This guide explains what Ethereum nodes do, which types exist, and what actually earns rewards in 2025.

You’ll learn how the post-Merge split into Execution and Consensus clients works, why only validator nodes get paid, and how recent upgrades changed staking economics. We break down solo vs pooled vs exchange staking, real costs, breakeven math, and MEV-Boost.

Quick Answer

TL;DR: Only validator nodes earn rewards. You need 32 ETH per validator. Base yield is driven by network conditions and increases with MEV-Boost. Home hardware has upfront CapEx; cloud has ongoing OpEx. See today’s snapshot and breakeven below.

- Validator nodes (EL+CL+validator client) earn protocol rewards, tips, and MEV.

- Full / light / archive nodes without a validator do not earn protocol rewards.

- Liquid staking (stETH, rETH, etc.) — lower admin, fee + smart-contract risk.

- Exchange staking — easiest UX, highest fees, custodial.

Who Is This For?

Solo builders / power users

Have 32 ETH, Linux + networking chops, and want full control, client diversity, and maximum net rewards.

Yield seekers with < 32 ETH

Prefer liquid staking or restaking for lower admin and composability, accepting protocol fees and smart-contract risk.

Small teams / institutions

Run multiple validators on reliable VPS or bare metal, optimize MEV-Boost and monitoring, standardize updates and on-call.

Ethereum Nodes 101 (What Pays vs What Doesn’t)

Ethereum nodes form the physical backbone of the network, acting as connected computers running the necessary software to validate transactions and secure the blockchain. By running your own node, you ensure a private, self-sufficient, and trustless interaction with the network, as you can verify data independently without relying on third-party services. The choice of node type depends entirely on a user's use case and available hardware resources.

Node Types at a Glance

Ethereum nodes are computers running client software that allows them to interact with the Ethereum network. There are several types of nodes, each serving a different purpose and requiring different resources:

- Full Nodes: These nodes download and store a complete copy of the blockchain data, specifically the most recent blocks (approximately the last 128 blocks). They verify all transactions and blocks independently and serve data to light nodes. Running a full node helps support the network's decentralization and security. They require significant storage space (e.g., 1TB+ SSD) and decent bandwidth.

- Light Nodes: These are designed for devices with limited resources, such as smartphones or low-power computers. They download only the block headers, which are small summaries of the blocks, and request specific details from full nodes when needed. Light nodes can verify transactions with less data, making them efficient but reliant on full nodes.

- Archive Nodes: An archive node stores all historical states and data from the genesis block onward, a massive amount of data (often 12TB or more). While a full node can theoretically recalculate older states, it is inefficient; archive nodes are necessary for services like block explorers or applications that require access to the entire blockchain history.

- Validator Nodes: In the current Proof-of-Stake (PoS) system, a validator node combines a full node (both execution and consensus clients) with a validator client. Validators stake a minimum of 32 ETH as collateral to participate in the consensus mechanism.

Only validators earn protocol rewards in the form of ETH for their participation in block creation and transaction validation (proposing and attesting).

Full, light, and archive nodes that are not set up as validators do not earn these protocol-level staking rewards, though some third-party services may pay node operators for infrastructure.

Post-Merge Architecture (Execution vs Consensus)

Blockchain networks function with the interaction of four essential layers: Data Availability, Consensus, Settlement, and Execution. And each of these layers plays a crucial role in ensuring that a blockchain operates efficiently, securely, and in a decentralized manner. Over the years, innovations/ EIPs (Ethereum Improvement Proposals ) Ethereum ecosystem have primarily focused on enhancing these layers. And the Merge was a compilation of such proposals.

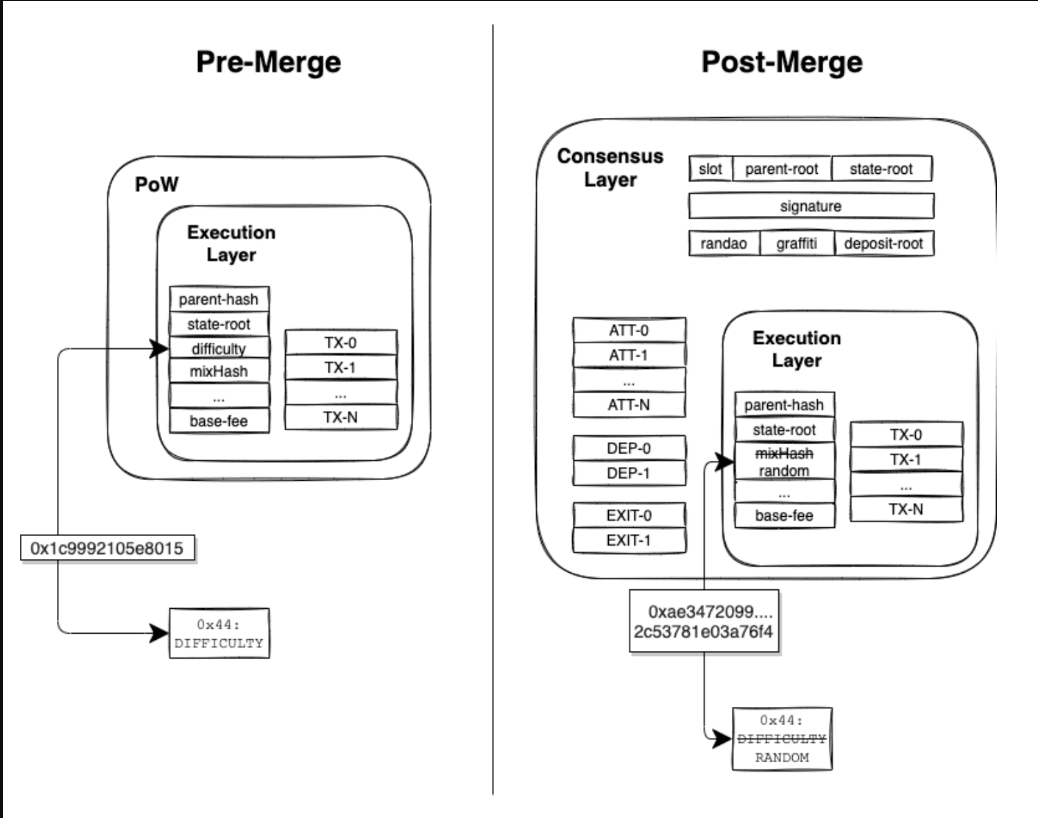

Ethereum's post-Merge architecture comprises two distinct yet interconnected layers that operate in tandem as a single system. This modular design separates the concerns of transaction processing from network security and agreement.

