For many centuries humankind has participated in investing of some sort. The most common type of investing nowadays is either directly or indirectly buying shares of a company. This has been happening since the early 17th century, when the first stock exchange was founded in Amsterdam. The problems that many faced during that time were the lack of capital and the lack of knowledge. How should you invest if you only have limited investment capital?

Diversification is tough since trading fees can eat most of your capital, and the amount you put in one asset seems close to nothing. On the other hand, you can't buy only one company either since you don't know which one to pick.

This problem still exists for many. Especially in crypto markets, buying a real cryptocurrency might feel hard and intimidating, not to mention that many people don’t even know what a cryptocurrency is. Luckily for us, however, we now have tools to solve these problems.

Exchange Traded Funds (ETFs) and other fund types open the opportunity for us to put a small amount of money into a bigger pool of money. This pool of money can, in turn, be diversified into a large number of assets according to the fund description. This type of investing is considered lower risk since we rely on professionals to know where to invest our money. Both ETFs and funds are thought of as investments which you buy and hold, not as speculative assets for traders.

If you are new to crypto investing or feel like you have more to learn, feel free to check out our guide on cryptocurrency investing.

ETFs and Funds for Cryptocurrencies

Many of you have likely laid eyes on at least a few news articles about discussions and filings for US-based crypto ETFs. The demand for crypto ETFs has surged because institutions want exposure to the crypto market without directly buying cryptocurrencies.

This has caused numerous companies to file for permission from the SEC to issue crypto ETFs. However, the SEC has not yet granted any permissions for ETFs, which has caused many people to get frustrated since there are already other countries offering these, for example, the US neighbour Canada.

There's lots of money waiting for an ETF approval from the SEC.

There's lots of money waiting for an ETF approval from the SEC. Funds are starting to pop up here and there, the most well-known one being the Grayscale Bitcoin Trust (GBTC). Another well-known and high-profile one is the Bitcoin Fund issued by New York Digital Investment Group (NYDIG). In addition to the demand for an ETF, the demand for other crypto funds has been exploding. One reason for this is that there aren’t any crypto ETFs in the US.

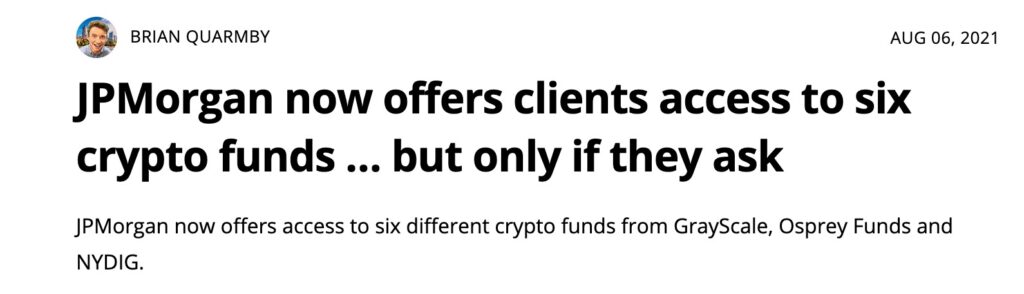

One significant piece of news recently for the whole crypto market was JP Morgan announcing they would make six different crypto funds available for their internal clients. This is extremely good news when even banks that could potentially take a massive blow from cryptos have to accept that their clients want to invest in cryptocurrencies, or otherwise they will leave.

Excellent example of the increasing demand for crypto exposure. Image via CoinTelegraph.

Excellent example of the increasing demand for crypto exposure. Image via CoinTelegraph. On top of crypto ETFs and other funds, there is still one similar investment, blockchain ETFs. Blockchain ETFs invest in companies that are active in both cryptocurrencies and blockchain. These include the likes of Riot Blockchain, Square, and Coinbase.

The problem with these is that you have to be quite careful choosing what you buy. Many of these ETFs have been criticized for not really relating to the topic they advertise. Goldman Sachs, for example, has plans to issue a DeFi ETF, which will hold companies including Nokia, Alphabet, and Sony, maybe not the companies you immediately think of when talking about DeFi unless the PS5 is something other than a gaming console.

