Bitcoin ATMs, or Bitcoin Teller Machines (BTMs), provide user-friendly way to purchase and sell cryptocurrencies.

BTMs are designed with simplicity in mind, featuring intuitive interfaces that guide users through the process. This ease of use will play an instrumental role in introducing newcomers to the crypto world as it eliminates the perceived complexity associated with crypto exchanges.

Coinsource is one such operating in the BTM space. In this Coinsource guide, we'll touch on its fees, locations and show you how to use a Coinsource BTM.

What are Bitcoin ATMs?

Owned and operated by third-party companies, Bitcoin ATMs are self-service kiosks that allow you to purchase and, in some cases, sell Bitcoin. Depending on the machine's operator, Bitcoin ATMs may have varying levels of identity verification, and some operators require customers to have an existing account with their service.

Featuring a user-friendly interface, these ATMs allow information input through either a touchscreen or a keypad. Users can engage with these ATMs by inserting cash or utilizing a debit card to convert their conventional fiat currency into Bitcoin. Credit cards aren't accepted due to chargeback issues.

As you're aware, cryptocurrency transactions take place outside the boundaries of traditional finance. When you use such an ATM, it doesn't dispense BTC (which exists digitally). Instead, the corresponding BTC is transferred to your wallet address.

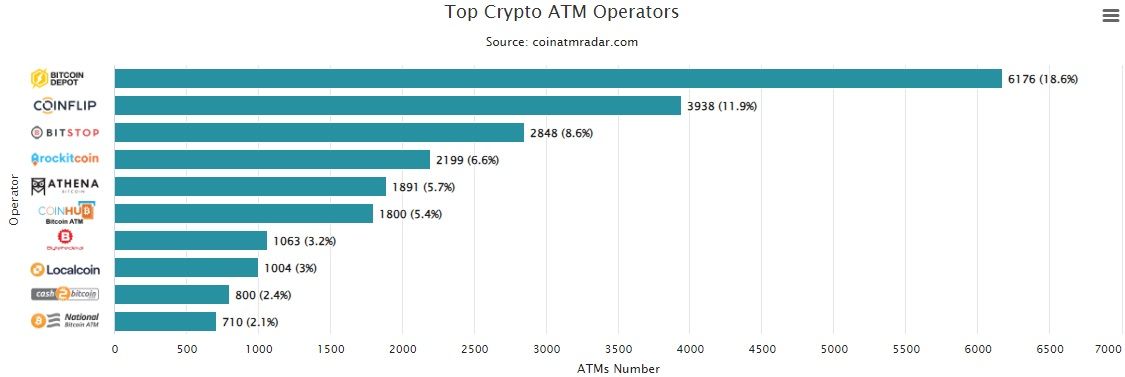

Crypto ATMs have grown at warp speeds. As of January 2017, there were only 970 such ATMs across the world. Fast forward to Dec. 3, 2023, and the total stands at over 33,000. Today, the top 10 crypto ATM operators run 22,429 kiosks, or 67.6% of the total. There are 496 other operators, who run another 10,764 crypto ATMs, representing 32.4% of the total.

With about 6,200 ATMs, Bitcoin Depot is the world's largest crypto ATM operator.