Explains How Ethereum Split Into Execution And Consensus Layer.Image via Consensys

Explains How Ethereum Split Into Execution And Consensus Layer.Image via ConsensysExecution Layer (EL)

The Execution Layer is where all transactional activity and smart contract operations occur. It is essentially the original Ethereum blockchain technology.

- Its primary function is to process user transactions and manage the global state of accounts and contracts. It listens for new transactions from the network's memory pool and executes the EVM (Ethereum Virtual Machine) logic.

- Clients running this layer include Geth, Nethermind, Besu, Erigon and Reth.

- This layer is the "working" part of the network, focused solely on executing the instructions given by users and DApps.

Consensus Layer (CL)

The Consensusblocks Layer is responsible for maintaining network security, validating , and ensuring the finality of the blockchain using the Proof-of-Stake mechanism. It is the new "Beacon Chain" component.

- Its primary function is to organize the network of validators.

- It manages validator deposits, withdrawals, and penalties.

- It decides which validator gets to propose the next block and processes all the votes (attestations) from other validators.

- Clients running this layer include Lighthouse, Prysm, Teku, Nimbus, and Lodestar. This layer acts as the "organizer," ensuring all participants agree on the single, correct version of the blockchain history.

The Connection

The two layers communicate seamlessly through a local connection called the Engine API, using a shared security token for authentication.

- The Consensus Layer directs the Execution Layer on when to build a block and what transactions to include.

- And the Execution Layer provides the validated transaction data (payload) to the Consensus Layer.

- This separation allows for independent upgrades to either the execution logic or the consensus rules without disrupting the entire system, making the network more robust and scalable.

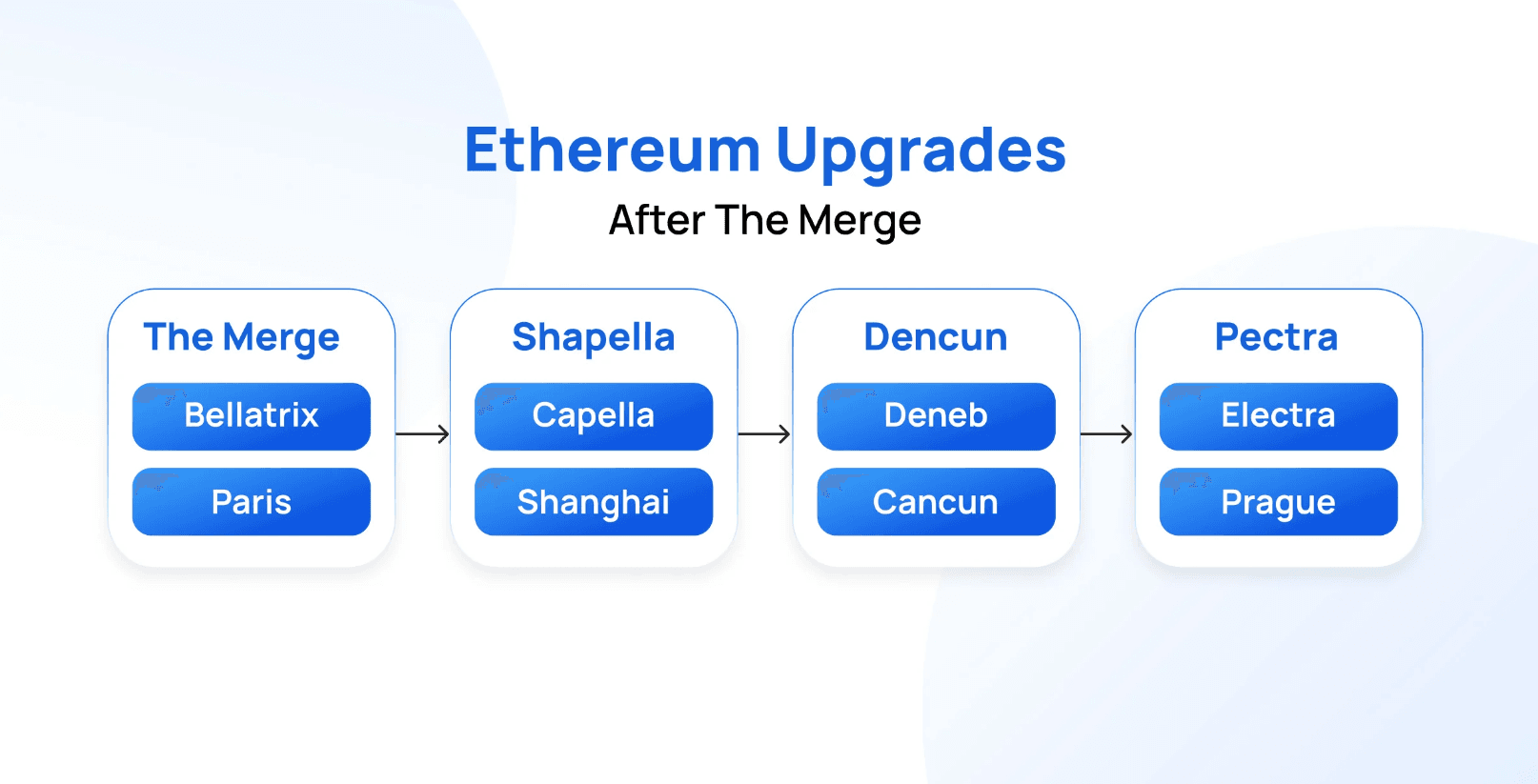

The 2023–2025 Upgrade Context (What Changed Your Economics)

Details How Ethereum’s Upgrades Reshaped Validator Rewards And Gas Economics. Image via Transak

Details How Ethereum’s Upgrades Reshaped Validator Rewards And Gas Economics. Image via TransakThese upgrades were critical milestones in Ethereum’s transition to a full Proof-of-Stake (PoS) system, building upon "The Merge" in 2022 that initially moved the network away from Proof-of-Work. The primary goals were to enhance scalability, improve efficiency, and increase security, addressing key challenges faced by the network and making it more competitive against other Layer 1 blockchains. The changes fundamentally altered staking dynamics and transaction processing, which had significant economic effects across the ecosystem.

Shanghai/Capella (March 2023)

The Shanghai (execution layer) and Capella (consensus layer) hard forks, collectively known as "Shapella," marked a crucial milestone by enabling the withdrawal of staked ETH and accumulated rewards for the first time since staking began in late 2020.

- Staked ETH Withdrawals (EIP-4895): Allowed validators to access their locked 32 ETH principal and accrued rewards, a major step in fulfilling the PoS roadmap and de-risking staking for participants.

