The concept of "yield" is well established in decentralized finance (DeFi). In DeFi, users often deposit funds into yield-generating protocols such as liquidity pools, lending platforms, or staking layers like staked Ether (stETH), which helps them earn additional units of the token they initially deposited. This form of passive income has become one of the core mechanisms driving participation in DeFi. Yield-generation protocols have cemented themselves as essential tools in the decentralized finance ecosystem by allowing users to grow their capital over time through continuous earnings.

However, bonds are another financial instrument that is not widely used in DeFi but offers a distinct opportunity. In traditional finance, bonds represent a promise to deliver a lesser quantity of an asset in the present (usually sold at a discount) in exchange for the full amount, or face value, at a future date. Bonds allow for time-based value accrual as the face value matures over time. While both bonds and yield-generating assets share the idea of earning from an initial deposit, they fundamentally differ in structure. This difference opens the door to a range of speculative strategies and market opportunities unique to each.

Pendle Finance introduces a novel twist by converting yield-based assets into bonds. Essentially, Pendle allows users to tokenize their future yield into separate tradable assets. Tokenization unlocks new possibilities for traders and investors, including the ability to speculate on future yields or lock in fixed returns by trading these tokenized yield-bearing assets.

In a previous article, we explored Pendle Finance and how it functions. This guide focuses on teaching you how to use Pendle Finance effectively. We will explore some of the advanced strategies traders can deploy on the platform, providing you with the knowledge needed to navigate this complex and powerful protocol. Whether you want to speculate on future yield or take advantage of its bond-like structures, this guide will walk you through the process.

Why Use Pendle Finance?

Pendle Finance is a yield tokenization protocol.

To understand Pendle Finance's value, we must first consider how yields work in the DeFi space. In yield-bearing tokens, like staked Ether (stETH), users' returns are never uniform. Instead, these yields fluctuate depending on various factors. Take staked ETH as an example. The yield it generates can be affected by several variables, such as:

- The issuance rate of ETH (how much new ETH is being created)

- The amount of gas collected and burned in each block (which influences the supply and demand of ETH)

- The market price of ETH, as higher prices, can drive more activity on the network

These factors combine to cause yield volatility, making it difficult to predict earnings over time.

Pendle is a Yield-Tokenization Protocol | Image via Pendle

Pendle is a Yield-Tokenization Protocol | Image via PendleLet’s break down three key aspects of this dynamic and why Pendle Finance offers a solution:

Unpredictable Yields

One of the biggest challenges with yield-bearing assets is that the returns can vary dramatically. For instance, the yield from your staked ETH might be 5% today, but there's no guarantee it will remain that way. It could drop to 3% or even lower, depending on how the market moves or network factors shift. This unpredictability makes it difficult to accurately estimate your earnings, which can lead to underwhelming returns. If you lock in your ETH expecting a steady 5%, but the yield suddenly drops, your overall earnings will fall short of what you anticipated.

Yield Speculation

Now, imagine you're a market analyst, and you've been following the trends closely. Based on your research, you speculate that the yield from staked ETH will drop from 4% to 2% over the next six months. With this insight, you can take action. For example, you might agree with someone where you offer them the yields from your staked ETH in exchange for a fixed return of 3%. If your prediction holds and the yield drops to 2%, you end up making an additional 1% profit from the deal because you secured a fixed 3% return while avoiding the lower market yield.

Leveraged Yield

On the flip side, suppose you believe the yield from staked ETH will increase. In this case, you might capitalize on that by acquiring the rights to someone else’s staked ETH yield. Suppose you promise them a fixed return of 4%, but the actual yield increases to 6%. You could pocket the 2% difference as profit, making a strategic gain based on your insight into how the yield will likely perform.

In these scenarios, the ability to separate and trade the yield from yield-bearing assets is key. However, the native Ethereum protocol doesn’t provide a way to do this. This is where Pendle Finance comes in.

Pendle is a DeFi protocol that enables you to execute these strategies in a formal, structured way. It allows users to tokenize their yield-bearing assets—like staked ETH—and split them into two parts: the principal (the staked ETH itself) and the yield. These tokenized components can then be traded or leveraged in various ways, allowing users to speculate on future yield, lock in returns, or capitalize on market trends in a composable, DeFi-native manner.

