Once you have entered the crypto market, understanding the withdrawal process is fundamental to ensuring your money accesses your bank securely, efficiently, and cost-effectively. And most of all, your mental peace!

Withdrawals matter for three primary reasons: cost, speed, and safety. Cost-wise, withdrawal fees can vary significantly depending on the method chosen, whether through fiat transfers like ACH, SEPA, or SWIFT, or through crypto network fees when sending digital assets.

Speed also differs, with some transfers completing within hours and others taking several business days due to banking systems and regulatory checks. Most importantly, security measures such as two-factor authentication (2FA), address whitelisting, and withdrawal locks protect your funds from unauthorized access.

This article provides a comprehensive, step-by-step guide on how to withdraw funds from Crypto.com, covering withdrawals of both fiat and cryptocurrencies. It includes detailed workflows, fee and limit information, regional specifics, and pro tips to avoid common pitfalls and delays.

Quick Verdict

If cost matters most, use ACH or SEPA and plan for a short wait. If speed is non-negotiable, send crypto on a low-fee network or use Faster Payments where supported. For cross-border transfers, price in SWIFT fees before you move. Withdrawals are a logistics problem, not a mystery. Pick the right rail for your goal, confirm the details, then let the system do its job.

| Withdrawal Method | Cost | Speed | Ease of Use | Regional Coverage | Security Level |

|---|---|---|---|---|---|

| ACH (US Dollar) | Low/Free | 1–3 business days | Easy | USA | High (2FA, whitelisting) |

| SEPA (Euro) | Low | 1–2 business days | Easy | Europe (Eurozone) | High |

| SWIFT (International) | Moderate to High | 3–5 business days | Moderate | Global | High |

| Crypto Withdrawals | Network fees (varies) | Minutes to Hours | Moderate | Global | High |

Read our full Crypto.com review.

Important Limitations Before You Start (Read This First)

It is important to know that every process in Web3 has its own prerequisites, and just like owning a typical bank account, one must follow them. Understanding these points will prime you for a smooth withdrawal experience.

Crypto.com App vs Exchange: The Key Difference

Fiat withdrawals are handled exclusively via the Crypto.com mobile app. You cannot withdraw fiat directly from the Crypto.com Exchange web interface.

If your funds are on the Exchange, you must transfer them first to the Crypto.com App wallet before initiating fiat withdrawals. Desktop users should note this limitation and consider practical workarounds such as using the app on mobile or an emulator.

Regional Restrictions & Bank Compatibility

Some regions have specific withdrawal restrictions; for example:

- New York state users cannot withdraw fiat due to regulatory reasons.

- The banking system’s compatibility varies per country and payment rail (ACH, SEPA, Faster Payments, SWIFT).

- The bank account must match your Crypto.com KYC name exactly to avoid rejection.

- Common fintech banks and certain international bank types may face compatibility issues.

- New payees or newly added withdrawal addresses may incur cooling-off or lock periods due to security measures.

First-Deposit Requirement & Security Readiness

You must have made at least one deposit from your destination bank account before withdrawing to it.

Security setup measures include:

- Mandatory two-factor authentication (2FA),

- Enabling passkey

- Biometric login or trusted device recognition and

- Withdrawal address whitelisting.

These controls are crucial to ensure withdrawal safety and comply with regulatory mandates.

Fiat Withdrawals Region-by-Region Guides

Fiat To Crypto Guidelines Differ Region By Region in Crypto.com. Image via d2.live

Fiat To Crypto Guidelines Differ Region By Region in Crypto.com. Image via d2.liveEach region’s fiat withdrawal process on Crypto.com follows a similar structured approach, including prerequisites, step-by-step instructions, fees, withdrawal limits, expected processing speed, and common "gotchas" such as holds or delays.

USD via ACH (United States)

General prerequisites for all USD withdrawals via ACH:

- Complete KYC Verification: You must complete Crypto.com's Know Your Customer (KYC) process, which involves providing your ID and address.

- Set Up Fiat Wallet: You must first set up a fiat wallet in the currency you want to withdraw. You can only withdraw fiat through the Crypto.com App, not the Exchange.

- First-Time Deposit: For SEPA, Faster Payments, and other region-specific methods, you must first make a successful deposit from your bank account to link and verify it before you can withdraw to that same account.

- Matching Account Names: Your bank account name must exactly match the legal name on your Crypto.com account.

- Sell Crypto for Fiat: Before withdrawing, you must sell your cryptocurrency to get the desired fiat currency in your Crypto.com fiat wallet.

Step-by-Step Withdrawal Process in the US

- Log in to your Crypto.com app.

- Open Wallet, select USD/fiat Wallet.

- Tap Withdraw > Bank Account > Select ACH US bank.

- Enter the withdrawal amount and confirm the details.

- Complete 2FA authentication.

- Submit withdrawal; track status in app.

Fees

Cypto.com does not charge fees for ACH withdrawals. However, your bank may charge a processing fee.

Limits

- Minimum: $100 per request.

- Daily: $100,000 or 5 requests.

- Monthly: $500,000 or 30 requests.

Speed

- Withdrawals typically take 1–3 business days.

- Bank holidays or ACH network issues may delay timing.

Holds and Gotchas

- First-time withdrawals to a new bank account may be subject to a hold or cooling-off period.

- Name mismatches result in automatic rejection.

- Users with bank accounts linked to a New York address cannot use ACH withdrawals due to regulatory reasons.

- ACH reversals may occur due to insufficient funds/closed destination accounts.

EUR via SEPA (Eurozone)

Requires a successful SEPA deposit from your bank account first to enable EUR withdrawals back to that same account. Other prerequisites include

- Verified Euro bank account with IBAN.

- Matching the account name with KYC.

- Prior deposits completed.

- 2FA enabled.

Step-by-Step Withdrawal Process in EU

- Open the Crypto.com app.

- Go to Wallet > EUR > Withdraw.

- Select SEPA account.

- Enter the amount and validate the IBAN.

- Authenticate 2FA.

- Submit withdrawal.

Fees

- €1.00 per withdrawal

Limits

- Limits vary by user tier; the app shows current daily/monthly limits.

- Minimum: €80 per request.

- Daily: €100,000.

- Monthly: €500,000.

- Common daily max around €10,000 or equivalent

Speed

- Standard SEPA transfers take 1–2 business days.

- SEPA Instant is available on supported banks with near-instant delivery.

Holds and Gotchas

- IBAN errors may cause delays or rejection.

- Bank-specific SEPA policies matter; incomplete remittance info may cause rejection.

- SEPA Instant availability depends on the receiving bank's facilities.

