As is the case in most countries buying Bitcoin in Canada can be accomplished in a number of ways. There are the obvious methods such as Bitcoin brokers and Bitcoin exchanges. There are also Bitcoin ATMs available, and peer-to-peer Bitcoin services that can be used.

All of these allow you to purchase and take possession of Bitcoin in your own personal wallet. Then there are the CFD brokers that allow you to speculate on the price of Bitcoin through financial derivatives called contracts for difference that do not convey any ownership of Bitcoin.

However most Canadians looking to invest in Bitcoin want to actually own the digital currency, and to help them out we’ve put together this review of the best ways to buy Bitcoin in Canada.

Image via Shutterstock

Image via Shutterstock In our research we found that one of the leading Bitcoin exchanges in Canada is Bitbuy, which we’ve covered before in this review Bitbuy is preferred for its low fees, top security, fast transactions, ease of use, and more.

And you can feel totally confident in buying Bitcoin in Canada. Even though digital currencies aren’t considered as legal tender money in Canada, Bitcoin is legal. According to the tax authorities in Canada there are tax rules for digital currency transactions, and Bitcoin and other cryptocurrencies fall under the Income Tax Act.

That means Canadians are free to buy, sell, and hold Bitcoin. It also means Canadian exchanges are regulated under anti-money laundering and counter-terrorism financing laws and users will need to complete appropriate KYC/AML procedures when purchasing Bitcoin in Canada.

With that out of the way let’s have a look at the top Bitcoin exchanges in Canada and find out how to buy Bitcoin in Canada.

Bitbuy

As one of the longest established Bitcoin and cryptocurrency exchanges in Canada it’s no wonder that we found Bitbuy to be superior for a number of reasons. One of those is the trust engendered by such a long-lived cryptocurrency exchange.

The Bitbuy website says they’ve been Canada’s trusted choice since 2016, and while that’s impressive, the fact is that Bitbuy started out as “InstaBT” all the way back in 2013. Now that might not seem so long ago, but in cryptocurrency terms that’s like going back to the earliest days of trading and exchange.

Main Features of BitBuy

Main Features of BitBuy Bitbuy follows a 95% cold storage policy, and secures all accounts with its 2FA security policy as well. Bitbuy clients can feel secure knowing they are dealing with an exchange that takes the security of their account and their Bitcoin very seriously.

Plus, Bitbuy doesn’t just offer Bitcoin for sale. Currently there are seven of the most popular and largest cryptocurrencies available for sale on the platform. These seven are Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), EOS (EOS), Bitcoin Cash (BCH), and Stellar Lumens (XLM).

All come with tight spreads thanks to the deep liquidity at Bitbuy (they access over 10 markets), and with the low fees (0.10% maker / 0.20% taker) that Bitbuy clients have come to appreciate.

