Not long ago, trading meant staring at charts and clicking every order by hand. Today, many exchanges come with bots built right in, so you can automate buy–sell rules around the clock with no extra software, and no APIs to wrestle with. Pionex is a poster child for this shift: it offers 16 free, built-in trading bots that can run 24/7 and handle the repetitive “buy low, sell high” grind for you.

Pionex gives you training wheels. You’ll see a Copy Strategy button with AI and community presets you can copy with a tap. For Futures Grid, there are easy modes like Long, Short and Neutral to point you in the right direction. They’re suggestions, not orders. We’ll talk about where these live and which settings actually matter.

In this guide, we will give you a quick background on Pionex, explain how grid trading works, help you decide if copying suits your risk tolerance, walk you through prerequisites (account, funding), show exactly where Copy Strategy lives on web and app, provide step-by-step setups for Spot and Futures grid copies, highlight the key settings to review, break down fees and funding rates, and finish with safety tips and common pitfalls.

TL;DR — Pionex Grid Bots 2025

- You can copy Pionex Grid Bots directly using the Copy Strategy button, which lets you duplicate AI or community presets without setting parameters from scratch.

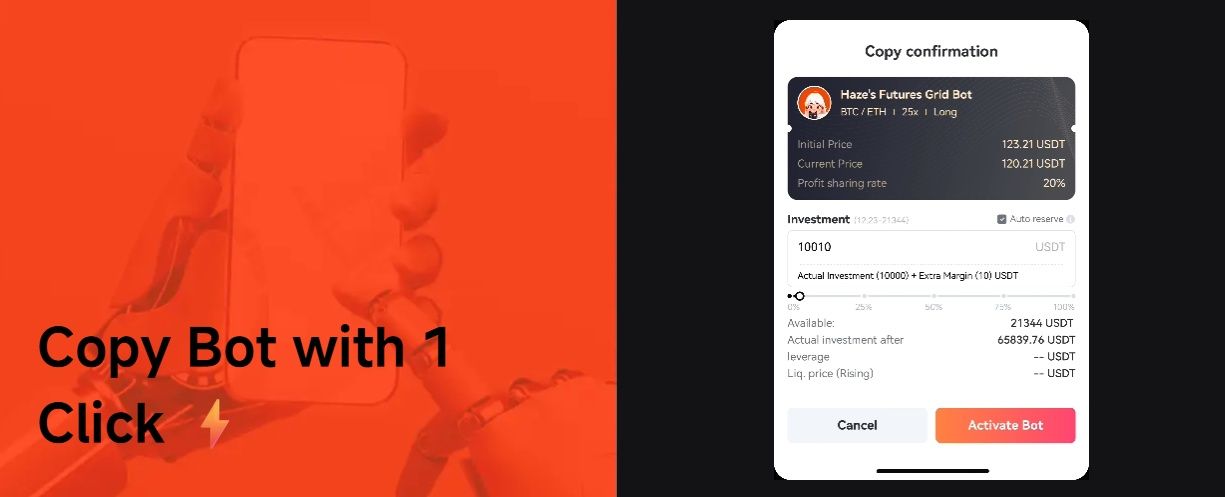

- CopyBot works differently by automatically mirroring futures grid bots created by traders you follow, launching the same setup in your account.

- Spot Grid Bots trade actual assets with no leverage, making them safer for sideways markets, while Futures Grid Bots use leverage but require caution with margin, liquidation, and funding fees.

- Before copying, always check the key settings: price range, number of grids, investment mode, and advanced risk controls like take-profit and stop-loss.

- Copying bots is a fast and beginner-friendly way to automate trading, but performance can change if markets trend strongly or if leverage is used recklessly.

👉 Copying a grid bot is one of the easiest ways to start automated trading, but you should always start small, keep leverage modest and double-check the strategy settings before launch.

What is Pionex: The Bot-First Exchange

Pionex jumped into the crypto arena in 2019 as an exchange built around automation. It even boasts being the world’s first exchange with in-built crypto trading bots. The platform advertises 16 free, built-in trading bots, so you don’t need extra software or paid subscriptions to start automating. The bots run in the cloud and live right inside the Pionex app and website.

Fees are straightforward: the spot trading fee is 0.05% for maker and taker. That’s it; no special token to unlock lower tiers, and the bots themselves are included.