In short, Pendle Finance provides a platform for executing sophisticated yield strategies, allowing users to profit from their insights and market predictions in a way previously impossible in the DeFi ecosystem.

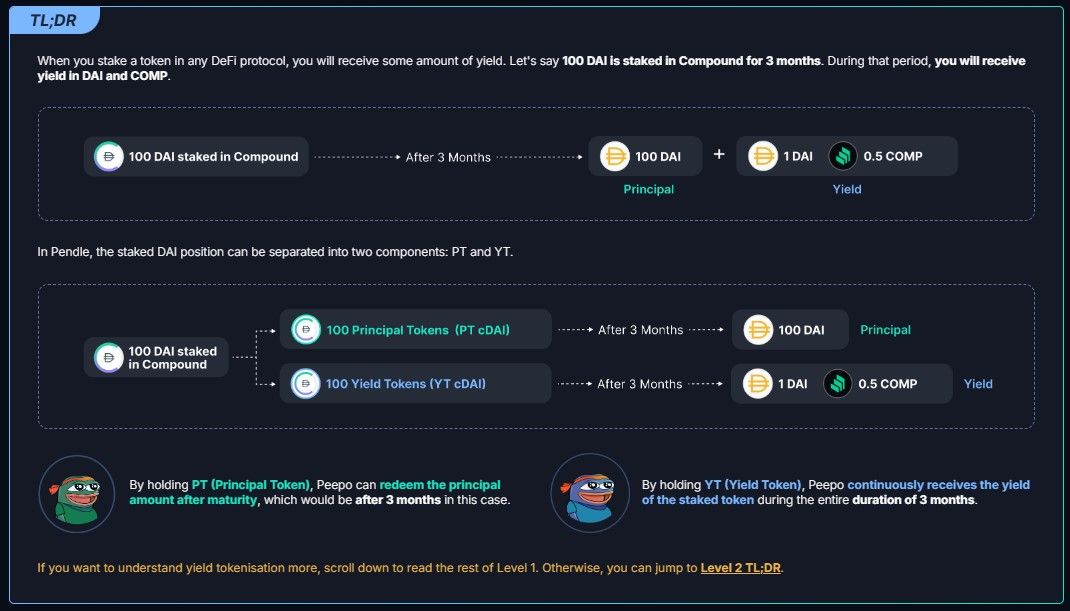

Yield Tokenization

The core concept behind Pendle Finance is yield tokenization, which essentially means splitting a yield-bearing asset into two components: the Principal Token (PT) and the Yield Token (YT). This allows for more flexible trading, speculation, and investment strategies on yield-generating assets. Let’s break this down using the example of 1 staked ETH (stETH) locked in a staking protocol for one year.

Yield-Tokenization TLDR via Pendle

Yield-Tokenization TLDR via PendleUnderstanding PT and YT Tokens

When you lock a yield-bearing asset like stETH in Pendle for a fixed duration (say, one year), its value is split into two parts:

- Principal Token (PT): This represents the right to receive the original 1 stETH at maturity (after one year).

- Yield Token (YT): This represents the right to receive all the yield generated by 1 stETH over the year.

In simple terms, PT gives you ownership of the staked ETH, which you can reclaim after the lock-up period ends, while YT gives you the right to the yield stETH generates during that time. Pendle allows you to split and trade these components independently, creating new opportunities for yield speculation and fixed-return strategies.

The Relationship Between PT and YT Values

Here’s where things get interesting: the combined value of PT and YT tokens always equals the value of the underlying stETH. This parity creates an inverse relationship between the two. For example, if the value of PT increases due to a high demand for fixed returns, the value of YT must decrease proportionally so that together they still equal the value of 1 stETH.

To put it simply:

- If PT is worth 0.9 stETH, YT would be worth 0.1 stETH.

- If PT rises to 0.95 stETH, YT must fall to 0.05 stETH.

This mechanism ensures that, regardless of how PT and YT fluctuate in price, their combined value will always match the underlying asset's value. Additionally, because both PT and YT are just fractions of the underlying, their values are always less than the value of the full underlying asset.

