There’s no shortage of crypto exchanges these days. Indeed, CoinGecko lists over 700 trading exchanges. With so many options available, it’s important that you choose one that’s right for your goals. This, of course, requires some due diligence on your part.

Ease of use, asset choices, security, reputation and trading fees are just some of the things you should keep in mind before selecting an exchange. Bitget is one exchange that checks all the boxes.

Boasting over 20 million registered users and 10 billion USDT daily trading volume, Bitget is the largest crypto copy trading platform. The exchange is registered in Seychelles and has over 1,300 employees in 60 countries.

Bitget boasts more than 550 cryptocurrencies and over 650 trading pairs. Interestingly, the company was founded during the 2018 bear market when Bitcoin collapsed to a low of $3,200 with Ethereum faring even worse, falling over 90% from its then-all-time high.

Today's article will take you through a Bitget trading guide. If you’d like to know more about the platform, you can check out our full Bitget review. If you are currently on the lookout for the perfect crypto exchange, we break down and compare the top crypto exchanges.

This Bitget trading guide will touch on everything you need to know — from account registration and placing your first trade to Bitget fees, with a little bit of trading wisdom thrown on top.

Note: Users located in the US and UK are not supported.

Getting Started with Bitget Trading

Beginning your crypto trading journey on Bitget is a breeze. This article will cover the sign-up basics, but if you're looking for more information on the sign-up process, here's a detailed step-by-step guide on how to get started with Bitget. For a shorter version, keep reading!

Beginning Your Crypto Trading Journey on Bitget is a Breeze. Image via Bitget

Beginning Your Crypto Trading Journey on Bitget is a Breeze. Image via BitgetAccount Registration

Once you’re ready, you can begin your account registration process with Bitget. To create a new account, you’ll either need to head over to their website through a desktop or download their mobile app, which is available for both iOS and Android. Bitget also has desktop applications for Mac and Windows.

You can choose “sign up” on the website or the Bitget mobile app. You’ll then be presented with two options:

- Sign up by phone

- Sign up by email

The two work in essentially the same manner. In both cases, you’ll have to provide personal information and identity verification such as pictures of your government-issued ID. Where the two differ is how you receive your verification code. If you choose to sign up via your phone number, you’ll get the code via SMS, whereas Bitget will send the verification code to your email if you sign up by, you guessed it, email.

Anyone who has received a verification code will tell you they can take their sweet time before appearing in your inbox. It’s best to give it a few minutes and not lose hope. However, if you don’t get a code at all, Bitget recommends reaching out to its customer services team at [email protected].

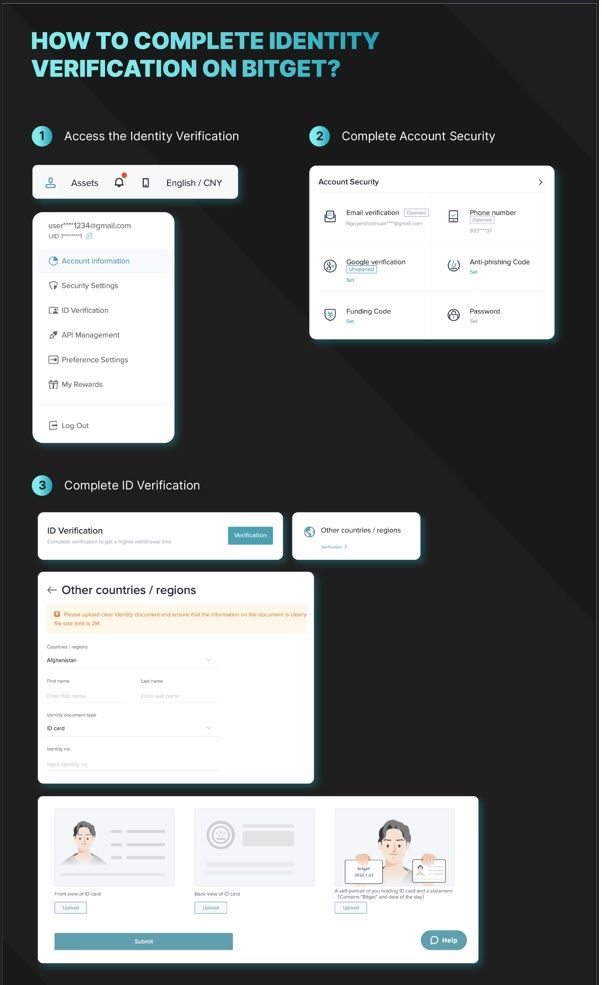

IMPORTANT: Know your customer (KYC) standards, or identity verification in plain English, are a requirement for everyone using the Bitget platform to protect against fraud and financing risks. Completing the KYC process allows you to use all Bitget products and services.

