Cryptocurrencies can come off as an untamed beast to newcomers, and buying Bitcoin or other digital assets can be a perplexing experience. The evolving nature of the crypto landscape, coupled with the plethora of platforms, wallets, and terminologies, can sow confusion.

As the largest coin, Bitcoin is typically the go-to digital asset for anyone looking to dip their toes into the world of crypto. However, it can be an unfamiliar landscape for someone used to traditional financial products. Thankfully, the experience of buying crypto has improved significantly over the years.

In this guide, we will show you how to buy Bitcoin in Canada and highlight some of the best exchanges.

Before we go any further, feel free to check out our picks for the best crypto exchanges and the best decentralized exchanges.

Best Exchanges to Buy Bitcoin in Canada

Here are our top picks if you're looking to buy Bitcoin in Canada.

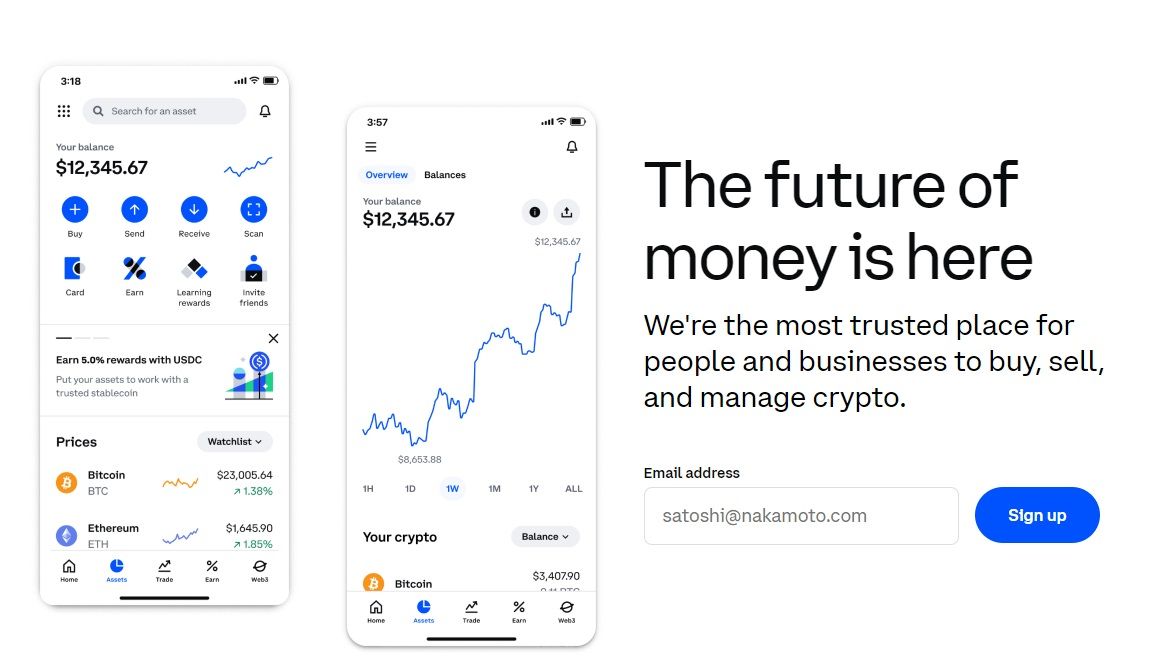

Coinbase

Coinbase was founded in June 2012 and went public in April 2021. Today, the exchange can be accessed in over 100 countries and it has $130 billion worth of assets on its platform.

Coinbased Is a Publicly Traded Crypto Exchange. Image via Coinbase

Coinbased Is a Publicly Traded Crypto Exchange. Image via CoinbaseIn addition to Bitcoin, users can also purchase other cryptocurrencies including Solana, Ethereum, Ripple and Cardano. Overall, the investment company support 233 coins and 391 trading pairs, according to CoinGecko.

In addition to trading crypto, Coinbase boasts several other products as well.

- Earn up to 10% APY on your crypto.

- Coinbase Card

- You can borrow up to $1 million from Coinbase using Bitcoin as collateral.

- Coinbase wallet

Coinbase is the most respected and regulated exchange in the world, holding firmly as the largest exchange in the United States as well. You can read about all that and more in our full Coinbase review.