Time to Maturity Component

Pendle Finance operates with a time-to-maturity model, which is essential to understand because both PT and YT tokens are tied to the maturity date of the underlying stETH (in this case, one year):

- PT Tokens: The holder earns a fixed yield until the maturity date. Once the maturity date arrives, the PT token can be redeemed for the full 1 stETH, regardless of its value before maturity.

- YT Tokens: The holder earns the variable yield generated by the stETH during the lock-up period. This yield fluctuates over time and depends on market conditions, such as ETH issuance rates or gas fees.

PT Tokens: Similar to Bonds

PT tokens can be considered zero-coupon bonds, similar to what we discussed earlier in the introduction. A zero-coupon bond doesn’t pay periodic interest but is bought at a discount and redeemed for its face value at maturity. Likewise, PT tokens are typically priced below the value of the underlying stETH because they only represent the future right to claim the stETH, not the yield it generates along the way.

Over time, the value of PT gradually increases as it approaches the maturity date, eventually reaching 1 stETH at maturity when it can be redeemed for the full underlying asset. This gradual increase in value is the fixed "yield" earned by PT holders, making it an attractive option for those seeking steady returns.

YT Tokens: Capturing Variable Yield

On the other hand, YT tokens represent the right to claim the variable yield generated by stETH over the lock-up period. However, YT tokens become worthless after maturity since they only represent yield, and no underlying asset is left to claim. As maturity approaches, the value of YT gradually decreases, reflecting the diminishing amount of future yield it can capture. This gradual decline ensures that, when added together, the value of PT and YT tokens remains equal to the value of 1 stETH throughout the lock-up period.

This dynamic is important because it allows traders and investors to exploit changing market conditions. Suppose you believe yield rates will fluctuate significantly in the future. In that case, you can use this system to speculate on those changes, trading either PT or YT to capitalize on your predictions.