Like Many Other Exchanges, You'll Have to Provide Identity Verification to Bitget. Image via Bitget

Like Many Other Exchanges, You'll Have to Provide Identity Verification to Bitget. Image via BitgetHow to log in to Bitget

Great, you’ve signed up with Bitget. Now comes the login part, and once again, you have two options:

- Log in with a password: Click the “log in” button in the app or on the Bitget website. Then, enter your account number and password, receive a verification code via SMS or email (depending on how you signed up), and viola you’re in.

- Scan QR code: This can only be done via the website. Once you’ve clicked log in on the top-right corner of the Bitget website, you can use the mobile app to scan a QR code on your PC to log in.

Funding Your Bitget Account

You can fund your account in three ways:

- Buy crypto with fiat currencies

- Deposit crypto into your Bitget wallet from another cryptocurrency wallet

- Person to person

Buy Crypto with Fiat Currencies

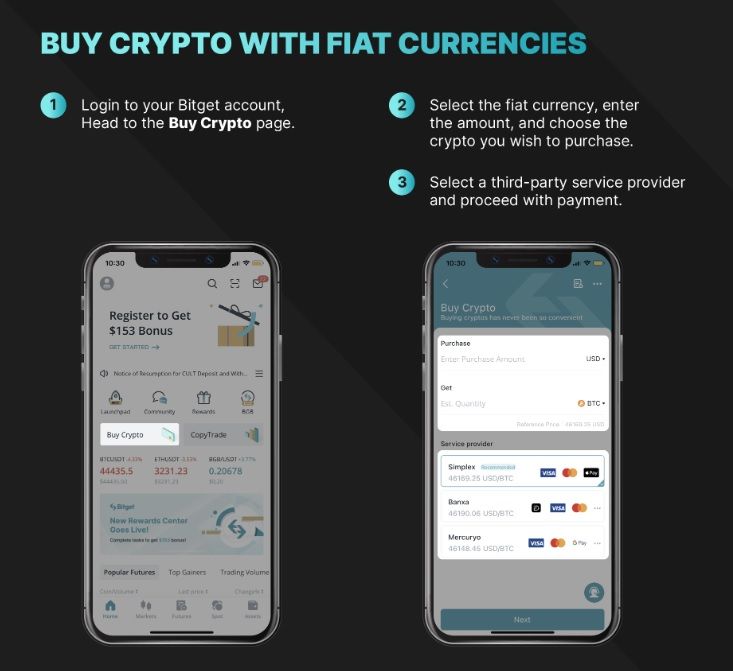

Depending on where you’re located, you can deposit over 30 fiat currencies, such as USD, EUR, GBP, HKD, JPY, and AUD to your Bitget account using third-party service providers.

You Can Deposit Over 30 Fiat Currencies to Your Bitget Account. Image via Bitget

You Can Deposit Over 30 Fiat Currencies to Your Bitget Account. Image via BitgetHere’s how you to buy crypto on Bitget with fiat currencies.

- Place your crypto order: Log in to your Bitget account, choose “Buy Crypto” and select “Credit/ Debit card.” Then, you can choose the fiat currency you want to deposit, the currency you want to buy, and the third-party service provider. Once you have all that locked down, click “Next.”

- Verify your identity: This is where you will leave the Bitget platform and be taken to third-party web pages like Banxa, Mercuryo, Simplex and Xanpool, among others. After verification, you may complete the payment. You will pay a fee to the third-party service provider and an on-chain transfer fee. Bitget does not charge any fees.

- Check your order details: After your payment is completed, Bitget recommends waiting between two and 10 minutes for the cryptocurrency to be topped up to your spot account. Once the order is completed, you can check the website of the third-party service provider. You may also check your Bitget’s spot account under “Asset.”