You can use Pionex on the web and mobile. When you set up a bot, you’ll see Copy Strategy options that surface AI and community presets you can copy with a tap, which is useful if you’re new and want sensible defaults.

For practice, there’s Futures Demo Trading (virtual funds) to learn the ropes before risking real money. Demo trading, however, is for manual futures, not bots. But having some practice can definitely help you narrow down on your bot strategies, so never underestimate its long-lasting impact on your learning curve.

New on the scene? Don't fret! We have an ultimate trading guide for beginners to get you going. Be sure to check it out!

On the transparency side, Pionex publishes Proof-of-Reserves with third-party audits, and offers an official verification page so you can confirm you’re using genuine Pionex channels. Pionex also holds a Money Services Business (MSB) registration with FinCEN.

In short, Pionex is an automation-first exchange with low fees, built-in bots, and simple on-ramps for beginners. Now, before we move forward, let's first get an overview of what trading bots are.

Want more? Read our full Pionex review.

Trading Bots on Pionex

Think of trading bots as little rule-followers that handle the busywork for you. You tell them the “recipe” (what to buy/sell, when, and how much), and they repeat it 24/7 without getting tired or emotional. Some bots stick to simple, fixed rules; others add AI hints to help you pick sensible settings.

Let’s quickly split those two styles, then run through the main bot types you’ll see on Pionex and where “copying” fits in.

Pionex is an Automation-First Exchange with Low Fees and Built-In Bots. Image via Pionex

Pionex is an Automation-First Exchange with Low Fees and Built-In Bots. Image via PionexCore Bot Line-Up

Grid Bots

If one bot steals the spotlight on Pionex, it’s the Grid Trading Bot. Think of it like setting shelves in a price range: the bot buys a little when the price drops to a lower shelf and sells a little when the price climbs to a higher shelf, repeating “buy low, sell high” while the market bounces around.

How it usually goes:

- Pick a price range (e.g., BTC/USDT between two levels you’re comfortable with).

- Choose the number of grids inside that range. More grids = more frequent, smaller trades; fewer grids = fewer, bigger trades.

- Set your investment and let the bot place the ladder of buy/sell orders automatically.

If you don’t want to pick settings from scratch, tap Copy Strategy in the setup screen to pull in AI or community presets and clone them in a couple of clicks, which is handy when you’re new and just want sensible starting values.

Who’s it for? Anyone who’s tired of chasing tops and bottoms and prefers a “set the rules, let it run” approach in choppy, range-bound markets.

Other Bots

- DCA (Martingale/DCA): Adds in steps on dips to average your entry; simple or trailing modes available. Check out more in our detailed DCA guide.

- Rebalancing: Keeps a target mix (e.g., 50/50) by auto-rebalancing over time.

- Infinity/Trailing variants: Grid-style logic that “floats” with trends instead of a fixed top price.

- Arbitrage (historical): Market-neutral hedge between spot and futures to capture funding. Pionex delisted its Spot-Futures Arbitrage Bot in February 2024.

Rule-Based vs. AI-Assisted

Most exchange bots follow fixed rules you set (for example: “place buy/sell orders inside this price band” or “buy more if price dips”). On Pionex, you’ll also see AI suggestions inside the setup screens via Copy Strategy. The system shows ready-made parameters you can clone, so you’re not guessing ranges or grid counts from scratch. Think of it as “rules first,” with AI giving you a starting preset.

PionexGPT is Pionex’s built-in chat helper for strategy building. You can describe an idea in plain English, get a ready-to-test framework, and even find strategies to mirror, right inside the platform. It’s basically a calm co-pilot that turns “I want the bot to do this” into concrete steps you can run or backtest, without wiring up extra tools.

Where Copying Fits

Copy Strategy lets you duplicate parameters from AI or influencer lists right in the bot creation flow (Spot Grid and Futures Grid). CopyBot is different, though; you follow a trader, and when they create a new futures grid bot, one is created for you with the same settings. (CopyBot currently supports futures grid only.)

We have been talking about grid bots, so let's just dive into how grid trading works for a better understanding.