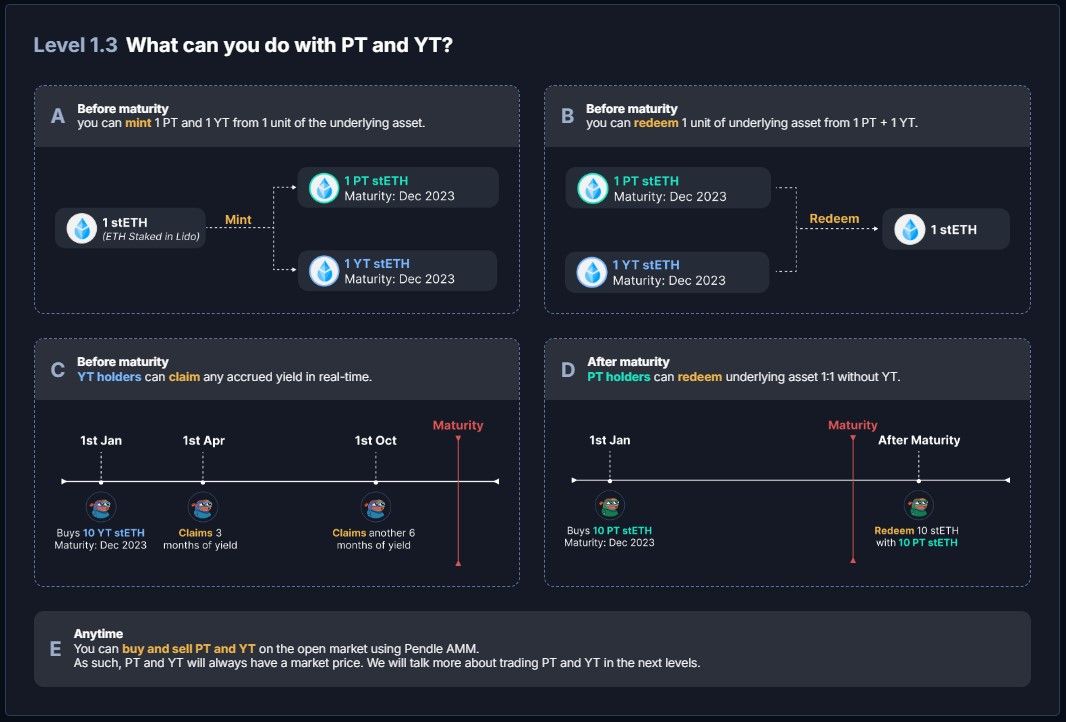

Yield-tokenization Use Cases | Image via Pendle

Yield-tokenization Use Cases | Image via PendleConclusion

Pendle’s unique tokenization of yield-bearing assets into PT and YT tokens opens up a wide range of trading possibilities. With PT, you can lock in fixed returns similar to zero-coupon bonds, while YT allows you to capture the variable yield from the underlying asset. This system creates opportunities for traders to speculate on future yield rates, unlocking advanced strategies for those who understand how to navigate these dynamics.

In the next section, we will explore some of the trading strategies traders can employ on Pendle Finance and the key factors traders should consider when crafting their strategies.

Pendle Finance Investment Strategies

This section will explore various investment strategies that traders and investors can apply when using Pendle Finance. Pendle offers a unique opportunity to separate and trade the principal and yield of yield-bearing assets, allowing users to speculate on future returns, lock in fixed income, or capitalize on changing market dynamics. To effectively navigate Pendle Finance, it’s essential to understand how different strategies can be tailored to your outlook on yield and market trends.

Before implementing any investment strategy on Pendle Finance, the key starting point is analyzing the future direction of yields for the asset in question. Whether you expect the yield to increase or decrease will form the foundation of your trading decisions. For example, if you believe the yield on a particular asset—such as staked Ether (stETH) or a yield-bearing stablecoin—will decrease over time, you might want to lock in a fixed return early on. Conversely, if you expect the yield to increase, you could position yourself to capture that growth.

The two most popular assets for speculation on Pendle Finance are staked Ether from various liquid staking protocols and yield-bearing stablecoins, which offer different yield dynamics and opportunities for strategic planning. In the following sections, we will discuss strategies to help you make the most of Pendle’s powerful tools for yield tokenization and speculation. Here are some factors influencing the yield from staked Ether for your reference:

Ethereum Network Staking Rewards

- Staking Participation Rate:

- The total amount of ETH staked affects the annual percentage yield (APY). As more ETH is staked, the network reduces the reward rate to maintain security incentives.

- Monitor the total ETH staked using platforms like Beaconcha.in or Eth2 Rewards Calculator. A decrease in staking participation could lead to higher yields per validator.

- Network Inflation and Issuance Rate:

- Changes in the ETH issuance rate directly impact staking rewards.

- Stay updated on Ethereum Improvement Proposals (EIPs) that might adjust issuance rates or introduce deflationary mechanisms.

- Transaction Fees:

- Validators receive a portion of transaction fees. Higher network congestion leads to increased gas fees, boosting yields.

- Observe network activity levels. High DeFi activity or NFT trading can increase gas fees, thus increasing yields.

- MEV (Maximal Extractable Value) Opportunities:

- Validators can earn extra income by reordering, including, or censoring transactions within a block.

- Assess the potential MEV opportunities by following MEV research and monitoring tools like Flashbots Dashboard.

- Protocol Upgrades and Changes

- Updates like EIP-1559 (which introduced fee burning) can alter the dynamics of staking rewards.

- Keep track of upcoming Ethereum upgrades through official channels and understand how they might affect staking yields.

- Validator Performance and Network Health

- stETH yield depends on validators performing optimally. Downtime or penalties reduce overall rewards.

- Check Lido's validator performance metrics. Reliable validators contribute to consistent yields.

- Network Stability:

- A stable network ensures consistent block proposals and attestations, maintaining expected yield rates.

- Watch for any network incidents or bugs that could affect performance.

- Market Conditions and ETH Price Dynamics

- While yields are paid in ETH, the USD value of these yields fluctuates with ETH's price.

- Consider how bullish or bearish market sentiments might affect ETH price and, indirectly, the attractiveness of staking. An increasing ETH price appreciates the PT part of stETH, affecting the value of YT components.

- Investor Behavior:

- In bull markets, more participants might stake ETH, potentially lowering individual yields.

- Assess market trends to predict changes in staking participation.