- Partial and Full Withdrawals: Enabled automatic "skimming" of rewards above 32 ETH (partial withdrawals) and full exits from the validator set.

- Node Operator Impact: Required node operators to update their withdrawal credentials (from 0x00 to 0x01 type) and run updated client software to process withdrawals. This increased confidence in the network and attracted new stakers by increasing liquidity.

Dencun (March 2024)

The Cancun (execution layer) and Deneb (consensus layer) upgrades, or "Dencun," went live on March 13, 2024. The upgrade was primarily focused on scalability, introducing "proto-danksharding" to provide a dedicated, cheaper data availability layer for L2 rollups.

- Proto-Danksharding (EIP-4844): Introduced a new transaction type that carries large, temporary data chunks called "blobs". Rollups use these blobs to post batched transaction data cheaply to Layer 1 (L1), dramatically reducing L2 gas fees for end users (by 10x or more).

- Temporary Data Storage: Blob data is stored temporarily by consensus nodes for about 18 days and then pruned, which prevents permanent data bloat on the main chain and keeps hardware requirements for node operators manageable.

- New Fee Market: Established a separate, EIP-1559-like fee market for blobs, ensuring L2 data posting does not compete with the regular L1 transaction space.

- Node Operator Impact: Required node operators to manage and store blob data temporarily and ensured all clients were updated to handle the new transaction types and fee structure.

Pectra + EIP-7251 (Mid-2025)

The Prague (execution layer) and Electra (consensus layer) upgrades, or "Pectra," were activated around May 7, 2025, bringing several enhancements to validator operations and user experience.

- Increased Max Effective Balance (EIP-7251): Raises the maximum effective balance per validator from 32 ETH to 2,048 ETH. This allows large stakers to consolidate their stake into fewer validators, simplifying operations and reducing network overhead (fewer signature aggregations needed).

- Execution Layer Triggerable Exits (EIP-7002): Enables validators to trigger their exit from the network via the execution layer, allowing for more programmable and automated staking services via smart contracts.

- Faster Validator Onboarding (EIP-6110): Moves validator deposit processing on-chain, reducing activation time for new validators from around 12 hours to about 13 minutes.

- Account Abstraction (EIP-7702): Allows standard externally owned accounts (EOAs) to temporarily function like smart contract accounts within a single transaction, enabling features like sponsored gas fees and transaction batching, a major UX improvement.

- Increased Blob Capacity (EIP-7691): Doubles the target number of blobs per block from 3 to 6, further increasing data availability for rollups and reducing L2 transaction costs even more.

- Node Operator Impact: Simplifies management for large staking entities, reduces the number of overall validators needed, and introduces new data handling and communication protocols between the execution and consensus layers, requiring all node operators to update their software.

Profitability First — 2025 Economics

Examines How Staking Rewards Vary Across Networks And Strategies. Image via Shutterstock

Examines How Staking Rewards Vary Across Networks And Strategies. Image via ShutterstockUnderstanding the profitability of running an Ethereum validator in 2025 requires a look at both the base protocol rewards and the variable income streams derived from network activity. The total yield for stakers is a dynamic figure influenced by market conditions, technical setup, and the total amount of ETH locked in the network. Optimizing for profit means navigating choices between solo staking, pooled services, and MEV extraction tools, each with its own risk and reward profile.

Current Reward Landscape

As of early 2025, the average annual percentage yield (APY) for Ethereum staking was around 3.5% to 4.2%, according to an OKX article from November 2025. The Compass Staking Yield Reference Index Ethereum, which measures the annualized daily staking yield on the Ethereum blockchain, stood at 2.9% as of Nov. 7, 2025.

The base APY fluctuates based on network activity and the total amount of ETH staked. This is supplemented by transaction tips and Maximal Extractable Value (MEV) rewards, which vary significantly.

- Yield drivers: Total ETH staked, proposer luck, EL tips, MEV variance, relays. The primary factors influencing a validator's yield include:

- Total ETH Staked: A larger pool of staked ETH generally leads to lower base protocol rewards APY, as rewards are distributed among more participants.

- Proposer Luck: The random chance of being selected to propose a block, which typically yields higher rewards than just attesting.

- EL Tips: Priority fees paid by users to have their transactions included quickly, which go directly to the block proposer.

- MEV Variance: The value extracted from optimizing block production order, which can be a significant and highly variable source of income.

- Relays: The use of MEV-Boost relays helps validators access this value generated by specialized block builders, increasing potential profits.

MEV-Boost & Relays

Maximal Extractable Value (MEV) refers to the profit a validator can make by including, excluding, or reordering transactions within a block. MEV-Boost is a piece of software that enables validators to outsource the complex and competitive process of building the most profitable block to third-party "block builders."

Relays act as a trusted intermediary between builders and validators. Builders send their optimized blocks to the relay, and the relay selects the most profitable one to forward to the validator for final signing and inclusion on the chain. Validators using MEV-Boost increase their profitability but rely on external infrastructure (the relay network), introducing a slight layer of operational complexity and trust.

There are ongoing concerns that large relays and builders might concentrate power or even censor certain transactions to comply with regulations like OFAC, posing a risk to network neutrality.

What You Actually Earn (Scenarios)

Calculating the "actual" earnings from Ethereum staking involves understanding the gross rewards and then factoring in commissions, operational costs, and potential penalties. Here are the scenarios:

Solo 32 ETH Staking

Solo staking provides direct access to all potential rewards but requires significant technical expertise and hardware investment.

| Factor | Description | Impact |

|---|---|---|

| Gross APR | Direct rewards from consensus layer (block proposals/attestations) and execution layer (tips/MEV). Current APR is typically around 3.0% - 3.5%. | Benefit: You receive 100% of the gross rewards. |

| Costs | Hardware costs (e.g., NUC or server), electricity, internet, and time spent on maintenance and troubleshooting. | Cost: Varies, but usually manageable over time. |

| Penalties | Potential for "slashing" (loss of ETH) for misbehavior or "inactivity leaks" if your node is offline. | Risk: High potential loss if mismanaged. |

| Net APR | After all factors, the net APR is likely very close to the gross APR if the node is well-maintained and online 100% of the time, potentially slightly higher due to receiving maximum MEV (Maximal Extractable Value) without a pool's commission. | Result: Highest potential net earnings for highly competent operators. |

Actual Earnings (Net APY)

The net APY can be very close to the gross APY (e.g., 2.8% - 4.8%) if the operator maintains high uptime (>99%) and has minimal operating costs (e.g., running from home). The actual ETH in hand can fluctuate due to the randomness of receiving high-value block proposals (MEV "jackpots").