How Grid Trading Works (Spot vs Futures)

At its core, a grid bot lays down a ladder of buy and sell limit orders inside a price range you choose. As the price moves up and down, it buys a little lower and sells a little higher, aiming to clip small gains over and over. Grids tend to work best when markets are sideways, with lots of back-and-forth without a strong trend.

Pionex Spot Grid Bot Temporarily Pauses once Price goes beyond your Upper or Lower Limit. Image via Freepik

Pionex Spot Grid Bot Temporarily Pauses once Price goes beyond your Upper or Lower Limit. Image via FreepikWhat if the price leaves your range? On Pionex Spot Grid, the bot temporarily pauses once the price goes beyond your upper or lower limit. It resumes automatically if the price comes back inside the band (unless you’ve set a stop-loss or take-profit to close it).

Spot Grid vs Futures Grid:

- Spot Grid trades the actual coin and has no leverage. Your inventory (coins and cash) will swing with the market, but there’s no liquidation price because you’re not using futures.

- Futures Grid uses leverage, so you must watch margin, funding, and liquidation. Pionex’s futures grids use mark price for liquidation logic, and funding fees are typically settled every 8 hours.

Futures Grid Modes (Long / Short / Neutral)

- Neutral: opens no initial position; places sells above and buys below the current price. Because it starts flat, the margin is roomier and the liquidation price is more favorable, which is useful when you expect sideways action.

- Long: leans with “sideways-up” conditions; starts by entering long and cycles with the grid as price oscillates.

- Short: suits “sideways-down” conditions; starts short and rides the grid during dips and bounces.

How to Execute Copy Strategy with Grid Bots on Pionex

Below is a simple, two-track walkthrough for Spot Grid and Futures Grid so you can find Copy Strategy on the web/app and launch a bot with sensible settings. We’ll keep it practical and beginner-friendly, and point to the exact screens you’ll see.

Copy Strategy Shows AI and Community Strategies You can Clone in a Tap. Image via Pionex

Copy Strategy Shows AI and Community Strategies You can Clone in a Tap. Image via PionexFirst things first: let's just go through some prerequisites before we dive into the details.

Prerequisites: Account, KYC, Funding & Demo

- Create a Pionex account and finish any required verification. Turn on 2FA (Google Authenticator) to lock down access. It just takes a minute and adds a big safety layer.

- Fund your account, ideally with USDT, since most bots are created with USDT by default. If you deposit another coin, you may need to convert to USDT first.

- Want a dry run? Use Futures Demo Trading to practice with virtual funds before risking real money.

- Know your wallets: robot strategies and spot trading use the main account, while manual futures uses a separate futures account and move funds accordingly before setup.

Once you check that all the prerequisites are there, you are good to go. So, let's get into the details of copying grid bots.

Spot Grid: Copy Strategy, Setup, and Launch

Where to find it (App & Web)

- App: Open Bot → Create → Spot → Spot Grid. Pick your coin, tap Copy Strategy, choose an AI or influencer preset, enter your amount, and hit Confirm.

- Web: Go to Spot → Trading bot → Trading bot → Grid Trading Bot → Create. Choose your coin, click Copy Strategy, pick a preset, set an amount, and Create Bot.

Pick the Pair

Start with liquid, popular pairs (e.g., BTC/USDT, ETH/USDT). Deeper liquidity helps your grid orders fill more smoothly and reduces weird price gaps. If you’re brand new, majors are easier to learn with because they’re less jumpy than tiny altcoins. (You can change pairs later once you’re comfortable.)

Use Copy Strategy

In the Spot Grid screen, Copy Strategy shows AI and community strategies you can clone with a tap. Pionex’s AI strategy uses historical backtests (last 7, 30, and 180 days) to suggest a price range and grid count, and the AI 2.0 panel shows a Maximum Drawdown indicator so you can gauge risk before you copy. Read those panels for a few seconds so you know what you’re signing up for.

Amount & optional tweaks

You can accept the preset, or adjust:

- Price range (upper/lower bounds) and Number of grids (more grids = more trades but smaller profit per trade).

- Investment mode (USDT only vs both sides, e.g., BTC+USDT), and Grid mode (Arithmetic vs Geometric spacing).

- Advanced: Trigger price, Take-profit, Stop-loss, Slippage control, Trailing up. These are handy guardrails, so turn them on if you already know your exit plan.