Buy crypto with crypto

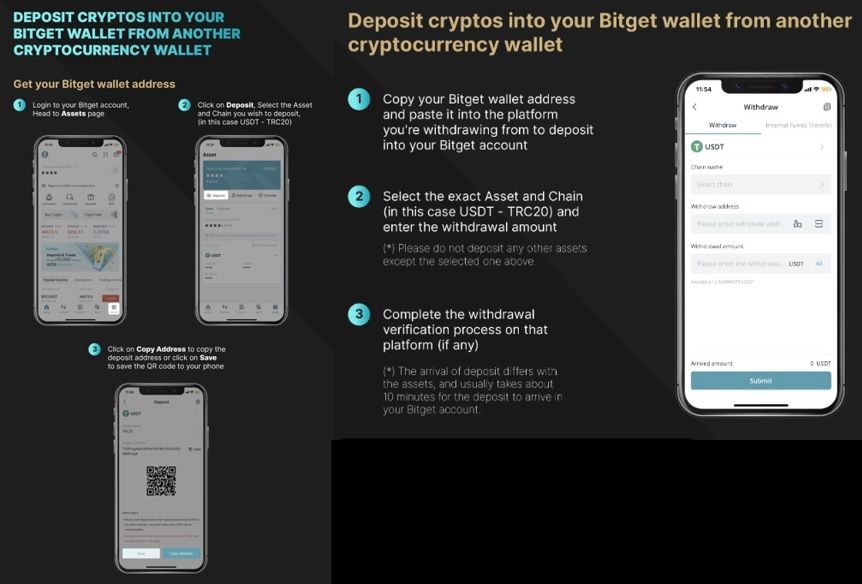

This can get a little technical, and you'll have to jump throw a few extra hoops.

- Step 1: Log into your Bitget account and tap “Deposit” on the app’s main page.

- Step 2: Select the type of coin and chain you’d like to deposit. It’s important that you choose the same chain (ER-C20, TRC-20, BEP-2, BEP-20, etc.) on the platform from which you are withdrawing your crypto. Otherwise, you may risk losing your assets.

- Step 3: After choosing your preferred token and chain, Bitget will generate an address and a QR code. You can use either option to make a deposit.

Person-to-person

P2P trading is a decentralized form of exchanging assets, such as cryptocurrencies, where users trade directly with each other without the intervention of an exchange as the middleman.

Click on “Buy Crypto,” then P2P trading on the top left corner of the navigation bar to enter the P2P trading page. You'll be able to see a list of available trades, along with their price and payment methods. Choose one that meets your requirements in terms of price and payment method. Once you've found a trade you're interested in, click on it to view the details.

In the P2P section, you can buy and sell cryptocurrencies at your preferred price. Once you have matched an order, you can proceed to execute the trade. Bitget employs an escrow service, which temporarily holds the funds until the trade is complete. Once the trade is executed, the assets will be transferred to the respective wallets.

In P2P trading, you’re dealing with a person you don’t know. As a result, there are a few best practices to keep in mind.

- You should have clear communication with your trade counterpart so any misunderstandings or issues can be avoided.

- Ensure that you’re trading with reliable users by checking their trade history and feedback.

- During any communication or trade, ensure that your personal information stays confidential.

- Enable all available security features, like 2FA for additional safety.

Placing Your First Trade

Bitget offers different types of trading products that cater to both newbies and pros. Before we dive into that, however, let’s first explore the order types you can expect on the Bitget platform.

Order Types

An order is simply an instruction given by an investor or a trader to a trading platform, such as Bitget, to execute a transaction.

- Market order: Orders executed immediately at the current market price are referred to as market orders. While the order is executed immediately, prices can vary slightly from the current market quote as a result of market volatility.

- Limit order: This order specifies a price at which you are willing to buy or sell. For example, if Bitcoin’s price is currently $26,000, but you’d like to purchase it for $24,500, you click on the drop-down button and choose limit order, and enter the price to initiate this trade. The order will then be triggered automatically once price hits your desired price point.

- Trigger order: This order type works mostly like a limit order, and an order is executed when a “trigger” price, chosen by you, is reached.

- Stop loss order: Designed to limit potential losses on a trade, this order type will automatically trigger a market order to close a trade when its price falls to or below a specified stop price.

