The Sui network is a high-performance, Move‑based layer‑1 blockchain developed by Mysten Labs. Designed to deliver fast, low‑cost, and parallelized transactions, Sui has cultivated a vibrant DeFi ecosystem over the past year. According to DeFiLlama, Sui’s on‑chain total value locked (TVL) is approximately $1.9 billion. What makes Sui stand out is its Move-based runtime, enabling secure and composable smart contracts that are wallet-friendly and efficient, perfect for modern DeFi use cases, such as yield farming, AMMs, liquid staking, and on-chain gaming.

As Sui has grown, certain sectors have gained prominence:

- DEXes and liquidity protocols, like Turbos Finance and Momentum Finance

- Lending and money markets such as Suilend

- Liquid staking, with platforms like iSUI and others, accounts for over $500 m in value deployed.

Enter Momentum Finance, one of Sui’s top concentrated‑liquidity automated market makers (CLMMs). Launched in early 2025, it represents the next generation of DEXes on the network. Momentum brings capital efficiency to liquidity and market making, including interesting features like single-sided liquidity provision.

What This Guide Covers:

This article is a comprehensive user guide to Momentum Finance, covering everything from:

- Connecting your wallet

- Swapping tokens with slippage controls

- Adding/removing liquidity using CLMM principles and price ranges

- Managing positions via NFTs, range orders, and multi‑band strategies

- Understanding rewards, dynamic mining, and vesting incentives

Key Takeaways

- To use Momentum Finance, connect a Sui-compatible wallet, select a pool or token pair, and execute swaps or provide liquidity within your chosen price range.

- Users can configure slippage tolerance, set custom fee tiers, and optimize yield by adjusting liquidity bands based on market expectations.

- Active liquidity positions earn fees only while within range, so monitoring price movement and impermanent loss is crucial for profitability.

What Is Momentum Finance?

Momentum Finance is an automated market maker (AMM) built on the Sui blockchain. An Automated Market Maker (AMM) is a decentralized exchange system that lets users trade cryptocurrencies directly from a pool of assets instead of matching with another user. These pools are managed by smart contracts, which automatically calculate prices and handle the exchange.

Launched in late March 2025, Momentum rapidly gained traction. Within one month of going live, it had achieved over $1 billion in cumulative trading volume and welcomed 200,000+ active wallets, handling millions of transactions across top Sui token pairs like $DEEP, $SUI, and $USDC.

Notable recent milestone: on June 6, 2025, OKX Ventures invested in the platform, highlighting its $70 m+ TVL and $3 billion–plus volume run in just two months, reinforcing institutional trust in Momentum’s Sui positioning.

Here are the key protocol metrics recorded in June 2025:

- Performance: As of June 2025, $90.8 million TVL is locked across its concentrated liquidity pools. It sees approximately $59.5 million in daily volume, generating around $21.8 million in annualized fees (per DefiLlama).

- Active Users: Over 200,000 unique wallets have used Momentum since launch, with 42,000 active wallets interacting regularly in just two months.

- Yields:

- DEEP–SUI pool delivering ~273% APR

- ETH–SUI pool with ~280% APR

- SUI–USDC stands at ~120% APR

- Others like LBTC–SUI see 152% APR, and WAL–SUI around 142%

These are among the highest yields on Sui, a powerful incentive for participants to provide liquidity.

Momentum Finance is a Major liquidity Layer on Sui | Image via LinkedIn

Momentum Finance is a Major liquidity Layer on Sui | Image via LinkedInCLMM: Concentrated Liquidity Explained

Momentum is a Concentrated Liquidity Market Maker (CLMM), a sophisticated evolution of classic AMMs:

Imagine a long bench stretching across a park (the price range from 0 to ∞). In traditional AMMs, LPs place their “chairs” (liquidity) evenly along this bench — lots of unused space, inefficient placement. In a CLMM, LPs concentrate their chairs in the busiest areas — say, near the entrance where most people walk (the current price) — maximizing their usage and earning more fees per chair.

This model achieves:

- Higher capital efficiency — only deploy funds where they’re actively used.

- Lower slippage — because liquidity is denser around active price zones.

- Greater control for LPs — choose your range: narrow (volatile pairs) or wide (stables).

