Editor's note: We fully overhauled this guide in February 2026 to reflect how the “crypto vs gold” debate actually played out in 2025 and what’s changed in early 2026. The refresh includes updated price context for both assets, a clearer 2025 performance scorecard, new crisis-window comparisons (to stress-test the “safe haven” vs “digital gold” narrative), and expanded sections on regulation, ETFs, and central-bank gold demand. We also added a more practical portfolio framework (allocation ranges + rebalancing rules) so readers can translate the comparison into real-world risk management, not just headlines.

Executive Summary (Read This First)

2026 Verdict in 30 Seconds

Want crisis ballast? Pick gold. Want asymmetric upside and can stomach savage drawdowns? Use a small Bitcoin / large-cap crypto sleeve. Want both jobs covered? Run a hybrid and let rebalancing do the heavy lifting when headlines get loud.

Data Snapshot (As of Feb 10, 2026)

- Bitcoin: About ~$68,854, down ~12.6% vs Feb 2 (about ~$78,768 on CoinGecko’s 7-day history).

- Gold: Spot gold was trading around $5,020–$5,050/oz on Feb 10, 2026 (TradingView), putting it roughly ~+15% above its 2025 close of $4,368/oz, even after the early-February pullback from January highs.

Who It’s For

- Gold is for investors who want drawdown control, liquidity, and protection when macro risk spikes.

- Bitcoin / Large-cap crypto is for investors seeking upside who can remain disciplined through deep, fast drawdowns.

- Both is for investors who want a rules-based blend: gold for stability, crypto for convexity, and rebalancing to control risk.

What Changed in 2025

- Gold dominated: Front-month COMEX gold futures rose about ~64% in 2025, behaving like classic crisis insurance.

- Bitcoin lagged on a full-year basis: CoinGecko’s calendar-year data shows BTC down about -6.4% in 2025, despite setting a new all-time high.

- Stress exposed the difference: During liquidation-heavy episodes (notably Oct 2025), Bitcoin fell sharply while gold held or rose.

- Central banks stayed active: The World Gold Council estimates 863 tonnes of net central bank gold buying in 2025, reinforcing a structural demand floor.

Quick Decision Tool (mini flowchart)

- Need stability in a crisis? → Lean gold

- Can tolerate 50% drawdowns? → Small Bitcoin/crypto sleeve

- Want defense and upside? → Hybrid + rebalancing

- Worried about winners taking over? → Set drift bands and rebalance

We recently covered crypto and gold in our YouTube video, which you can watch below:

Methodology and Sources

Before we dive in, let's just lay out our method of research and our preferred sources for this particular topic.

How We Built This Comparison

We built this comparison using benchmark-grade market data and large, established institutional references. For gold, we primarily used datasets and market notes from the London Bullion Market Association and the World Gold Council. For bitcoin and crypto market statistics, we relied on widely used market data aggregators such as CoinGecko and CoinMarketCap, and we referenced CME Group materials when discussing futures mechanics like margins.

We used time windows that match how investors typically evaluate assets: full-year 2025 results, early-2026 context updates, and short “stress windows” for the crisis test. In plain terms, “volatility” describes how widely returns swing, “max drawdown” is the worst peak-to-trough fall, and “VaR” (if included) is a simple estimate of an unusually bad one-day loss based on historical behavior.

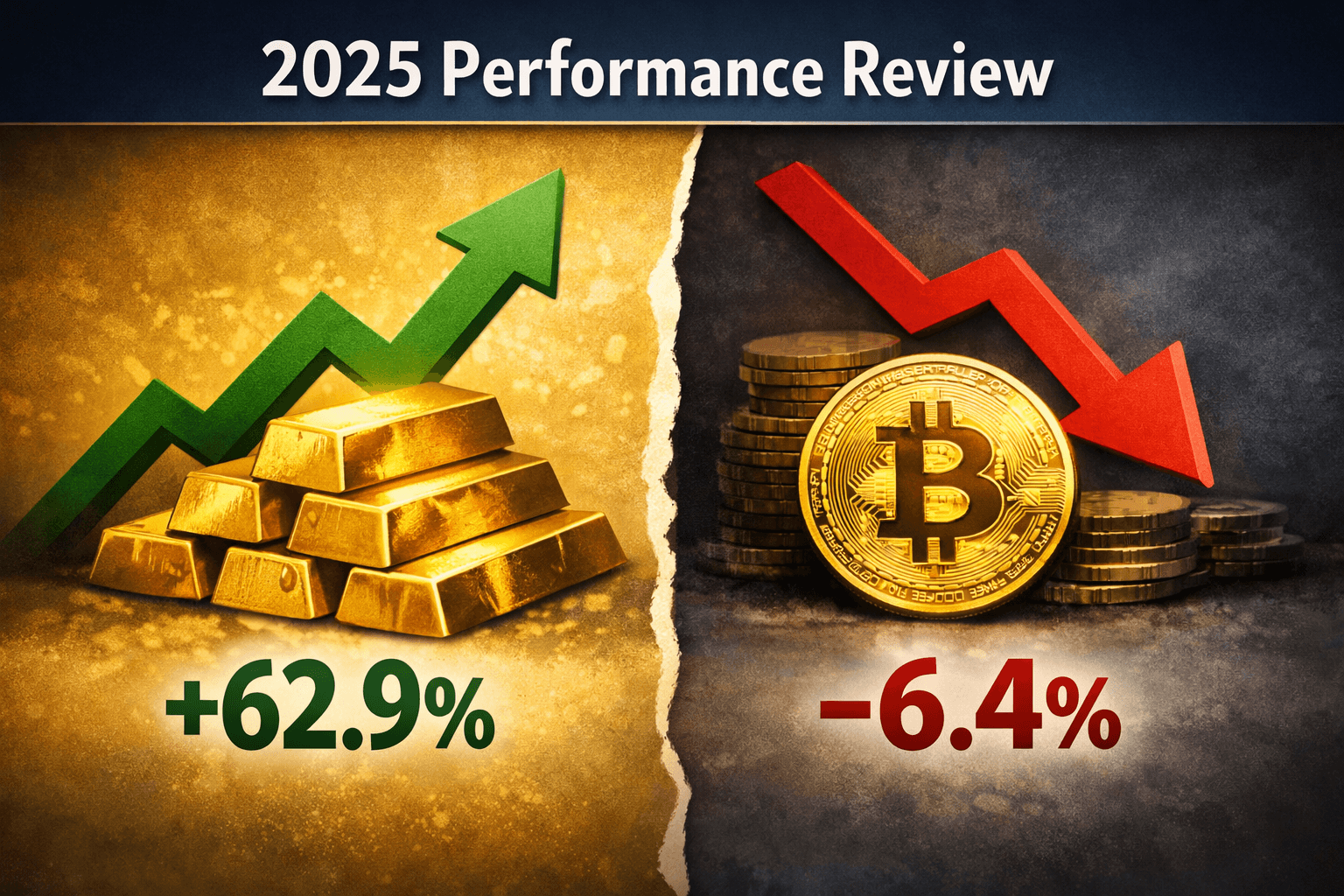

2025 Performance Review

If 2025 tested the “digital gold” narrative, it did so in the most direct way possible: gold surged while Bitcoin slipped (in USD terms). In other words, the two assets didn’t just diverge, they told different stories about what investors were trying to protect themselves from.