Why do we need crypto ETFs and Funds?

As pointed out in the introduction, many don’t know where to put their investment capital. Because they don't know how to build a portfolio they tend to either copy what someone else does or let them do it for them, either in the form of ETFs or some other kinds of funds. All this applies to cryptocurrencies as well.

Since we are still extremely early in their development, there is much less knowledge about investing in cryptos versus stocks. Cryptocurrencies are also vastly different kinds of assets than stocks, and the whole process of buying some and storing them in a wallet of some sort can be intimidating.

There are also over 11,000 different coins and tokens listed on CoinMarketCap, which is a lot considering that most newbies usually know about Bitcoin, Ethereum, and Dogecoin. Therefore if you are someone who has been an investor in cryptocurrencies for a longer time, then you might not feel the need to invest in a crypto ETF, but for people entering the crypto markets for the first time, it might feel a lot safer to start it off with buying an ETF.

The same also applies to institutions and wealthier people. When we’re talking about people who manage or have at least 100 million, they might not want to go through the trouble of researching something they don’t truly understand. Still, they might be very tempted to allocate 1-5% of their portfolio to something that can go up hundreds of per cent in a year.

Wealthy people can easily allocate 1-5% of their portfolio for a potential 5-10x return.

Wealthy people can easily allocate 1-5% of their portfolio for a potential 5-10x return. Furthermore, it’s much easier to report taxes on ETFs versus cryptos. ETFs are treated like stocks, which makes taxation simple. In cryptos, depending on where you live and which exchanges you use, it might be quite a lot of effort to report taxation on cryptocurrencies.

Many countries have not yet had the time to investigate cryptos fully, and the regulations might be a bit confusing. Therefore, for institutions to avoid the risk of using a scammy exchange or storing their cryptos without reporting it the correct way, might feel like too big of a risk.

Digital Assets Managers

Now for most people, these digital assets managers are completely useless since they do not accept small amounts of money, and many retail investors (like our readers) probably invest in cryptocurrencies directly.

Still, even though you're not using these companies yourself, it’s good to know what companies the news refers to and understand how big of an impact these asset managers can have since they manage huge sums of money. Furthermore, although you won’t use the company, you might still buy their products from the secondary markets.

Grayscale

Grayscale is a large asset manager with over $40 billion under management. They promote themselves as leaders in digital currency investing. At the moment, they offer both trusts that are tied to one currency alone, along with two larger funds. If you want to become their private client, you need to have an annual income of at least $200,000 and a net worth of $1 million. Keep in mind, however, these figures do include both you and your spouse's income and net worth.

For most of us, that is quite the barrier to entry, but no worries. Many Grayscale products are offered over the counter on stock exchanges, which means you can trade them as you do with any stocks. Most of you who are reading this article probably already own cryptos. Therefore investing in a stock that acts just as crypto might not be that tempting or necessary. However, Grayscale offers a few products that might be interesting for you too; their diversified funds.

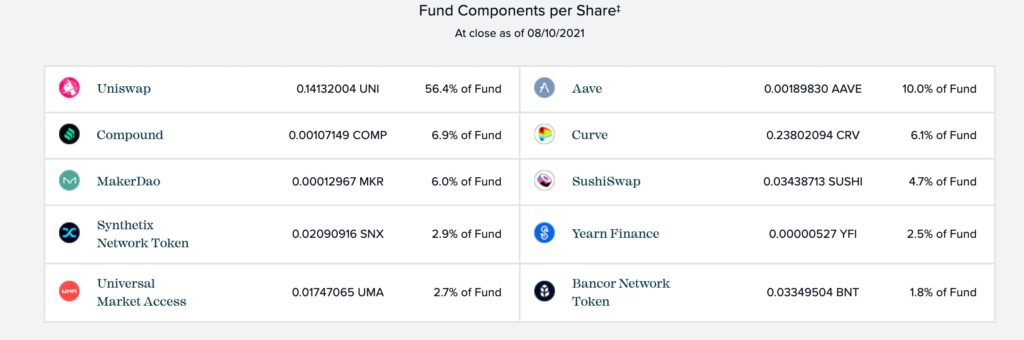

This is DeFi, take notes Goldman Sachs. Image via Grayscale.