Momentum implements this similarly to Uniswap V3 but optimized for Sui and enhanced with incentives and rewards distribution.

Institutional backing (OKX Ventures, Coinbase Ventures, etc.) signals both performance credibility and longer roadmap vision. The combination of impressive volume, substantial TVL, and attractive APRs reinforces its status as one of the top liquidity layers on Sui, making it ideal for low-slippage swaps, efficient capital deployment, and high yields for LPs.

Next up, we'll guide you through step-by-step usage — from connecting your wallet and performing swaps, to adding liquidity, managing price ranges, and optimizing rewards. Let’s dive into the practical side of Momentum Finance.

How to Use Momentum Finance

Now that you know a bit about what Momentum Finance is and how it works, let’s walk through how to actually use it. The platform is designed to be familiar to anyone who has interacted with DeFi applications before, especially if you’ve used a Uniswap-style AMM.

We’ll begin with the first step: connecting your wallet.

Connecting to Momentum

Connecting to Momentum is straightforward. Like most DeFi apps, you’ll need a wallet that supports the network; in this case, the Sui blockchain.

Here’s how to get started:

- Install a supported Sui-compatible wallet.

- Ensure your wallet is set to the Sui network.

- Head over to the Momentum Finance app.

- Click on “Connect Wallet” in the top-right corner and select your preferred wallet.

Momentum currently supports the following wallets:

- Sui MetaMask Snap

- Slush Wallet

- OKX Wallet

- Binance Wallet

- Gate Wallet

- Bitget Wallet

If your chosen wallet isn’t installed yet, the interface will prompt you to do so. Once connected, you’re ready to start exploring swaps, liquidity pools, and rewards.

Next, we’ll look at how to execute a swap on Momentum and manage slippage settings effectively.

Making a Swap

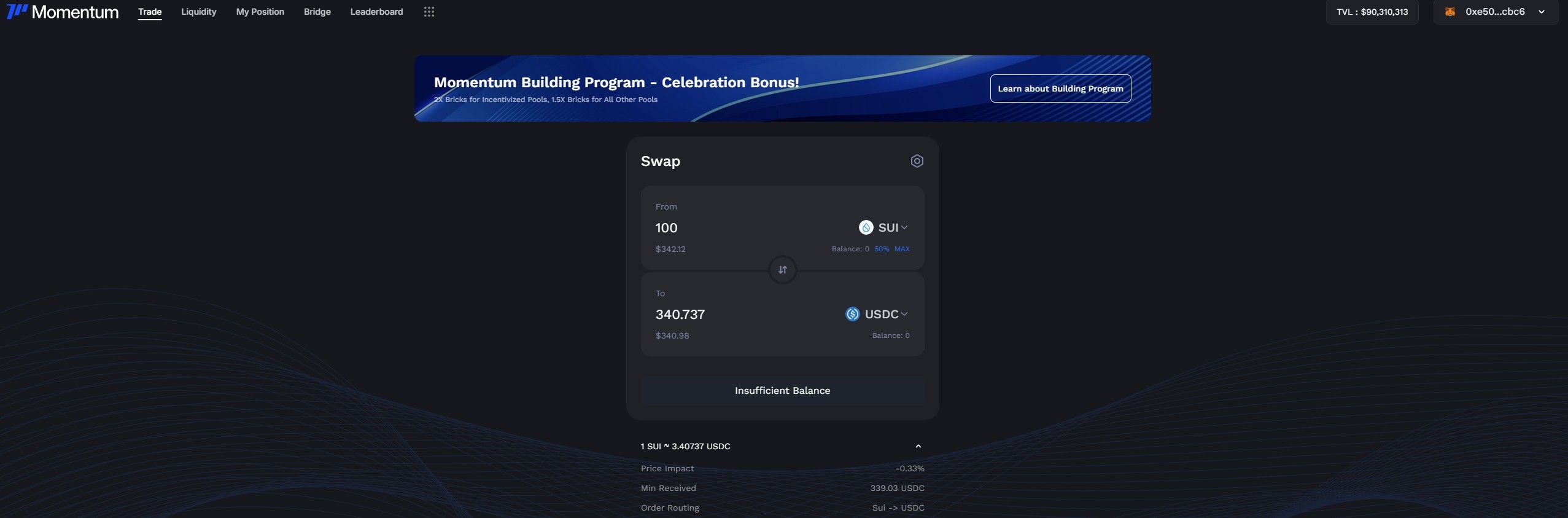

On the Momentum interface, token swaps are handled under the “Trade” tab. Clicking on it opens a clean, minimal swap page, as seen in the screenshot below:

Momentum Features a Minimal Swap Interface | Image via Momentum

Momentum Features a Minimal Swap Interface | Image via MomentumThe swap UI is intuitive. On the top, you select the token you want to trade (“From”), and below that, the token you wish to receive (“To”). You can click on either token to change it from a drop-down list. Gas fees for swaps are paid in SUI, so make sure your wallet holds a small amount of SUI before initiating a trade.

Once you enter an amount in the “From” field, the interface will automatically calculate:

- The expected amount you’ll receive

- The USD value of both tokens

- The conversion rate, displayed at the bottom (e.g., 1 SUI ≈ 3.40 USDC)

Key Swap Details (bottom of the UI):

- Price Impact: This represents slippage, or the extent to which the swap alters the market price due to available liquidity. For example, a –0.29% price impact means your trade will execute slightly below the market rate.

- Min Received: The lowest possible amount you'll receive if the price moves unfavorably during the transaction.

- Order Routing: Displays the swap path. In some cases, especially with cross-chain tokens like ETH or BTC, the swap may involve multiple route hops, or even bridges, to complete.

Adjusting Slippage

Click the gear icon in the top-right of the swap box to configure your slippage tolerance. You can choose between:

- 0.1% – safest, ideal for large trades or volatile tokens

- 0.5% – default setting for most swaps

- 1.0% – more lenient, suitable for low-liquidity tokens

For example, setting a 1% slippage means your trade will still go through even if the price moves by up to 1% from the moment you initiated it.

Finalizing the Swap

Once everything looks good, click Swap, and your wallet will prompt you to approve the transaction. Confirm and sign, and the swap will be processed within a few seconds.

In the next section, we’ll explore how to provide liquidity on Momentum, where things get a bit more hands-on with price ranges and reward mechanics.

Providing Liquidity on Momentum

This section walks through the liquidity provisioning process on Momentum Finance, how to add or remove liquidity, choose the right pool, and understand key mechanics like range placement and position NFTs.

If you're unfamiliar with how liquidity pools or AMMs work, we recommend reading Coin Bureau’s deep dive on Automated Market Makers first. It covers the basics of how liquidity provision enables swaps, how LPs earn fees, and the tradeoffs involved.