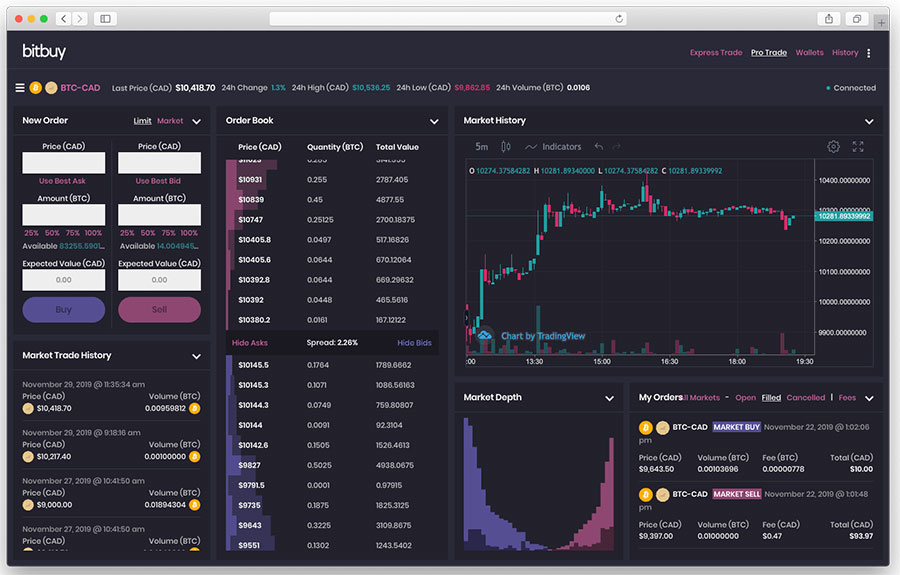

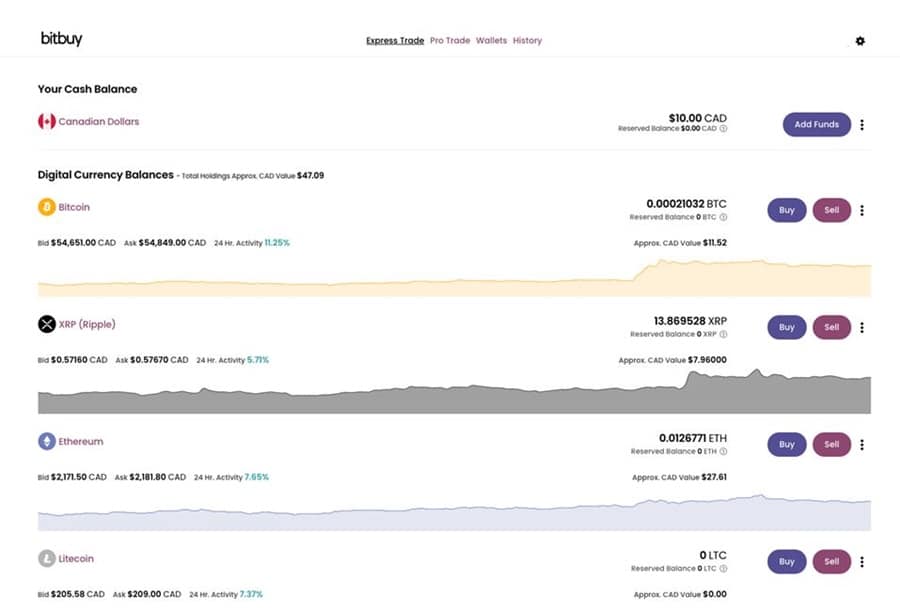

BitBuy's Advanced Trading Platform.

BitBuy's Advanced Trading Platform. Deposits and withdrawals at Bitbuy are done in CAD or in cryptocurrencies.

For fiat transfers in CAD there are two options: Interac e-transfer and bank transfer. Interac transfers come with a 1.5% fee on both deposits and withdrawals, while bank transfers come with a 0.5% deposit fee and a 1.5% withdrawal fee.

Cryptocurrency deposits can be made in any of the supported coins at Bitbuy and there are no fees. Withdrawals can also be done using any of the supported cryptocurrencies, and the user will be responsible for the mining fees, which vary by cryptocurrency.

If all of this sounds appealing let’s have a quick look at how to set up an account at Bitbuy in four easy steps.

1. Set Up Your Account:

We like Bitbuy for buying Bitcoin in Canada for all the reasons noted above. What really attracts us is the trustworthiness of the exchange, and all the effort they’ve put into security. It’s also incredibly easy to use, and even beginners will be able to quickly set up an account and start investing in Bitcoin, or any of the other six cryptocurrencies offered at Bitbuy. Plus, there’s a Pro Trading platform where advanced traders will feel more at home.