Launch & verify

Hit Create and the bot places its ladder of buy/sell orders. If price exits your range, Spot Grid pauses and resumes when price comes back inside (unless your TP/SL closes it). You can view the bot in your running bots list and see fills and grid profit building over time.

Futures Grid: Copy Strategy, Modes, and Risk Checks

Open Futures Grid, Select your Futures Pair, then Tap Copy Strategy. Image via Pionex

Open Futures Grid, Select your Futures Pair, then Tap Copy Strategy. Image via PionexWhere to find it (App & Web)

Open Futures Grid, select your futures pair, then tap Copy Strategy. You’ll see Long / Short / Neutral mode tiles. Pick a mode; Pionex will surface AI strategies you can copy with Copy Bot. This is the fastest way to get a futures grid live without guessing settings.

Choose a Mode that Matches your View

- Neutral: starts flat (no immediate position), buys below and sells above, and is handy when you expect a sideways price and want more buffer to liquidation.

- Long: tilt toward “sideways-up.”

- Short: tilt toward “sideways-down.”

Leverage, Margin, and Liquidation (don’t skip)

Before you copy, set leverage modestly. Your margin is the safety cushion between you and liquidation; the more cushion = the farther from the liquidation price. Pionex shows margin and liquidation estimates on the setup screen, so read them. If you later see risk rising (price trending hard against you), you can add margin to widen the buffer.

Amount & Optional Tweaks

As with Spot, you can accept the AI preset or tweak the range and grids. Futures grids also incur funding fees at set intervals (commonly every 8 hours, but check your pair), so avoid cranking leverage just to make numbers look exciting, as funding costs can eat into gains if the trade drags on. (We cover fees and funding in a later section.)

Final checks & launch

Confirm your mode, leverage, price range, number of grids, and investment. If the AI panel shows a drawdown from recent backtests, glance at it for a sanity check. Tap Copy Bot to create your futures grid. After launch, monitor it from your running-bots list; if market conditions change (strong one-way trend), consider adjusting or closing rather than hoping it “comes back.”

Quick tip: If you ever feel lost, the Spot Grid and Futures Grid help pages include the exact menu paths and buttons shown above, so use them as your checklist while you’re setting up.

Settings and Safety Review Before You Copy

Before you hit Create, pause for a quick check. Copying a preset gets you most of the way there, but these four settings decide where the bot trades, how often it fires, and how it protects you if price sprints. Here’s the short checklist to help you tune what you need, and keep the rest.

Learn and Understand the Setting Parameters to be able to Fine Tune Your Strategy if Markets Shift. Image via Freepik

Learn and Understand the Setting Parameters to be able to Fine Tune Your Strategy if Markets Shift. Image via FreepikPrice Range

Set an upper and lower price for the bot to work in. Try to keep the current price inside this band so buys and sells can fire. If the price moves outside the band, the bot pauses and then resumes when the price re-enters. You can add a stop-loss/take-profit if you want it to close instead.

Number of Grids

This is how many “rungs” sit inside your range. More grids = more frequent, smaller profits per trade. Fewer grids = fewer trades, larger profit per trade. There’s no single “best”, so pick what matches your patience and fees.

Investment & Grid Modes

Investment mode:

- USDT only uses USDT.

- Both can use both assets (e.g., BTC+USDT), which can smooth order placement if you already hold the coin.

Grid mode:

- Arithmetic spaces orders by equal price gaps (e.g., 1, 2, 3…).

- Geometric spaces by equal percentage gaps (e.g., 1, 2, 4…), which scale better across wide ranges. Pick the one that fits how you expect the price to move.

Safety with Risk Controls (Advanced)

Add these guardrails before you hit Create:

- Trigger price: Start the bot only when the price hits your chosen level (helps avoid chasing a spike).

- Take-profit (TP): Auto-close the bot at a target to lock in gains.

- Stop-loss (SL): Auto-close if price moves against you beyond a set threshold to cap losses.

- Slippage control: Limit how far the initial fill can deviate from your order price, so you don’t overpay in a fast move.

- Trailing up: Automatically lift the whole grid as the price climbs, so the bot keeps working in an uptrend.

- Review & adjust: Set what fits your plan now, then revisit if market conditions change.

Read: For sizing, leverage discipline, diversification, and exit planning, see our risk mitigation strategies guide before going live.