Accessing the Liquidity Dashboard

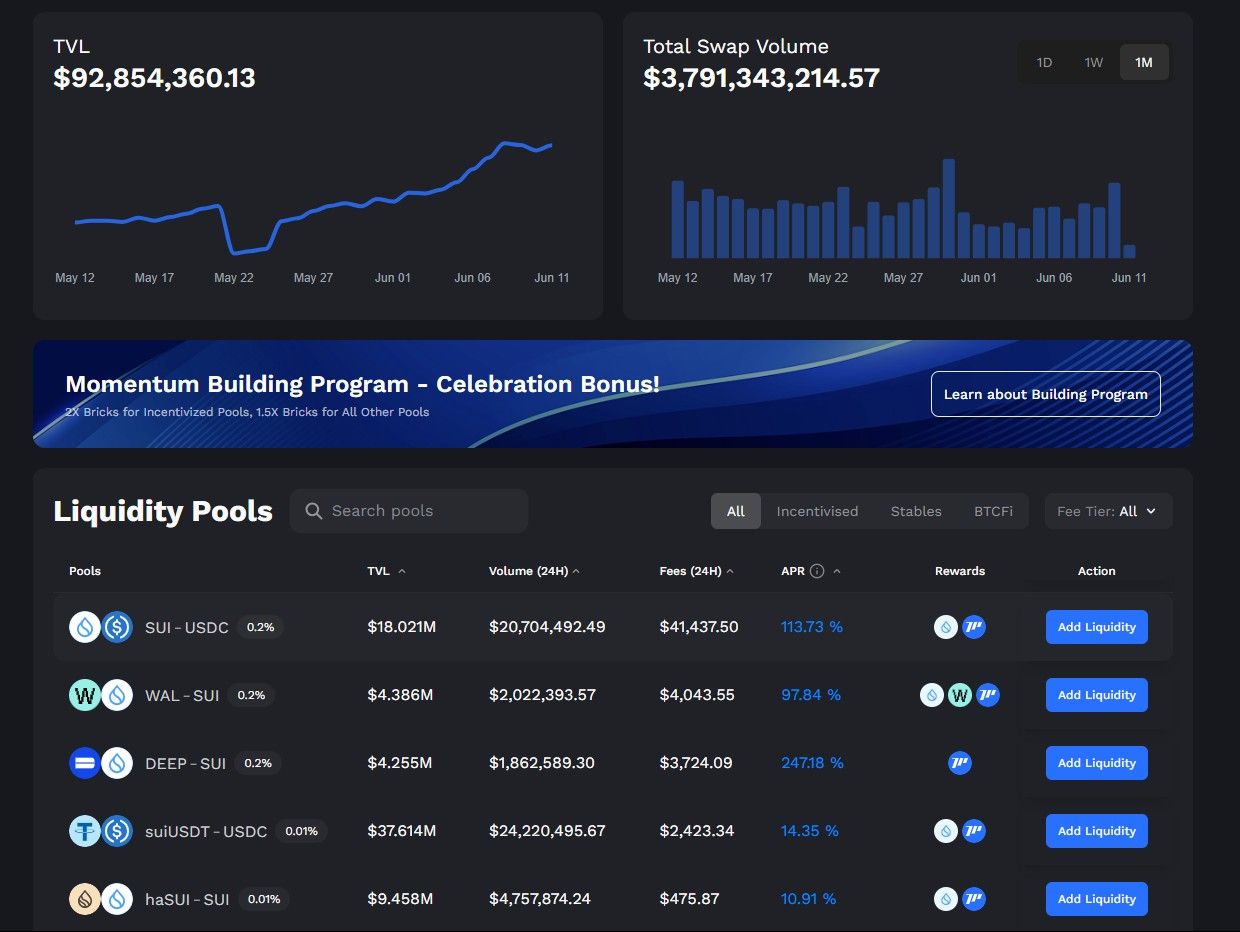

To get started, click on the “Liquidity” tab at the top of the Momentum interface. This opens the platform’s liquidity dashboard, which presents both broad protocol metrics and a list of all active pools.

Here’s a preview of what that looks like:

A Snapshot of Momentum's LP Dashboard | Image via Momentum

A Snapshot of Momentum's LP Dashboard | Image via MomentumAt the top of the dashboard, you’ll see:

- TVL: Total Value Locked across all pools — recently crossing $92.8 million

- Total Swap Volume: Cumulative trading volume — already over $3.7 billion

Below that, the liquidity pool list displays sortable columns like:

- TVL — total liquidity in the pool

- Volume (24H) — trading activity in the past day

- Fees (24H) — total fees earned by LPs in the last 24 hours

- APR — current annualized yield for LPs

You can filter pools by incentivized, stable, or BTCFi, and also sort by fee tier.

If you're new to liquidity mining, it’s wise to begin with stablecoin pools or those that pair a stablecoin with a major token (e.g., SUI–USDC). These pools typically offer more predictable outcomes and lower impermanent loss exposure.

Once you’ve identified a pool that fits your strategy or risk appetite, click on it to access the dedicated pool page and start the process of adding liquidity.

