In January 2024, the world witnessed the most historic moment in the cryptocurrency industry since the emergence of the Bitcoin whitepaper in 2008 (or Bitcoin Pizza Day 🍕)- The SEC’s approval of Spot Bitcoin ETFs in the United States. The event marked the end of a longstanding battle between the SEC and Bitcoin supporters about its eligibility to permeate the walls of traditional finance.

AI Illustrating Bitcoin's Wall Street Entry

AI Illustrating Bitcoin's Wall Street EntryThe ETF approvals have established Bitcoin as a legitimate asset. Today, bitcoin is more accessible than it has ever been in history. Many investors who were initially reluctant to buy Bitcoin want in on the action. For instance, the top three wealth managers by assets under management are:

- BlackRock: $9.425 trillion

- Vanguard: $7.25 trillion

- Fidelity Management & Research: $3.88 trillion

Of these wealth managers, BlackRock (IBIT) and Fidelity (FBTC) offer Bitcoin ETFs already, potentially exposing their millions of clients to gain BTC exposure. If you are in the US and wish to buy Bitcoin, here is an updated guide to help you demystify the ideal pathway based on your preferences and considerations.

Factors to Consider While Buying Bitcoin

When considering the purchase of Bitcoin, several critical factors must be evaluated:

- Reason for Ownership:

- Price Potential: Some investors buy Bitcoin anticipating an increase in its value. This speculative approach is driven by Bitcoin's historical price trends and its potential for high returns despite its volatility.

- Asset Ownership: Others view Bitcoin as a digital asset and a store of value to hold as a part of a diversified investment portfolio and its intrinsic value as a digital asset.

- Alternative Monetary Asset: Many hold Bitcoin as an alternative asset that exists outside of the traditional monetary system. It is often considered a hedge against currency debasement risk, government collapse, inflation, authoritative overreach, and irresponsible monetary and fiscal policy.

- Currency- Bitcoin offers a more efficient means of value transfer over the traditional fiat system. Bitcoin is faster and cheaper to send internationally than fiat currencies and is more portable.

- Cost:

- Trading Costs: Frequent trading incurs costs like fees, spreads, commissions and interest. The impact of these fees can be significant, especially for frequent traders. If you are going to be actively trading, be sure to use a low-cost exchange.

- Downside Hedge: Traders may seek futures as a low-cost investment strategy to limit their downside with leverage. While derivatives can potentially multiply gains, they also expose the trader to heightened risk.

- Non-Custodial Ownership: ETFs, brokers, centralized exchanges, and many other platforms offer BTC, albeit with varying operation costs and degrees of asset ownership.

- Custodial Ownership: Direct ownership of Bitcoin, particularly through on-chain transactions, can be expensive due to network fees, especially during periods of high network congestion. Tip: Bitcoin Lightning Network can offer low-cost custodial ownership of Bitcoin. Coin Bureau has a guide to choosing the Best Bitcoin Lightning Wallets.

- Duration of Investment:

- Long-Term Holding: Storing Bitcoin in cold (offline) or hot (online) wallets is considered safer for long-term investment. Cold wallets offer better protection against hacking but are less convenient for regular transactions.

- Short-Term Trading: For those interested in short-term investments or trading, centralized exchanges (CEXs) or Bitcoin ETFs provide liquidity and ease of trading. However, these options can be less secure and more exposed to market risks.

- You can find a breakdown of the best crypto exchanges on Coin Bureau.

- Security:

- Evaluating the security of your Bitcoin investment is paramount. This includes the security measures of ETFs, CEXs, and wallets.

- ETFs and American-based centralized exchanges are regulated entities that typically have robust security protocols but are still vulnerable to broader market risks.

- Wallets, especially cold wallets, offer high security for direct Bitcoin ownership but require the user to be responsible for their own private keys and security measures.

- Privacy:

- On-Chain: Direct, on-chain ownership of Bitcoin offers more privacy, as transactions are recorded on the blockchain without revealing the parties' identities.

- Off-Chain: Buying Bitcoin via ETFs or some CEXs can involve less privacy as these entities often require personal identification and adhere to regulatory compliance standards.

- Technical Knowledge About Cryptocurrencies:

- Limited Knowledge: Investors with limited know-how surrounding blockchain technology may find dealing with wallets and decentralized applications a little overwhelming. Such investors are generally motivated by Bitcoin’s price action rather than its value as a digital asset.