- Trailing stop loss order: This type of trading order "trails" the market price at a predetermined distance or percentage. While a standard stop-loss order has a fixed price level, a trailing stop-loss order is designed to automatically adjust its stop price based on the market's price movements.

With that out of the way, we’ll now explore trading products offered by Bitget and how you can place an order.

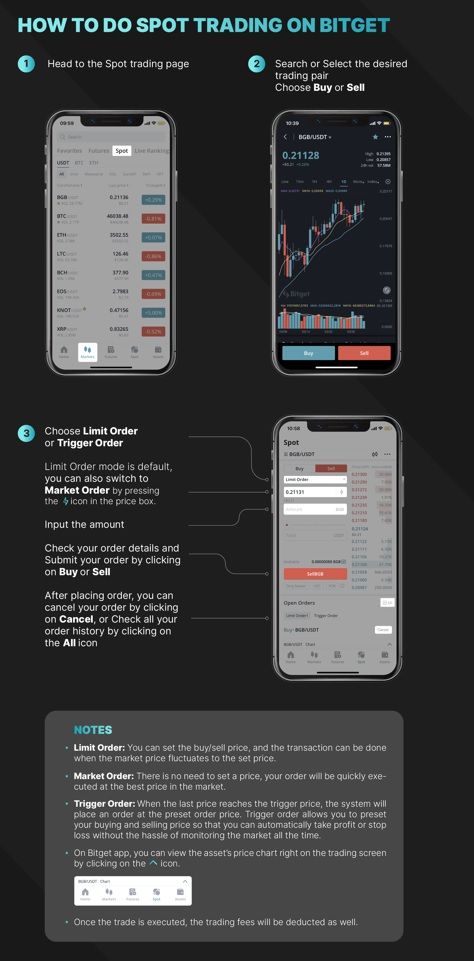

Spot Trading

Buying and selling a token at the current market price for instant delivery is called spot trading. A transaction happens “on the spot” (get it?), meaning the buyer pays for the asset, and the seller delivers it immediately.

Here's an easy real-world example:

Imagine you want to buy a car from a friend. You both agree on a price of $20,000. You pay your friend, finalize the paperwork, and they hand over the keys to you. That's a spot trade for a car.

It works similarly in the world of finance:

- You find an asset you want to buy, like a cryptocurrency.

- You agree on a price with the seller. Typically, it’s whatever the current market price is.

- You pay for the asset, and the seller transfers it to you immediately or shortly after.

Buying And Selling a Token at the Current Market Price for Instant Delivery is Called Spot Trading. Image via Bitget

Buying And Selling a Token at the Current Market Price for Instant Delivery is Called Spot Trading. Image via BitgetHere’s how you can conduct spot trading on Bitget. For your ease, this part of the guide picks up after you’ve funded your account.

Once your Bitget account is funded, head to the Bitget Spot Trading section. Here, you’ll find an overwhelming number of cryptocurrency trading pairs. Choose your preferred pair, and fill in the number for market order and other conditional orders. Once you’re done, click Buy/Sell, and you’re done.

Futures Trading

In simple terms, futures trading is like making a promise to buy or sell something at a specific price on a future date. Think of it as making a bet as to the future price of something, in this case, a cryptocurrency.

Coin-Margined Futures Is a New Futures Trading Method Launched by Bitget. Image via Bitget

Coin-Margined Futures Is a New Futures Trading Method Launched by Bitget. Image via BitgetCoin-Margined Futures is a new futures trading method launched by Bitget. Unlike the traditional trading method that only applies to corresponding coins, Coin-Margined Futures support multiple currencies as a margin for multiple futures trading pairs. For example, using ETH as a margin, you now can trade BTC-USD, ETH-USD, EOS-USD with profit and loss calculated in ETH.

