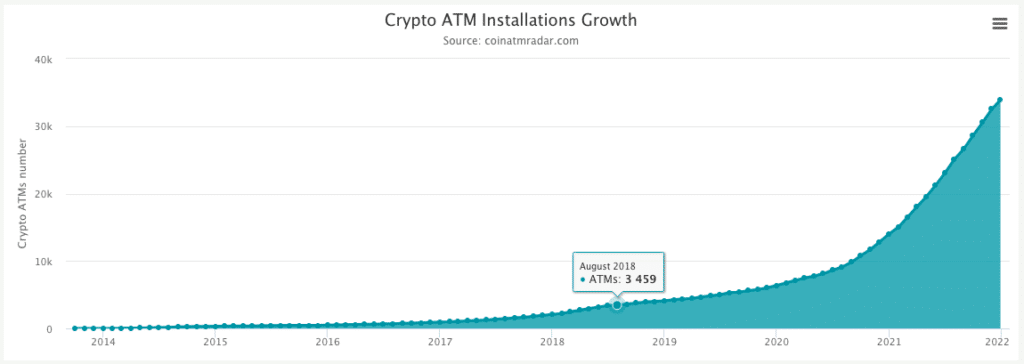

Bitcoin ATM machines skyrocketed in 2021, more than doubling during the year’s crypto bull market.

According to data from Coin ATM Radar, there are currently 33,911 Bitcoin ATMs worldwide, up 163% from December of 2020, when only 12,868 machines were recorded.

The parabolic rise in machines was primarily spread out between the United States, Canada, Spain, and Switzerland. Bitcoin ATMs have been declining in the United Kingdom and Austria since 2020 and 2019 respectively.

Coin ATM Radar

Coin ATM Radar

While a surge in Bitcoin ATMs is being recorded in a handful of Western countries, most African, Asian, or island nations have somewhere between zero and 5. However, a recent report from blockchain tracker Chainalysis suggests that global adoption is, overall, exploding.

According to an October report, Chainalysis looks beyond ATM machines and looks at metrics such as exchange deposits, use of DeFi protocols, and on-chain data. The firm says that leading the charge of crypto adoption worldwide is Vietnam, followed by India, Pakistan, Ukraine and Kenya.

“Several countries in emerging markets, including Kenya, Nigeria, Vietnam, and Venezuela rank high on our index in large part because they have huge transaction volumes on peer-to-peer (P2P) platforms when adjusted for PPP per capita and internet-using population. Our interviews with experts in these countries revealed that many residents use P2P cryptocurrency exchanges as their primary on-ramp into cryptocurrency, often because they don’t have access to centralized exchanges.

Knowing that, it’s no surprise that regions with many emergent markets account for a huge portion of web traffic to P2P services’ websites.”

Chainalysis also revealed that the US and China were falling behind in adoption compared to the emerging markets. The biggest reason that both countries dropped in rankings is that their peer-to-peer trade volume weighted for internet-using population declined dramatically, with China falling from 53rd place to 155th, and the US falling from 16th to 19th.

“Our biggest question for the next twelve months is how much adoption will continue on those platform categories compared to new and emerging models we haven’t seen yet.

The clear takeaway though is this: Cryptocurrency adoption has skyrocketed in the last twelve months, and the variation in the countries contributing to that show that cryptocurrency is a truly global phenomenon.”