In 2025, Gold Surged while Bitcoin Slipped, in USD Terms

In 2025, Gold Surged while Bitcoin Slipped, in USD Terms2025 Full-Year Returns (Gold vs Bitcoin)

2025 delivered a clean split between the “traditional” and the “digital” store-of-value narratives. Front-month COMEX gold futures rose about ~64.37% in 2025, which is exactly the kind of behavior investors usually associate with a store of value in uncertain periods: it held up in risk-off moments and attracted sustained demand rather than depending on constant risk appetite. Bitcoin, by contrast, finished the year weaker on CoinGecko’s calendar-year scoreboard, with Bitcoin down about -6.4% in 2025.

Why the divergence happened in 2025:

Central bank bid + fiscal fears: Central banks were a meaningful, steady source of demand throughout the year, buying 863 tonnes of gold in 2025 according to the World Gold Council. To make that concrete without listing every quarter, Q1 alone accounted for 244 tonnes, a useful snapshot of how official buying can keep supporting gold even when prices are already high. Central banks typically buy for reserve diversification and geopolitical risk management, not for short-term trading, which can help create a more durable “demand floor” under gold during uncertain periods.

Rates / real-yields expectations: Gold’s performance was helped by shifting rate expectations and the macro backdrop that tends to influence non-yielding assets, a relationship the World Gold Council discusses with great detail in its Gold Outlook 2026.

Risk-off episodes favoring gold: When stress hit, crypto was more vulnerable to liquidity and leverage dynamics. CoinGecko's annual report highlights a major liquidation cascade where BTC fell about -15.7% on Oct 10, 2025, reinforcing the point that Bitcoin can still trade like a high-volatility risk asset in panic conditions.

2025 Scorecard (USD)

| Metric | Gold | Bitcoin |

|---|---|---|

| Full-year performance | +62.90% (Jan 2–Dec 31, 2025) | -6.4% (calendar year 2025) |

| 2025 high | $4,481.85 (Dec 23, a.m.) | $126,272 (Oct 6, 2025) |

| 2025 low | $2,631.80 (Jan 6, a.m.) | ~$76.3K (reported 2025 low “around” this level) |

| Low-to-high range (in-year) | 70.30% | ~65.5% (based on the figures above) |

What those numbers actually mean

A simple way to interpret 2025: gold acted more like “insurance,” while Bitcoin acted more like a high-volatility risk asset, capable of big upside, but prone to sharp drops when liquidity or leverage shifts.

- Gold’s move looked like classic safe-haven momentum. The LBMA Precious Metals Market Report notes gold broke $4,000 at the London morning auction on October 8, 2025 and then showed “few signs of falling back,” staying above $3,900 thereafter and gaining over 10% in Q4.

- Bitcoin’s year was more about volatility and liquidity conditions. CoinGecko’s 2025 Annual Crypto Industry Report highlights the contrast directly: gold rose +62.6% in 2025 while Bitcoin fell -6.4%.

- A headline peak doesn’t guarantee a strong year. On TradingView’s BTCUSD page, Bitcoin’s highest price ever is listed as $126,272 on Oct 6, 2025, yet CoinGecko’s annual figure still shows Bitcoin finishing 2025 down overall.

Early 2026 Update

Gold hit all-time high, while Bitcoin continued its decline.

- Gold: After closing 2025 at $4,368/oz (following a late-December peak of $4,449/oz), gold went on a fresh tear in January 2026, printing a new all-time high of $5,589.38 per ounce in January 2026 amid global economic uncertainty, safe-haven buying, and central bank diversification. By Feb. 10, 2026, gold has pulled back from that peak but remains comfortably above $5,000/oz. According to TradingView, spot gold has hovered around $5,020–$5,050/oz, a correction off the January highs but still well above late-2025 levels and supportive of a broader uptrend. This correction was driven by profit-taking after the record rally, some technical selling and cautious positioning ahead of U.S. economic data that could influence interest rate expectations.

- Bitcoin: As of Feb. 10, 2026, CoinGecko’s BTC→USD daily rate is $69,291, which is roughly -20.8% versus Bitcoin’s Jan. 1, 2026 price of $87,508.05 (CoinMarketCap historical data)

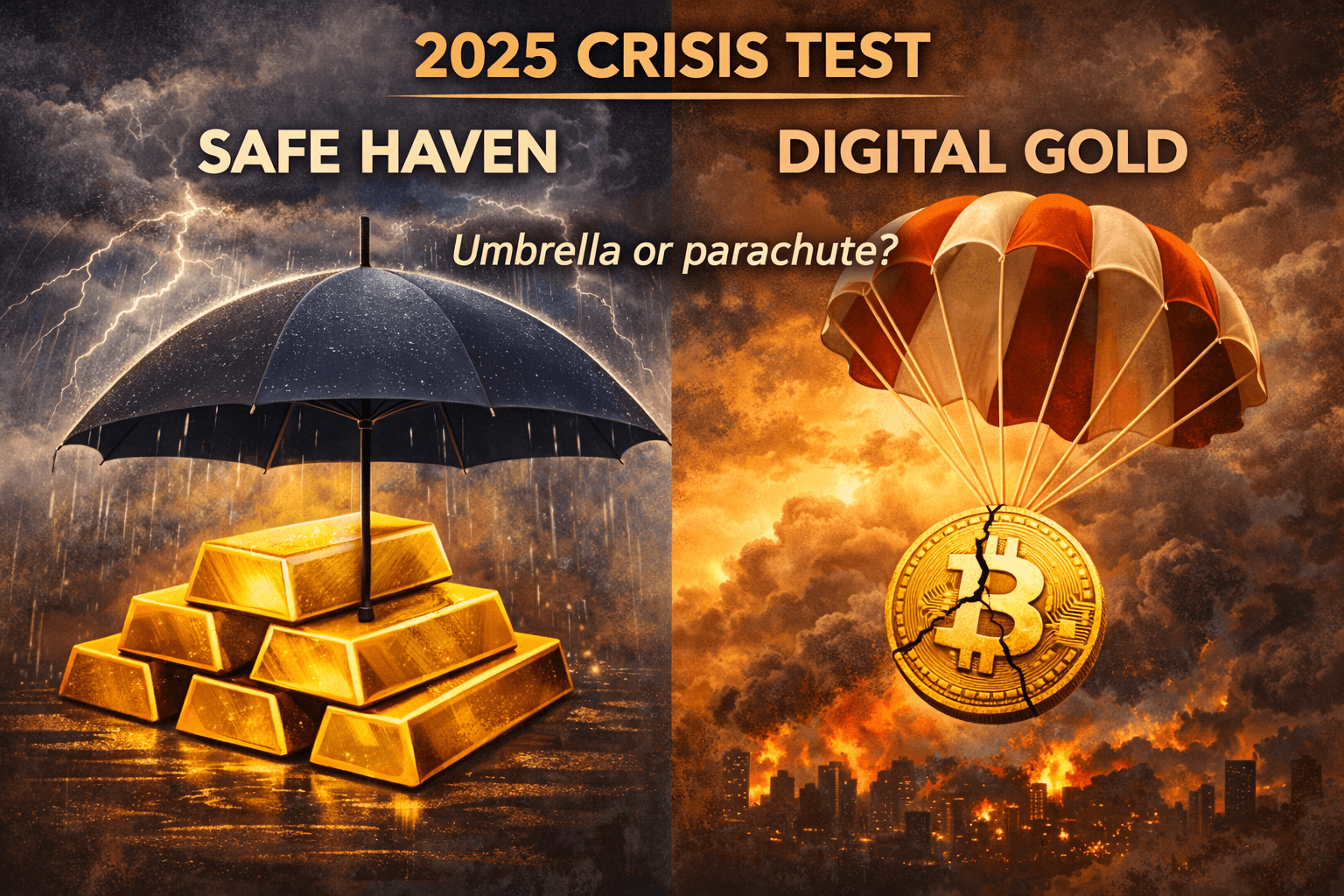

The 2025 Crisis Test (Safe Haven vs "Digital Gold")

Big labels tend to sound convincing until markets get messy.

