Fractal Brownian motion is one of the most well-known theories in the world of physics. It has also been used to great effect to model asset prices by the quants on Wall Street. However, today it is being used to model the price of Bitcoin.

In a recent paper by physicist Mariusz Tarnopolski, he has predicted the price of Bitcoin over the next few months and according to his model, the price should breach $6,000 by early 2018 with a target of $6,358.32.

These are only a few of the number of Bitcoin price predications that have been hitting the wires over the past few months. Most of these, however, have been based on fundamental economic theories such as supply and demand.

One can indeed get a sense of the diverse range of opinions on the price of BTC from the prediction Subreddit. Most range between $5,000 to $12,000 which gives you the sense that these are nothing more than mere guesses. That is why it is interesting to read studies that are based in theory.

What is Brownian Motion?

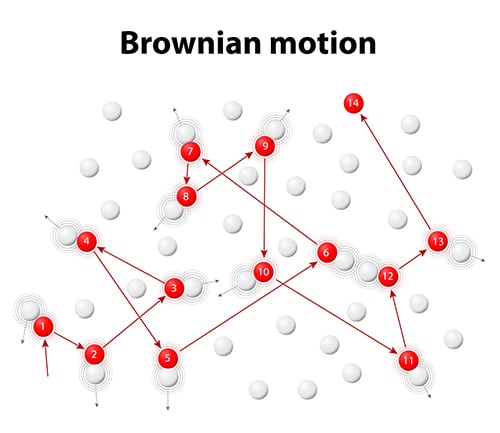

Brownian motion is a theory whereby physicists can measure the movement of particles. It has been applied to numerous natural progressions and is able to predict these with a great degree of accuracy.

Brownian motion is a theory whereby physicists can measure the movement of particles. It has been applied to numerous natural progressions and is able to predict these with a great degree of accuracy.

When expanded into fractal analysis and the random walk theory, a range of other applications can be implemented. One of those that has been the bedrock of financial modelling has been Geometric Brownian Motions (GBM).

GBM is a continuous time stochastic process that is the fundamental underpinnings of the Black-Scholes option pricing model. It is used extensively in stochastic calculus and mathematical finance.

Given its use in the Black Scholes model, GBM calculations underpin billions of dollars of value in financial options on a range of assets. It is also used quite extensively to model predictions in asset prices.

Hence, it would make sense to apply the theory to the price of Bitcoin and produce predictions of the price.

Modelling Bitcoin with GBM

The Bitcoin price exhibits many of the same characteristics of other financial time series data. In the paper by Tarnopolski, the previous data in Bitcoin prices were the input to the model to predict the price down the line.

In order to produce the statistical distribution, a Monte Carlo simulation is run on a sample of 10,000 Brownian motions. This is what will produce the "random" part of the random walk.

Similarly, in order to get the most data points and more accurate modelling, a longer time period for the asset was used. The analysis was run with data from December 2011 to June 2017. Once simulated, Tarnopolski had enough data to calculate the probability of particular price levels in 180 days. He also calculated important price characteristics such as the statistical distribution of the median, mode and mean.

This model was also back tested with predictions from modelling data only up to 31 December 2016. Some of the predictions from that back testing were that the price could exceed $5,000 with a 9.3% probability in 180 days or that there was only 5.3% chance that the price would fall below $955.

Yet, the most compelling prediction was the median estimate of the price 180 days in at $2,357. This was not far off from the actual price of Bitcoin towards the middle of the year at $2,618. This accuracy gave weight to his current prediction of the price.

Other interesting predictions for early 2018 are that the price could exceed $10,000 with a 27.5% chance. This will no doubt add weight to those predictions of a price above this key level.

Modelling with a Pinch of Salt

While modelling asset prices using GBMs is an established discipline in the options world, their accuracy is by no means conclusive. There are many academics who are of the view that natural processes cannot be applied to finance where human psychology plays an important part.

The author also makes note of this by using the example of Black Monday in 1987 or the recent financial crisis as examples of periods which are nearly impossible to predict. These are "black swan" events and are the reason that all the investment bank's models did not predict the crisis.

He lays an example as the hard forks in Bitcoin's code as example of events that cannot be accurately predicted.

Featured Image via Fotolia