- Sound Technical Knowledge: Investors who are already comfortable dealing with wallets and Dapps, and understand the intrinsic value of digital assets, may be more inclined to hold bitcoin on-chain. They are motivated by Bitcoin for its alternative properties, store and value and its price action.

In conclusion, buying Bitcoin involves carefully considering your investment goals, cost sensitivity, intended investment duration, need for security, and privacy preferences. Each method of buying and holding Bitcoin has advantages and risks, making it crucial to align your choice with your overall investment strategy and risk tolerance.

Where to Buy Bitcoin in the US

Residents of the United States have several Bitcoin exposure avenues at their disposal today. With brokerage accounts, payment channels, centralized exchanges, and ATMs all offering a means to buy cryptocurrencies, buying Bitcoin has never been this easy. We have curated a list of avenues to buy bitcoin from and matched it with several investor profiles that are ideal for each method. All you need to do now is to find a profile that best describes your preferences.

Bitcoin ETFs

Bitcoin ETFs Hit The Stock Market

Bitcoin ETFs Hit The Stock MarketBitcoin Exchange-Traded Funds (ETFs) are financial products that track the price of Bitcoin and are traded on traditional stock exchanges. These are ideal for investors looking for price potential without the complexity of handling actual Bitcoin. ETFs offer a way to invest in Bitcoin through a regulated framework, attracting investors who prioritize security and regulatory compliance.

Ideal Profile: Investors seeking exposure to Bitcoin's price movements without owning the asset directly. Suitable for those valuing security, ease of investment, and regulatory safeguards. It is ideal for long-term holding, particularly for those with limited technical knowledge of cryptocurrencies.

Financial Apps (PayPal and Venmo)

These apps allow users to buy, hold, and sell Bitcoin. They are extremely user-friendly and cater to individuals who are familiar with these platforms for other financial transactions. However, these platforms do not offer true ownership of Bitcoin; users cannot transfer the BTC out of their accounts.

Ideal Profile: Casual investors or beginners in cryptocurrency focused on price potential. Due to its ease of use, it is best suited for short-term trading and those looking for minimal exposure, but it has limited functionality regarding actual asset ownership and higher trading costs.

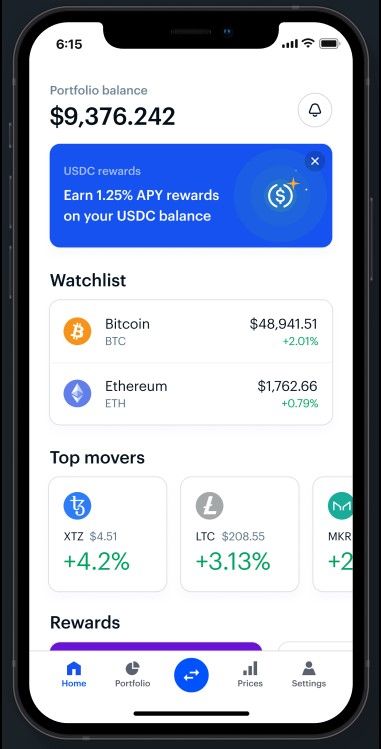

Centralized Exchanges (Coinbase, Kraken)

Coinbase is Among The Leading Crypto Exchanges in The US | Image via Coinbase

Coinbase is Among The Leading Crypto Exchanges in The US | Image via CoinbaseCentralized exchanges are the most popular platforms for buying, selling, and trading Bitcoin. They offer deep liquidity, high security, ease of use, and a range of trading options that are relatively easy to use. CEXs balance security (through regulation) and convenience but may have higher fees and less privacy.

Ideal Profile: Investors interested in both short-term trading and long-term holding. It is ideal for those with some technical knowledge who value security and ease of trading. Suitable for investors considering cost, downside hedge, and custodial ownership. Most CEXs also offer withdrawals to custodial wallets to retail complete ownership.

Coinbase

Coinbase is the largest crypto exchange in the US and the first crypto exchange to publicly list and offer shares on the US stock exchange, making Coinbase the most regulated and trusted exchange in the industry.

A Look at the Coinbase Homepage.

A Look at the Coinbase Homepage. Coinbase is praised for being beginner-friendly and offers a popular crypto debit card for those who want to spend crypto on the go. The platform attracts crypto-enthusiasts from all walks of life from traders to long-term holders. You can find out everything you need to know about Coinbase in our in-depth Coinbase review.

Kraken

Kraken is a fantastic Coinbase alternative and is often our recommended exchange for both US users and internationals. Kraken excels at being beginner-friendly while also having advanced options for more experienced traders.