GBP via Faster Payments (UK)

Again, GBP Withdrawal requires a successful GBP deposit via FPS from your bank account first to enable withdrawals back to that same account.

Prerequisites

- Verified UK bank account.

- Name must match KYC.

- Previous deposit.

- 2FA enabled.

Step-by-Step Withdrawal Process in the UK

- Access GBP Wallet in the app.

- Select Withdraw > Faster Payments account.

- Input withdrawal amount.

- Verify account number and sort code.

- Authenticate withdrawal.

- Submit and monitor status.

Fees

- £1.90 per withdrawal.

Limits

- Minimum: GBP 70.

- Daily: GBP 100,000.

- Monthly: GBP 500,000.

Speed

- Same-day payments during bank cutoff hours

Holds and Gotchas

- Bank cutoff times impact processing speed.

- Name mismatches cause issues.

- New payees incur security holds.

SWIFT International Wire Transfers

Prerequisites for USD SWIFT withdrawals via the SWIFT Network are

- Verified international bank account with SWIFT/BIC.

- Prior deposits must be completed.

- 2FA enabled.

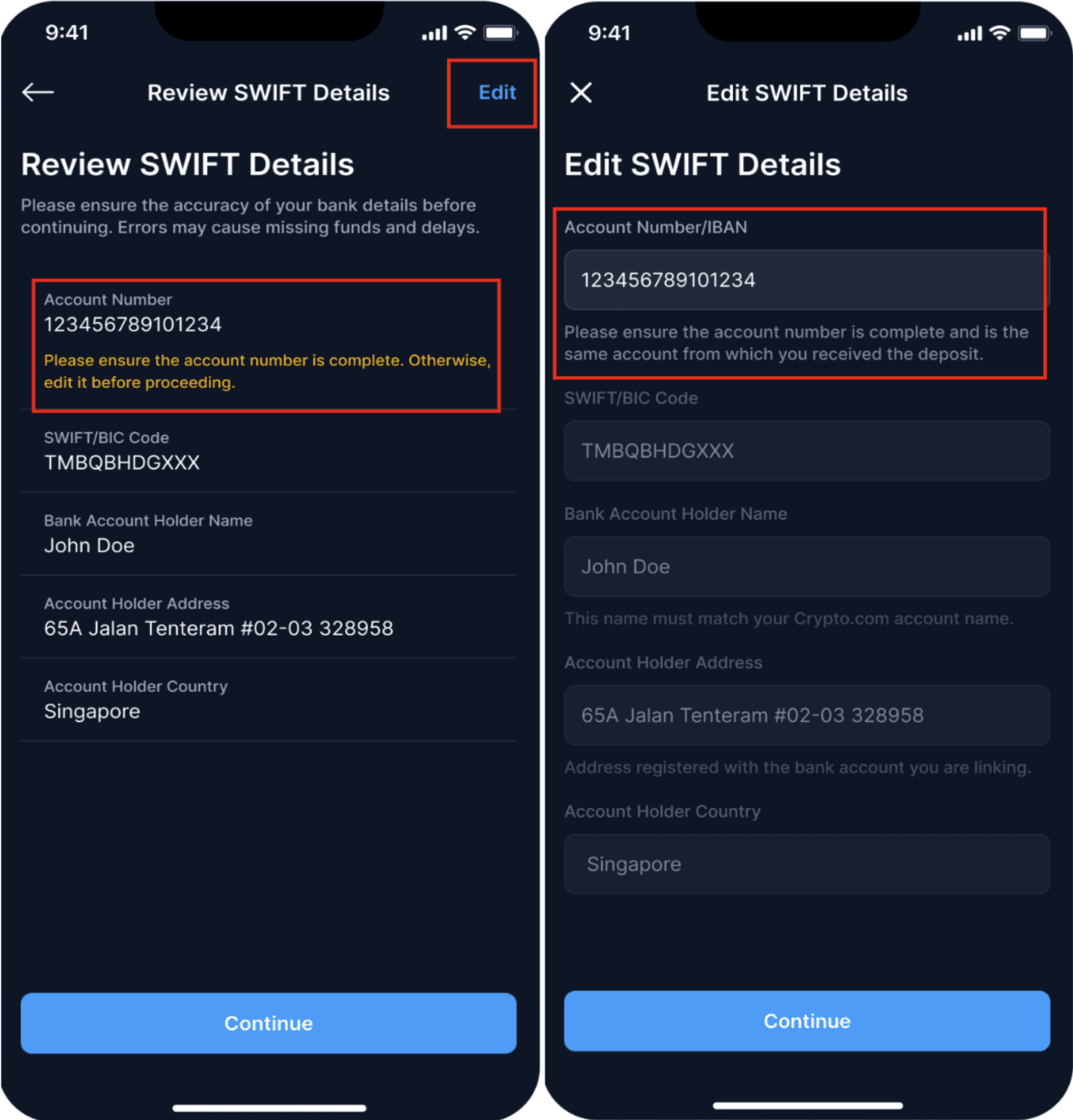

Step-by-Step SWIFT Withdrawal Process

1. Choose a fiat currency wallet.

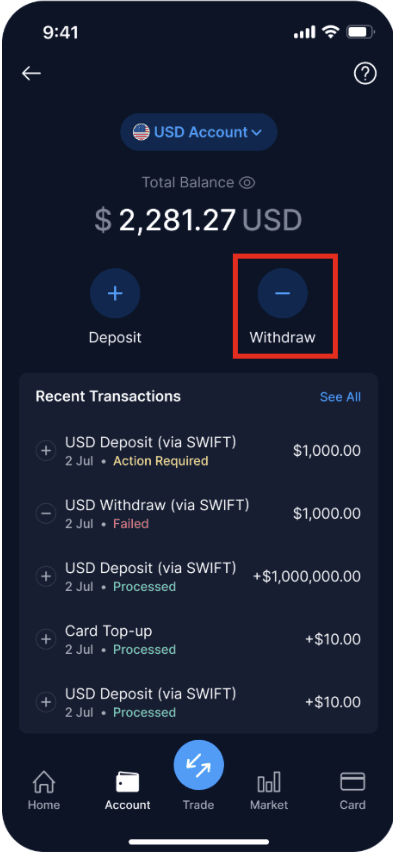

Initiating A USD Withdrawal From Crypto.com. Image via Crypto.com

Initiating A USD Withdrawal From Crypto.com. Image via Crypto.com2. Ensure you have USDC in your wallet and USD Account/Wallet.