Big Labels Tend to Sound Convincing until Markets get Messy

Big Labels Tend to Sound Convincing until Markets get MessyWhat “Safe Haven” Actually Means

In practice, “safe haven” is less about never falling and more about how an asset behaves when everything else is stressed.

- Liquidity under stress: It should still be easy to buy/sell without huge price gaps (like being able to exchange cash at an airport without an absurd spread).

- Shock absorption: It should fall less than risk assets, or even rise, during sudden risk-off moments.

- Narrative resilience: It shouldn’t depend on leverage-heavy positioning to “work” in a panic.

2025 Case Study Timeline

Below are three “stress-test” windows where markets were reacting to real-world shocks. The goal isn’t to cherry-pick winners; rather it’s to show how gold and bitcoin tend to behave when people suddenly care about capital preservation.

| Stress episode (dated) | 7-day move (Gold) | 7-day move (Bitcoin) | 30-day move (Gold) | 30-day move (Bitcoin) | What drove flows (plain English) |

|---|---|---|---|---|---|

| June 20, 2025 — Geopolitics / energy-risk headlines | Gold -1.9% w/w (LBMA Gold Price PM in USD closed Friday at US$3,368/oz) | Bitcoin -2.62% (7d) | Gold ~ -0.3% w/w (LBMA Gold Price PM in USD closed at US$3,344/oz). | Bitcoin ~ +15.0% (to $118,754.96) | Gold: demand cooled once the “worst-case” headlines didn’t escalate. Bitcoin: still traded like a risk asset, then rebounded hard as broader risk appetite returned. |

| Oct 10, 2025 — Tariff tensions / macro policy uncertainty | Gold +2.3% w/w (LBMA close $3,974.5/oz) | Bitcoin -7.60% (7d) | Gold ~ +0.5% (to $3,994/oz) | Bitcoin ~ -8.0% (to $105,996.60) | Gold: benefited from “policy fog” (tariffs + shutdown uncertainty) because it’s easy to hold and doesn’t rely on a specific issuer. Bitcoin: sold off with other risk assets during the risk-off pulse. |

| Late Jan → early Feb 2026 — Gold hits new highs; risk mood whipsaws | Gold +7.3% w/w (LBMA close $4,946/oz) | Bitcoin -4.63% (7d) | Gold ~ +14.0% (from $4,338/oz to $4,946/oz) | Bitcoin ~ -10.1% (from $87,508.83 to $78,688.76) | Gold: momentum + geopolitics + positioning drove a surge early 2026 that briefly broke $5,000/oz and spiked over $5,500/oz before pulling back. Bitcoin: fell as liquidity/risk appetite deteriorated, showing “digital gold” can still trade like a high-beta asset in choppy macro. |

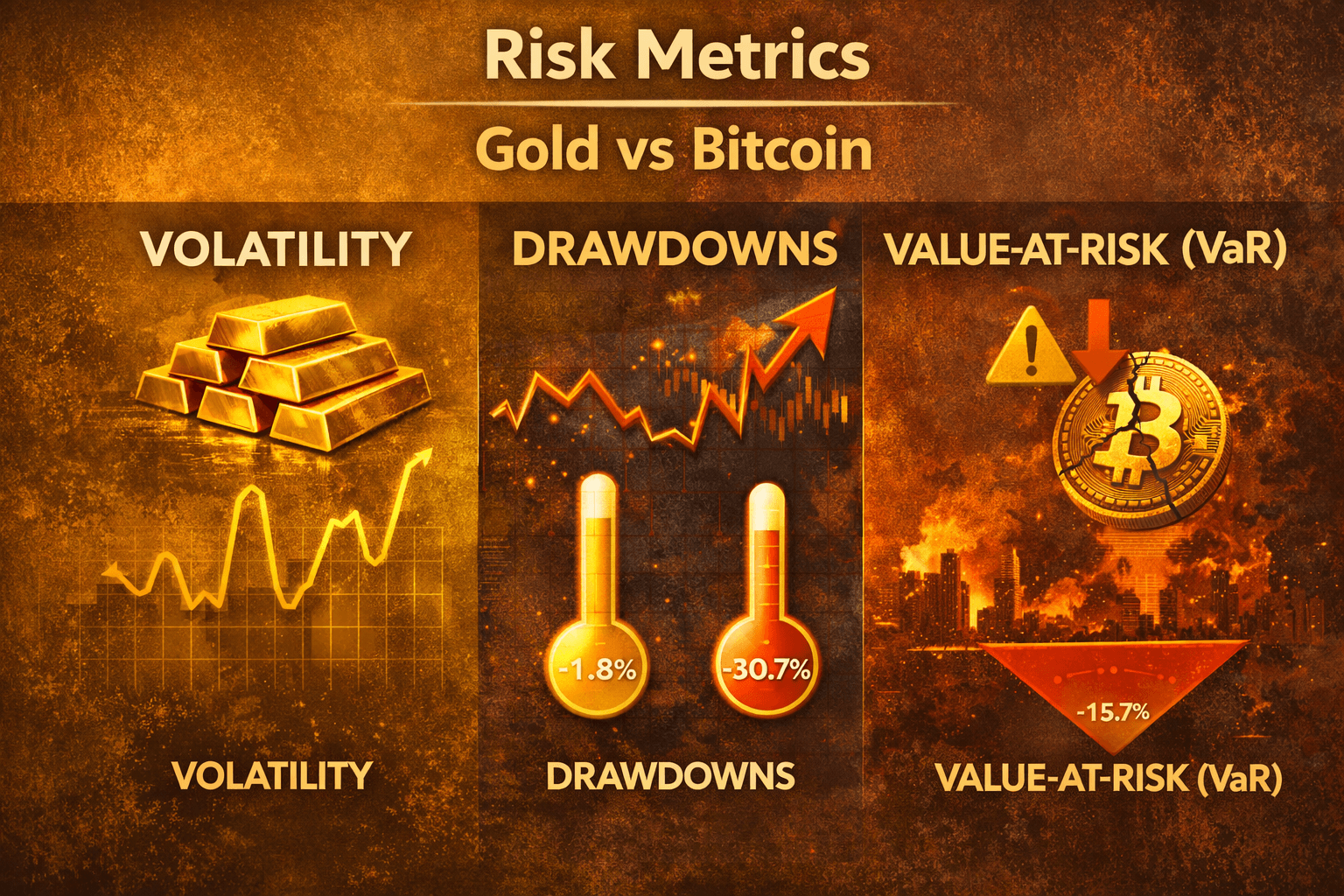

Risk Metrics That Actually Quantify the Difference

If “gold vs Bitcoin” feels like a story battle, risk metrics turn it into numbers. Think of them like a car’s dashboard: instead of predicting the road ahead, you’re checking how the vehicle behaves when the road gets rough.

