In their latest report, crypto analytics firm Glassnode says that Bitcoin’s recent market meltdown was driven by a cascade of overleveraged traders getting liquidated, and that newer market entrants bore the brunt of the pain.

The firm takes a look at the behavior of both long-term holders (LTHs) and shot-term holders (LTHs) during the market crash. An LTH is considered any address that has held onto BTC for more than five months. According to Glassnode, LTHs remained virtually unfazed during the correction, while STHs decreased their stacks significantly.

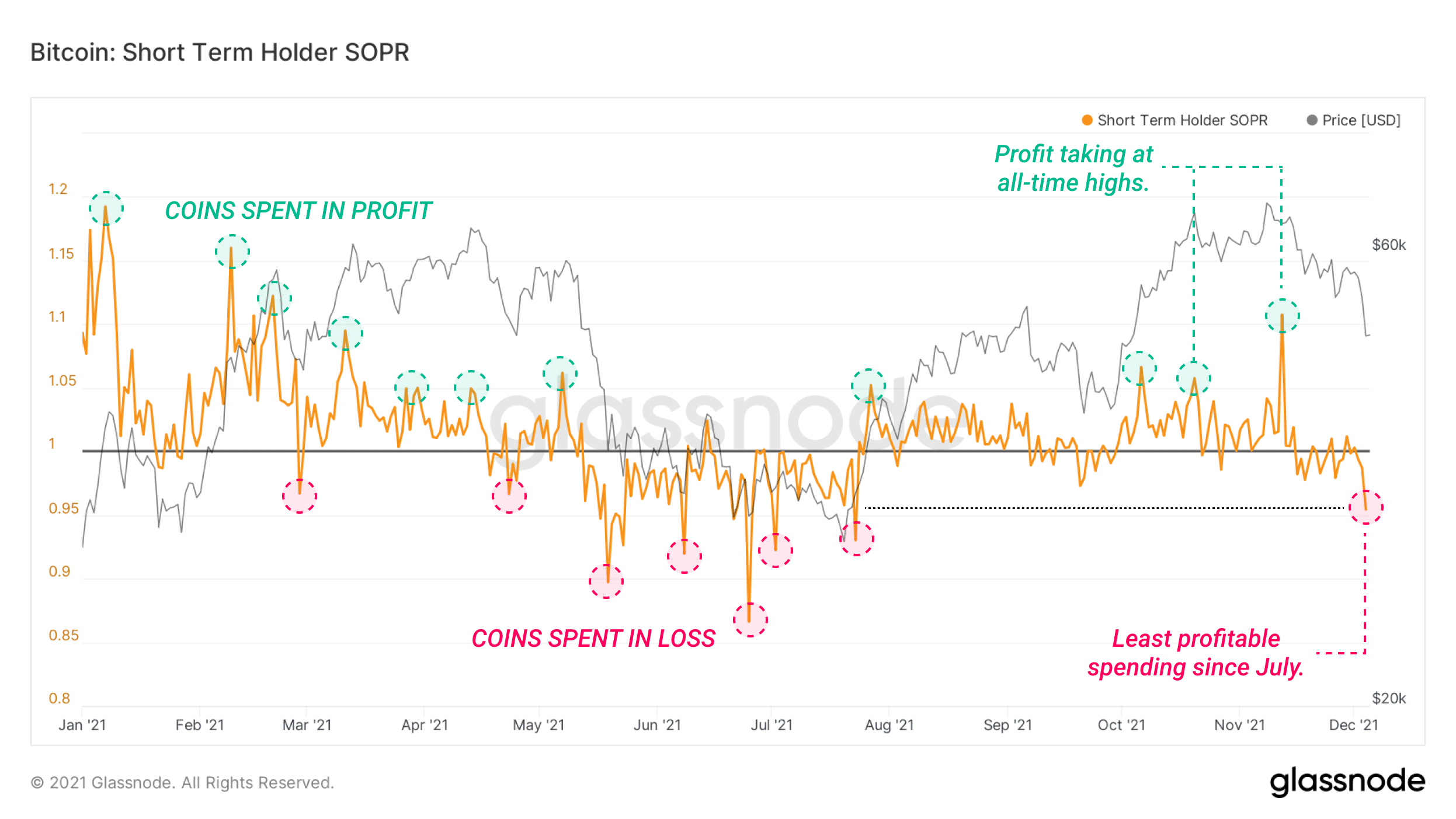

Glassnode says that when BTC made its new high, new investors came into the market and bought the top as always, before having their conviction tested by a price drop. The firms data recorded $3 billion worth of coins spent at a loss during December 4th's correction, comparable only to May 19 and June 25, which saw $4.5 billion and $3.8 billion in losses respectively. Most of these losses are coming from the short term holders, according to Glassnode.

“Short-Term Holder SOPR printed its lowest value since late July, which shows the hallmark signature of a capitulation by newer investors. For Short-Term Holders to be realizing losses here means they had to buy their coins at the recent tops, and are already spending them to new hands. This group appears to be the only cohort reacting significantly to the events of last week. More mature HODLers remain unmoved

Those who are spending coins appear to be predominantly those who bought the top, and they are realizing losses and capitulating.”

Glassnode

Glassnode

The firm says that excessive amounts of leverage in the system followed by price volatility is a classic recipe for correction, and that "capitulative moments" are necessary for markets to return to equilibrium.

"The key question we will seek to answer in the coming weeks, is whether market sentiment has taken a severe enough hit that the underlying conviction seen this week deteriorates, or does it hold on.”

Glassnode's full report can be read here.