A Look at the Kraken Homepage

A Look at the Kraken HomepageKraken has our seal of approval as they are the most secure exchange in the industry, being the only platform around since 2011 without ever being hacked or suffering a security breach. It also has fantastic customer service which is important, especially for new crypto users. You can learn more in our dedicated Kraken review.

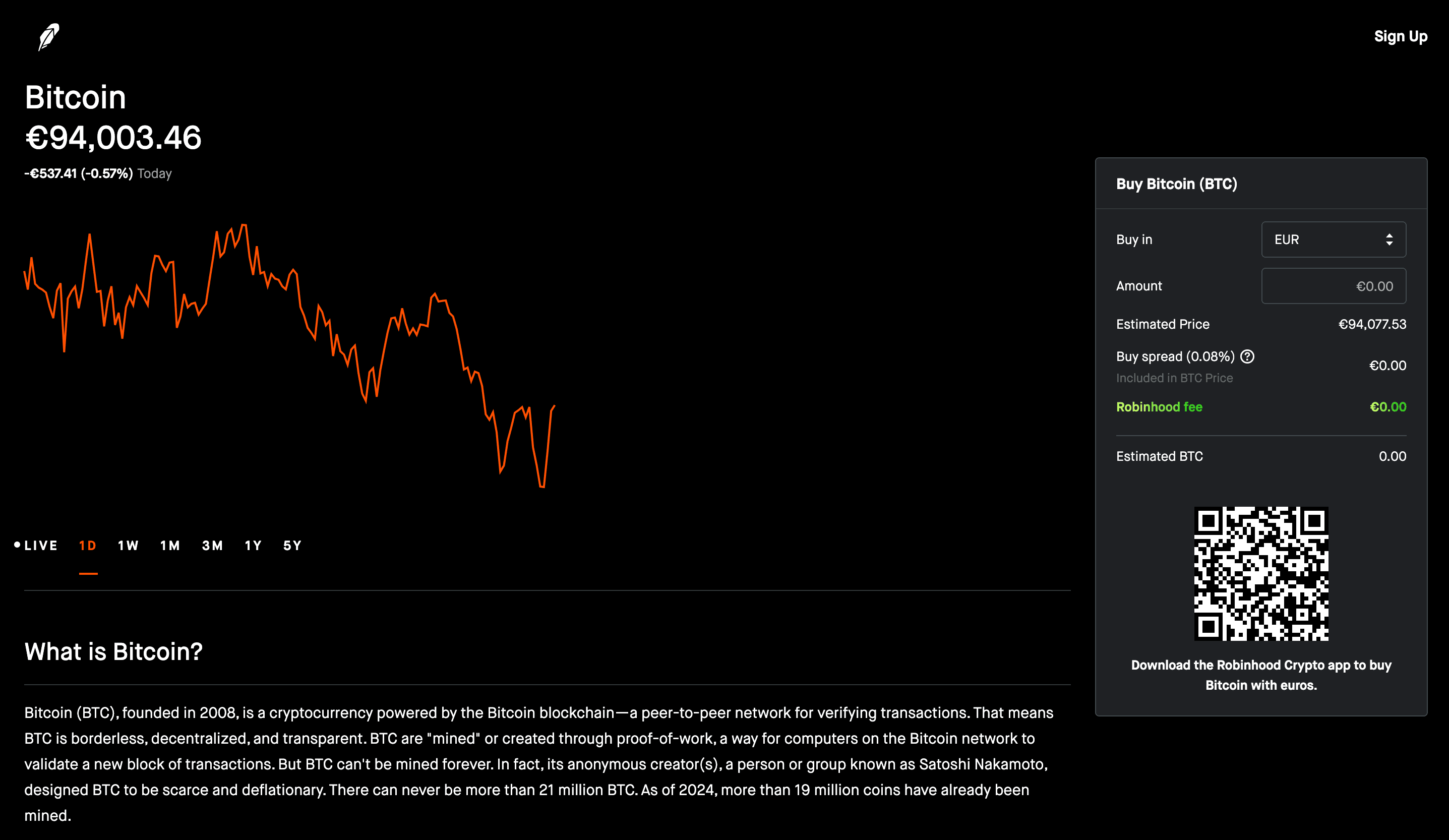

Trading Apps like Robinhood & eToro

You Can Buy Bitcoin on Robinhood. Image via Robinhood

You Can Buy Bitcoin on Robinhood. Image via RobinhoodTrading apps are similar to financial apps but are more focused on investment and trading. These platforms are user-friendly and integrate Bitcoin trading into a broader investment portfolio. However, they often do not offer actual Bitcoin ownership (similar to financial apps).