Configuring a Liquidity Position

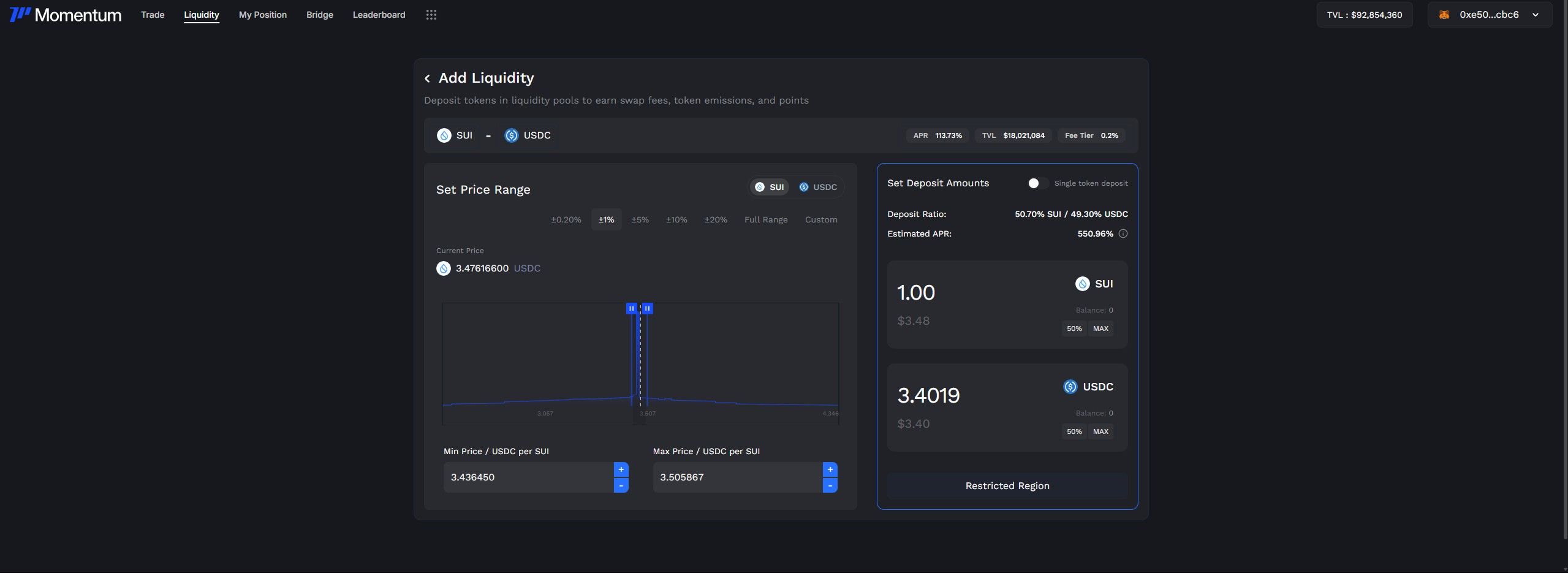

Clicking on a pool from the dashboard takes you to the Add Liquidity interface. The screenshot below shows the setup for the SUI–USDC pool.

The Liquidity Pool Interface on Momentum Used To Add/Remove Liquidity | Image via Momentum

The Liquidity Pool Interface on Momentum Used To Add/Remove Liquidity | Image via MomentumAt the top, you’ll see:

- APR — annualized return for LPs based on fees and incentives

- TVL — total liquidity locked in the pool

- Fee Tier — the percentage cut LPs earn from every swap (e.g., 0.2%)

The interface is divided into two panels:

- Left: for selecting your price range

- Right: for entering token amounts

Selecting a Price Range

On the left, you’ll define the active price range where your liquidity will be deployed. You can set it using presets (±1%, ±5%, etc.) or enter custom values. The current market price is shown in the middle.

Your liquidity will only be active—and earn fees—while the market price stays within this range.

- Tighter range = higher fee concentration, but your funds go inactive faster if the price moves outside.

- Wider range = more uptime, but lower earnings per trade.

For relatively stable pairs (like SUI–USDC), you can afford to keep the range tighter. For volatile tokens, it’s safer to go wide unless you’re confident about the price action.

Deposit Ratio and Token Amounts

On the right panel, you’ll enter how much of each token you want to deposit. Momentum calculates the deposit ratio automatically. Unlike Uniswap V2-style AMMs, this is not always a 50-50 split. The required token ratio depends on the position of your range relative to the current price:

- If your price range is entirely above the market, you’ll mostly deposit one token (e.g., USDC).

- If your range is entirely below, you’ll provide mostly the other token (e.g., SUI).

- If it straddles the current price, the system balances the ratio accordingly (e.g., 50.7% SUI and 49.3% USDC, as shown).

If the price leaves your range entirely, you’ll stop earning fees, and your position will convert entirely into one asset, whichever direction the price exits toward. This is where impermanent loss kicks in: if you withdraw at that point, you’ll only receive one side of the pair.

Optional: Single Token Deposit: Momentum also allows single-token deposits. Just toggle the option, and the protocol will automatically execute the necessary swaps to convert part of your deposit into the other token, aligning with the required ratio.