When Stress Hits, Gold has Historically been Used as a Diversifier, while Bitcoin often Behaves more like a Risk Asset

When Stress Hits, Gold has Historically been Used as a Diversifier, while Bitcoin often Behaves more like a Risk AssetVolatility, Drawdowns, and Value-at-Risk (VaR)

All figures below are computed from 1 year of returns using monthly averages (gold from the World Gold Council gold price averages dataset; Bitcoin from your CoinGecko export aggregated into monthly averages from CoinGecko historical data for the same window).

Why it matters: sizing is everything. An asset can be useful, but if its normal volatility is high, it needs a smaller allocation so you can stick to the plan during routine drawdowns.

Risk Metrics Snapshot (1Y, monthly-average method)

| Metric | Gold (1Y) | Bitcoin (1Y) |

|---|---|---|

| Volatility (annualized) | 15.6% | 33.1% |

| Max drawdown (within 1Y window) | -1.7% | -22.7% |

| VaR (95% daily) per $10k | ~$162 | ~$343 |

| Worst month (1Y) | -1.6% | -15.2% |

| Best month (1Y) | +11.6% | +20.0% |

Correlations and Portfolio Behavior

Correlation is the “moves together” score. When stress hits, gold has historically been used as a diversifier, while Bitcoin often behaves more like a risk asset. CoinGecko reported Bitcoin’s correlation with the S&P 500 rising from 0.75 (2024) to 0.86 (2025), while its correlation with gold weakened to 0.53 as of August 2025, not what you’d expect if they reliably acted the same in crises.

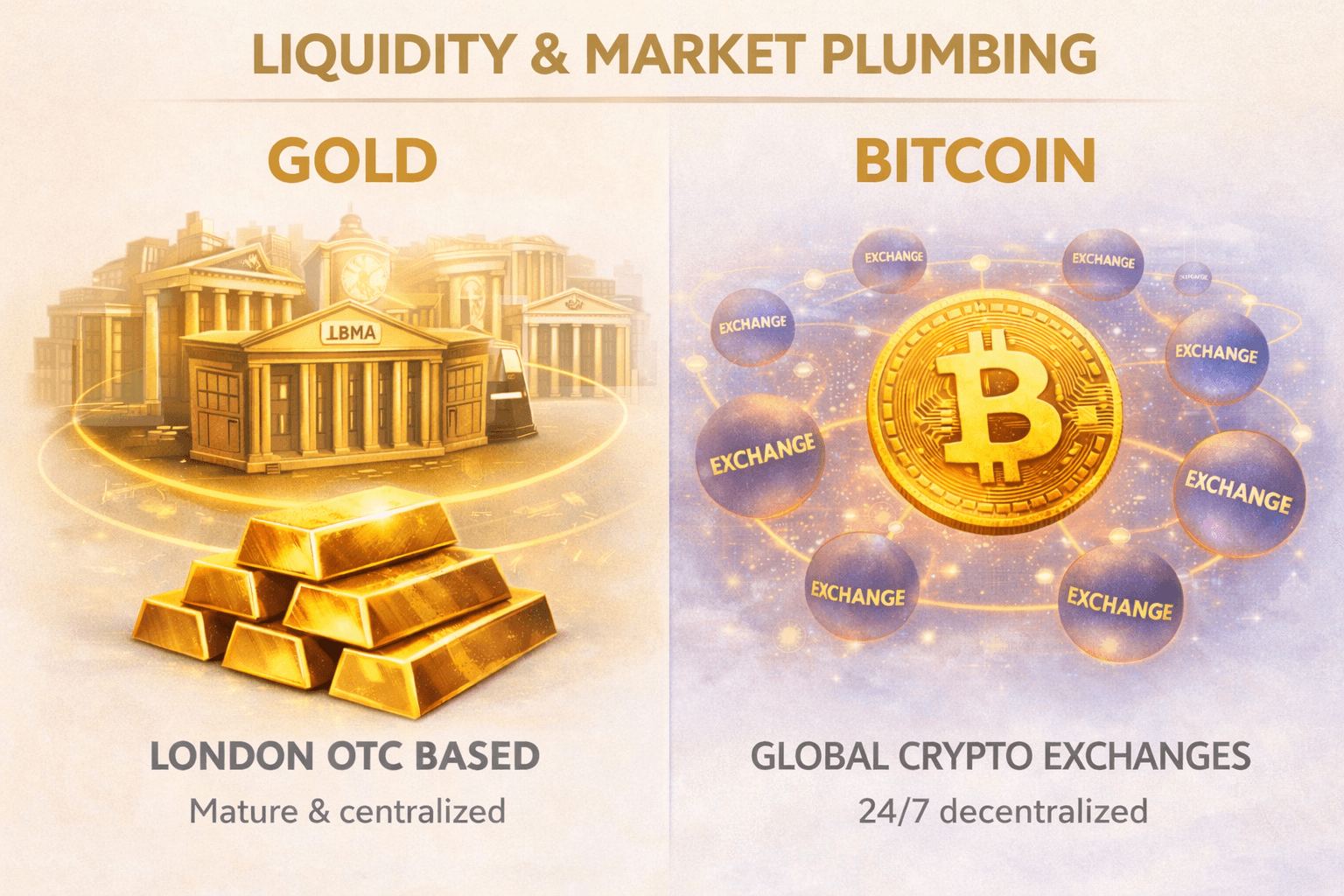

Liquidity, Access, and Market Plumbing

Price charts can make gold and Bitcoin look similar; both trade globally and both can move fast. But under the hood, they run on very different “plumbing.” And when markets get stressed, plumbing matters because it affects slippage, execution quality, and even whether forced selling snowballs.

Price Charts can make Gold and Bitcoin Look Similar, but they Run on Very Different “Plumbing”

Price Charts can make Gold and Bitcoin Look Similar, but they Run on Very Different “Plumbing”Liquidity Reality Check (24/7 vs “deepest pool”)

Bitcoin trades 24/7, but liquidity is spread across many venues, which can make the “real” executable price vary more during fast moves. CoinMarketCap tries to quantify this with its Liquidity Score (and its methodology), designed to help compare markets where you should expect less slippage.

Gold, by contrast, sits on mature institutional rails. The LBMA OTC market is centered in London but global in reach, and trades are cleared and settled through LPMCL (the electronic net settlement system for loco London bullion).

How to Own Gold (and what you’re really buying)

You can access gold in several “wrappers,” and each changes what you truly own:

- Physical gold: allocated vs unallocated accounts (allocated is closer to “this specific metal is mine”; unallocated is more like an IOU). See the LBMA’s OTC guide mentioned above for how this market works.