- Supply and Demand for stETH

- High demand for stETH can influence its price relative to ETH, affecting effective yields.

- Monitor stETH liquidity on exchanges and DeFi platforms to gauge market sentiment.

- stETH Price Peg:

- Track the stETH/ETH exchange rate for any significant disparities.

- Regulatory Environment

- New regulations could affect staking services, possibly altering participation rates.

- Stay informed about regulatory developments in major jurisdictions that impact cryptocurrency staking.

- Competition from Other Staking Services

- New or existing platforms offering better rewards can draw participants away from stETH.

- Compare yields across different staking services and watch for shifts in user preferences.

- Economic Factors and Macro Trends

- Traditional financial market conditions can affect crypto investments.

- Consider how low-interest environments might push investors toward higher-yielding assets like stETH.

- Global Economic Events:

- Events like economic recessions or geopolitical tensions can impact investor behavior.

- Analysis: Keep an eye on global news that could affect market stability.

- Technological Developments and Adoption

- Increased usage of Ethereum-based applications can lead to higher network fees, enhancing staking rewards.

- Track metrics like total value locked (TVL) in DeFi and active users on Ethereum.

- Slashing Risks and Security Concerns

- Slashing events reduce overall yields and can affect stETH holders.

- Security breaches or 51% attacks can disrupt staking operations.

- Community Sentiment and Governance Decisions

- Changes proposed by the community can influence staking parameters.

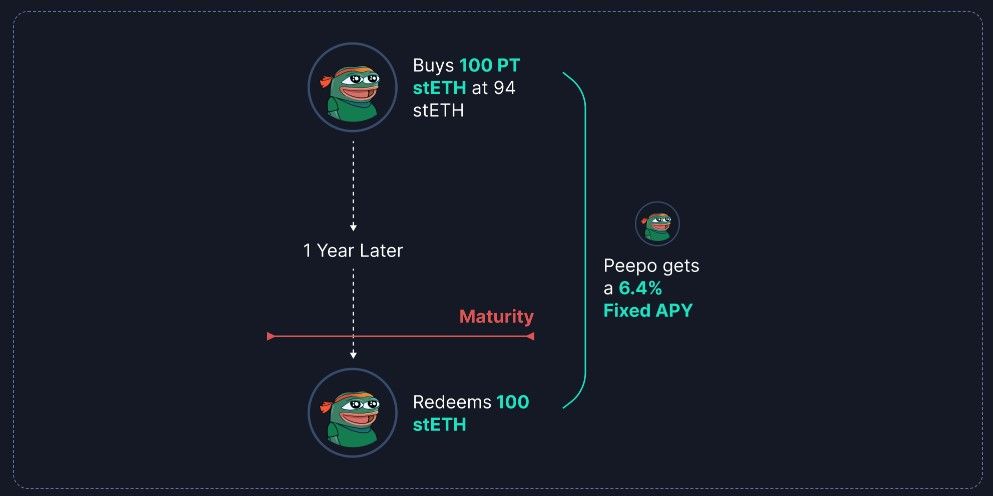

Fixed Income Strategy

A fixed yield strategy on Pendle Finance involves buying Principal Tokens (PT) of a yield-bearing asset to secure a fixed yield until maturity. By purchasing PT tokens, you essentially lock in the right to redeem the underlying asset at a future date while avoiding the volatility of the variable yield associated with that asset. This strategy is ideal for investors who want predictable returns and are looking to shield themselves from the potential decline in yield over time.

Fixed Income Strategy | Image via Pendle

Fixed Income Strategy | Image via PendleWhen Should You Buy PT?

Buying PT tokens to achieve a fixed yield is a good strategy when the yield from the underlying asset is relatively high and you believe it may decline in the future. Here’s a step-by-step breakdown of when and how to implement this strategy:

Step 1: Analyze Yield Trends

Start by analyzing the current yield of the asset you’re interested in, such as staked Ether (stETH) or a yield-bearing stablecoin. For example, if the yield for stETH is currently 5%, but you expect it to drop to 3% over the next few months due to changes in market conditions, now may be the right time to lock in the higher yield.