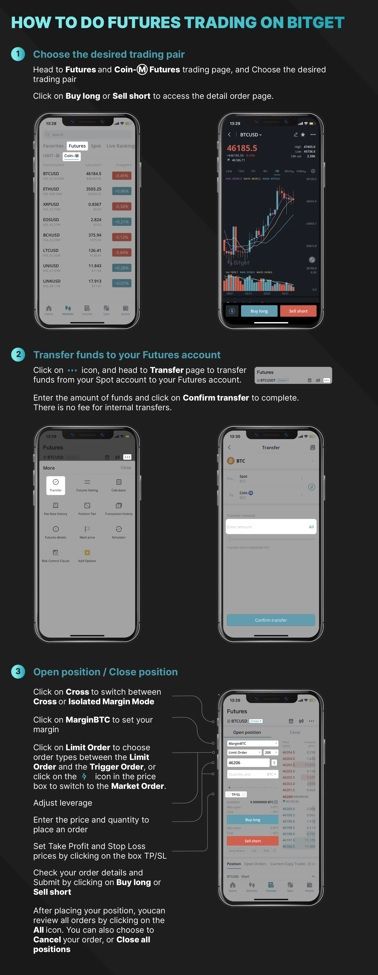

To begin, go to the future trading page and transfer assets from your spot account to your futures account. This will not incur any fees. Here’s what the rest of the process looks like:

Open a position (start trading)

Here, you can select your trading pair, whether you’d like to go with cross-margin mode (using the entire account balance as margin) or isolated margin mode (allocating a certain amount as margin) and how much leverage you’re comfortable with. Then, you can enter the price and amount and choose the direction in which to place an order i.e. whether you think the price of the token will fall or gain.

Close the position

Switch to the closing operation, enter the price and amount, and finally select the position to be closed (buy or sell).

There are two ways to close a position: Limit order or flash order. With the latter, you can immediately close the position as there is no requirement to enter the price and amount.

Risks of futures trading

Futures trading is more suited for advanced traders. While it can be lucrative when the bet pays off, this trading strategy carries considerable risks as well.

- Leverage: Futures contracts are highly leveraged, meaning you can control a large amount of an underlying asset with a relatively small amount of capital. As a result, a small price movement against your position can magnify your losses.

- Price volatility: I think we can agree that cryptocurrencies are extremely volatile. This volatility can lead to both substantial gains and losses in a short period.

- Margin calls: Remember the cross-margin and isolated margin modes I mentioned earlier? To trade futures, you are required to maintain a certain amount of capital (aka margin) in your trading account. If the value of your account dips below the required maintenance margin, Bitget will issue a margin call. You will then have a short period of time to meet the call by either injecting new equity into your account or by closing certain positions until your cash flow satisfies the maintenance margin.

- Lack of control: The SEC could a sue couple more exchanges or it could approve a Bitcoin spot ETF application. Who knows? You can’t control how the market will react to this news. As a result, depending on whether you decided to go long or short on a particular token, you’re either looking at a windfall or a massive loss.

Copy Trading

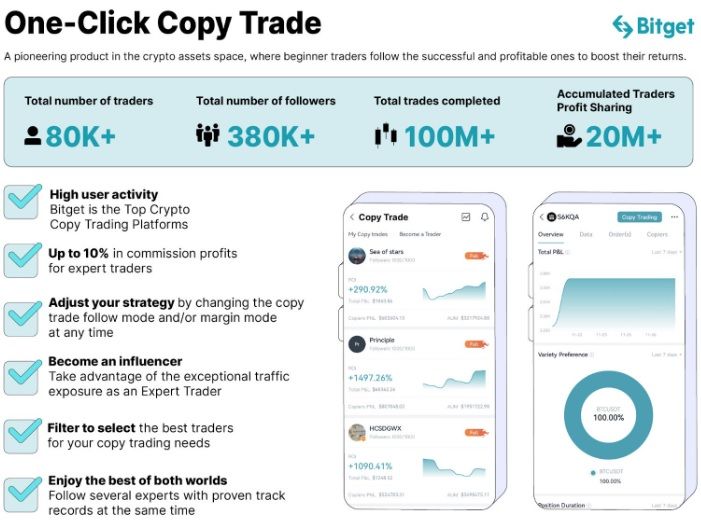

Don’t know much about trading but would like to dip your toes? Say hello to Bitget’s one-click copy trade.

Bitget is the Largest Crypto Copy-Trading Platform. Image via Bitget

Bitget is the Largest Crypto Copy-Trading Platform. Image via BitgetAs the name suggests, copy trading lets you mimic the actions of more experienced traders. This makes it easy for novice traders to get involved without needing a deep understanding of the financial markets.

