Crypto investment giant Pantera Capital says that the digital asset markets are set to decouple from the rest of the financial landscape.

Joey Krug, co-chief investment officer says in Pantera’s latest newsletter that the crypto markets “definitely got hit” by the news cycle surrounding likely interest rate hikes coming from the Fed later this year.

However, Krug says these fears have mostly already been priced in and markets have adjusted to the possibility of at least five rate hikes, which he thinks is largely “overplayed” in crypto.

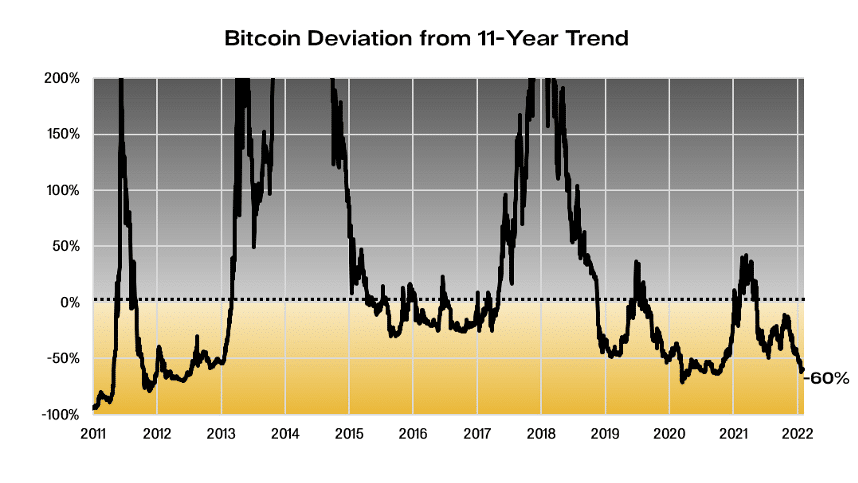

According to the Krug, there is a historical cycle of correlation between crypto and traditional markets that lasts about 70 days each time macro gets hit with bearish action, before crypto decorrelates. He predicts that we are now more or less at the point where crypto breaks away.

“And so we think over the next number of weeks, crypto is basically going to decouple from traditional markets and begin to trade on its own again,” he said.

“There are a couple of reasons for that. One is that crypto is still a relatively small market and so things like the federal funds rate being at 1.25% versus 0% doesn’t make a huge, huge difference for something that’s growing four to five times year over year, especially if you look at stuff like DeFi, where it’s already trading at fairly cheap multiples. There are a lot of DeFi assets that trade from P/E multiples anywhere from 10 to 40. They’re not crazy high-valued; tech stocks are trading at multiples of 400 to 500x.”

It’s Kurg’s personal view that $2,200 was the bottom for Ethereum, for example.

Pantera Capital

Pantera Capital

Dan Morehead, the company’s CEO, also believes in short-lived correlations between crypto and traditional markets. He also claims that in a rising interest rate environment, crypto is the best place to be, contrary to what many believe.

“Once people do have a little bit of time to think this through, they’re going to realize that if you look at all the different asset classes, blockchain is the best relative asset class in a rising rate environment,” Morehead said, adding that he thinks bonds are “going to get killed.”

“Whereas blockchain isn’t a cashflow-oriented thing. It’s like gold. It can behave in a very different way from interest-rate-oriented products. I think when all’s said and done, investors will be given a choice: they have to invest in something, and if rates are rising, blockchain is going to be the most relatively attractive.”