Step 2: Buy PT Tokens at a Discount

Due to the inverse relationship between PT and YT tokens (as discussed earlier), PT tokens typically sell at a discount when the yield is high. This is because YT tokens capture a higher yield, leaving PT undervalued relative to the underlying asset. By buying PT tokens when they are undervalued, you secure the right to the underlying asset at maturity while locking in a higher fixed return.

Step 3: Monitor Timing and Market Conditions

Timing is crucial in Pendle Finance. The value of PT tokens is influenced by the yield of the underlying asset and the supply and demand for PT and YT tokens on the Pendle platform. If you notice that PT tokens are oversold (perhaps due to an excess of YT trading activity), you can capitalize on this and buy PT at an even better price, boosting your overall returns from the fixed yield.

Step 4: Hold or Sell Prematurely

Once you’ve bought PT tokens, they will be locked in the protocol until maturity. At that point, you can redeem them for the underlying asset (such as stETH) at full value. However, if you prefer not to wait until maturity, you also have the option to sell your PT tokens prematurely on the Pendle Automated Market Maker (AMM). This allows you to book your returns early if market conditions change or if you need liquidity.

Example of a Fixed Yield Strategy

Let’s say you’ve analyzed the current market and noticed that the yield on stETH is unusually high at 6%. Based on your research, you predict that the yield will drop to 4% over the next six months. To lock in the 6% yield, you buy PT tokens representing 1 stETH at a discount (say 0.94 stETH).

By buying PT at 0.94 stETH, you’ve effectively secured the right to redeem 1 full stETH at the end of the year. YT tokens will lose value if the yield drops to 4% as expected, making your decision to lock in the higher yield profitable. You can either hold the PT until maturity and redeem 1 stETH or sell it on the Pendle AMM if the market conditions are favorable before maturity.

This strategy allows you to secure stable returns in a volatile market, protect yourself from potential drops in yield, and have the flexibility to exit your position early if necessary.

In the next section, we’ll explore other strategies on Pendle Finance, including how to leverage variable yields through YT tokens and what factors you should consider when making these decisions.

Speculating with YT Tokens

In Pendle Finance, Yield Tokens (YT) are traded on the same Automated Market Maker (AMM) pool as Principal Tokens (PT), but they have a distinct function. YT tokens give holders the right to accrue the variable yield generated by the underlying asset (like stETH or a yield-bearing stablecoin) until maturity. However, it’s crucial to remember that the value of YT tokens decreases to zero as they approach maturity, reflecting the dwindling amount of yield left to be collected. As a result, YT tokens are only profitable if the cost of acquiring them is less than the yield they generate over time.

If you believe that PT tokens are currently overvalued or that the yield on a particular yield-bearing asset is about to increase due to market conditions, buying YT tokens can be a profitable strategy. By purchasing YT, you pay the fixed rate to PT holders and gain the right to collect the variable yield, creating a potential upside if your prediction holds.

Benefits of Buying YT Tokens

- Cheaper Yield Exposure: YT tokens are significantly more affordable than the underlying yield-bearing asset. This means that YT tokens provide a way to gain exposure to the yield without purchasing or owning the full asset. For example, if you want to benefit from the yield of stETH but don’t wish to invest in the full value of 1 ETH, buying YT stETH allows you to participate in the yield at a fraction of the cost.

- Token Liquidity: Pendle’s AMM offers flexibility by allowing users to buy YT tokens using a variety of other tokens, including stablecoins. For instance, you can purchase YT stETH with stablecoins like USDC, providing a convenient way to gain yield exposure without first converting assets to stETH. This reduces the friction of holding specific tokens for yield exposure, allowing you to enter positions directly from the assets you already hold.

- Leverage with No Liquidation Risk: YT tokens, being cheaper than the underlying asset, can scale your yield position without the risk of liquidation often associated with leveraged trading. For example, if YT sDAI is priced at $0.05 and the yield rate on sDAI is currently 8% APY per $1, purchasing YT sDAI offers a leveraged return of 160% APY for every $1 invested in YT sDAI—without the risk of a margin call. This feature makes YT tokens attractive for yield-hungry traders who want to multiply their exposure to yield without adding liquidation risk.