Ideal Profile: Investors focused on speculative trading and price potential. It is best for those with limited cryptocurrency knowledge, preferring a simple interface integrated with other investments.

eToro

eToro is a great platform for users who are familiar with trading and investing apps and want to avoid the learning curve that comes with using a centralized crypto exchange. eToro is not only user-friendly but also provides investors and traders with access to multiple assets outside of cryptocurrencies, making diversification possible in one place.

Image via etoro

Image via etoroeToro is a safe choice for US-based users thanks to strong regulations and a long-standing reputation in the market as one of the leading investment platforms in the world. We have a guide on How to Buy Bitcoin on eToro if you want to see the process in action.

Disclaimer: Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS:1769299) and is not FDIC or SIPC insured. Investing involves risk.

Buying Bitcoin On Chain

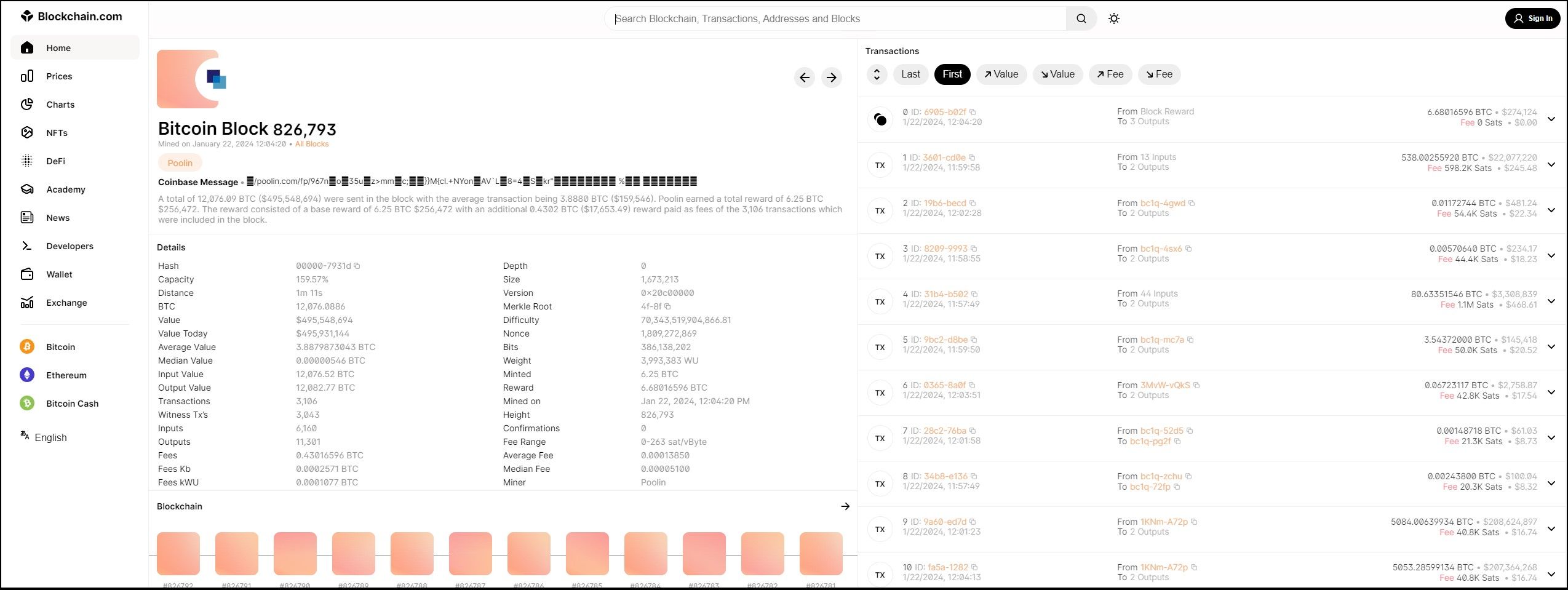

Numerous Bitcoin Transactions Settle Onchain Daily | Image via Blockchain.com

Numerous Bitcoin Transactions Settle Onchain Daily | Image via Blockchain.comPurchasing Bitcoin on-chain is facilitated by direct peer-to-peer trading without intermediaries. They offer high privacy and full control over one's assets. However, they require a good understanding of blockchain technology and come with risks like lower liquidity and less regulatory oversight.