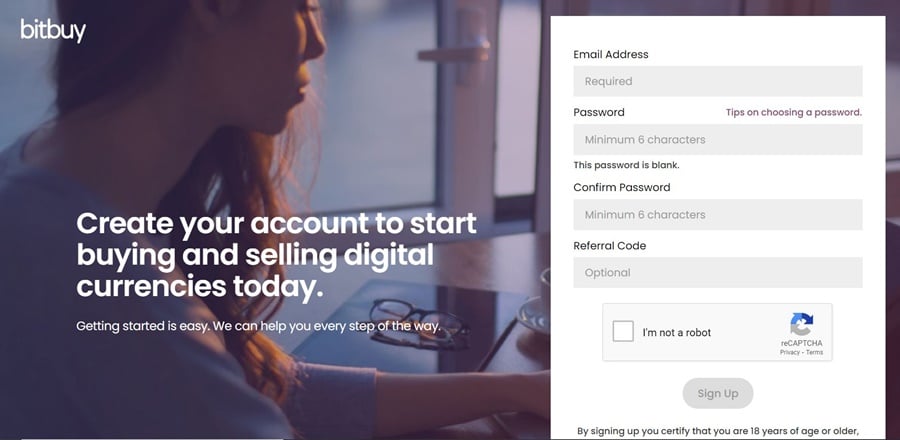

Clicking this link will take you to the Bitbuy homepage, where you’ll see the blue “Sign up to Get Started” button. Clicking it will take you to the screen shown below:

Registration at Bitbuy is quick and easy.

Registration at Bitbuy is quick and easy. Fill in the requested information and click the Sign Up button. Bitbuy will then send you an email with a link to click that will verify your email address and take you to the next step.

2. Verify Your Account:

After verifying your email you will be required to enter your phone number. This is where SMS messages are sent with codes to secure your account. After entering your phone number Bitbuy will immediately send a six digit code to the number entered. This code needs to be entered before you can continue.

Once that’s out of the way Bitbuy will ask you for some additional information. If you want to buy Bitcoin you’ll need to provide this information as it is part of the AML / KYC requirements in Canada. This also includes giving permission for Trulioo to verify your identity.

Trulioo is a third-party provider that will take the personal information provided and compare it with the information held in a number of external databases to verify your identity. This saves the hassle of scanning and submitting documents, but if Trulioo can’t locate you in the external databases you may be required to submit ID and residence documents.

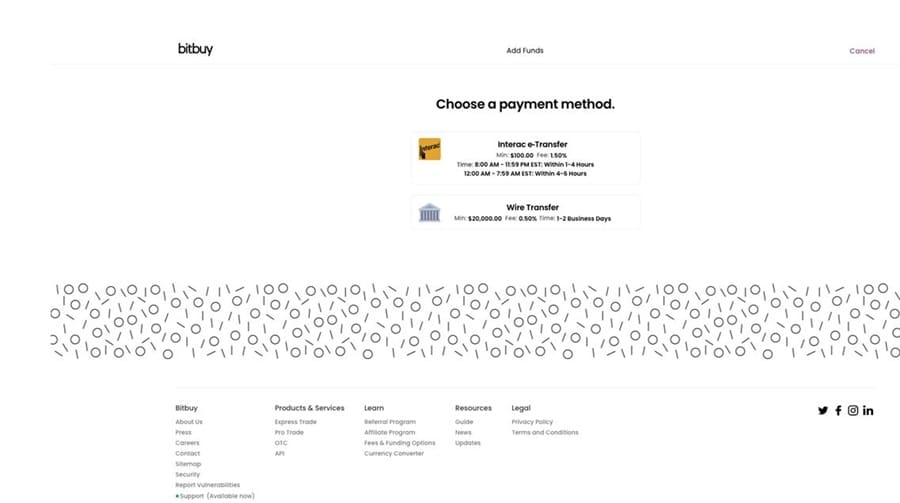

3. Adding Funds:

Next step after verifying your account will be to add funds. You can deposit CAD by clicking the “Add Canadian Dollars” link in your account dashboard, or you can deposit one of the seven supported cryptocurrencies if you already own them and want to use those cryptocurrencies to buy Bitcoin.

Fund your account in CAD or in cryptocurrencies.