Kraken

Founded in 2011, Kraken today boasts over 10 million clients and a quarterly trading volume of over $207 billion. The exchange can be accessed in over 190 countries.

Kraken is One of the World's Largest Crypto Exchanges. Image via Kraken

Kraken is One of the World's Largest Crypto Exchanges. Image via KrakenKraken stands out with its top-notch security, competitive trading fees, and a diverse selection of available cryptocurrencies (you can buy and sell 200+ crypto). This makes it an appealing choice for both novice investors and experienced traders.

For new users exploring Kraken, the beginner platform is a useful starting point. Advanced traders utilizing Kraken Pro benefit from not only very reasonable fees but also gain access to an extensive array of crypto trading markets. An additional advantage is the fee structure, which becomes more favourable as trading volumes increase.

Turning to security, Kraken ranks second on the crypto exchange security review site CER. Kraken is often our #1 recommendation for users looking for a beginner-friendly exchange or for those who prioritize security above all else as Kraken has the most robust security framework and is the only exchange that has been in operation since Crypto's early days and has never been hacked. Our full Kraken review covers everything you need to know about this exchange.

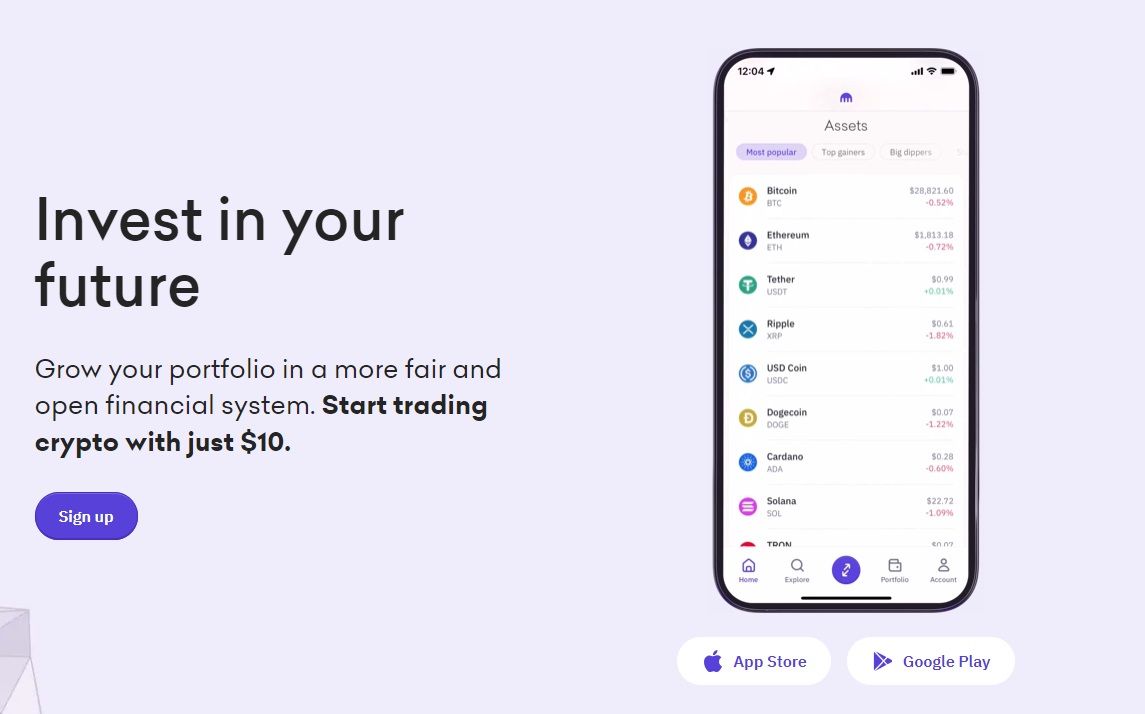

Crypto.com

Crypto.com lets you buy and sell more than 250 cryptocurrencies and you can trade with 20+ fiat currencies. The exchange is trusted by over 80 million users.

Crypto.com is The Most Secure Crypto Exchange. Image via Crypto.com

Crypto.com is The Most Secure Crypto Exchange. Image via Crypto.comOne notable strength of the platform lies in its comprehensive educational resources and in-depth research and analysis. Users can access valuable insights into the markets, along with regular educational updates.

