The Bank for International Settlements (BIS) is partnering with central banks from Australia, Malaysia, South Africa, and Singapore to lay down the blueprints for a new global settlement system.

According to an executive summary from the BIS, the initiative called “Project Dunbar,” aims to explore how a common platform for multiple central bank digital currencies (CBDCs) could enable cheaper, faster and safer cross-border payments.

BIS admits that currently, “cross-border payments lag significantly behind domestic payments in meeting user expectations for services.”

“Faster, cheaper, more transparent and more inclusive cross-border payments could have widespread benefits for citizens and economies worldwide, supporting economic growth, international trade, global development and financial inclusion.”

The bank suggests that a common platform for international settlements using CBDCs could provide improvements to cross-border payments, “much like how national payments systems have made domestic payments seamless, instant and low cost in many countries.”

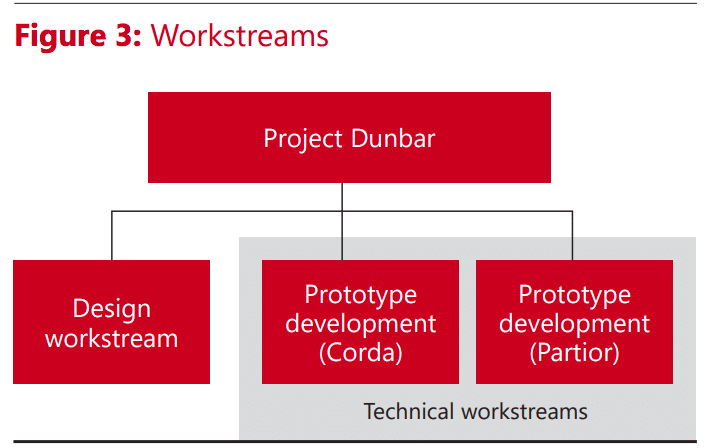

“At the same time, this new type of arrangement also brings new challenges," they said, adding, "Project Dunbar aims to explore the potential benefits and opportunities of a multi-CBDC platform, understand the critical obstacles and challenges to implementing such a platform, develop design approaches to address them, and prove the viability of the concept through the building and testing of technical prototypes.”

The new initiative appears to have significant political and manpower behind it. Besides the four central banks, BIS says that observers from the Bank of France and Hungary’s Magyar Nemzeti Bank also contributed to the discussion. In addition, Singaporean-state backed investment holdings company Temasek, as well as consulting giant Accenture also had a hand in design workstream.

BIS

BIS

Research was done using the Corda and Quorum blockchains. Corda was built by enterprise technology and services company R3, who also led development during research. Quorum is a service from Consensys, and development was led by Partior with input from DBS and JPMorgan.

“A series of workshops, which were conducted across three sprints with the participating central and commercial banks, utilised a structured design-thinking approach to discuss and develop an innovative yet practical solution.

The goal of the technical workstreams was to develop technical prototypes on two different DLT platforms – Corda and Quorum – to transform the idea of a multi-CBDC platform into working prototypes.”

The report from BIS comes as discussions of CBDCs accelerate among governments and top financial regulators.

Last week, Big 4 accounting firm Deloitte released a full report on CBDCs, highlighting the differences between Bitcoin and a hypothetical CBDC, or what they referred to as a “state-sponsored cryptocurrency.”

“The foundation of a state-sponsored cryptocurrency would be much like Bitcoin – individuals or companies would utilize computer-generated public ‘addresses’ to send and receive payments,” Deloitte said.

“Payers could use an electronic wallet on a smartphone or computer to send money to the public address of the recipients. Unlike Bitcoin’s current system, however, banks and other financial institutions, previously approved by the Central Bank, would be the custodians of a shared, distributed computer-based ledger (called a blockchain in Bitcoin parlance).”