Fund your account in CAD or in cryptocurrencies. 4. Purchase Bitcoin:

After completing a deposit you can go ahead and purchase some Bitcoin, or any of the other cryptocurrencies they support. Once you are on the home screen below just click the “Buy” button to purchase.

Buy and sell Bitcoin and six other popular cryptocurrencies.

Buy and sell Bitcoin and six other popular cryptocurrencies. Using the Express Trade feature will let you buy within seconds, but the fee is a bit higher than when using the Pro Trade feature. Any coins you purchase here go to your included Bitbuy wallet.

5. Sell Bitcoin

Bitbuy is also useful for selling Bitcoin and other cryptocurrencies. Simply go to the home screen as above and this time click the “Sell” button. You can sell your Bitcoin for another of the supported cryptocurrencies, or for CAD. You can also transfer supported cryptocurrencies that you purchased elsewhere and sell them on the Bitbuy platform.

Bitbuy is a very safe exchange, undergoing regular proof-of-reserves audits to ensure users' funds. They are also the only Canadian exchange to offer 1:1 BTC insurance thanks to their partnership with Knox.

Major International Exchanges

While we prefer Bitbuy over other exchanges we know that people do like to have some choice when dealing with their finances. With that in mind we also include the following international exchanges that can be used in Canada to buy Bitcoin.

Binance

Binance is one of the largest cryptocurrency exchanges in the world. Based in Malta, they have operations that span the globe, and offer their services in over 180 countries worldwide. It also lists nearly 300 different cryptocurrencies (including Bitcoin of course) and offers trading in nearly 1,000 different cryptocurrency pairs. They also have a Fiat-to-Crypto gateway that allows users in certain jurisdictions to purchase Bitcoin using more than 40 different fiat currencies.

As of March 2021 the exchange boasts more than 15 million users, and it settles roughly $4 billion a day on average, with the busiest days seeing over $20 billion in trading volume.

Main website of Binance.com.

Main website of Binance.com. One of the benefits of trading through Binance is that they offer some of the lowest trading fees that can be found for cryptocurrencies. Both market makers and market takers pay a low 0.1% fee, which can be reduced even further for those holding the native Binance Coin (BNB) token, or for referring new clients. There must be a lot of traders using BNB to get discounts as it has grown to be the third largest cryptocurrency by market cap.

Another feature at Binance that many traders like are the frequent promotions and bonuses offered by the platform.

One of the downsides to Binance is the lack of regulation for the exchange. Even though the exchange has put its own insurance into place for traders, it’s called the Secure Asset Fund for Users, if Binance were to go bankrupt there is no protections offered for any of its clients.

Overall Binance is a very good exchange, and you aren’t likely to find another that has as many features and offerings as Binance.

Coinbase

San Francisco based Coinbase is another large and popular global broker for buying Bitcoin and other cryptocurrencies. They are also a main competitor of Binance, although to be honest they have far fewer tools available, and offer far fewer cryptocurrencies.

Coinbase is far larger in terms of total users, with more than 30 million users, but is far smaller in terms of daily trading volume, with Binance outpacing them by as much as 10x on some days.

Coinbase has also recently announced that they will be going public, which to our knowledge will make them the very first publically traded cryptocurrency exchange.