Bitcoin Deport in the World's Largest BTM Operator. Image via CoinATMRadar

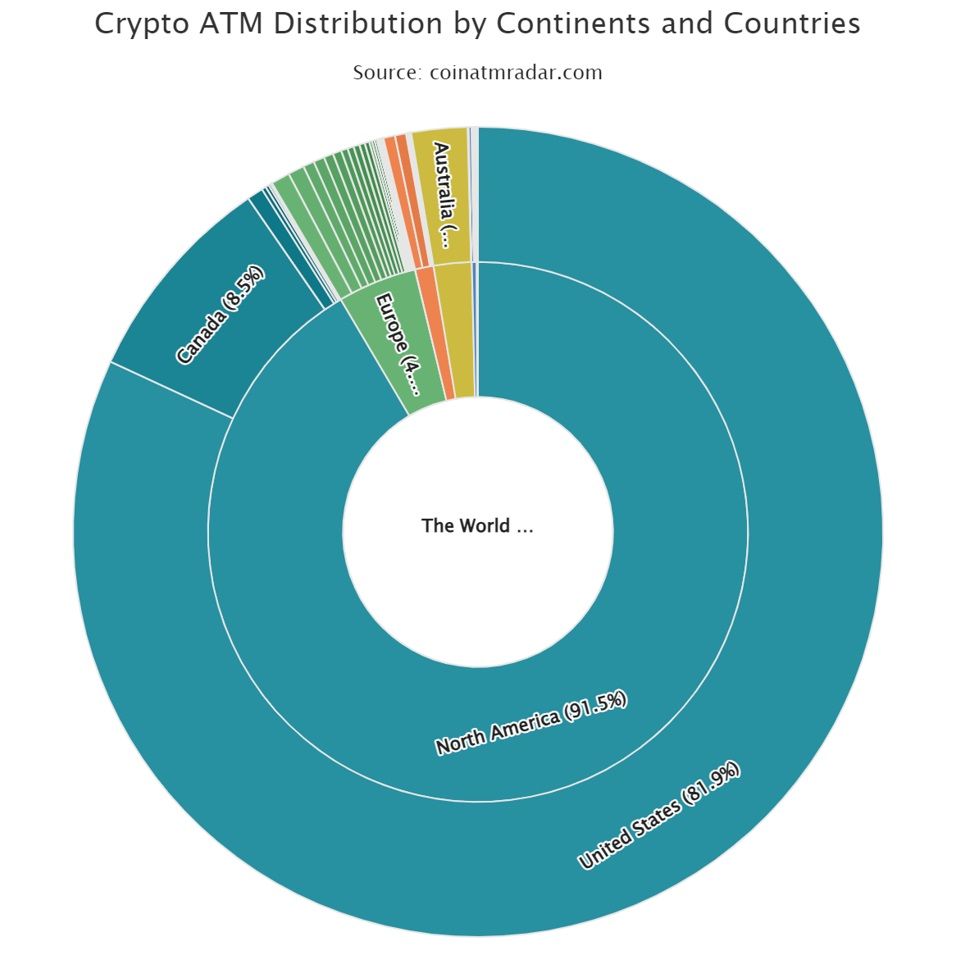

Bitcoin Deport in the World's Largest BTM Operator. Image via CoinATMRadarGeophrically, North America leads the pack with over 91% of the total count. The US makes up about 82% of the total crypto ATM market share.

North America Houses the Most Bitcoin ATMs. Image via CoinATMRadar

North America Houses the Most Bitcoin ATMs. Image via CoinATMRadarSo, where can you find these ATMs? In places that attract a lot of foot traffic like airports and shopping malls.

What is Coinsource?

Based in Texas, Coinsource operates hundreds of Bitcoin ATM locations across 45 states and D.C. that let you buy and sell BTC.

It all started in February 2015 when Coinsource launched its first Bitcoin ATM on the Las Vegas Strip as a test to gauge the crypto industry's viability. For reference, BTC's price on Feb. 28, 2015, was $254.26, according to Statmuse. It's safe to say both Coinsource and the crypto industry have grown leaps and bounds since then.

Coinsource Operates Hundreds of Bitcoin ATMs across the US. Image via Coinsource

Coinsource Operates Hundreds of Bitcoin ATMs across the US. Image via CoinsourceToday, Coinsource has grown to be a leader in the Bitcoin ATM industry. It is the only “full-service and fully compliant Bitcoin ATM operator” that offers solutions to anyone looking to own and operate their own network of cryptocurrency ATMs.

In November 2018, Coinsource secured a virtual currency license from the New York Department of Financial Services. At the time, Coinsource operated 40 kiosks in the state allowing users to buy and sell Bitcoin.

While Coinsource currently only has a presence in the US, it plans to eventually expand its footprint internationally.

Coinsource Locations

Bitcoin ATMs aren't as widely available as traditional ATMs that deal with fiat money.