Final Steps

Once you’ve set your range and deposit amounts:

- Click “Add Liquidity”

- Confirm the transaction in your wallet

- Sign the approval prompt

Your position will go live once the transaction is finalized.

Strategy Tip: LPing Is Part Prediction, Part Planning

Providing liquidity effectively isn’t just about yield; it’s about anticipating both direction and volatility.

For example:

If you expect SUI to rise from $3.40 to $3.60, and you place liquidity in the 3.45–3.65 range (currently inactive), once the price enters your range, you’ll begin collecting fees. And because there are likely fewer LPs in that tight price band, you’ll earn a larger share of the pool’s fees during that period.

This approach takes more effort but rewards strategic foresight. LPing isn’t passive; it’s active capital management.

Managing and Removing Liquidity

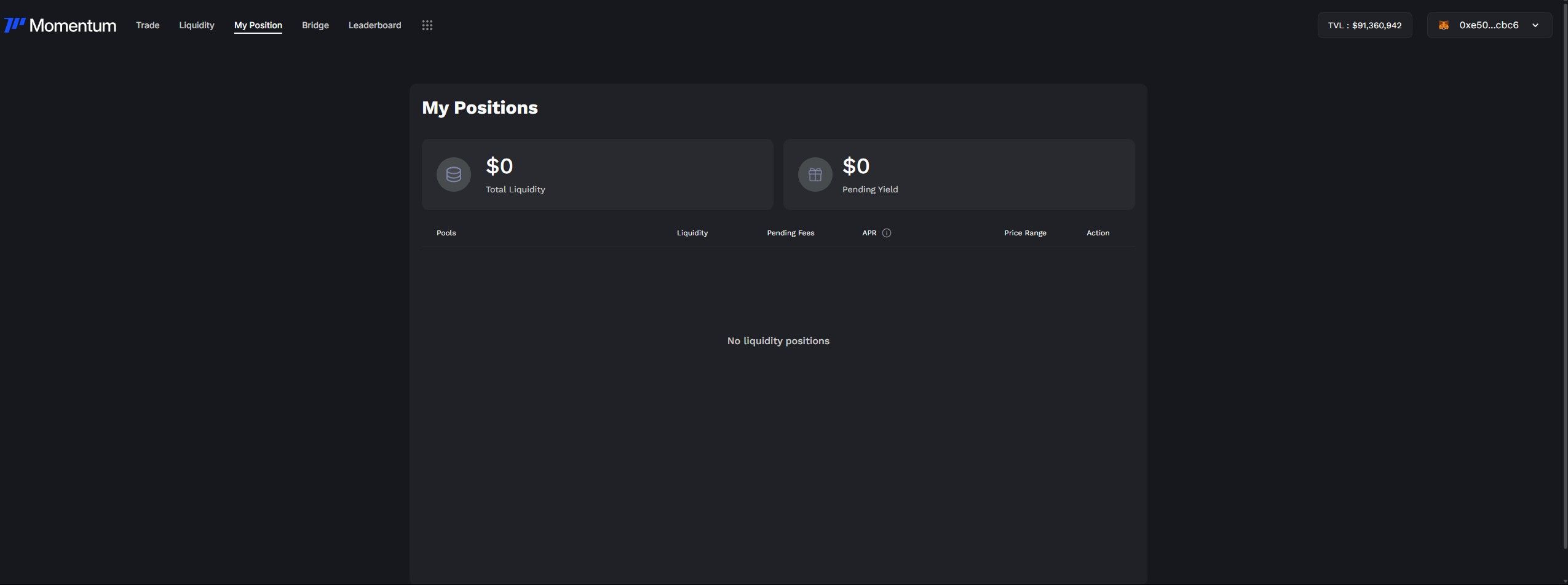

To view and manage your active liquidity positions, head to the “My Position” tab on the Momentum interface.

Momentum's Portfolio Page, Details Active Positions | Image via Momentum

Momentum's Portfolio Page, Details Active Positions | Image via MomentumThis dashboard displays:

- Your total liquidity across pools

- Pending fees earned but not yet claimed

- Pool-wise breakdown of each position’s value, APR, active status, and price range

If you had any open positions, they would appear here along with contextual options:

- Add More Liquidity — top up the current range without needing to reset it

- Remove Liquidity — withdraw funds from the pool and convert them back into the underlying token(s), based on the current price and your position range

As with any other DeFi interaction, removing or modifying a position requires wallet confirmation. Just initiate the action, sign the transaction, and it will be processed on-chain within moments.