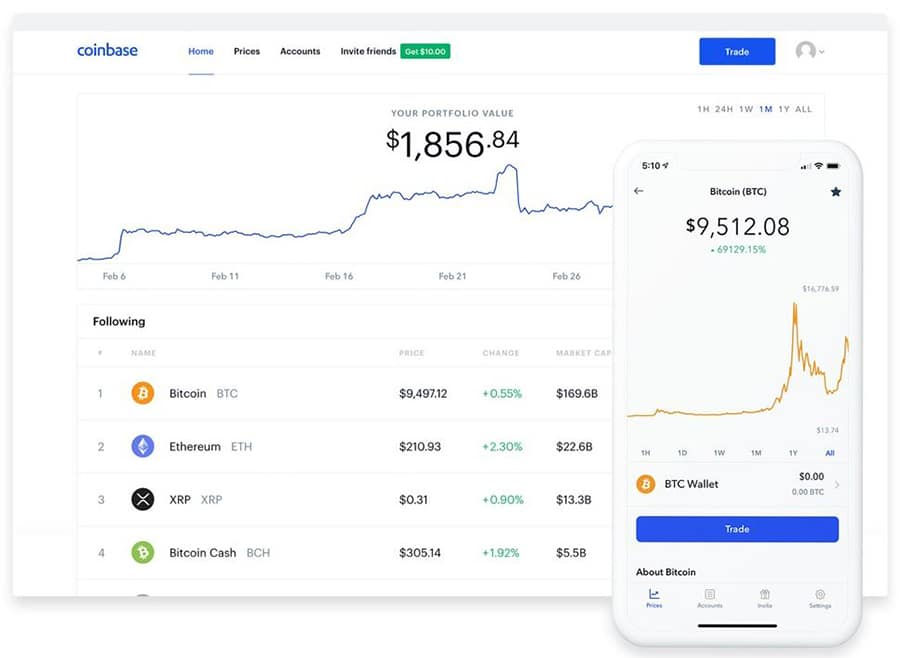

Coinbase Trading Platform on Desktop & Mobile

Coinbase Trading Platform on Desktop & Mobile We should also note that Coinbase has both a broker and an exchange service. The broker service is simply called Coinbase, and it is used to buy and sell coins directly from the broker. This makes Coinbase incredibly easy to use, and it contributed greatly to the early adoption of the platform and its rapid growth.

The downside to using Coinbase as a broker is the cost involved. Coinbase charges a either a variable fee of around 0.5% on transactions or a fixed fee, whichever is greater. The flat fees are as follows: for purchases less than or equal to $10, Coinbase charges a fee of $0.99; for purchases between $10-25, $1.49; for $25-$50, $1.99; and for $50-200, $2.99. In addition, for Canadians there is an additional variable fee for buying with a credit or debit card that is 3.99%.

There is also a traditional exchange known as Coinbase Pro, which is more technical and designed for experienced cryptocurrency users. Coinbase Pro uses an order book and you are buying and selling to other users just as you would at Binance or any other exchange.

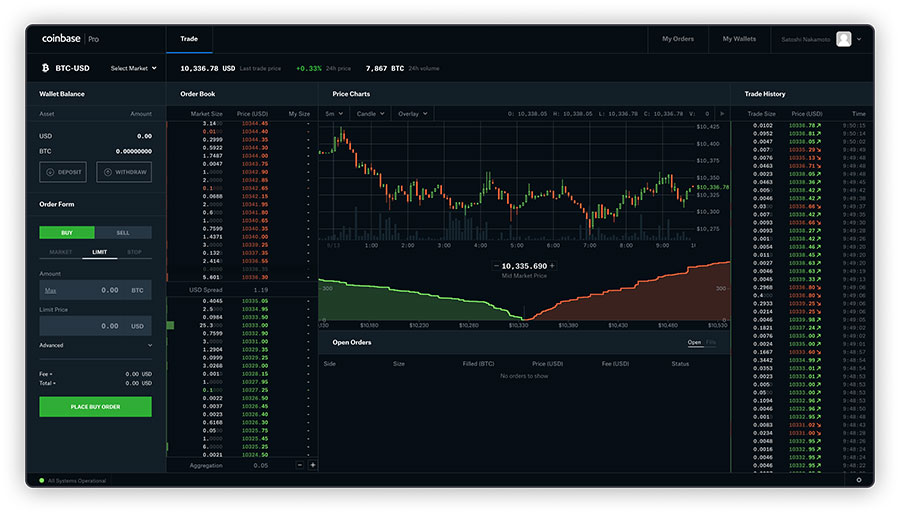

User Interface of Coinbase Pro

User Interface of Coinbase Pro While this is cheaper compared with Coinbase as a broker, it is still far more expensive than Binance. In fact, maker and taker fees are 0.5% for those who trade less than $10,000 per month. If you want to reduce the Coinbase Pro fees to match the 0.1% maker rate offered at Binance you would need to trade $100,000 per month. That’s nothing though. If you were looking to match Binance’s 0.1% taker rate you would need to trade $50 million per month.