Pool Staking (Lido/Rocket Pool)

Pools provide an easier barrier to entry via "liquid staking" (e.g., stETH, rETH tokens) or by running a "mini-node" with less ETH required (Rocket Pool). They abstract away much of the technical burden in exchange for a fee.

| Factor | Description | Impact |

|---|---|---|

| Gross APR | Similar to solo staking's gross rate. | Benefit: You receive a share of the pool's total rewards. |

| Commission Fees | Pools charge a percentage fee (typically 10% for Lido, 15% for Rocket Pool's node operators) on rewards. | Cost: Reduces your net earnings. |

| Operational Costs | For users simply holding the liquid staking token, there are minimal operational costs. For Rocket Pool node operators, costs are lower than solo stakers. | Benefit: No complex hardware management required for token holders. |

| Penalties | Penalties are socialized across the pool, minimizing individual impact. | Risk: Lower risk of significant individual loss. |

| Net APR | Lower than solo staking due to fees, but consistent and reliable. The current net APR for token holders is around 2.8% - 3.2%. | Result: Lower net earnings than solo staking, but much simpler and lower risk. |

Actual Earnings (Net APY)

Net APY is lower than solo staking due to fees, but more consistent.

Example:

- Lido (stETH): Approximately 2.5%, 4.5% after the 10% fee.

- Rocket Pool (rETH for stakers): Approximately 2.4% -4.3% after the 14% commission.

Exchange Staking (Coinbase, Kraken, etc.)

Exchange staking is the simplest option, requiring almost no effort. You simply hold ETH on the exchange and opt in to their staking program.

| Factor | Description | Impact |

|---|---|---|

| Gross APR | Similar gross rate to other options. | Benefit: Easy access to staking rewards. |

| Commission Fees | Exchanges typically charge the highest commissions, often 25% or more of the earned rewards. | Cost: Significantly reduces net earnings. |

| Operational Costs | Zero operational costs for the user. | Benefit: Zero effort required. |

| Penalties | Handled entirely by the exchange. Users are generally protected from slashing risk. | Risk: Minimal risk to the user's principal. |

| Net APR | The lowest net APR due to high fees, typically 2.5%–2.9%. | Result: Lowest net earnings, but maximum convenience and ease of use. |

Actual Earnings (Net APY)

The lowest net APY due to high fees, but offers the highest convenience and the lowest technical barrier.

Example: Approximately 2.2% to 3.8% after exchange fees (e.g., Coinbase can be around 4.5% gross, with their fees applied).

Explore our in-depth guide to learn how and where to stake Ethereum.

Costs, Breakeven & Sensitivity

Costs, Breakeven & Sensitivity of Staking ETH. Image via Shutterstock

Costs, Breakeven & Sensitivity of Staking ETH. Image via ShutterstockRunning an Ethereum validator requires careful consideration of both initial capital expenditure (CapEx) and ongoing operational expenses (OpEx). The total cost and potential profitability are heavily dependent on whether an operator chooses a home setup (bare metal) or a Virtual Private Server (VPS) / cloud-based solution. The key is finding the right balance of reliability, cost, and control that fits a staker's risk appetite.

Home vs Cloud Cost Stack

The choice between home hosting and cloud services involves different capital expenditures (CapEx) and operational expenditures (OpEx). Let’s break down where the money goes in each model.

| Feature | Home Hosting (On-Premise) | Cloud Hosting (VPS) |

|---|---|---|

| Setup Cost (CapEx) | Higher ($800 – $2,000+ for hardware) | Zero (you rent resources) |

| Ongoing Costs (OpEx) | Lower ($10 – $20/month electricity/internet) | Higher ($50 – $150+/month for reliable service) |

| Hardware Management | Full responsibility for maintenance and replacement. | Handled by the provider; instant replacements. |

| Uptime Reliability | Dependent on home internet/power stability. | High uptime guarantees (often 99.9%+ SLA). |

| Control | Full control over hardware and data sovereignty. | Reliance on a third-party provider. |

| Decentralization | Better for network decentralization. | Contributes to cloud provider centralization ris |

Breakeven Math at Today's Rates

Calculating the breakeven point and payback horizon involves considering current APY ranges and market conditions:

Assumptions (as of November 2025):

- ETH Price: $3,500

- Net APY (Solo Staker): 4% (a reasonable estimate for a well-run node)

- Total Staked: 32 ETH

- Monthly USD Earnings (Gross): -$373

Breakeven Scenarios

| Scenario | Monthly Operating Cost | Monthly Net Profit (Approx) | Time to Recover CapEx |

|---|---|---|---|

| Home (Hardware CapEx: $1,500) | -$20 (electricity/internet) | $353 | 4–5 months |

| Cloud (e.g., $100/mo VPS) | -$100 (subscription) | $273 | Immediate (no CapEx to recover) |

Profitability is highly sensitive to the price of ETH and the network's APR. A significant drop in either will extend the breakeven period and reduce net earnings. Cloud setups are more sensitive to ongoing profitability as costs are perpetual, whereas home setups eventually eliminate major ongoing costs after the initial hardware is paid off.

Hidden Costs & Penalties

Actual earnings must account for less obvious costs and potential financial penalties.

- Opportunity Cost of Capital: Your 32 ETH is locked and illiquid, preventing investment in other assets or trading.

- Downtime Penalties ("Inactivity Leak"): Your node loses a small amount of ETH for every epoch it is offline. While minor for short periods, prolonged outages can add up. You earn zero rewards during this time.

- Bandwidth Overages: Ethereum node traffic is significant (several hundred GB per month). Ensure your ISP or cloud provider plan accommodates this without charging extra fees.

- Administrative/Tax Burden: Staking rewards are generally considered taxable income at the time they are earned. Tracking and correctly reporting these earnings adds administrative time and potential costs.

- Hardware Failure: A failed component (especially the SSD due to high write cycles) requires immediate replacement to minimize downtime and the associated penalties.

- Slashing: A severe penalty for running a validator improperly (e.g., running the same keys on two machines).

Slashing results in:

- An immediate penalty of at least 0.25 ETH.

- Forced exit from the validator set.

- A 36-day "slashing window" where additional ETH leaks away.

The actual profitability of running an Ethereum validator node is a calculated trade-off between convenience, cost, risk tolerance, and technical expertise. Ultimately, the most profitable option "for you" depends on your capacity to manage the operational burdens and risks of solo staking versus your willingness to pay fees for convenience and minimized risk.