Risks of Buying YT Tokens

While YT tokens can provide amplified exposure to yield, they also carry certain risks. One key risk is that yield rates can be unpredictable, making negative returns possible. For instance, if the demand for fixed-rate PT tokens rises, pushing the cost of PT closer to the value of the underlying asset, the APY for YT tokens could drop significantly. In extreme cases, where PT reaches near-parity with the underlying, the APY from YT tokens could fall as low as -100%. This risk underscores the importance of closely monitoring market conditions and understanding that YT tokens can expose holders to potentially negative returns.

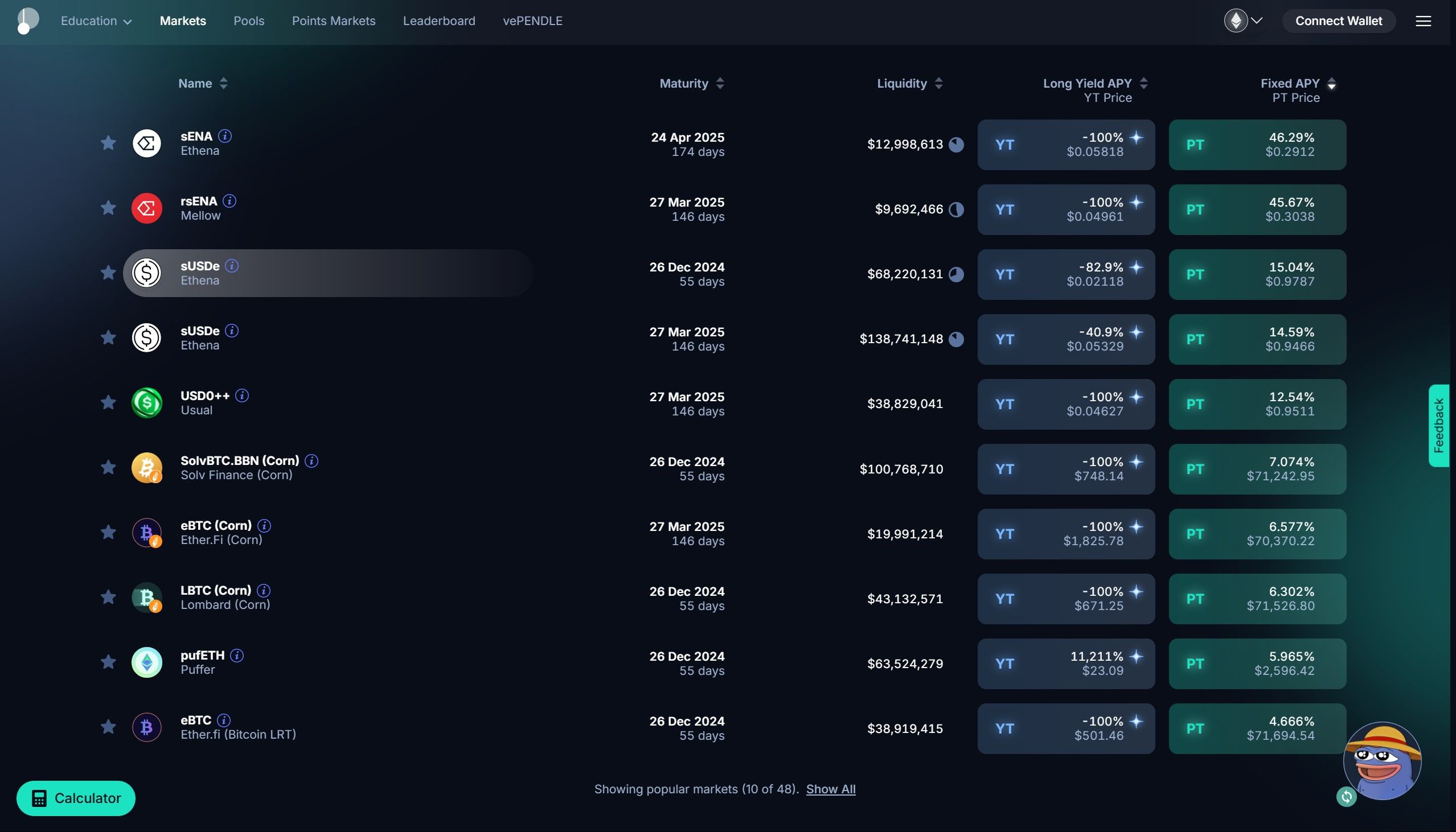

APY For Many YT Tokens on Pendle Have Negative Yields | Image via Pendle

APY For Many YT Tokens on Pendle Have Negative Yields | Image via PendleIn summary, YT tokens offer a strategic way to speculate on variable yield, providing cost-effective exposure to yield assets, increased liquidity, and leverage without liquidation risks. However, the speculative nature of YT tokens also requires an awareness of the potential for negative returns. In the next section, we’ll explore how to combine PT and YT tokens for balanced strategies on Pendle Finance, allowing traders to customize their exposure to fixed and variable yields.

Providing Liquidity on Pendle AMMs

Pendle Finance offers a unique Automated Market Maker (AMM) specifically designed for trading PT (Principal Tokens) and YT (Yield Tokens). The functionality is similar to other decentralized exchange pools, such as those found on Uniswap, but with an important difference: the assets within each pool are both derived from the same underlying yield-bearing token, which creates specific advantages for liquidity providers on Pendle.

How Pendle AMM Liquidity Pools Work

On Pendle, liquidity pools pair PT tokens with their corresponding YT tokens. For instance, a Pendle liquidity pool for staked ETH (stETH) would consist of PT stETH and YT stETH, allowing traders to swap between these tokenized assets seamlessly. The pair is uniquely suited for low-risk liquidity provision since both PT and YT tokens are derived from the same underlying asset.

Minimal Impermanent Loss

A standout feature of Pendle’s AMMs is the low impermanent loss associated with providing liquidity. Impermanent loss typically occurs in AMMs when the value of one asset in a liquidity pair diverges significantly from the other, leading to potential losses for liquidity providers. However, on Pendle, the underlying asset in a PT-YT pool is the same, and the combined value of PT and YT is designed to always equal the value of the underlying yield-bearing token (e.g., stETH). This symmetry minimizes the chance of price divergence, thereby reducing impermanent loss. Liquidity providers on Pendle benefit from this feature, making liquidity provision on Pendle AMMs relatively low-risk compared to traditional AMM pools.