On a more positive note there are no withdrawal fees to contend with at Coinbase Pro, and there are also no deposit fees as long as you are depositing and withdrawing cryptocurrencies, not fiat currency. If you do want to deposit or withdraw in fiat currency there’s a $10 fee for deposits and a $25 fee for withdrawals.

Gemini

Gemini is another international exchange based in the U.S., and unlike every other exchange it is actually backed by U.S. regulators. The exchange is owned by the Winklevoss twins, who are famous for once controlling 1% of the total Bitcoin supply.

Gemini was very careful to secure the backing of U.S. regulators, beginning with the New York Department of Financial Services. Gemini has also created and released its own stablecoin called the Gemini Dollar (GUSD).

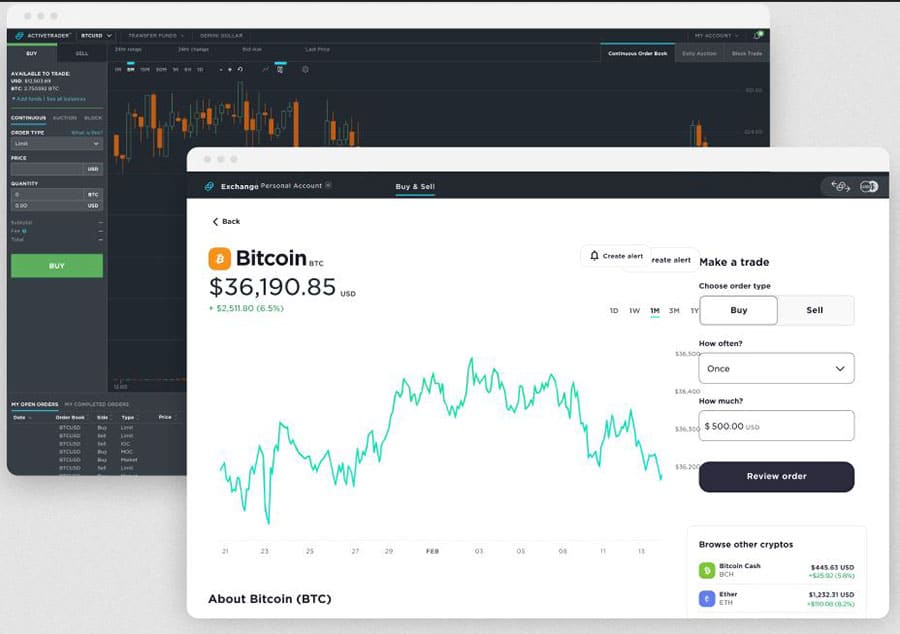

Gemini Simple & Advanced Trading Platforms

Gemini Simple & Advanced Trading Platforms Of course it isn’t cheap to secure regulation in the U.S. and that cost has led to high fees for Gemini users. Fees at Gemini rival those at Coinbase and transaction fees for trades less than or equal to $10, are $0.99; for purchases between $10-25, it’s $1.49; for $25-$50, $1.99; for $50-200, $2.99; and for greater than $200, it’s $1.49. In addition to transaction fees, there’s a “convenience fee,” which is 0.5 percent above the cost of the coin at the time of purchase.

Gemini isn’t really geared towards retail investors. Rather it is for wealthy investors and institutions. It offers a secure institutional custody service backed by New York Banking Laws. That custody service, which is used to store cryptocurrencies securely in offline wallets, has a global infrastructure. Gemini also offers insurance on cryptocurrency holdings, which is somewhat unique among exchanges.