3 Ways to Stake ETH — Which Fits You?

Stake ETH The Way It Fits You. Image via Shutterstock

Stake ETH The Way It Fits You. Image via ShutterstockChoosing the right method to stake Ethereum involves a trade-off between control, potential rewards, technical complexity, and risk. The three primary methods cater to different user profiles, from the highly technical enthusiast to the passive investor. The best option depends entirely on an individual's available capital, expertise, and risk tolerance.

Solo Validator (32 ETH)

This method involves running your own physical or virtual validator node using a full 32 ETH stake. It represents the purest form of staking.

You are a full-fledged participant in securing the Ethereum network. You run the validator client and execution client software 24/7, manage hardware/cloud infrastructure, and are responsible for all maintenance and updates. Rewards include all consensus and execution layer earnings (MEV, tips).

Pros

- Maximum Rewards: You receive 100% of the protocol and execution rewards (tips/MEV), without any third-party fees.

- Full Control & Security: You maintain self-custody of your assets and have complete control over your validator setup.

- Network Contribution: Direct participation aids in the decentralization and security of the Ethereum network.

Cons:

- High Barrier to Entry: Requires 32 ETH, significant technical knowledge, and a reliable internet connection and power supply.

- Slashing Risk: Misconfigurations or malicious behavior can result in the loss of a portion of your staked ETH.

- Operational Burden: Requires ongoing maintenance, software updates, and monitoring to maintain high uptime.

Best Suited For:

- Individuals with strong technical expertise in hardware, Linux, and networking.

- Those who prioritize decentralization and self-sovereignty (you control your keys).Risk-takers who want 100% of the rewards and are willing to manage the risk of slashing/downtime penalties.

Solo staking is the most hands-on approach, where an individual runs their own validator node with a minimum stake of 32 ETH. This method offers the highest potential rewards and maximum control..

Liquid Staking / Liquid Restaking (2025 trend)

Liquid staking allows users to stake any amount of ETH by pooling assets and receiving a derivative "liquid staking token" (LST) in return. Similar to that, restaking in the Ethereum ecosystem allows validators to use their staked ETH, a form of collateral, to participate in additional financial activities and thereby amplify their potential rewards.

In Liquid staking, you deposit your ETH into a protocol like Lido, Rocket Pool, or EigenLayer. In return, you receive a liquid staking token (LST) or liquid restaking token (LRT) that represents your staked ETH plus earned rewards. You can use these tokens in other DeFi protocols to earn additional yield (restaking is using these tokens to secure other networks/protocols for more rewards). The pool handles the validator operations for a fee.

Pros:

- Liquidity: The LST can be traded or used in DeFi, eliminating the opportunity cost of locked funds.

- Lower Barrier to Entry: No 32 ETH minimum and no technical expertise needed.

- Compounding Yield: Potential to earn additional yield through DeFi strategies.

Cons:

- Smart Contract Risk: The funds rely on the security of the liquid staking and restaking protocols' smart contracts, which could contain bugs.

- De-peg Risk: The LST might trade slightly below the value of the underlying ETH during market stress.

- Fees: Protocols charge a commission on the rewards (e.g., Lido takes 10%).

Best Suited For:

- Individuals who want to maintain liquidity of their assets (via liquid staking tokens like stETH, rETH, or ezETH).

- Users are comfortable with smart contract risk in exchange for ease of use and potential yield optimization.

- Those seeking to maximize yield by restaking their staked ETH for additional protocol rewards.

Take a look at our in-depth comparison of solo mining and pool mining.

Centralized Exchanges

Centralized exchanges (CEXs) like Coinbase and Binance offer the simplest and most accessible staking option, often requiring very low minimum amounts of ETH. You simply opt in to the exchange's staking program using ETH held in your exchange wallet. The exchange pools user funds to run validators and handles all technical aspects and penalties.

Pros:

- Ease of Use: Extremely simple process with no technical knowledge or hardware required.

- Low Minimums: Often allows staking with very small amounts of ETH (as low as 0.01 ETH).

- Convenience: Integrated directly into your existing exchange account/wallet.

Cons:

- Custodial Risk: You do not control your keys; you trust the exchange with your funds, introducing counterparty risk (e.g., exchange collapse or hack).

- Lower Net Rewards: Exchanges typically charge high commissions (often 15%-25% or more) on earned rewards.

- Centralization: Relying heavily on large exchanges increases centralization risk for the Ethereum network.

Best Suited For: Beginners or users who prioritize simplicity and convenience over control, decentralization, and maximizing returns.

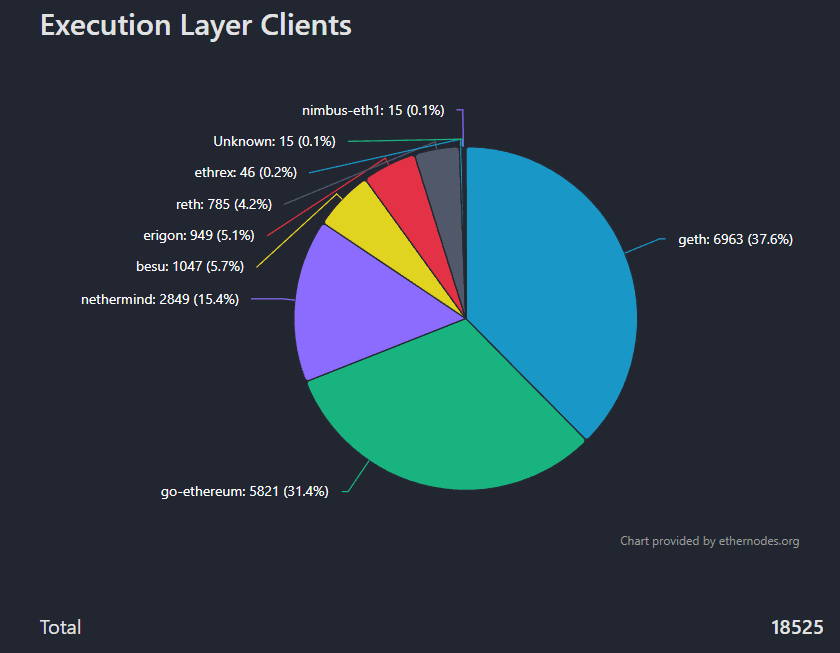

Client Diversity & Avoiding Monoculture Risk

Client diversity refers to the practice of having multiple independent software implementations (clients) that nodes can use to run the Ethereum protocol. A "monoculture risk" arises when a single client implementation is used by a supermajority (more than 66%) of the network's validators.