Unlike spot or margin trading, going about copy trading is pretty simple. Head to the CopyTrade homepage and select the trader you want to follow. Then, click the “Copy” button, go over the details page and customize the trades to your liking. And that’s it! You can follow several expert traders simultaneously and Bitget allows you to adjust your strategy at any time.

You can learn more about Bitget copy trading in our in-depth review.

While copy trading is easy, it comes with its own set of risks.

- No control: You’re essentially giving away the keys to someone you don’t know. You are bound by the decisions made by the trader you're copying, even if they make mistakes or change their strategy unexpectedly.

- Poor performance risk: No trader or investor has a winning streak that lasts forever — everyone has good and bad days. Copying the wrong trader can result in losses.

- Dependency: The ease of copy trading may deter you from pouring in the time and learning about investing and making decisions on your own.

- Overconfidence: A long winning streak can make most people cocky — just look at Vegas casinos. This series of wins may lead you to take on more risks than you can handle.

Key Features of Bitget Trading

Beyond its investment offerings, Bitget offers a number of other tools and services that can enhance your experience. Wherever you are in your crypto journey, you can be sure Bitget has something in store for you.

- Launchpad: Released in 2022, Bitget Launchpad supports the launch of new crypto projects and airdrops. The platform provides direct access to buying or earning new tokens. To engage in an initial exchange offering on Bitget Launchpad, users must possess Bitget’s native token, BGB, to acquire lottery tickets and successfully complete KYC verification. Participation in Bitget Launchpad follows a subscription model.

- Lauchpool: This is a crypto platform where users can stake and earn tokens. By staking with BGB or other coins into the Launchpool, users have the chance to earn free airdrops, earnings, and access to a substantial prize pool.

- CandyBomb: A centralized task-and-airdrop platform tailored for crypto enthusiasts seeking investment prospects, CandyBomb doesn’t require users to lock their BGB holdings for potential access to new tokens at a discounted rate. Instead, participants are simply required to fulfil specified tasks, then new tokens will be deposited into their wallets without any associated costs.

- Bitget Swap: This acts as an advanced DeFi aggregator, pooling liquidity from various trading pools to ensure optimal pricing and minimal fees. Currently, Bitget Swap supports thousands of tokens on nine prominent blockchains including Ethereum, Polygon, Arbitrum, and BNB Chain.

- Bitget Knowledge Hub: Everything and anything you need to know to elevate your trading journey like in-depth guides and practical tips.

Supported Cryptocurrencies

The number of supported cryptocurrencies plays a major role in the success and usability of the exchange — the more tokens it supports, the more it's likely to be used.

Bitget boasts more than 550 cryptocurrencies. This number includes blue-chip coins like Bitcoin (BTC) and Ethereum (ETH), as well as other famous names like Tron (TRX), Uniswap (UNI), Solana (SOL) and Polygon. Have a liking for meme coins? Bitget has PEPE, Shiba Inu (SHIB) and Dogecoin (DOGE).

A word of caution on meme coins: While popular, they are driven by their speculative and entertainment-driven nature. Sure, you’ll find stories of investors profiting off these, but it’s important to approach them with caution.

Trading Pairs

Bitget offers a wide variety of trading pairs — both crypto-to-crypto and fiat-to-crypto. All told, Bitget has over 650 trading pairs, including some most common pairs such as BTC/USDT ETH/USDT and ETH/BTC.

Each digital asset the exchange lists is regularly reviewed for quality assurance to ensure it adheres to the platform’s standards. Bitget takes into account a number of factors such as:

- Trading volume and liquidity

- Team involvement in the project

- Development of the project

- Network or smart contract stability

- Activeness of the community

- Responsiveness of the project

- Negligence or unethical conduct

A wide variety of trading pairs offers investors a plethora of benefits:

- Market access and liquidity

- Diversification

- Customer attraction and retention

- Opportunities for various trading strategies

Understanding Bitget Fees

Bitget’s fee structure is pretty straightforward and easy to understand. For starters, the exchange doesn’t charge fees for crypto deposits but does for everything else.

