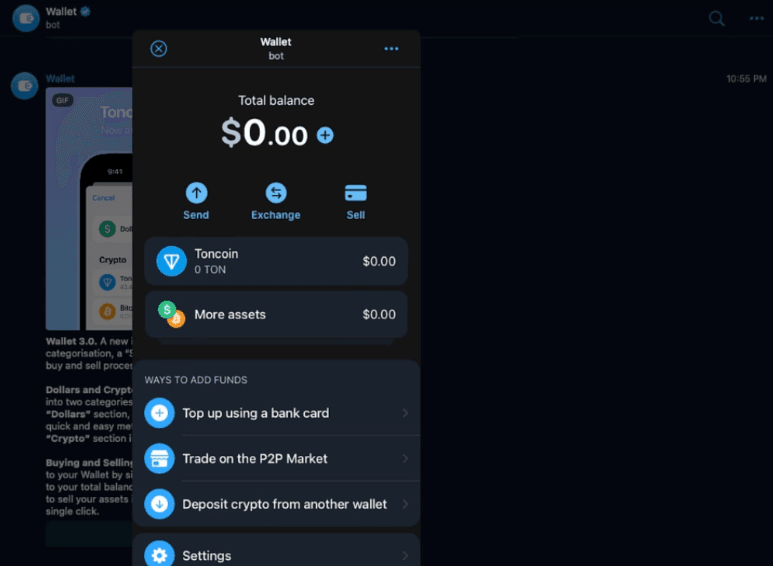

- To start using the TON network, users need a TON wallet. Options include @wallet, which integrates with Telegram, Tonkeeper, and more.

- These wallets provide interfaces to manage assets and interact with decentralized applications on the network.

- To fund your TON wallet, you can deposit crypto assets from another wallet by selecting the "Deposit crypto from another wallet" option within the wallet menu when using @wallet.

- Choose the asset you wish to deposit and copy the provided address. Then, send the specified asset to the address.

- Supported assets for deposit typically include Toncoin, Bitcoin, and ERC20 USDT.

- Additionally, @wallet offers an on-ramp payment option, allowing users to top up their wallets directly from their bank accounts.

- Simply select "Top up using a bank card" from the list of ways to add funds and proceed to purchase the desired asset via credit card. This funding process ensures that users have the necessary assets in their wallets to engage with the TON network seamlessly.

- Check out this comprehensive guide by Coingecko on downloading and funding a TON wallet.

When funding your wallet, it's advisable to start with small amounts to familiarize yourself with the process. Overall, the experience is intuitive and streamlined, making it easy to navigate.

Source

SourceTON Projects

The TON ecosystem currently features around 14 DeFi protocols specifically designed for its network. Let’s take a look at a few and the different functions they serve within the TON ecosystem.

Liquid Staking Platforms

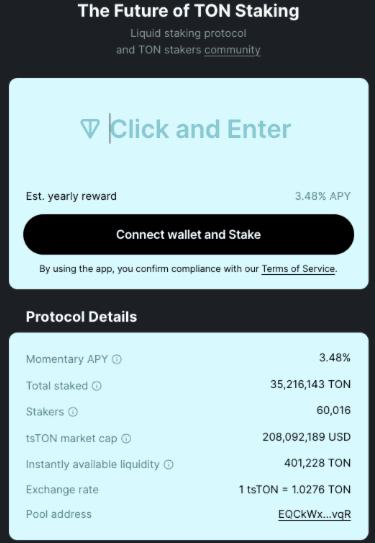

Liquid staking on TON involves staking Toncoin to earn rewards while maintaining liquidity, allowing users to contribute to network security and earn passive income simultaneously. The most popular protocols are seeing their TVL rise into the tens of millions.

- Tonstakers: This liquid staking platform provides Toncoin holders with the opportunity to earn rewards through staking while maintaining liquidity. Tonstakers simplifies the staking process, enabling users to contribute to network security while receiving passive income.

- Stakee: Similar to Tonstakers, Stakee allows Toncoin holders to earn rewards by staking their tokens while retaining the ability to withdraw funds at any time. Its user-friendly interface and attractive yields make it a popular choice among stakers in this ecosystem.

- Ton Whales: A prominent staking platform within the TON ecosystem, offering high yields while maintaining liquidity for staked assets.

- Atomic Wallet: Offers a liquid staking option for Toncoin directly within the Atomic Wallet, providing users with convenient staking rewards.