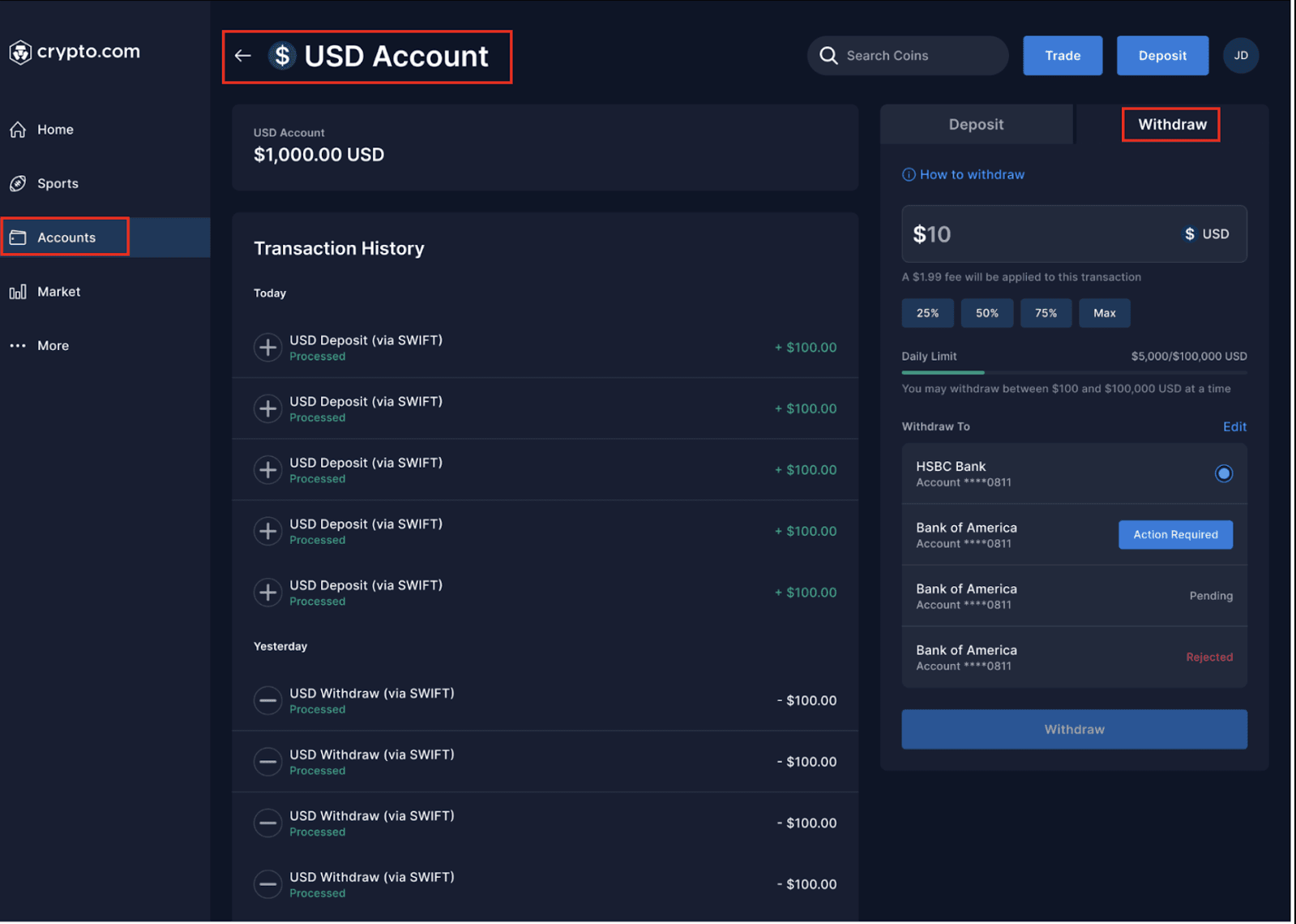

Select Your USD Account And Enter The Amount For Withdrawal. Image via Crypto.com

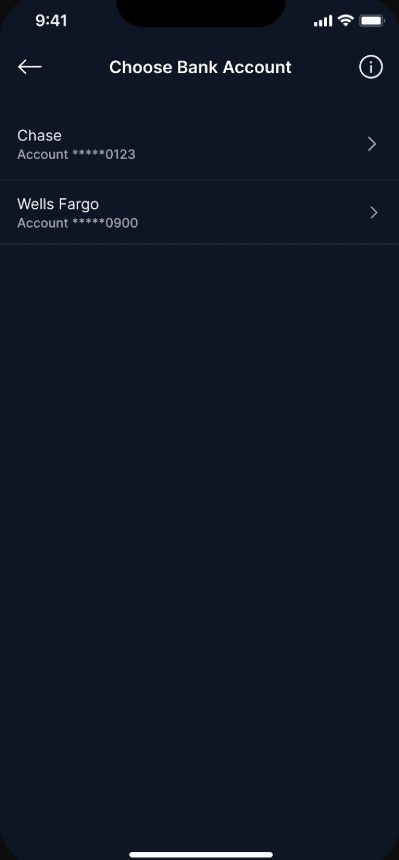

Select Your USD Account And Enter The Amount For Withdrawal. Image via Crypto.com3. Select your bank account for withdrawal.

Select Your Bank Account For Withdrawal. Image via Crypto.com

Select Your Bank Account For Withdrawal. Image via Crypto.com4. Enter SWIFT/BIC and bank details.

Review SWIFT Details Of Your Bank. Image via Crypto.com and Confirm The Transaction. Image via Crypto.com

Review SWIFT Details Of Your Bank. Image via Crypto.com and Confirm The Transaction. Image via Crypto.com5. Enter the amount, review the fees, and authenticate the security prompt finally, submit the withdrawal.

Fees

- Crypto.com charges a fixed or percentage fee, $25 or 0.1–0.5%.

- Banks and intermediaries have additional wire fees.

- Currency conversion and FX fees are likely.

Limits

- Minimum: $500 (for USDC withdrawal).

- Daily: $500,000 (for USDC withdrawal).

- Monthly: $2,000,000 (for USDC withdrawal).

Speed

- Usually 3–5 business days.

- Delays may occur due to intermediary banks.

Holds and Gotchas

- Incorrect SWIFT/BIC or account numbers cause returns.

- FX spreads and extra fees can surprise users.

- Some countries restrict SWIFT receipts.

Other Local Methods (CAD, SGD, BRL, TRY)

- Supported with local EFT, GIRO, and TED rails.

- App-only withdrawals.

- Fees, limits, and speeds vary by region.

- Users should confirm details in the app as methods and conditions change.