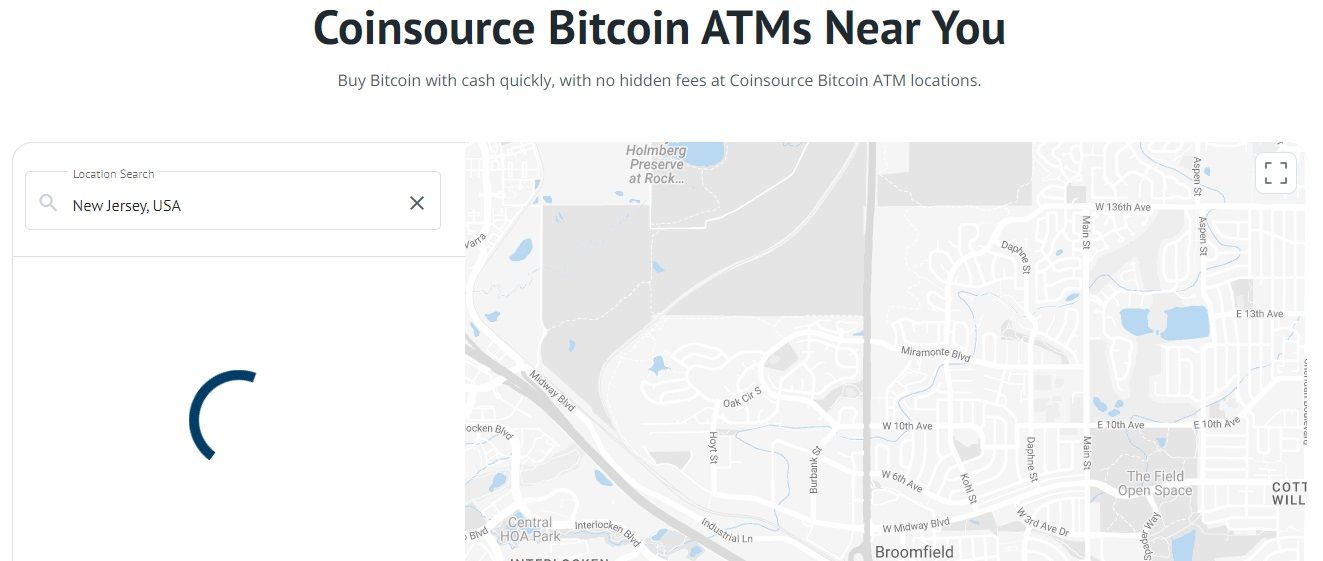

Coinsource hosts an ATM locater on its website. However, I haven't been able to make it work. I added New York, New Jersey and Washington as my location, but wasn't shown any results.