Fees & Funding Rates

Spot trading fee: Pionex charges a flat 0.05% per trade on spot markets. There’s no extra fee to use bots, so you just pay normal trading fees.

Confirm Fees and Funding Timing on the Pair’s Page Right Before Launching Your Bot. Image via Shutterstock

Confirm Fees and Funding Timing on the Pair’s Page Right Before Launching Your Bot. Image via ShutterstockFutures funding: Perpetual futures have a funding fee exchanged between longs and shorts, typically every 8 hours. Some pairs may switch to every 4 hours (or other intervals), so always check the pair’s latest notice before you copy a strategy. Funding can add up, especially with high leverage.

Slippage & spreads: Thin pairs can slip more, so fills may be worse than expected. Maker/taker rules also matter as makers post liquidity, and takers remove it, so your actual cost depends on how your orders execute against the fee schedule.

Tip: Confirm fees and funding timing on the pair’s page right before launching your bot.

Is Copying a Grid Bot Right for You?

Copying a grid bot is a shortcut: you borrow settings that already worked for someone else, then let the bot do the busywork.

Always Go for a Capital You can Risk without Stress. Image via Freepik

Always Go for a Capital You can Risk without Stress. Image via Freepik✅ Pros

- Fast setup with pre-tested parameters

- Fewer guessy choices; emotion-free execution once it’s running

- Easy way to learn what “sensible” ranges and grid counts look like

❌ Cons

- Market regime changes (range → strong trend) can hurt results

- Presets can age; what worked last month may not fit today

- On futures, leverage amplifies mistakes and funding costs can stack up

Fit checklist:

- Capital you can risk without stress.

- Comfort with volatility and sideways markets (where grids shine).

- Time to check in and adjust if conditions change.

- Clear timeframe (days/weeks vs. set-and-forget).

- If using futures: basic grasp of margin, liquidation, and funding.

If most boxes are ticked, copying can be a safe first step, but always start small, then scale.

Oh, and remember:

- Copy Strategy is a one-time clone of settings from AI or community lists inside the bot setup screen (you pick a pair, tap Copy Strategy, choose a preset, then create the bot).

- CopyBot is different: you follow a trader, and when they create a new futures grid bot, one is created for you with the same parameters. As of now, CopyBot only supports futures grid bots per Pionex’s policy.

Common Pitfalls & Troubleshooting

If Something Feels Off, Open the Specific Bot’s Page and Check the Info Panels. Image via Freepik

If Something Feels Off, Open the Specific Bot’s Page and Check the Info Panels. Image via Freepik“No buy orders in my range”

That can be normal. Pionex uses dynamic order placement (a “two-layer buffer”), so it doesn’t place every grid order at once, only the ones near the current price. As prices move, orders update.

Grid Profit is up, but Total P&L is down

Grid Profit counts only completed buy/sell pairs. Total P&L also includes unrealized gains/losses on positions you still hold, so it can dip even when grid profit looks good.

I can’t start a futures grid even though I have funds

Bots run from the main account, while manual futures uses a separate futures account. If your money is sitting in the futures account (or in futures trial funds), move it to the main account, then try again.

If something still looks off, open the specific bot’s page and check the info panels, as they usually explain why an order hasn’t been placed or where your P&L numbers come from.

Closing Thoughts

Copying a grid bot on Pionex is a convenient way to get moving without reinventing the wheel. You pick a sensible preset, let the bot handle the routine “buy low, sell high,” and spend more time on the big picture. But convenience doesn’t cancel responsibility. Markets change. Presets age. And with futures, leverage can turn small errors into big ones fast.

Treat every copy as a starting point, not a guarantee. Read the strategy panel, note the drawdown, and sanity-check the price range and grid count before you hit Create. Start with amounts you can sleep on. If you use futures, keep leverage modest and watch margin and funding, costs add up quietly.

Make a habit of checking both Grid Profit and Total P&L, and set clear exits (TP/SL) so the bot can act even when you’re away. When the market stops ranging and starts trending, adjust or close; “hope” is not a setting.

Finally, keep learning. Revisit our risk guides, practice in demo where you can, and review results after each run. The goal isn’t to win every trade, rather to build a simple, repeatable process that limits mistakes. Copying can help you begin; judgement and discipline help you stay in the game.