Here is a table to summarise it for you. And while you do that, also take a look at some of the best Fiat-to-Crypto Exchange platforms.

| Method | Region | Typical Speed | Platform Fee | Bank/Intermediary Fees | Daily/Monthly Limits | Best For |

|---|---|---|---|---|---|---|

| ACH (Automated Clearing House) | United States | 1–3 business days | Free from Crypto.com | May be charged by your bank | $100,000 daily / $500,000 monthly | US users making regular, non-urgent withdrawals |

| SEPA (Single Euro Payments Area) | Eurozone | Same day to 1 business day | €1.00 per withdrawal | None (within SEPA zone) | €100,000 daily / €500,000 monthly | Eurozone residents needing affordable and fast transfers |

| Faster Payments | United Kingdom | Within 1 business day | £1.90 per withdrawal | None (within the UK) | £100,000 daily / £500,000 monthly | UK residents seeking quick and direct GBP withdrawals |

| SWIFT International Wire | Global (for USD via USDC withdrawal) | 1–5 business days, varying by bank | Free from Crypto.com | Possible charges from intermediary and receiving banks | $500,000 daily / $2,000,000 monthly (via USDC) | High-value, international USD withdrawals, especially where local transfers aren't available |

Crypto Withdrawals to External Wallets

Crypto Withdrawal Addresses Can Be Whitelisted on Crypto.com. Image via Shutterstock

Crypto Withdrawal Addresses Can Be Whitelisted on Crypto.com. Image via ShutterstockWithdrawing cryptocurrency directly to external wallets is a critical feature for users wanting full control over their funds or to use crypto for payments, trading on other platforms, or storage in private wallets. This section covers how to safely add withdrawal addresses, the stepwise process to send crypto, and important fee and limit considerations.

Adding and Whitelisting Withdrawal Addresses

To prevent errors and unauthorized activity, withdrawal addresses must be added and whitelisted before use. This section explains the setup process.

Prerequisites

- Two-factor authentication (2FA) must be enabled.

- The Crypto.com app or website supports address whitelisting to enhance security.

- Withdrawal addresses can incur a cooling-off period, typically 24-48 hours, for first-time additions or changes.

- Ensure you are using a trusted device; new devices may trigger additional verification steps.

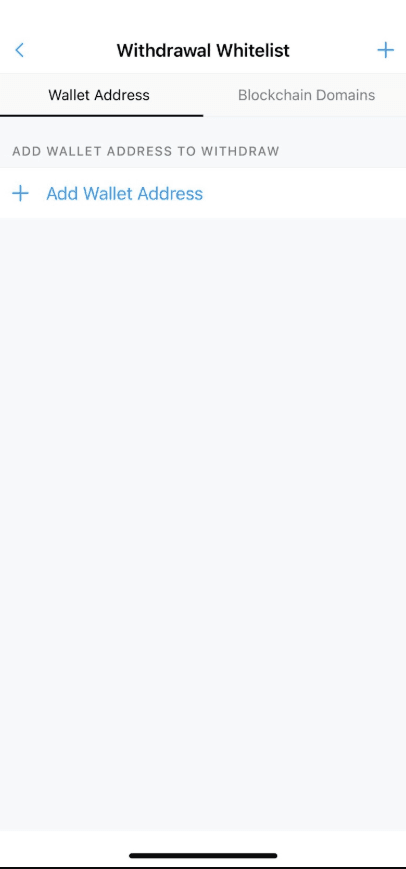

Steps to Add and Whitelist an Address

- Log in to the Crypto.com app or website.

- Navigate to the "Security" or "Settings" section.

- Find the "Withdrawal Addresses" or "Address Whitelisting" submenu.

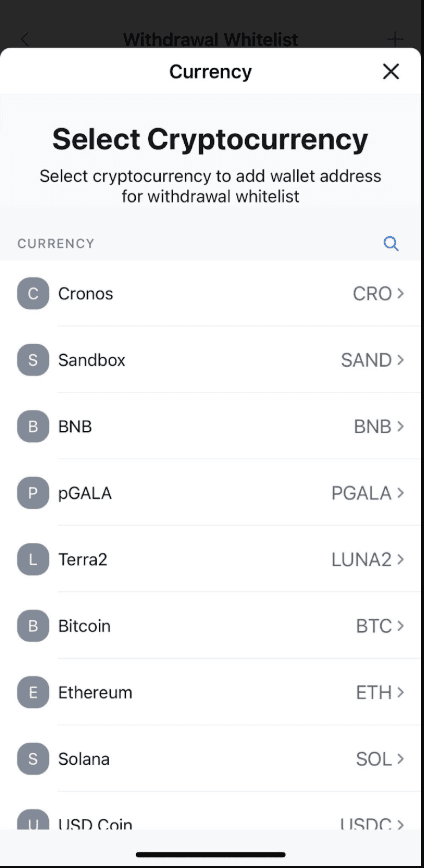

- Add the new external wallet address by selecting the cryptocurrency type and entering the address carefully.

- Submit and complete 2FA confirmation.

- Wait for the cooling-off period to pass if it’s your first time adding this address.

- After approval, the address becomes available for withdrawal.

Security Tips

- Always double-check the wallet address; crypto sent to the wrong address cannot be recovered.

- Enable withdrawal address whitelisting to restrict withdrawals to approved addresses only.

- Regularly update and audit your whitelist for unused or outdated addresses.

