The Fintech research provider, autonomous next, has released details about its latest survey into the hedge fund landscape on Bitcoin. In their report they detailed that there are at least 124 funds that are invested in crypto based assets. This brings the total amount of Bitcoin AUM to about $2bn, an impressively large sum. This clearly shows that the tide may be turning for institutions.

According to CNBC, Autonomous next claimed that there are at least 90 funds that are focused on these digital assets such as Bitcoin which have launched this year. In terms of the composition of the larger funds, the top 37% of the funds used VC investment strategies and had about $1.1bn in funding. The rest used "statistical arbitrage" on the cryptocurrencies.

On total, the research now estimates that the total amount of money that is invested in Digital currencies in the hedge fund space is about $2.3bn. It is indeed quite an achievement to know that a mere 4 years ago this was the entire market cap of all cryptocurrencies.

Contrary to Opinion

Of course, there are many naysayers that will go on TV and claim that Bitcoin is a bubble and one should not invest. People such as Jamie Dimon of JP Morgan have even labelled it a "fruad". Yet, the research shows that the most seasoned investors are moving some of their money into assets such as digital currency.

Although this is indeed a great move forward for cryptocurrency adoption, it still pales into comparison when one was to look at the total funds under management by hedge funds. At the most recent count, there is at least $3.15 trillion dollars invested in the industry.

Prevalence of ICOs

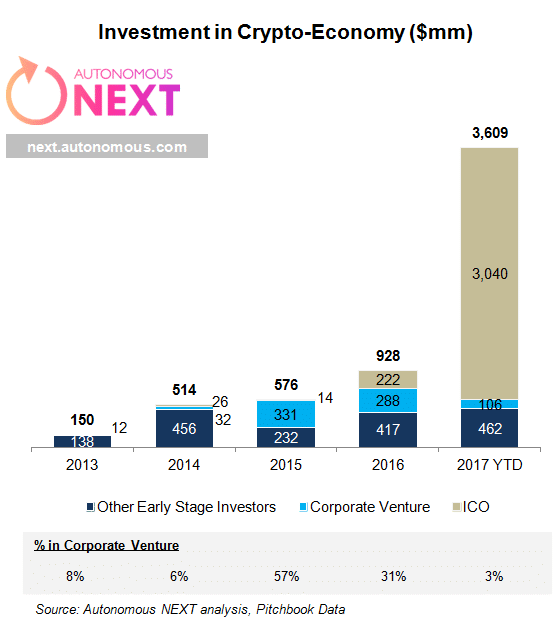

In that same report, Autonomous next delved into the massive explosion that we have seen Initial Coin Offerings (ICOs) with over $3bn going into the funding medium. They did this by tracking the number of ICOs that had raised over $1m. This allowed them to come to the conclusion that:

It is hard not to conclude that the market has shifted considerably from Enterprise blockchain to the public chains in terms of committed resources (even if you assume 50% of 2017 ICOs are scams)

Taking a look at the chart below that was drawn up by autonomous next one can see the enormous jump in the amount of ICOs that were issued this year in comparison to those last year.

They have also excluded from their research those funds that are "investment vehicles built by traditional asset managers that package exposure to a single currency, such as the Bitcoin Investment Trust from DGC/Grayscale".

Even though the data is sometimes hard to come by in this space and what one may think of as a "fund", they were able to piece together a pretty solid picture of hedge fund interest in the crypto space. They said that:

75%+ of these funds were started in 2017, that in total they manage between $2 and $3 billion

What this could mean for the cryptocurrency ecosystem is no doubt interesting. As more hedge funds decide to get involved the increased liquidity could result in less volatility in the assets. Moreover, with the advent of cryptocurrency derivative exchanges new avenues for hedge fund strategies are also opened.

Featured Image via Fotolia