If that dominant client has a critical bug, it could cause the chain to fork, stall finalization, or lead to massive slashing events for all users running that client simultaneously, creating significant financial loss and network instability. Avoiding this single point of failure is crucial for the overall health, resilience, and security of the decentralized network.

Market Share Snapshot (EL & CL)

As of late 2025, while the situation has improved slightly, the Ethereum network still faces a concentration issue, particularly within the Execution Layer (EL). Ethereum relies on two layers, the Execution Layer (EL) and the Consensus Layer (CL), each run by different client software. Maintaining client diversity is crucial for network resilience; a bug in a dominant client could pose a systemic risk.

If a majority of clients experience a consensus-impacting bug, the network could split, with the non-buggy minority chain being the valid one. Validators on the faulty chain would face severe inactivity penalties and potential slashing, losing a portion of their staked ETH.

The Ethereum Foundation's goal is for no single client to have more than a 33% market share, as this threshold mitigates the risk of a single bug halting network finality.

Execution Layer (EL) share

Lists And Compares Core Software Clients Powering Ethereum Transactions.Image via Ethernodes

Lists And Compares Core Software Clients Powering Ethereum Transactions.Image via EthernodesThe Geth client continues to dominate the EL market, with its share hovering around 62%. While efforts by major staking providers have helped boost minority clients like Nethermind (22%) and Besu (10%), Geth remains a supermajority client, a significant risk factor.

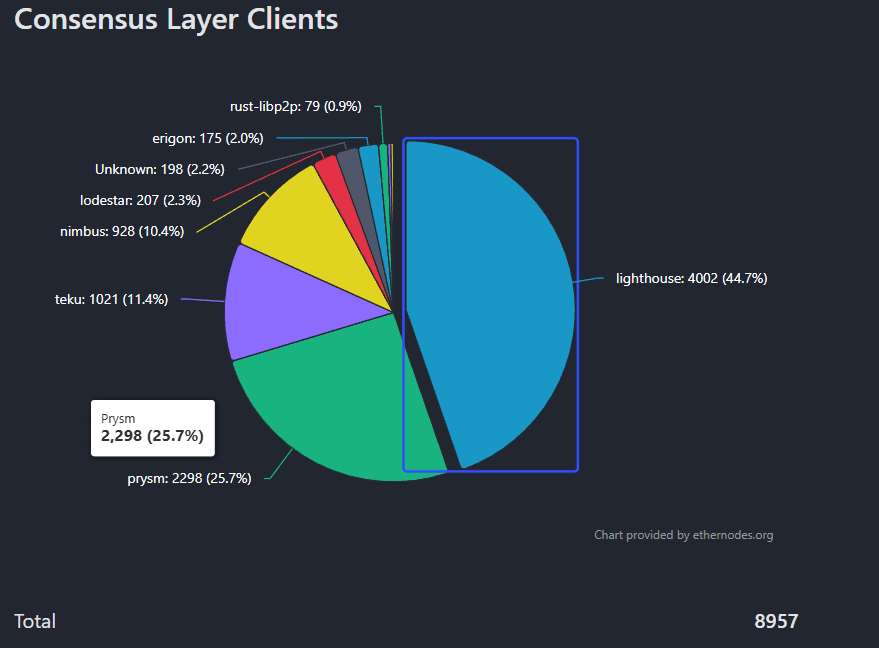

Consensus Layer (CL) share

Outlines Software Clients Managing Ethereum’s Validation And Block Finalization. Image via Ethernodes

Outlines Software Clients Managing Ethereum’s Validation And Block Finalization. Image via EthernodesClient diversity is much healthier on the consensus layer. Lighthouse is the leading client at approximately 42.7%, followed closely by Prysm at 30.9%, and then Teku and Nimbus. This diversity provides better resilience against a CL-specific bug.

Recommended Mix & Update Hygiene

To maximize the security and resilience of the Ethereum network, node operators are strongly encouraged to avoid running the most dominant clients in both the Execution Layer (EL) and Consensus Layer (CL). The goal is to ensure that a bug in any single client affects less than 33% of the network.

Recommended Client Mix (Client Diversity)

| Layer | Dominant Client(s) (Avoid if possible) | Recommended Minority Clients (Use these) |

|---|---|---|

| Execution Layer (EL) | Geth (62% market share) | Nethermind, Besu, Erigon, Reth |

| Consensus Layer (CL) | Lighthouse (42%), Prysm (31%) | Teku, Nimbus, Lodestar |

Update Hygiene for Node Operators

Disciplined software updates are critical to avoid penalties, maximize rewards, and ensure you are ready for network upgrades.

- Stay Informed: Actively monitor official client developer channels (Discord, GitHub, alerts services) for release announcements and critical security patches.

- Prioritize Critical Updates: Security vulnerabilities or consensus-critical bugs require immediate updates.

- Read Release Notes: Always review release notes for specific instructions or breaking changes before updating.

Additional Tips:

Operator error is the leading cause of slashing. Follow a rigorous process when updating or migrating nodes.

| Step | Action | Rationale / Risk Mitigation |

|---|---|---|

| 1. Stop the Node | Stop both EL and CL client services on the old setup. | Prevents running duplicate validators simultaneously (slashing). |

| 2. Verify Offline Status | Confirm your validator is missing attestations on a block explorer. | Ensures the old validator is truly inactive before starting the new one. |

| 3. Transfer Data | Export/import the slashing protection database to the new client. | Protects against accidental double-signing history when migrating keys. |

| 4. Start the New Node | Start the EL client, then the CL client, monitoring performance. | Ensures seamless synchronization and minimizes downtime penalties. |

| 5. Use Safety Features | Utilize “Doppelganger” protection (if available) during setup. | Provides an automated final check for duplicate running validators. |

Validator Setup (Step-by-Step)

Outlines Software Clients Managing Ethereum’s Validation And Block Finalization..Image via Shutterstock

Outlines Software Clients Managing Ethereum’s Validation And Block Finalization..Image via ShutterstockSetting up an Ethereum validator is a multi-phase process that typically spans a few days, largely due to initial sync times and the network's activation queue. The entire process involves preparing the right hardware, generating secure keys, syncing both execution and consensus clients, and finally implementing monitoring and MEV (Maximal Extractable Value) strategies. Following this guide helps ensure a secure and efficient setup that maximizes uptime and potential rewards.

Phase 1 — Prep (1–2 days)

This phase focuses on acquiring hardware/cloud services, securing your system, and installing prerequisites.

- Acquire a reliable computer or cloud VPS with appropriate specs (32+ GB RAM, 2TB+ SSD, fast internet).

- Install a secure Linux operating system (e.g., Ubuntu Server).