The Coinsource ATM Locator Doesn't Appear to Work. Image via Coinsource

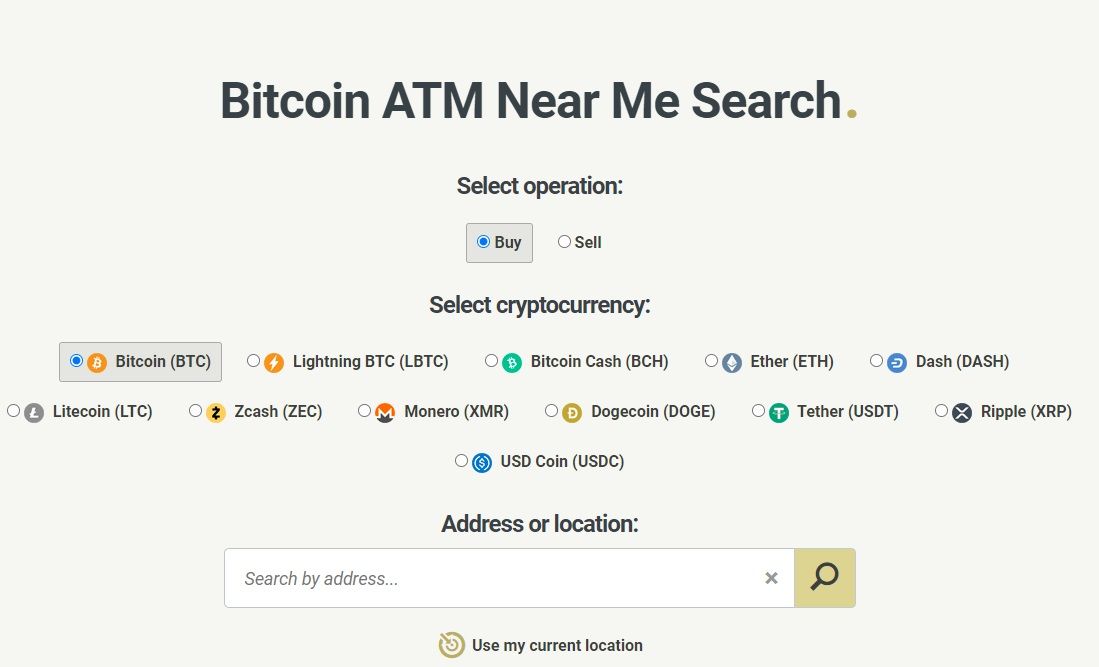

The Coinsource ATM Locator Doesn't Appear to Work. Image via CoinsourceThankfully, services like CoinATMRadar can help you locate BTMs in the U.S. I added New Jersey as my location, and was shows results in a few seconds that included the ATM's fees and daily limits, where available.

Platforms like CoinATMRadar Can Help You Locate BTMs in the US. Image via CoinATMRadar

Platforms like CoinATMRadar Can Help You Locate BTMs in the US. Image via CoinATMRadarCoinsource ATM Fees

Unfortunately, Coinsource isn't very transparent about the fees it levies on the user, only saying it charges “low rates."

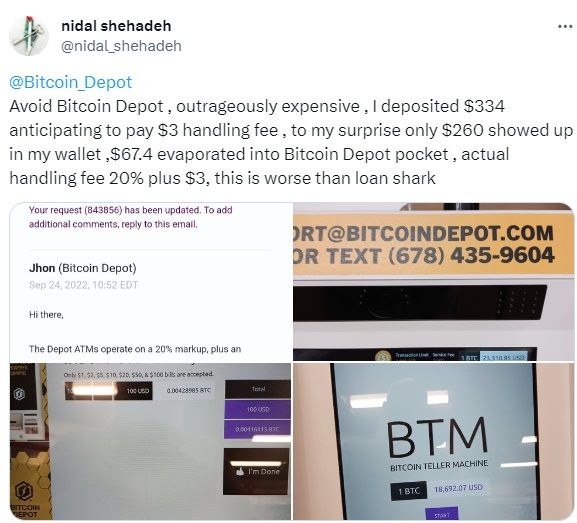

According to Crypto Dispensers, crypto ATMs charge a fee of 10% to 23% of the total amount. For example, if you deposit $500, you'll lose $115 to fees and receive BTC worth $385. An investigation by nonprofit Truthout found that Bitcoin Depot, which operates the largest crypto ATM network, charges a 20% markup as well as a $3 handling fee. The customer is only made aware of the handling fees.

Bitcoin Depot Charges High Fees to Use its BTMs. Image via X

Bitcoin Depot Charges High Fees to Use its BTMs. Image via XAs someone who's bought some coins via an exchange, these fees are criminally higher. According to crypto exchange Bybit, buying and selling crypto typically incurs fees of between 0.05% and 0.25% of the transaction volume. Using the same $500 example above, you would pay just $1.25 in fees at the high end when transacting with an exchange.

If you're looking to buy Bitcoin or another crypto through an exchange, you can check out our picks for the best crypto exchanges.

How to Use Coinsource

Using a Coinsource ATM is very much like using a traditional ATM except that you get BTC instead of cash.

How to Setup a Coinsource Account

Creating a Coinsource account only requires your government-issued state ID or driver's license. It's important to note that Coinsource doesn't accept foreign IDs, city IDs or passports.

With that out of the way, this is what the process entails.

Fill out the Coinsource enrollment form starting with your phone number. To ensure you're using the same number, Coinsource will send a six-digit code via text message.

Then comes identity verification so Coinsource can ensure it complies with all state and federal banking regulations. The company says it keeps this information confidential and doesn't share it with any third party.

Once you've uploaded the front and back of your state ID card, you're good to start transacting at any Coinsource Bitcoin ATM in the US.