Ideal Profile: Technically savvy investors seeking non-custodial ownership and valuing privacy. It is ideal for those who understand the intrinsic value of digital assets and are comfortable with the risks associated with lower regulation and potential security concerns.

You can try the peer-to-peer marketplaces on many of the leading centralized exchanges or use a non-custodial exchange like Bisq or Changelly to buy Bitcoin on-chain without centralized intermediaries.

Bitcoin ATMs

Bitcoin ATMs | Image via Coindesk

Bitcoin ATMs | Image via CoindeskBitcoin ATMs allow users to buy Bitcoin with cash or debit cards. They offer a quick and straightforward way to purchase Bitcoin but often incur high transaction fees. These ATMs provide a good mix of convenience and privacy, though they are unsuitable for large transactions.

Ideal Profile: Users seeking immediate transactions without technical knowledge. Suitable for small-scale investors focused on asset ownership and willing to bear higher costs for convenience.

Investor Profiles Based on Factors:

- Price Potential: Bitcoin ETFs, CEXs and DEXs, Financial Apps, and Trading Apps like Robinhood are suitable.

- Asset Ownership: Centralized Exchanges, Decentralized Exchanges, and non-custodial exchanges to be used with self-custodial wallets.

- Cost Concerns: Centralized Exchanges for frequent trading; Bitcoin Lightning Network for low-cost transfers.

- Downside Hedge: Centralized or Decentralized Exchanges or ETFs that offer futures and derivatives options.

- Duration of Investment: Long-term (cold storage wallets); Short-term (Centralized Exchanges, Bitcoin ETFs); Medium-term (Centralized Exchanges, ETFs)

- Security: ETFs and Centralized Exchanges for regulated security; Decentralized Exchanges and cold wallets for high-security & privacy-conscious investors and those looking to remove third-party risk.

- Privacy: Decentralized and non-custodial exchanges & Bitcoin ATMs for enhanced on-chain privacy.

- Technical Knowledge: Limited (Financial Apps, Trading Apps); Sound (Centralized and Decentralized Exchanges, direct wallet management).

Each method offers unique benefits and drawbacks, catering to different investor profiles based on their priorities, technical knowledge, and investment strategies.

How to Buy Bitcoin

This section will explain the steps to buy Bitcoin from the above-mentioned sources.

How to Buy Bitcoin ETFs

Buying a Bitcoin ETF in the United States involves several steps. Here's a step-by-step guide:

Step 1: Research and Choose a Bitcoin ETF

- Understand Bitcoin ETFs: Before investing, understand what a Bitcoin ETF is. A Bitcoin ETF tracks the price of Bitcoin, allowing you to invest in Bitcoin without owning the cryptocurrency directly. They are traded on the stock market.

- Research Available ETFs: Look for available Bitcoin ETFs in the U.S. market. Consider factors like the ETF's performance, fees, and the fund manager's reputation.

- The 11 Spot Bitcoin ETFs approved by the SEC are as follows:

- ARK 21Shares Bitcoin ETF (NYSE:ARKB)

- Bitwise Bitcoin ETF (NYSE:BITB)

- Blackrock’s iShares Bitcoin Trust (NASDAQ:IBIT)

- Franklin Bitcoin ETF (NYSE:EZBC)

- Fidelity Wise Origin Bitcoin Trust (NYSE:FBTC)

- Grayscale Bitcoin Trust (NYSE:GBTC)

- Hashdex Bitcoin ETF (NYSEARCA:DEFI)

- Invesco Galaxy Bitcoin ETF (NYSE:BTCO)

- VanEck Bitcoin Trust (NYSE:HODL)

- Valkyrie Bitcoin Fund (NASDAQ:BRRR)

- WisdomTree Bitcoin Fund (NYSE:BTCW)

Step 2: Select a Brokerage

- Choose a Brokerage Firm: Select a brokerage firm that trades Bitcoin ETFs. Consider factors like trading fees, platform usability, and customer service.

- Open a Brokerage Account: If you don’t already have one, open one. This will typically involve providing personal information and completing a verification process.

Step 3: Fund Your Account

- Deposit Funds: Transfer funds into your brokerage account. This can usually be done via bank transfer, credit/debit card, or other payment methods offered by the brokerage.

Step 4: Place an Order

- Log into Your Account: Access your brokerage account through the firm’s platform (website or app).

- Search for the ETF: Find the Bitcoin ETF you want to invest in by searching its ticker symbol.