- Configure the system's security: set up a firewall (UFW), secure SSH access with keys, and disable root login.

- Install any required system dependencies and basic monitoring tools.

Phase 2 — Keys & Clients

This phase involves securely generating your validator keys and installing the chosen client software.

- Select your Execution Layer (EL) and Consensus Layer (CL) clients, prioritizing a minority mix for better network resilience.

- Install both the EL and CL client software on your node machine.

- Generate your validator keys using the official staking-deposit-cli tool (ideally on an offline machine).

- Crucially: Securely store your 24-word mnemonic phrase offline in a safe place.

- Safely transfer your deposit_data.json file and validator keystore files to your node machine.

- Configure a shared JWT secret file for secure communication between the EL and CL clients.

Phase 3 — Sync & Activation

Once the clients are installed and configured to run concurrently, they need to synchronize with the network before your validator can go online.

This phase involves syncing the blockchain history and officially activating the validator.

- Start both your EL and CL clients simultaneously.

- The clients will begin downloading the entire blockchain history.

- Ensure both the Execution Layer and Consensus Layer clients are fully synchronized.

- Verify clients are communicating correctly using the JWT secret file you created.

- Navigate to the official Ethereum Launchpad website (launchpad.ethereum.org).

- Follow the prompts and upload your deposit_data.json file.

- Send your 32 ETH to the official deposit contract address.

- Import your validator keystore files into your CL client on the node machine.

- Wait for the activation queue process to complete.

- Monitor your validator status; it will change from 'pending' to 'active' on the block explorer.

Phase 4 — MEV-Boost & Monitoring

Once the validator is active and running, focus on optimizing rewards and ensuring ongoing stability.

- Configure a fee recipient address in your client to direct any earnings. This is typically a secure wallet address.

- Consider exploring options like MEV (Maximal Extractable Value) software to potentially increase your rewards from transaction processing. This involves connecting to a network of builders and relays.

- Implement monitoring tools to keep track of your node's health and performance. Tools like Prometheus and Grafana are commonly used for this purpose.

- Set up alerts to notify you of critical events, such as your validator going offline or missing attestations (votes on the blockchain).

- Maintain a rigorous schedule for applying updates to your client software. Staying updated is crucial for security and performance on the network.

Risk Management (Keep What You Earn)

Risk Management Is Essential While Staking In Crypto Market. Image via Shutterstock

Risk Management Is Essential While Staking In Crypto Market. Image via ShutterstockEffective risk management is crucial to running a profitable and secure Ethereum validator node. The goal is to maximize earned rewards while preventing penalties and ensuring long-term operational viability.

Slashing Prevention

Slashing is the protocol's harshest penalty, designed to punish malicious behavior like double-signing blocks or contradictory attestations. Accidental slashing, almost always caused by operator error, can result in a loss of 0.25 ETH to over 1 ETH, plus forced validator exit and a 36-day downtime penalty.

- Never Run Duplicate Keys: The cardinal rule is to never run the same validator signing keys on two different machines simultaneously. This is the single biggest cause of accidental slashing.

- Use Slashing Protection: Modern client software includes local anti-slashing databases that track past votes. When migrating hardware, always export and import this database to prevent signing conflicting messages.

- Implement "Safety Over Liveness": Prioritize safety over 100% uptime. It is better to be offline (incurring minor inactivity penalties) than to risk accidental slashing by running redundant systems that might come online at the same time.

- Utilize Protection Features: Employ client features like "Doppelganger detection," which checks the chain for recent activity from your validator keys before starting full operation.

Operational Hygiene

Good operational hygiene is the daily practice of maintaining a healthy node and minimizing downtime, which helps keep your earned rewards consistent.

- Prompt Software Updates: Regularly apply client software updates. These patches fix bugs, improve performance, and address security vulnerabilities or consensus-critical issues. Delaying updates can lead to missed rewards or network synchronization problems.

- Consistent Monitoring and Alerting: Set up comprehensive monitoring tools (like Prometheus and Grafana) to track key metrics such as CPU/RAM usage, disk space, synchronization status, and validator performance. Configure alerts to notify you immediately of any issues.

- Secure Infrastructure: Use firewalls, secure SSH access, and follow least-privilege principles. Restrict access to your node machine from the public internet as much as possible to mitigate hacking attempts.

- Regular Backups and Disaster Recovery: Maintain secure backups of your client configurations and database snapshots (excluding your private keys/mnemonic). Have a tested disaster recovery plan in place to quickly restore your node in the event of hardware failure without risking slashing.

Legal/Compliance Notes

The regulatory landscape for cryptocurrency is rapidly evolving globally. Staking carries specific legal and compliance considerations.

- Tax Obligations: Staking rewards are generally considered taxable income in most jurisdictions (e.g., the U.S.) at the time they are earned. You are responsible for tracking the fair market value of rewards when received and for reporting them accurately for tax purposes.

- Securities Classification: Regulatory bodies, notably the U.S. SEC, have scrutinized staking services offered by centralized exchanges, arguing they may constitute securities offerings. Solo node operators face less direct scrutiny, but the overall legal environment remains fluid.

- AML/KYC Frameworks: While solo staking is a pseudonymous activity, centralized exchanges and major liquid staking protocols must comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

- Seek Professional Advice: Given the complexity and evolving nature of tax and securities law, it is highly advisable to consult with legal and tax professionals to ensure full compliance with local regulations.

Also, check out our top tips for managing risk in your crypto portfolio.

Case Studies

Scenarios Showing Staking Models And Reward Outcomes

Scenarios Showing Staking Models And Reward OutcomesThe following case studies present real-world scenarios for running an Ethereum validator in late 2025. These vignettes highlight the tangible differences in setup, operational costs, and profitability across various operational choices, providing experience signals for those deciding on their staking path. These scenarios include estimated Net APY, a qualitative Risk level assessment (ranging from Low Admin to High Admin), and an operational burden evaluation.

Solo 32 ETH at Home (Baseline)

This represents the sovereign baseline: full control, zero fees, and maximum decentralization, but requires technical self-sufficiency.

"Alex" runs a single validator from home using a dedicated NUC mini-PC. This represents a baseline solo staker experience.

- Setup: A NUC with a 2TB SSD, running Ubuntu Server, Geth + Lighthouse client mix. Hardware cost: $1,100.

Experience:

- Control & Satisfaction: High sense of ownership and satisfaction from directly securing the network. “It feels great to be a true part of decentralization.”

- Operational Burden: Requires dedicated time for maintenance and updates. “I get nervous every time there's a client update or a Pectra upgrade. My downtime is on me.”