Sending Crypto Out: BTC, ETH, USDC Examples

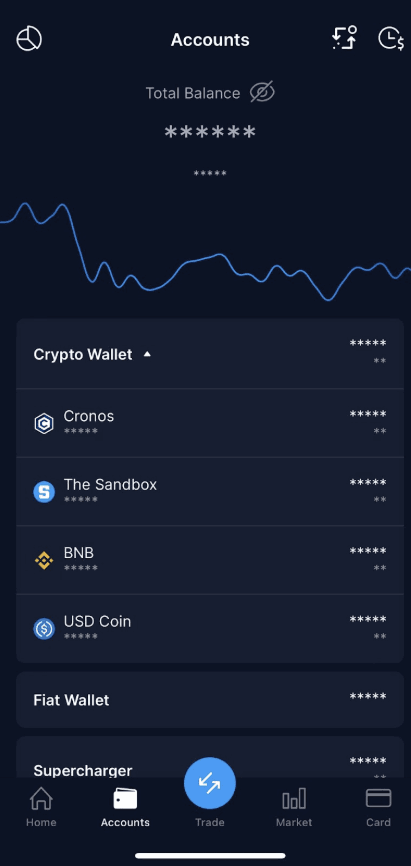

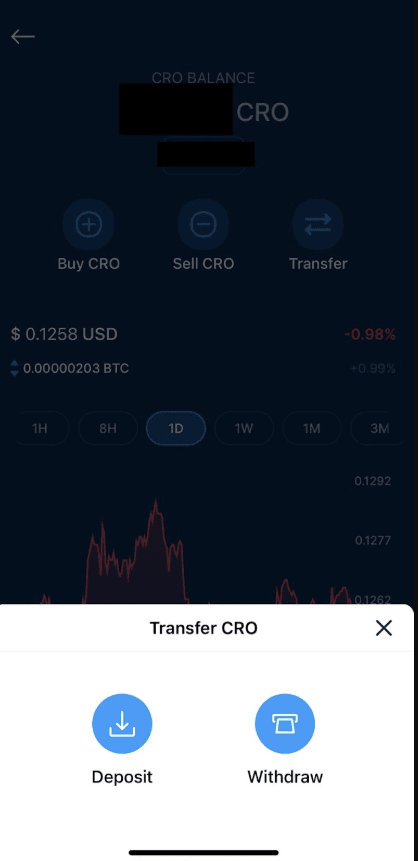

Once your withdrawal address is approved and active, you can start sending crypto out to your chosen wallet.

Steps for Withdrawing Bitcoin (BTC)

1. Open the Crypto.com app.

Log Into Your Crypto.com App. Image via Crypto.com

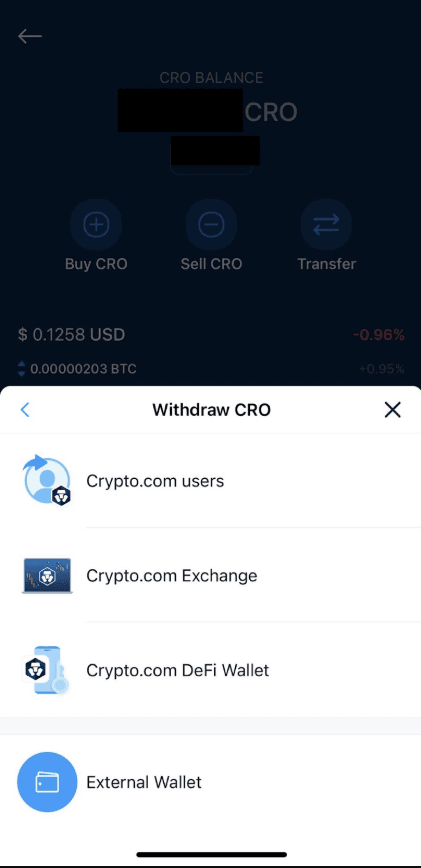

Log Into Your Crypto.com App. Image via Crypto.com2. Tap "Withdraw" and choose “External Wallet.”

Select Withdraw. Image via Crypto.com

Select Withdraw. Image via Crypto.com Select External Wallet. Image via Crypto.com

Select External Wallet. Image via Crypto.com3. Select the cryptocurrency and your whitelisted addresses.

Select Withdrawal Whitelist. Image via Crypto.com

Select Withdrawal Whitelist. Image via Crypto.com Select The Cryptocurrency Of Withdrawal. Image via Crypto.com

Select The Cryptocurrency Of Withdrawal. Image via Crypto.com4. Enter the amount to withdraw.

5. Choose the network.

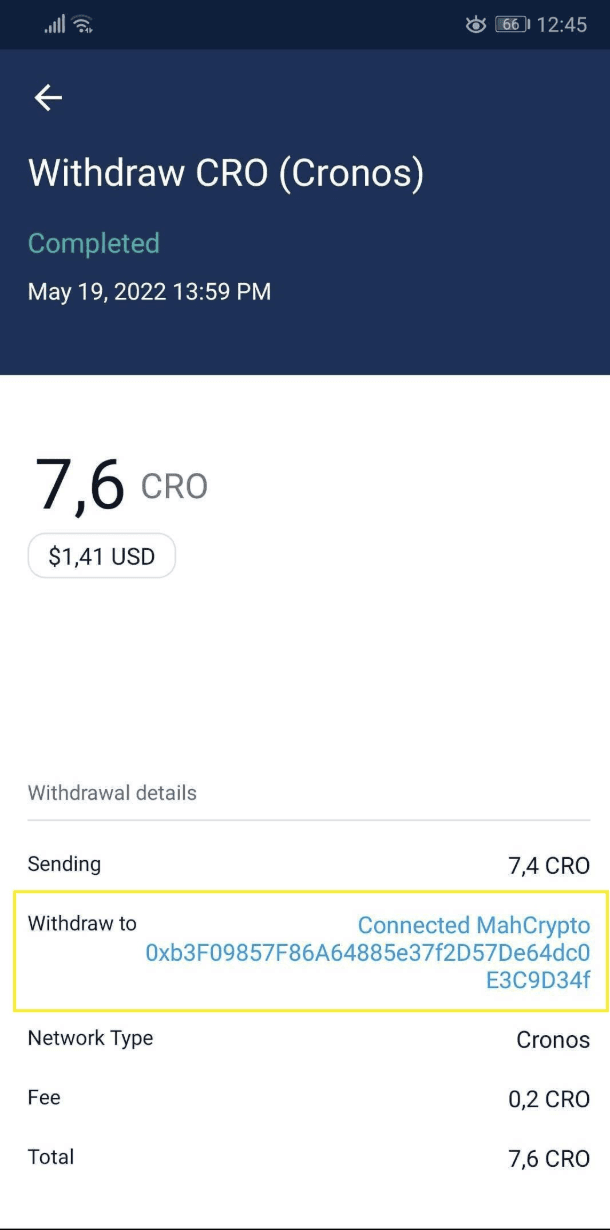

6. Review the transaction details, including the estimated network fee(example with CRO).

Review The Transaction Details. Image via Crypto.com

Review The Transaction Details. Image via Crypto.com7. Confirm withdrawal with 2FA and track the transaction via TxID on a blockchain explorer.

Use Your TxnID to Track. Image via Crypto.com

Use Your TxnID to Track. Image via Crypto.comSimilarly, one must follow the steps below for withdrawing Ethereum (ETH) or ERC20 Tokens (e.g., USDC)

- Access your ETH or ERC20 token wallet in the app.

- Select "Withdraw" > "External Wallet."

- Pick the whitelisted Ethereum address.

- Specify withdrawal amount.

- Select the transfer network: ERC20 (ETH mainnet), or any supported Layer 2 network (e.g., Polygon) for cost savings.

- Check gas fees and confirmation times for the chosen network.

- Authorize the withdrawal via 2FA.

- Monitor TxID on the appropriate blockchain explorer.