- ETFs (example: SPDR Gold Shares (GLD)): convenient access, but you hold fund shares, not bars.

- Miners: equity exposure to gold-related businesses (can move differently than the metal).

- Futures/options (COMEX): powerful but leverage-sensitive; margins can change quickly. CME explains performance bonds (margins).

How to Own Crypto

Crypto is available to buy through crypto exchanges. Crypto ownership is mostly a custody decision:

- Exchange custody: easiest, but you rely on the platform.

- Self-custody: you control the keys (more control, more responsibility).

- ETFs/ETPs (where available): exposure without managing keys (jurisdiction-dependent).

Custody failure modes checklist:

- Key loss (self-custody).

- Exchange insolvency (custodied platforms).

- Phishing/social engineering (both; often the biggest real-world risk).

For DeFi-based exposure, DeFiLlama’s TVL is a common way to track where capital is concentrated; though TVL isn’t the same as “how easily you can sell without moving price.”

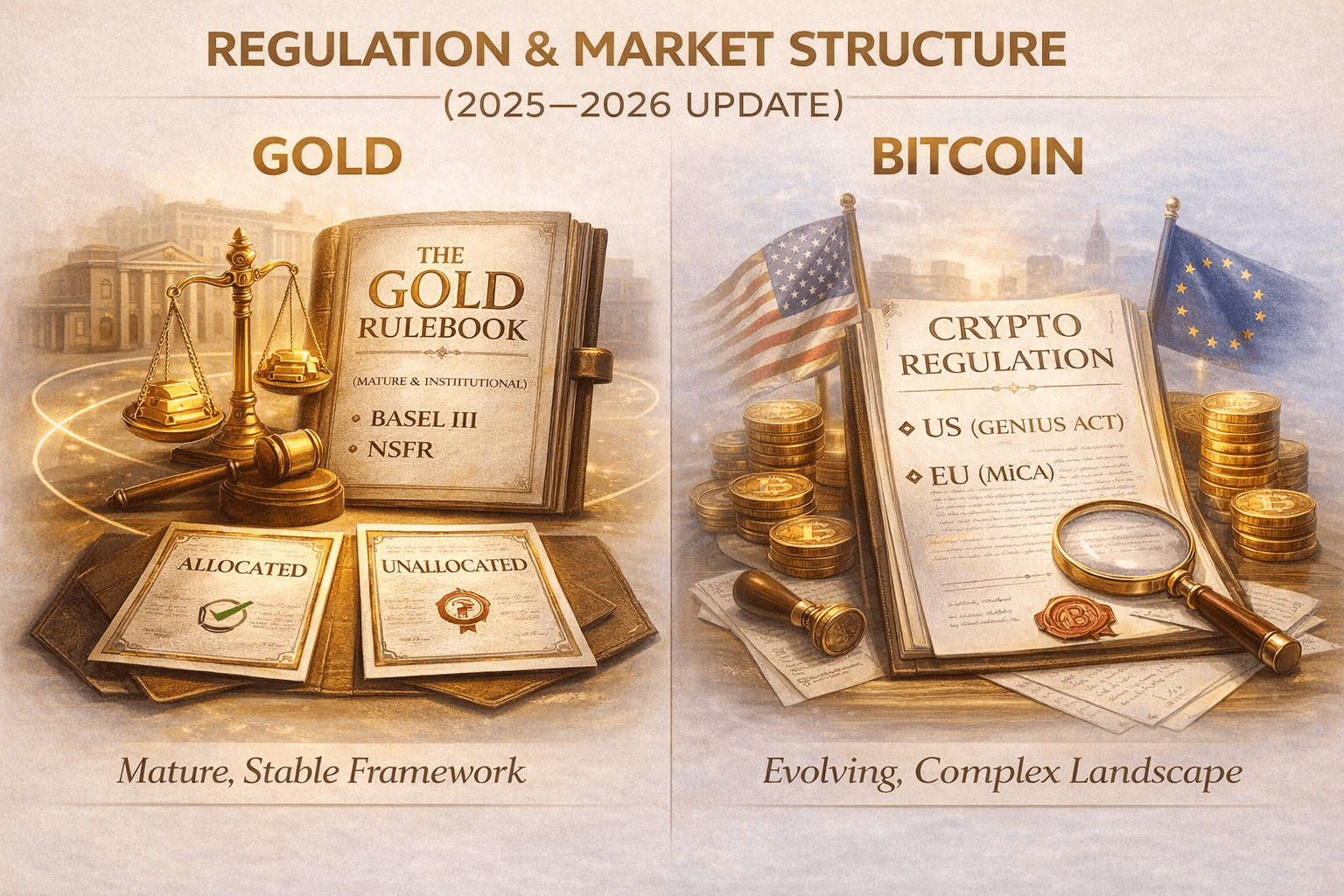

Regulation and Market Structure (2025–2026 Update)

Gold and Bitcoin can both be bought in seconds, but they sit inside very different regulatory “containers.” That matters because regulation shapes who can participate, how products are packaged, and what happens when something goes wrong.

Gold is Time-Tested and a more Universal Market, while Crypto Rules Remain Fragmented Globally

Gold is Time-Tested and a more Universal Market, while Crypto Rules Remain Fragmented GloballyThe Gold Rulebook (mature, boring, powerful)

Gold’s market structure is old, highly institutional, and built around clear distinctions between physical metal and paper claims. One practical concept investors often hear is allocated vs unallocated. In plain terms, allocated is closer to this specific metal is yours, while unallocated is closer to a claim on a pool of metal.

On the banking side, Basel III didn’t “change gold overnight,” but it did raise the cost of certain balance-sheet activities, especially those tied to unallocated positions, via liquidity rules like the Net Stable Funding Ratio (NSFR).

For investors, the takeaway is simple: product structure matters more than headlines. If you want the lowest “plumbing risk,” understand what you own.

Crypto Regulation: What Actually Changed Since 2025

In crypto, the biggest change since 2025 is less about a single global rulebook and more about large regions getting clearer frameworks; while enforcement and definitions still vary by country.

- EU (MiCA): Under the Markets in Crypto-Assets Regulation (MiCA), key provisions became applicable in phases: rules for ART/EMT issuers from June 30, 2024, and rules for crypto-asset service providers (CASPs) from December 30, 2024, as reflected in the Central Bank of Ireland’s MiCA overview. This is a major step toward more consistent standards across the EU, but supervision still happens through national authorities.

- US (GENIUS Act): The GENIUS Act became law on July 18, 2025 and focuses on payment stablecoins: who can issue them, what reserves are required, and how disclosures and oversight should work. A useful plain-English takeaway: the US is pushing stablecoins toward something that looks more like regulated payments infrastructure, not “free-for-all crypto.”

The key caution: This is not “regulation solved.” Crypto rules remain fragmented globally, and enforcement can differ widely even within broadly similar frameworks.

Spot Bitcoin ETFs and Institutional Flows

Spot Bitcoin ETFs matter because they package Bitcoin exposure into a regulated wrapper that can be used by retirement and wealth platforms, potentially changing the “marginal buyer” from short-term traders to long-horizon allocators. In the US, the SEC approved 11 spot Bitcoin ETP Rule 19b-4 applications on Jan. 10, 2024, which helped normalize access through mainstream brokerages.

