Interoperable blockchain Polkadot is the most widely held altcoin among venture capital firms and hedge funds, according to a report from Messari.

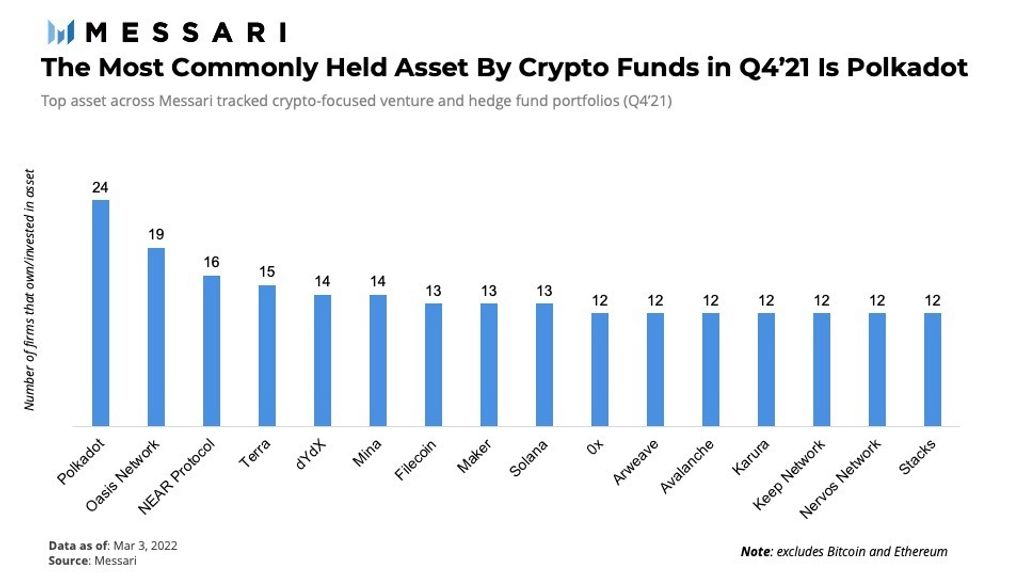

In an analysis of 57 funds, Messari found that over 24, or 42% of the funds, hold DOT, making the smart contract platform the most bet-on crypto asset on the market.

“Additionally, as parathreads gain popularity and parachain auctions continue into Q1 of 2023, the influence of DOT-holding funds will remain quite prevalent as projects vie to secure their slots on the Polkadot platform.”

After Polkadot, the following four altcoins held by the funds were Oasis Network (ROSE), Near Protocol (NEAR), Terra (LUNA), and dYdX (DYDX).

Messari says that of the top 30 invested assets, Terra has the highest-circulating market capitalization.

“This is significant for Terra considering they were fourth in market cap last quarter behind Solana, Polkadot, and Avalanche,” the firm said.

“Nervos Network (CKB) possesses the lowest-circulating market capitalization of the top 30 assets, and Cosmos (ATOM) possesses the lowest-circulating market cap of the top five assets.”

Messari finds that since Q3 of 2021, a trend has formed where funds have begun to regularly favour smart contract platforms and decentralized exchanges (DEXs). Out of the top 50 assets, smart contract platforms remains the biggest category of altcoins.

“The smart contract battles continue to heat up as both funds and projects look to scale and build superior smart contract alternatives. Evidently, four of the top five invested assets this quarter are all smart contract platforms. Given how Oasis Network, NEAR Protocol, and Mina are still gaining traction within the smart contract landscape, time will tell how they match up against industry leaders like Ethereum, Cosmos, Polkadot, and Solana.”

Bitcoin and Ethereum were excluded from the reports given that almost every fund holds both.