This is DeFi, take notes Goldman Sachs. Image via Grayscale. Both of these funds have a minimum investment of $50,000 and an annual fee of 2.5%. However, those who purchase the fund have a one-year holding period before they can trade their holdings on the secondary markets. Sadly for most of us, only one of these funds is available since their DeFi fund was launched in July 2021.

This means we need to wait for one year until the first shares hit the market. The fund we can invest in now is their large-cap fund which has major positions in both Bitcoin and Ethereum, along with smaller positions in Cardano, Chainlink, Bitcoin Cash, and Litecoin.

CoinShares

CoinShares is the equivalent to Grayscale; the difference is that CoinShares operates in Europe, and the amount they manage is substantially less than what Grayscale manages. CoinShares offers various services and products for their clients, from their physically-backed ETPs (Exchange-traded products) to simple investment advisory.

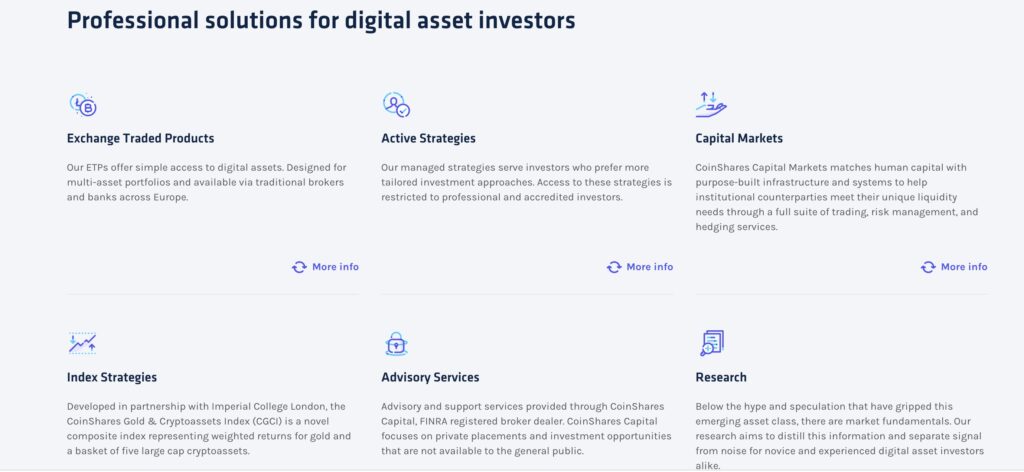

CoinShares is a leading pioneer in digital assets investing, this is what they have to offer for their clients. Image via CoinShares.

CoinShares is a leading pioneer in digital assets investing, this is what they have to offer for their clients. Image via CoinShares. The two interesting things CoinShares offer are their ETPs and their crypto indexing products. Their ETPs work exactly like the one's offered by Grayscale. In other words, the ETPs track the price of one particular crypto. Their index futures, on the other hand, track a broader set of things. Currently, they offer three different indexing strategies.

The first is the Elwood blockchain Global equity index which tracks the cryptocurrency and blockchain-related equities. The second is another one mirroring Bitcoins price through updates every hour. The third one is more interesting since it’s a mix of the three biggest cryptocurrencies by market cap plus gold. The hypothesis is that it works as a great hedge for inflation while offering lower risk than just holding Bitcoin since it also includes gold.

3iQ

Next up is Canada. Yes, 3iQ is the Canadian equivalent of the previous two, although it’s again a bit smaller. They offer their own Bitcoin and Ethereum funds along with two others issued by CoinShares. Additionally, they offer another one with a mix of Ethereum, Bitcoin, and Litecoin. All in all, nothing special here; it’s just good to be familiar with the name, especially if you’re Canadian.