Why that changes behavior:

- Access expands (more accounts can buy a familiar ETF instead of handling keys).

- Buyer mix shifts (more financial advisors and institutions, fewer self-custody-first users).

- Flows can move price (big net inflows or outflows can become a measurable driver).

What to watch:

- Inflows/outflows (do ETFs absorb dips or amplify selling?).

- Custody concentration (who controls the underlying Bitcoin held for ETFs).

- Fee wars (lower fees can speed adoption and shift market share).

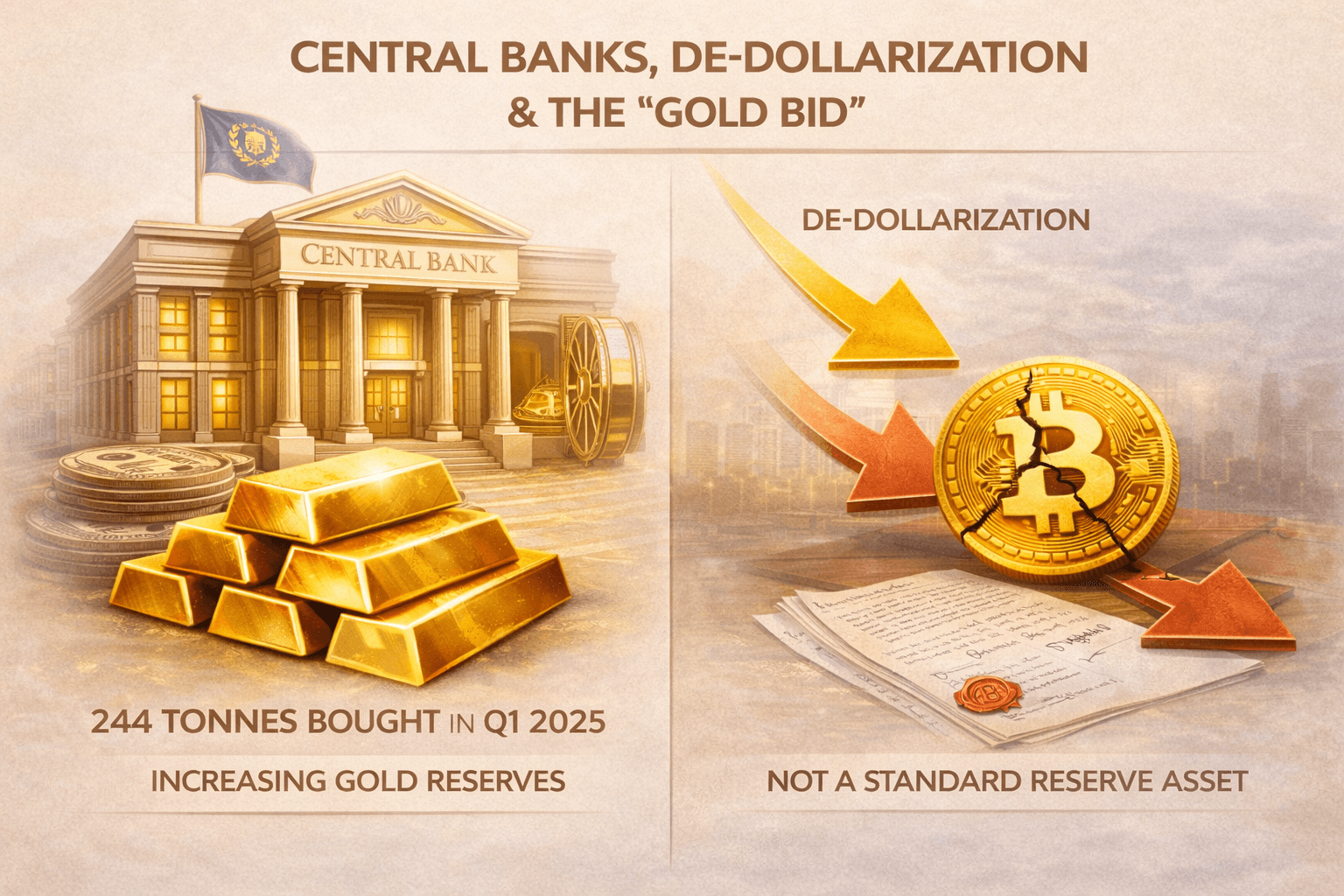

Central Banks, De-Dollarization, and the "Gold Bid"

One reason gold can behave differently from Bitcoin is who buys it. Central banks don’t trade like hedge funds; they actually manage national reserves, so their behavior can create a slower, steadier “bid” under the market.

One Reason Gold can Behave Differently from Bitcoin is Who Buys it

One Reason Gold can Behave Differently from Bitcoin is Who Buys itCentral Bank Demand: What the Data Says

Central bank demand stayed strong through 2025. The World Gold Council estimates central banks bought 863 tonnes in 2025, with Q4 purchases rising to 230 tonnes. The key point is that reserve buying is usually structural rather than speculative; where central banks tend to add gold to diversify reserves and manage geopolitical risk, and the WGC notes that unreported buying remained a significant feature, meaning some official demand doesn’t show up immediately in public disclosures.

Why central banks buy gold (in plain terms):

- Diversification: Gold isn’t tied to any single government’s credit risk.

- Sanctions/geopolitics: IMF research finds sanctions are associated with increases in gold’s share of reserves in some cases, which helps explain why gold demand can rise in geopolitical stress.

- Long-run “floor”: Persistent official-sector demand can act like a slow-moving support beam under prices.

What Crypto Is (and Isn’t) in This Context

Bitcoin has growing institutional adoption, but it isn’t a central bank reserve asset in the same standardized way today. Official reserve reporting frameworks like the IMF’s COFER dataset track currency reserves, and not crypto, highlighting a key difference: institutional demand ≠ sovereign reserve behavior.