Earning Extra Yield on PT and YT Tokens

By providing liquidity to Pendle AMM pools, traders can earn additional yield on their PT and YT tokens. When you add liquidity to a Pendle pool, you benefit from trading fees and earn additional incentives through Pendle’s native rewards, which can further boost your returns. This allows liquidity providers to generate extra income from their PT and YT tokens and any fixed or variable yield they receive from holding them directly.

In summary, providing liquidity on Pendle AMMs allows traders to earn additional returns on PT and YT tokens while benefiting from minimal impermanent loss. This strategy suits investors looking to leverage their tokenized yield-bearing assets to capture further yield in a relatively low-risk liquidity environment. These are a few of the countless strategies you can execute on Pendle Finance, and they are meant to give you an idea of the thought process you need to follow to create your own strategies.

Final thoughts

Pendle Finance is a unique AMM in the DeFi space, offering derivative products for yield-bearing assets—a first for decentralized finance. While options and futures markets have already allowed traders to speculate on spot crypto assets, Pendle introduces a new layer by enabling trading of fixed and variable yields. This innovation allows users to speculate on, lock in, or amplify returns based on their yield outlook, marking a major evolution in DeFi’s scope.

In traditional finance, bonds are a cornerstone, providing stable, low-risk returns for investors. Pendle Finance effectively brings this concept into the DeFi ecosystem, allowing users to access bond-like products on-chain through Principal Tokens (PT) and Yield Tokens (YT). With Pendle, DeFi users can now achieve the fixed returns typically associated with bonds but in a fully decentralized and permissionless environment, making it accessible to a global user base.

Lastly, Pendle is a testament to DeFi's power of composability. Separating the principal and yield of assets it unlocks new strategies and possibilities, demonstrating how DeFi’s composability can replicate and even expand upon traditional financial structures. As DeFi continues to evolve, protocols like Pendle showcase how decentralized systems can innovate and reshape finance by building on existing financial principles in new, interoperable ways.