- Reliability Issues: Experienced several short internet outages, leading to missed attestations and minor penalties. Has a small UPS backup but not a full internet backup solution.

- Earnings: Captures all MEV and tips directly. Net APY is high (4.5%), as operational costs (electricity) are low. Recovered hardware costs within the first 6 months of operation.

Key Takeaway: High potential profit and control come with the direct responsibility for uptime and technical management.

Small Team (5 Validators on VPS)

"BlockRunners" is a small group of friends running five validators using a professional cloud provider (Hetzner) to manage infrastructure.

- Setup: Five separate validators running on robust VPS instances, using a Nethermind + Teku client mix. Monthly cost per validator: $30-$40/month. Total monthly ops cost: ~$175.

Experiene Signals:

- Reliability & Uptime: Extremely high uptime (99.9%+) due to professional data center infrastructure. Minimal downtime issues.

- Scalability: Easy to add new validators as needed. The setup is highly repeatable.

- Cost vs. Profit: While the monthly fees are a perpetual expense, the reliability justifies the cost. Earnings are consistent and predictable, with a healthy net APY (4%).

- Team Collaboration: Shared responsibility for monitoring and alerts reduces individual stress. They rotate "on-call" duty for updates.

Key Takeaway: Using a cloud provider is a trade-off: stable, reliable infrastructure for a recurring operational expense. Teamwork mitigates individual stress.

0.1 ETH Liquid (Lido) + Restaking

This scenario balances a level of control with outsourced infrastructure, suitable for a technically competent small team or partnership.

Setup: Holds 0.1 ETH, which she deposited into Lido for stETH. She then used her stETH in an EigenLayer restaking protocol to earn additional rewards.

Experience Signals:

- Simplicity & Accessibility: Extremely easy to set up. “It literally took 5 minutes to convert my ETH to stETH and start earning.”

- Yield Farming: Enjoys the "yield stacking" potential. “I'm earning base staking APY plus additional protocol points/rewards. The potential yield is very exciting.”

- Risk Concerns: Aware of the increased risk exposure. “I'm layered in several protocols. I worry about a smart contract bug in one of them, or if stETH de-pegs during a market crash.”

- Liquidity: Values the ability to exit her position anytime by swapping stETH on a DEX.

Key Takeaway: Liquid staking and restaking offer accessible, potentially high-yield options for small holders, but they introduce compounding smart contract risks and centralize a lot of capital in a few protocols.

Should You Run a Validator?

Deciding whether to run an Ethereum validator requires considering your capital, technical skills, and risk appetite. The optimal choice depends on your specific circumstances.

Do you have access to exactly 32 ETH and are willing to lock it up long-term?

- If No: Your path leads to liquid staking or exchange staking (see below).

- If Yes: Proceed to the next question.

Are you technically proficient in Linux, networking, and hardware management?

- If No: You should likely use a liquid staking pool or an exchange, which abstracts technical complexity.

- If Yes: You are a strong candidate for a solo validator setup.

Do you prefer full control over your physical hardware and minimal ongoing operational costs, accepting higher initial setup costs?

- If Yes: A home setup is for you. You prioritize control and minimize recurring expenses.

- If No: A cloud VPS setup may be better, trading a recurring monthly fee for professional reliability and less physical maintenance.

Ultimately, your decision can be summarized by prioritizing your needs:

- Choose Solo Staking (Home or Cloud): If you are technically capable, have 32 ETH, value decentralization, and want the highest potential rewards and full control.

- Choose Liquid Staking / Restaking: If you have any amount of ETH (even <32 ETH), prioritize asset liquidity, are comfortable with smart contract risk, and want flexibility and potential extra yield.

- Choose Centralized Exchange Staking: If you prioritize the absolute simplest method, maximum convenience, and are comfortable with custodial risk and lower overall returns.

Check out our top picks for ETH staking pools.

Non-Financial Reasons to Run Your Own Node

While financial incentives like staking rewards and MEV are significant, many participants in the Ethereum ecosystem choose to run their own nodes for fundamental, philosophical, and technical reasons. These reasons often align with the core principles of the Ethereum ecosystem: decentralization, self-sovereignty, and security.

- Support Network Decentralization (Eg, DeFi): By running your own node, you contribute directly to the distribution of the network's power and data. The more independent nodes that are running across diverse geographical locations and client software, the more resilient the network becomes against attacks, censorship, or single points of failure like a major cloud provider outage.

- Enhanced Security and Privacy: Operating your own node allows you to verify transactions and interact with the blockchain without relying on third-party services (like Infura or Alchemy). This means these third parties do not gain access to your IP address, transaction patterns, or other potentially personal information, thus enhancing your operational privacy.

- True Trustlessness and Sovereignty: The foundational principle of blockchain is "don't trust, verify." Running your own node enables true trustless verification, allowing you to independently validate every single transaction and block according to the network's consensus rules. You do not have to trust a third-party's data feed, ensuring a consistent and accurate view of the blockchain state.

- Censorship Resistance: Having your own node ensures that your access to the Ethereum network is guaranteed and cannot be censored. Third-party providers could theoretically choose to block transactions from specific IP addresses or certain smart contracts, but your own node ensures your transactions are broadcast directly to the peer-to-peer network without interference.

- Educational Value: The process of setting up, monitoring, and maintaining an Ethereum node provides invaluable hands-on learning about how the network functions at a technical level. It is an excellent way for enthusiasts, developers, and students to gain a deep understanding of blockchain technology.

- Personal Reliability and Low Latency: Running a local node can provide faster, lower-latency interaction with the blockchain for your own dApps or wallet. You are not subject to the potential throttling or downtime issues of public RPC (Remote Procedure Call) providers.

- Voice in Governance and Client Diversity: As a node operator, you implicitly vote for network changes by choosing which client software you run. By consciously selecting a minority client, you actively contribute to client diversity, a critical factor in the network's long-term health.

Bottom Line

The decision to run an Ethereum validator is a complex trade-off between maximizing financial returns and upholding the network's decentralized ethos. While solo staking offers the highest potential APY and full sovereignty, it demands significant technical expertise, high upfront capital (32 ETH), and constant operational vigilance to mitigate risks like slashing and client monoculture. For users with less capital or time, liquid staking pools offer a highly liquid, lower-admin alternative, albeit with added smart contract risks.

Centralized exchanges provide the simplest "set-and-forget" option but sacrifice custody and incur higher fees. Ultimately, the right choice aligns a staker's available capital, technical comfort, and risk tolerance with a method that supports both personal profit goals and the long-term health of the decentralized network.