Local Canadian Exchanges

Coinsquare

Coinsquare is a Toronto-based Bitcoin exchange that’s been in business since 2015. It is also the largest Canadian exchange by volume. Along with Bitcoin users are able to purchase a handful of other cryptocurrencies, including Litecoin and Ethereum. One benefit the exchange offers is the ability to purchase Bitcoin using CAD.

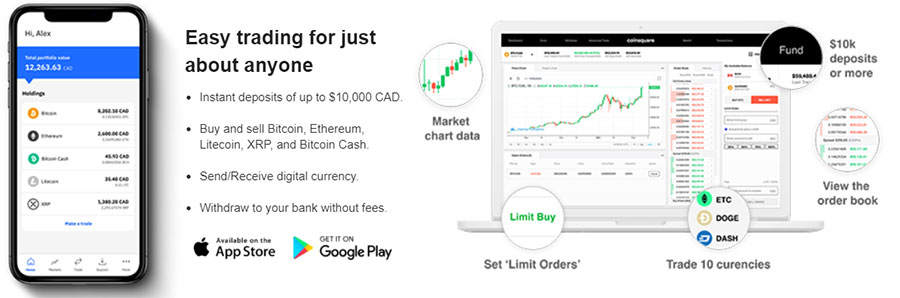

Coinsquare's Main Features

Coinsquare's Main Features It also has pretty competitive fees of just 0.2% on trades, and 2.5% on deposits using bank draft, Flexepin, or Interac. Transfers by wire have a 0.5% fee, but credit card deposits come with a hefty 10% fee. When it comes to withdrawals users are limited to direct bank deposits, and the fee is 2%, with a minimum transfer of $100. Alternatively a wire transfer can be used, but the minimum transfer is $10,000, while the fees are 1-2%.

Coinsmart

Coinsmart is also Toronto based, but it is fairly new, having launched in mid-2018. Coinsmart allows for Bitcoin purchases using CAD directly with a credit or debit card, although there is a 6% processing fee involved. Wire transfer funding is far better with no fees incurred.

There are also no fees for e-transfer deposits that are greater than $2,000, but deposits that are smaller than this incur a 1.5% fee. After funding your account there is a 0.2% fee on trades, and when you’re ready to withdraw there is a 0.0005 BTC fee. If it sounds like a lot of fees, we agree, it is.

Coinberry

Coinberry is FINTRAC registered for Bitcoin purchases and sales in Canada, and it’s been in business since 2017. It is competitive in terms of fees as there are none for deposits or withdrawals. It also offers plenty of funding methods, and deposits can be made via credit cards, wire transfers, or Interac e-transfers.

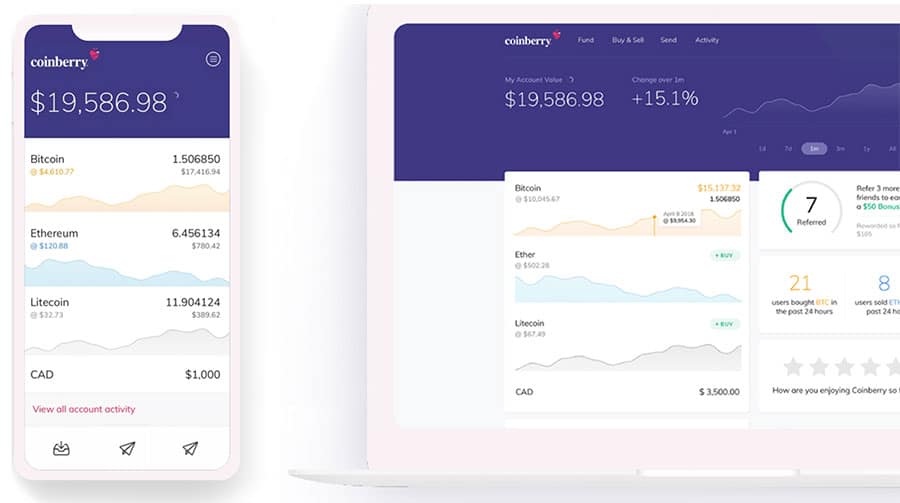

Coinberry Mobile & Desktop Trading

Coinberry Mobile & Desktop Trading Trades come with a 0.5% fee, so that’s a bit high. Also, credit card deposits are limited to $500, which won’t get you much Bitcoin these days. The platform also has a policy of locking withdrawals for 72 hours from the time of first deposit for first-time users in order to avoid fraud and money laundering. An interesting bit of history is that Coinberry’s partnership with the Town of Innisfil resulted in the first payment of property taxes with Bitcoin in Canadian history.