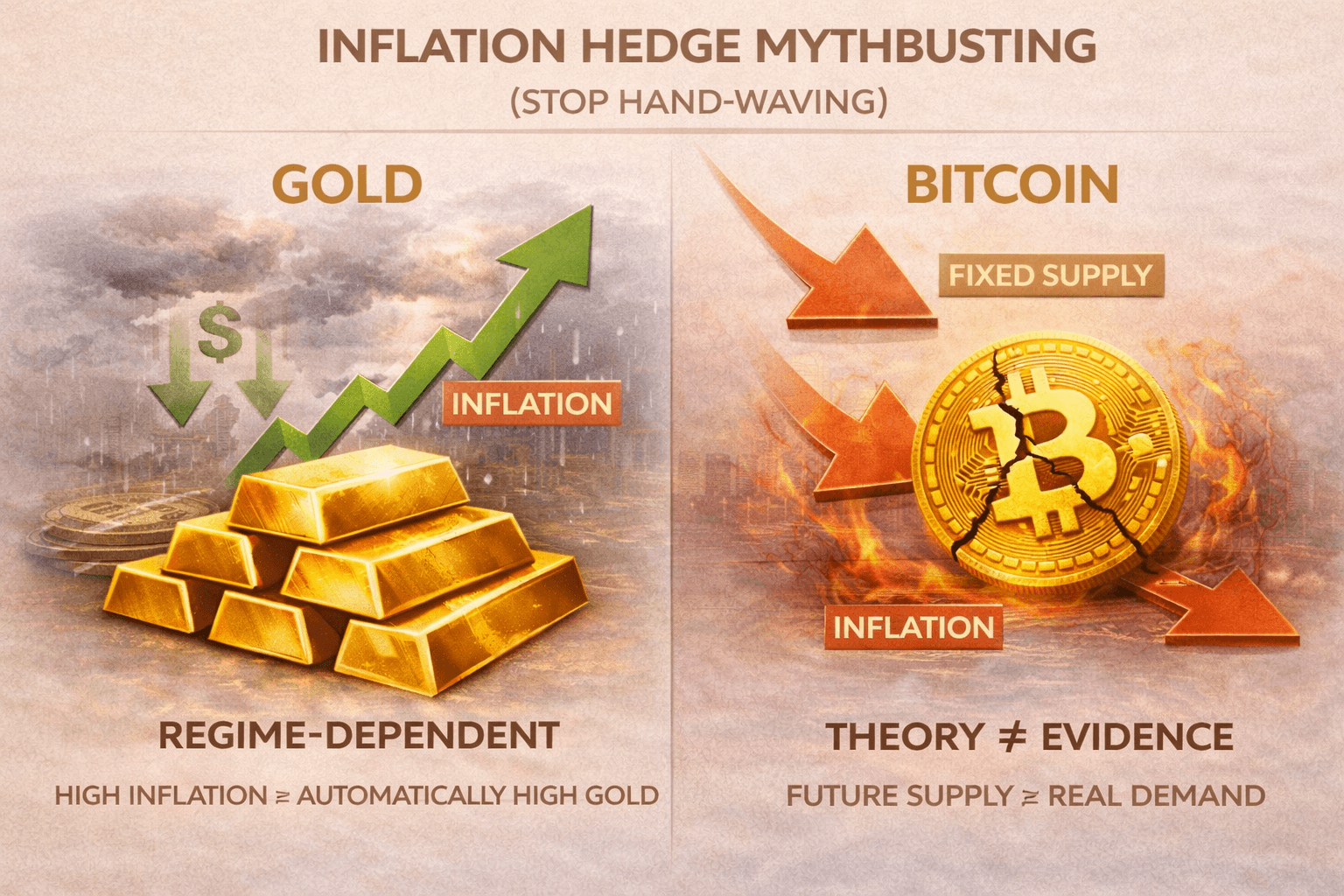

Inflation Hedge Mythbusting

“Inflation hedge” gets thrown around like it’s a permanent feature of an asset, like every umbrella works in every storm. In reality, inflation comes in different “weather patterns,” and assets react to different parts of the macro mix.

Inflation comes in Different “Weather Patterns,” and Assets React to Different Parts of the Macro Mix

Inflation comes in Different “Weather Patterns,” and Assets React to Different Parts of the Macro MixGold vs Inflation: Regime-Dependent, Not Magic

Gold’s “inflation beta” (how much it tends to respond to inflation shocks) isn’t stable. The World Gold Council consistently frames gold as reacting strongly to real rates, the US dollar, and risk-off positioning, which is why its inflation link can look strong in some periods and weak in others.

- When real yields rise or the dollar strengthens, gold can struggle even if inflation is high.

- In risk-off episodes, gold can perform well even without an inflation impulse. WGC also highlights geopolitics and uncertainty as drivers in Gold Market Commentary (Dec 2025).

Bitcoin as an Inflation Hedge: Theory vs Evidence

The theory: Bitcoin’s fixed supply schedule should make it attractive when money loses purchasing power.

The evidence: In the short-to-medium term, Bitcoin often trades more like a liquidity/adoption cycle asset than a clean inflation hedge. Academic research has found mixed results on whether Bitcoin reliably hedges inflation across periods.

ESG and Externalities

ESG is where the “gold vs crypto” debate gets less theoretical and more physical. Both systems have real-world footprints, just in different places: gold’s impact is mostly upstream (mining and supply chains), while crypto’s impact depends heavily on the consensus mechanism powering the network.

Both Systems have Real-World Footprints, just in Different Places

Both Systems have Real-World Footprints, just in Different PlacesGold’s ESG Costs

Gold’s footprint is tied to extraction and sourcing. The World Gold Council’s Gold Demand Trends (Full Year 2025) shows recycling rose to 1,404 tonnes in 2025, highlighting how secondary supply can reduce reliance on new mining (though it didn’t surge as much as prices did). Supply chain integrity matters too: the LBMA Responsible Sourcing Programme is designed to promote audited due diligence among refiners that want access to the London bullion market.

Crypto’s ESG Costs

Crypto’s ESG profile hinges on Proof-of-Work (PoW) vs Proof-of-Stake (PoS). For PoW networks like Bitcoin, energy use is tracked by academic benchmarks such as the Cambridge Bitcoin Electricity Consumption Index (CBECI) and explained in its methodology. Governments also reference it: the U.S. Energy Information Administration cites CBECI ranges when discussing Bitcoin’s electricity demand. For PoS systems, energy needs are far lower, but “mitigation claims” (renewables, stranded energy) still face policy and verification risk.

| ESG lens | Gold | Crypto |

|---|---|---|

| Environmental | Land use, water, and waste from mining; recycling can offset some demand (as per WGC's Gold Demand Trends) | PoW can be energy-intensive; PoS generally reduces energy needs. |

| Social | Labor practices and community impacts in mining regions; sourcing standards matter (as per LBMA Responsible Sourcing) | Consumer harm often comes via scams/security failures; impacts are “digital” but real. |

| Governance | Established compliance pathways in bullion supply chains (as per LBMA Responsible Sourcing) | Governance varies by protocol and jurisdiction; enforcement is uneven. |

| Transparency/auditability | Physical supply chains can be complex to trace end-to-end (as per LBMA guidance) | On-chain activity is transparent, but identities and off-chain energy mix often aren’t. |