- Place an Order: Decide how many shares you want to buy and place a buy order. You can place different types of orders, such as market orders (buy at current price) or limit orders (buy at a specific price).

Step 5: Monitor Your Investment

- Track Performance: Regularly check the performance of your Bitcoin ETF investment.

- Stay Informed: Keep up with news about Bitcoin, the cryptocurrency market, and any regulatory changes that might affect your investment.

Step 6: Selling Your ETF Shares

- Decide When to Sell: Based on your investment strategy, decide when it might be right to sell your ETF shares.

- Place a Sell Order: Through your brokerage account, place an order to sell your ETF shares.

How to Buy Bitcoin on Financial Apps

Here is a step-by-step guide on how to buy Bitcoin on PayPal:

Buying Cryptocurrency on PayPal Web Platform:

- Click Finances: Log in to your PayPal account and click on the "Finances" section.

- Click Buy: In the Finances section, find and click on the "Buy" option.

- Choose a Cryptocurrency: Select the type of cryptocurrency you want to buy (e.g., Bitcoin).

- Select Amount and Frequency: Choose the amount you want to buy and the frequency of purchase (Daily, Weekly, Biweekly, or Monthly). The frequency will default to One-time if not specified.

- Choose Payment Method: Select your preferred payment method (PayPal balance, a PayPal-linked debit card, or bank account) and tap "Next".

- Confirm Purchase: Click "Buy Now" to finalize the transaction.

Note: The PayPal mobile application also follows similar steps.

Buying Bitcoin on Centralized Exchanges

Buying Bitcoin on Centralized Exchanges involves typical steps like registering with the exchange and completing their KYC norms to verify your identity. Once verified, you can deposit funds and start trading cryptocurrencies. CEXs offer a myriad of deposit options, ranging from fiat to crypto. We have dedicated trading guides for the top centralized exchanges.

Buying Bitcoin on Trading Apps Like Robinhood

Here is a step-by-step guide on how to buy cryptocurrency, such as Bitcoin, on Robinhood:

- Create and Fund an Account: First, you need to create a Robinhood account and complete the Know Your Customer (KYC) process. Robinhood will provide instructions for this step.

- Open the App: Once your account is set up, open the Robinhood app.

- Search for Cryptocurrency: Go to the search bar and look for the cryptocurrency you wish to buy, or navigate to the cryptocurrency page on the app.

- Select a Cryptocurrency: Choose the cryptocurrency you want to buy (e.g., Bitcoin) and press “Buy.”

- Enter Purchase Amount: Input the amount of cryptocurrency you want to buy.

- Review Your Order: Select “Review” to check the details of your purchase.

- Submit Your Order: Swipe up to submit your order.

- Order Confirmation: After submitting your order, you will receive an order confirmation. Be aware that there is a delay between submitting an order and the transaction settlement, so ensure you have sufficient funds in your Robinhood account.

Additional Information

- Trading Fees: Robinhood is known for its commission-free trading for stocks and crypto. However, every crypto transaction includes a network fee, which varies depending on the cryptocurrency and current network activity. Robinhood notifies you of this fee before completing a transaction.

- Wallet Functionality: Robinhood Crypto transfers are available in most U.S. states, with some limitations. You can send up to $5,000 worth of crypto or conduct up to 10 total transfers per 24-hour period.

- Security and ID Verification: Robinhood implements security measures like cold storage for crypto assets. To enable crypto transfers, you must verify your identity and add two-factor authentication to your account.

- Tax Reporting: Keep crypto taxes in mind when trading on Robinhood. The platform provides cost-basis information to help you file your tax returns, depending on where you purchased the cryptocurrency.

Buying Bitcoin On Chain

Buying Bitcoin "on-chain" typically refers to purchasing Bitcoin directly on the blockchain, as opposed to using a centralized exchange or broker. This process usually involves using a decentralized exchange (DEX) or a peer-to-peer (P2P) platform. Here's a general step-by-step guide:

Step 1: Set Up a Bitcoin Wallet

- Choose a Wallet: Select a Bitcoin wallet that supports on-chain transactions. This could be a software wallet (like Electrum, Exodus, or Mycelium) or a hardware wallet (like Ledger or Trezor).

- Install and Secure Your Wallet: Follow the installation instructions. Make sure to securely store your private keys or recovery phrase.

- Tip: Take your pick from the five best hardware wallets in 2024.

Step 2: Find a Platform for On-Chain Transactions

- Choose a Platform: Select a decentralized exchange (like Bisq or Hodl Hodl) or a peer-to-peer platform.