Important Notes on Other Networks

- For XRP, ATOM, and other assets, ensure correct memo/tags when applicable.

- Some networks have different confirmation times and fee structures; choose wisely to optimize for speed or cost.

Fees, Minimums, and Limits

Withdrawals generally involve a platform withdrawal fee and a network/gas fee. Beyond the mechanics of transferring funds, it’s important to understand the costs and thresholds tied to each withdrawal.

| Cryptocurrency | Minimum Withdrawal | Platform Withdrawal Fee | Estimated Network Fee | Notes |

|---|---|---|---|---|

| Bitcoin (BTC) | 0.001 BTC | 0.0004 BTC | Varies by network load | Network fees fluctuate with congestion. |

| Ethereum (ETH) | 0.01 ETH | 0.000067 ETH | Gas fee varies | Can be high during peak times. |

| USDC (ERC20) | 10 USDC | 5 USDC | Gas fee varies | Layer 2 options may reduce gas costs. |

| Solana (SOL) | 0.1 SOL | 0.000019 SOL | Low | Fast, inexpensive network fees. |

- Withdrawal fees consist of platform fees plus network (gas) fees.

- Network fees are dynamic and depend on blockchain congestion.

- Always verify fees and minimum withdrawal amounts before submitting.

Security and Confirmation

The final step is confirming withdrawals safely and securely through layered protections.

- Crypto withdrawals require multiple authentication layers (2FA, device approval).

- Withdrawal transactions are irreversible once confirmed on the blockchain.

- Confirmation times depend on the network and chosen transfer method.

- Always keep withdrawal receipts and TxIDs for tracking and record-keeping.

Crypto.com Fee Breakdown

Fee Breakdown On Crypto.com By Type Of Currency. Image via Shutterstock

Fee Breakdown On Crypto.com By Type Of Currency. Image via ShutterstockUnderstanding the exact fees imposed by Crypto.com and the underlying blockchain network is vital to planning withdrawals optimally and avoiding unexpected costs. This section breaks down all fees with examples for fiat and crypto withdrawals and offers tips to minimize charges.

Before we go into the exact breakdown, it's important to also understand different kinds of fees by method.

- Maker/Taker Fees (Trading): These are charged during trading activity and are distinct from withdrawal fees. Maker fees are for adding liquidity, taker fees are for removing it. Staking CRO can offer reduced or 0% maker fees.

- Withdrawal Fees: These are charged by Crypto.com for transferring crypto from the exchange to an external wallet and generally include a platform fee and a network/gas fee.

- Network Fees (On-chain/Gas Fees): These are paid directly to the blockchain network (miners/validators) to process transactions and are dynamic, fluctuating based on network congestion and transaction complexity.

Fiat Withdrawal Fees

| Region/Method | Crypto.com Fee | Bank/Network Fee | Example Fee for $1000 Withdrawal |

|---|---|---|---|

| ACH (USD) | Free | Possible bank fees (~$0-$15) | $0 - $15 |

| SEPA (EUR) | Free or minimal | Usually free | €0 |

| Faster Payments (GBP) | Free or minimal | None | £0 |

| SWIFT (International) | None of amount | Variable, | $25-$50+ |

Real-world Example

A UK user withdrawing £1,000 via Faster Payments generally pays no fees, with funds arriving the same day. A US user withdrawing $1,000 via ACH might avoid Crypto.com fees but encounter a $10 bank incoming transfer fee occasionally.

Crypto Withdrawal Fees vs Network Fees

Cryptocurrency Crypto.com Fee Network Fee (Avg.) Example Fee for Withdrawal

Fee Minimization Tips

- Use Layer 2 or low-cost networks supported by Crypto.com to reduce Ethereum gas fees.

- Consolidate withdrawals to avoid multiple small fee payments.

- Time withdrawals during low network congestion periods.

- Prefer fiat withdrawals via low-cost networks or ACH/SEPA over international SWIFT to save fees.

Withdrawal Limits and Holds

- Limits are tier and region-dependent. Basic verified users have lower limits; enhanced KYC increases limits significantly.

- Maximum daily withdrawal could be $10,000 to $250,000, depending on verification and currency.

- Holds for withdrawal security range from instant to 48 hours for new devices or withdrawal addresses. Some methods, like SWIFT, suffer additional bank intermediary delays.

- Crypto.com app displays precise limits and pending hold info in the withdrawal interface.

Security Measures for Safe Withdrawals

Crypto.com Follows The Best Security Measures for Safe Withdrawals. Image via Shutterstock

Crypto.com Follows The Best Security Measures for Safe Withdrawals. Image via ShutterstockCrypto.com follows the best security practices to protect the users' funds against unauthorized access, fraud, and theft. The exchange mandates several layers of security controls to ensure withdrawals are safe and compliant with regulations.

Mandatory Security Measures

- Two-Factor Authentication (2FA): 2FA via authenticator apps or SMS is required to confirm withdrawal transactions, adding a critical second verification step beyond passwords.

- Passkey or Biometric Authentication: Users are encouraged to enable biometric login (fingerprint, Face ID) or passkeys on supported devices for convenient and secure app access.

- Withdrawal Address Whitelisting: Users must whitelist external cryptocurrency addresses before withdrawals. This prevents funds from being sent to unapproved or fraudulent wallets.

- Device Recognition: Crypto.com tracks trusted devices, requiring additional verification for withdrawals initiated from new or unrecognized hardware.

- Mandatory Identity Verification (KYC): All users must complete Know Your Customer (KYC) checks before withdrawals, ensuring compliance with anti-money laundering regulations.

Advanced Options

- Withdrawal Locks: Users can activate withdrawal locks, temporarily disabling withdrawals for a set period in case of suspicious activity or account compromise.

- Custodial Insurance: Crypto.com maintains insurance coverage for digital assets held in its custody, offering an additional layer of user asset protection.

- Withdrawal Notification Alerts: Real-time notifications via email and app alerts inform users immediately of withdrawal activity, enabling rapid response to unauthorized transactions.

- IP Whitelisting and Geo-Restrictions: Advanced users can restrict withdrawals to certain IP addresses or geographic regions for added security controls.

Best Practices for Users

- Always enable and regularly update 2FA credentials.

- Regularly review and manage whitelisted withdrawal addresses.

- Avoid using public or unsecured Wi-Fi when making withdrawals.

- Monitor account activity for any unusual withdrawals or login attempts.

- Keep contact information, such as email and phone numbers, updated for swift recovery and alerts.