Blockchain ETFs

As previously mentioned in this article, Blockchain ETFs can be an excellent alternative to cryptocurrency ETFs and other funds. If you find a good ETF with a great mix of companies that are highly active in the crypto space, along with quality companies that have good potential, you can decrease your portfolio's overall risk while improving your return. If you want to learn more about which companies could be well-positioned and make significant moves in the crypto space, then have a look at this Coin Bureau article about crypto-related equities.

High Crypto Exposure

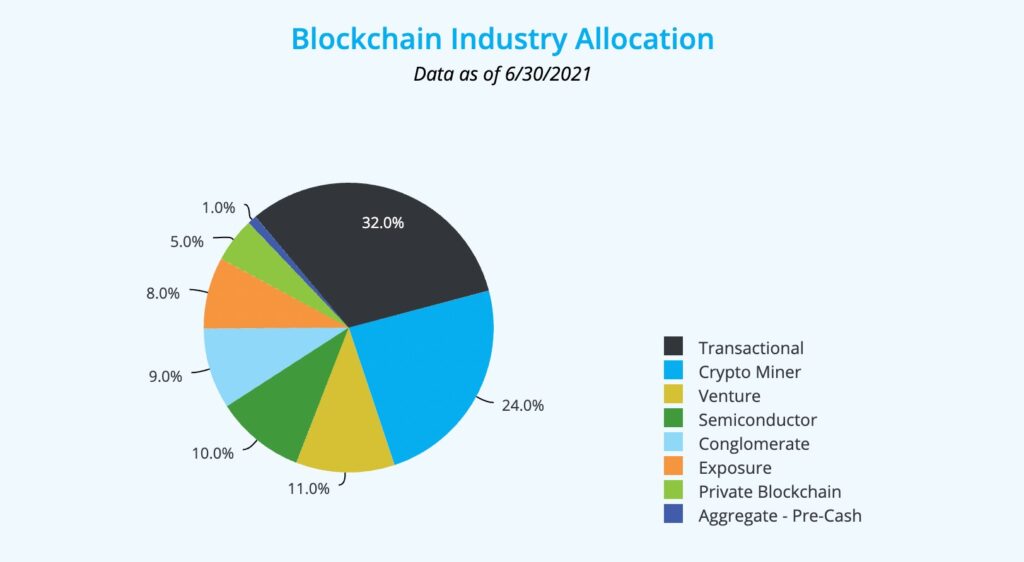

Amplify Transformational Data Sharing ETF (BLOK). This ETF is great for all who want exposure to the crypto markets. It features all the major crypto-related companies; just have a look at the picture down below. It also has a good selection of blockchain industries. Its largest component is for transactions that consist of mostly Paypal and Square.

The year-to-date return from this ETF is almost 30%. It might not be as much as Bitcoin itself (almost 60%) but keep in mind that when Bitcoin tumbled 50% from $60,000 to $30,000, BLOK only lost under 30% of its value. This shows that this is a great investment for those who can’t handle, or aren’t looking for, the heavy volatility of cryptocurrencies but still want exposure to one of the most promising new technologies.