IMPORTANT: Make sure there aren't any glares or obstructions like a thumb or a finger in the photo. Also, Coinsource doesn't accept any pictures with filters.

How to Buy Bitcoin with Cash

Buying Bitcoin via an ATM works a lot like using your debit card to get cash. However, instead of your card, you'll insert cash to get BTC.

Right, back to the agenda at hand. This is how you can buy Bitcoin with cash.

- STEP 1: Enter the amount you're looking to pour into BTC. You can transact as little as $5 and as much as $8,500 per day from a Coinsource ATM.

- STEP 2: Provide your Bitcoin wallet address. BTMs have a camera, which can be used to scan the QR code of your Bitcoin wallet address. Also, check out our top picks for Bitcoin wallets if you're undecided on which one to choose. We've also laid out the best Android Bitcoin wallets.

- STEP 3: Pay. Coinsource currently only lets you pay in cash. The company says it doesn't charge any hidden fees or inflate Bitcoin prices.

Once you've paid, the corresponding amount of Bitcoin will be transferred to your wallet. Coinsource says you'll receive your Bitcoin "within minutes." However, that claim appears to be all bark and no bite.

According to a Reddit thread, a user shared their experience of using a Coinsource ATM. While you're told you'll have BTC within an hour, this user got theirs in eight hours. The comment section is full of users sharing similar experiences. One user had to wait 24 hours, while another said they got Bitcoin in 48 hours. Another theme in the post is Coinsource's lacklustre customer service, which tends to stop responding.

The company has a dismal 2.5-star rating on Trust Pilot with users sharing similar experiences.

Whether you choose a Bitcoin ATM or exchange to make your BTC purchases, you're going to need a good crypto wallet. Check out our picks for top mobile Bitcoin wallets and our favourite hardware wallets.

Coinsource Licenses and Regulation

Coinsource is nationally licensed and federally regulated. Here's a table of its licences.

| State | License |

|---|---|

| Alabama | Money Transmitter License #620 |

| Alaska | Money Transmitter License #012206. |

| Arizona | Money Transmitter License #0950095 |

| Arkansas | Money Transmitter License #113515 |

| Florida | Money Transmitter License FT230000202 |

| Georgia | Money Transmitter License MT.0000331 |

| Illinois | Money Services License MS – 2019-0125 |

| Massachusetts | Check Seller License CS1573723 |

| Minnesota | Money Transmitter License MN-MT-1573723 |

| Mississippi | Money Transmitter License #3540 |

| New York | Virtual Currency Business Activity License #122509 |

| North Dakota | MT103570 |

| Ohio | Money Transmitter License OHMT 147 |

| Oregon | Money Transmitter License MTX-30189 |

| Puerto Rico | Money Transmitter License TM-081 |

| South Carolina | Money Transmitter License |

| Tennessee | Money Transmitter License #1573723 |

| Washington | Money Transmitter License 550-MT-107548 |

For disclosures related to some of these licenses, you can check out the Coinsource licenses page.

Coinsource Guide: Closing Thoughts

Coinsource, operating across 45 states in the U.S., allows individuals to buy and sell Bitcoin through its network of ATMs.

The expansion of Bitcoin ATMs globally, with over 33,000 in operation as of December 2023, highlights the increasing acceptance and demand for cryptocurrencies. North America, particularly the U.S., leads the charge with over 91% of the total count, showcasing a strong appetite for these decentralized financial solutions.

However, while Bitcoin ATMs offer convenience, they come with their own set of considerations. The fees associated with transactions, although not explicitly outlined by Coinsource, can be relatively high compared to traditional cryptocurrency exchanges. Transparency in fee structures is an aspect that could be improved industry-wide.

Coinsource's commitment to compliance is evident through its acquisition of a virtual currency license from the New York Department of Financial Services, demonstrating adherence to state and federal regulations. Despite this, user reviews and ratings on platforms like TrustPilot suggest room for improvement in customer service responsiveness.

As the industry continues to mature, addressing transparency in fees and enhancing customer experiences will be key factors in ensuring the sustained growth and success of Bitcoin ATMs.