Custody & Coverage (Know What’s Insured)

The vast majority of user assets on Crypto.com are stored offline (“cold”) with multiple layers of physical, operational, and cryptographic security. As of September 2025, Crypto.com maintains one of the largest insurance programs in the industry, with more than $750 million in coverage through Lloyd’s and Aon. This insurance covers physical damage, destruction, and third-party theft (such as loss from an exchange hack or custodian compromise), but does not cover individual investment losses due to market fluctuations.

Recovery Steps if Compromised:

If an account is compromised, users should:

- Immediately activate withdrawal locks via the app.

- Contact Crypto.com support for a rapid account freeze and investigation.

- Provide all withdrawal and notification logs for audit.

- Reset all security methods: passkey, biometrics, 2FA, and PINs.

- Crypto.com’s insurance may cover losses resulting from platform breaches, but users must cooperate with the incident response to maximize recovery chances.

Here is a list of the most secure crypto exchanges that follow these practices.

Tracking Crypto.com Withdrawals

Tracking the status of your withdrawals helps ensure transparency, gives peace of mind, and allows for timely action if issues arise. Crypto.com provides clear tracking and notification tools for both fiat and crypto withdrawals.

Fiat Tracking

- Withdrawal status can be viewed directly in the Crypto.com app under Wallet > Transaction History.

- Statuses include: Pending, Processing, Completed, or Failed.

- Push notifications and email alerts inform users upon withdrawal initiation and completion.

- Processing times depend on the withdrawal method and banking rails; users are encouraged to check their bank accounts after receiving a "Completed" status.

Crypto Tracking

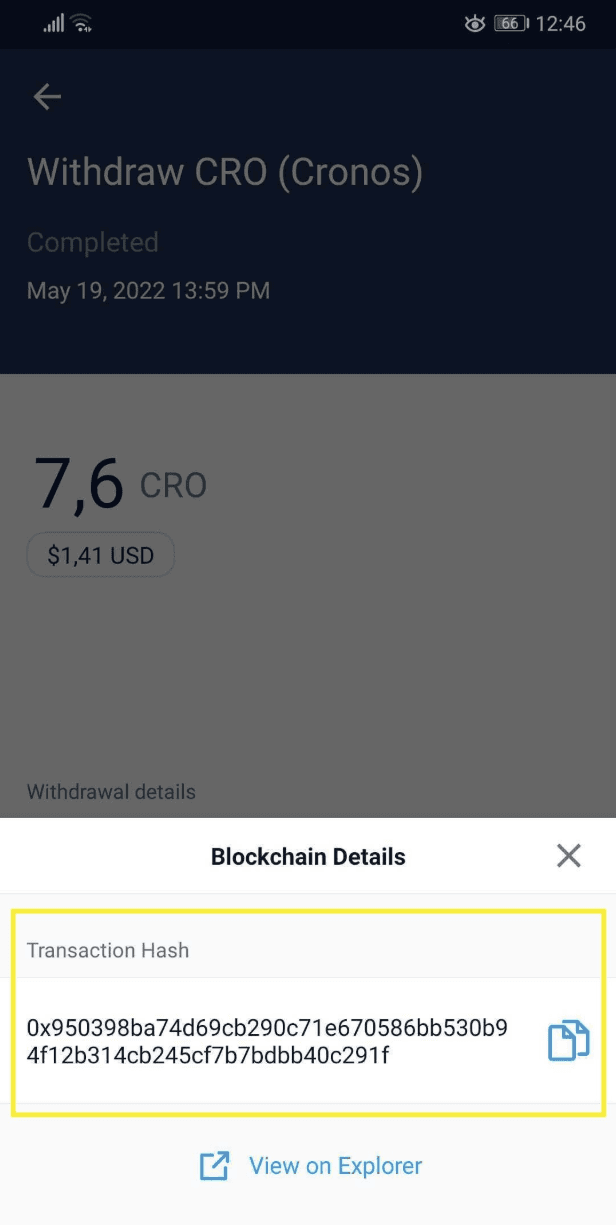

TxID/Hash Lookup on the Block Explorer

After your crypto withdrawal is processed (normally within 2-3 hours), you will receive a confirmation email. To find the transaction ID (TxHash/TxID), go to the Transaction History in your Crypto.com app, locate the transaction, and tap on the 'Withdraw to' address hyperlink. You can then copy the TxHash or view the transaction in a Blockchain Explorer.

Confirmation Counts

Crypto transactions on various blockchains require a certain number of confirmations to be considered final. For instance, some sources mention 3 confirmations for Bitcoin and 50 for Ethereum before funds are credited. You would need to check the specific blockchain explorer using your TxID to see confirmation progress.

Finality by Chain

Crypto.com handles transactions across different blockchains, each with its own finality mechanism (e.g., probabilistic finality for chains like Bitcoin and Ethereum, where confirmations are required for increased security).

Pro Tips for Efficient Tracking

- Enable push notifications and link verified email addresses in the app.

- Regularly check the relevant blockchain explorer when withdrawing crypto.

- Contact Crypto.com support immediately if the withdrawal status remains Pending beyond normal timeframes.

Notifications & Receipts

Crypto.com automatically sends real-time notifications for all withdrawal-related activities. This includes:

- Alerts when a withdrawal request is initiated, processed, or completed.

- Email notifications if a new withdrawal address is added or if any security settings related to withdrawals change.

- Warnings and response instructions if unauthorized withdrawal or whitelisting activity is detected, providing a crucial window for users to react.

Users can easily generate and export detailed receipts for accounting of all completed withdrawals. These can be found within the Transaction History section of the Crypto.com app.

Tap the history icon at the top right, select the relevant withdrawal, then use the export or download option (often as CSV or PDF) for accounting or tax reporting. For higher volume users, bulk download of transaction history across specified dates is available, streamlining bookkeeping and compliance.

For legal and audit purposes, users should archive digital receipts shortly after each transaction and cross-check notification logs with the exported data.

Troubleshooting Common Problems

Beaware Of All Challenges And Delays Faced By Your Crypto Exchange. Image via Medium

Beaware Of All Challenges And Delays Faced By Your Crypto Exchange. Image via MediumEven with careful attention, withdrawals from Crypto.com may face delays or failures due to operational or regulatory reasons. This section helps identify typical problems and guides resolutions.

Delays & Holds

- Bank Holidays & Processing Times: Withdrawals relying on banking rails like ACH, SEPA, or Faster Payments may be delayed due to local public holidays or weekends when banks are closed. This can extend withdrawal processing beyond usual timeframes.

- Compliance & Verification Reviews: Occasionally, Crypto.com may flag transactions for additional KYC or regulatory checks, especially for large or suspicious amounts. This can cause temporary holds until verification is complete.