This wraps up the LP mechanics on Momentum. In the next section, we’ll look at the key risks, fee dynamics, and how to assess reward potential when using concentrated liquidity protocols like this.

Factors and Considerations

Before actively trading or providing liquidity on Momentum, it’s worth understanding the key factors that affect profitability and risk. This section walks through the core mechanics and externalities that every user should account for.

Slippage

Slippage occurs when the executed price of a trade differs from the expected price due to insufficient liquidity or sudden volatility. Momentum allows users to manually set slippage tolerance, ranging from 0.1% to 1%, through the gear icon on the swap interface.

Larger trades or low-liquidity pairs should use tighter slippage settings to avoid overpaying.

For example, setting a 1% slippage tolerance means your trade will be cancelled if the price moves by more than 1% before execution.

Always check “Price Impact” and “Minimum Received” before confirming a swap to avoid unexpected outcomes.

Impermanent Loss (IL)

Impermanent loss occurs when the price of tokens in a liquidity pool changes relative to their deposit price, causing the LP’s eventual withdrawal value to be lower than if they had just held the tokens.

This risk is amplified in volatile pairs or when using narrow liquidity ranges:

- If your range goes out of bounds and you withdraw, you may receive only one token (whichever side the price moved to).

- IL doesn’t always mean losses, especially if fees earned compensate for the difference, but it’s worth monitoring regularly.

For new users, starting with stablecoin pairs or wide ranges can help minimize IL exposure while learning the mechanics.

Fees

Momentum distributes swap fees to LPs whose positions are currently active. If a trade occurs outside your set range, you earn nothing until the price re-enters your bounds.

There are multiple fee tiers, ranging from 0.01% to 2%, depending on the asset type and volatility:

- Low (0.01%–0.1%): Stablecoin pairs and high-liquidity assets

- Mid (0.25%): Major assets like ETH, BTC

- High (1%–2%): Volatile or exotic assets with higher risk

These tiers let the market self-regulate and balance yield with liquidity availability.

Additionally:

- 20% of swap fees go to the Momentum treasury

- The remaining 80% are fully allocated to LPs

Bridging Assets

Momentum supports assets bridged from other chains via the Bridge tab in the top menu. It integrates with:

- Wormhole

- Sui Bridge

- Squid Finance

This allows you to bring in tokens like ETH and WBTC from external ecosystems to trade or LP with on Sui. However, keep in mind that assets bridged through different routes may be treated as separate tokens.

For example, Wormhole ETH and Sui-native ETH are not always fungible, so check the pool you're entering supports the version you're using.

Using the correct bridging path ensures smooth interoperability within the protocol.

Additional Notes

- Wallet Security: Only connect trusted wallets with your SUI funds. Avoid interacting with unofficial DApps claiming to be Momentum clones.

- Gas Fees: Momentum transactions are fast and cheap, but you’ll still need a small amount of SUI to cover gas. Keep a reserve in your wallet before using the protocol.

- Point Farming: Liquidity providers may earn Bricks, Momentum’s native points system, expected to tie into future token rewards. Incentivized pools often distribute more Bricks, as shown in the liquidity dashboard.

Closing Thoughts

Momentum Finance offers a clean, functional gateway into Sui’s on-chain liquidity ecosystem. Whether you’re swapping assets with tight slippage control or deploying capital as a liquidity provider, the protocol gives users full visibility and autonomy over their activity.

We covered the essentials—from connecting a wallet and executing swaps, to managing CLMM positions, navigating fees, and understanding risks like slippage and impermanent loss. Tools like custom range selection and fee tier routing give LPs the ability to fine-tune their exposure—something rarely available on centralized exchanges.

And that’s the bigger takeaway: on-chain finance isn’t just an alternative—it’s a toolkit. You control the rules of engagement. No middlemen, no opaque order books—just direct participation in a live, transparent system.

For users comfortable with learning the mechanics, protocols like Momentum offer a level of control and composability that centralized platforms simply can’t replicate.