- Create an Account: Register on the platform, if required. Some DEXs and P2P platforms might not require an account.

Step 3: Fund Your Wallet

- Deposit Funds: If you already own cryptocurrency, you can transfer it to your Bitcoin wallet. If not, you might need to buy Bitcoin using fiat currency on a P2P platform.

Step 4: Buy Bitcoin

- Find a Seller: On the chosen platform, look for offers to sell Bitcoin. Compare prices and terms.

- Place an Order: Once you find a suitable offer, place an order to buy Bitcoin. You might need to deposit funds into an escrow service if using a P2P platform.

- Make Payment: Follow the instructions to make a payment. This could be a bank transfer, cash deposit, or other payment methods accepted by the seller.

- Confirm Transaction: After making the payment, confirm the transaction on the platform. The seller will release the Bitcoin from escrow to your wallet.

Step 5: Transfer Bitcoin to Your Wallet

- Receive Bitcoin: The purchased Bitcoin will be transferred to your wallet address. This is an on-chain transaction.

- Verify the Transaction: Check your wallet to confirm that the Bitcoin has been received.

Step 6: Secure Your Bitcoin

- Backup Your Wallet: Ensure your wallet and its recovery information are securely backed up.

- Keep Private Keys Private: Never share your private keys or recovery phrase with anyone.

Additional Considerations

- Transaction Fees: Be aware of transaction fees on the Bitcoin network, which can vary.

- Security: Exercise caution when trading on P2P platforms. Use platforms with a good reputation and escrow services.

- Regulations: Be aware of the legal and tax implications of buying Bitcoin in your jurisdiction.

Final Note:

- Stay Informed: The cryptocurrency space is constantly evolving. Stay updated on best practices for security and compliance.

This process involves a higher degree of self-management and responsibility compared to using centralized services. If you're new to cryptocurrency, you might want to start with a more user-friendly method, such as a centralized exchange, before moving on to on-chain transactions.

Before choosing to use a self-custodial wallet or decentralized exchange, I would recommend getting familiar with our Crypto Safety Guide as there are plenty of pitfalls to be aware of.

Buying Bitcoin on ATMs

Buying Bitcoin through a Bitcoin ATM is a straightforward process, but it's important to understand the steps and requirements. Here's a step-by-step guide:

Step 1: Find a Bitcoin ATM

- Locate an ATM: Use a website like CoinATMRadar or a similar service to find a Bitcoin ATM near you. These services provide details about the location, operating hours, and supported transactions (buy and sell).

Step 2: Prepare for the Transaction

- Bitcoin Wallet: Have a Bitcoin wallet ready. This can be a mobile wallet, a hardware wallet, or a paper wallet. Ensure you have access to your wallet's QR code for receiving Bitcoin.

- Identification: Some ATMs require identification for KYC (Know Your Customer) compliance. This could be a government-issued ID or a phone number.

- Cash: Most Bitcoin ATMs accept cash, so have enough fiat currency to cover your intended purchase plus any transaction fees.

Step 3: Initiate the Purchase

- Verify Identity (if required): Follow the ATM’s instructions for identity verification. This might involve scanning your ID or entering a phone number.

- Scan Wallet QR Code: Use the ATM’s scanner to read the QR code of your Bitcoin wallet address. This ensures the Bitcoin you purchase is sent to your wallet.

- Insert Cash: Put the fiat currency into the ATM’s cash acceptor. The amount of Bitcoin you can buy will depend on the current exchange rate provided by the ATM.

Step 4: Complete the Transaction

- Confirm the Amount: Verify the amount of cash and the equivalent amount of Bitcoin you will receive. Be aware of the exchange rate and transaction fees, which can be higher than online exchanges.

- Complete the Purchase: Confirm the transaction on the ATM. The machine will process the transaction and send Bitcoin to your wallet address.

- Transaction Receipt: Take the printed receipt, if provided. It contains details about the transaction, including the amount of Bitcoin purchased and the wallet address to which it was sent.

Step 5: Verify the Receipt of Bitcoin

- Check Your Wallet: It may take a few minutes to several hours for the transaction to be confirmed on the Bitcoin network. Check your wallet to confirm that the Bitcoin has been received.

Additional Considerations

- Privacy and Anonymity: Bitcoin ATMs offer varying degrees of privacy. Some don’t require any personal information, while others may require ID verification.

- Transaction Limits: ATMs have limits on the amount of Bitcoin you can buy, which can vary by machine and location.