The largest staking protocol on TON, Tonstakers, is currently offering an APY of 3.48%.

Source

SourceDecentralized Exchanges

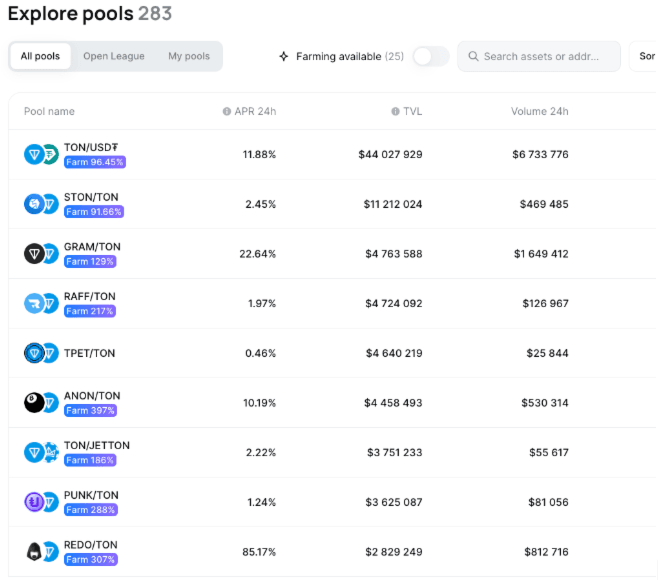

Decentralized exchanges are the second-largest category of applications within the TON ecosystem. Leading DEXs like STON.fi and DeDust collectively manage over $150M in TVL, with STON.fi surpassing the $100M mark on April 28th.

- STON.fi: The leading Dex in the TON ecosystem, STON.fi offers a diverse selection of trading pairs. On April 28th, it exceeded $100M in TVL, securing its position as the top Dex on the network. STON.fi's most popular pools include native meme coins like Ton Pet (TPET) and Ton Punks (PUNK), which continue to attract decent trading volumes.

- DeDust: Another prominent Dex in the TON ecosystem, DeDust focuses on trading native meme coins like adDICKted (DICK) and pavel durev (DUREV). Together, DeDust and STON.fi hold over $150M in TVL.

A selection of just some of the pools on STON.fi can be viewed below. Some have been experiencing noticeable volumes over the last 24H.

Source

SourceAdditional Protocols

In addition to the aforementioned protocols, there are several others worth exploring within this evolving ecosystem.

- Tonnel Network: Employing ZK technology, this protocol enhances privacy within the SocialFi ecosystem on the TON Blockchain, seamlessly integrated with the Telegram platform.

- Evaa: TON's pioneering decentralized lending protocol offers users the opportunity to engage in lending and borrowing activities directly, bypassing the need for centralized intermediaries.

- Storm Trade: This protocol stands as the inaugural dex on the TON blockchain, facilitating trading across various asset classes including cryptos, stocks, forex, and commodities. Offering leverage options and accessible through both web and Telegram platforms, it represents a versatile trading solution within the TON ecosystem.

- DAOLama: This platform introduces an innovative decentralized peer-to-pool NFT liquidity protocol, providing a novel approach to NFT liquidity within the TON ecosystem.

Wrapping Up

The TON ecosystem is on the brink of substantial growth and adoption within the DeFi arena. With a surge in TVL and novel DeFi protocols tailored specifically for the TON network, 2024 holds promise as the year that cements TON's standing as a major industry player.

As TON's DeFi TVL eclipses $200M and continues its upward trajectory, the potential for expansion is undeniable. Exclusive top-tier applications within the TON ecosystem present ample opportunity for early adopters to leverage its vast potential.

The TON ecosystem boasts a diverse range of prospects, spanning from liquid staking platforms to decentralized exchanges, all underpinned by the stability of the Telegram social application. With an intuitive user interface and streamlined processes, engaging with and participating in the TON ecosystem has never been more straightforward.

Moreover, compared to other emerging DeFi ecosystems like Bitcoin, the user experience within TON is notably smoother, facilitating easier access and capitalization on opportunities.

Lastly, it's essential for users to exercise caution, particularly regarding storage of significant amounts on Telegram wallets. Start with small amounts and familiarize yourself with the various apps and ecosystem as a whole before committing substantial funds.

That's all for today, anon!

We hope you found this issue enlightening. Keep an eye on TON. It has a readymade, crypto-native user case. Remember - Crypto lives on Telegram. As such, its future projections are pretty impressive.

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space