- Device & Address Trust Resets: Introducing new withdrawal addresses or using new/untrusted devices triggers cooling-off periods or extra verification steps, typically 24 to 48 hours in duration, to protect accounts from unauthorized withdrawals.

- First Deposit & Withdrawal Correlation: Withdrawals to a bank account require prior deposits from that same account to prevent fraud and money laundering risks. Attempts to withdraw to unlinked accounts can cause holds or rejections.

- Name Mismatches: Account holder names on Crypto.com must exactly match beneficiary bank account names. Even minor discrepancies or formatting differences can lead to funds being rejected or returned.

Failed or Rejected Withdrawals

- Unsupported Bank or Account Type: Withdrawal attempts to investment accounts, virtual cards, or unsupported bank types usually fail. Crypto.com supports standard checking/savings accounts matching specific domestic payment rails.

- Incorrect Wallet Addresses or Missing Memo/Tag: For crypto withdrawals, a missing or incorrect destination memo, tag, or payment ID (especially for XRP, XLM, or EOS) causes permanent loss of funds or returns.

- Exceeded Limits or Minimum Amounts: Withdrawals below minimum thresholds or exceeding user-specific limits will be rejected. Users should verify their withdrawal limits and split large amounts if necessary.

What To Do Next?

- Check the Crypto.com app for detailed error messages or transaction status updates.

- Confirm all bank/wallet details are correct and comply with Crypto.com’s supported formats.

- Ensure your account is fully verified with updated KYC information.

- Contact Crypto.com Support directly via in-app chat or help center if the issue persists.

- Provide transaction references, screenshots, and detailed information when requesting support for faster resolution.

Crypto.com vs Competitors: When to Consider Alternatives

This section is designed for users comparing Crypto.com with other leading cryptocurrency exchanges, especially those who may need different withdrawal rails or have specific priorities for speed, fee structure, or fiat/crypto access.

Crypto.com vs Binance

Crypto.com vs Binance Comparision. Image via Binance

Crypto.com vs Binance Comparision. Image via BinanceBinance supports 350+ cryptocurrencies, a larger coin and network breadth than Crypto.com, which also supports 300+. Binance adds more alt networks and competitive stablecoin and on-chain options for international users.

The exchange offers more method flexibility (including credit/debit card and P2P), typically processes crypto withdrawals faster (30–60 min vs Crypto.com’s 2–3 hours), and has lower maker/taker fees (down to 0.10% or as low as 0.075% with BNB discounts). Crypto.com offers more regional fiat on/off-ramps and sometimes cheaper fiat withdrawals in USD or EUR, but it's not as fast with certain assets. Binance runs frequent zero-fee promos for top assets.

Best for

Cost-effective on-chain moves, frequent altcoin users, traders who prioritize speed, and those wanting P2P or card withdrawal options. Take a look at what our experts say about Binance in the latest review

Crypto.com vs Kraken

Crypto.com vs Kraken Comparision. Image via Kraken

Crypto.com vs Kraken Comparision. Image via KrakenKraken offers an intuitive desktop-first user experience and support for USD, EUR, GBP fiat rails, Fedwire, SWIFT, ACH, and SEPA. Crypto.com is app-first with more mobile features, but sometimes limited on desktop for fiat withdrawals.

The trading fees (0.24–0.16% for higher volumes) are slightly lower than Crypto.com’s tiered model for low and high volumes. Kraken's fiat off-ramp methods are transparent with clear per-rail breakdowns and are preferred for larger volume or international fiat transfers.

Best for

Power users, professional traders, those needing web-based access, large international fiat off-ramps, or transparency in fees/support.

Crypto.com vs Bybit

Crypto.com vs Bybit Comparision. Image via Ledger Insights

Crypto.com vs Bybit Comparision. Image via Ledger InsightsBybit offers competitive asset coverage, derivatives trading, and usually fast on-chain withdrawals. However, Bybit’s fiat withdrawal options are limited compared to Crypto.com, and users often encounter tiered withdrawal limits based on KYC level (non-verified: 20K USDT/day; fully verified: up to 30M USDT/day).

The exchange frequently runs withdrawal promotions and gives high asset-specific withdrawal limits for derivatives users over Crypto.com.

Best for

Active derivatives traders needing periodic, large crypto withdrawals, and those who don’t care about fiat diversity.

Here is an honest review of Bybit, evaluating its fees and other pros and cons for you.

Mini Table: Platform Withdrawal Comparison

| Platform | Fiat Rails | Crypto Networks | Speed | Notable Limits | Who Should Switch |

|---|---|---|---|---|---|

| Crypto.com | ACH, SEPA, FPS, SWIFT | 300+ (BTC, ETH, others) | 1–3 days (fiat), ~2 hours (crypto) | Daily/monthly by KYC, regional rules | Generalist users, heavy fiat withdrawals |

| Binance | Card, SEPA, SWIFT | 350+ (BTC, ETH, BNB, more) | ~30 min (crypto), varies (fiat) | Per coin, region, card limits | On-chain traders, speed/fee focused |

| Kraken | Fedwire, SEPA, SWIFT | 200+ (BTC, ETH, LTC, XMR) | 1–2 days (fiat), ~1 hour (crypto) | High-end Pro tiers, region limits | Web users, large fiat off-ramps |

| Bybit | Limited fiat (mostly crypto) | 200+ (BTC, ETH, USDT, many more) | ~15 min – several hours (crypto) | Tiered KYC, high USDT limits | Derivatives users, large periodic moves |

Pros & Cons of Withdrawing Through Crypto.com

Now let's zoom out for a minute. Here’s what Crypto.com gets right and where it drags.

Pros

- Multiple fiat withdrawal rails (ACH, SEPA, SWIFT, local transfers).

- Supports over 350 cryptocurrencies, including major and altcoins.

- Strong security with 2FA, biometric/passkey login, and withdrawal address whitelisting.

- Official insurance coverage protecting assets stored in custody.

- Easy-to-use mobile app with real-time transaction tracking and notifications.

- Competitive withdrawal fees for fiat in key regions.

- Quick crypto withdrawal processing (usually under 2 hours).

- Global reach with extensive coverage in multiple countries.

Cons

- Fiat withdrawals are only possible via the mobile app; desktop users are excluded.

- Some countries and regions (e.g., New York) face withdrawal restrictions.

- Crypto network fees can be high and variable, especially for Ethereum-based tokens.

- Withdrawal holds triggered by new devices, withdrawal addresses, or KYC updates cause delays.

- Limits on daily and monthly withdrawal amounts depending on KYC levels.

- Customer support response times fluctuate during peak periods, occasionally causing frustration.

- Some banking partners may impose additional fees beyond Crypto.com’s control