Crypto.com's customer support options are primarily limited to chat support. While the platform excels in providing educational materials, users might find the customer support offerings somewhat lacking compared to other platforms that may offer a broader range of support channels.

Security-wise, Crypto.com ranks atop CER's ranking of the most secure crypto exchanges. Crypto.com is our #1 pick for users looking for an “all-in-one” crypto platform as they offer a crypto debit card, staking, trading, launchpad and more! You can learn about everything Crypto.com has to offer in our comprehensive Crypto.com Review.

BitPay

Established in 2016, Bitpay bills itself as Canada's “most secure and trusted platform” for crypto. All told, you can buy and sell 43 tokens through BitPay, and you can get started with as little as $50.

You Can Buy And Sell over 15 Coins Through BitPay. Image via BitPay

You Can Buy And Sell over 15 Coins Through BitPay. Image via BitPayBitPay is approved by the Ontario Securities Commission and the Canadian Securities Administrators as the first Canadian registered marketplace for cryptoassets. It is also registered with FINTRAC as a money services business. In addition, 90% of the crypto is kept secure in cold storage, and the company has a comprehensive insurance policy in place.

You can fund your account and withdraw through Interac e-transfer, bank wire and debit and credit card.

How to Buy Bitcoin in Canada

Here's how you can buy Bitcoin in Canada.

STEP 1: Open an Account

Once you've identified a suitable exchange, you can initiate the account creation process. Most platforms offer a user-friendly registration process, typically requiring your email address or mobile phone number. So, which one you should use to sign up? Whatever's more convenient for you.

Following the account creation, you'll undergo a verification process. Know Your Customer (KYC) measures are in place to verify your identity and ensure compliance with anti-money laundering regulations. This often involves submitting documents that prove your identity.

STEP 2: Deposit Funds

Once your account setup is complete, the next step in your cryptocurrency journey involves funding it. Strategic decision-making at this stage can contribute to a more efficient and cost-effective investment experience.

Exchanges offer a variety of options for depositing funds, and users make a choice based on their preferences and convenience. These options commonly include linking your debit or credit cards, P2P trading and direct crypto deposits.

Credit and debit cards are often the go-to choice for many users, primarily due to their speed and convenience in facilitating cryptocurrency purchases. However, users must exercise vigilance and closely monitor the associated fees. In our experience, funding your crypto account via a bank transfer is a more cost-effective alternative. In some cases, it may even be free of charge. It's worth noting, though, that this method usually entails a longer processing time, typically ranging between 3 to 5 business days for the funds to fully reflect in your account.

As you navigate the funding process, it's also advisable to engage in proactive communication with your bank, particularly when considering the use of a credit card for cryptocurrency purchases. Some financial institutions may classify such transactions as cash advances, resulting in the imposition of high interest rates and the absence of an interest-free grace period.

STEP 3: Buy Bitcoin

Once your account is funded, all that's left now is for you to purchase BTC. However, it's important to be aware of the various order types exchanges offer:

- Market Order: One of the most straightforward options available to users is the market order. This type of order is designed for swift execution, taking place immediately at the prevailing market price.

- Limit Order: This order type allows individuals to specify the exact price at which they are willing to buy Bitcoin. Unlike market orders, limit orders are executed only when the predetermined price is reached.

- Stop-Loss Order: Designed to mitigate potential losses, a stop-loss order triggers a market order to close a trade when the price falls to or below a predetermined stop price.

- Trailing-Stop Loss Order: This order employs a "trailing" mechanism, following the market price at a predefined distance or percentage. In contrast to a conventional stop-loss order, which maintains a fixed price level, a trailing stop-loss order is crafted to adapt its stop price automatically in response to the fluctuations in the market's price movements.

If you are looking to get into crypto for the first time you may find our following guides helpful:

- How to Build a Crypto Portfolio

- How to Build a Crypto Portfolio Using Modern Portfolio Theory

- Beginner's Guide to Technical Analysis

What Are The Fees to Buy Bitcoin?

The fees associated with purchasing Bitcoin can depend on several factors. Here are a few fees to be mindful of:

- Exchange Fees: Most cryptocurrency platforms impose fees for buying, selling, and trading digital assets, including Bitcoin. These fees can either be a percentage of the transaction amount or a fixed sum. Regardless, you should look into the fee schedule of the specific exchange you choose to ensure transparency in your transactions.