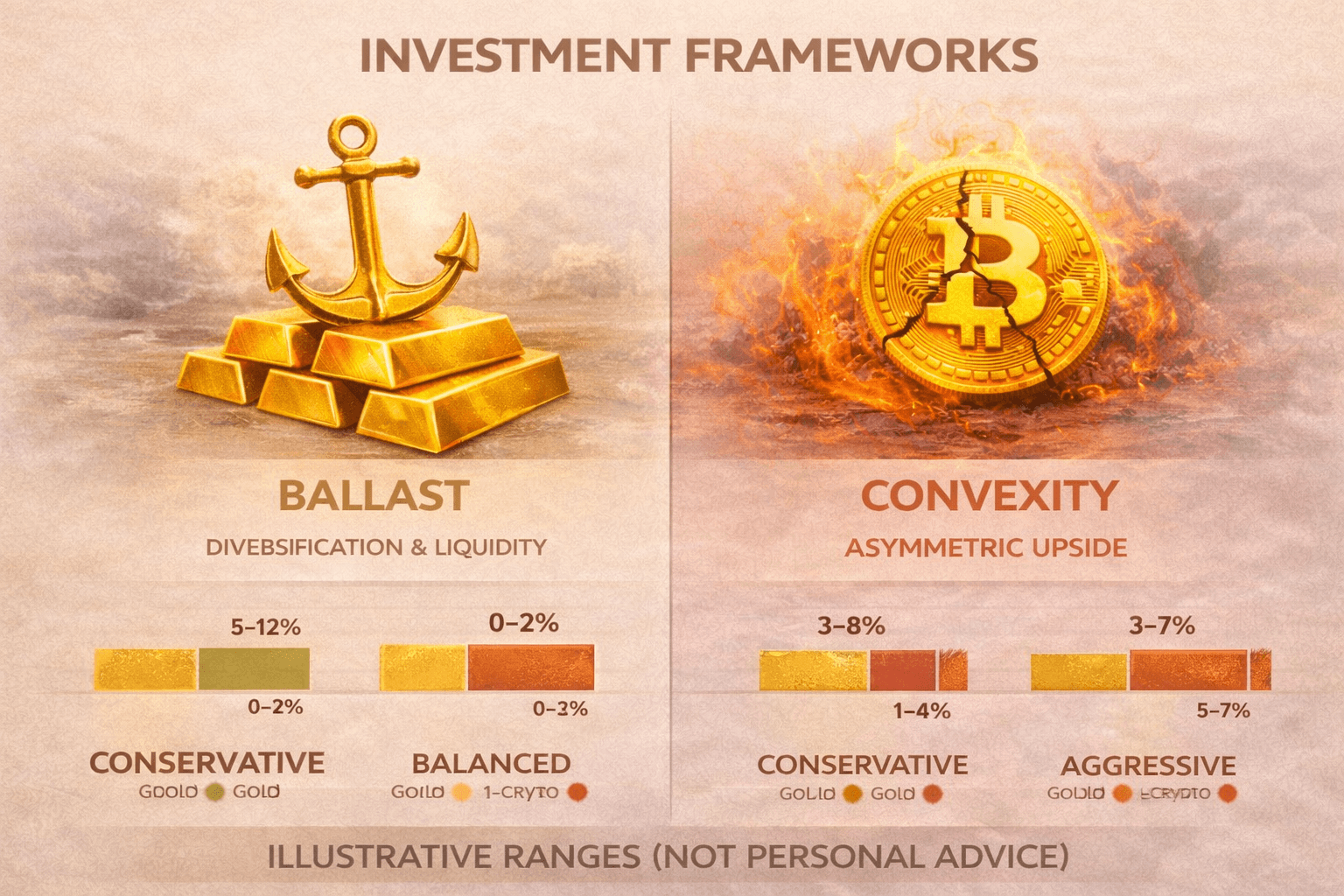

Investment Frameworks

The biggest mistake in the “gold vs Bitcoin” debate is treating it like an either/or. In portfolio terms, they can serve different jobs, and the practical question becomes: what role do you need filled, how much risk can you tolerate, and what rules will keep you disciplined when prices swing?

The Biggest Mistake in the “Gold vs Bitcoin” Debate is Treating it like an either/or

The Biggest Mistake in the “Gold vs Bitcoin” Debate is Treating it like an either/orPortfolio Role Mapping (ballast vs convexity)

Think of this as building a ship:

- Gold as ballast: It’s widely used for diversification and as a source of liquidity in stressed markets. The World Gold Council describes gold’s strategic role as improving diversification and providing liquidity, the stabilizing “weight” that can reduce portfolio wobble when other assets sell off.

- Crypto as convexity: A small Bitcoin/crypto sleeve is typically about asymmetric upside (the potential for gains that are large relative to the amount invested). The tradeoff is bigger drawdowns and more sensitivity to liquidity conditions, which is why sizing and rules matter more than narratives.

Allocation Models for 2026

These are illustrative ranges, not personal advice. The goal is to keep Bitcoin exposure meaningful but capped, while letting gold do the defensive job.

- Conservative: 5–12% gold, 0–2% Bitcoin/crypto sleeve.

- Balanced: 3–8% gold, 1–4% Bitcoin/crypto sleeve.

- Aggressive: 2–6% gold, 3–7% Bitcoin/crypto sleeve (still capped; risk-managed).

Rules (non-negotiables)

- Rebalance on a schedule (quarterly) or with drift bands (e.g., rebalance if an asset moves ±20% away from its target weight).

- Cap crypto exposure so rallies don’t let it “take over” the portfolio.

These rules align with how regulators explain the purpose of rebalancing: the SEC’s investor education materials describe rebalancing as bringing a portfolio back to its original mix so it doesn’t unintentionally overemphasize one asset class.

Rebalancing Playbook

- Pick target weights (for example, 6% gold and 2% Bitcoin).

- Define drift bands (e.g., rebalance if gold moves outside 4.8–7.2% or Bitcoin outside 1.6–2.4%).

- Rebalance on schedule or threshold. The U.S. government’s investor education site explains rebalancing as a way to keep risk aligned as winners grow faster than losers.

- Account for taxes/fees: selling can create taxable events, and spreads/fees can be higher in volatile conditions.

Mistakes to avoid

- Chasing tops (increasing allocation because it already surged).

- Storing physical gold without a plan (storage, insurance, and how you’d sell).

- Leaving large crypto on exchanges (custody concentration risk).

Crypto and Gold's 2026 Outlook

Rather than guessing prices, a more reliable approach is to track the forces that tend to move each asset. For 2026, that means watching macro conditions for gold and flows + policy + security for crypto.

A more Reliable Approach is to Track the Forces that Tend to Move each Asset

A more Reliable Approach is to Track the Forces that Tend to Move each AssetGold Watchlist

- Real yields and the US dollar: Gold often responds to shifts in real interest rates and USD strength, which the World Gold Council highlights as key drivers.

- Central bank demand: Ongoing official-sector buying can create a durable “demand floor,” visible in Gold Demand Trends reporting.

- Policy and fiscal risk: Watch debt, deficits, and geopolitical headlines that feed safe-haven demand, topics the WGC regularly tracks in its Weekly Markets Monitor.

Crypto Watchlist

- ETF flows: Net creations/redemptions can become a major marginal driver in markets where spot Bitcoin ETFs are available.

- Regulation milestones: The EU’s MiCA regime is now live, while the US is shaping stablecoin compliance via the GENIUS Act, as mentioned earlier as well.

- Security and concentration risks: Track custodial concentration and protocol risk; for “future tech threats,” keep an eye on NIST’s post-quantum cryptography program at a high level.

Closing Thoughts: Choosing Your Path to Crypto or Gold

If you strip away the narratives, this decision comes down to what job you need the asset to do in your portfolio, and how much short-term volatility you can live with.

If You Want Stability…

Prioritize gold as a portfolio ballast: it’s widely used for diversification and liquidity in stressed markets (see the World Gold Council’s strategic case for gold). Use the Conservative allocation model above as your starting point.

If You Want Upside…

Consider a small, capped Bitcoin/crypto sleeve for asymmetric upside, but treat it like a high-volatility allocation that needs rules. Use the Balanced or Aggressive allocation model above, and stick to the rebalancing guardrails.

If You Want Both…

Use a hybrid approach: gold for shock absorption, Bitcoin for convexity. Then rebalance (quarterly or with drift bands) to prevent winners from taking over; an approach consistent with how investor education guidance frames portfolio rebalancing.