- Fees: Bitcoin ATM fees are typically higher than online exchanges. Fees can range from 5% to 15% or more.

- Support: In case of issues, use the contact information provided on the ATM for support.

Final Note:

- Safety: When using a Bitcoin ATM, ensure you are in a safe, public place. Be cautious of your surroundings, especially if carrying a large amount of cash.

Bitcoin ATMs provide a convenient way to purchase Bitcoin, especially for those who prefer cash transactions or value privacy. However, it's important to be aware of the higher transaction fees and to understand the process before using one for the first time.

We have a Guide to Using Coinsource Bitcoin ATMs if you would like to get a better understanding of how Bitcoin ATMs work.

What are the Fees to Buy Bitcoin?

Here is a table comparing the fees associated with buying Bitcoin from the above sources. Remember that fees should not be your only factor while considering buying Bitcoin. Investors must also weigh the value of privacy and ownership with fees to find the best source for their preferences.

| Source | Estimated Fees | Notes |

| Bitcoin ETFs | 0.2% - 1.5% | Varies by ETF provider. Includes management fees. |

| Centralized Exchanges (CEX) | Average ~0.1% - 0.5% | Average fees for Binance.US, Coinbase, Kraken, OKX. Fees vary based on platform and trade volume. |

| PayPal | 10-2.5% for transactions under $200, sliding scale down to 1.5% for transactions over $1,000 | Includes spread and transaction fees. Lower fees for larger transactions. |

| Robinhood | 0% (free) | Robinhood offers commission-free trading, but prices may include a spread. |

| On-Chain | Varies (network fees) | Fees depend on the Bitcoin network congestion at the time of the transaction, typically high. |

| Bitcoin ATMs | 7% - 12% average | Varies by ATM location and operator. Typically higher than online platforms. |

Note: The fee structure is derived from information available in January 2024 and is subject to updations. Investors are advised to check the latest value before making any financial decisions.

Best Places to Store Bitcoin

The best places to store Bitcoin depend on your individual needs for security, accessibility, and control. Among the options mentioned earlier, only on-chain storage offers complete autonomy over where to store your Bitcoin. This method allows for full control of your private keys and, consequently, your assets. By now, you likely have a clearer picture of your preferred storage option based on your requirements and risk tolerance. If you've decided on on-chain storage, numerous resources are available to guide you. For example, Coin Bureau offers insights on the best hardware wallets of 2024, which can provide robust security for your Bitcoin. Remember, the choice of storage should align with your security needs and ease of access preferences.

Crypto Tax in the US

In the U.S., Bitcoin and other cryptocurrencies are treated as property for tax purposes, according to the IRS. This means that they are subject to capital gains tax. When you sell, trade, or otherwise dispose of Bitcoin, you must report the capital gain or loss. The amount of tax depends on how long you held the Bitcoin (short-term for less than a year, and long-term for more than a year) and your income tax bracket. Additionally, receiving Bitcoin as payment or mining it is taxable as income at its fair market value. It's important to keep detailed records of transactions to accurately report and calculate potential taxes. For comprehensive and specific guidance, it's advisable to consult the IRS website or a tax professional.

We highly recommend using crypto tax software to keep track of your crypto tax obligations. These tools can automatically integrate with your crypto wallets and platforms to accurately categorize and classify your transactions in real-time and without you needing to lift a finger. Crypto tax software can save hours of your time come tax time and ensure compliance, the sooner in your crypto journey you adopt a tax platform the easier your life will be. We have a list of the 7 best crypto tax tools on the market.

How to Buy Bitcoin in the US: Closing Thoughts

As we conclude this guide, it's vital to recognize that the journey into Bitcoin investing encompasses various aspects, from understanding buying options like ETFs, CEXs, and direct on-chain purchases to considering the tax implications set by the IRS. Each method carries its unique features, costs, and security measures. Importantly, storing your Bitcoin securely, be it through hardware wallets or other means, is crucial for safeguarding your investment.

This guide aims to educate and provide a foundational understanding of Bitcoin investment in the U.S. However, it's essential to remember that this is not financial advice. Your financial decisions should be made based on your research and, if needed, with advice from financial professionals. Stay informed and approach your Bitcoin journey with diligence and a clear understanding of your investment goals and risk tolerance.

Enjoyed this content? If you want to hear more from us and get up-to-the-minute updates and behind-the-scenes content, feel free to check out our Socials Channels, Discord, and Resource Hub.