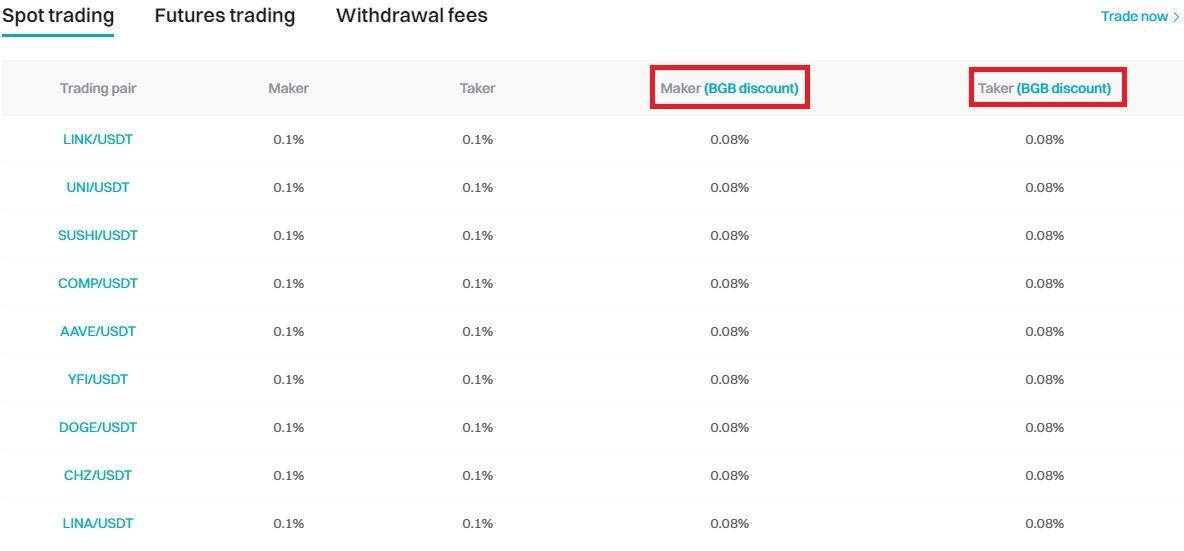

- Spot trading: Each trade carries a standard trading fee of 0.1% for both makers and takers. This fee will be reduced if you pay with Bitget’s native BGB token (more on that later).

- Futures trading: Each trade will carry a transaction fee of 0.02% for makers and 0.06% for takers. Unlike spot trading, there’s no BGB discount here.

- Withdrawal fees: These fees are automatically adjusted based on the status of the market.

We've also covered Bitget exchange fees in great detail.

Using BGB for Fee Discounts

BGB is Bitget’s native token that powers its ecosystem. If you use BGB in spot trading, the maker and taker fees will be reduced by 20% to 0.08%.

Using BGB in Spot Trading Shaves Off The Maker and Taker Fees By 20%. Image via Bitget

Using BGB in Spot Trading Shaves Off The Maker and Taker Fees By 20%. Image via BitgetWhile it’s unfortunate that the same discount isn’t extended to futures trading a la Binance, which shaves 10% off its futures trading fee, it’s still better than no discount at all especially considering the fact that most people engage in spot trading than futures trading.

Nobody likes paying trading fees, but they’re an important aspect of maintaining the Bitget ecosystem. Nevertheless, the exchange is very transparent about its fees. For an exhaustive list of Bitget fees, you can check out its fee schedule.

We've written a review of the BGB token as well, covering its utility, price history and how it's used in the Bitget ecosystem.

Security and Trustworthiness of Bitget

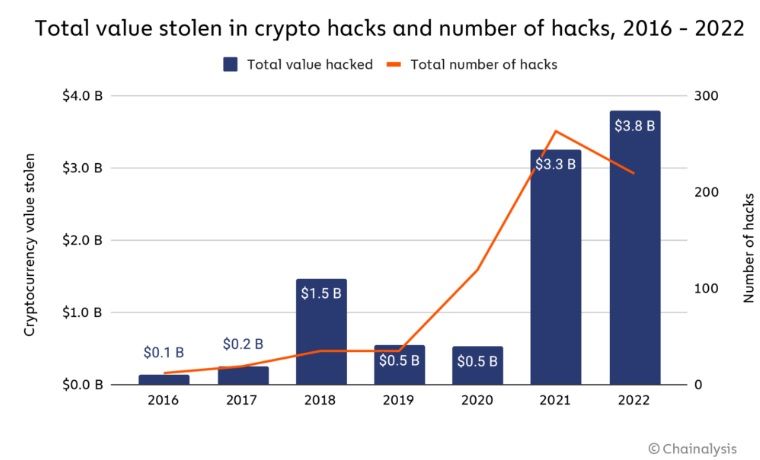

Here’s an interesting fact: Since Bitget’s founding in 2018, it hasn’t had any security incidents.