- Payment Method: How you fund your account can significantly influence the fees as well. Using a credit card or a payment service such as PayPal may result in higher fees compared to alternatives like bank transfers or cryptocurrency deposits.

- Withdrawal Fees: Should you plan to transfer Bitcoin to a personal wallet, you will likely encounter withdrawal fees on the exchange. Additionally, network fees, contingent on network congestion, may apply.

In addition, fees can also be influenced by:

- Transaction Size: Certain exchanges may implement tiered fee structures based on the size of your transaction. As a result, larger transactions could potentially incur higher fees, either as a percentage of the transaction amount or a fixed sum.

- Market Conditions: The cryptocurrency market is volatile, and during periods of heightened market activity, you might experience increased fees or wider spreads between buying and selling prices. It is essential to stay abreast of prevailing market conditions before executing any transactions.

Best Places to Store Bitcoin

Once you buy Bitcoin, it'll be stored in your on-exchange wallet. While this may seem convenient, it exposes users to various risks.

- Lack of Control: When you store Bitcoin in an exchange wallet, you're using a custodial wallet, which means you relinquish control over your private keys and, consequently, your funds. This lack of control leaves you vulnerable to the policies and potential financial challenges of the exchange. A stark example of this was witnessed in the collapse of the FTX crypto exchange, where millions of users lost access to their funds.

- Security Vulnerabilities: Exchange wallets are prime targets for hackers due to their centralized nature. Over the years, there have been notable instances of significant crypto exchange breaches, such as the $600 million hack of the now-defunct FTX on the day of its bankruptcy declaration and the $570 million loss suffered by Binance in October 2022. A compromised exchange could lead to the theft of your Bitcoin holdings.

- Exchange Insolvency: In the event of an exchange becoming insolvent or facing financial challenges, the safety of your Bitcoin holdings is at risk. Recovering assets under such circumstances can be a complex and uncertain process. The insolvency of an exchange could potentially result in the loss of your Bitcoin holdings.

Given these risks, using an off-exchanged self-custodial wallet would be the best choice. You can choose from hardware wallets, desktop wallets, and mobile wallets, depending on your preferences and needs.

Hardware wallets such as Ledger Nano X, Ledger Nano S Plus, and Trezor (One, Model T and Safe 3) are among the preferred choices due to their robust security features. These hardware wallets offer an elevated level of security, making them a solid option for keeping your Bitcoin holdings safe. Still unsure? We picked our top Bitcoin Lightning Network wallets.

You can learn more about wallets by reading about the types of crypto wallets available or how hardware wallets work before deciding on whether you need one.

We also go into far greater detail on the security strengths and weaknesses of crypto storage devices in our crypto safety guide.

Crypto Tax in Canada

The Canada Revenue Agency categorizes crypto as property, with gains subject to taxation either as business income or capital gains based on income tax rates. It is crucial to determine whether your transactions fall under the business category, as 100% of business income is taxable, while only 50% of capital gains are taxable.

Here's an example of a capital gain:

You purchase $20,000 worth of BTC. The price appreciates and you sell it later for $30,000. Here, you've made a $10,000 gain but only be liable for taxes on half of the profit ($5,000).

Certain crypto transactions are tax-free in Canada:

- Purchasing and holding crypto with fiat

- Receiving crypto as a gift

- Moving crypto between wallets you own

Despite the relative anonymity of crypto transactions, the Canadian government can trace them. Cryptocurrency exchanges are mandated to report transactions exceeding $10,000 to the CRA to ensure compliance.

Speaking of taxes, our article on crypto tax tools will help make tax time a breeze.

How to Buy Bitcoin in Canada: Closing Thoughts

This guide outlined the steps to buy Bitcoin in Canada, highlighting some of the best exchanges such as Coinbase, Kraken, Crypto.com, and BitPay. Each of these platforms offers solid features, security measures, and various options that cater to both novice investors and experienced traders.

When buying Bitcoin, users need to consider various factors, including account setup, depositing funds, and understanding different order types. Additionally, being aware of fees associated with transactions, payment methods, and withdrawals is essential for a cost-effective experience.