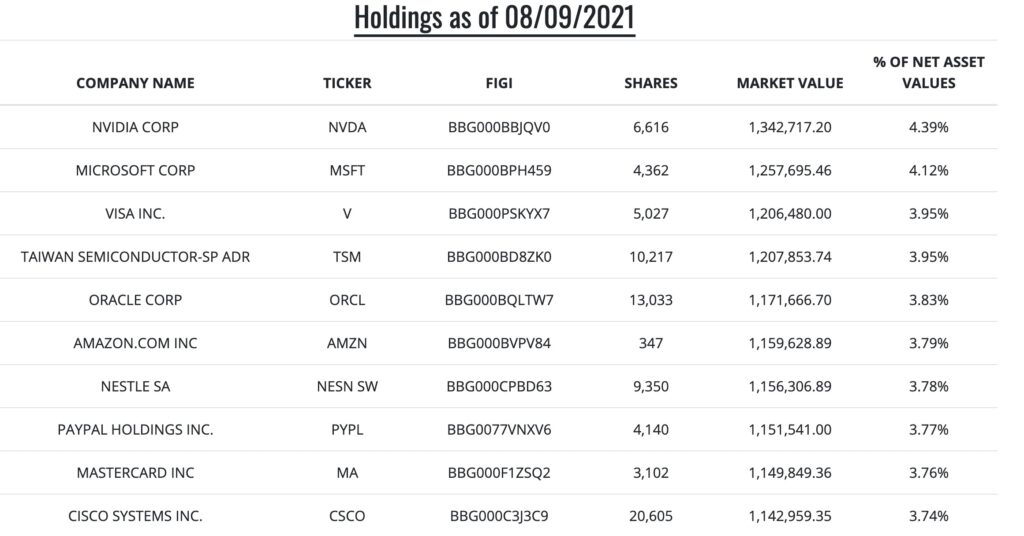

BLOK offers a great mix of companies along with good diversification. Images via Amplifyetfs.

BLOK offers a great mix of companies along with good diversification. Images via Amplifyetfs. Other similar ETFs would be the Siren NextGen Economy and VanEck Digital Assets ETF. They hold mostly the same companies but with slightly different allocations. It’s hard to say which one is the best in the long term, so make sure to do your own research before buying. The fees can also vary, so keep that in mind.

Quite similar to these two would be the Bitwise Crypto Industry Innovators ETF. This I would still consider a higher risk ETF and suitable for those more hardcore crypto lovers. This ETF holds only true cryptocurrency companies, with the biggest allocation being MicroStrategy (13%). This gives the ETF a large exposure to Bitcoin, which means it'll move somewhat together with Bitcoin.

Low Crypto Exposure

I’m only going to briefly mention these since I couldn’t find many that make much sense to invest in if you’re looking for exposure to the crypto markets. Many I found were on the same level as the Goldman Sachs DeFi ETF mentioned earlier.

However, one ETF that could be thought of as a Blockchain ETF and offers a good potential is KOIN by Capital Link. This includes companies like Nvidia, Microsoft, and Visa. Most of these companies are already well-established with both good history and growth. This naturally lowers the downside risk, but on the other hand, many of these companies are massive, which makes the impact of their crypto-related incomes relatively small.

Many great companies, however, not maybe the leaders in blockchain, nor cryptocurrencies. Image via Capital Link.

Many great companies, however, not maybe the leaders in blockchain, nor cryptocurrencies. Image via Capital Link. However, for someone who likes both equities and cryptocurrencies, this could be a nice bridge between the two worlds. Even if cryptocurrencies don’t become successful, this ETF might still offer decent returns.

Conclusion

As mentioned by many, including myself, the barrier of entry to cryptocurrencies sometimes feels intimidating and scary. Therefore it’s great to see these “newbie” products, which will hopefully pour lots of money into the cryptocurrency markets. Also made evident in this article is that there are many different products to invest in, and likely lots more coming.

It will also be interesting to see more of these mixes of cryptocurrency sector funds and ETFs like the one Grayscale offers for DeFi. The more narrow and in-depth funds will also be great since it highlights how big an ecosystem the whole cryptocurrency space is, and hopefully, it will boost investment in smaller altcoins.

Additionally, for those who are wondering why we haven’t yet seen an ETF in the US and when it might be available, you should know this. The cryptocurrency regulatory frameworks are being formed all over the world as we speak. This is why the US most likely first wants to develop proper rules and regulations for cryptocurrencies before allowing large amounts of money to pour into something they can’t control. Hopefully, we will see an ETF before the end of 2021. It now looks as if an Ethereum ETF might be coming before we see one for Bitcoin.

It’s not just a coincidence that numerous companies want a crypto ETF approved by the SEC at the same time. All these crypto-related products make it impossible for even the most anti-crypto people to turn a blind eye. Cryptos are here to stay, and they are going to revolutionise many sectors.