Shakepay

While many of the exchanges are Toronto-based, Shakepay is Montreal-based. It is superior to many other exchanges in its policy of allowing purchases and sales of Bitcoin free of any fees. That means no deposit fees, no withdrawal fees, and no trading fees. One downside is that Shakepay does not accept credit card deposits, only wire transfers and Interac e-transfers. Shakepay was launched in 2015 and is well-known for its excellent customer support.

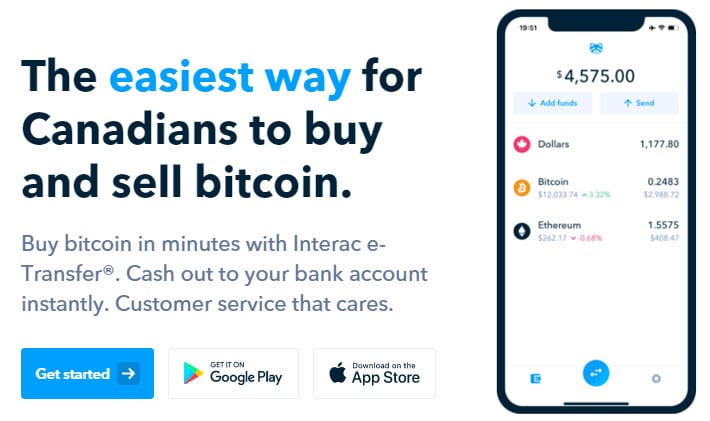

Shakepay claims to be the easiest way for Canadians to buy and sell Bitcoin.

Shakepay claims to be the easiest way for Canadians to buy and sell Bitcoin. Newton

Newton is another no-fee exchange that’s located in Toronto. It does not support credit card purchases, but users are able to connect their bank accounts to make purchases, or they can use wire transfers or Interac e-transfers. Newton claims to have the best cryptocurrency prices in Canada.

One positive for new cryptocurrency enthusiasts is the Newton platform is quite user friendly, streamlining buying and selling by only offering market orders. While there are indeed no actual fees charged, Newton makes its revenues in the spread, so users should be careful that they aren’t paying too much due to wide spreads from the exchange.

No fee crypto trading is good, but watch the spreads.

No fee crypto trading is good, but watch the spreads. Note that while deposits and trades are free of fees, the same is no longer true for withdrawals. Due to the huge increase in network fees Newton introduced something they call Surge Pricing in February 2021. With this they cover the first $5 in network fees and users are responsible for any additional amounts above $5. Newton also offers third-party custody for secure asset storage and is a registered money service business with FINTRAC in Canada and FinCEN in the US.

Conclusion

As you can tell from the broad choice of exchanges available, Canadians have certainly embraced Bitcoin. It’s quite easy, and in many cases also inexpensive, to purchase Bitcoin if you’re Canadian. Based on our own research, one of the best exchanges in terms of fees and service is Bitbuy. There are others who do well in terms of fees, but in the overall service and trading platform we have to give the nod to Bitbuy. We were also pleased that they are also the only Canadian exchange to offer 1:1 BTC insurance, which provides a level of security not found at other brokers.

We did notice that fees are most competitive for actual exchanges like Bitbuy. When dealing with the likes of Coinbase or Gemini, which function more like brokers than exchanges, fees can get quite expensive.

Overall Canadians have a very good selection of brokers, and anyone who wants to own Bitcoin shouldn’t find it too difficult, or too expensive to do just that.