Not many exchanges can make that claim. Binance, whose example I cited above in the fee section, suffered a $570 million hack in October 2022. More recently Huobi (now HTX), was hacked for $7.9 million on Sept. 24.

All in all, 2022 was a pretty bad year for crypto, with hackers stealing $3.8 billion in total with DeFi protocols being the biggest victims, according to Chainalysis.

Crypto Hackers Stole $3.8 Billion in 2022. Image via Chainalysis

Crypto Hackers Stole $3.8 Billion in 2022. Image via ChainalysisOver at Bitget, the following security measures are in place:

Application level security

- Server security: The protection of information assets that can be accessed from a web server.

- Captcha: Website and user protection from automatic actions such as brute force and spam.

- Multi-factor authentication: An additional level of security that protects user accounts.

SSL/TLS connection

- Compliance with requirements: Checks for outdated SSL/TLS algorithms in server settings. Outdated algorithms allow hackers to decrypt user traffic and gain access to logins/passwords.

- Most recent SSL/TLS vulnerabilities and weaknesses: checks for the known SSL/TLS vulnerabilities. These vulnerabilities allow hackers to decrypt the traffic and gain access to logins/passwords, the server, private keys, etc.

- Presence of third-party content: If a website contains third-party content and uses HTTP transmission, an attacker can replace the transmission with another one and steal the accounts of users.

Domain security

- SPF domain records: Verifies the letter sender, and protects from forgery such as email spoofing.

- DNSSEC records: Protects users from a substitution of an IP address.

- Web application firewall: Protects exchanges from various attacks.

We have a dedicated article that examines Bitget's security measures.

Bitget Trading Tips for Beginners

I won’t sugarcoat this: Crypto trading isn’t a walk in the park. The asset class is volatile and prone to wild price swings. That said, there are still people who successfully trade crypto.

Here are a few tips to help make your foray into trading easy.

- Research for the win: You wouldn’t buy a car or insurance without doing some research, right? Before you start trading, you have to sink hours into learning about the financial markets, trading strategies and the crypto you’re looking to trade.

- Risk management: Don’t put all of your eggs in one basket. As a new investor, only invest when you’re willing to lose. Establish a risk tolerance level and stick to it. Remember stop-loss orders? They’re used as a means to limit potential losses.

- Have a goal: Before you start trading, you should have a clear goal. Paying for college? A new car? Whatever it is, it’s important to define your “why.”

- Keep emotions out: That meme coin’s pumping? Emotions can cloud judgment and lead to impulsive decisions. FOMO only leads to irrational decisions. Trading psychology is paramount to understand.

- Start small: Inexperienced investors should start with a small amount to test the waters or consider using a demo account. This minimizes risk as you gain experience and confidence in your trading abilities. Once you feel ready, you can let out your sails.

- Stay informed: It’s important that you keep a pulse on macroeconomic events, geopolitical developments and Gary Gensler’s crypto enforcement, which can all impact the industry as a whole.

Closing Thoughts

Bitget is a comprehensive crypto exchange platform that offers a range of products and features for both beginners and experienced traders. It supports various trading options, including spot trading, futures trading, and copy trading, catering to traders with different risk tolerance levels. It emphasizes ease of use, asset variety, and security, and has a transparent fee structure.

The exchange also places a strong emphasis on security, and its track record of no security incidents since its founding in 2018 is reassuring. The platform employs multiple security measures, such as multi-factor authentication, SSL/TLS encryption, and domain security, to protect users' assets and personal information.

👉 Sign Up for Bitget and Enjoy a 20% Discount on Trading Fees for Life!

Bitget's comprehensive offerings make it a viable option for those seeking a user-friendly and secure trading platform. Still, users should conduct due diligence, like comparing multiple exchanges and considering their requirements, before selecting an exchange.